Principal Payments: The Quiet Compounder Driving Real Estate Wealth (And How to Model It Correctly)

Learn about Principal Payments for real estate investing.

The Overlooked Return Quietly Making You Wealthy

When I help clients dissect their rentals inside RealEstateFinancialPlanner.com, the same blind spot shows up: they underrate principal payments.

Sarah did this for five years on three rentals.

When we added principal paydown to her Return Quadrants™, she realized $47,000 of tenant-funded equity was sitting idle.

She thought her returns were “okay.”

They were excellent.

What Principal Payments Really Are

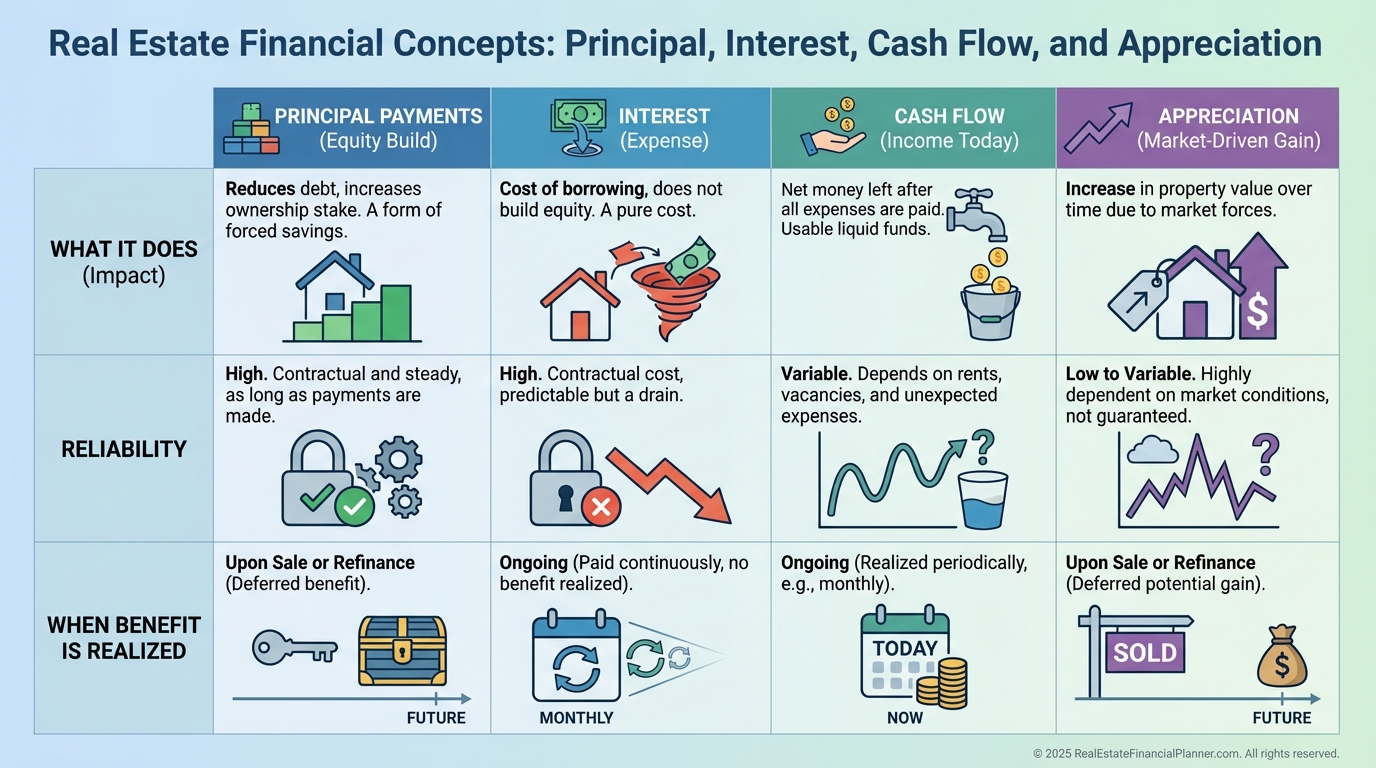

A principal payment is the part of your mortgage that reduces the loan balance.

Tenants fund it, your net worth grows, and it compounds without drama.

In practice, it’s forced savings with leverage and tax efficiency.

That’s why I treat it as a core return stream, not a rounding error.

