Gross Operating Income: The Investor’s Playbook for Accurate Cash Flow, Valuation, and DSCR

Learn about Gross Operating Income for real estate investing.

Why Gross Operating Income Is the First Number I Verify

When I help clients underwrite a deal, I don’t start with price. I start with Gross Operating Income because it sets the ceiling for everything downstream.

If we get GOI wrong, all the sexy metrics lie—NOI, DSCR, value, cash-on-cash, and even True Net Equity™.

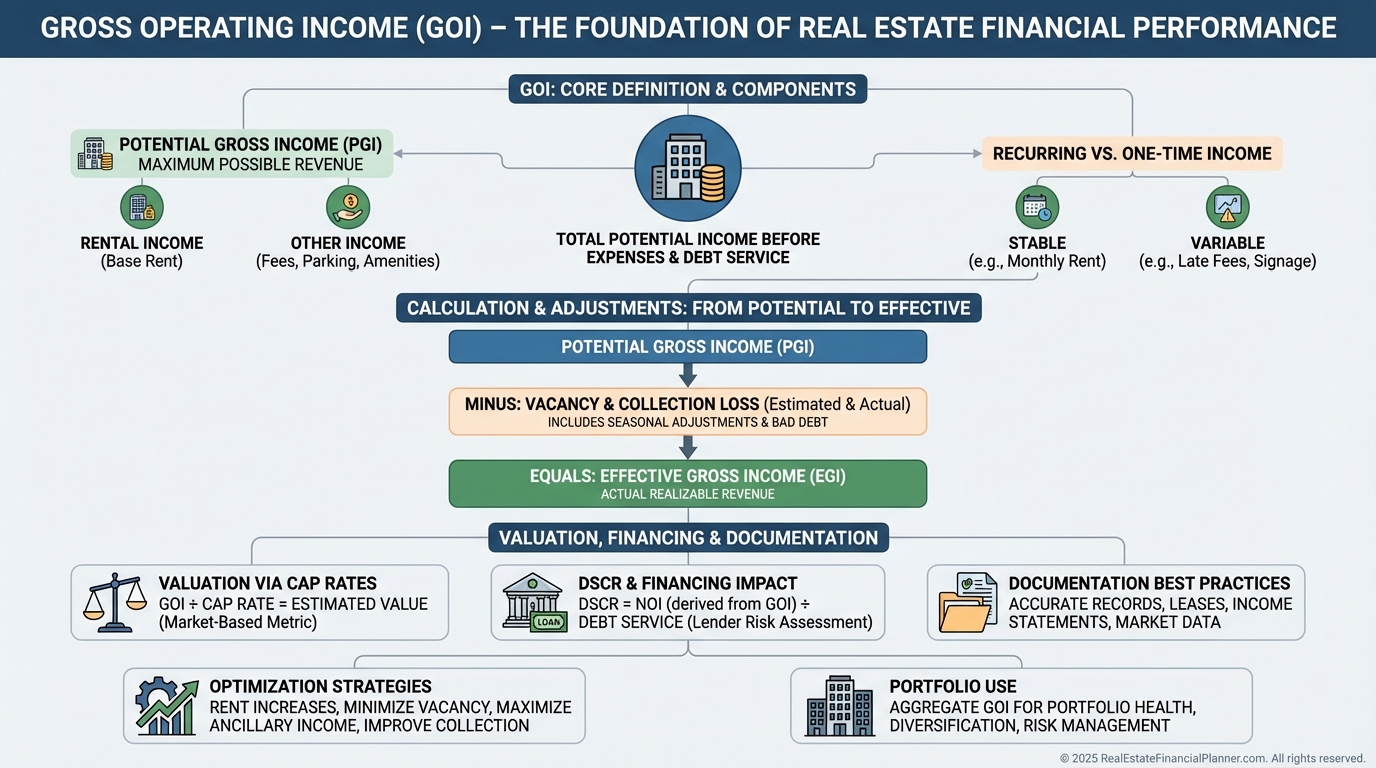

What Counts as GOI (And What Doesn’t)

