Plumber Playbook for Real Estate Investors: Stop Water Damage, Protect Cash Flow, and Boost Returns

Learn about Plumber for real estate investing.

Why the Plumber Is a Profit Center

Most investors treat plumbing as a cost center. I don’t.

When I help clients map risks, water is the silent destroyer of cash flow, True Net Equity™, and reputation.

The right plumber reduces claims, stabilizes income, and earns you back months of vacancy in avoided disasters.

When I rebuilt after bankruptcy, 3 of my 5 most expensive mistakes were water-related and 100% preventable.

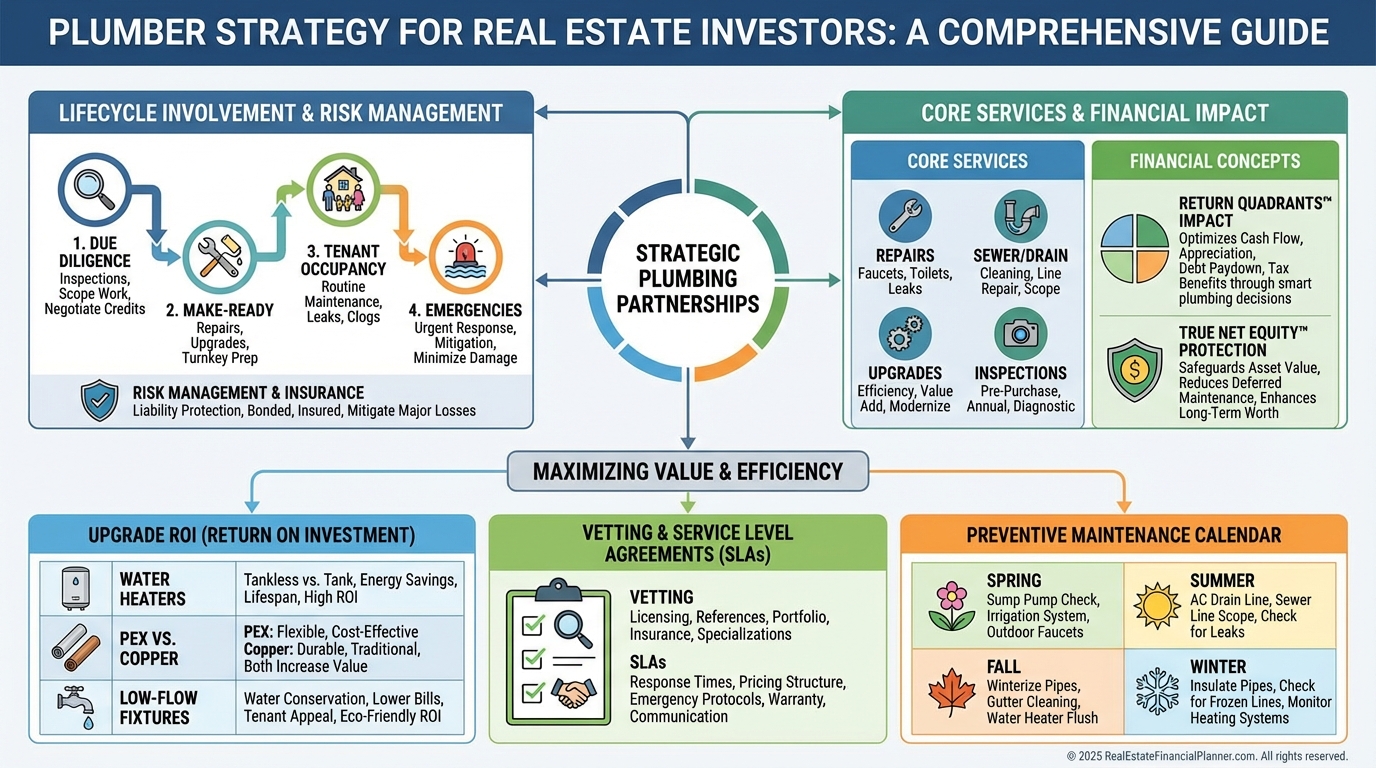

What a Great Plumber Actually Does

They repair or replace fixtures, supply lines, shutoffs, toilets, faucets, garbage disposals, and water heaters.

