FHA Loans Explained for Real Estate Investors and Nomads™

Learn about FHA Loans for real estate investing.

Most investors misunderstand FHA loans.

They see “low down payment” and stop thinking.

When I help clients analyze financing options, FHA loans often look attractive on the surface—but they hide long-term tradeoffs that can quietly erode your True Net Equity™ if you don’t model them correctly.

I’ve personally used FHA loans after bankruptcy when conventional financing wasn’t an option.

They helped me restart.

But they are not “cheap money,” and they are not free leverage.

They are tools—and tools can hurt you if you use them wrong.

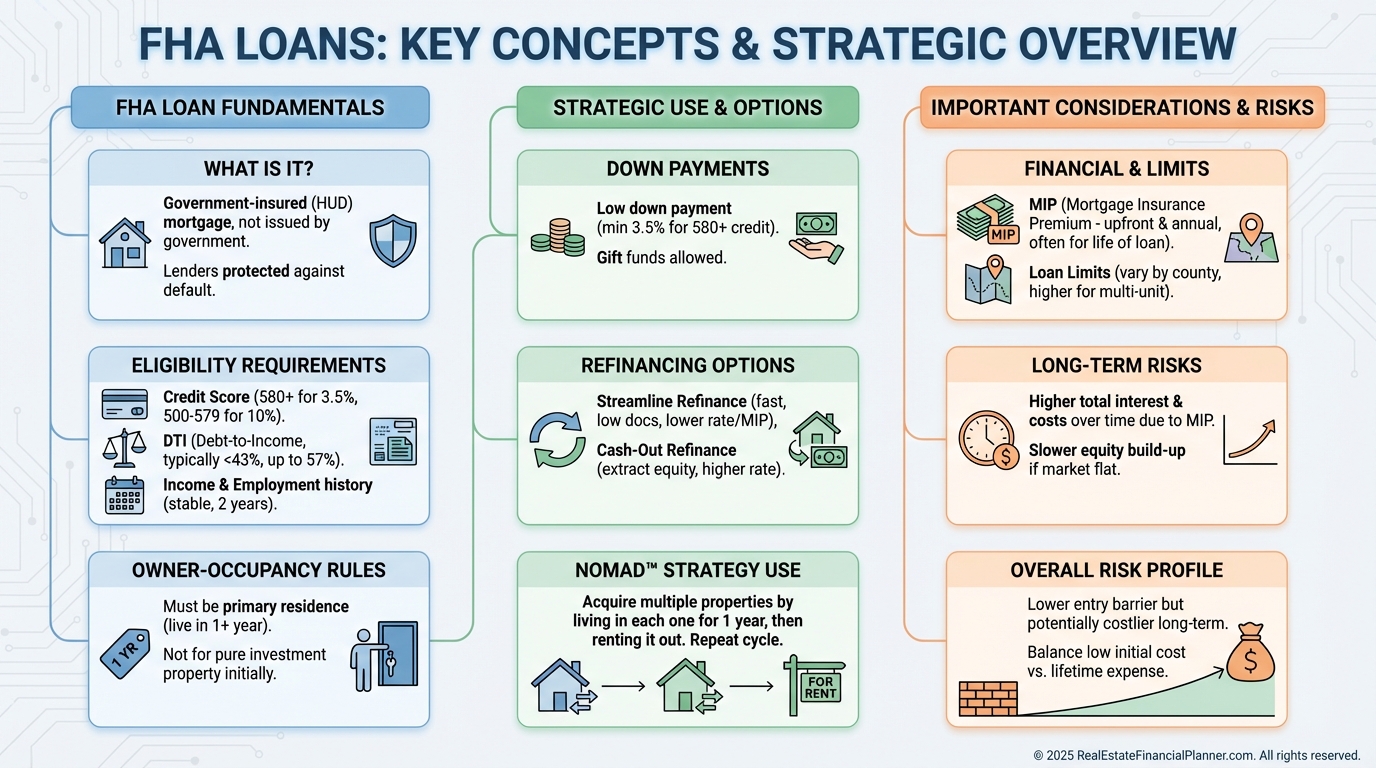

What FHA Loans Actually Are

FHA loans are government-backed, owner-occupant mortgage programs insured by the Federal Housing Administration.

