Rent Credit, Done Right: Structure, Model, and Close Profitable Lease-Option Deals Without Legal Surprises

Learn about Rent Credit for real estate investing.

Why Rent Credit Belongs in Your Toolkit

When I help clients structure lease-options, rent credit is the lever that aligns incentives without giving away control.

Done wrong, it creates equitable interest, muddles taxes, and invites courtroom drama.

When I rebuilt after bankruptcy, I learned to love tools that lower risk while improving returns.

Rent credit can do both—if you follow a precise playbook.

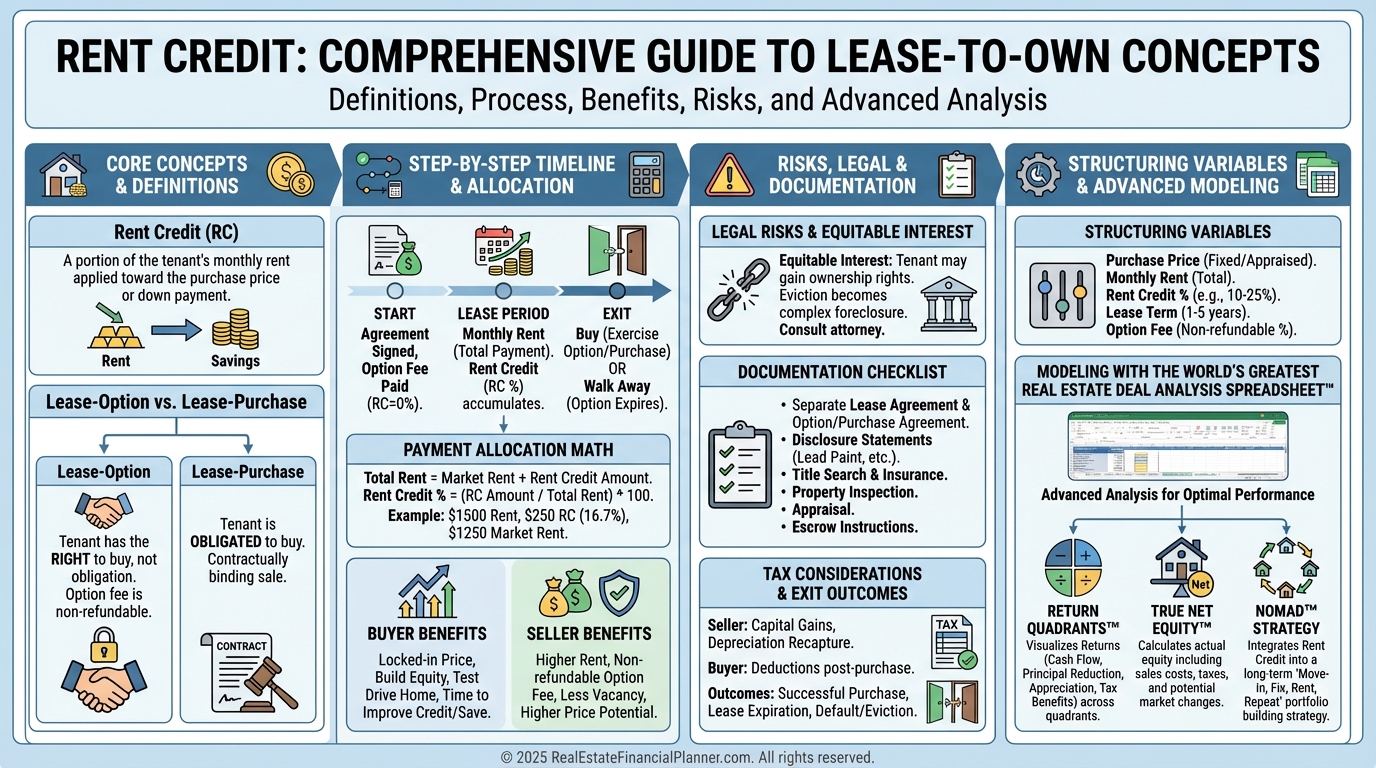

What Is Rent Credit?

Rent credit is an agreement where part of the monthly payment is credited toward a future purchase.

It typically lives inside a lease-option or lease-purchase with a set price and timeline.

