Financial Independence Through Real Estate: The Metrics That Actually Set You Free

Learn about Financial Independence for real estate investing.

Most real estate investors chase cash flow without understanding what financial independence actually is.

They show me a property making $500 a month and assume they’re “on the path,” even though that number alone tells me almost nothing.

When I help clients evaluate deals, I’m not asking, “Does this cash flow?”

I’m asking, “Does this move you closer to never needing a paycheck again?”

That distinction is where most investors go wrong.

I’ve watched people buy the wrong properties, over-leverage themselves, or sell income-producing assets right before everything would have clicked.

Not because they were lazy.

Because they misunderstood the goal.

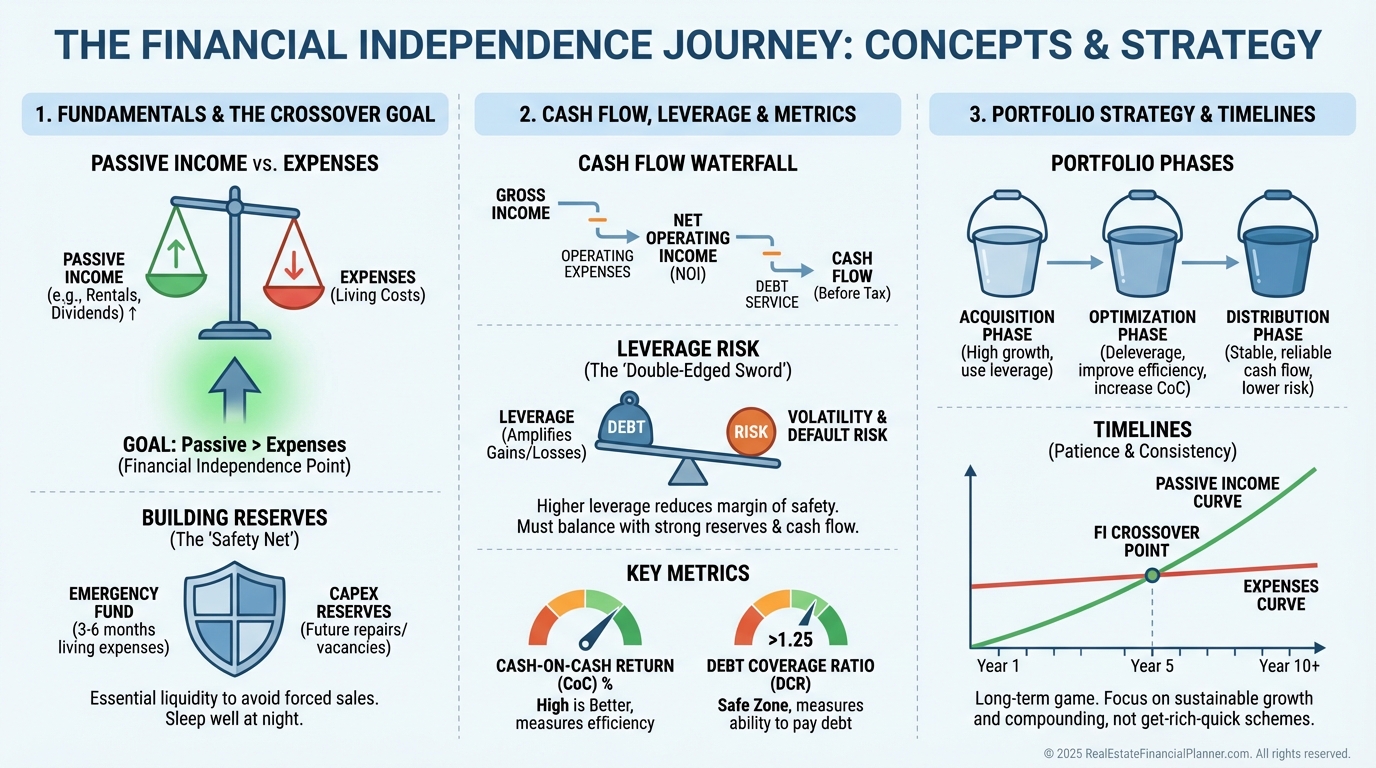

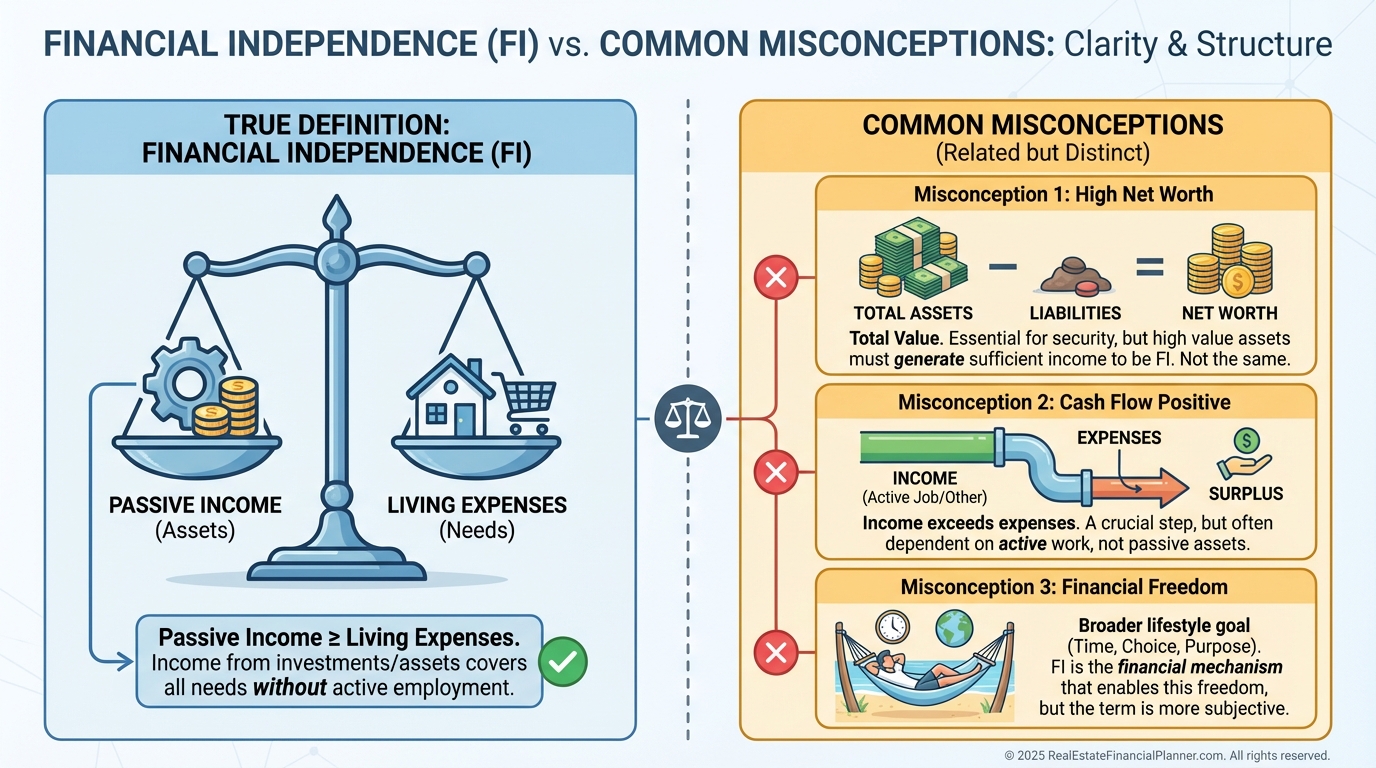

What Financial Independence Really Means

Financial independence happens when your passive income reliably exceeds your living expenses without consuming your assets.

Not someday.

Not on paper.

Reliably.

This has nothing to do with owning a certain number of properties or hitting a net worth milestone.

I’ve met millionaires who couldn’t miss a paycheck and modest investors who never had to work again.

