The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor in Real Estate

Learn about the most important thing when investing in this book by Howard Marks.

Why “Uncommon Sense” Wins in Real Estate

Most investors chase what’s obvious and recent.

Thoughtful investors model what’s probable and risky.

When I help clients, we start with the most important thing: protecting downside while pursuing reliable, compounding returns.

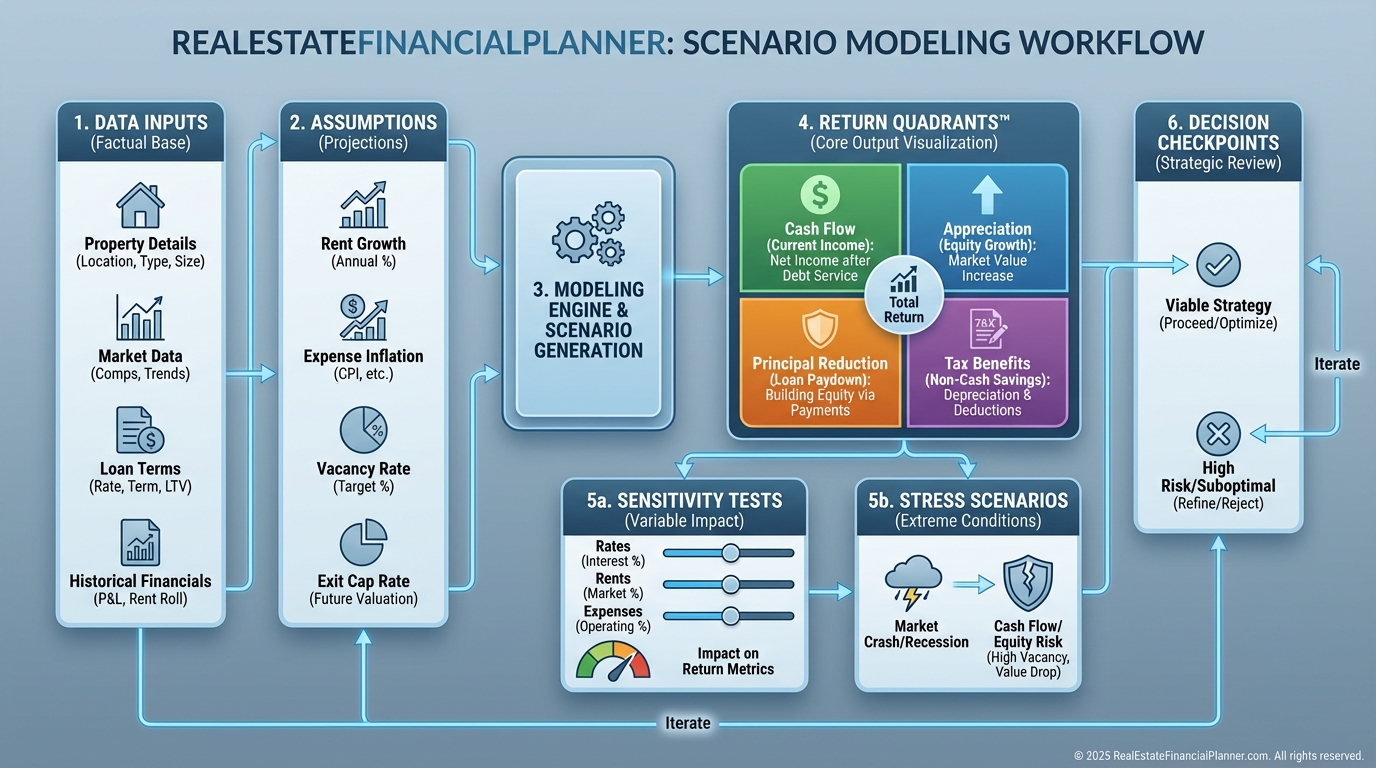

We do that by modeling outcomes before money moves.

