How Real Estate Investors Choose an Insurance Agent

Learn about Insurance Agent for real estate investing.

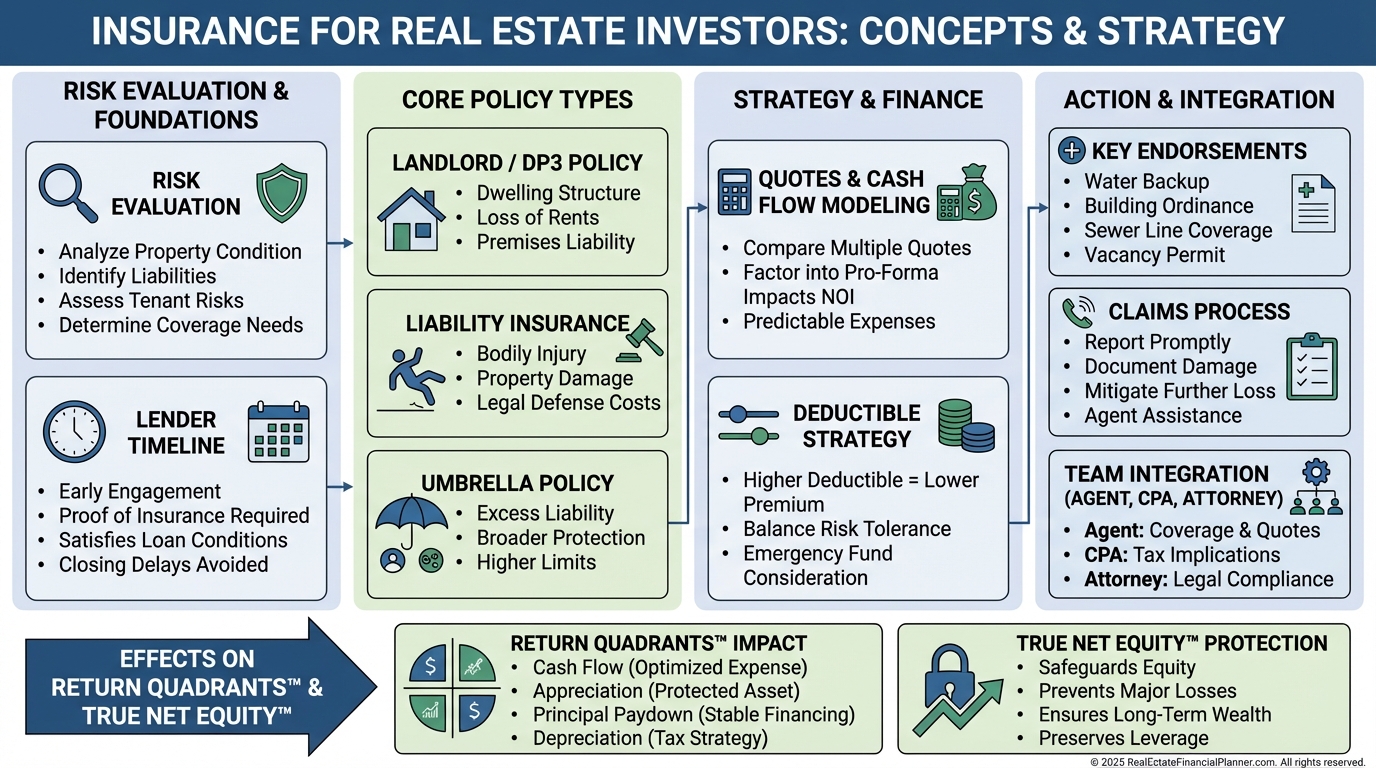

Why Your Insurance Agent Belongs on Your Deal Team

When I help clients build durable portfolios, the insurance agent is always on the short list of must-have pros.

A single misstep—wrong policy form, missing endorsement, underinsured replacement cost—can wipe out years of Return Quadrants™ gains in one afternoon.

Your lender won’t fund without proof of coverage.

But the real value starts much earlier, when we’re still analyzing deals.

What Great Insurance Agents Actually Do

They translate property risk into precise, cost-effective coverage.

They quote early so you underwrite with real numbers, not guesses.

They coach you through claims when something breaks, burns, floods, or bites.

Here’s what I expect from an investor-savvy insurance agent:

•

Evaluate risk by location, construction, use (LTR/STR/MTR), and systems.

