Lazy Marketing Methods That Actually Work: Scale Your Deal Flow by Spending Smart, Not Hustling Hard

Learn about Lazy Marketing Methods for real estate investing.

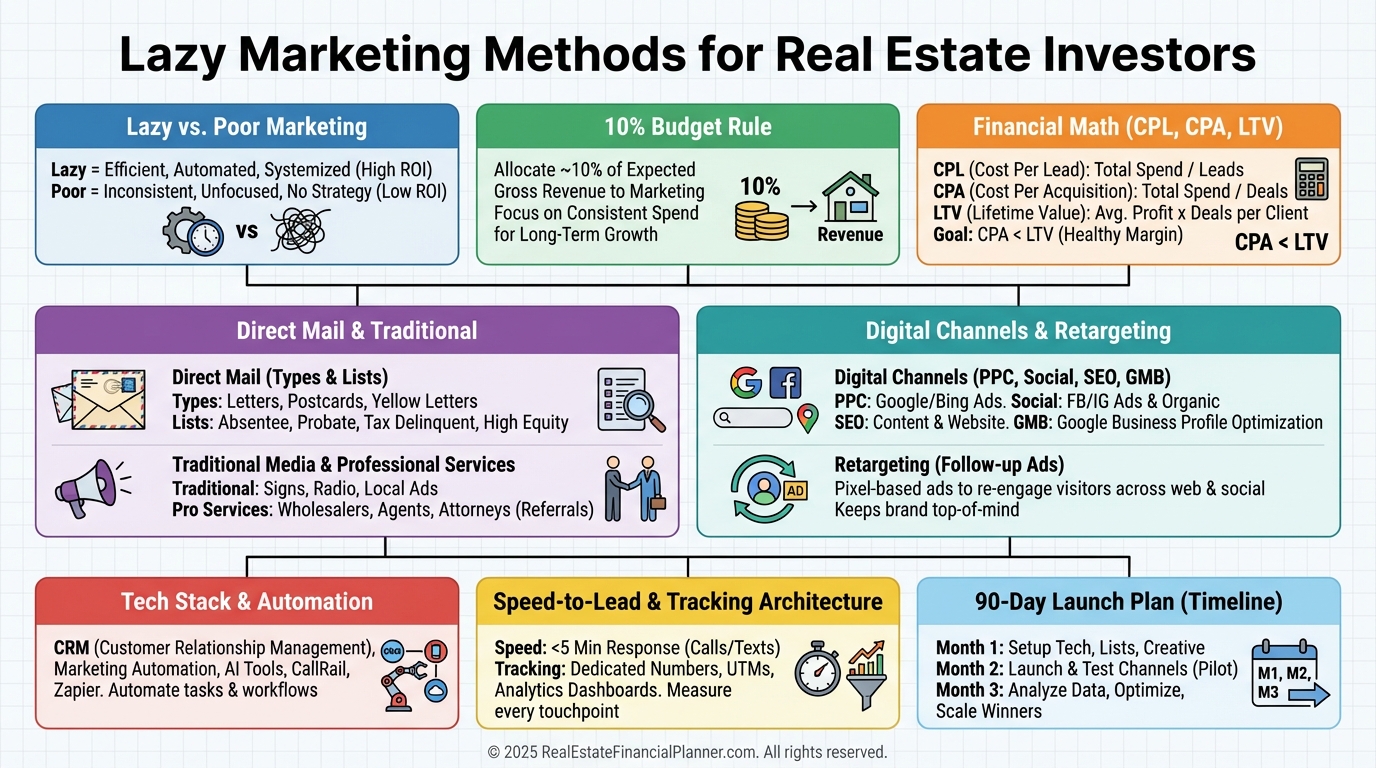

Why Lazy Marketing Wins

When I rebuilt after bankruptcy, I promised myself I’d stop trying to out-hustle math.

Lazy Marketing Methods are not about being careless.

They’re about replacing grind with predictable systems funded by a smart budget.