Why Most Investors Misjudge It

Interest is the rent you pay the bank.

Principal is you buying the property back from the bank—one payment at a time.

Cash flow pays you today.

Principal payments improve your balance sheet forever.

Appreciation is market-dependent; principal paydown is contractual as long as you make payments.

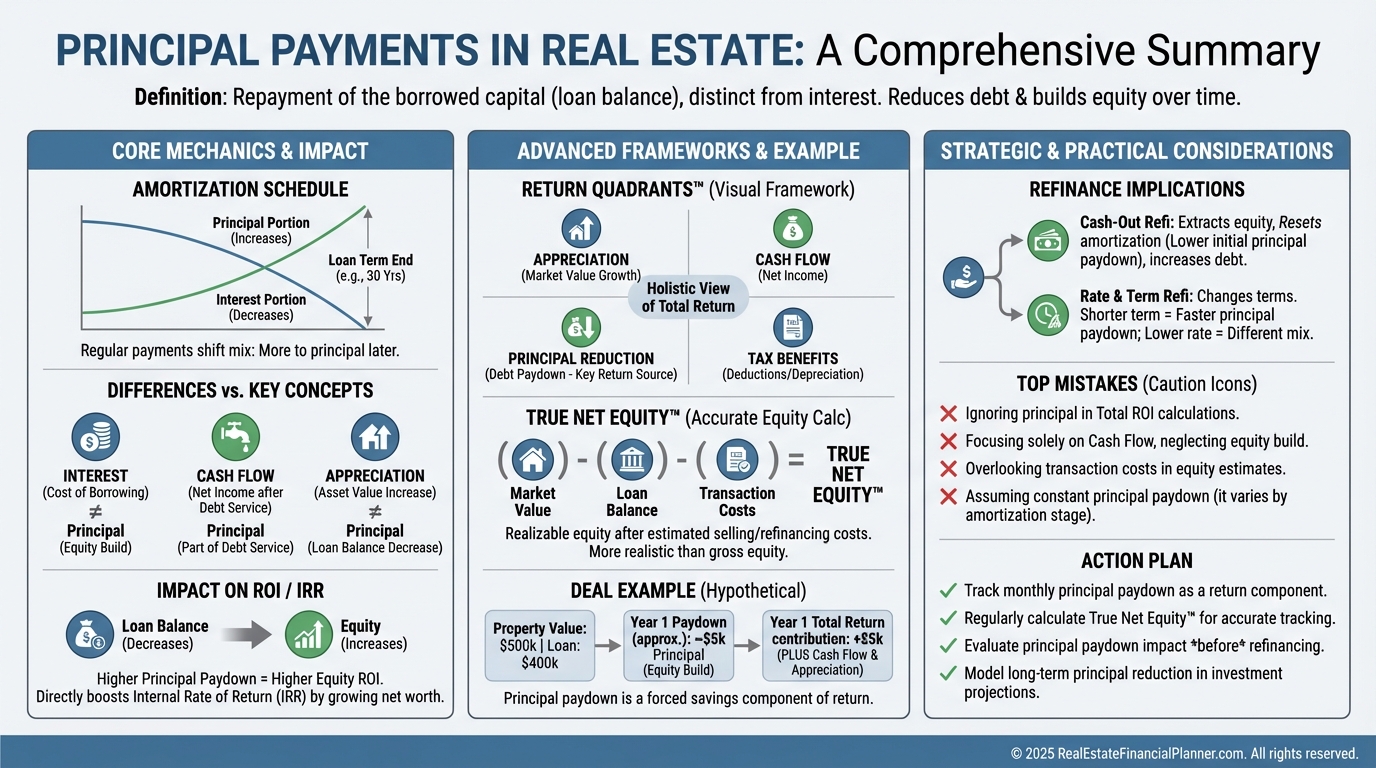