Here’s where confusion creeps in.

Financial freedom means work is optional.

Cash flow positive means a property makes money.

A high net worth just means you own things.

Financial independence means your income covers your life whether you work or not.

That’s it.

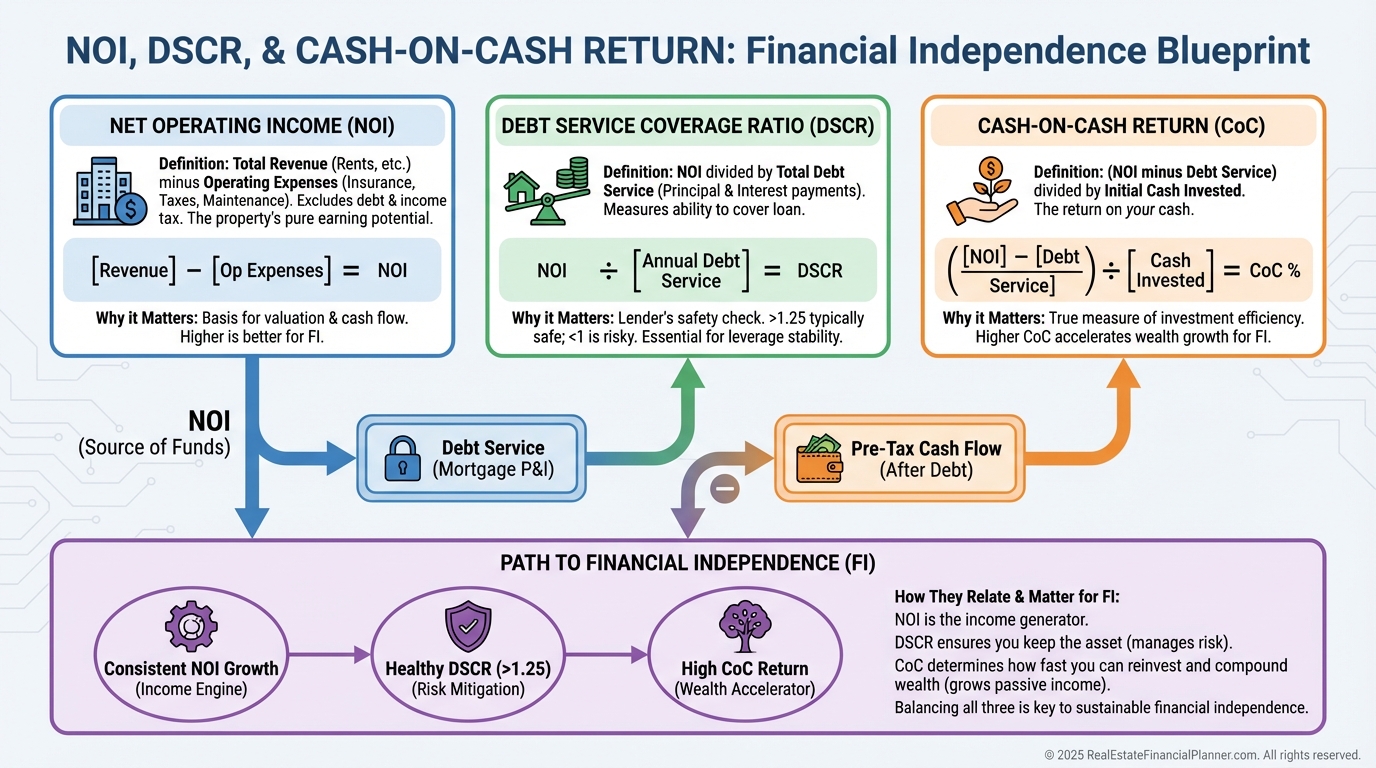

The Metrics That Actually Matter

When I analyze properties with clients, we focus on relationships, not single numbers.

Three metrics tell the real story.

Net Operating Income shows whether the property can stand on its own.

Debt Service Coverage Ratio tells you how fragile or resilient that income is.

Cash-on-cash return reveals how efficiently your capital works.

