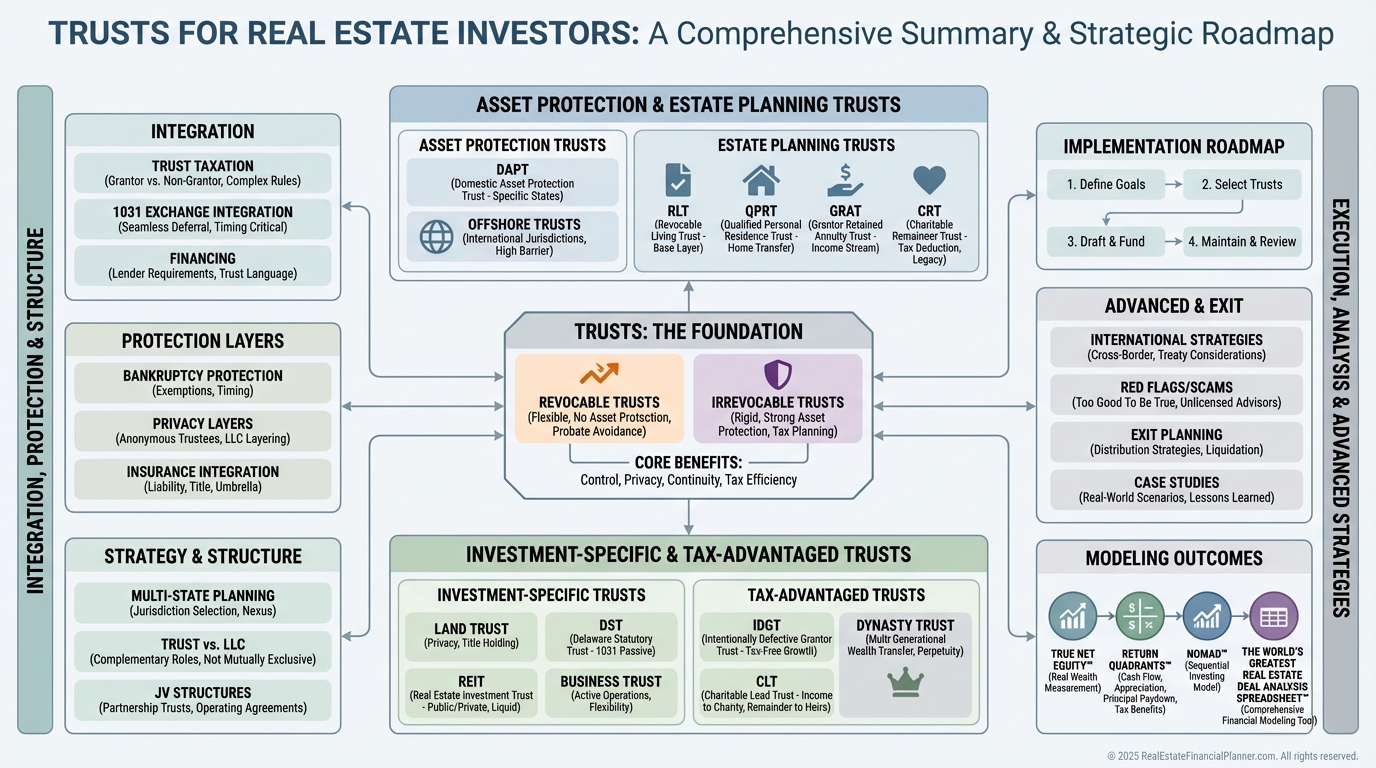

Trusts for Real Estate Investors: The No‑Fluff Playbook to Protect, Optimize, and Transfer Your Portfolio

Learn about Trusts for real estate investing.

Why Trusts Belong in Every Serious Investor’s Toolkit

When I rebuilt after bankruptcy, I prioritized structures that protected cash flow and equity without killing financing options.

Trusts were the quiet multiplier.

They improved privacy, reduced taxes in the right scenarios, and made transfers to heirs painless.

When I model strategies for clients, I check two things first: their True Net Equity™ if they sold or exchanged today, and how Return Quadrants™ change with different trust structures.

The right trust makes your returns more durable.

Trusts 101: The Fast Basics

Think of it as a container that can shape ownership, taxes, and control.