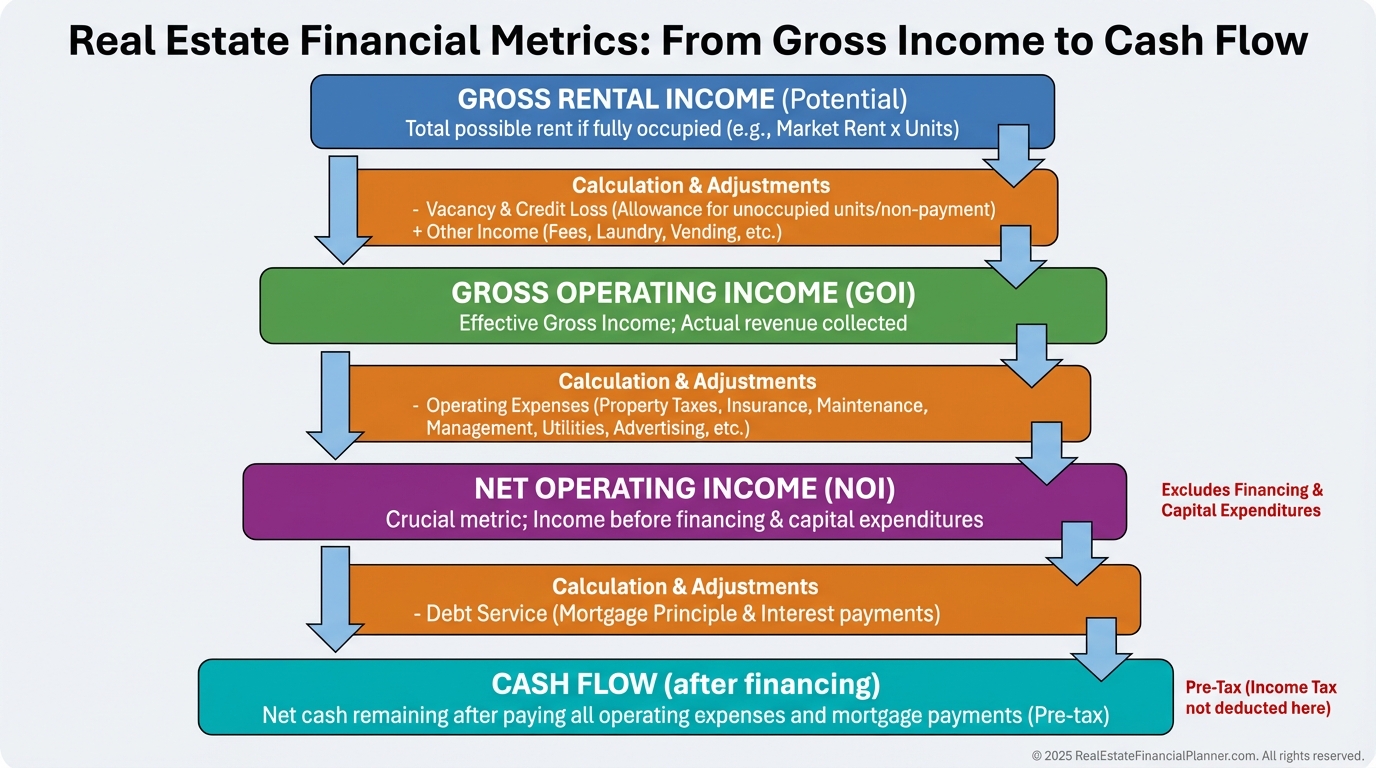

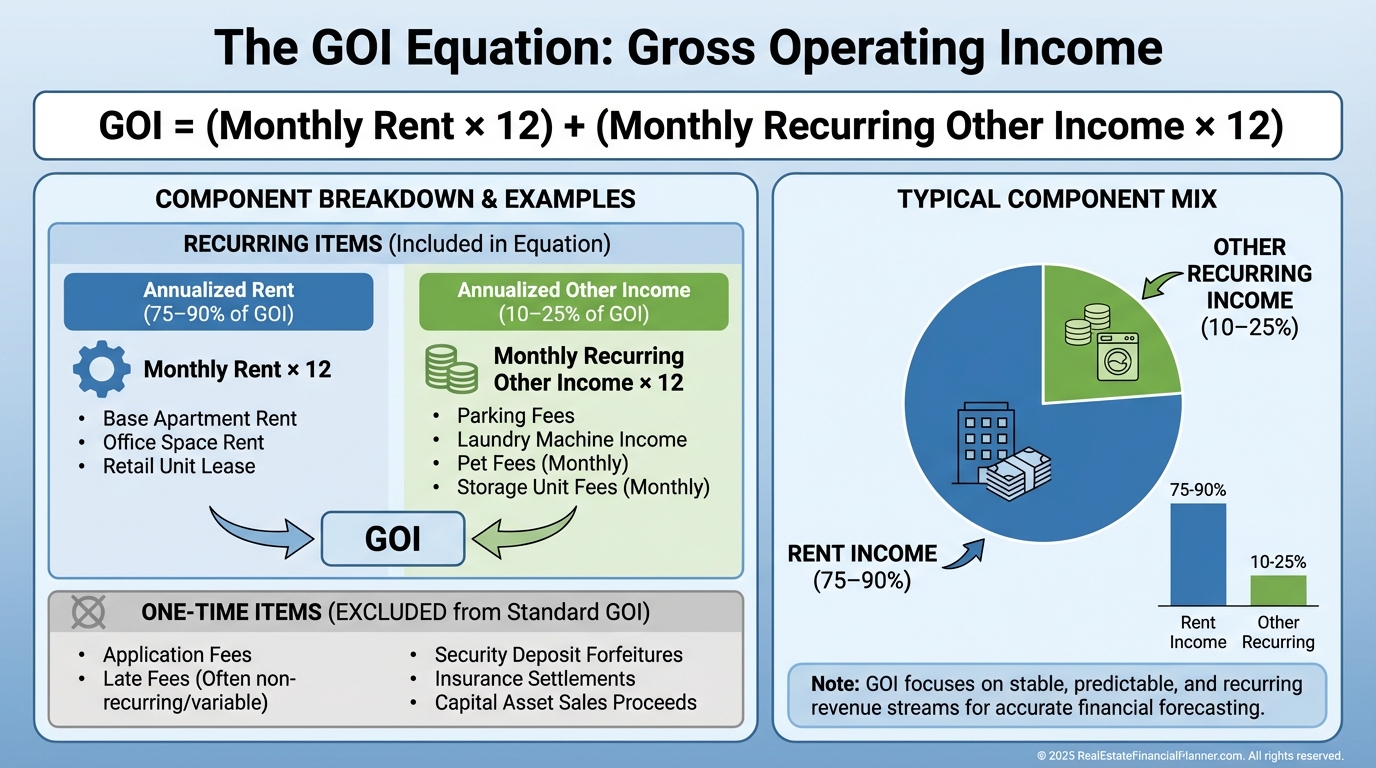

Gross Operating Income is annual rent plus annual other recurring income before operating expenses.

Rent is usually 75–90% of GOI, but the last 10–25% often decides whether a deal cash flows.

Recurring income includes parking, storage, pet rent, RUBS, laundry, and premium amenities. I model each line item monthly, then annualize.

One-time charges like application fees, late fees, lease-up bonuses, and move-in fees do not belong in GOI. They are sporadic and not bankable.

If I can’t document it in a lease or a standing addendum, I won’t include it in GOI. Lenders and appraisers think the same way.

