Asset Protection for Real Estate Investors: How to Keep One Lawsuit From Wiping You Out

Learn about Asset Protection for real estate investing.

Building wealth with real estate is exciting.

Losing it because of a lawsuit is devastating.

When I help investors analyze deals or structure portfolios, asset protection is always part of the conversation, even if they wish it wasn’t. You cannot separate “making money” from “keeping money.”

I learned this lesson the hard way.

After bankruptcy and foreclosures, I rebuilt very deliberately. One of my non-negotiables was never allowing a single lawsuit to take down everything again.

Asset protection is not about paranoia.

It is about acknowledging reality.

Understanding Asset Protection

Asset protection is the system you use to make yourself a hard target.

Not invisible.

Not untouchable.

Just expensive and annoying to pursue.

The goal is simple.

Make lawsuits settle for insurance limits or never get filed at all.

There are two primary layers.

Insurance is your first line of defense.

Legal structures are your second.

When both are designed correctly, most problems never reach you personally.

Why Real Estate Investors Face Unique Risk

When you buy rental property, you inherit risk you cannot diversify away.

Tenants slip and fall.

Contractors get injured.

Neighbors claim damage.

Cities enforce code violations.

Even driving to check on your properties exposes you to liability that can attach to your net worth.

Without asset protection, everything you own is connected.

Your rentals.

Your bank accounts.

Your brokerage accounts.

Your future income.

Asset protection is how you break those connections.

Good Enough Beats Perfect

I see investors delay asset protection constantly.

They want the perfect structure.

The perfect state.

The perfect attorney.

Meanwhile, they own properties in their personal name with minimum insurance.

This is backwards.

Start simple.

Improve over time.

Asset protection is cumulative. Each layer helps, even if it is not perfect.

The Core Asset Protection Layers

No single strategy works on its own.

Protection comes from stacking defenses.

Insurance Coverage

Insurance handles most problems before attorneys ever get involved.

Landlord policies.

General liability.

Commercial umbrella insurance.

When I review portfolios, underinsurance is one of the most common issues I see. Saving a few hundred dollars per year creates catastrophic downside.

Umbrella insurance is one of the best risk-adjusted investments you can make.