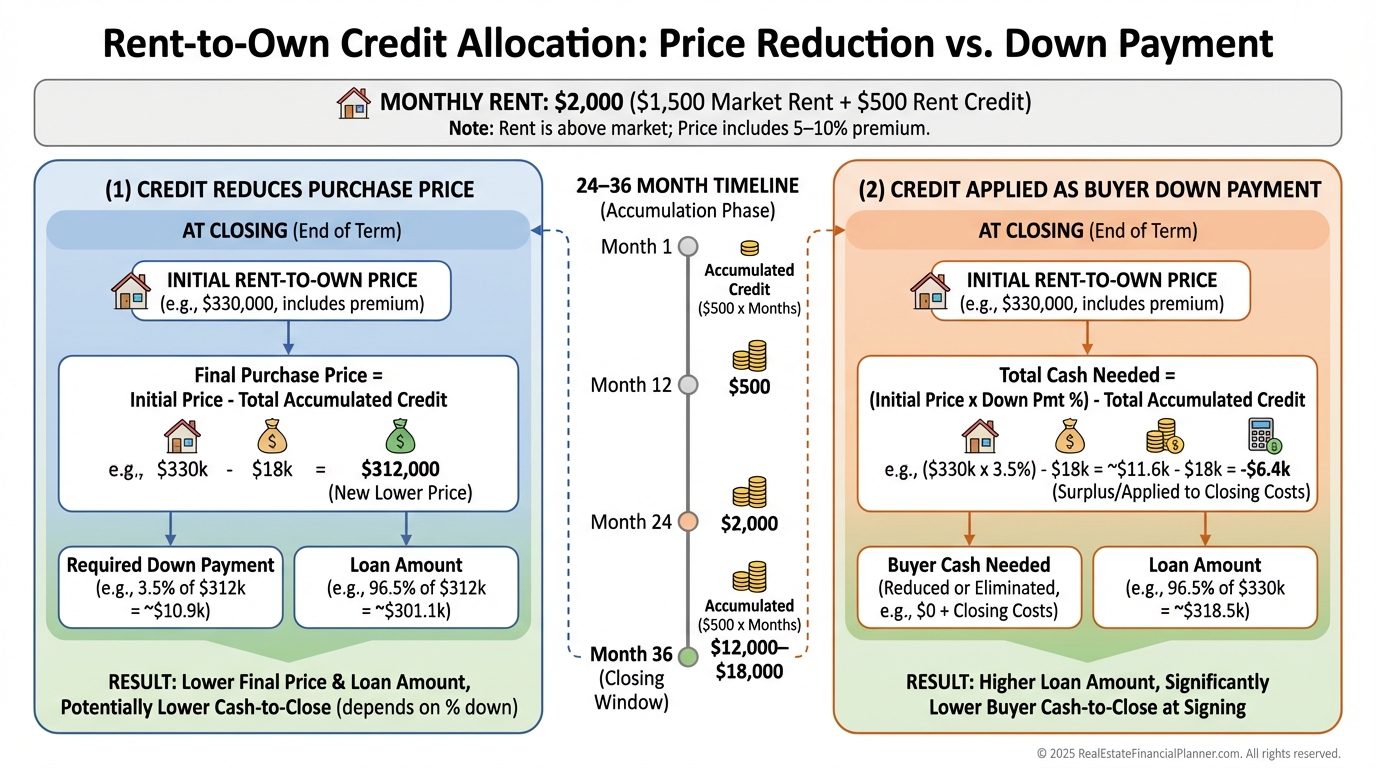

Credits can reduce the price at closing or count toward the buyer’s down payment—define which in writing.

Common credits range from 25% to 50% of the monthly rent, but the math must pencil for both parties.

Higher credits usually require above-market rent and a purchase price premium.