This is why I don’t get excited about a deal until I see all three together.

A property can cash flow and still destroy your independence if the margin is thin.

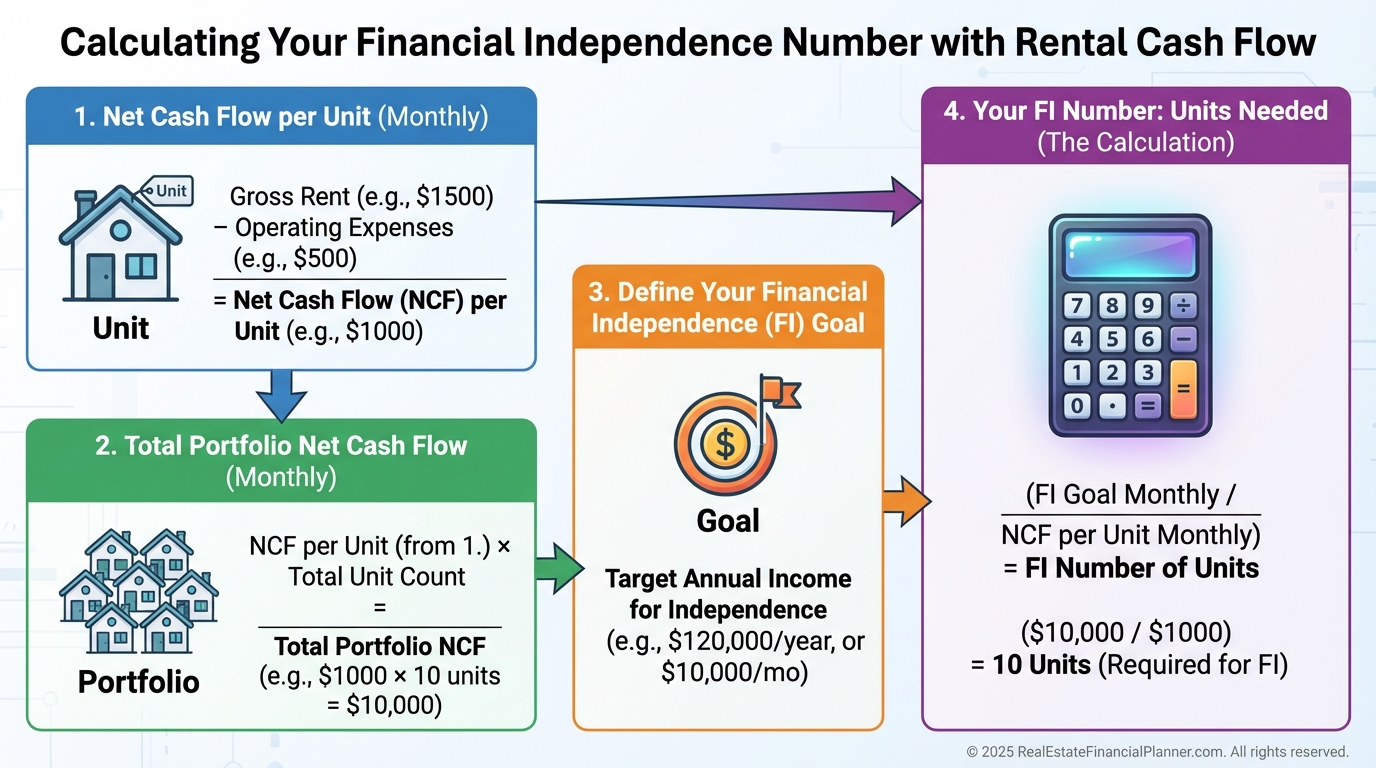

Calculating Your Real Independence Number

The math looks simple.

Monthly expenses divided by average cash flow per unit equals units required.

The danger is inaccurate cash flow.

Most investors underestimate expenses and overestimate rents.

Every time.

When I rebuilt after bankruptcy, I stopped trusting optimistic assumptions.

I budgeted aggressively.