When I help clients, I design campaigns that turn dollars into leads at a known cost, so acquisition becomes a math problem, not a willpower contest.

Your job becomes analyzing deals, making offers, and closing—while the marketing runs.

The Economics That Make This Work

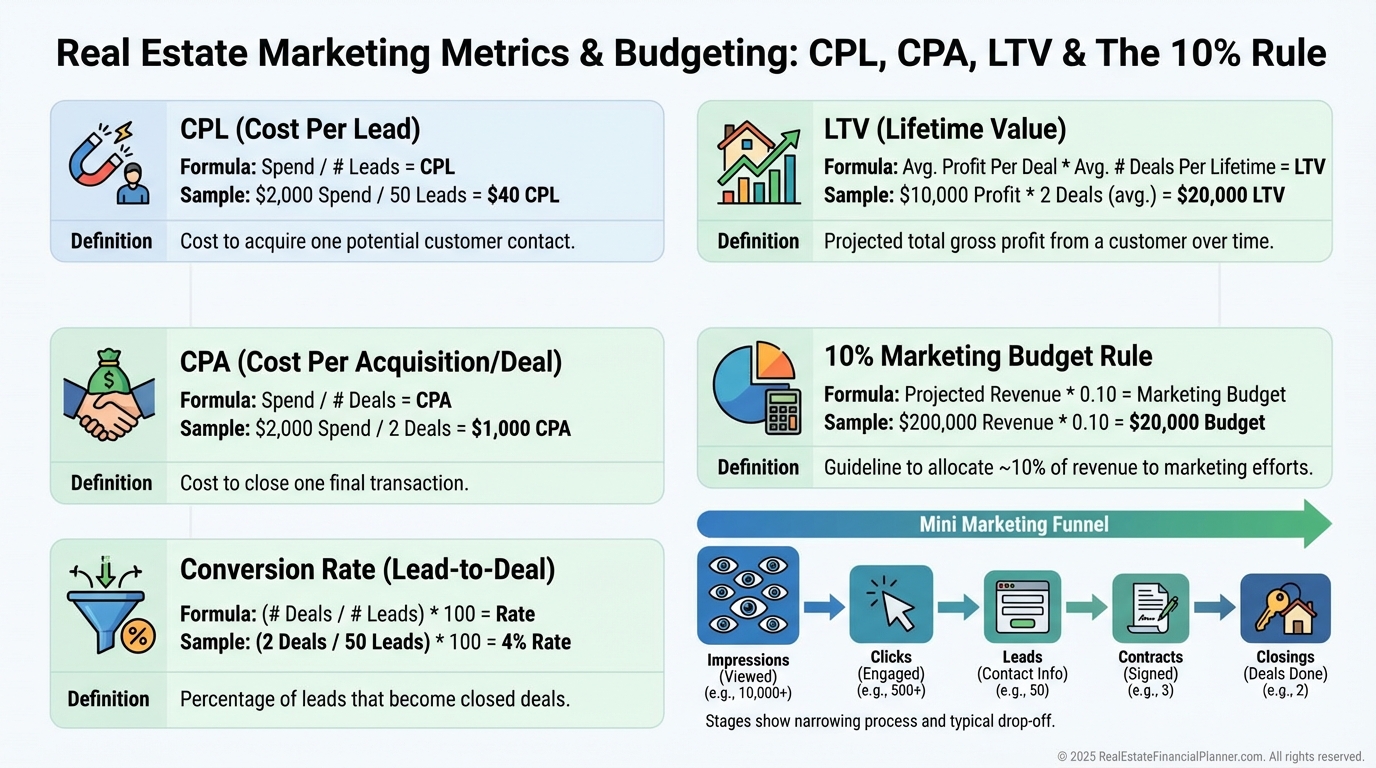

The only way lazy marketing scales is if the numbers are brutally clear.

I track cost per lead (CPL), cost per acquisition (CPA), lead-to-deal conversion rate, and lifetime value (LTV) by channel.