They clear drains and sewer lines, diagnose low pressure, and eliminate hidden leaks that inflate your water bill.

They upgrade old materials, add shutoff valves, and install leak-detection tech to cut incident severity.

They document code compliance, permits, and warranties so you can defend your decisions to insurers and buyers.

When to Involve the Plumber Across the Property Lifecycle

Before you buy, have them inspect, pressure-test, and sewer-scope.

During rehab, let them standardize materials, fixtures, and shutoffs for speed and cost control.

During occupancy, schedule maintenance, respond to leaks fast, and analyze water-use trends monthly.

Before sale or refi, collect invoices, permits, and warranties to support valuation and lender questions.

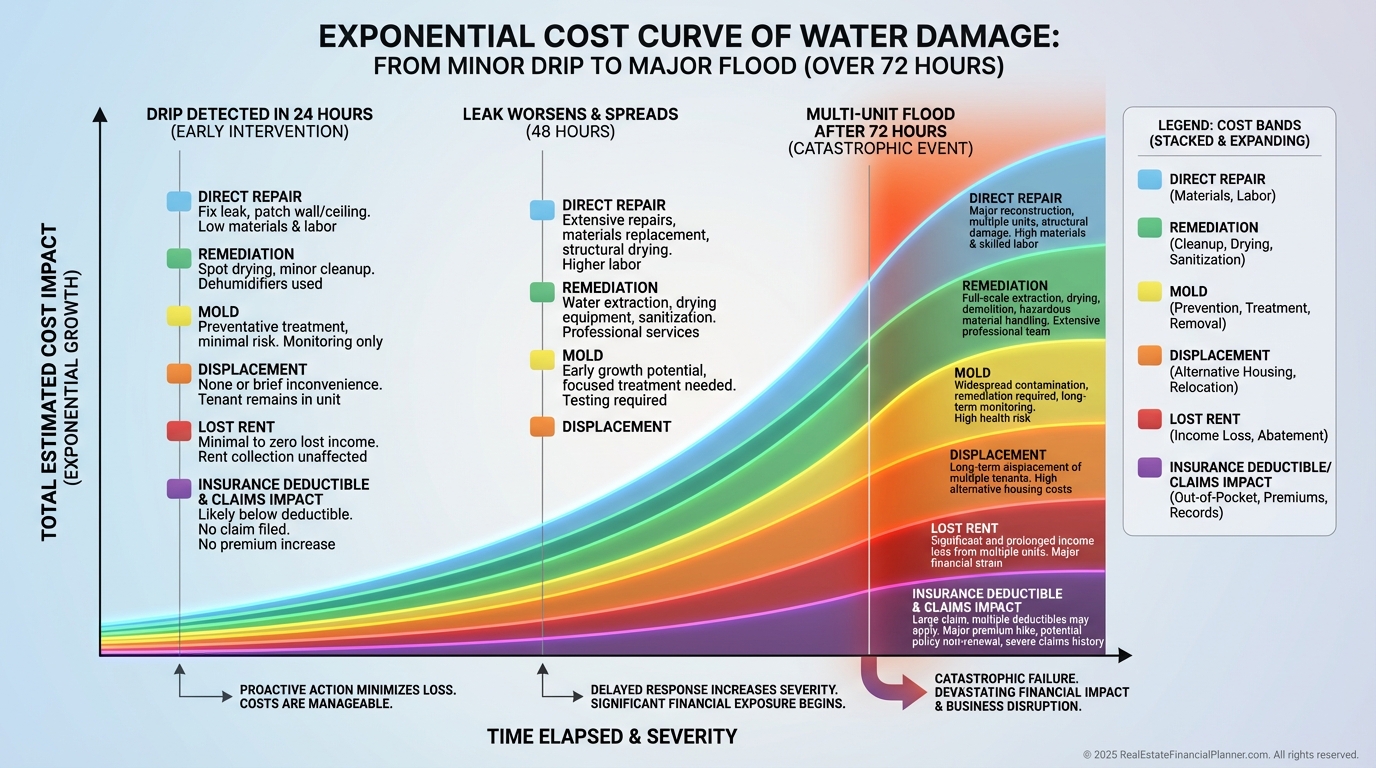

Risk Management: Water Is Your Most Expensive Liability

A burst supply line can cost $12,000–$45,000 by the time you remediate, rebuild, and cover lost rent.