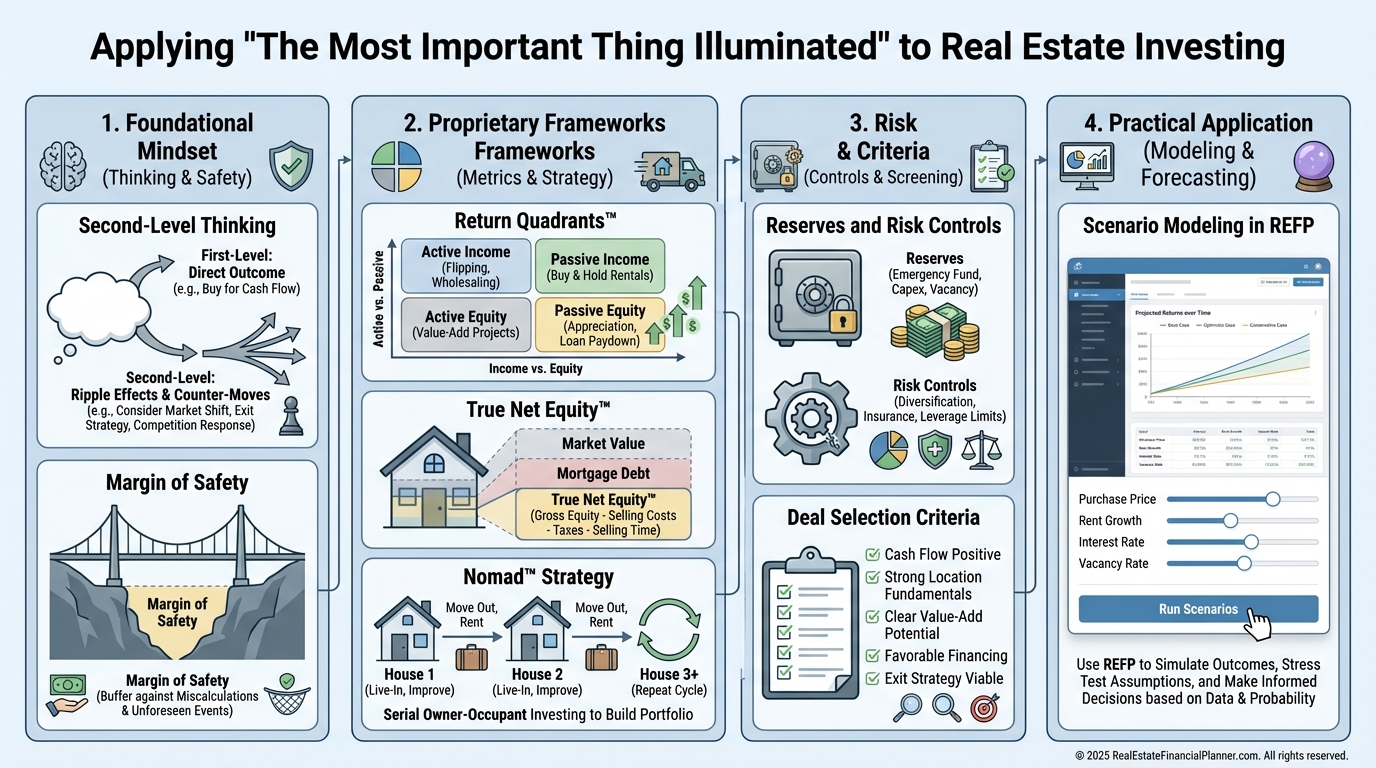

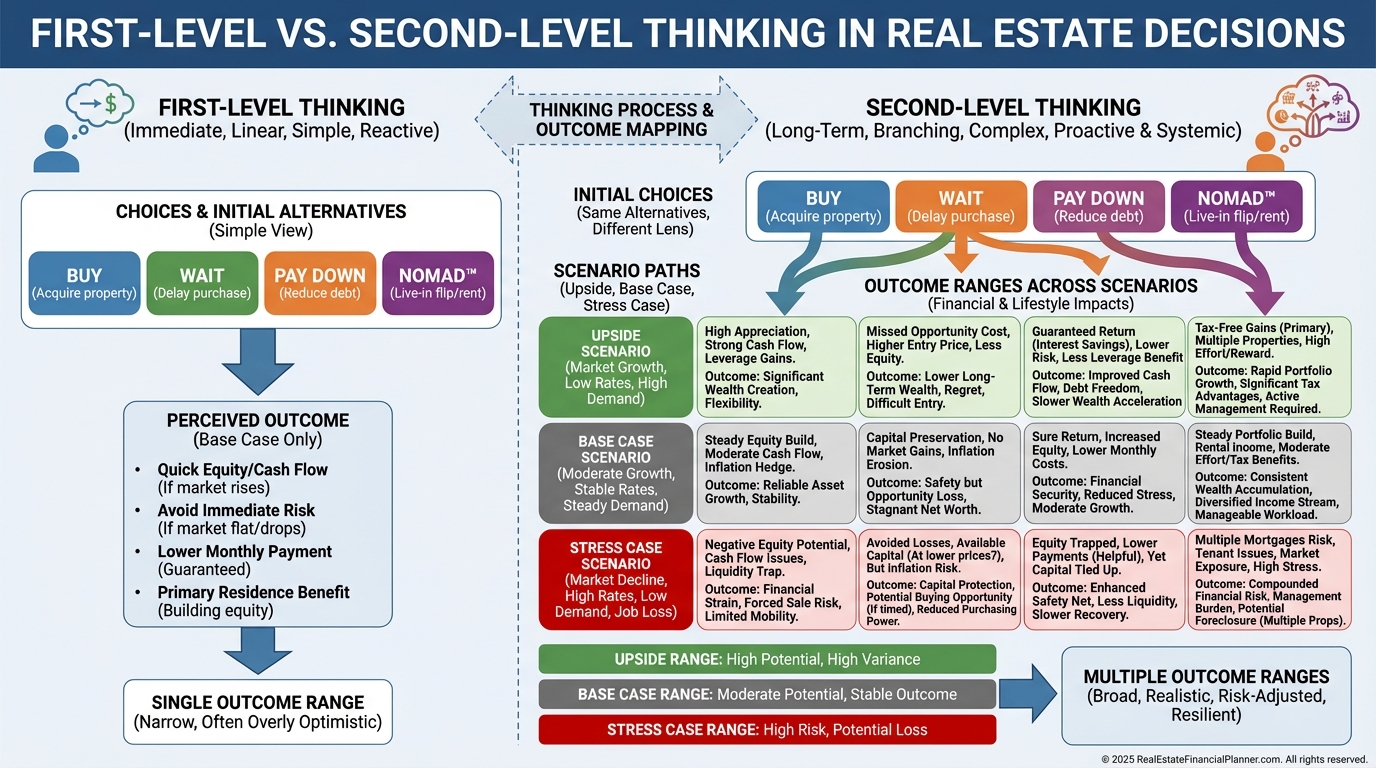

First Principles: Second-Level Thinking

First-level thinking asks, “Is this a good deal?”

Second-level thinking asks, “Good for whom, compared to what, under which conditions, and with what risk if the world looks different?”

I compare each purchase not just to other properties, but to holding cash, paying down debt, or advancing the Nomad™ plan.

We don’t guess. We calculate.

I build base, conservative, and stress scenarios and look at how returns change.

That’s where fragile assumptions get exposed.