•

Recommend proper forms (DP-3 or equivalent landlord), liability limits, and an umbrella.

•

Quote replacement cost accurately and check coinsurance so you don’t get penalized at claim time.

•

Add loss of rents, ordinance or law, water backup, service line, and other key endorsements where appropriate.

•

Coordinate binder timing with your lender, and update policies as you transition strategies (e.g., Nomad™: owner-occupant to rental).

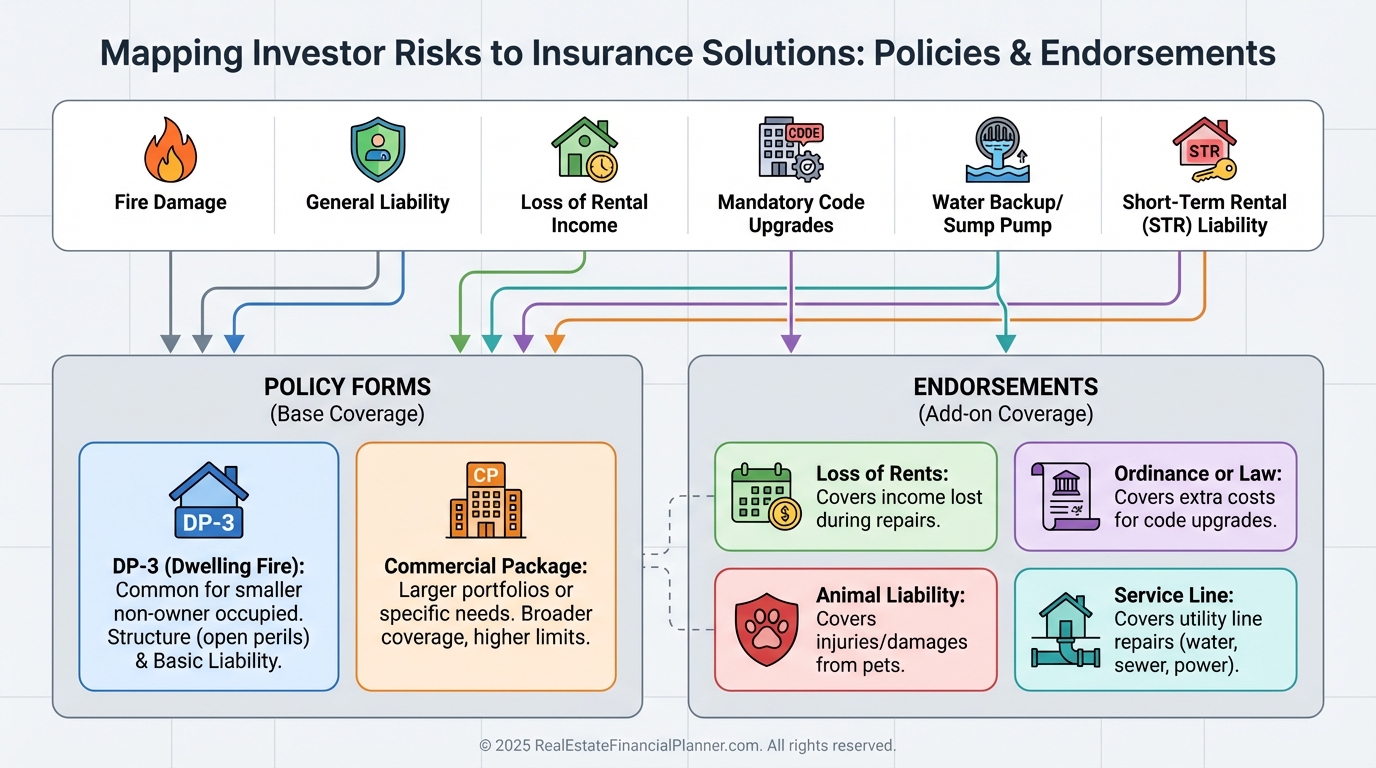

Policy Types Investors Actually Use

For long-term rentals, I default to a DP-3 (or equivalent landlord) with replacement cost on the dwelling.

For short-term rentals, I ask for business liability that explicitly covers transient occupancy and any local ordinance requirements.

I want loss of rents tied to covered causes of loss, not just vacancy.

On older properties or markets with strict building codes, I add ordinance or law to handle code-mandated upgrades after a partial loss.

If you have trees, older sewer lines, or finished basements, I talk to the agent about service line, equipment breakdown, and water/sewer backup limits.