A $12 braided steel line and a 15-minute install eliminates most of that risk.

I model worst-case severity plus downtime and compare it to the cost of prevention. The prevention wins.

For insurance, I assume a $2,500–$5,000 deductible and a premium increase for one to three years after a claim.

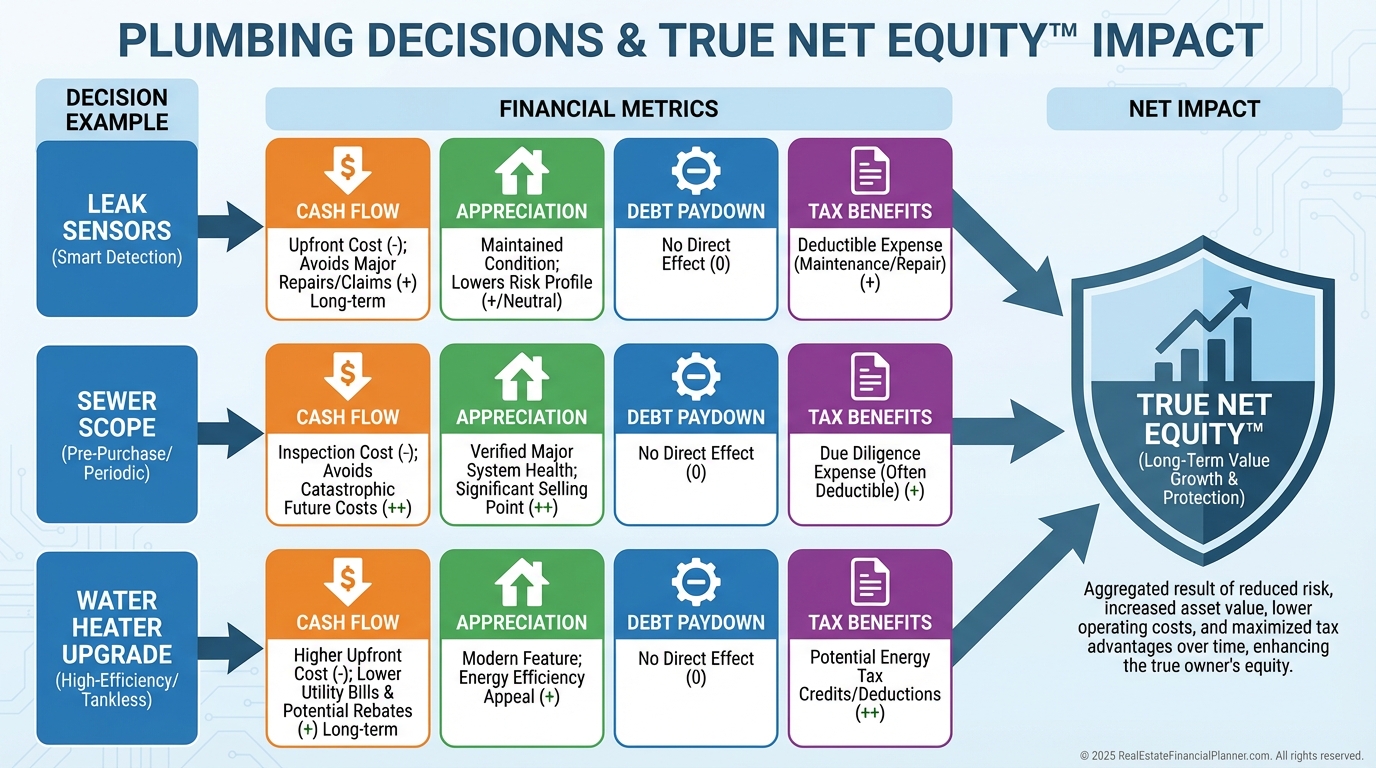

Modeling the Return Impact (Return Quadrants™)

Plumbing choices hit all four Return Quadrants™.

Cash Flow: fewer emergencies, faster turns, lower utility bills, and fewer concessions after bad experiences.

Appreciation: modern systems and documented upgrades improve buyer confidence and appraisal comps.

Debt Paydown: less downtime keeps principal reduction marching every month.