Where Principal Fits in Return Quadrants™

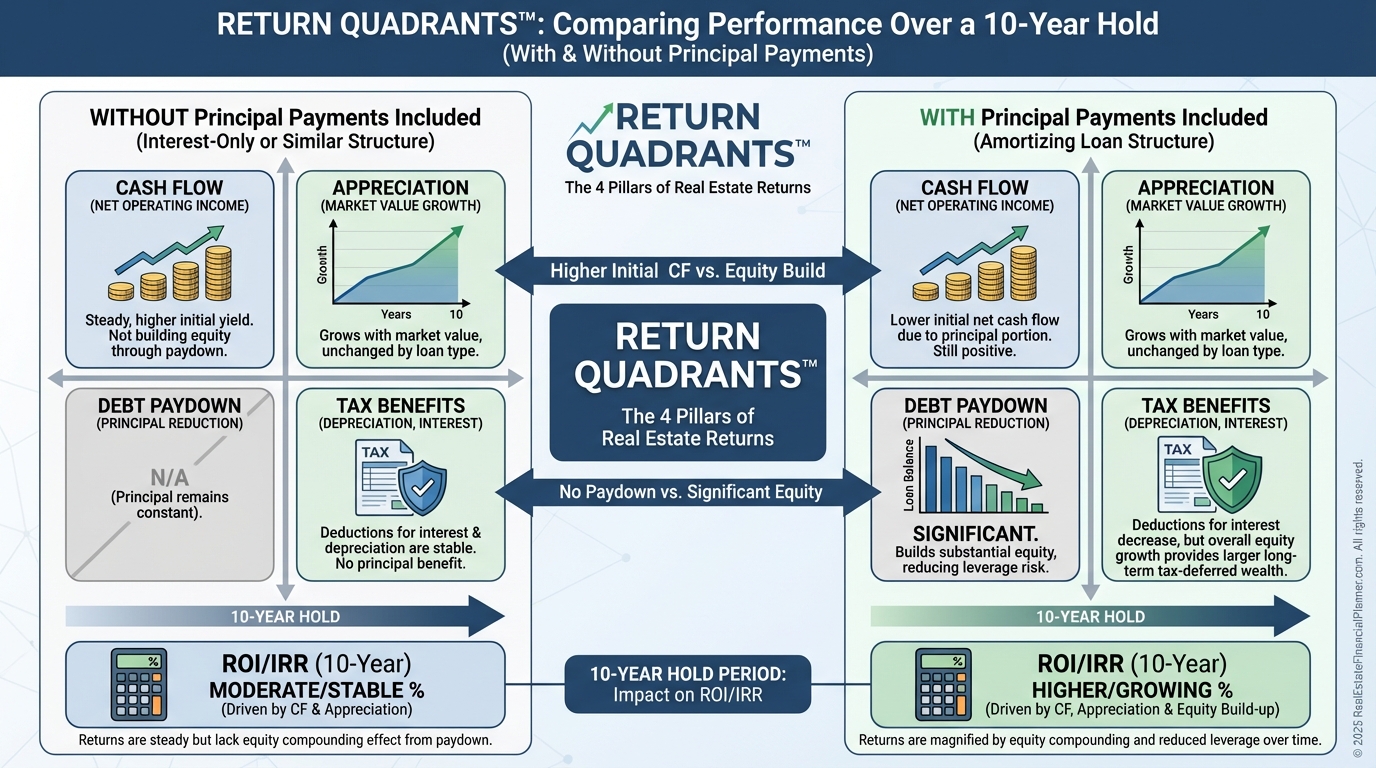

Return Quadrants™ splits your return into four: cash flow, appreciation, debt paydown, and tax benefits.

In our models, principal often accounts for 20–30% of total return over a 10-year hold.

This is why a “meh” 6–8% cash-on-cash often becomes an 11–12% IRR once you include paydown.