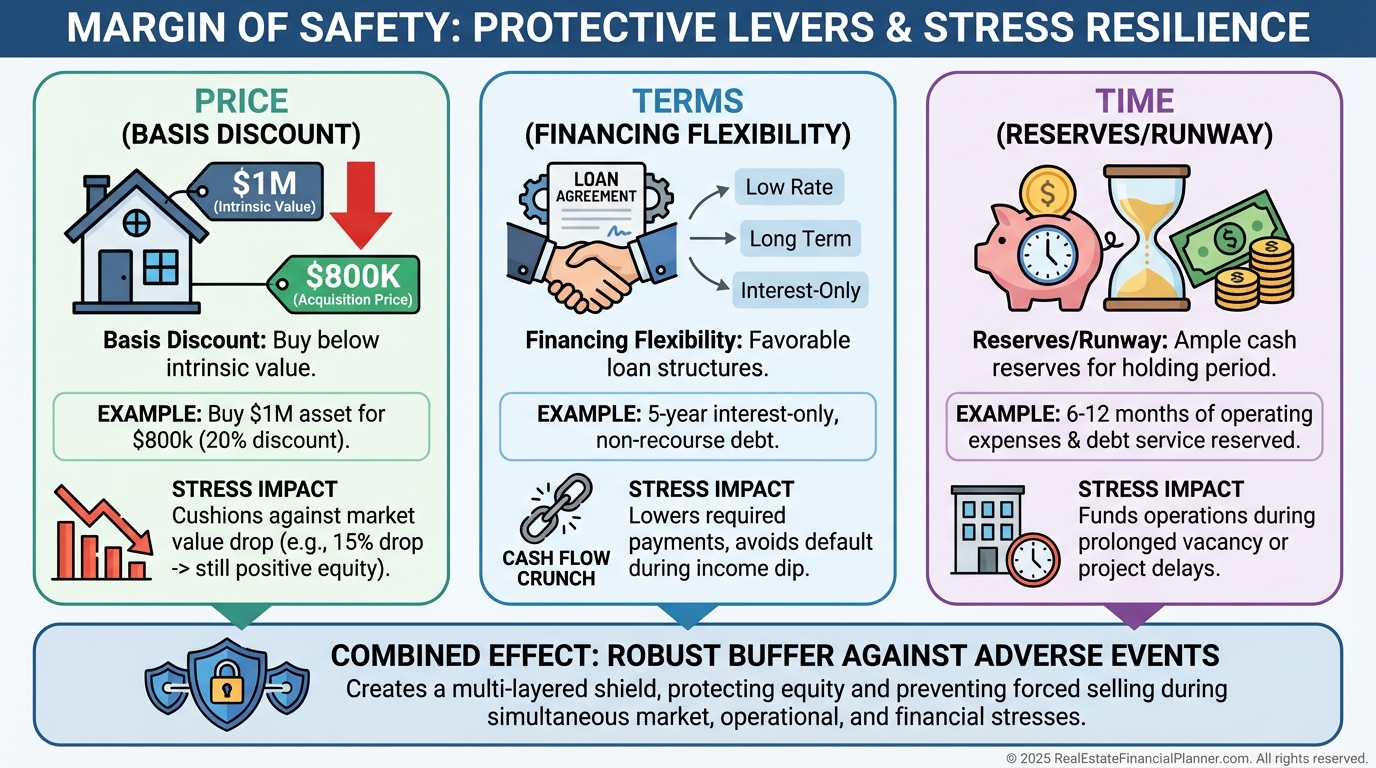

Margin of Safety: Price, Terms, and Time

Margin of safety is not just price.

It’s favorable terms, adequate reserves, and runway for mistakes.

When I review offers, I look for three cushions: under-market basis, flexible financing, and 12–24 months of liquidity.

If we can’t secure at least two, we usually pass.