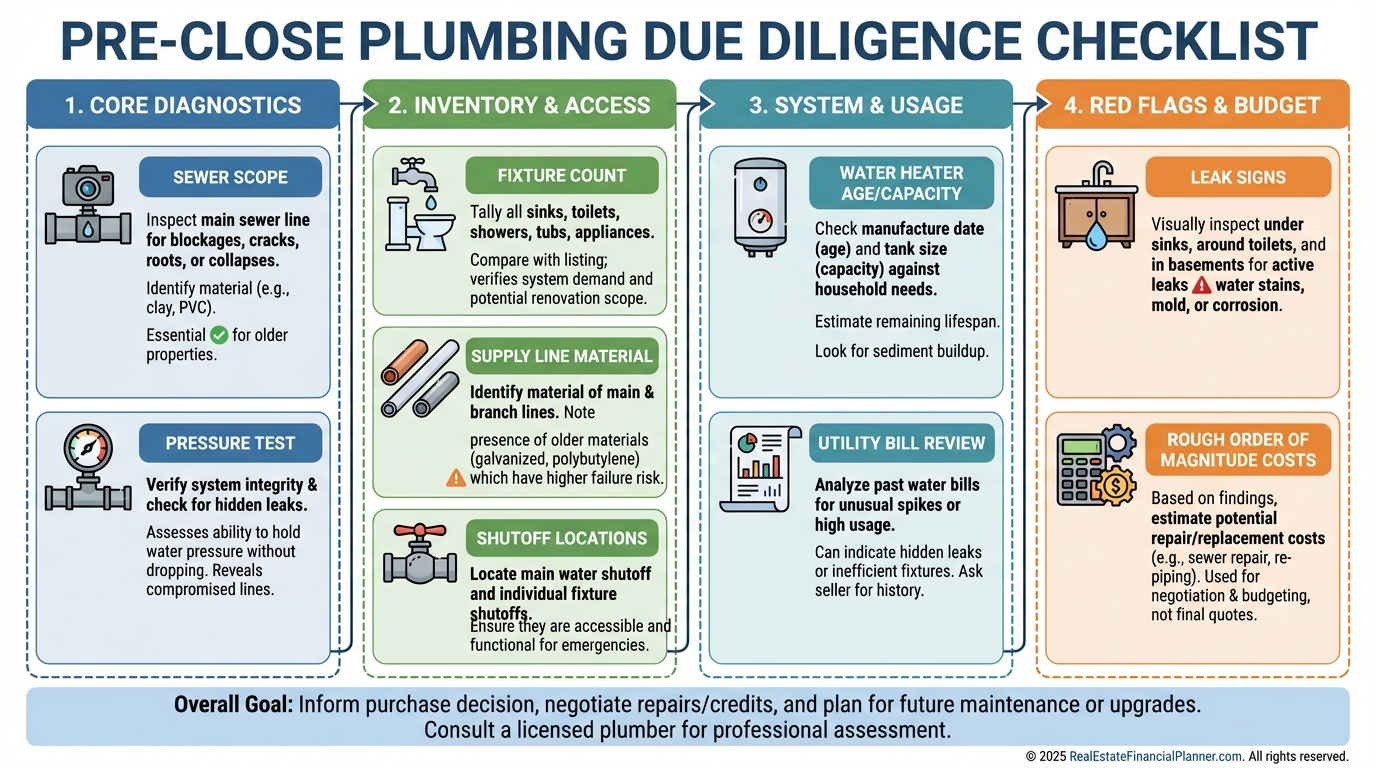

Due Diligence Before You Buy

I budget a sewer scope on every property with trees or unknown line material. It’s $150–$400. A replacement can be $6,000–$18,000.

I pressure-test and target 50–60 PSI. Over 80 PSI needs a pressure-reducing valve. Under 40 PSI signals supply issues.

I ask my plumber to inspect visible supply lines. Polybutylene or corroded galvanized is a repipe discussion, not a minor repair.

I also estimate remaining life on the water heater. If it’s 10+ years old, I plan to replace at turn.