That discipline is why the second portfolio worked when the first one didn’t.

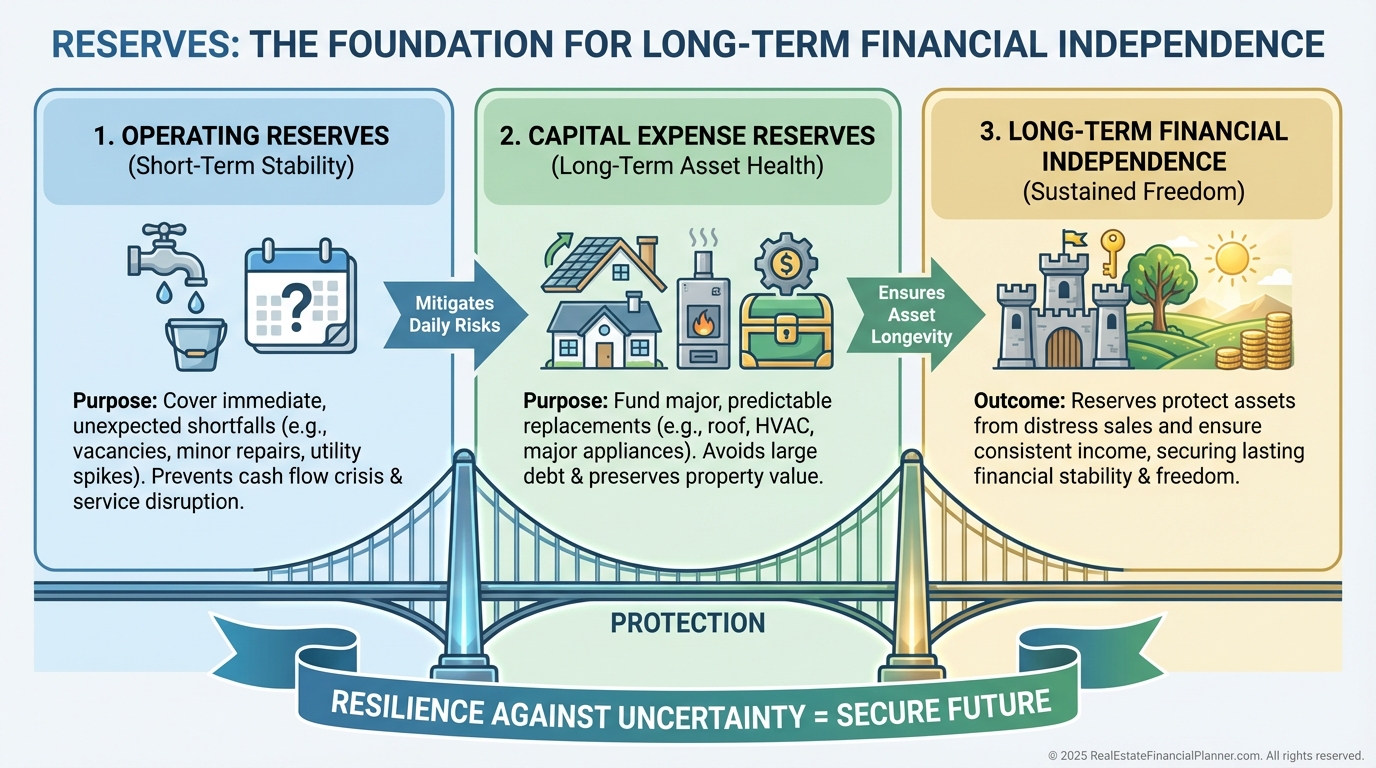

The Role of Reserves (And Why Most Investors Ignore Them)

Reserves are not optional.

They are the difference between temporary stress and permanent failure.

I’ve seen investors forced to sell great properties because they didn’t have $15,000 available at the wrong moment.

Cash flow without reserves is an illusion.