If a $120 lead reliably becomes a $12,000 net profit deal at 1 in 30, I’ll scale that until it breaks.

Follow the 10% rule.

Budget at least 10% of your target gross profit for marketing.

If you want $200,000 in gross profit, plan $20,000 in marketing.

Then measure weekly and adjust monthly.

I separate tracking by source with unique phone numbers, UTMs, and landing pages.

If it isn’t tracked, it didn’t happen.

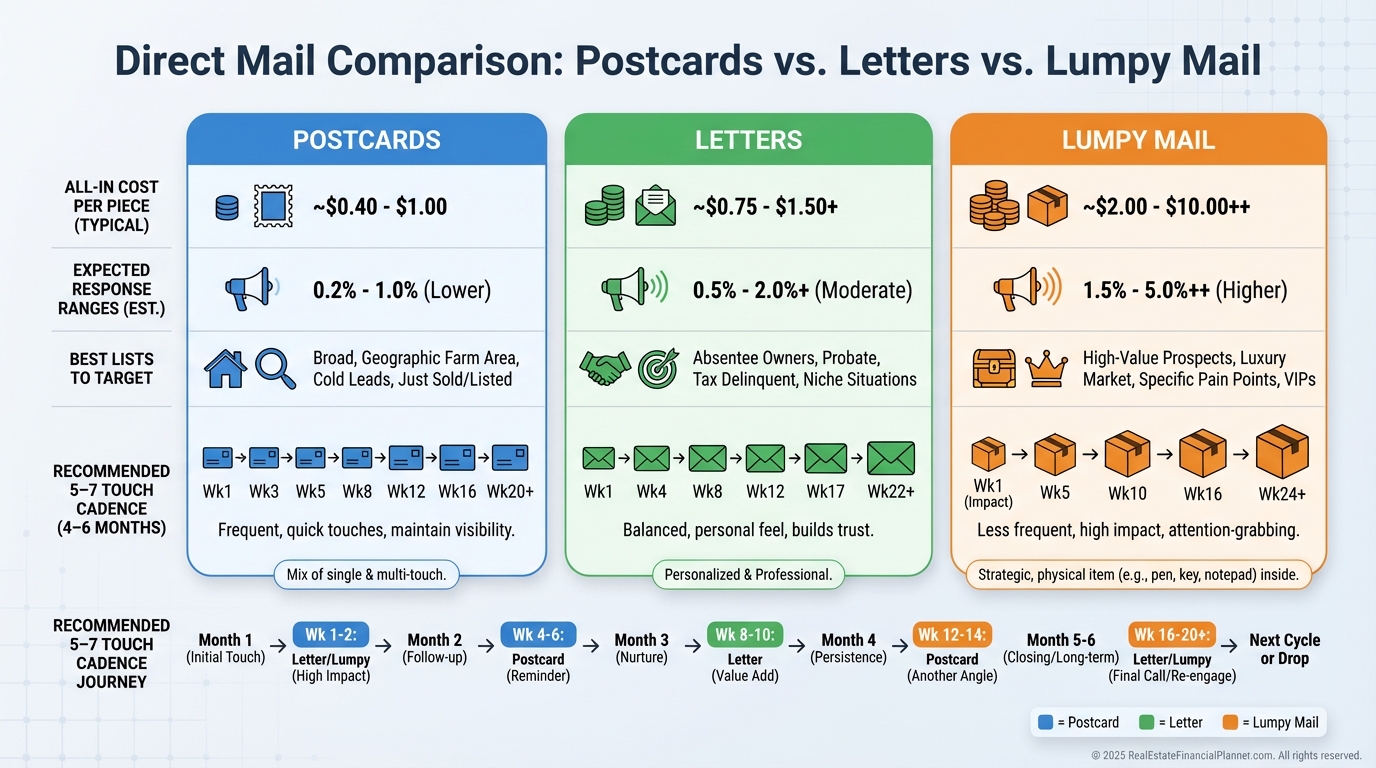

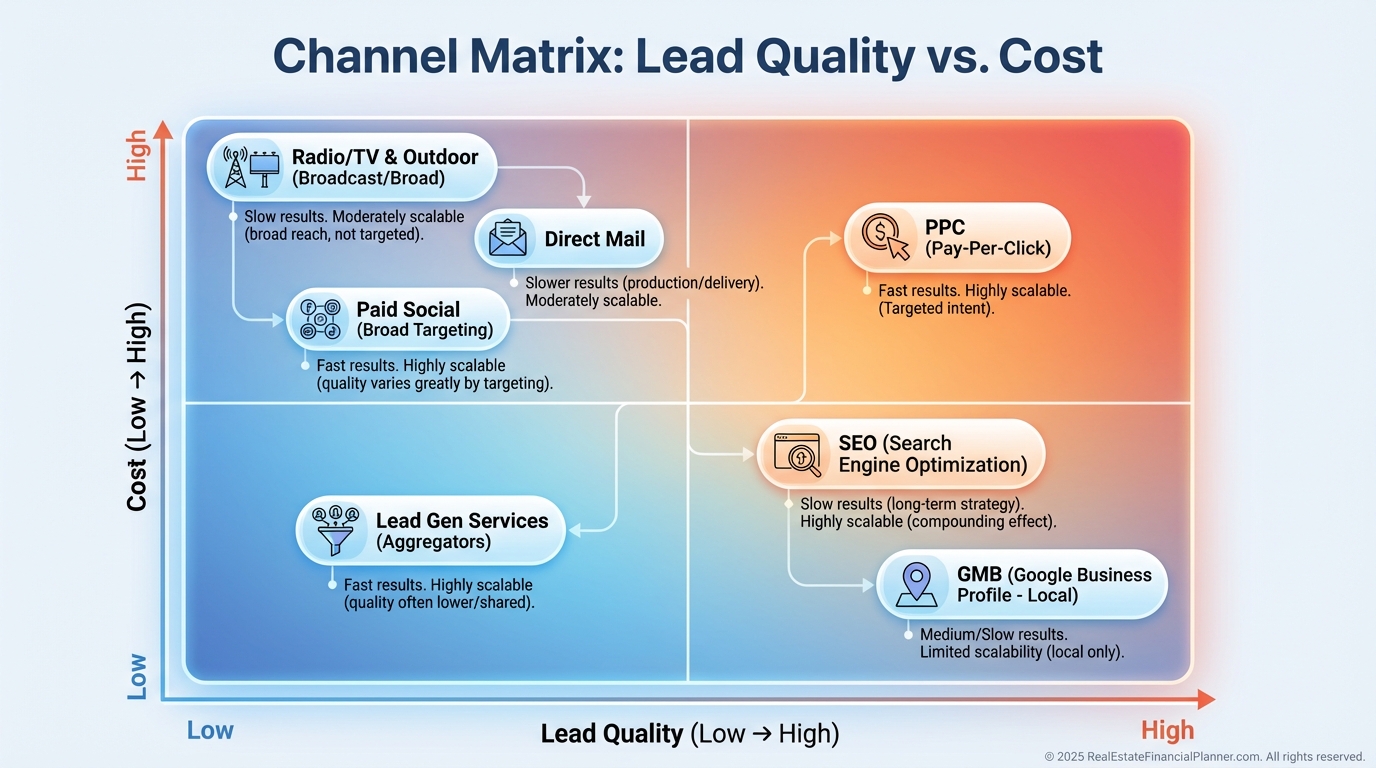

Direct Mail That Pulls Real Sellers

Direct mail still works because distressed owners open mail.

Postcards win on cost-per-touch and speed; letters win on open rate and perceived credibility; lumpy mail wins on attention for small, high-value lists.

I target intent, not zip codes.

Probate, tax delinquent, code violations, absentee owners, and pre-foreclosure lists consistently produce deals if you mail them 5–7 times over 4–6 months.

I’d rather mail 1,000 perfect records seven times than 7,000 once.