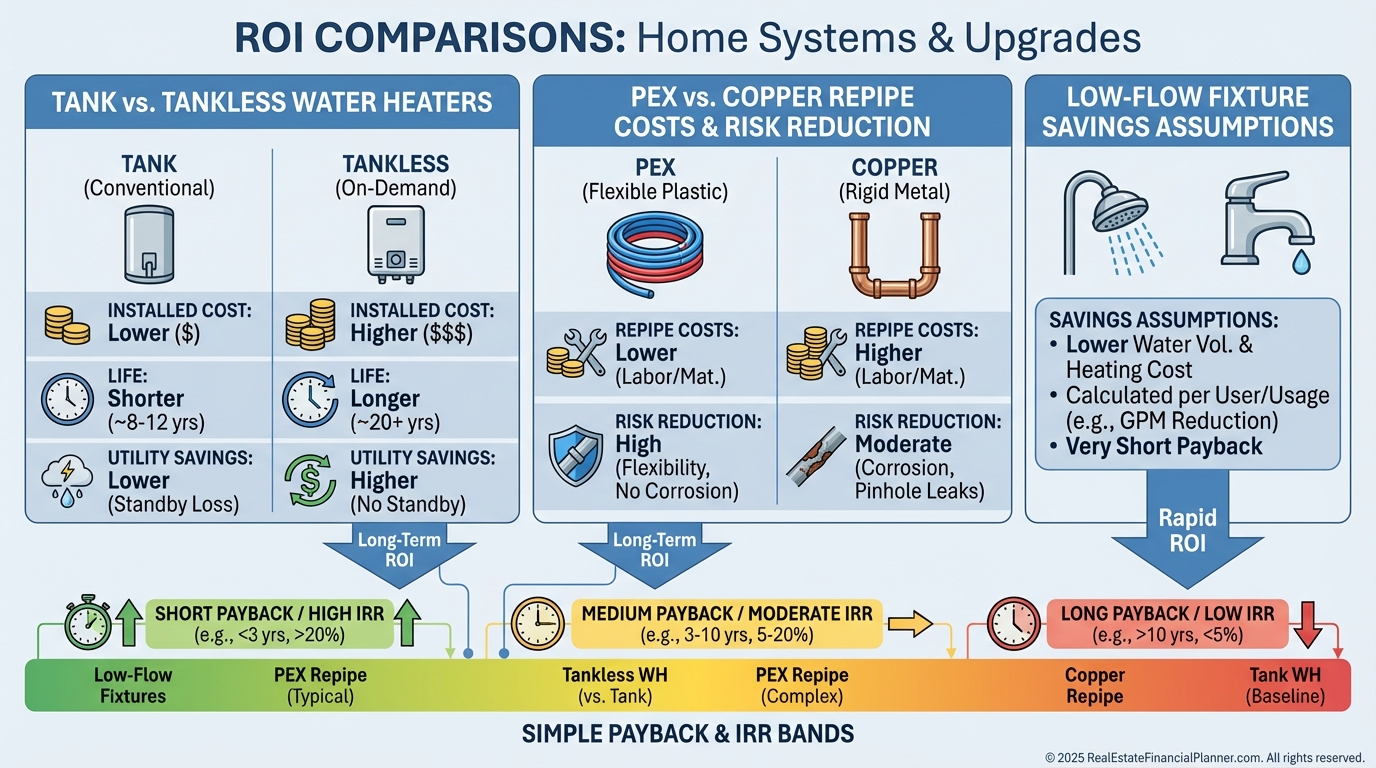

Renovations and Upgrades That Pay

Low-flow toilets (≤1.28 gpf) and aerators cut water bills 15–30% in high-usage rentals. I install them during turns.

Replace rubber supply lines with braided, add quarter-turn shutoffs, and label main shutoffs.

PEX repipes often run $3,000–$10,000 per unit and can eliminate chronic leaks. Copper can be $8,000–$20,000 but may last longer.

Standardize fixtures across your portfolio so your plumber stocks parts and closes tickets faster.

