Equity Isn’t Wealth: How Smart Investors Turn Trapped Equity Into Real Returns

Learn about Equity for real estate investing.

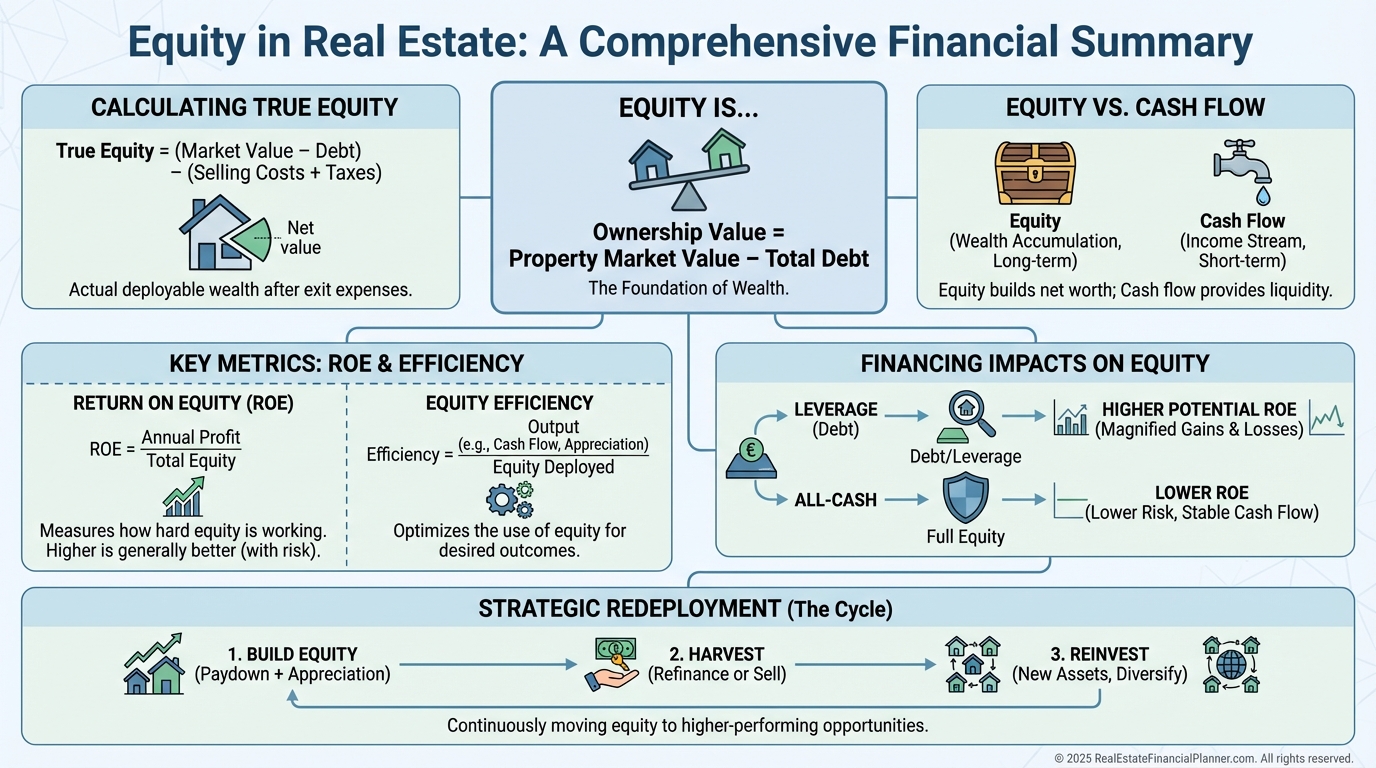

Infographic Prompt:

"Create a 16:9 infographic summarizing all major concepts taught in this article about equity, including what equity is, how to calculate true equity, equity vs cash flow, return on equity, equity efficiency, financing impacts, and strategic redeployment. Use a clean, structured layout that helps readers understand the entire topic at a glance. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

Most real estate investors believe they understand equity.

When I sit down with clients, that belief is often the most expensive mistake they make.

They treat equity like a scoreboard instead of a tool. They calculate it once, feel good about it, and then stop thinking about it altogether.

That mindset quietly kills returns.