They are designed to expand access to homeownership, not to optimize investor returns.

That distinction matters.

As an investor, you use FHA loans despite their design—not because of it.

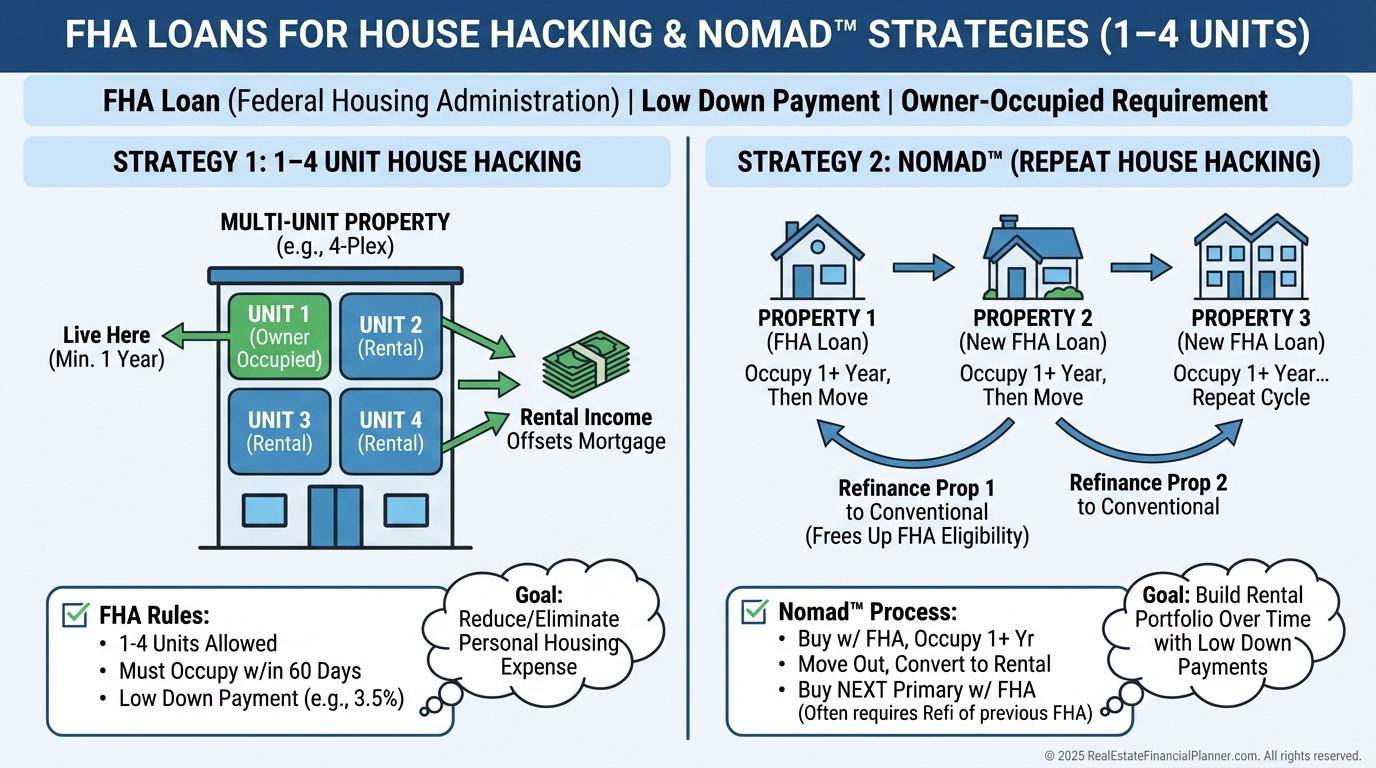

They work best when paired intentionally with Nomad™ or house-hacking strategies.