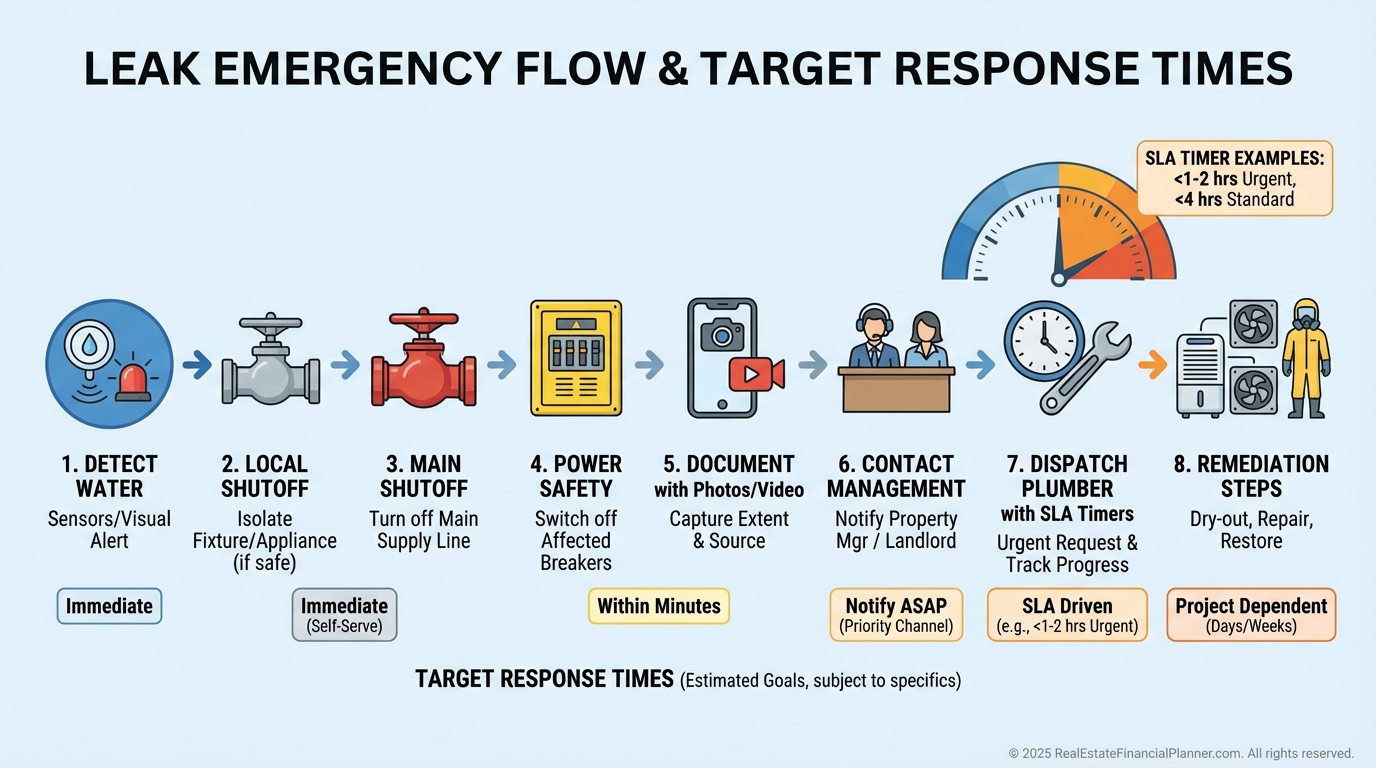

Emergency Playbook and SLAs

I require a plumber who answers 24/7 and commits to a 60-minute response for active leaks. That’s in the SLA.

My team has a tenant script: shut off local valve, then main, then electricity if water is near outlets, then call us and text photos.

We keep shutoff photos and maps in the unit file and in the tenant welcome packet.

We price in after-hours rates in reserves so we never hesitate to dispatch immediately.