When I rebuilt my portfolio after bankruptcy, equity wasn’t something I admired. It was something I measured, stress-tested, and redeployed deliberately. That difference matters.

What Equity Really Means (And What It Doesn’t)

Equity is your ownership stake in a property after all debts are accounted for.

That definition sounds simple, but it’s dangerously incomplete.

Equity is not cash.

Equity is not income.

Equity is not liquidity.

Equity is potential energy.

Until you sell, refinance, or leverage it, equity produces nothing on its own.

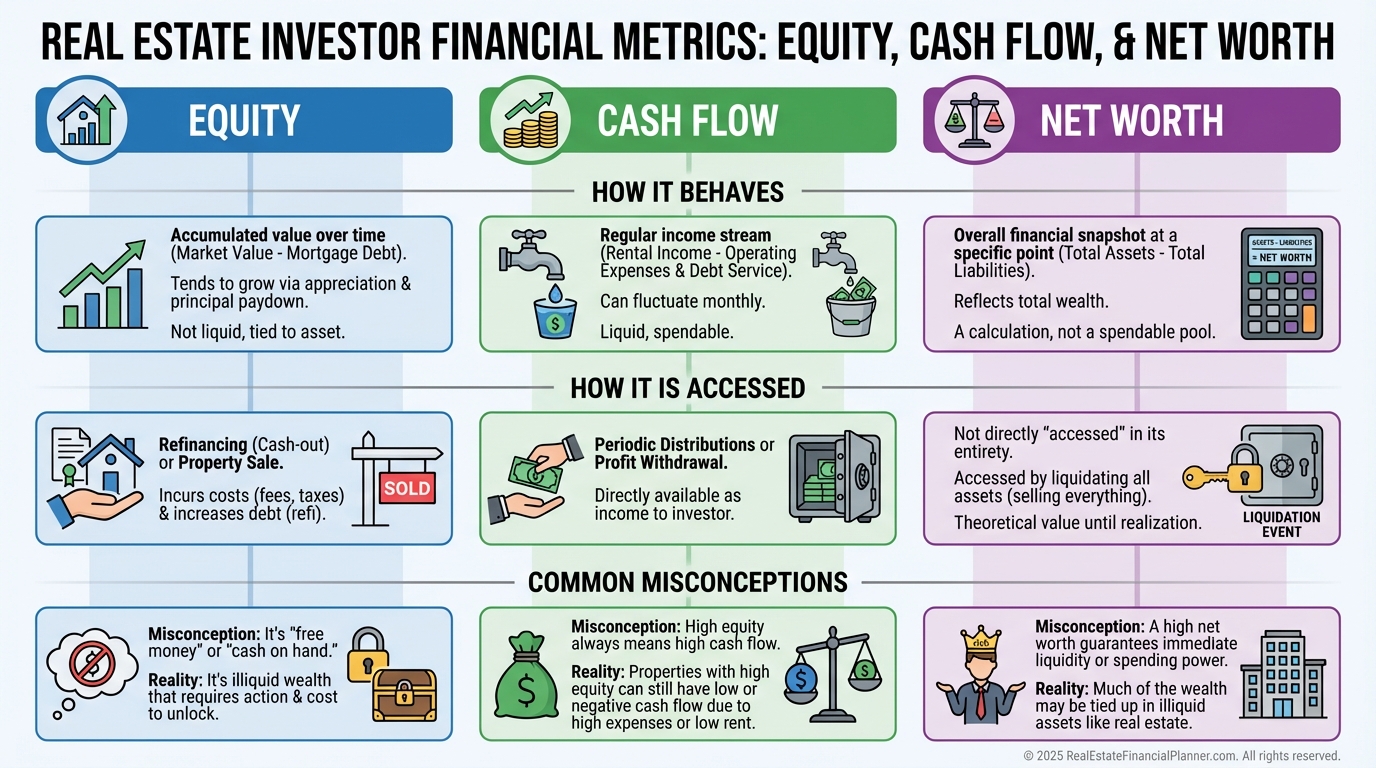

Infographic Prompt:

"Create a 16:9 infographic comparing equity, cash flow, and net worth for real estate investors, showing how each behaves, how each is accessed, and common misconceptions. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

I’ve seen investors with seven figures of equity struggle to qualify for financing because their equity was trapped, poorly structured, or inefficient.