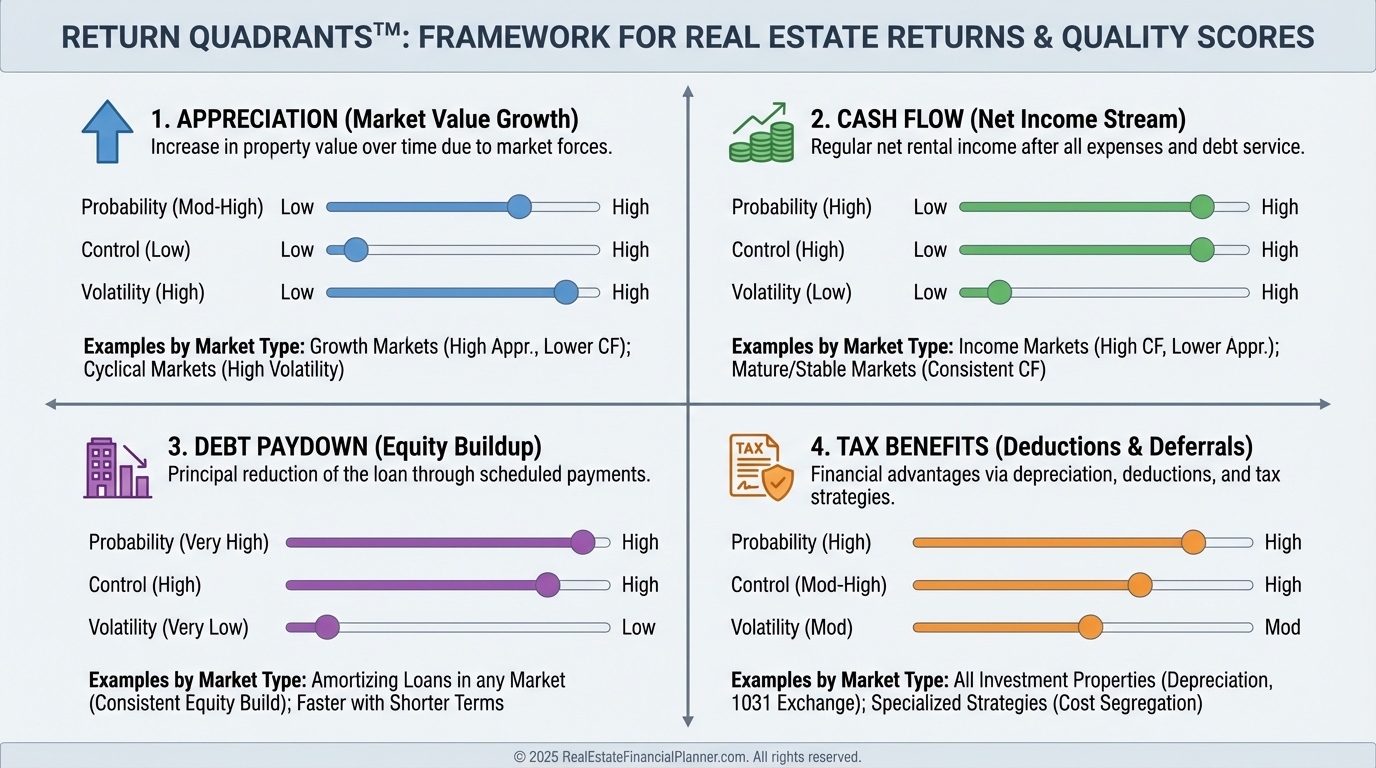

The Return Quadrants™ with Uncommon Sense

Uncommon sense is weighting each by probability and durability, not hope.

In low cap rate markets, I teach clients to lean on Debt Paydown and Tax Benefits while negotiating terms that protect Cash Flow.

Appreciation is a bonus, not the plan.