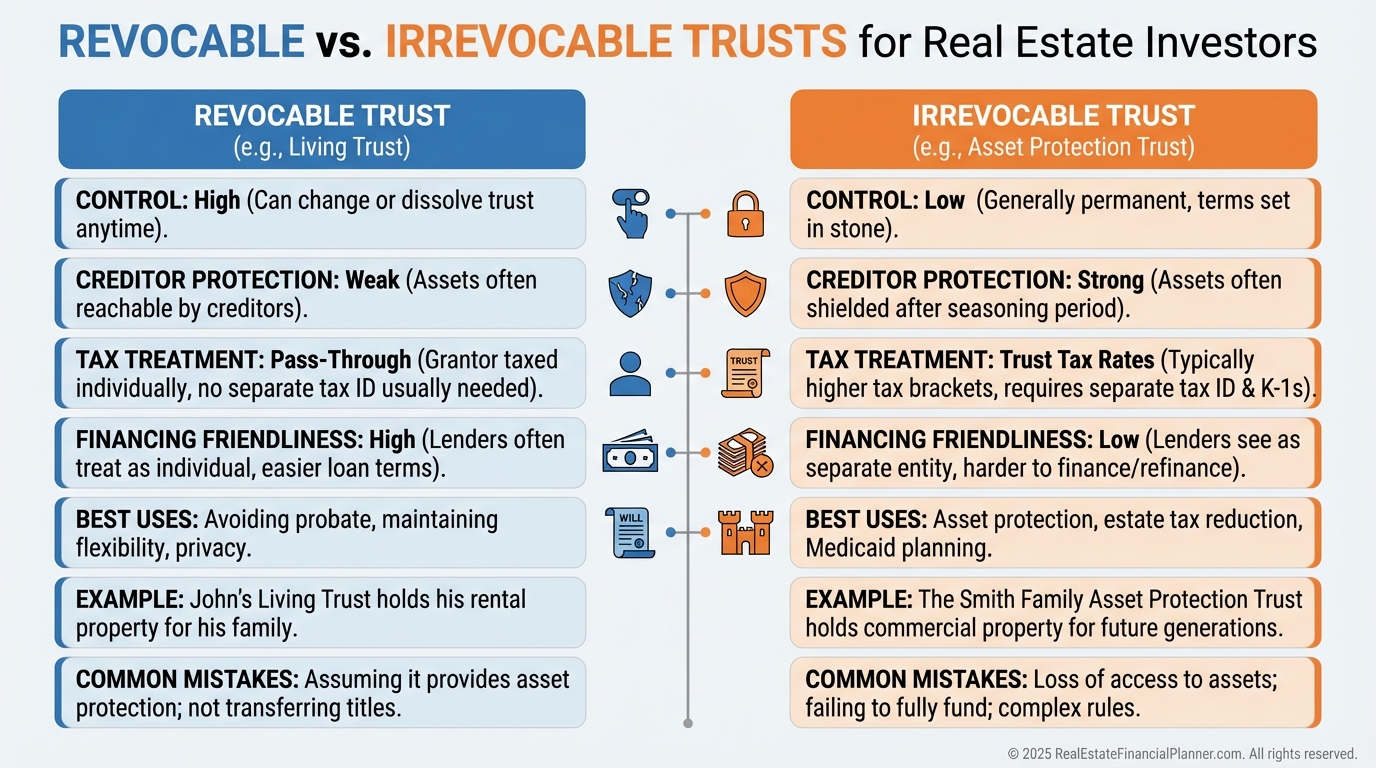

The key split is simple.

Revocable trusts are flexible and ignore income taxes, but offer no asset protection.

Irrevocable trusts are harder to change, but can deliver strong protection and tax benefits.

The Four Big Wins for Investors

•

Asset protection from personal lawsuits and business creditors.

•

Tax planning with charitable, estate, and income tax strategies.

•

Privacy to keep your name off title and out of easy searches.

•

Estate planning to bypass probate and control distributions.

When I help clients, I map these wins against their goals and timeline.

Then I select the lowest‑complexity trust that achieves the target outcome.

Asset Protection Trusts You Should Actually Consider

Domestic Asset Protection Trusts (DAPTs) let you be a beneficiary and still gain statutory protection in certain states.

Nevada, Delaware, and Alaska lead domestically, with seasoning periods you must respect.

Offshore trusts in the Cook Islands or Nevis raise the wall much higher.

They are expensive, complex, and best for higher net worth or high‑liability profiles.