Meanwhile, others with less net worth but better equity deployment quietly outperformed them.

The Equity Formula Most Investors Get Wrong

Most investors stop at this equation:

Market Value − Loan Balance = Equity

That’s headline equity.

It’s not usable equity.

When I help clients model real decisions, I use True Net Equity™ instead.

That means subtracting the real costs required to access that equity.

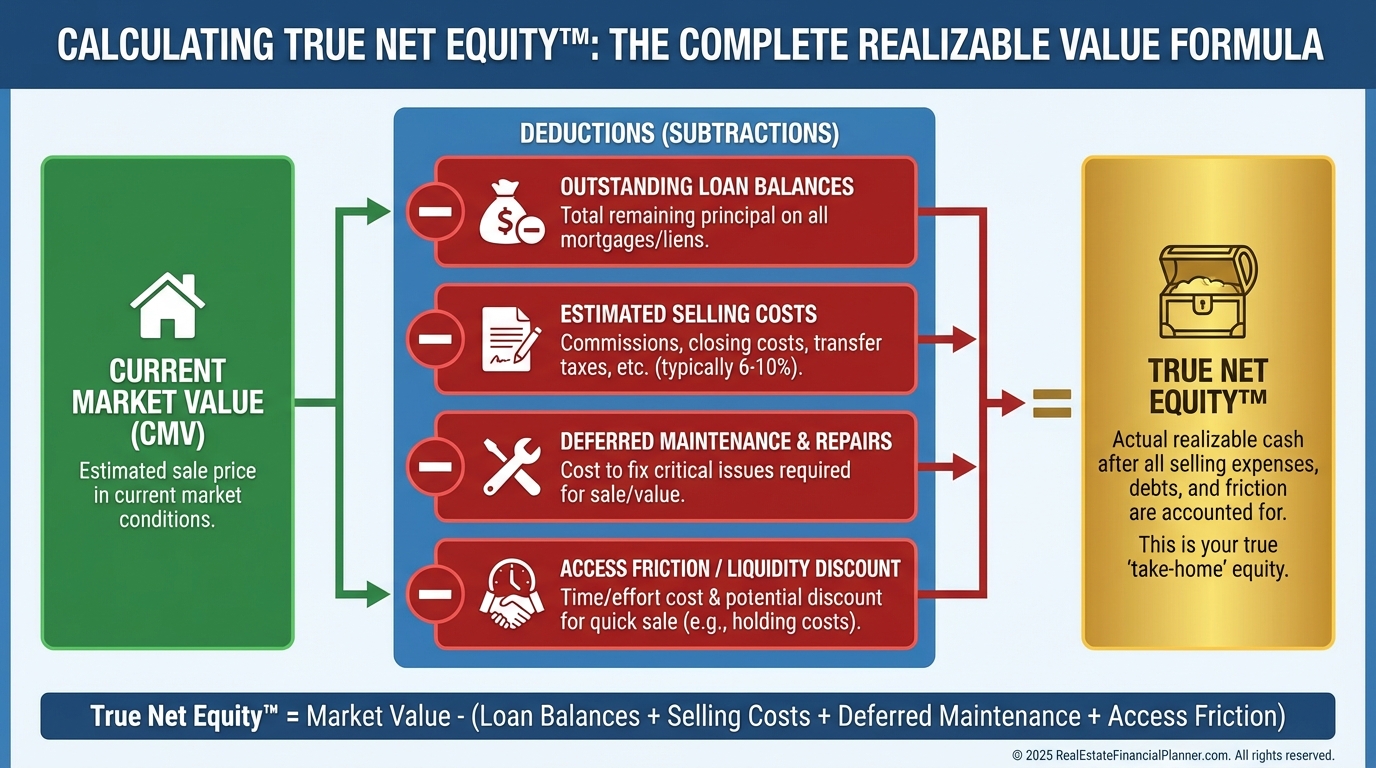

Infographic Prompt:

"Create a 16:9 infographic explaining how to calculate True Net Equity™, including market value, loan balances, selling costs, deferred maintenance, and access friction. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

True Net Equity accounts for:

•

Agent commissions

•

Repairs and deferred maintenance

•

Carrying costs

•

Taxes triggered on exit

Ignoring these inflates confidence and leads to bad decisions.