Eligibility and Credit Requirements

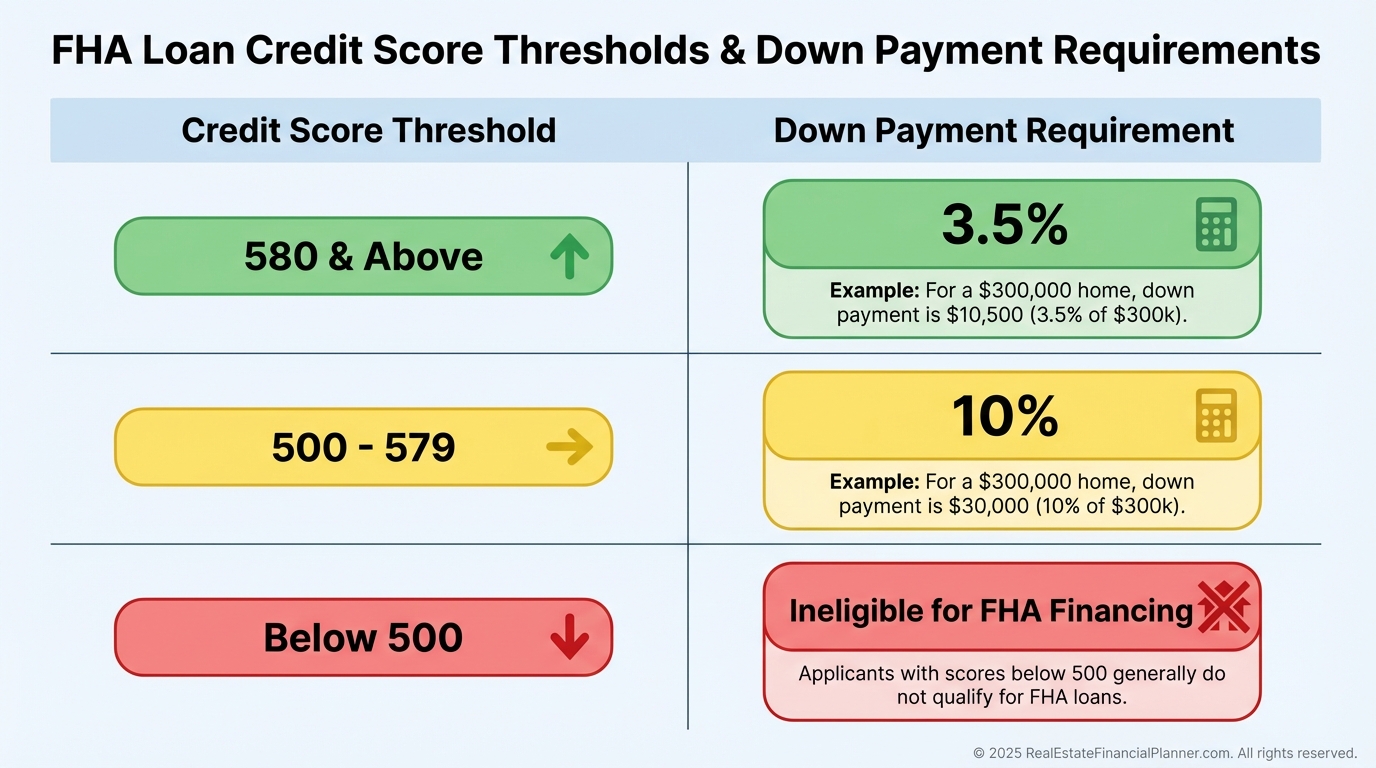

FHA loans allow lower credit scores than conventional loans.

That flexibility can be a lifeline—or a trap.

Minimum Credit Score: Typically 580 for the standard 3.5% down payment.

Lower Scores: Scores between 500 and 579 require at least 10% down.

When I model FHA scenarios in REFP™, I don’t just check approval.

I check survivability.

Lower credit often means thinner margins and less flexibility when rents soften or expenses spike.

The Owner-Occupancy Rule That Investors Ignore

You must live in the property.

At least one year.

No exceptions for “intent.”

This is where FHA loans align perfectly with Nomad™ investing.

You buy as an owner-occupant.

You live there.

You move out later.

You convert it to a rental.

But if you shortcut this rule, you risk loan fraud.