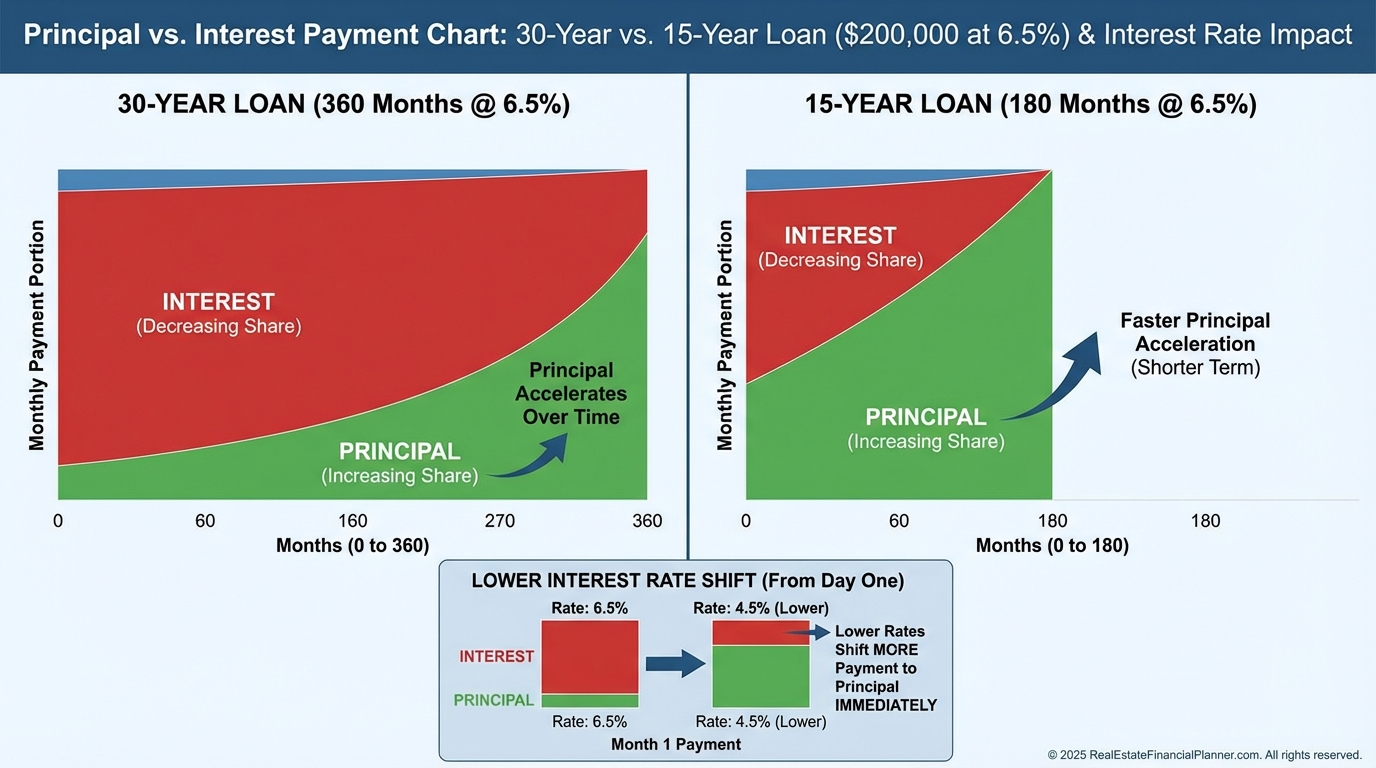

Amortization: Why It Accelerates Later

Amortization front-loads interest and back-loads principal.

On a $200,000 loan at 6.5% for 30 years, the first month’s interest is roughly $1,083 and only about $181 reduces principal.

By mid-loan, the principal portion often triples versus year one.

By the later years, four-figure monthly principal payments are normal.

This is why selling too early can be expensive—you leave the most efficient years of paydown behind.

How I Calculate Principal in Practice

When I model deals, I verify principal three ways.

First, I compute it directly: interest = current balance × rate ÷ 12, and payment − interest = principal.

Second, I load the loan into The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and confirm the amortization matches the lender’s schedule.

Third, I compare our projections against actual mortgage statements to catch escrow or rounding surprises.

If the math disagrees, I redo it.