Use live stamps, clear calls-to-action, and more than one contact option.

Stagger drops to match your team’s follow-up capacity.

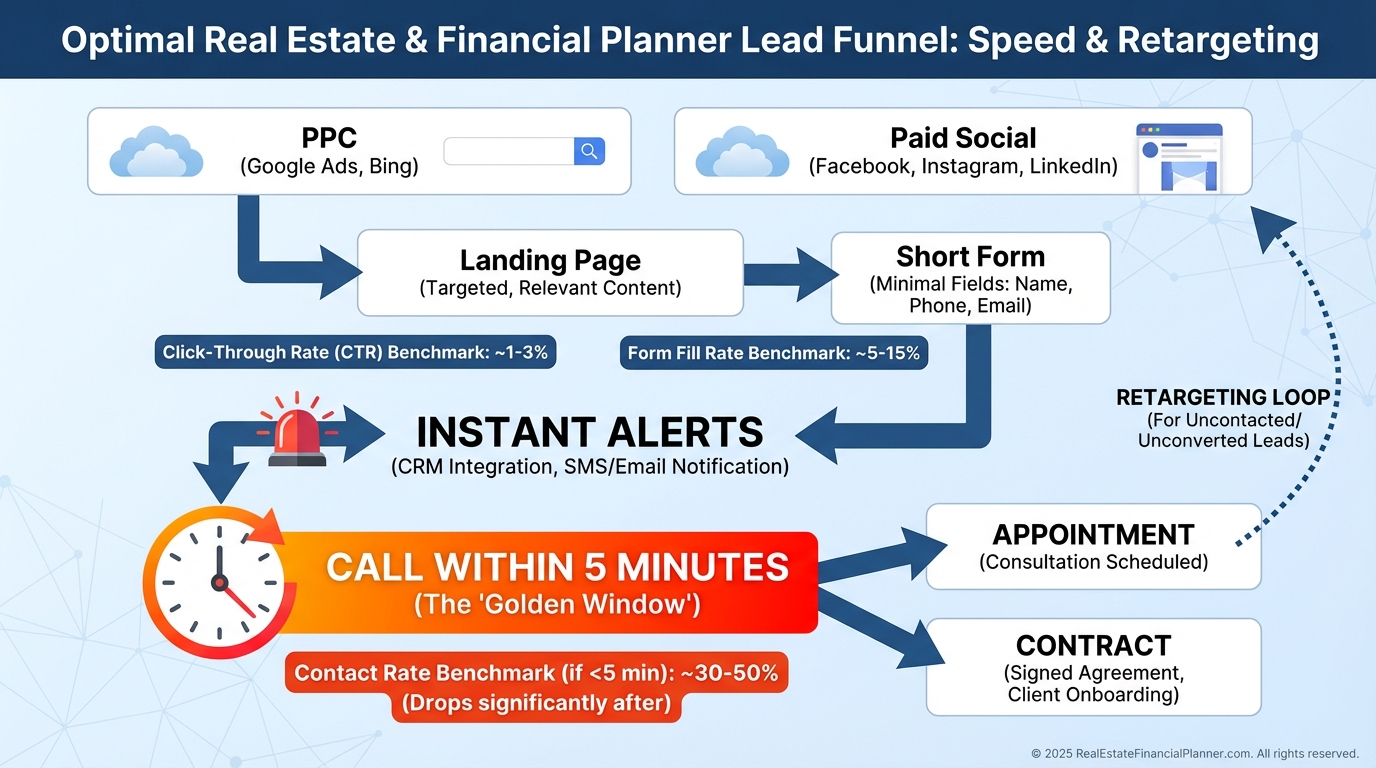

Digital Channels With Speed and Targeting

PPC captures high intent.

“Sell my house fast [city]” converts because timing is urgent.

Budget enough to learn—usually $2,000+/month—to dial in keywords, negatives, and landing pages.

Paid social finds sellers before they search.