A Real Equity Example That Changes Decisions

When I review portfolios, this is a common pattern.

An investor believes they have $150,000 in equity.

After we run the numbers properly, the usable equity is closer to $95,000.

That difference determines:

•

Whether refinancing makes sense

•

How much risk they can absorb

•

What deals they can realistically pursue

Equity accuracy matters because it drives every downstream choice.

Equity and Return on Equity (ROE)

As properties age, equity grows.

That growth silently destroys returns if you don’t monitor it.

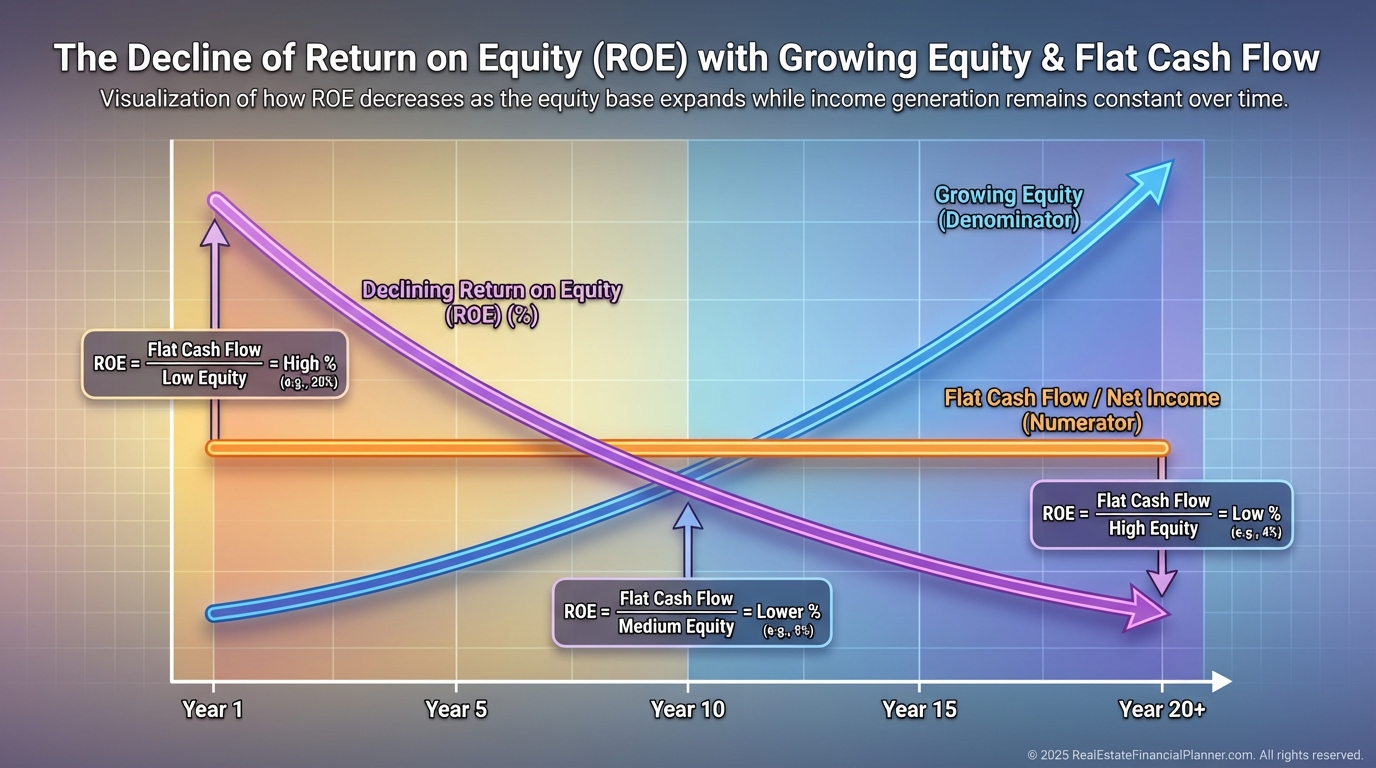

Infographic Prompt:

"Create a 16:9 infographic showing how Return on Equity (ROE) declines over time as equity grows while cash flow remains flat. Use a timeline or curve visualization with clear labels. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

When I review mature rentals with clients, ROE is often the wake-up call.