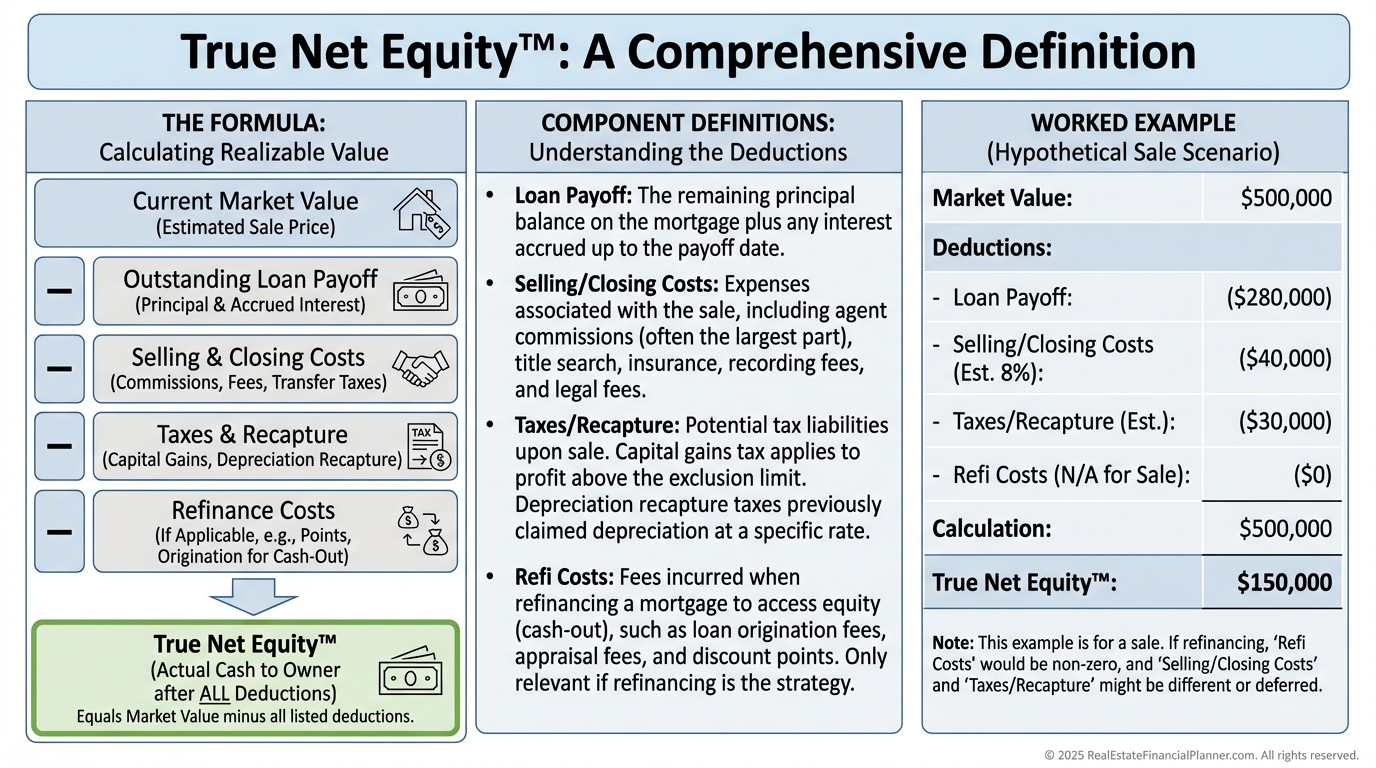

True Net Equity™: The Only Equity That Counts

On paper, equity looks big.

In reality, accessing it costs money and adds risk.

I calculate True Net Equity™ by subtracting closing costs, selling costs, capital gains/depreciation recapture, and refinance costs.

That’s the equity you can actually redeploy.