I rarely recommend them before clients cross a meaningful net‑worth threshold, or before we fix simpler gaps.

Series LLCs aren’t trusts, but pair well with trusts.

We often put LLCs on title and own the LLC interests inside a DAPT or a revocable trust for estate planning.

Estate Planning Trusts That Keep You in Control

A Revocable Living Trust is the default for almost everyone.

You keep control now and avoid probate later.

It won’t protect assets during life, but it organizes how everything passes—fast.

A Qualified Personal Residence Trust (QPRT) can move a residence or vacation home to heirs at a discount for estate tax.

It shines when values are rising and rates are favorable.

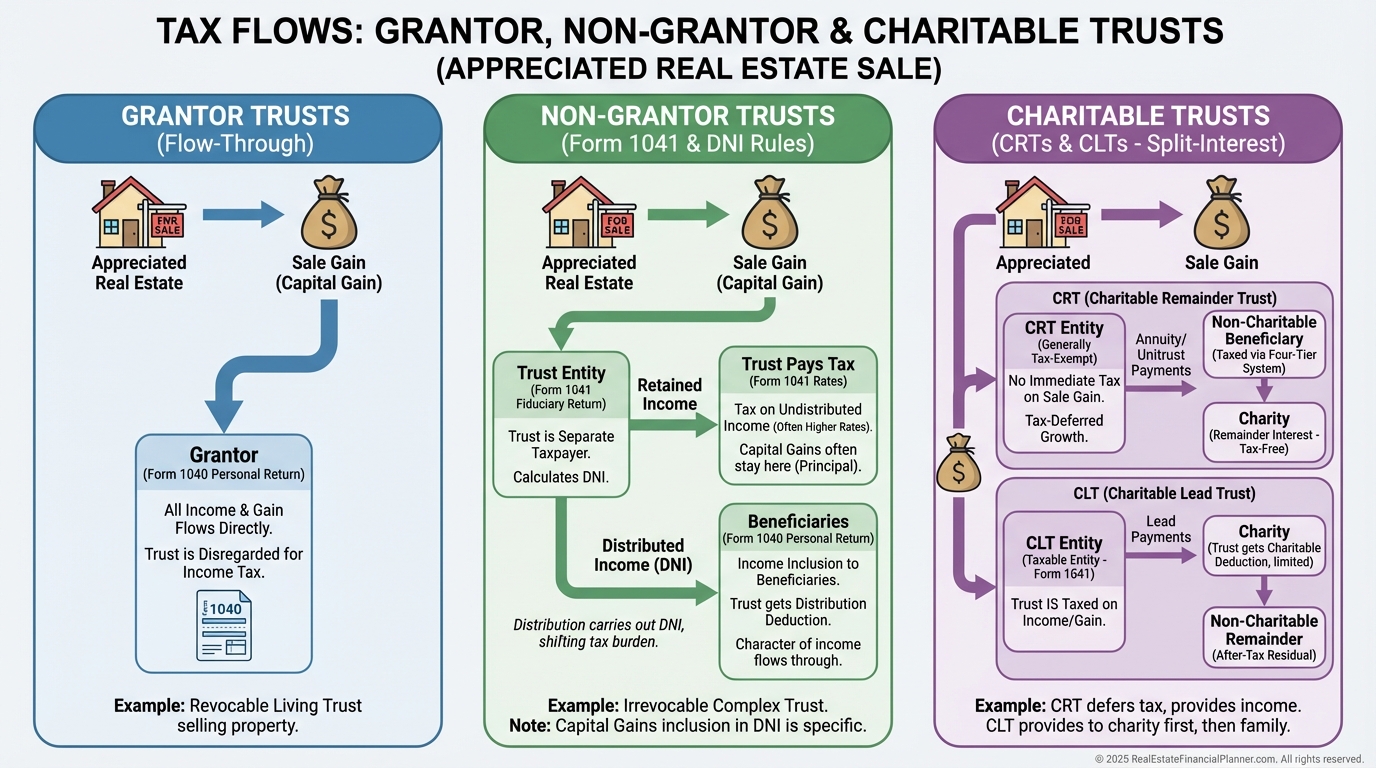

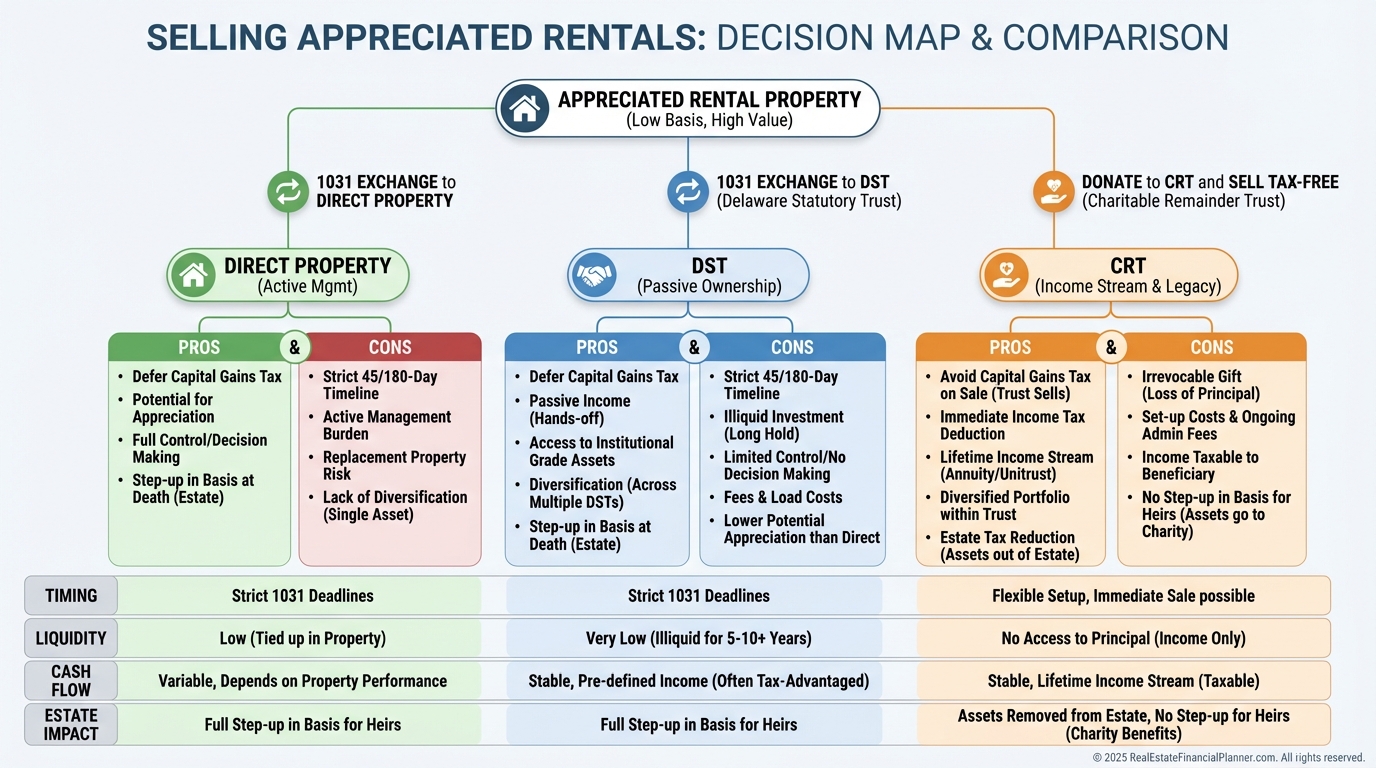

A Charitable Remainder Trust (CRT) can sell appreciated property without immediate capital gains.

You get lifetime income and a charitable deduction.

A Grantor Retained Annuity Trust (GRAT) can shift appreciation to heirs at very low gift tax cost.

It works best with assets you expect to grow faster than the IRS hurdle rate.

When I model these, I compare True Net Equity™ for sell‑now vs. sell‑via‑CRT vs. 1031, and I check how distributions change Return Quadrants™.

Investment-Specific Trusts You’ll Actually Use

Land trusts are simple privacy tools.

They keep your name off title and make beneficial interest transfers easier.

I use them for wholesalers, subject‑to deals, and investors who value anonymity.

Delaware Statutory Trusts (DSTs) are great 1031 landing spots.

You exchange into fractional interests in institutional assets and go passive.

It’s the de‑management button for tired landlords.

Business trusts (Massachusetts trusts) can structure syndications and JVs with liability protections and pass‑through taxation.

They add flexibility for waterfalls and preferred returns.

Private REITs are powerful but complex.