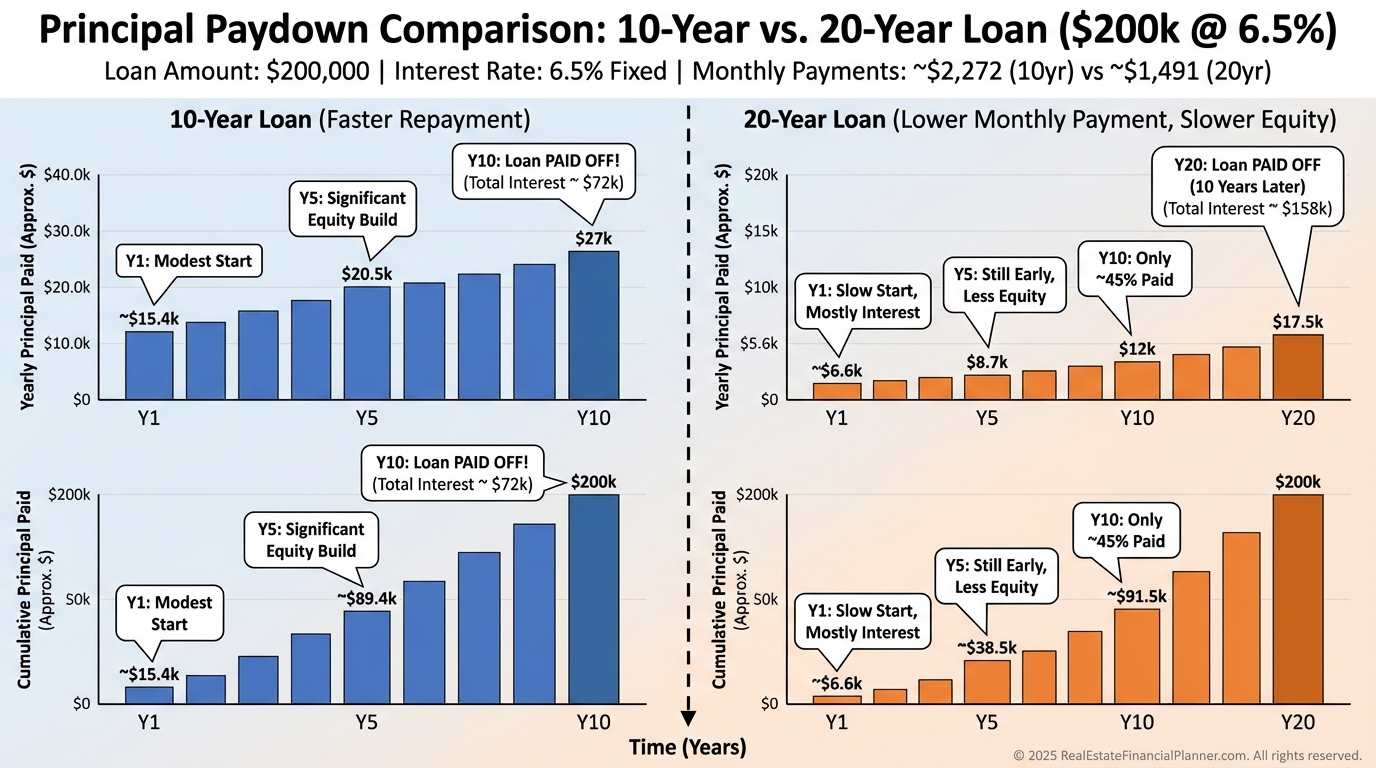

A Concrete Example You Can Replicate

•

Estimated monthly payment (principal and interest): about $1,264

•

Year 1 principal: about $2,340 (≈ $195/month)

•

Year 5 principal: about $2,940 (≈ $245/month)

•

Year 10 principal: about $4,032 (≈ $336/month)

•

Year 20 principal: about $7,548 (≈ $629/month)

After 10 years, cumulative principal paid is roughly $33,000.

That’s tenant-funded equity you can deploy—tax-deferred if you refinance.