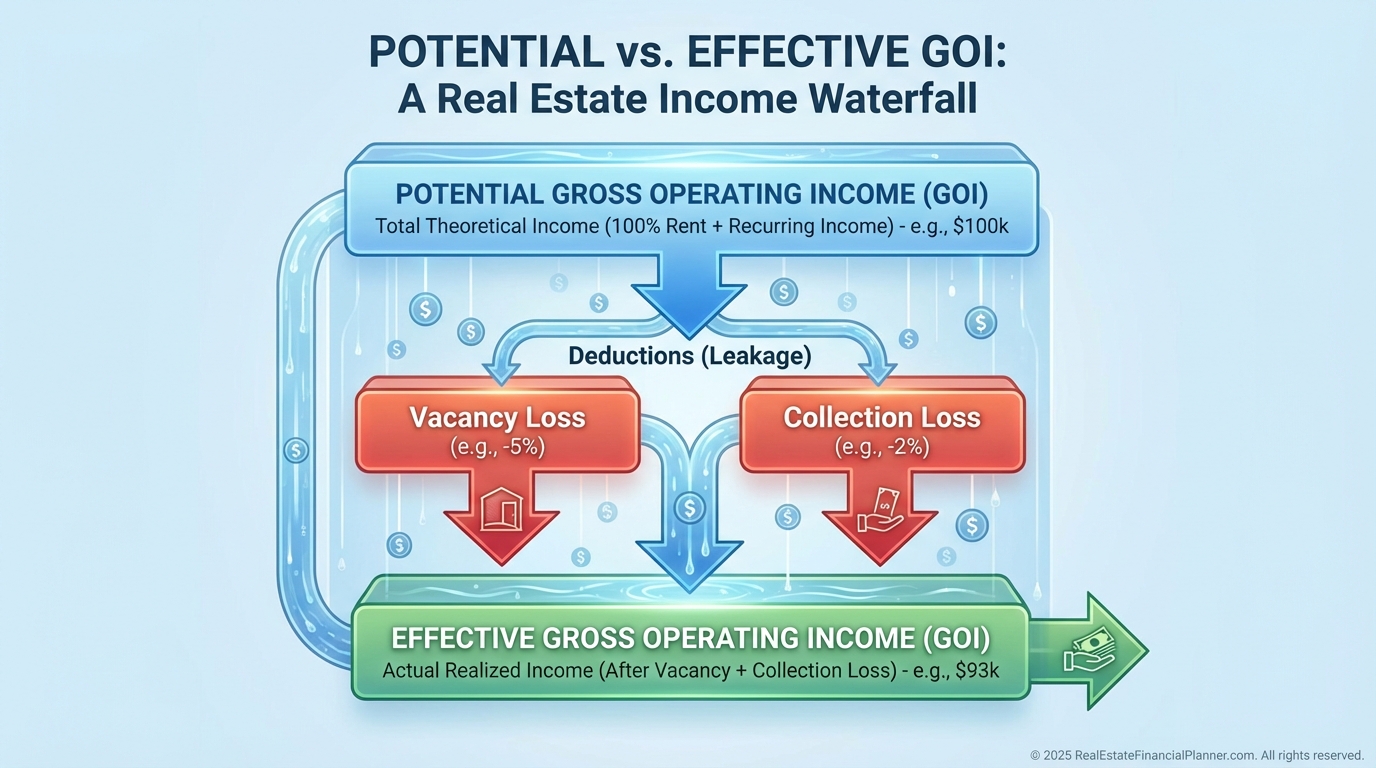

From Potential to Effective GOI

Potential GOI assumes 100% occupancy and perfect collections. It’s a starting point, not reality.

Effective GOI subtracts vacancy and collection loss to reflect what you’ll likely collect.

In most markets I model 5–8% vacancy for stabilized assets and 8–12% for value-add. Then I apply 1–3% collection loss depending on tenant profile and management quality.