I warn clients about this constantly.

Your future portfolio is not worth jeopardizing your financing reputation.

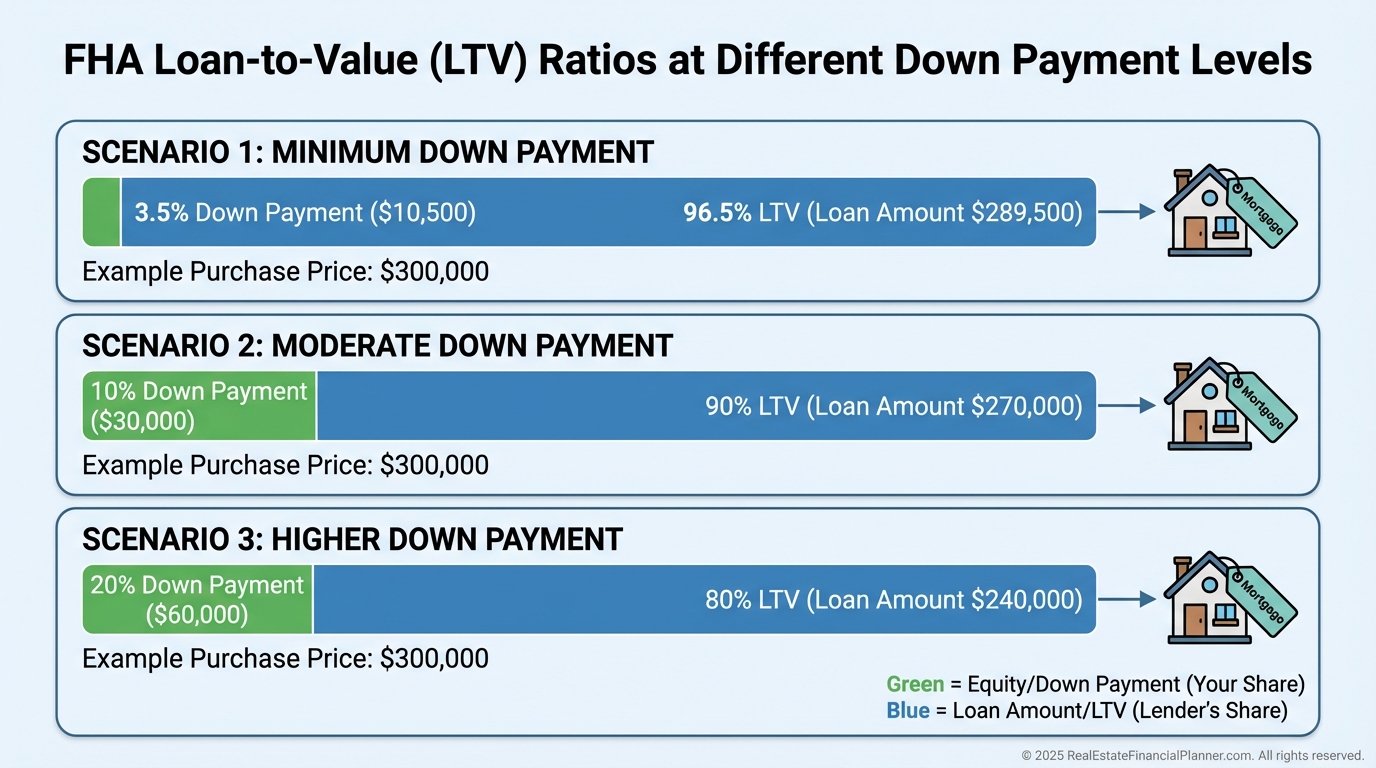

Down Payments and Loan-to-Value Ratios

FHA loans shine here—but only initially.

3.5% Down: Requires a 580+ credit score.

10% Down: Required for lower credit scores.

LTV: Up to 96.5% with minimum down payment.

High leverage accelerates appreciation returns.

It also amplifies mistakes.

That’s why I always run Return Quadrants™ before recommending FHA financing.