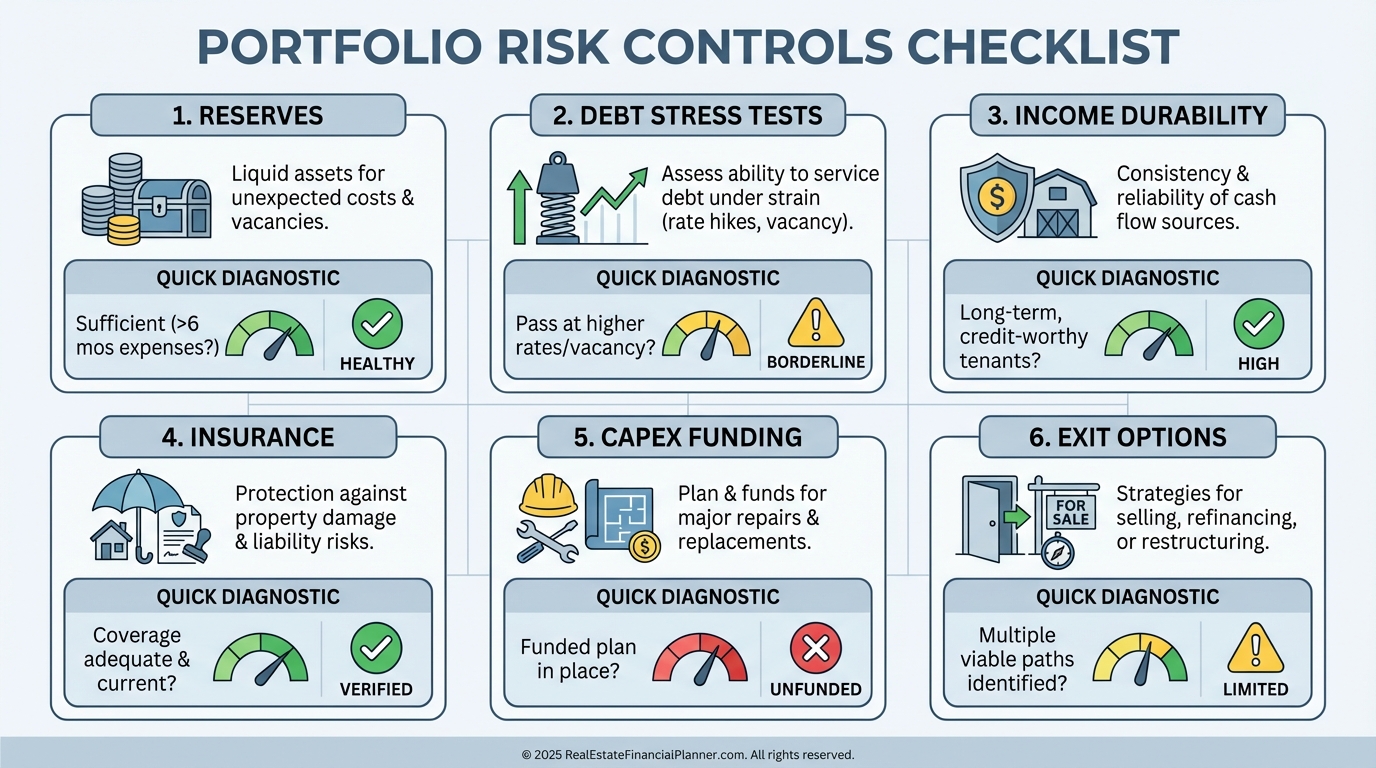

Risk Management: What I Check Before “Yes”

Before I greenlight a purchase, I verify six things.

Reserves cover 12 months of PITI and expenses across the portfolio.

Debt structure can survive rate resets, vacancy, and rent drops.

Income durability is tested against local employer risk and supply pipeline.

Insurance is right-sized for rebuild, liability, and loss of rents.

CapEx is pre-funded for roofs, HVAC, and plumbing, not “we’ll figure it out later.”

Liquidity exits exist: refinance, HELOC, or sale without a fire sale.