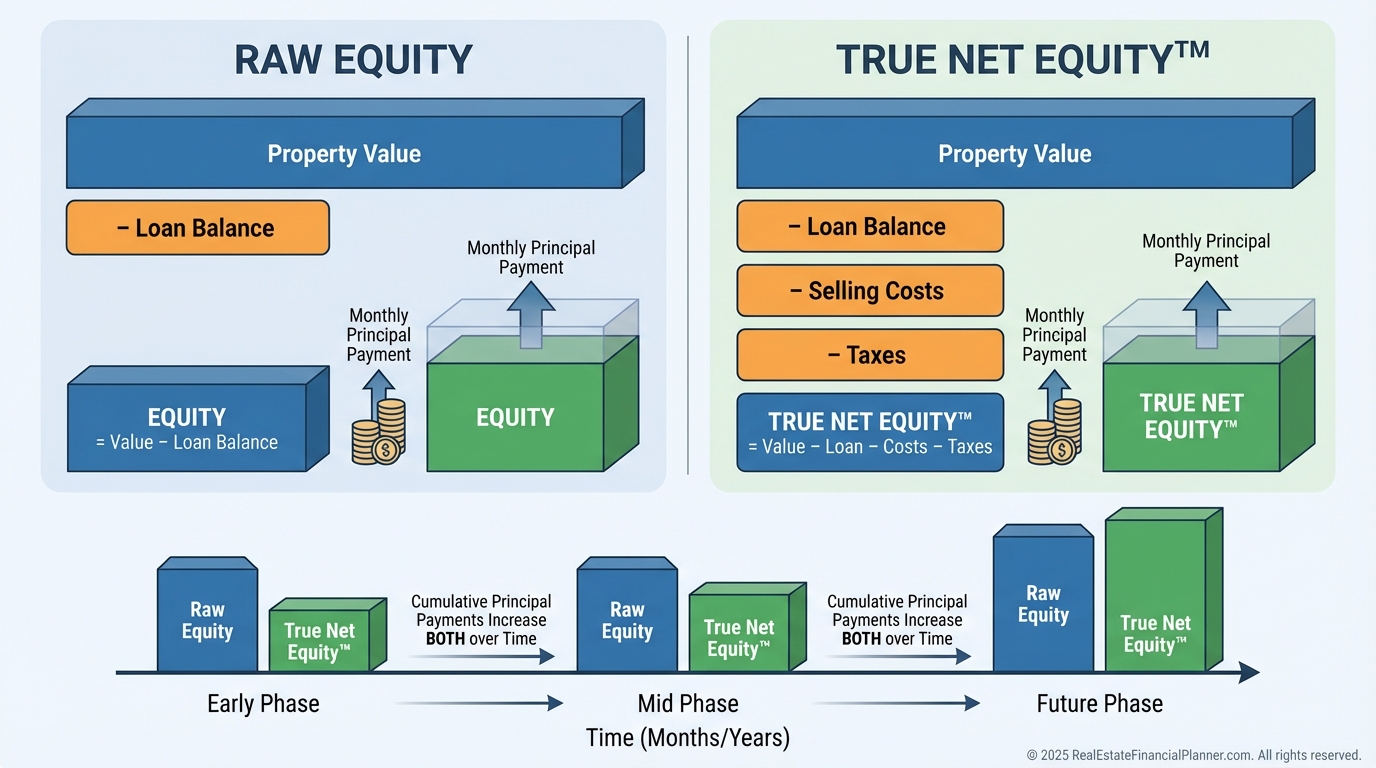

The Hidden Leverage on Equity (True Net Equity™)

Raw equity is market value minus loan balance.

True Net Equity™ subtracts selling costs and taxes to show what you can actually spend.

When I coach clients, we compare two properties with equal raw equity but different True Net Equity™ due to depreciation recapture and capital gains.

The one with cleaner True Net Equity™ often wins, even if the Zillow value is lower.

Principal payments improve your True Net Equity™ every month, which is why I track it portfolio-wide.

Financing Implications Most Investors Miss

As principal reduces your balance, your loan-to-value improves.

That opens doors for lower-rate refinances, portfolio loans, and acquisitions via cross-collateralization.

It also tends to improve DSCR as rents drift up while the payment stays fixed.

Marcus used seven years of principal paydown plus modest appreciation to refi a fourplex and pull out $75,000 tax-free for the next down payment.

He thought he needed to wait three more years.

He didn’t.

How Principal Changes ROI, IRR, and Exit Timing

When you calculate ROI without principal, you’re ignoring a forced contribution to your balance sheet.

When we add it, IRR jumps and the hold period decision often flips from “sell” to “hold and refinance.”

Inside Return Quadrants™, principal is the dependable quadrant that compounds quietly.

I warn clients not to reset amortization clocks lightly; the later years are where paydown accelerates.