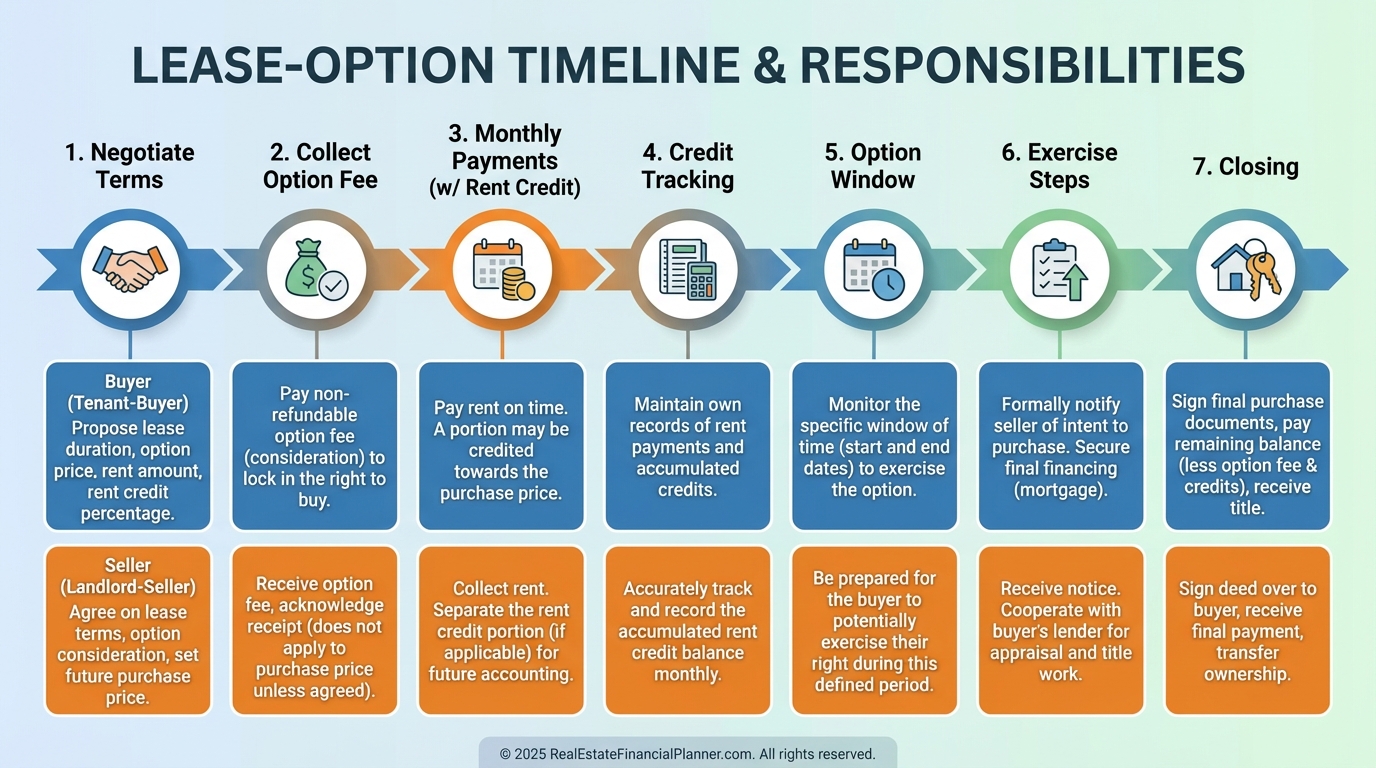

How Rent Credits Work (Step-by-Step)

Negotiate price, rent, credit amount, option fee, term, and conditions first.