They fit institutional‑style operators, not most small investors.

Tax-Advantaged Trusts for Specific Outcomes

Intentionally Defective Grantor Trusts (IDGTs) let you pay the income tax while the trust grows for heirs.

They shine with cash‑flowing rentals when you’re building a multigenerational plan.

Charitable Lead Trusts (CLTs) pay charity first, then family.

They can neutralize estate tax while supporting causes you care about.

Dynasty trusts can preserve wealth across generations in states that allow long‑duration trusts.

They require careful drafting and a committed family education plan.

Trust Taxation You Must Understand

Grantor trusts, including most revocable trusts and many IDGTs, are ignored for income tax.

The numbers flow onto your 1040.

Non‑grantor trusts file Form 1041 and hit top brackets quickly.

Distributions carry out income to beneficiaries and can reduce overall tax through rate arbitrage.

Charitable trusts can create tax‑free sales and deductions.

I always model after‑tax cash flows in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ before recommending a path.

1031 Exchanges and Trusts

DSTs have become the go‑to for investors exiting active management.

They preserve 1031 treatment and provide professional management.

Traditional trusts can also hold 1031 property.

The taxpayer who sells must be the taxpayer who buys.

Revocable trusts usually pass this test.

Irrevocable trusts require careful alignment of taxpayer identity.

When I design a 1031 path, I often park assets in a revocable trust first to keep options open.

Bankruptcy and Creditor Realities

Revocable trusts offer no bankruptcy protection.

Irrevocable trusts can protect if funded before trouble and drafted correctly.

DAPTs are strong domestically after seasoning periods.

Offshore trusts add another wall but increase cost and scrutiny.

I remind clients: courts look for bad facts.

Last‑minute transfers or inadequate insurance can unwind even good planning.