If you use a property manager, I want them added as additional insured.

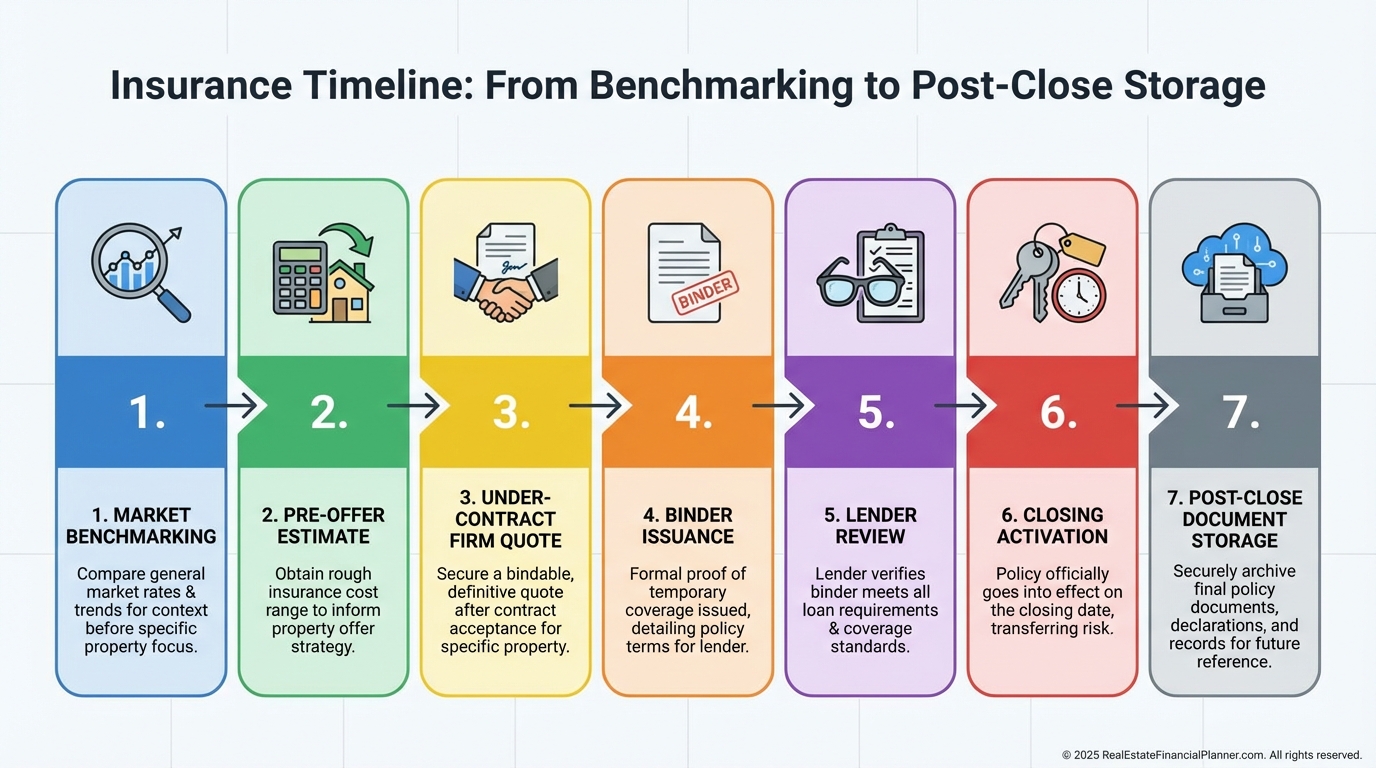

When to Involve the Insurance Agent

I involve the agent before I analyze my first deal in a market.

We price a representative property so I can model realistic insurance costs in my spreadsheet.

When I go under contract, I request a firm quote, confirm replacement cost assumptions, and align the binder for closing.

Your lender will require the binder and mortgagee clause prior to funding.

You activate coverage at closing.