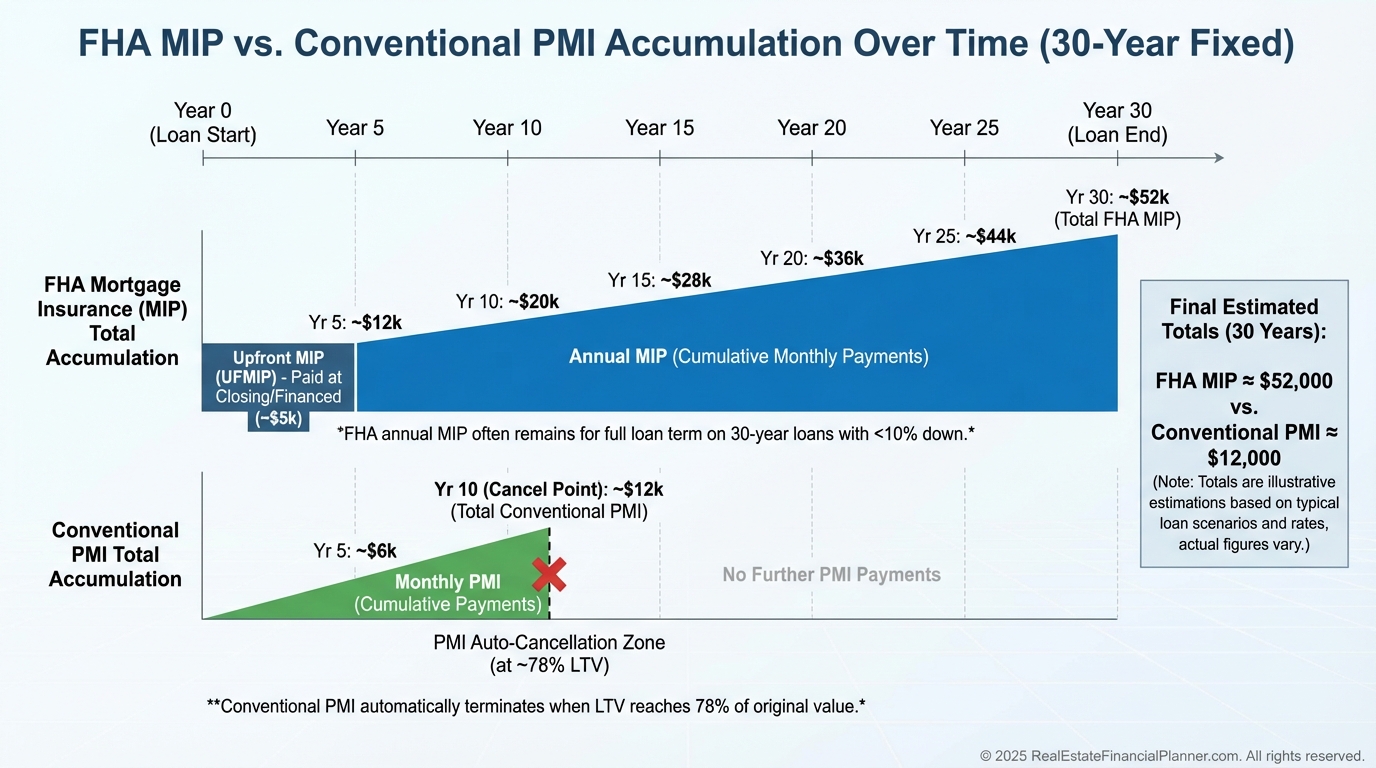

Mortgage Insurance: The Silent Wealth Killer

FHA mortgage insurance is not optional.

And it does not go away.

Upfront MIP: 1.75% of the loan amount.

Annual MIP: Added to your monthly payment.

Duration: Life of the loan if you put less than 10% down.

This is where many investors get burned.

They analyze cash flow—but forget MIP never disappears.

Unless you refinance.

Or sell.

Mortgage insurance directly reduces your Return on Equity.