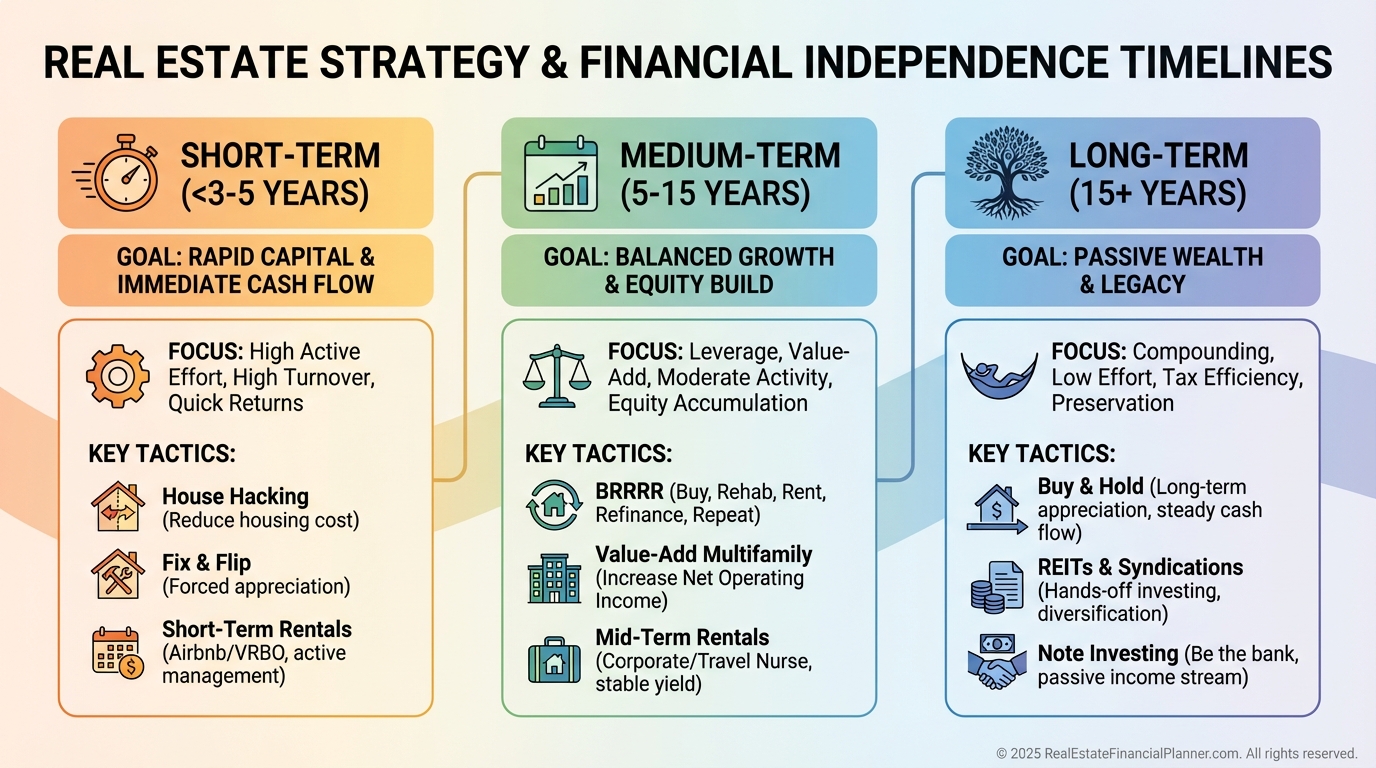

How Your Timeline Changes Everything

A ten-year horizon and a three-year horizon require different properties.

This is where investors sabotage themselves by copying strategies that don’t match their lives.

If you need income soon, appreciation won’t pay your bills.

If you already crossed the finish line, risk matters more than growth.