A property that once earned twenty percent on equity quietly drops to five percent.

Nothing broke.

Nothing changed.

The equity simply stopped working.

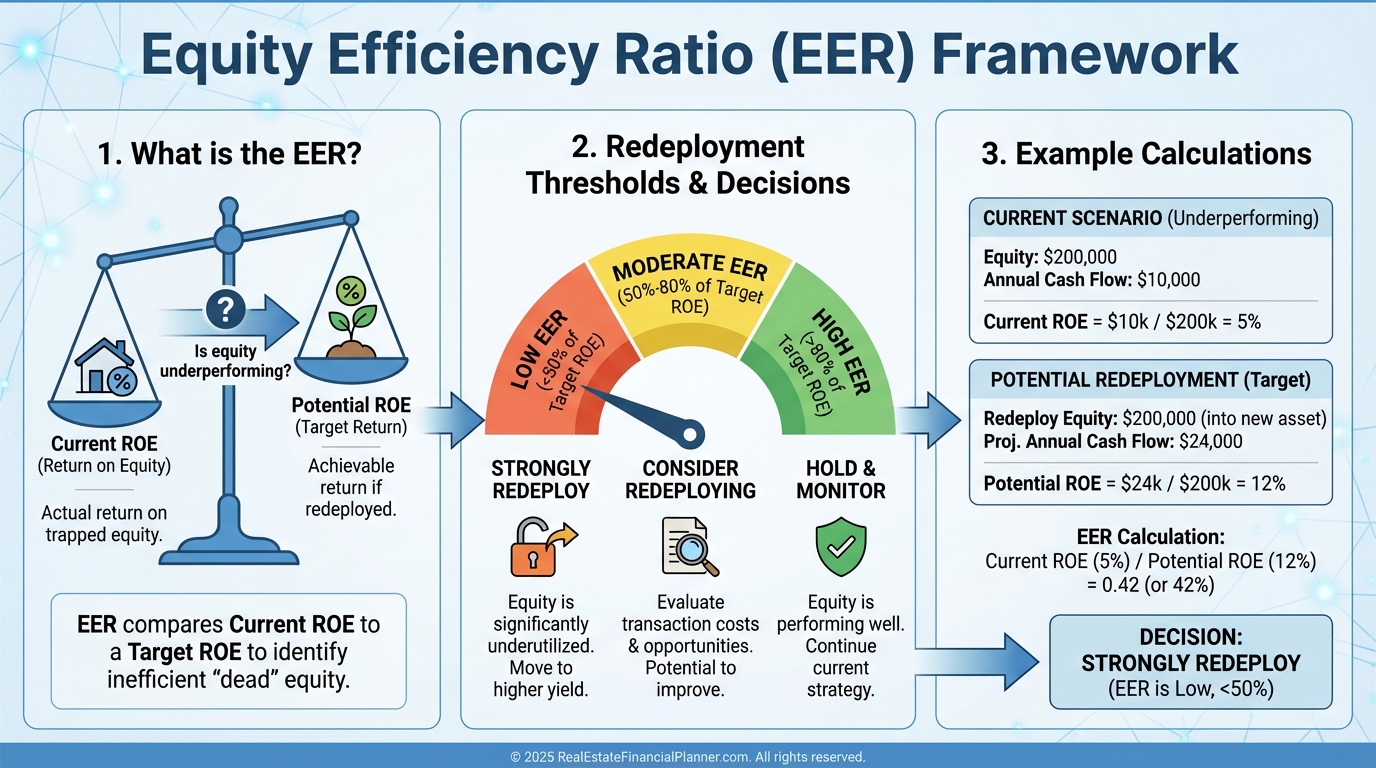

Equity Efficiency: The Metric That Drives Action

One of the simplest ratios I use with clients is what I call equity efficiency.

Annual Cash Flow ÷ Total Equity

Infographic Prompt:

"Create a 16:9 infographic explaining the Equity Efficiency Ratio, including thresholds for redeployment decisions and example calculations. Use clear labels, structured layout, and concise text. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

As a general framework:

Below eight percent signals underperformance.

Eight to twelve percent requires judgment.

Above twelve percent indicates efficient deployment.

This single number often reveals which properties are silently holding portfolios back.