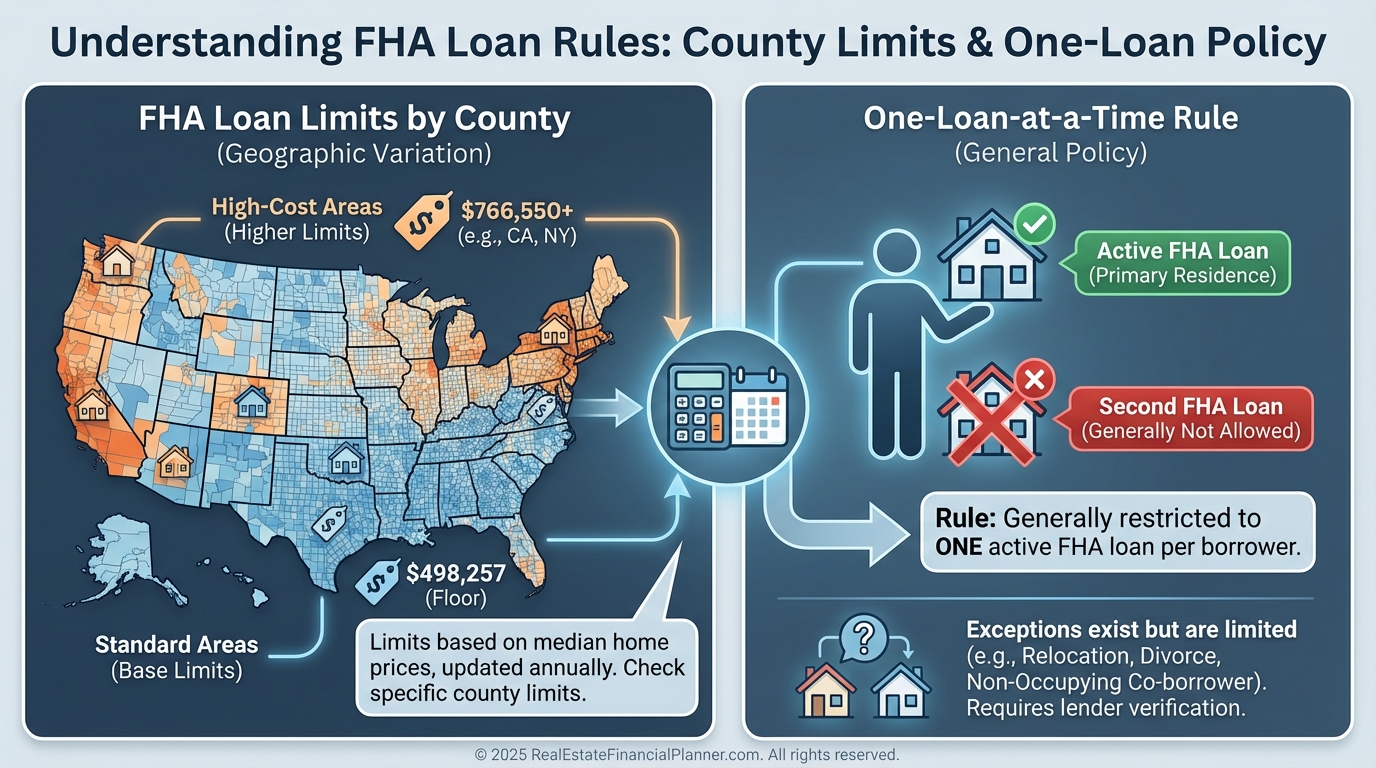

Loan Limits and Portfolio Growth Constraints

FHA loans have county-based loan limits.

In high-cost areas, they may cap your buying power.

In lower-cost areas, they can work beautifully for small multifamily properties.

But remember this rule:

You usually can only have one FHA loan at a time.

This is why FHA works best early—not forever.

