Debt Paydown: The Quiet Return That Builds Real Estate Wealth Faster Than You Think

Learn about Debt Paydown for real estate investing.

Debt paydown is the return almost no one gets excited about.

And yet, it is the return that quietly rescued my portfolio more than once, especially when appreciation stalled, cash flow tightened, or my confidence took a hit.

When I rebuilt after bankruptcy and foreclosure, I stopped chasing flashy numbers. I needed returns that showed up whether I felt smart that year or not. Debt paydown became one of the few returns I could count on.

That reliability matters more than most investors realize.

What Debt Paydown Really Is

Debt paydown is the reduction of your mortgage principal over time.

Each payment includes interest and principal.

The principal portion permanently reduces what you owe.

This is forced savings.

You cannot skip it.

You cannot spend it.

You cannot overthink it.

When I review deals with clients, I always remind them that tenants are not just covering expenses. They are buying the property for you, one payment at a time.

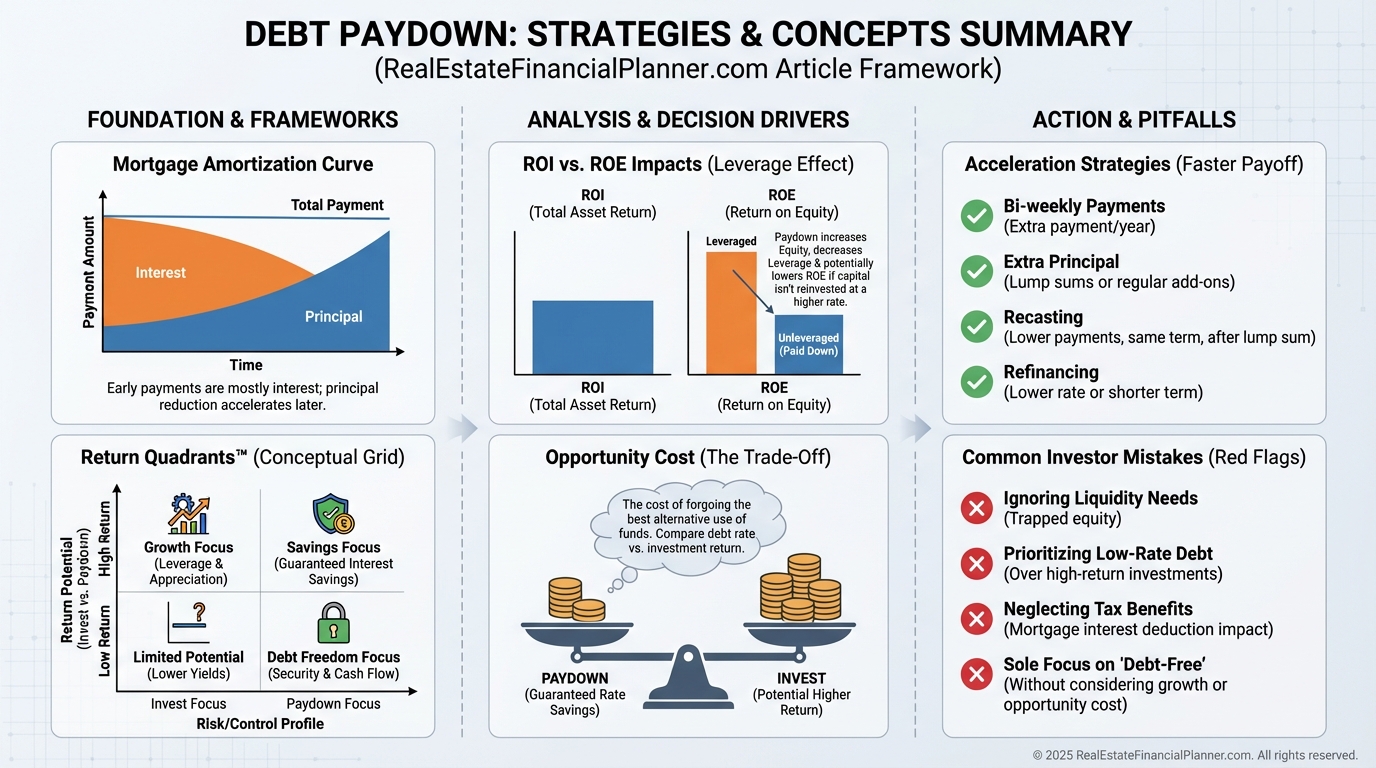

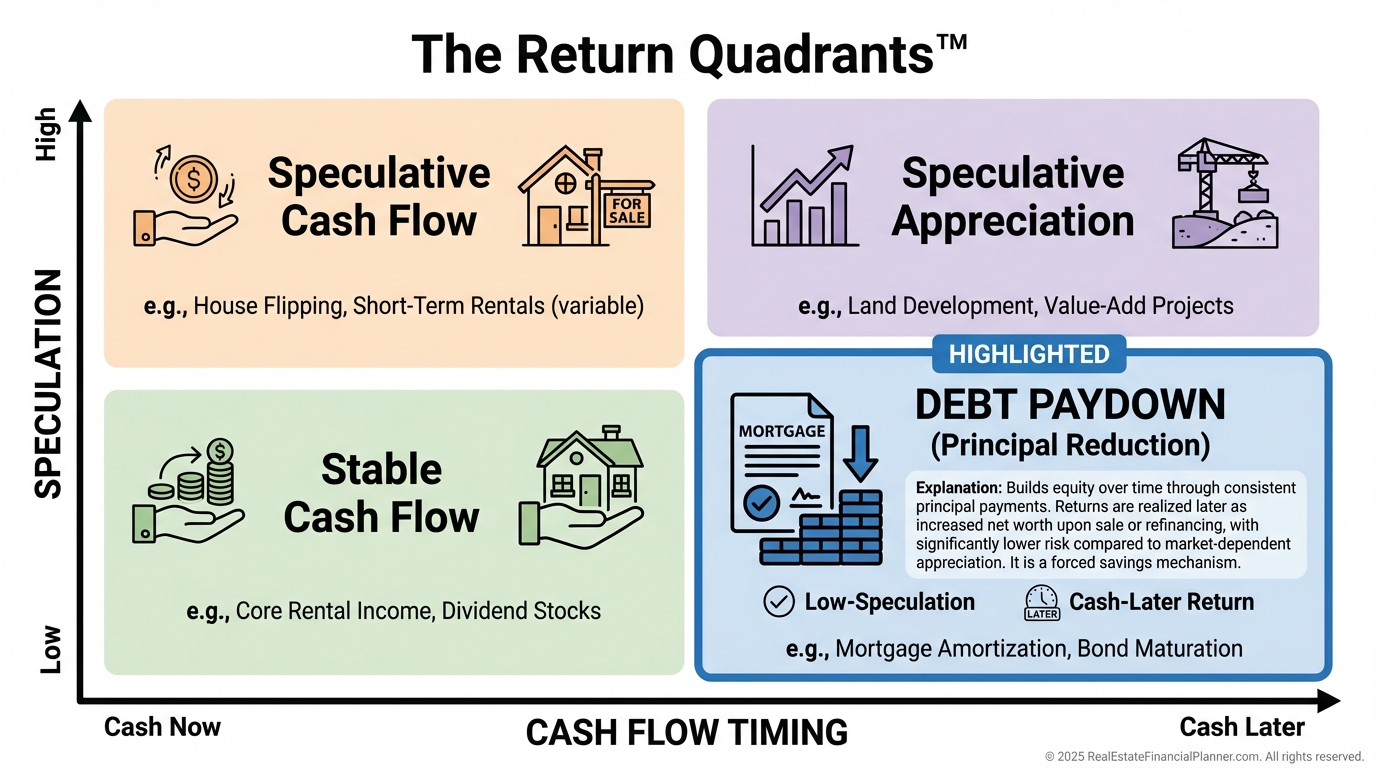

Debt Paydown Inside the Return Quadrants™

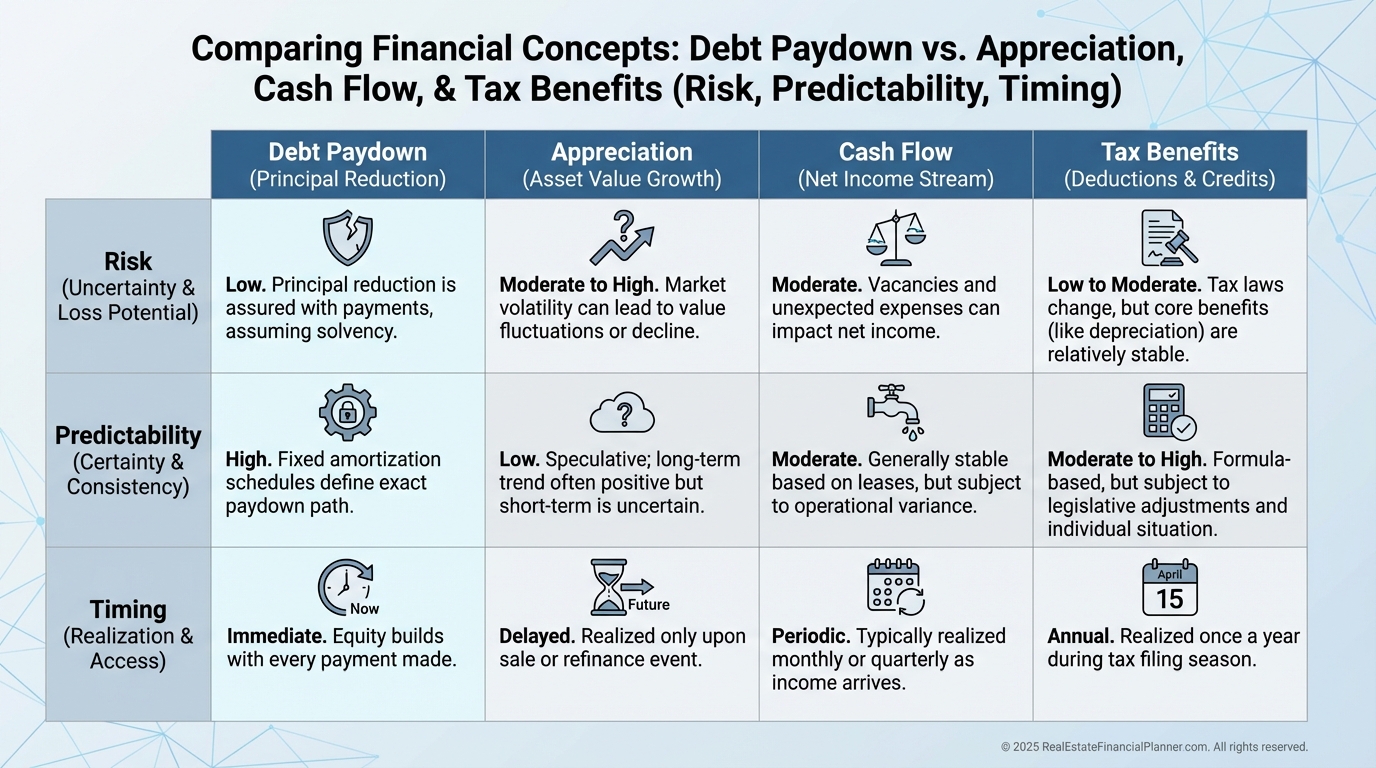

Debt paydown is one of the four returns in the Return Quadrants™ framework, alongside appreciation, cash flow, and tax benefits.

Its placement tells you everything you need to know.

Debt paydown sits in the lower half of the quadrant.

That means it is less speculative.

Market crashes do not change your amortization schedule.

It also sits on the cash-later side.

You cannot buy groceries with equity.

You access this return by selling or refinancing.

There is also a hard ceiling.

If you borrow $400,000, your lifetime debt paydown return is exactly $400,000.

No more. No less.

That limitation is not a flaw. It is a design feature.

Why Debt Paydown Is the Most Certain Return

Cash flow fluctuates.

Appreciation lies.

Tax benefits depend on laws you do not control.

Debt paydown is contractual.

When I help clients stress-test deals, I always ask, “Which returns survive a bad decade?” Debt paydown almost always does.

Even during vacancies, even during flat markets, principal reduction keeps happening as long as the loan is being paid.

This is why leveraged real estate works at all.

Someone else pays down your debt.