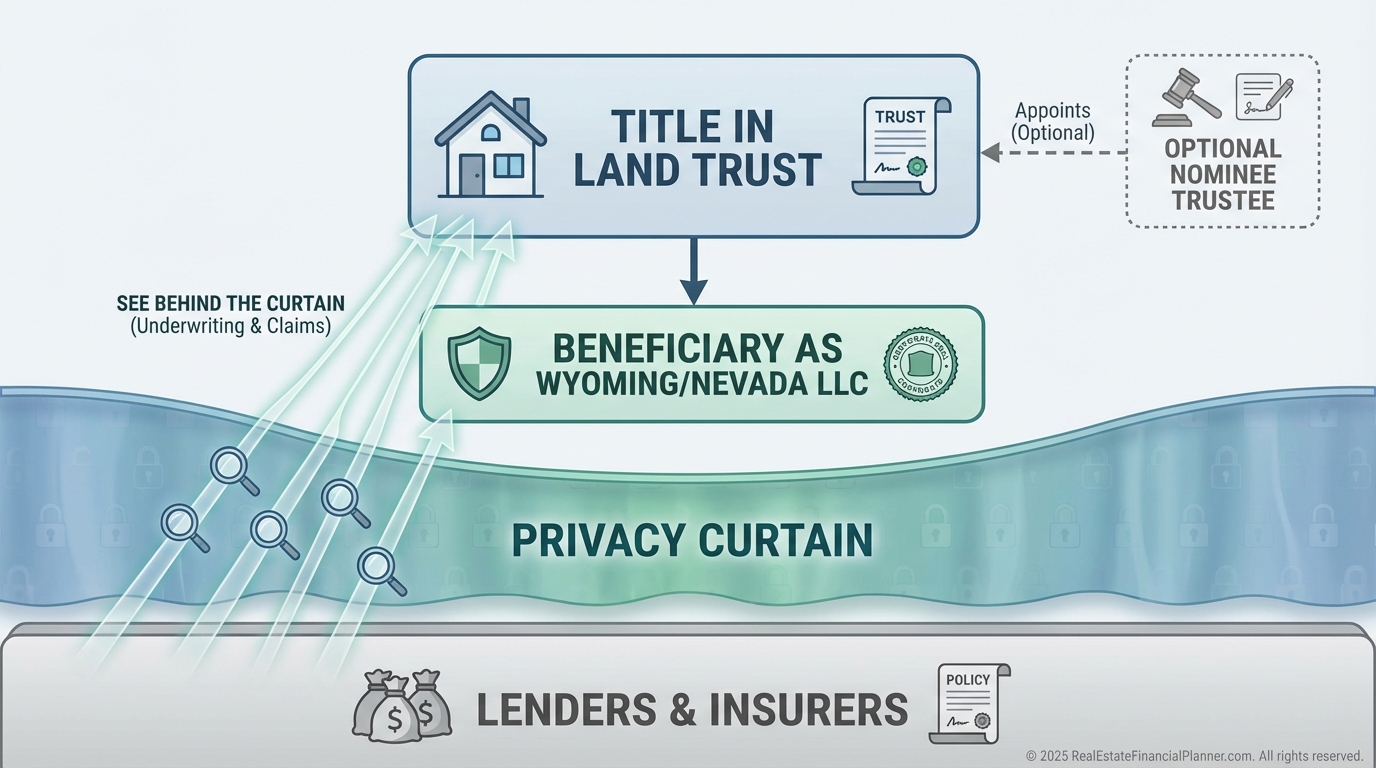

Privacy: Keeping Your Name Out of Easy Searches

Land trusts keep your name off record.

Pair the beneficial interest with a Wyoming or Nevada LLC for another layer.

Nominee trustees can add separation if your state allows.

Privacy discourages predatory lawsuits, but it’s not for hiding wrongdoing.

It’s for controlling who knows what and when.

Multi‑State Investing Without Stepping on Rakes

Trust rules vary by state.

California treats out‑of‑state DAPTs harshly for residents.

Illinois has unique land trust practices.

Texas Series LLCs pair well with trust ownership.

When I build multi‑state plans, I match entities to the state and let a master trust own the interests.

We also consider state income taxes and situs rules for trusts.