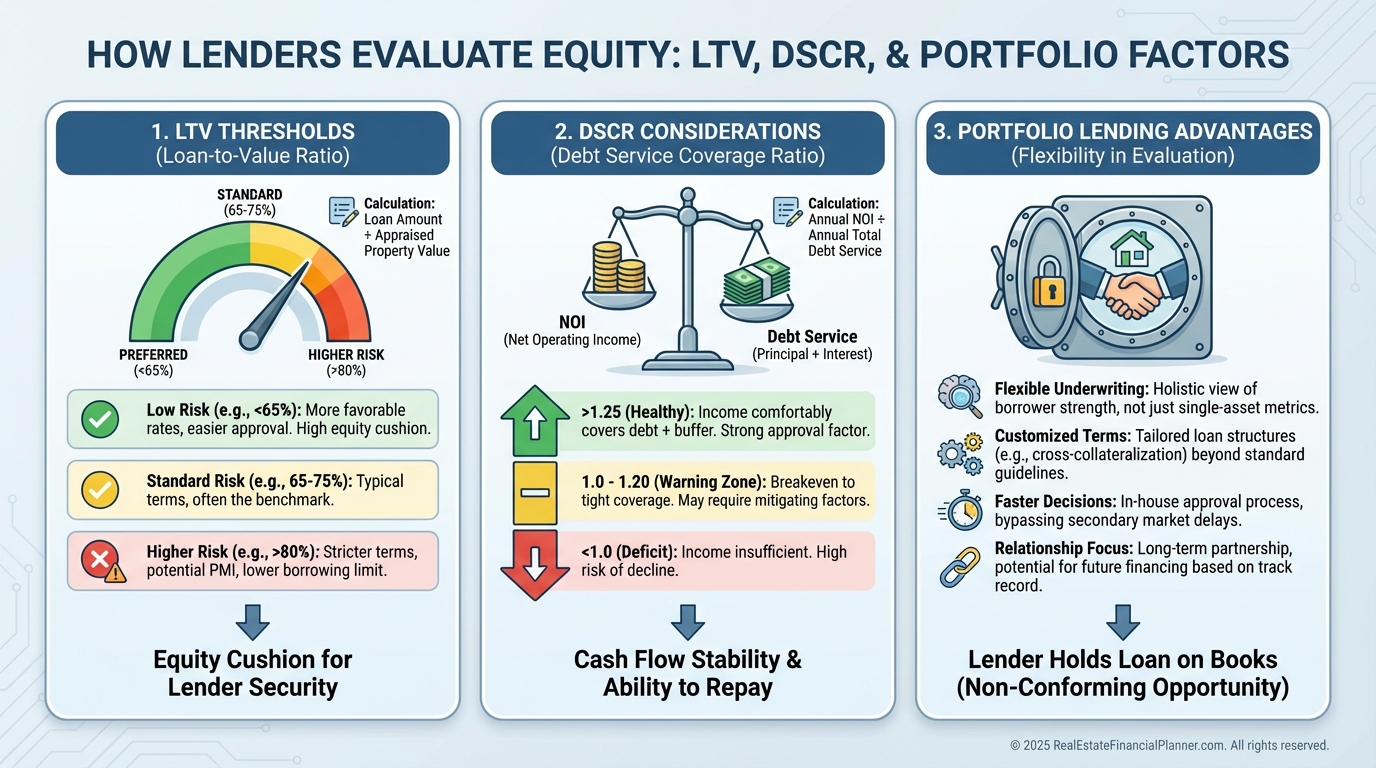

How Lenders Actually View Your Equity

Lenders don’t admire equity.

They measure risk.

High equity improves:

•

Loan-to-value ratios

•

Interest rates

•

Financing flexibility

Infographic Prompt:

"Create a 16:9 infographic showing how lenders evaluate equity, including LTV thresholds, DSCR considerations, and portfolio lending advantages. Use clear labels and structured sections. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

Once clients cross certain equity thresholds, portfolio lenders appear.

That’s where blanket loans, lines of credit, and cross-collateralization become available.

That’s a different game entirely.