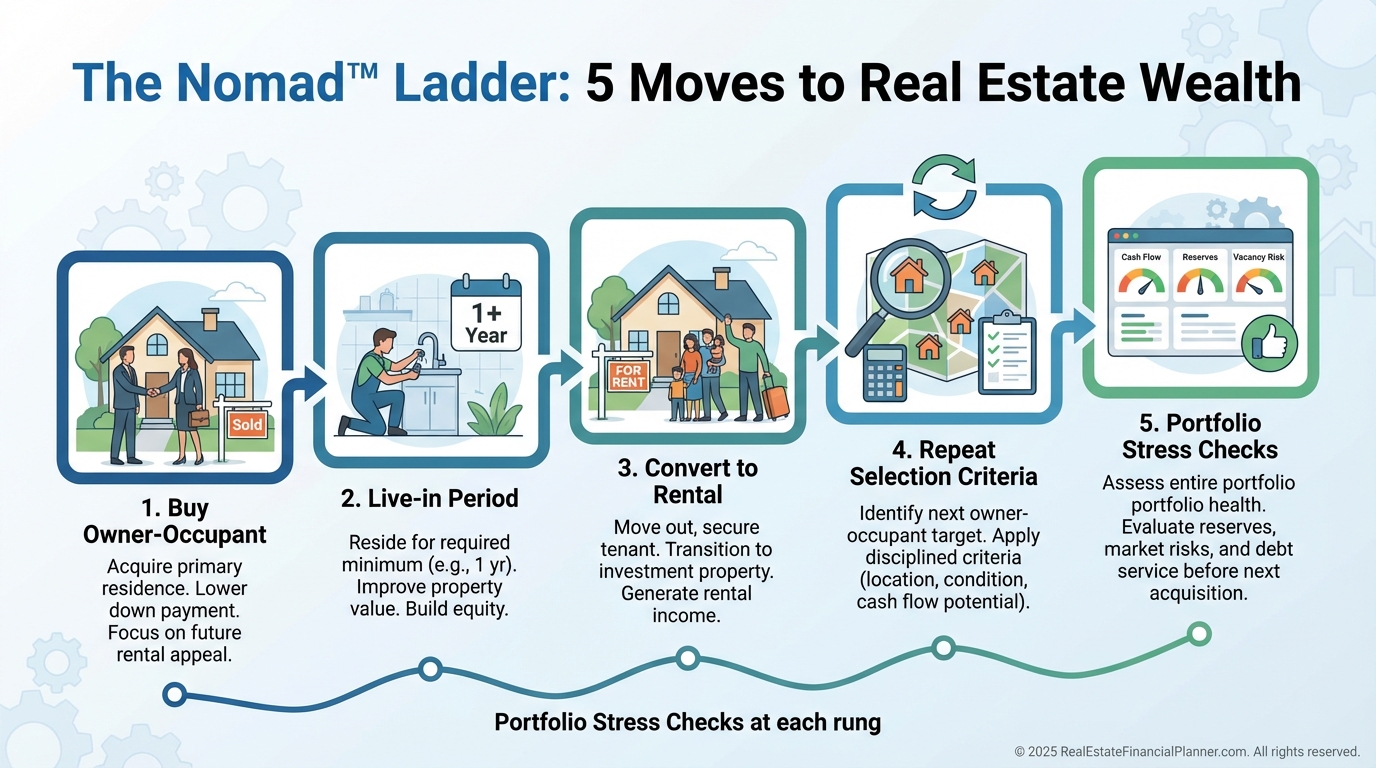

Smart Acquisition: The Nomad™ Path Done Right

The Nomad™ strategy can be brilliant when executed with discipline.

Owner-occupant financing lowers down payments and rates, compounding safely with each move.

When I coach Nomads, we pick properties that rent cleanly, avoid HOA fragility, and match medium-term rentability.

We model the first five moves before making the first offer.

What I Model, What I Avoid

I model returns net of vacancy, maintenance, and management, even if self-managing.

I model exit taxes so we’re not surprised when we sell.

I avoid deals that only work at today’s peak rents or with zero CapEx.

I avoid floating-rate debt without matching reserves and rate caps.

I avoid neighborhoods where one employer controls demand.

Common Mistakes I See

Investors overestimate rent growth and underestimate repair cliffs.

They buy the cheapest financing, not the right structure.

They ignore True Net Equity™ and scale too fast on paper equity.

They skip reserves because the last two years looked easy.

Signals I Watch Before Expanding

Months of inventory trending up tells me to slow acquisitions.

Insurance rates spiking signals a need to rework cash flow buffers.

Local building permits rising fast means more supply and future concessions.

A Simple Deal Filter You Can Use Today

If a deal fails a 2% rent drop, 2% rate rise, or 10% expense overrun, pass.

If you can’t fund 12 months of portfolio reserves after closing, pass.

If Debt Paydown and Tax Benefits don’t carry the weight in a flat-price scenario, pass.

If the Nomad™ five-move plan breaks on paper, pass.

Putting It All Together

Uncommon sense means you buy fewer, better properties and keep them longer.

It means you measure what you can control and plan for what you can’t.

When clients follow this, their portfolios feel boring.

Boring is bankable.

Your Next Five Moves

1) Inventory your reserves, debt structures, and insurance.

2) Calculate True Net Equity™ for each property.

3) Re-model each deal in base, conservative, and stress scenarios.

4) Rank opportunities by Return Quadrants™ quality, not headline IRR.

5) If Nomad™ fits you, design all five rungs before the first step.

When you’re ready, we’ll model it together and let the math make the decision.

Contents

Howard Marks' Principles Applied to Real Estate Investing

Learn about the author Howard Marks and his book The Most Important Thing.