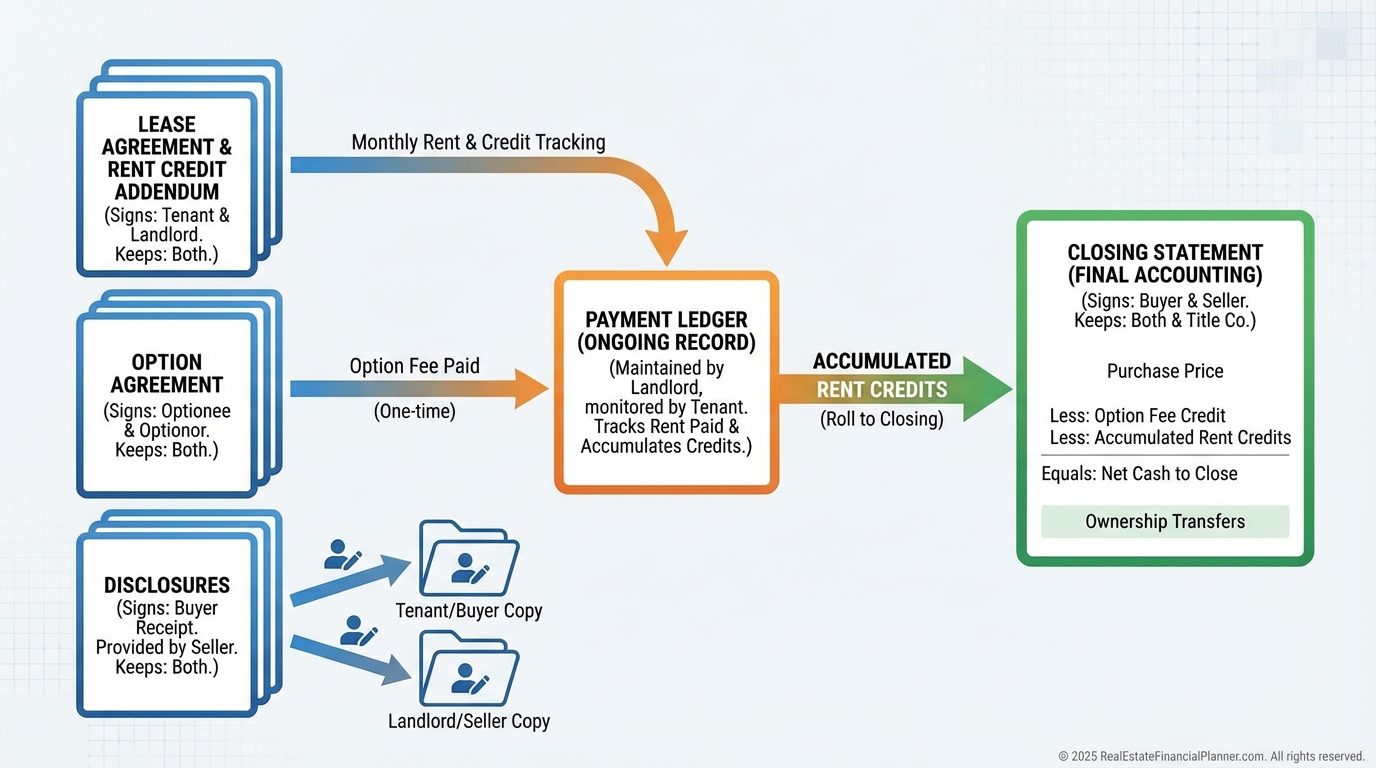

Then paper it with separate lease and option agreements, plus a rent credit addendum.

Collect a meaningful, non-refundable option fee and start monthly payments.

Track every payment and credit with a ledger that both parties can see.

Buyer decides to exercise within the option window; credits apply as agreed at closing.

If they don’t exercise, the seller typically keeps the option fee and above-market rent.