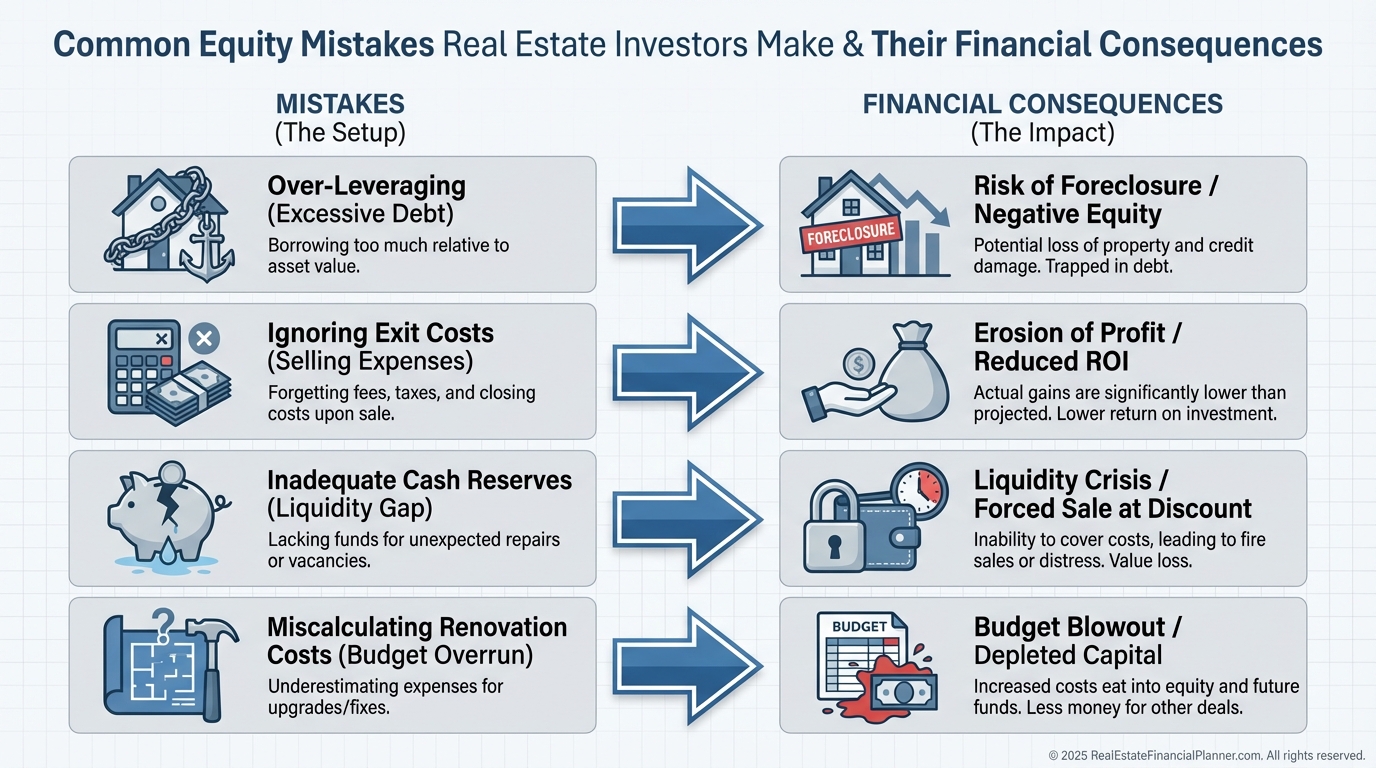

The Most Expensive Equity Mistakes I See

These mistakes show up constantly in portfolio reviews.

•

Treating equity as wealth instead of potential

•

Hoarding equity out of fear

•

Pulling equity without stress-testing cash flow

•

Using tax assessments instead of market data

•

Ignoring opportunity cost

•

Assuming equity only rises

Infographic Prompt:

"Create a 16:9 infographic outlining the most common equity mistakes real estate investors make and the financial consequences of each. Use icons, concise labels, and a clean layout. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

Equity hoarding is especially costly.

Idle equity earns nothing while inflation and opportunity cost quietly erode its value.