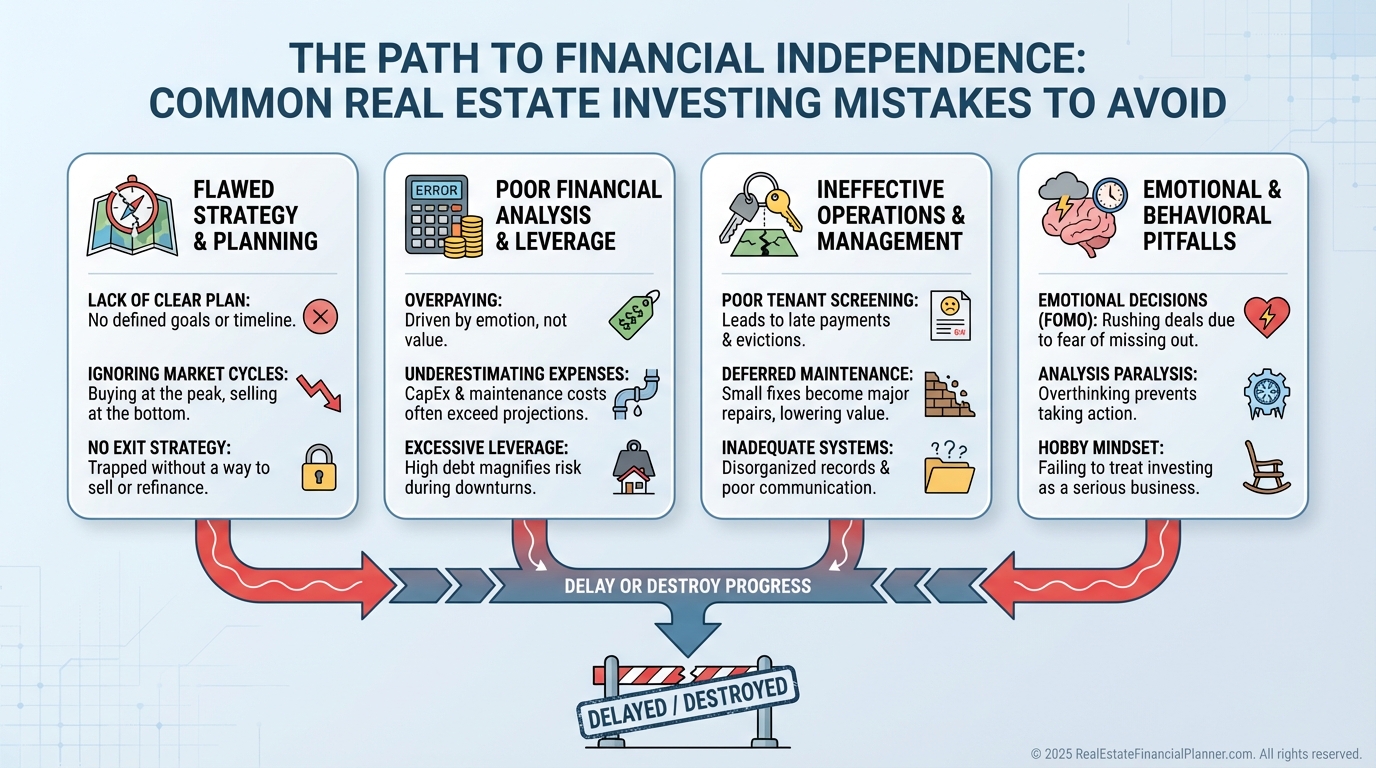

The Most Common Independence Killers

When clients get into trouble, it’s rarely a single bad deal.

It’s a pattern.

Counting gross rent as income.

Maxing leverage because someone said debt is “good.”

Buying in shrinking markets for headline returns.

Ignoring property management costs until burnout hits.

I’ve watched smart people undo years of progress in one downturn because they optimized for speed instead of durability.

Strategies That Actually Accelerate Independence

There are only a few levers that matter.

Reducing your personal expenses.

Recycling capital efficiently.

Using tax rules intentionally.

House hacking works because it lowers the target.

BRRRR works because it reuses capital.

Depreciation works because it keeps more income in your control.

None of these are shortcuts.

They’re force multipliers when used responsibly.