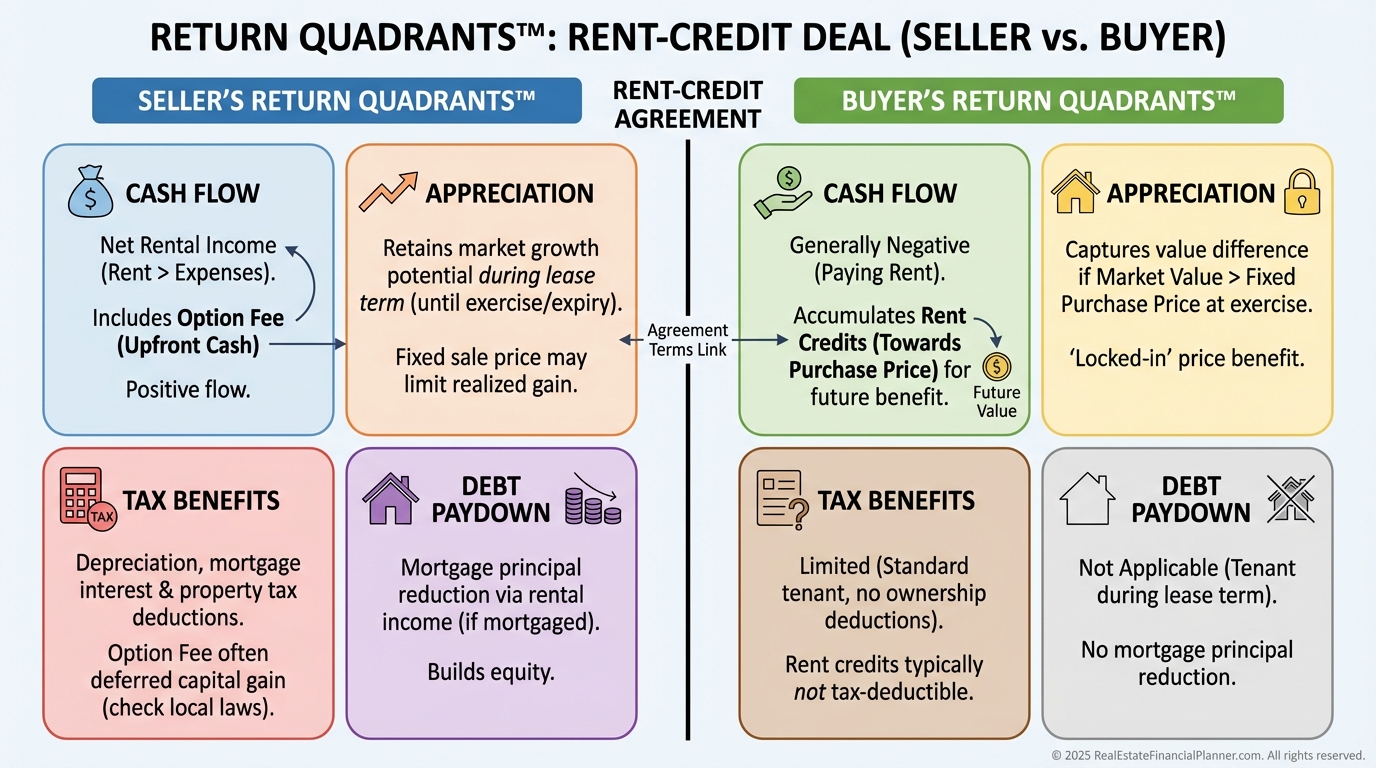

Benefits for Sellers

Tenant-buyers pay a premium for the pathway to ownership.

That premium often exceeds the credit, improving cash flow today while preserving exit flexibility.

Motivated occupants tend to care for the property, reducing calls and turnover.

You can price the property 5–10% above today’s market to reflect convenience, risk, and time value.

If the buyer doesn’t purchase, you keep the option fee and premiums and can repeat the strategy.

Benefits for Buyers

Rent credit can bridge the gap while you repair credit, season income, or bolster reserves.

You live in the home you intend to buy and lock a price in advance.

Each month, you’re building a tangible benefit instead of paying pure rent.

I coach buyer clients to use this time to lower DTI, pay off revolving debt, and save closing costs.

Nomad™ investors sometimes use rent credit for a primary home that becomes a future rental.