Seasonal assets need monthly modeling. College rentals, vacation markets, and snowbird towns are not linear.

If premium rent only holds six months, I average it with off-season months rather than multiplying the peak by twelve.

Fieldwork: How I Verify and Model GOI

On existing properties, I start with the rent roll, last 24 months of bank statements, and every lease and addendum.

Then I walk the property to confirm income sources actually exist and are usable. A ‘storage’ line item means nothing if the room is full of owner junk.

I call two property managers for market validation of parking, laundry, pet rent, and RUBS. I want utilization rates, not just posted prices.

For acquisitions, I underwrite GOI two ways: “as-is trailing-12” and “stabilized year-1.” The World’s Greatest Real Estate Deal Analysis Spreadsheet™ makes this easy to compare.

Conservatism wins. I assume the lower of market rent or in-place rent, and the lower of claimed or validated other income utilization.

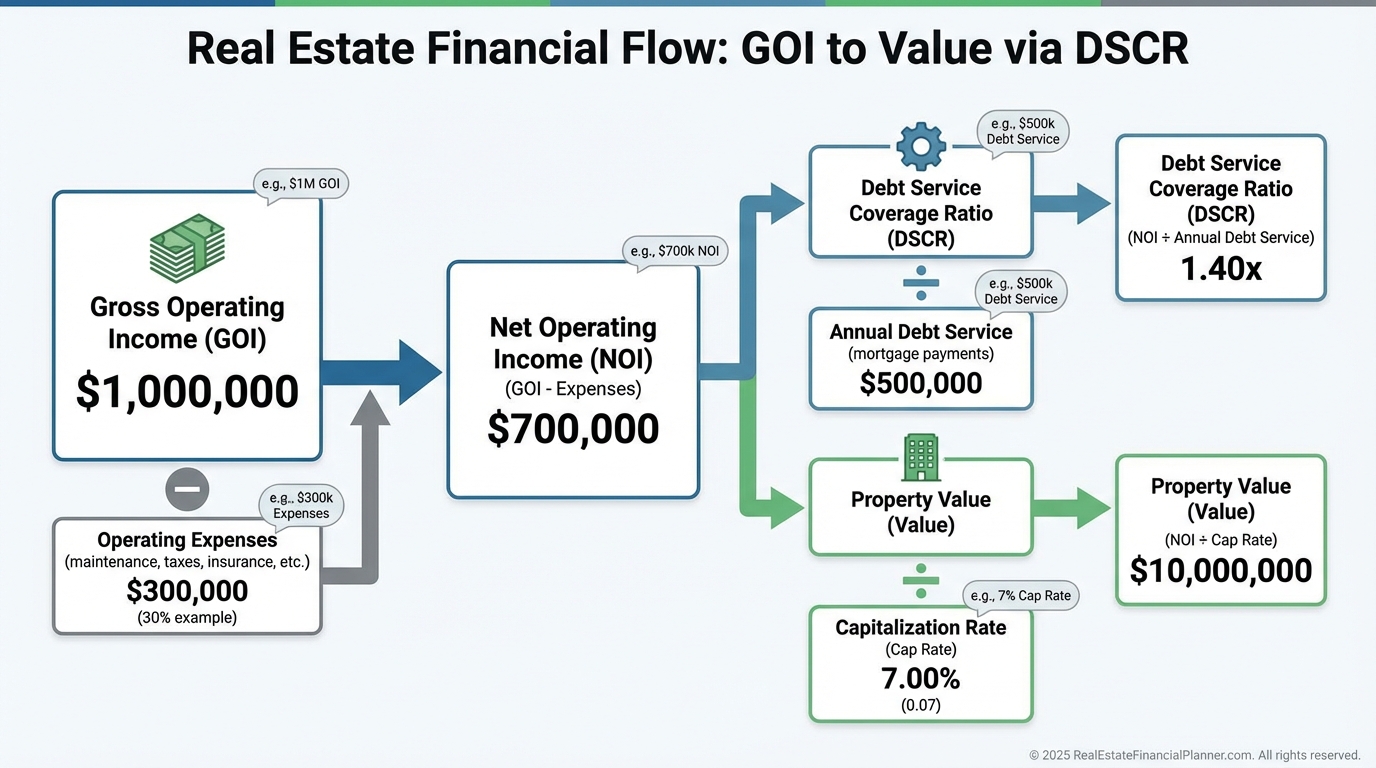

GOI’s Direct Line to Value and Loans

GOI feeds NOI. NOI divided by cap rate sets value. That chain is non-negotiable.

At a 6% cap, every $1 of annual GOI that reaches NOI adds about $16.67 of value. Small tweaks compound into big valuations.

DSCR underwriting starts here too. Higher Effective GOI produces higher NOI and safer DSCR, which often lowers your rate and boosts proceeds.