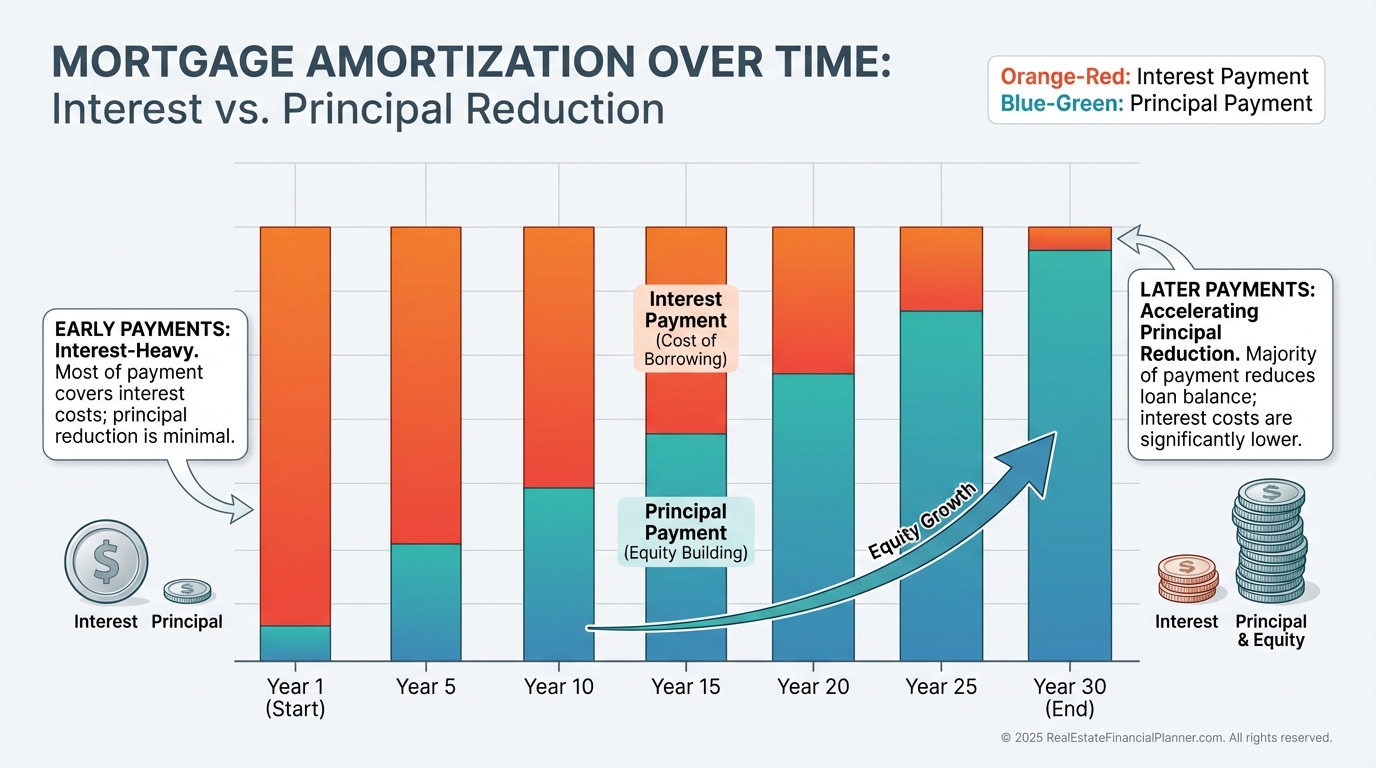

How Mortgage Amortization Actually Works

Most investors know their monthly payment.

Very few understand how it changes over time.

Early payments are mostly interest.

Later payments are mostly principal.

On a thirty-year loan, debt paydown feels slow at first.

Then it quietly accelerates.

When I run numbers in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, this is where investors usually have their first “oh wow” moment.

They see year ten versus year twenty side by side.