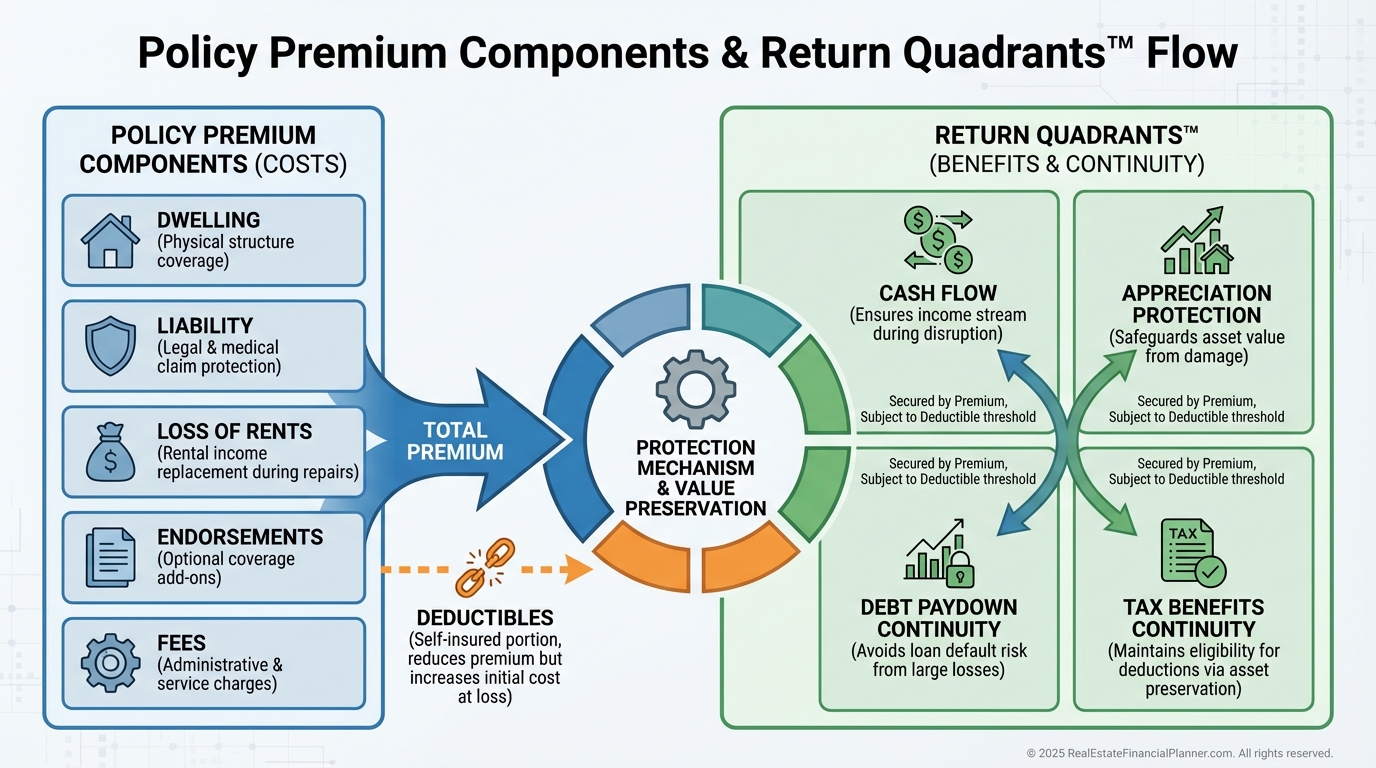

Modeling Insurance in Your Deal Analysis

When I underwrite, I place the annual premium in operating expenses and test cash flow sensitivity at ±15%.

I also size reserves to at least the deductible plus a “bad day” buffer so a claim doesn’t force a capital call.

On the Return Quadrants™, insurance directly lowers cash flow, but it defends the other three—protecting the asset so appreciation, debt paydown, and tax benefits can continue after a loss.

Underinsurance inflates your True Net Equity™ on paper and sets you up for a painful surprise.

I model a True Net Equity™ haircut if I see coinsurance exposure, missing code coverage, or ACV instead of replacement cost on key items.