Legal Considerations and Risk Control

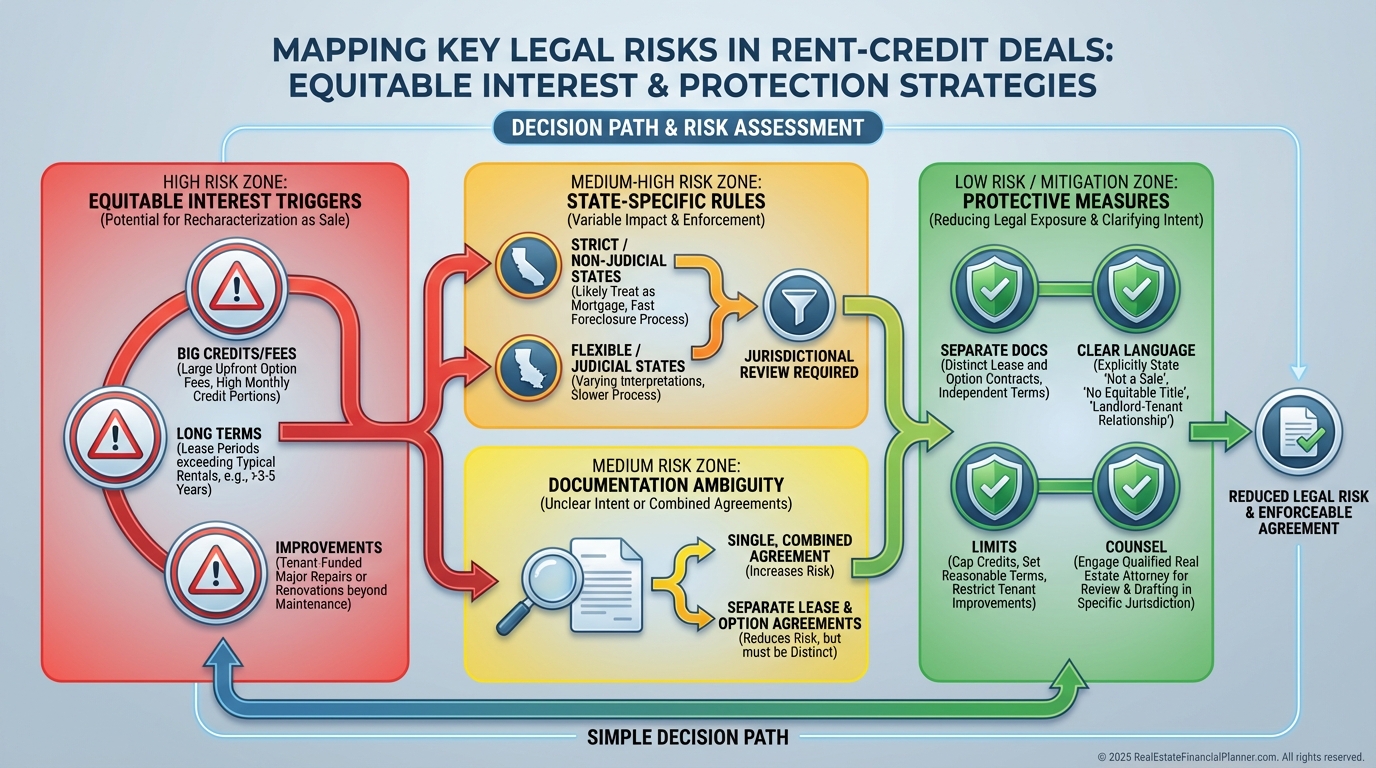

Your biggest legal risk is accidentally creating equitable interest.

That risk spikes with large credits, large option fees, long terms, or granting major improvement rights.

Keep lease and option as separate documents.

Avoid language that confers owner-like rights or responsibilities on the tenant.

Use state-specific forms and counsel; rules vary widely by jurisdiction.

If you need additional separation, consider standard market rent plus a separate promissory note for extra funds instead of an in-lease credit.