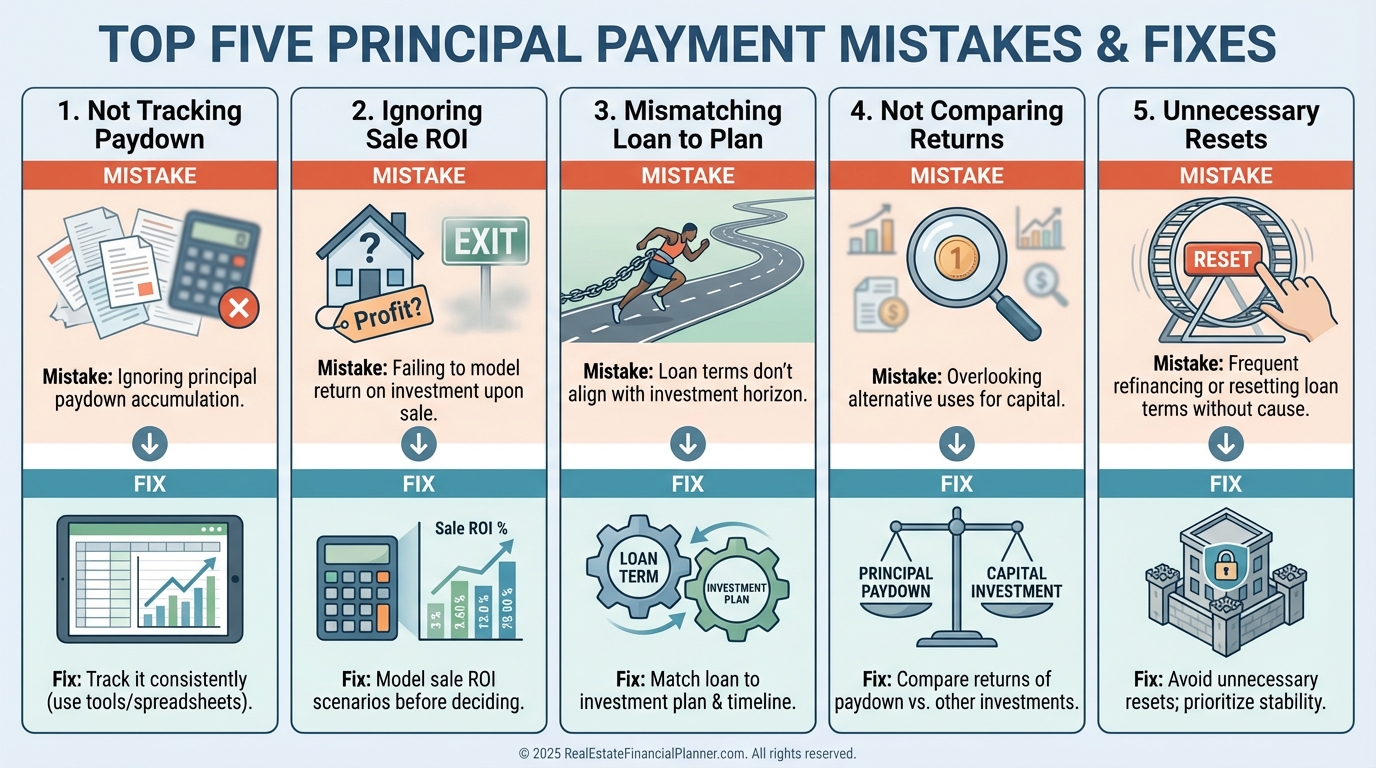

The 5 Principal Payment Mistakes That Cost Investors

Mistake 1: Ignoring it completely.

You miss 20–30% of your total return and make poor buy/hold/sell decisions.

Mistake 2: Misstating ROI at sale.

Profit is price minus remaining loan balance, not just appreciation.

Mistake 3: Selecting the wrong loan.

Interest-only and frequent ARMs can starve your principal engine.

Mistake 4: Premature payoff.

Paying extra toward a 6.5% loan while you can earn 10–12% total returns elsewhere is often suboptimal.

Mistake 5: Refinancing too often.

You reset amortization and forfeit the rich paydown years for a tiny payment decrease.

Advanced Ways to Harness Principal Paydown

The Equity Harvest Method uses periodic, conservative cash-out refinances to redeploy principal into new acquisitions while maintaining DSCR.

The Snowball Approach channels surplus cash flow from mature properties to accelerate principal on newer loans.

With Nomad™, owner-occupants acquire with better terms, move, and convert to rentals, allowing principal paydown to compound across more doors sooner.

Sophisticated investors time 1031 Exchanges and portfolio rebalances to coincide with optimal equity positions shown on their amortization curves.

Your Action Plan

•

Pull amortization schedules for every loan and enter them into The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

•

Calculate monthly and annual principal across the portfolio and total it.

•

Update Return Quadrants™ and IRR to include principal.

•

Track True Net Equity™ and set LTV targets for refinance triggers.

•

Compare “extra principal” vs. “next acquisition” using modeled IRR, not feelings.

•

Set calendar reminders to revisit refi/exchange options at years 5, 7, and 10.

When I rebuilt after a setback, I stopped guessing.

I modeled principal precisely, and my timeline to the next purchase shrank by years.

Do the boring math.

It’s the most reliable wealth builder you have.