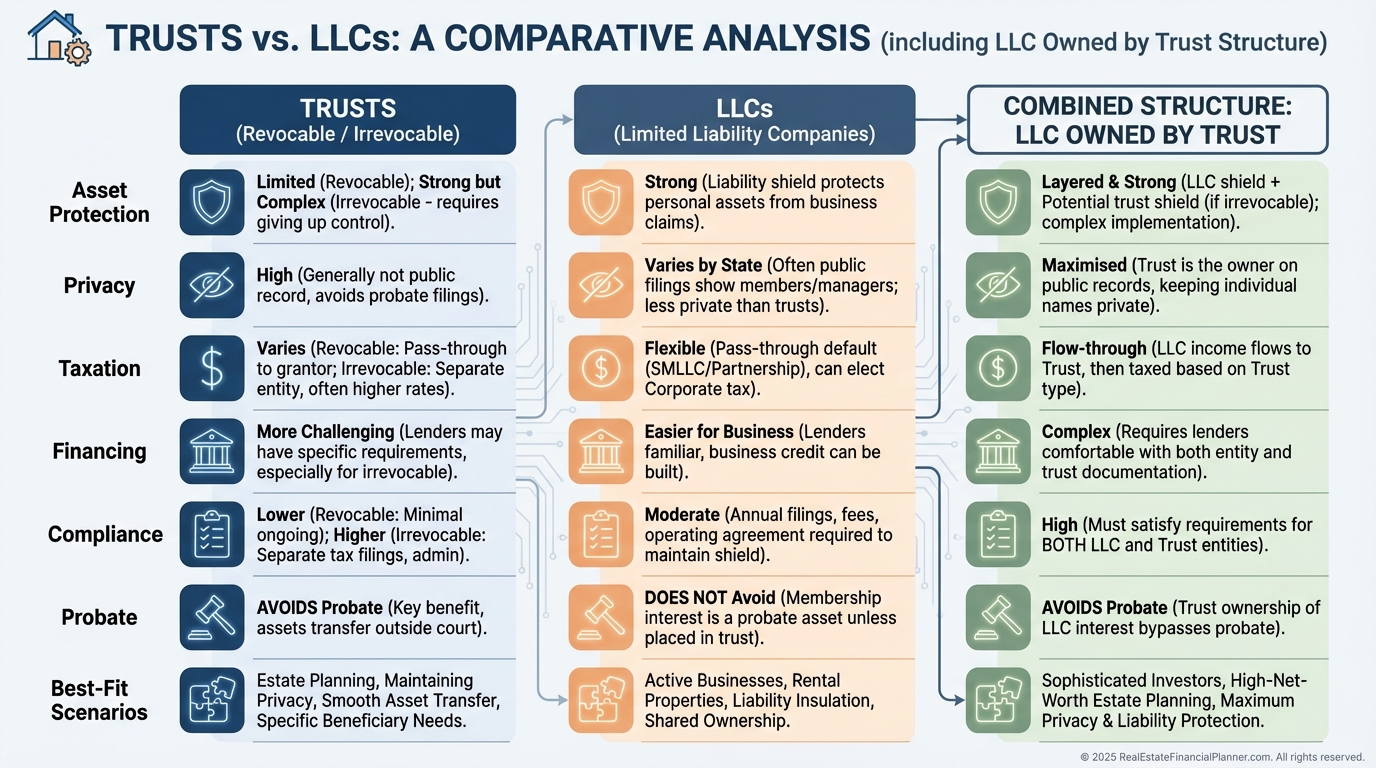

Trusts vs. LLCs: Don’t Pick—Combine

LLCs are great for operations, financing, and charging order protection.

Trusts excel at privacy and succession.

Financing often favors LLCs or revocable‑trust ownership.

My default is property in an LLC, LLC interest owned by a revocable trust or DAPT depending on goals.

It keeps lending smooth and estate planning clean.

Red Flags and Trust Mill Warnings

Avoid “pure trusts” or “constitutional trusts” promising tax elimination.

That’s fraud.

Be wary of one‑size‑fits‑all packages and high‑pressure sales.

Ask for state‑licensed attorneys with real estate trust experience.

Get itemized quotes and second opinions for complex setups.

If a promise sounds perfect—tax‑free, lawsuit‑proof, and full control—it isn’t real.

International Real Estate and Foreign Trusts

Foreign asset protection trusts can own foreign LLCs that hold property.

They’re powerful but come with heavy reporting and real cost.

U.S. persons must file Forms 3520, 3520‑A, and often 8938.

For many, a two‑trust approach—domestic for U.S. holdings, foreign for international—keeps reporting clean.

Always verify local rules on foreign ownership.

Joint Ventures and Syndications with Trusts

Business trusts can simplify JVs and protect passive investors.

DSTs are another JV‑like path with 1031 eligibility.

For syndicators, a master trust can own the managing entity to harden the structure and provide succession.

Spell out waterfalls, prefs, and catch‑ups with surgical clarity in the trust agreement.

Confirm lender requirements early so you don’t draft into a financing dead end.

Exit Planning Starts on Day One

Revocable trusts give you fast pivots for sales, refis, and exchanges.

Irrevocable trusts need built‑in flexibility.

I like powers to substitute assets, trust protectors, and decanting language.

Separate long‑term holds from flips.

Keep flips in LLCs or revocable structures for easy moves; park legacy assets in irrevocable planning.

Insurance Integration

Tell your insurer about trust ownership.

Some carriers balk at trust‑titled properties.

Make sure umbrella coverage aligns with the titled owner.

Larger portfolios can explore captive insurance, but only with competent counsel and actuarial support.

Courts expect reasonable insurance regardless of trust planning.

Financing Without Drama

Conventional lenders are most comfortable with revocable trusts and LLCs.

Irrevocable trusts face more friction and personal guarantee requests.

Portfolio lenders and credit unions tend to be more flexible.

For land trusts, expect the lender to identify the beneficiary and require guarantees.

Private money, seller financing, and inter‑trust loans can fill gaps while keeping your plan intact.