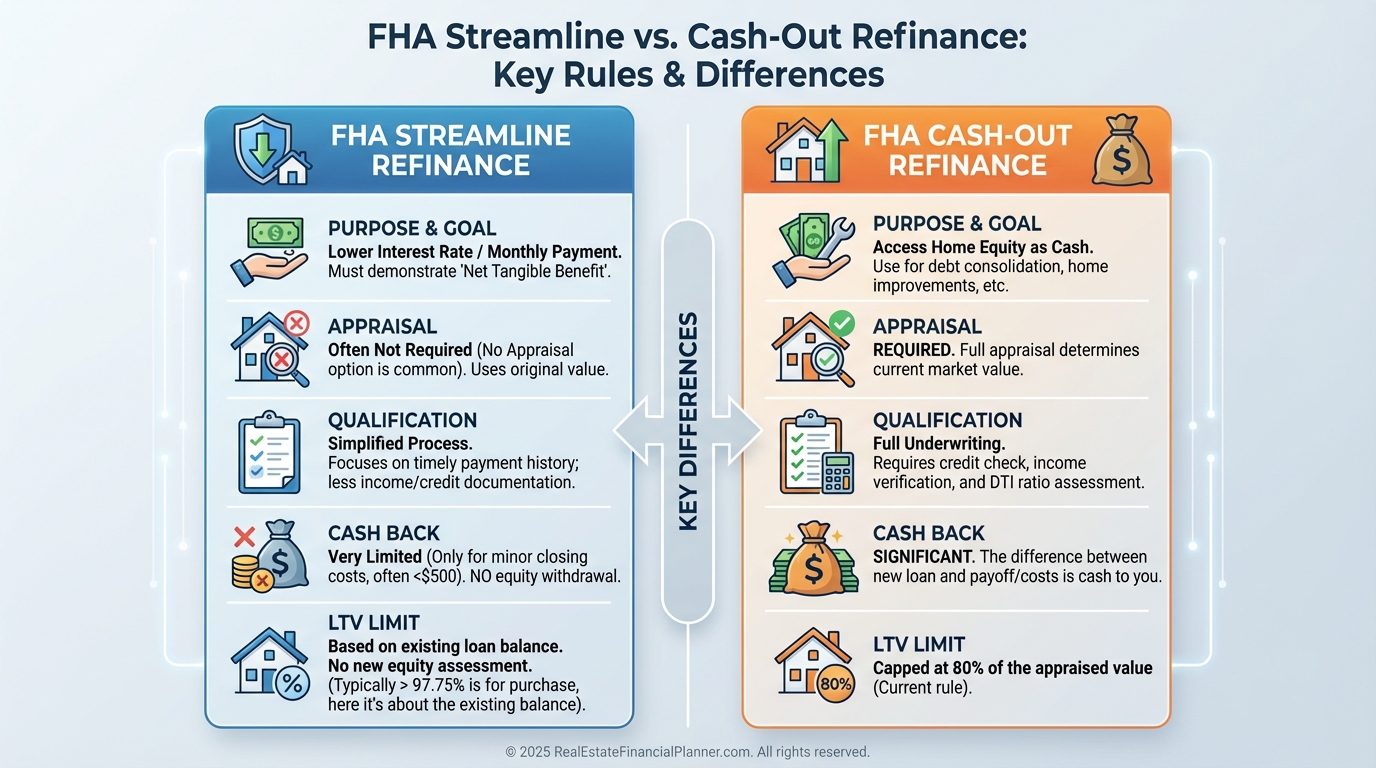

Refinancing, Cash-Out, and Exit Strategy

FHA loans are not meant to be permanent.

They are stepping stones.

Streamline Refinance: Minimal documentation, no appraisal.

Cash-Out Refinance: Max 80% LTV.

Recasting: Not allowed.

When I analyze FHA deals, I always model the refinance date.

Exit strategy is not optional.

It’s the entire point.

FHA for House Hackers and Small Multifamily

FHA loans allow 1–4 unit properties.

You must live in one unit.

This is one of the most powerful on-ramps into investing.

But power without discipline creates fragility.

High leverage plus poor reserves is a dangerous mix.

When FHA Loans Make Sense—and When They Don’t

FHA loans are excellent when:

You need low down payment access.

You are rebuilding credit.

You plan to Nomad™ or house hack.

You have a refinance plan.

They are dangerous when:

You ignore mortgage insurance.

You plan to hold long-term without refinancing.

You overestimate rent growth.

You don’t model Return on True Net Equity™.

Used correctly, FHA loans can launch your portfolio.

Used casually, they quietly tax it.