I target life events and interests, then retarget all site visitors with testimonials and case studies.

SEO compounds quietly.

Location-specific pages and helpful content win over 6–12 months while lowering your blended CPL.

Your Google Business Profile is free and underused.

Reviews, photos, and regular posts generate calls every week in most markets.

Speed-to-lead is non-negotiable.

Call within five minutes and your close rate doubles.

Professional Services When You Want Done-For-You

Sometimes the laziest option is to buy expertise.

Full-service firms will run PPC, build pages, and optimize.

Demand transparent reporting and month-to-month terms.

Virtual assistants can build lists, scrub data, and push leads into your CRM.

Skip tracing fills in phone and email gaps so you can call, text, and mail the same owner.

List providers are worth it if you stack distress indicators.

Absentee + tax delinquent + code violations beats any single filter in isolation.

I give vendors 90 days and a target CPA.

If they win, I scale.

If not, I replace.

Traditional Media Still Reaches Sellers

Radio, cable TV, and community print reach owners who don’t live on social.

These are brand-plus-direct response plays.

Use a memorable number, an easy URL, and consistent frequency for at least three months.

Outdoor ads work when your message is simple and your phone number is sticky.

Track with unique numbers and train your intake to ask, “How did you hear about us?”

The Tech Stack That Makes It Truly Lazy

You need a CRM that enforces follow-up, prioritizes hot leads, and logs every touch.

REI-focused CRMs like REsimpli or Podio (with InvestorFuse) are built for investors.

Auto-dialers and compliant SMS reduce manual labor dramatically.

Use them responsibly with opt-outs and consent logs to avoid TCPA issues.

Email nurtures long-tail leads.

Segment by seller situation and speak directly to their pain.

AI lead scoring is now practical.

It surfaces the next best action so your team uses time where conversion likelihood is highest.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ should be connected so every qualified lead gets analyzed instantly with current assumptions.

How I Analyze Leads Fast (And Say No Faster)

When I help clients, we gatekeep with numbers.

If the deal can’t clear our minimum Return Quadrants™ targets—Appreciation, Cash Flow, Debt Paydown, and Tax Benefits—it doesn’t earn more follow-up.

On appointments, I model True Net Equity™ for the seller.

When they see what they actually walk away with after commissions, repairs, holding, and concessions, a fair cash offer often becomes the easiest option.

I keep exit strategies flexible.

Speed without guessing is how you stay lazy and profitable.

A 90-Day Launch Plan You Can Copy

Week 1–2: Set targets, pick two channels, and build tracking.

Unique numbers, UTMs, and a CRM with stages.

Week 3–4: Launch direct mail to one high-intent list and PPC to three buyer-intent keywords.

Prepare two landing pages and three ad variants.

Week 5–6: Add retargeting, tighten negatives in PPC, and send mail touch #2.

Record every call.

Week 7–8: Review CPL and CPA by source, improve speed-to-lead, and deploy social proof on pages.

Send mail touch #3.

Week 9–10: Layer a second list or scale the winner by 30%.

Add email nurture for non-responsive leads.

Week 11–12: Kill losers, scale winners, and lock in a 90-day vendor test if outsourcing.

Set the next quarter’s budget using the 10% rule tied to your updated profit target.

Risk Management and Compliance You Can’t Ignore

I warn clients not to confuse velocity with recklessness.

Respect TCPA and CAN-SPAM.

Document consent, provide opt-outs, and avoid auto-dialing cell phones without permission.

In deals, I underwrite conservatively and model downside first.

If a campaign “works” but produces low-margin headaches, we adjust targeting, not just budgets.

Lazy is only good when it’s repeatable and compliant.

What to Do When Leads Start Flowing

Call in five minutes.

Set the appointment.

Then run the numbers in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

If it meets your thresholds on the Return Quadrants™, write the offer and get it signed.

If not, nurture and move on.

Track your sources, your speed, your conversion, and your profit per deal.

Scale proven channels and keep one small test running.

That’s how lazy turns into leveraged.