Lenders love predictable, documented, diversified GOI. They discount hype and one-time fees.

Quick Math Example You Can Steal

Example inputs: $2,000 average rent per unit on 10 units, 5% vacancy, $35 monthly other income per unit, 2% collection loss, 40% expense ratio, 6.25% cap.

Potential rent = $2,000 × 10 × 12 = $240,000.

Potential other income = $35 × 10 × 12 = $4,200.

Potential GOI = $244,200.

Vacancy (5%) = $12,210. Collection loss (2%) on collected rent/other ≈ $4,640.

Effective GOI ≈ $227,350.

NOI at 40% expenses ≈ $136,410.

Value at 6.25% cap ≈ $2,182,560. Every $25 monthly increase per unit that sticks can add six figures to value.

Optimizing GOI Ethically

When I rebuilt after bankruptcy, I avoided junk fees that spike short-term income but kill retention. I focused on value that residents willingly pay for.

Here are durable, lender-friendly levers I use:

•

Pet rent with pet amenities and DNA tracking to reduce issues.

•

Reserved parking where scarcity exists.

•

Private storage lockers with lighting and cameras.

•

In-unit or smart laundry upgrades where feasible; shared coin/card ops otherwise.

•

Utilities rebilling (RUBS) with compliance and transparency.

•

Premium units: smart locks, Wi-Fi packages, or furnished options in select markets.

I test utilization on a subset, measure for 90 days, then roll out. I only underwrite expansion once the data proves sticky.