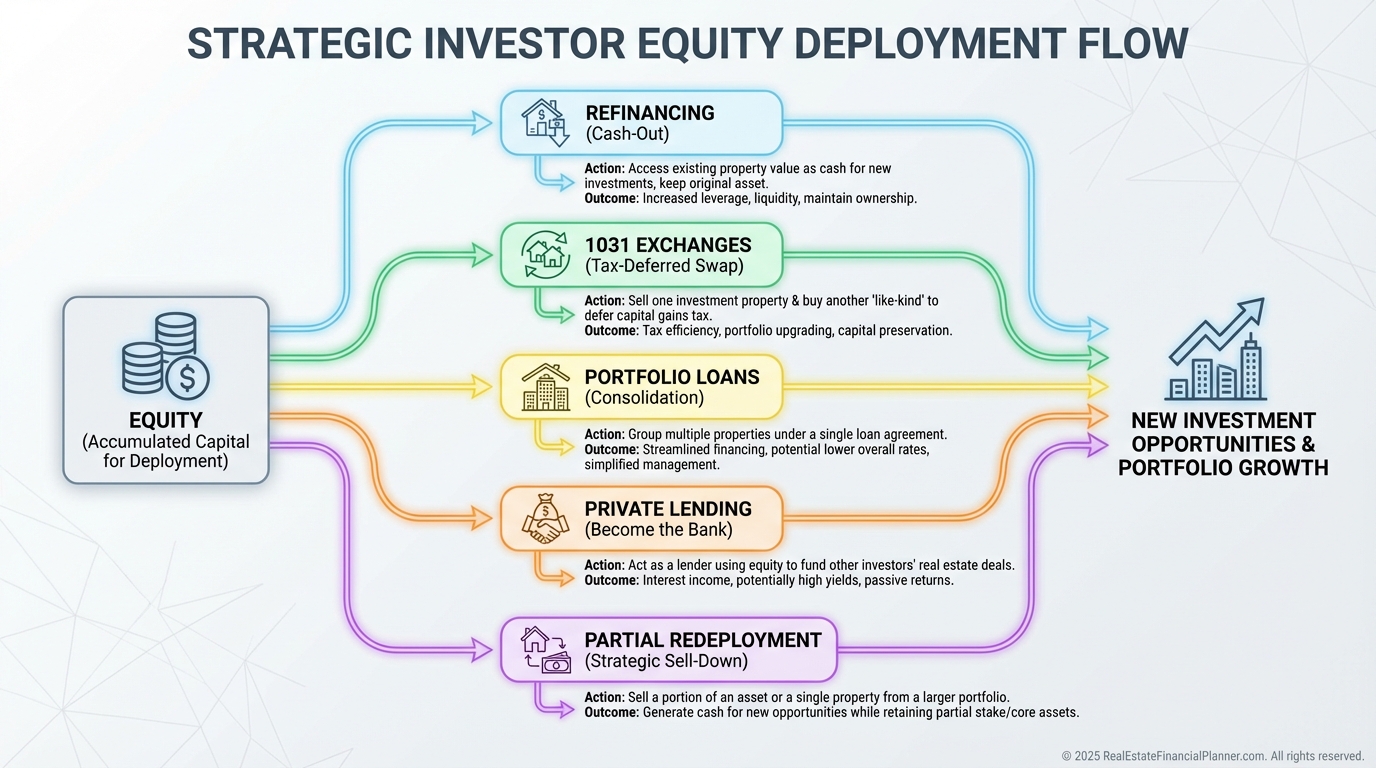

Strategic Equity Deployment in Real Portfolios

Sophisticated investors don’t ask, “How much equity do I have?”

They ask, “How efficiently is it working?”

Infographic Prompt:

"Create a 16:9 infographic showing strategic ways investors deploy equity, including refinancing, 1031 exchanges, portfolio loans, private lending, and partial redeployment. Use a decision-tree or flow layout. Add the text '© 2025 RealEstateFinancialPlanner.com. All rights reserved.' in a subtle position."

Equity becomes powerful when paired with intention.

That’s how investors scale without increasing risk recklessly.

Equity Is a Tool, Not a Trophy

When I help clients model decisions, equity is never the goal.

Performance is.

Cash flow stability is.

Optionality is.

Equity is simply one lever among many.

If you’re proud of your equity but haven’t measured its efficiency, you’re flying blind.

If you’re afraid to use it, you’re paying a hidden tax in missed opportunity.

The investors who build real wealth don’t just accumulate equity.

They deploy it with discipline.