How I Structure Rent Credit Deals

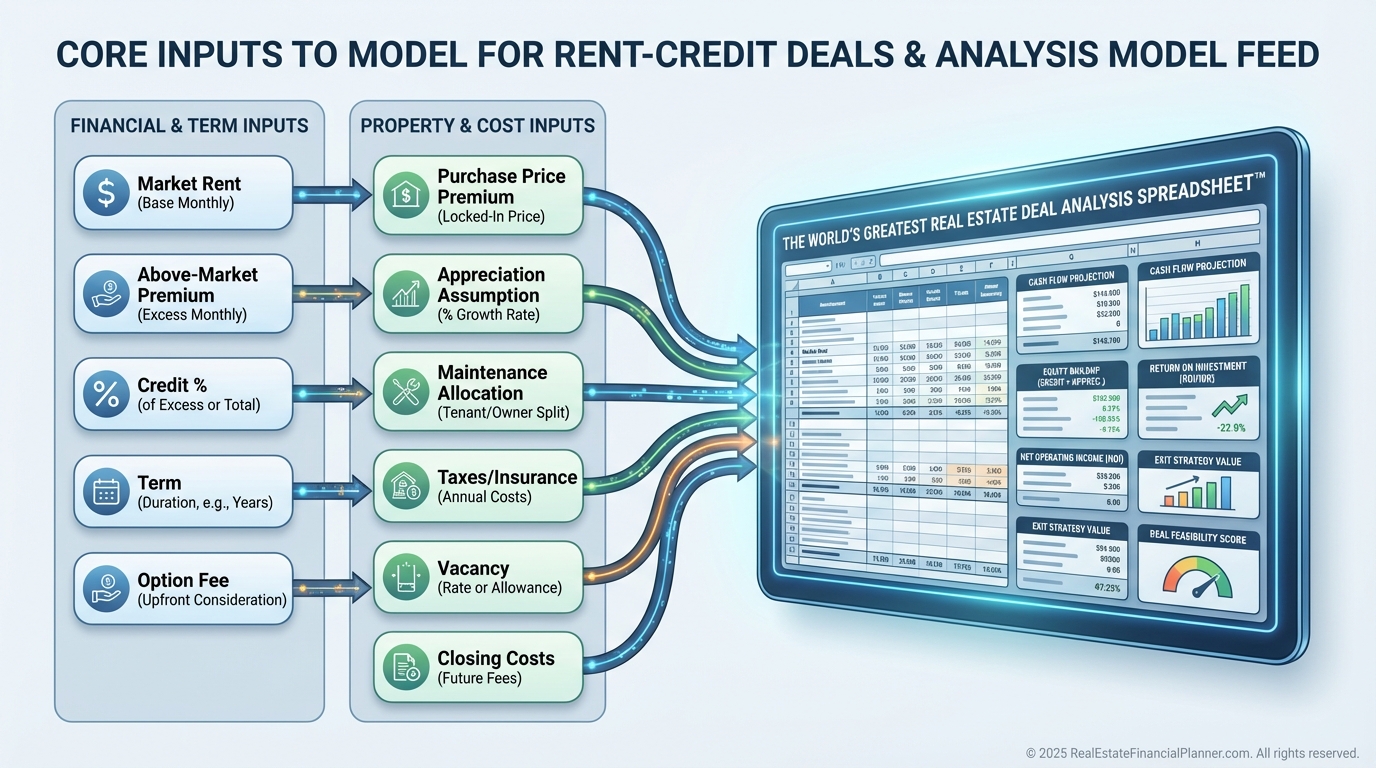

I start with The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to stress-test the deal for both sides.

I model rent, credit percent, price premium, option fee, term, appreciation, maintenance, taxes, insurance, and vacancy.

Then I verify lender line-of-sight so the buyer’s credits will be recognized under the chosen structure.

I cap credits to avoid creating an outsized perceived equity position relative to down payment requirements.

I define exactly how credits apply at closing—price reduction vs closing credit—so underwriting is smooth.

Pricing, Credits, and Option Fees

Price the home at today’s value plus 5–10% to reflect appreciation risk and carrying cost.

Set rent slightly above market if credits are meaningful, so net yield remains attractive.

Keep credits in the 25–50% of rent range for most deals.

Collect a 1–5% option fee—big enough to signal commitment, small enough to be achievable.

Spell out whether any portion of the option fee is credited at closing.

Documentation That Protects You

Use a standard lease.

Use a separate option agreement.

Attach a rent credit addendum that defines the monthly credit and its application.

Add disclosures, default provisions, maintenance responsibilities, and a ledger requirement.

Record a memorandum only if counsel advises; sometimes privacy and flexibility serve you better.

Taxes and Accounting

Sellers typically treat monthly payments as rent until the sale closes.

Option fees are generally recognized at exercise or expiration; confirm timing with your CPA.

Buyers usually cannot deduct rent; credits are not mortgage interest.

At closing, credits can change basis and cash needed—track precisely.

I reconcile all credits monthly so nobody is surprised at the closing table.

Common Mistakes I See (And How to Avoid Them)

Credits so large they telegraph ownership.

Letting buyers do major improvements without written limits and approvals.

Sloppy documents that blur lease and option terms.

No shared ledger for payments and credits.

Pricing the home without a premium, then regretting it two years later.

A simple rule: if it helps you sleep at night and pass underwriting, keep it. If not, change it.

Case Study: A Clean, Profitable Rent-Credit Deal

Purchase price today is $400,000.

We set the option price at $428,000 (7% premium) for 30 months.

Market rent is $2,200; we charge $2,450 with a $600 credit.

Option fee is 3% ($12,000), non-refundable, with $10,000 credited at closing.

Buyer cleans up credit and seasons income while building a $600 x 30 = $18,000 credit.

At closing, the spreadsheet shows the seller captured premium rent, preserved appreciation, and minimized maintenance calls.

For the buyer, Return Quadrants™ shifts from zero cash flow ownership to strong appreciation capture and debt paydown post-close.

We verify True Net Equity™ for the buyer at closing by subtracting selling costs and loan payoff assumptions from the market value, ensuring the numbers are honest.

This deal works because the math was modeled first, then documented tightly.

Action Plan and Next Steps

Model three versions in The World’s Greatest Real Estate Deal Analysis Spreadsheet™: conservative, expected, and stretch.

Have counsel customize state-compliant lease, option, and rent credit addendum templates.

Cap credits and terms to manage equitable interest risk.

Track payments and credits in a shared ledger from day one.

Confirm with a lender how credits will be recognized for the buyer’s loan program.

Start with shorter terms and modest credits; scale once your process is tight.

If in doubt, use market rent plus a separate promissory note instead of an in-lease credit.