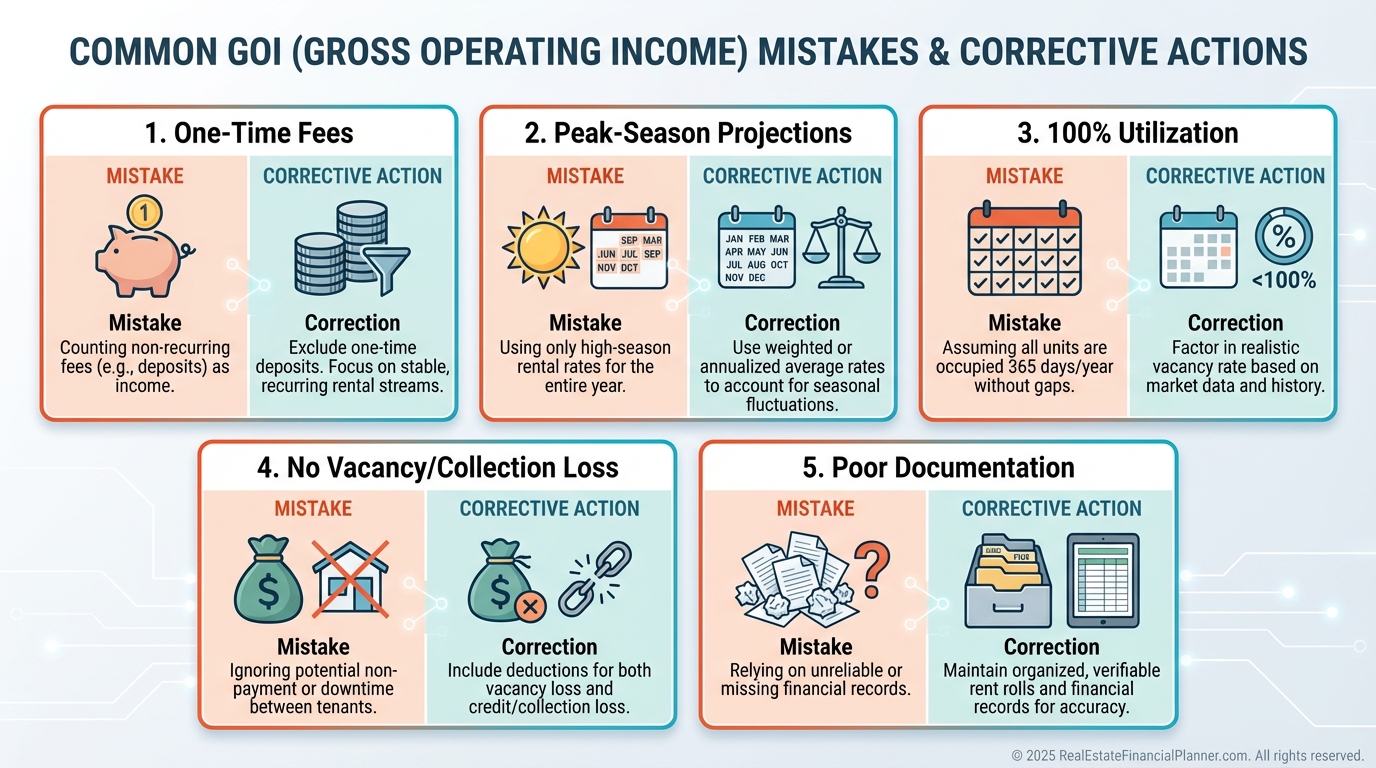

Common Mistakes I See

Counting one-time fees as recurring income. Lenders will strip them, and you’ll overpay.

Assuming 100% utilization for laundry, storage, or parking. I model 40–60% for laundry and context-specific rates for parking.

Using peak-season rents for the whole year. Monthly modeling fixes this.

Mixing gross and net numbers. GOI is gross receipts only—before any expenses.

Poor documentation. If it’s not on a lease or addendum and flowing through deposits, it won’t survive appraisal or refinance.

Using GOI in The World’s Greatest Real Estate Deal Analysis Spreadsheet™

I enter rent and recurring other income separately, then apply vacancy and collection loss to produce Effective GOI.

I stress test with ±2% vacancy, ±1% collection loss, and ±$25 other income to see DSCR sensitivity. The bad case must still clear lender minimums.

I connect this to Return Quadrants™. Stronger GOI boosts cash flow and appreciation via cap rate math, which compounds True Net Equity™ after selling costs and taxes.

For Nomad™ investors, I model Year 2 GOI when the property converts from owner-occupant to rental. That avoids rosy assumptions from your cheap initial payment.