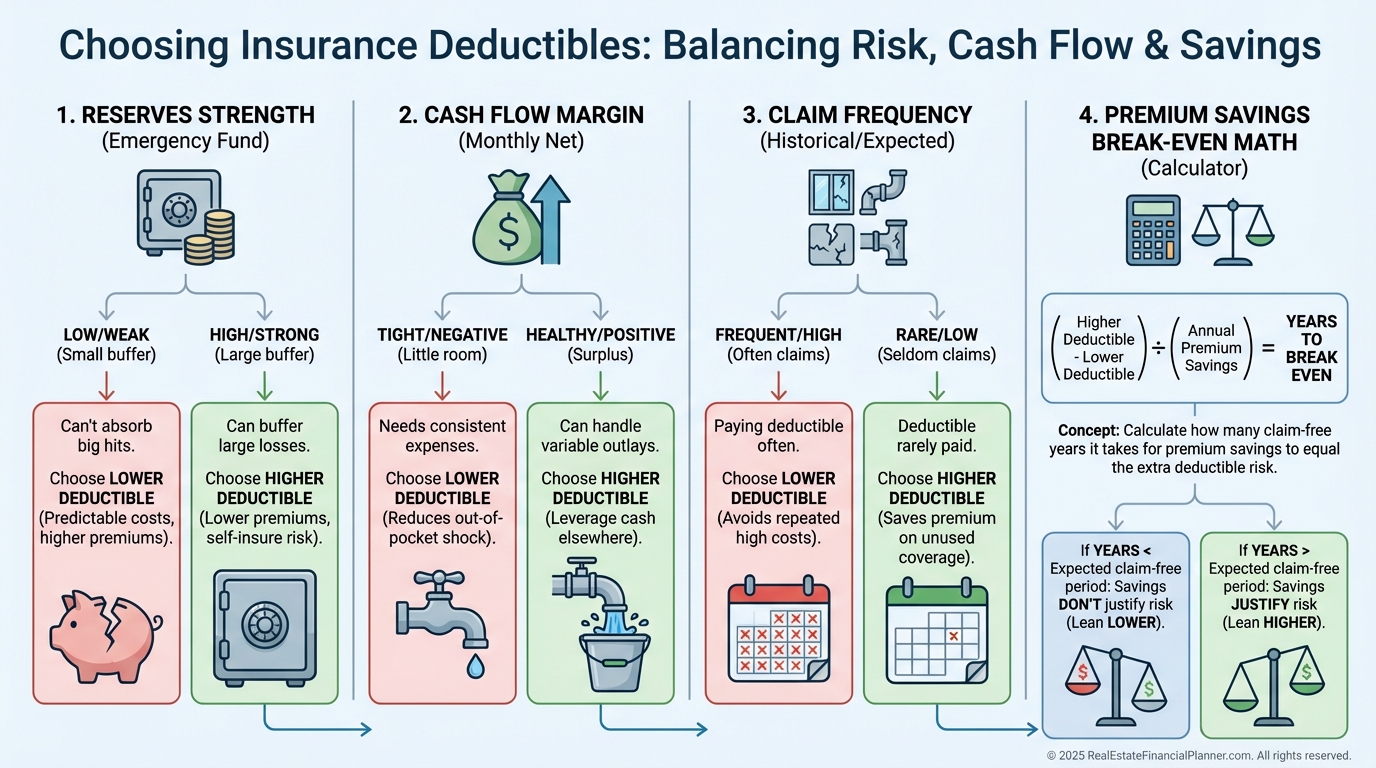

Deductibles, Reserves, and Risk Tolerance

Bigger deductibles reduce premium, but only if your reserves can handle the hit.

I compare the premium savings to the increased out-of-pocket at claim time.

If a $1,000 premium savings requires a $5,000 higher deductible, your break-even is roughly one qualifying claim every five years.

I prefer taking higher deductibles only when reserves are strong and cash flow margins are healthy.