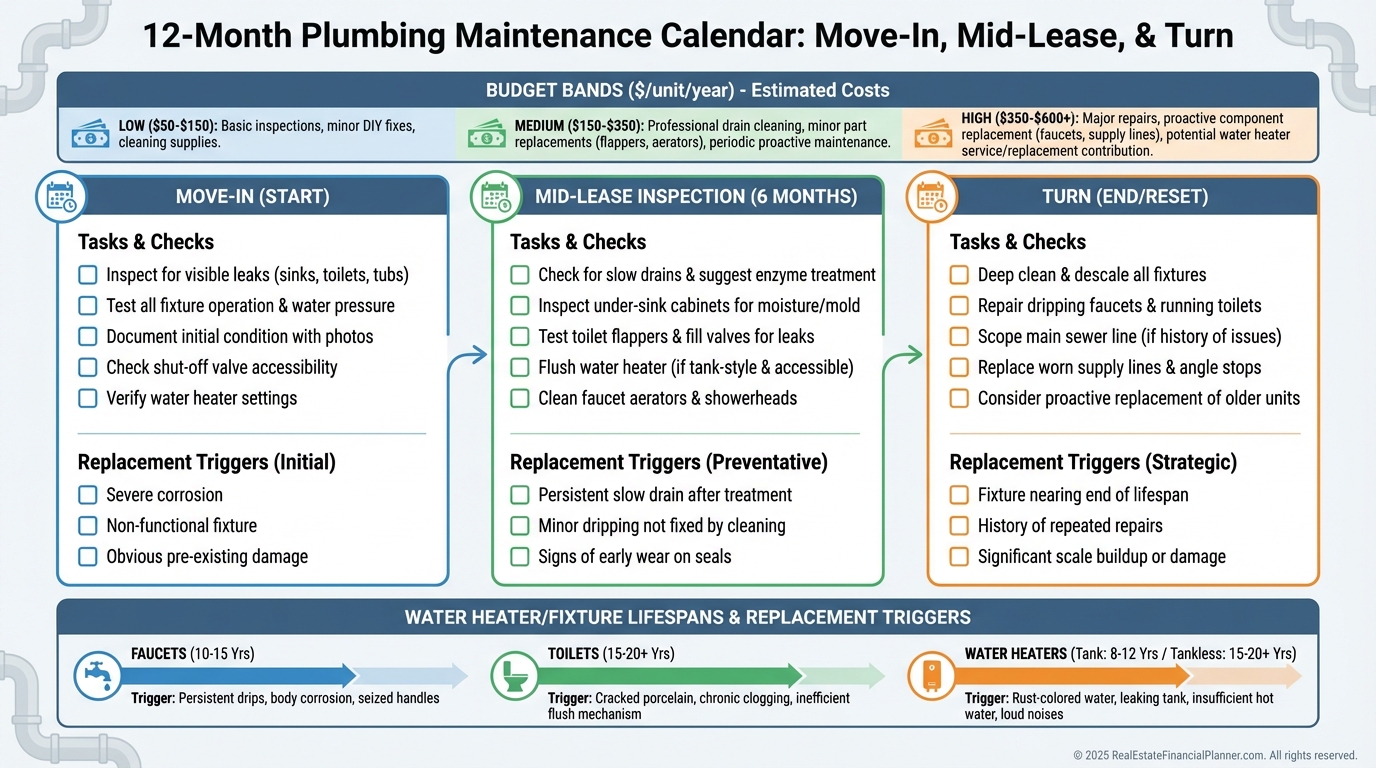

Maintenance Calendar and Budgeting

I schedule an annual plumbing walkthrough at renewal or turnover. It’s a 30–45 minute visit.

We test shutoffs, inspect supply lines, check traps, look for slow drips, and verify heaters and T&P valves.

Budget $150–$300 per unit per year for proactive plumbing and minor parts. It pays for itself in avoided calls.

I set CapEx reserves assuming water heater life of 8–12 years and fixture replacement cycles at turns.