Legal Entity Structures

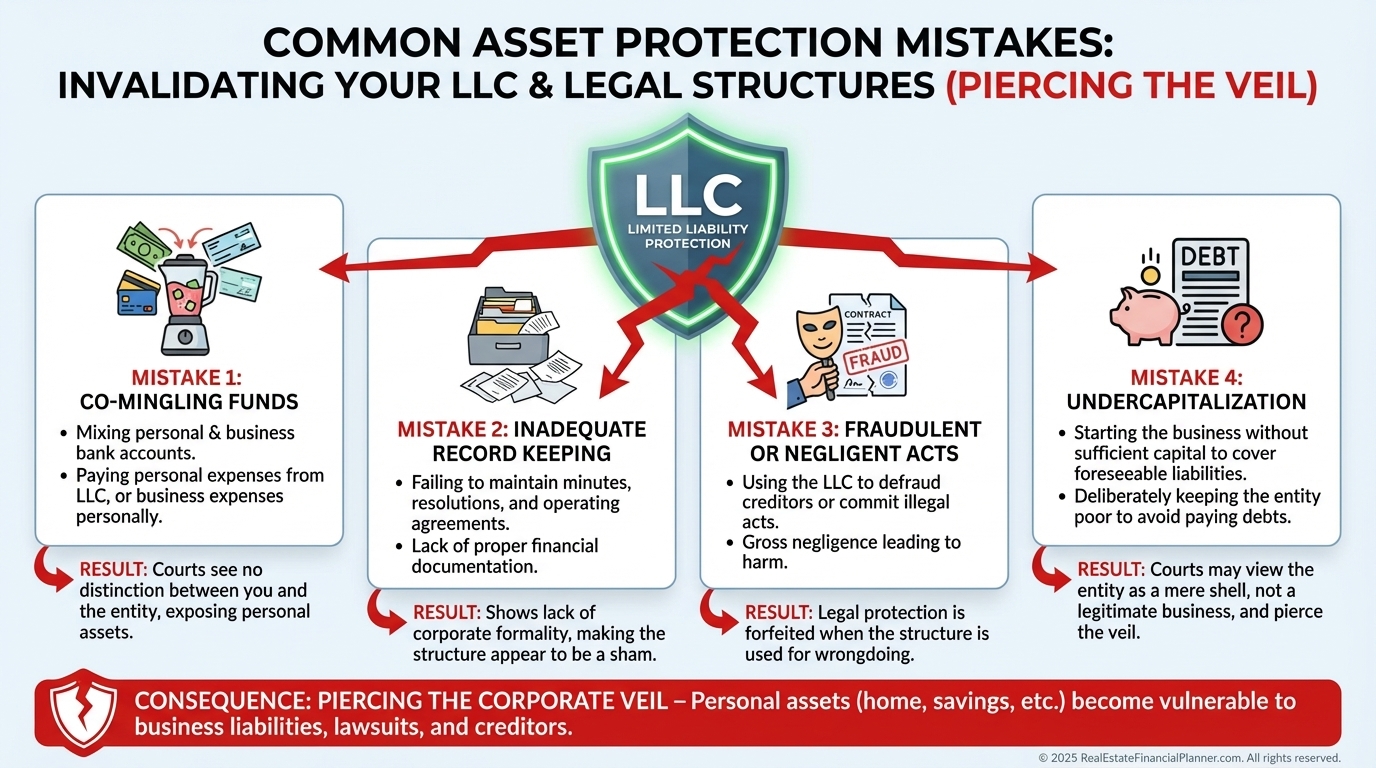

LLCs exist to separate risk.

The property takes the hit.

You do not.

That separation only works if you respect it.

Separate bank accounts.

Proper documentation.

No commingling of funds.

Single-member LLCs are a good starting point.

Multi-member LLCs often provide stronger protection, depending on state law.

When I model deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I include entity costs because protection is part of the investment, not an optional add-on.

Equity Exposure Matters

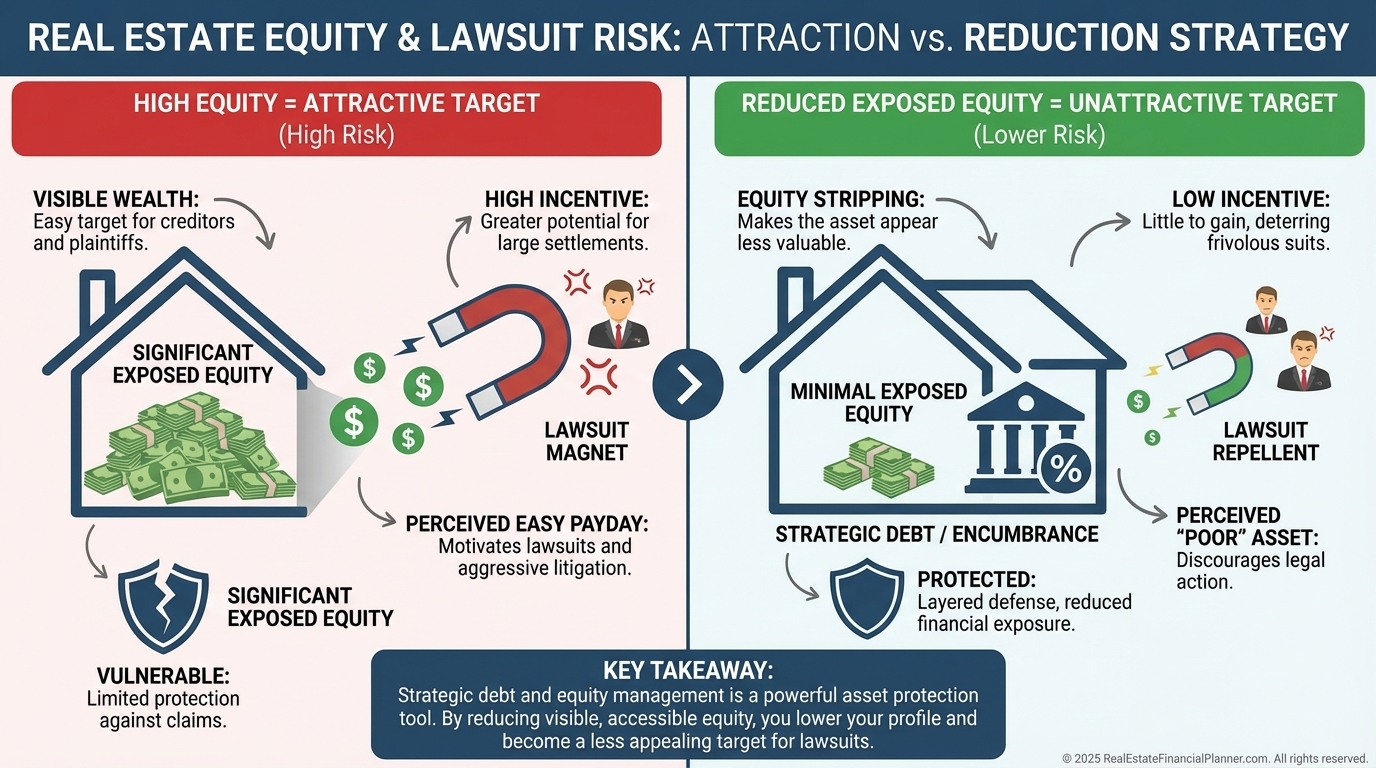

Lawsuits follow equity.

A property with little equity is unattractive.

A property with large exposed equity is a magnet.

This is why I often talk about equity differently than most investors.

Raw equity is not safety.

True Net Equity™ is what matters.