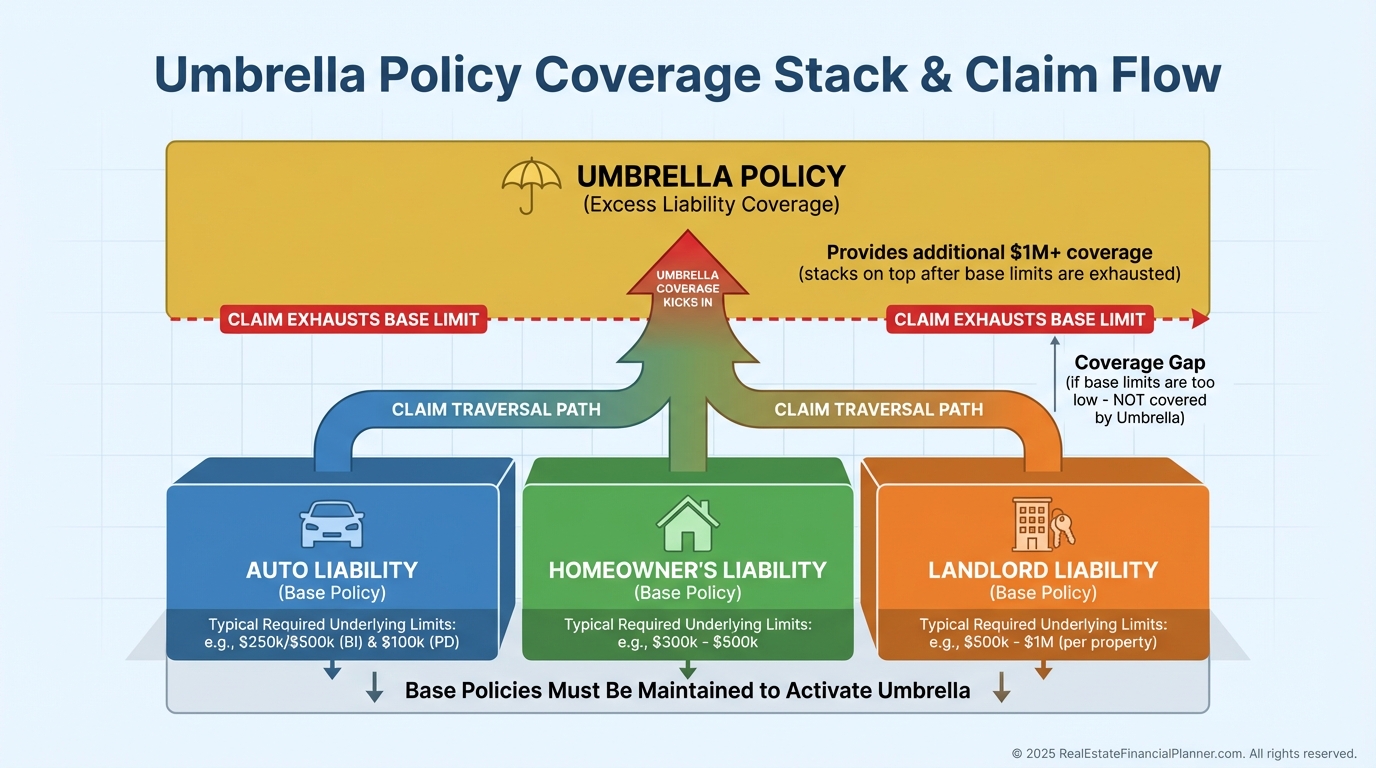

The Umbrella Policy: Quiet, Cheap, Essential

Umbrella policies extend liability beyond your auto and property limits.

They are inexpensive relative to risk and often required by lenders on larger portfolios.

I coordinate liability limits so the umbrella sits cleanly on top of underlying policies.

Work with your CPA and attorney on entity structure, but remember: entities can help with separation; insurance pays the lawyers and settlements.

If you have assets to lose—or plan to—an umbrella is a simple yes.

Timeline: From First Look to Closing Day

Before analyzing deals, get a benchmark quote for a typical property.

When a property is a serious contender, request a property-specific estimate with replacement cost verified.

Under contract, order the binder and confirm the effective date is closing.

Verify the mortgagee clause is exact.

At closing, confirm escrow impounds, and store digital copies of the policy and declarations in your deal folder.

STRs, Vacancy, Animals, and Other Gotchas

Short-term rentals require policies that explicitly allow transient use.

If the policy excludes “business activity,” you do not have coverage.

Vacancy clauses can restrict coverage after 30 or 60 days empty, so plan turns accordingly.

Ask about animal liability if your lease allows pets.

For flips and rehabs, consider builder’s risk if work is substantial.

What I Ask My Insurance Agent to Confirm

•

Replacement cost calculation and coinsurance requirements.

•

Loss of rents limit and whether it’s time-based (e.g., 12 months) or dollar-based.

•

Ordinance or law coverage for code upgrades.

•

Water/sewer backup and service line coverage amounts.

•

Short-term rental or mid-term rental liability language when applicable.

•

Property manager listed as additional insured.

•

Named insured alignment with your entity plan.

•

Vacant property restrictions and inspection requirements.

When I rebuilt after bankruptcy, I learned the expensive way that vague assumptions become very clear exclusions at claim time.

Now I verify every assumption in writing.