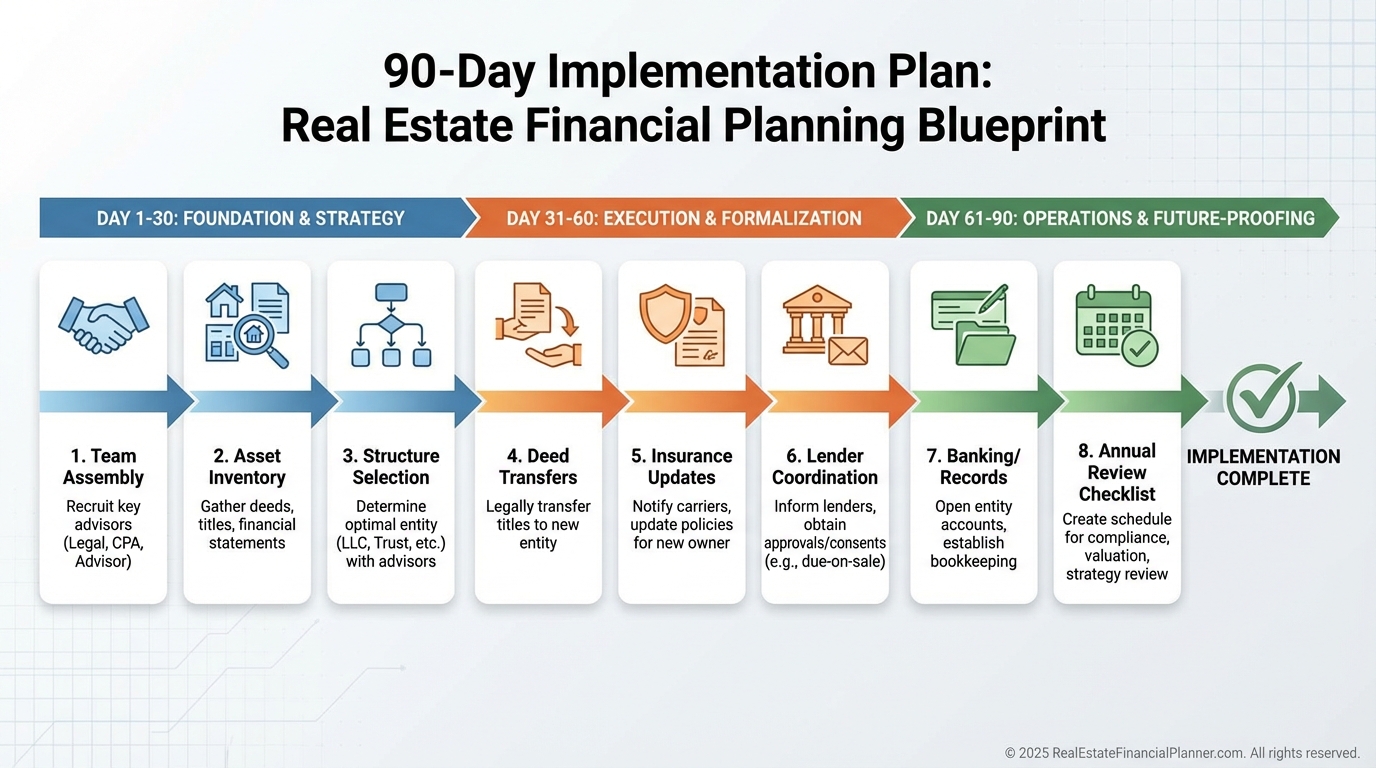

Implementation: What I Ask Clients to Do First

Build your team: a real estate‑savvy trust attorney and a CPA who actually does trust returns.

Inventory your properties and current titling.

Pick primary objectives for each asset: protection, tax, or estate speed.

Fund the trust.

Unfunded trusts are paperweights.

Update deeds, leases, insurance, and banking.

Keep minutes for trustee actions and sign “as Trustee” every time.

Annual reviews keep structures aligned with your life.

Case Studies You Can Model

Sarah, a Chicago wholesaler, took title in land trusts and assigned beneficial interests.

Her deal velocity jumped, and her name vanished from title searches.

Bob, a retiree with 12 rentals, 1031‑exchanged into DSTs.

He deferred a large tax bill and turned management into mailbox money.

Maria used a QPRT for her home, GRATs for appreciating commercial assets, and a CRT for highly appreciated land.

Her estate tax dropped sharply, income rose, and her plan matched her values.

I recreated their outcomes using True Net Equity™ comparisons and Return Quadrants™ for each exit path.

The math made the decisions obvious.

Choosing Your Next Best Step

Start simple.

Most investors begin with a revocable living trust and add land trusts or LLCs for properties.

As equity grows, consider DAPTs, CRTs, or IDGTs where they actually move the needle.

If you’re a Nomad™ investor, align your residence strategy with QPRT and future rental conversions.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to quantify cash flow, taxes, equity, and liquidity across scenarios.

Trusts aren’t magic.

They’re precision tools.

Use them where they win, and skip them where they don’t.

Action Steps

•

This week: list all properties, titling, loans, equity, and insurance; define your top three priorities.

•

Next 30 days: interview three trust attorneys, price options, and pre‑clear financing impact with lenders.

•

Next 90 days: set up your first trust, transfer title properly, update insurance, and open dedicated banking.

•

Ongoing: annual legal and tax reviews, training heirs, and revising structures as laws and life change.