Equity stripping, lines of credit, and strategic leverage reduce what a creditor can realistically reach.

These strategies must be done long before trouble appears.

Timing matters.

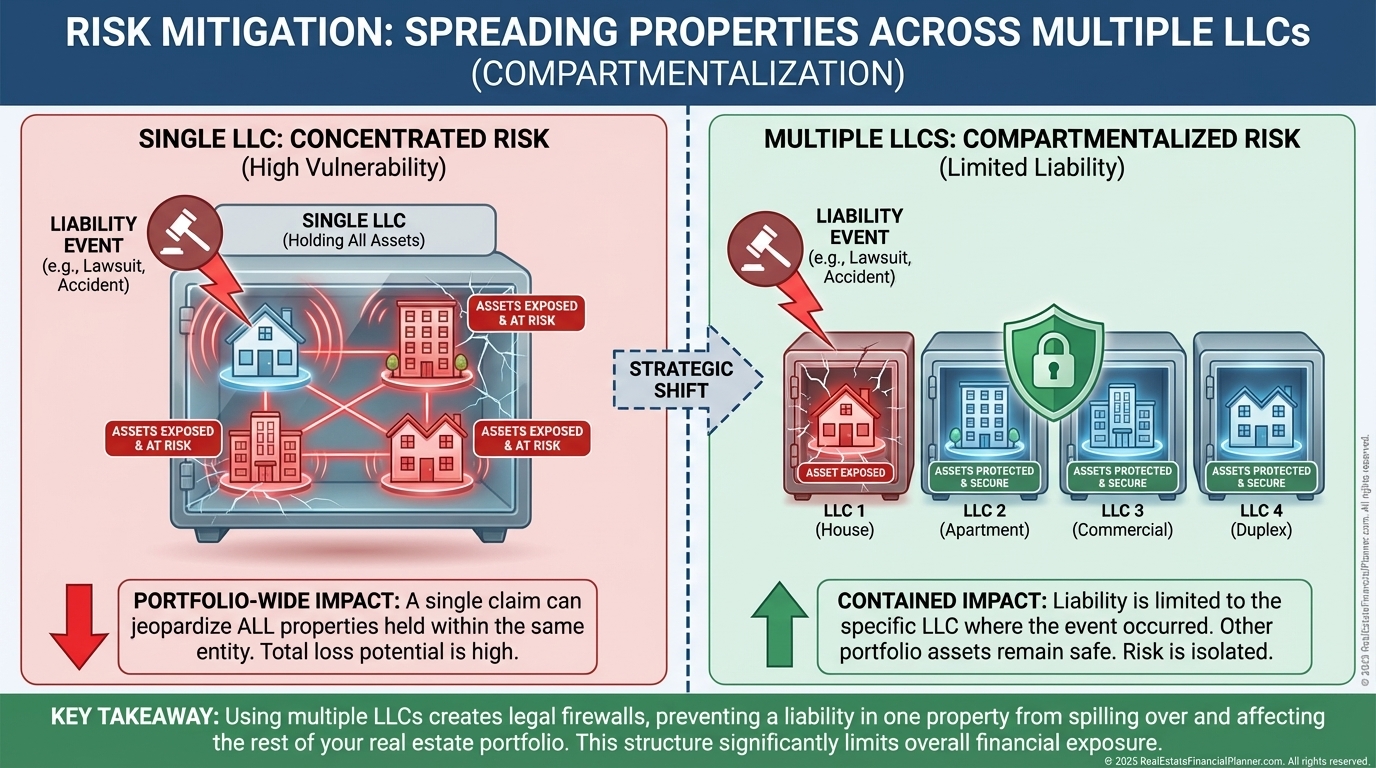

Multiple Entity Strategy

One property per LLC sounds nice.

It is rarely practical.

What matters is equity concentration and risk grouping.

I usually see investors do best grouping three to five similar properties per entity, adjusting based on value, location, and risk profile.

Pools, bad neighborhoods, or high equity often justify separate entities.

The goal is controlled damage, not total isolation at all costs.

Privacy and Anonymity

Privacy is not liability protection.

But it is deterrence.

Land trusts and anonymity tactics make you harder to research and less attractive to contingency-fee attorneys.

When layered with LLCs and insurance, anonymity reduces how often you are targeted in the first place.

This is about reducing attention, not hiding assets illegally.

Common Asset Protection Mistakes

I see the same failures repeatedly.

Commingling funds destroys protection.

DIY legal work creates false confidence.

Overcomplicated structures drain time and money.

The worst mistake is waiting until something goes wrong.

Asset protection only works when it is boring and uneventful.

How I Think About Asset Protection Today

Asset protection is part of deal analysis.

It is part of portfolio design.

It is part of peace of mind.

I do not chase perfection.

I chase resilience.

Just like cash flow resiliency or equity resiliency, asset protection is about surviving bad outcomes without permanent damage.

You do not need to eliminate risk.

You need to survive it.