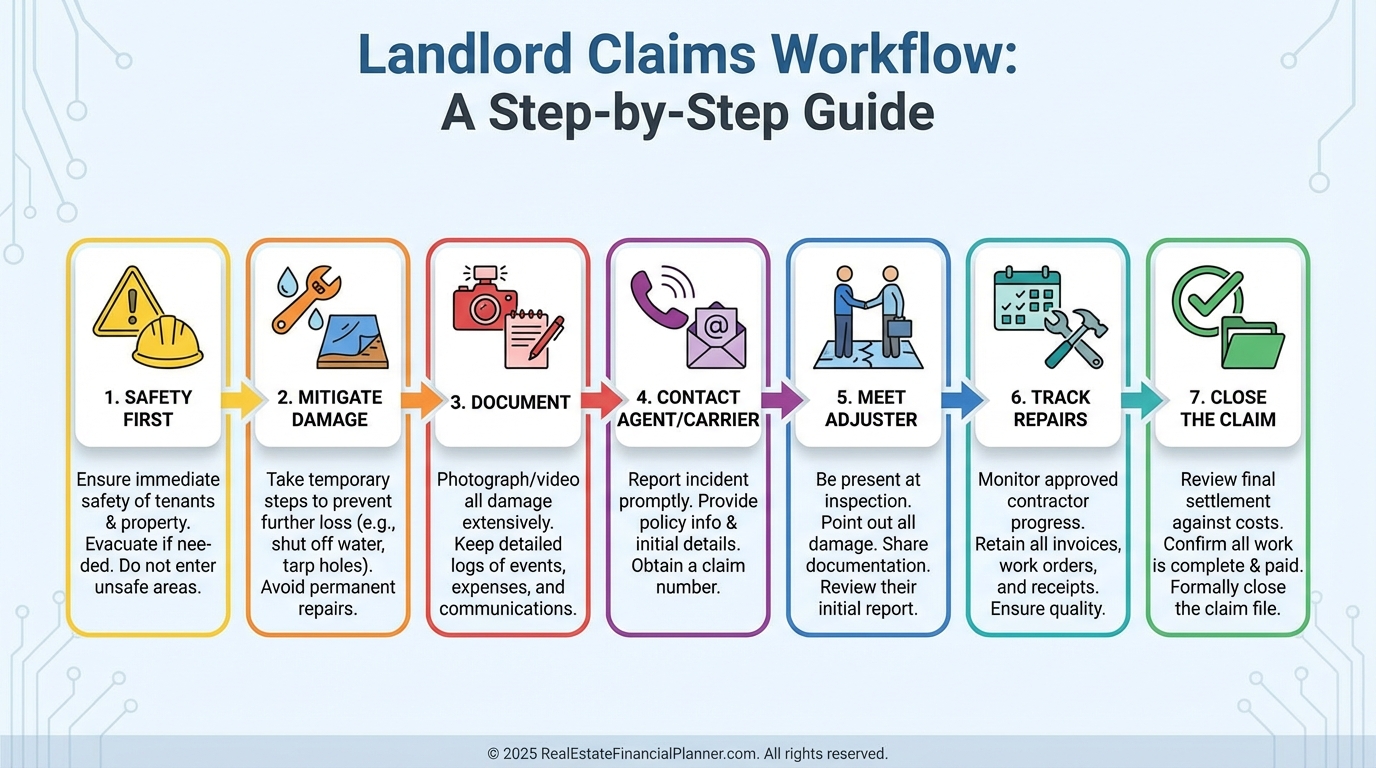

Claims: Prepare Before You Need It

Photograph major systems and the interior at acquisition and after big updates.

Keep tenant contact protocols for emergencies.

Report claims promptly, document damage thoroughly, and track all communications.

Your agent should guide coverage, but you decide whether to file based on deductible, frequency, and long-term premium impact.

Finding and Managing a Great Insurance Agent

Ask your mortgage broker and real estate agent for referrals.

Brokers see a stream of quotes and know who consistently closes on time with solid coverage and fair pricing.

Interview for investor experience: LTR vs STR, loss-of-rents design, coinsurance, and ordinance or law.

Expect proactive annual reviews as values, rents, and codes change.

I keep a running “coverage gaps” checklist and review it every renewal.

How This Ties Back to Your Numbers

Insurance cost goes in operating expenses.

Deductibles define reserve targets.

Umbrellas cap catastrophic liability risk.

Together they stabilize cash flow and protect True Net Equity™ so your Return Quadrants™ keep compounding.

That’s how you buy well, sleep well, and hold long enough to let the math work.