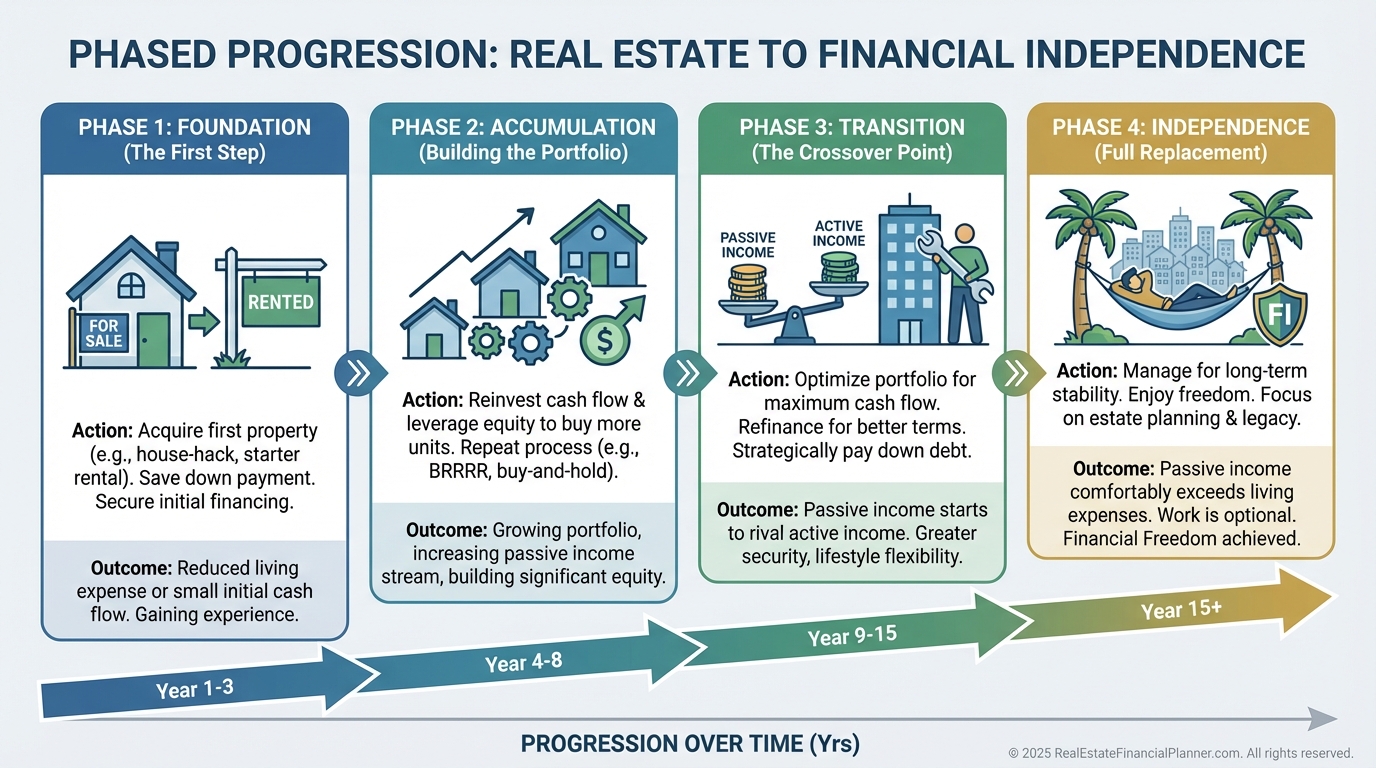

Building Your Personal Independence Roadmap

I always start with expenses.

Not dreams.

Not Instagram numbers.

Real expenses.

From there, we reverse engineer a realistic plan.

The investors who succeed aren’t reckless.

They’re patient.

They track progress.

They survive downturns.

And they make decisions through the lens of sustainable income, not ego or speed.

The Reality Most People Don’t Want to Hear

Financial independence through real estate isn’t passive at first.

It requires learning.

Systems.

Attention.

The portfolio you start with won’t be the portfolio you end with.

But if every property moves you closer to replacing your income reliably, the math eventually becomes boring.

And boring is freedom.

That’s the version of financial independence worth pursuing.