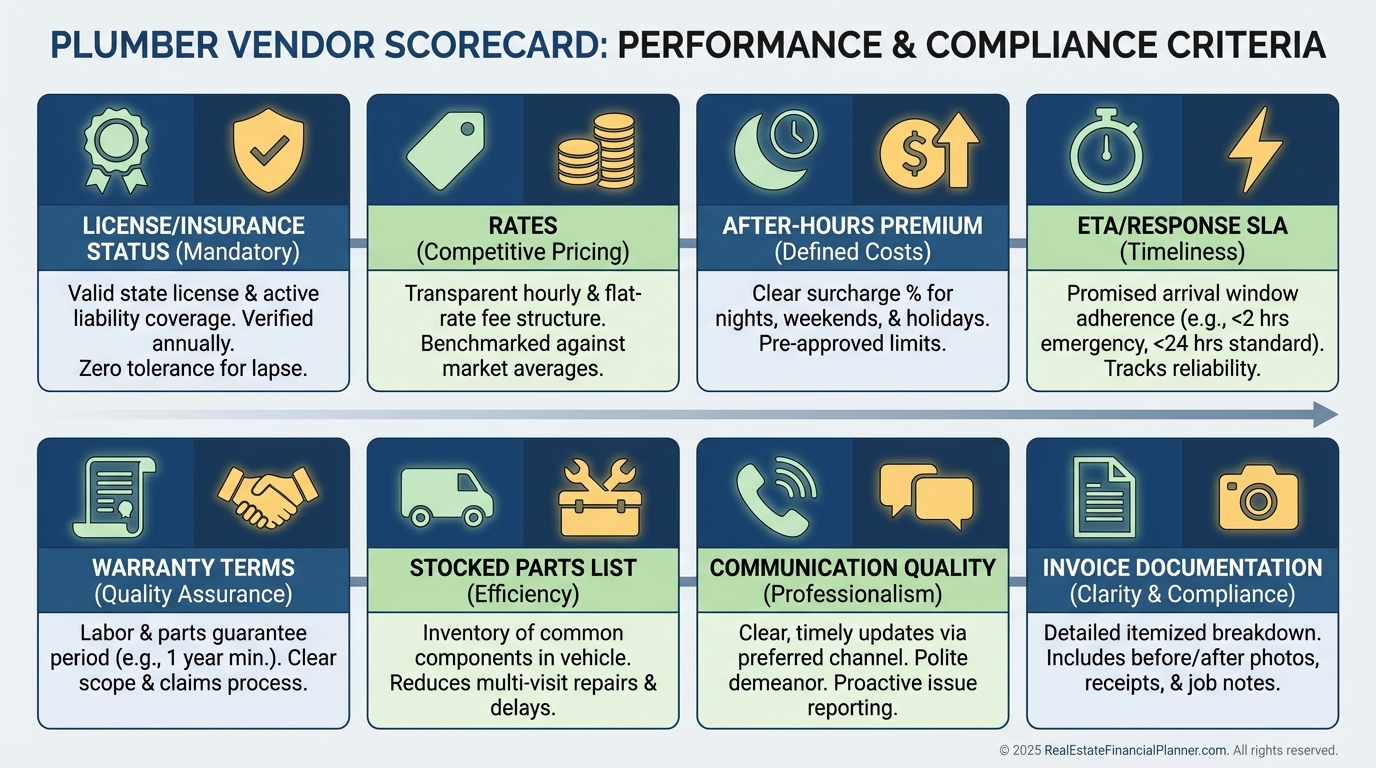

Hiring, Vetting, and Managing Plumbers

I only hire licensed and insured plumbers and verify both annually.

I ask for rates, after-hours premiums, typical ETA windows, warranty terms, and whether they stock my standardized parts.

I test communication with one small job before awarding larger scopes.

I pay fast and send consistent volume. In exchange, I ask for priority dispatch and fair pricing.

Tech Stack: Leak Detection and Monitoring

I install smart leak sensors under sinks and near heaters in high-risk units. They cost $25–$60 each.

A smart main shutoff costs $400–$800 plus install, but it can cut loss severity by 70–90%.

For multifamily, submetering or allocation plus leak analytics flags silent leaks.

I track average gallons per day per unit and investigate outliers.

Common Mistakes I See and How to Avoid Them

Not scoping the sewer before closing, then inheriting a $12,000 line replacement.

Skipping shutoff upgrades, then paying for drywall repair across three rooms.

Buying tankless without gas line or vent capacity, erasing ROI with change orders.

Letting tenants self-repair, voiding warranties and creating liability.

Templates You Can Steal

Emergency script for tenants and VAs.

Pre-close plumbing checklist with rough order of magnitude costs.

Standardized fixture list and SKUs for turns.

SLA with response times, warranty terms, and stocked parts.

Final Checks Before You List for Rent

Document shutoff locations and take labeled photos.

Replace braided lines and test all shutoffs.

Log water heater age and serial number in your property file.

Educate tenants on leak response and how to submit a priority work order.

In Nomad™, I front-load these upgrades during my owner-occupancy year. It sets the property up for lower CapEx and smoother landlording when I move out.

Protect cash flow first. Your plumber is not just a vendor—they’re a defensive coordinator for your portfolio.