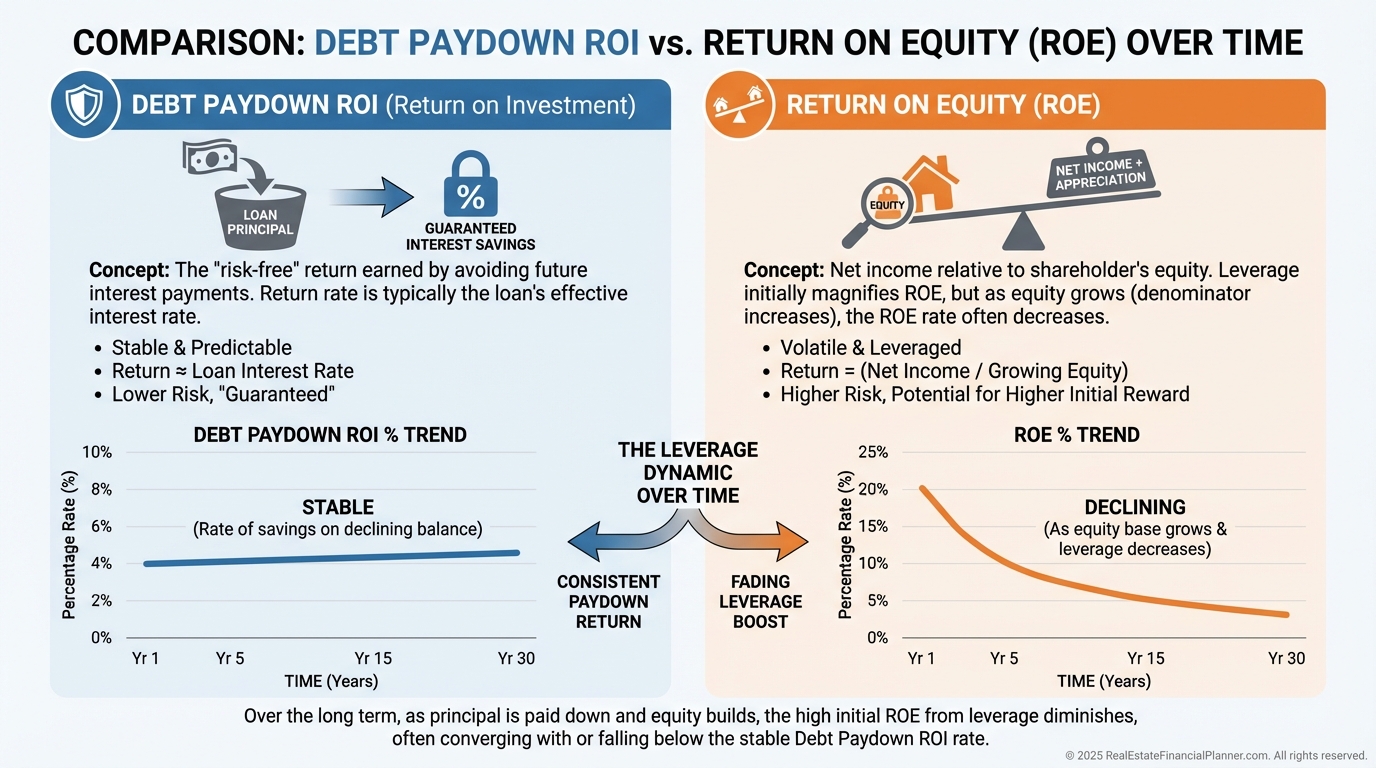

ROI vs ROE and Debt Paydown

Debt paydown behaves differently depending on how you measure returns.

Your return on investment from debt paydown stays relatively stable.

Your return on equity declines over time.

As equity grows, the same principal reduction represents a smaller percentage return.

This is why highly leveraged properties often look amazing early and mediocre later.

It is not failure.

It is math.

Should You Accelerate Debt Paydown?

This is where investors get emotional.

Paying off debt feels good.

But feelings are expensive.

Extra payments reduce interest.

Shorter terms build equity faster.

But every extra dollar has an opportunity cost.

When I model this for clients, we always compare accelerated paydown against:

•

Buying another property

•

Building reserves

•

Preserving flexibility

Sometimes accelerating makes sense.

Often, it does not.

Debt Paydown Versus Other Returns

Debt paydown is not meant to win beauty contests.

It is meant to stabilize portfolios.

Think of debt paydown as ballast.

It keeps the ship upright when markets get rough.

When appreciation disappears and rents soften, debt paydown keeps quietly doing its job.

Advanced Portfolio-Level Thinking

Sophisticated investors stop looking at properties in isolation.

They think in portfolios.

Sometimes the best move is not paying down faster.

Sometimes it is spreading debt paydown across more properties.

This is where concepts like True Net Equity™ matter.

Not all equity is equally usable.

Common Mistakes I See Investors Make

Ignoring debt paydown entirely.

Over-prioritizing it emotionally.

Forgetting inflation works in your favor.

Never revisiting old assumptions.

When I review portfolios annually, we adjust.

Strategies evolve as numbers change.

Final Thoughts

Debt paydown is not exciting.

It is dependable.

It is the return that shows up when others disappoint.

When I rebuilt from scratch, this return gave me confidence long before I felt confident. It reminded me that progress was happening even when nothing felt dramatic.

Let your tenants buy your properties.

Let time do the heavy lifting.

Let debt paydown quietly build your wealth.