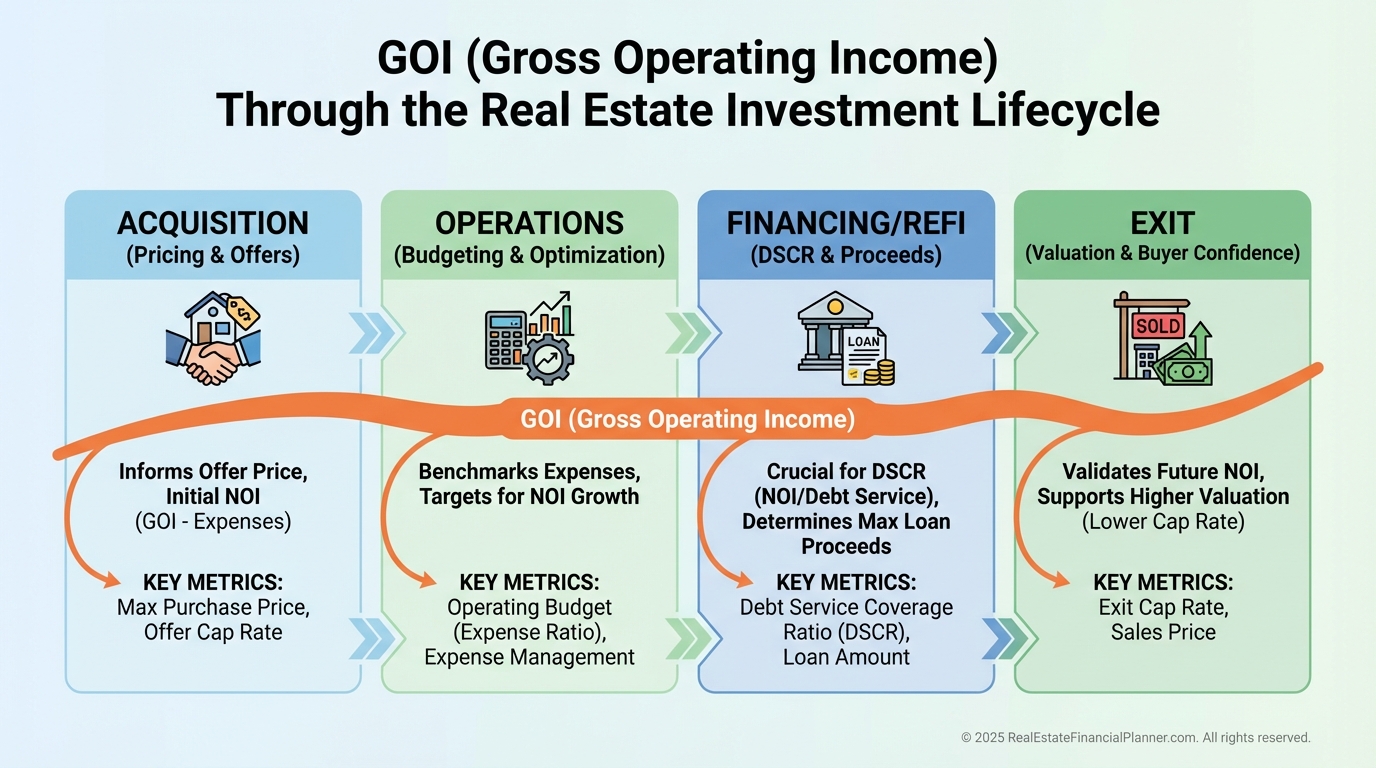

Acquisition, Asset Management, and Exit

At acquisition, I price to Effective GOI, not the broker’s glossy Potential GOI. I also underwrite upside, but I won’t pay for it before I create it.

During operations, I track GOI per unit, per square foot, and per occupied unit. The lagging metric tells me where to focus next.

Before exit, I finish and document all income initiatives for 90 days. A clean trailing-12 with diversified GOI is sale-price rocket fuel.

Checklist: How I Validate GOI in 30 Minutes

•

Pull rent roll, leases, addenda, bank statements (T-12 or T-24 preferred).

•

Rebuild monthly income by line item and compare to deposits.

•

Cross-check other income utilization with market comps and PM calls.

•

Apply market vacancy and collection loss for Effective GOI.

•

Run sensitivity in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

•

If refinancing, prepare a narrative for each income line with documentation.

Final Thought

Treat Gross Operating Income as a strategic target, not a static number. When you measure it honestly and improve it methodically, everything else gets easier—financing, valuations, and long-term wealth.