Asset Management Fee Explained: The Silent Return Killer in Real Estate Syndications

Learn about Asset Management Fee for real estate investing.

Most investors focus on purchase price, rent, and interest rate.

Very few focus on the asset management fee.

That’s a mistake.

When I help clients analyze syndications or partnerships, this is one of the first numbers I isolate and model. Not because it’s flashy, but because it compounds quietly and predictably against your returns year after year.

I’ve seen deals with solid properties and decent markets underperform simply because the fee structure was misaligned. I’ve also seen higher-fee deals outperform because the asset manager actually earned it.

The difference is understanding what you’re paying for and how it flows through your returns.

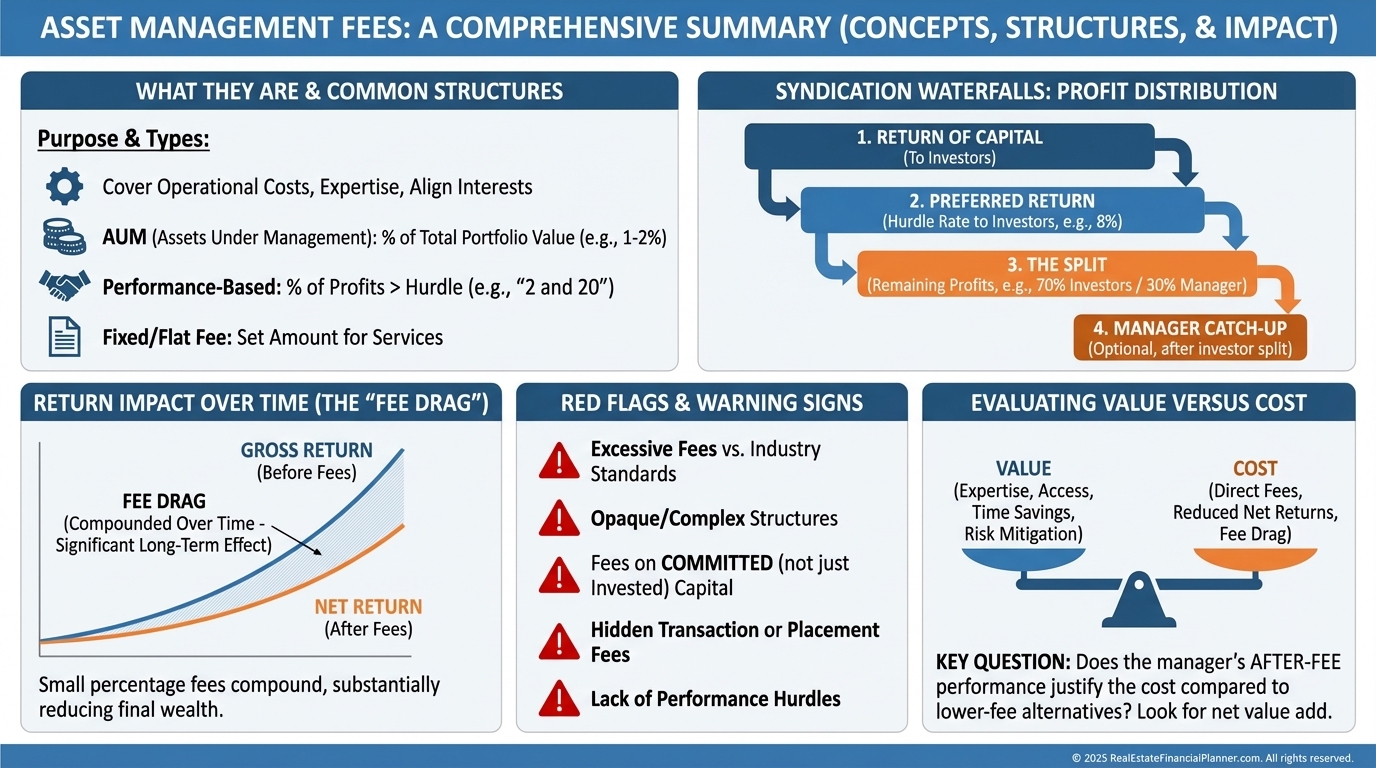

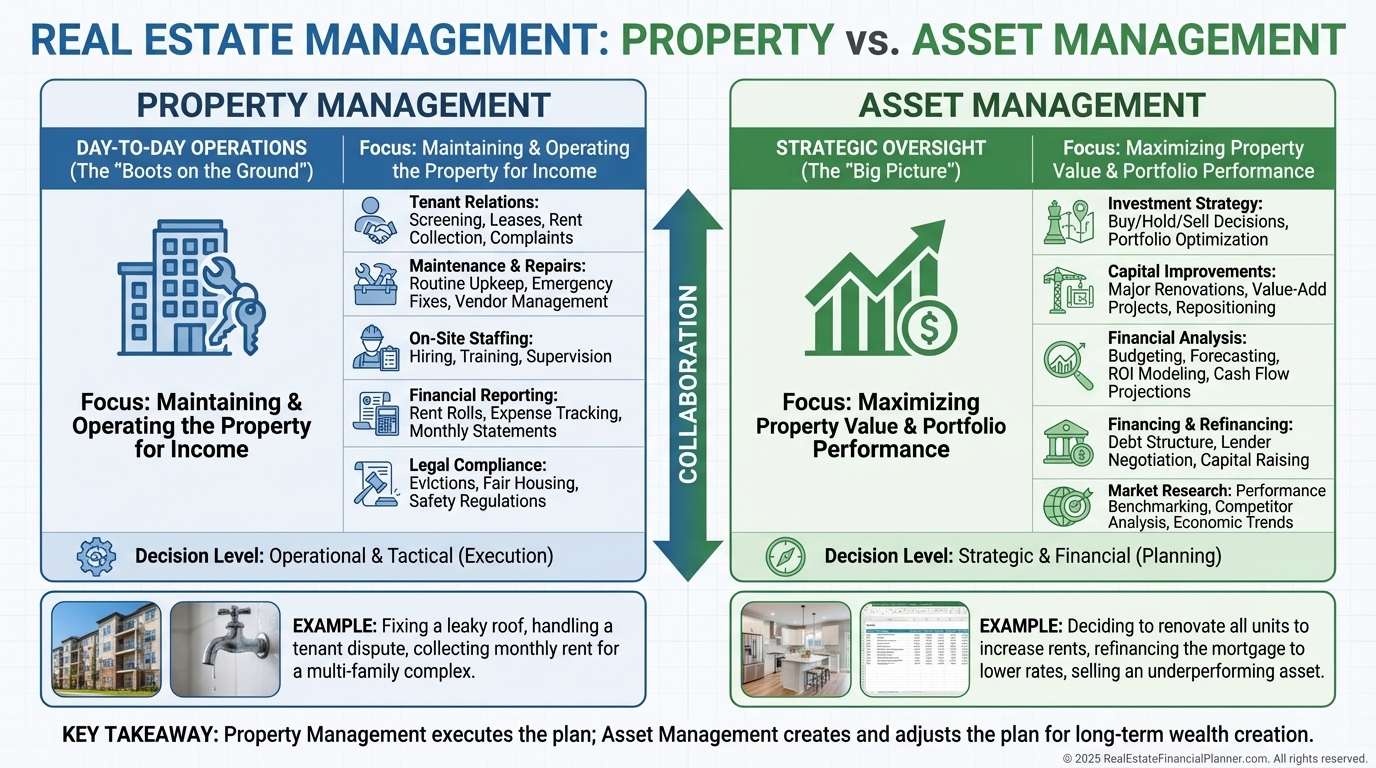

What an Asset Management Fee Really Is

An asset management fee is an ongoing fee paid to the sponsor or general partner for overseeing the investment after acquisition.

This is not property management.

Property management handles tenants, maintenance, and rent collection.

Asset management handles strategy, capital allocation, oversight, and timing decisions.

If property management keeps the engine running, asset management decides where the train goes and when to change tracks.

The fee usually starts after closing and continues throughout the hold period.

It is commonly calculated as a percentage of gross revenue or net operating income.

Crucially, this fee is paid whether or not you receive distributions.

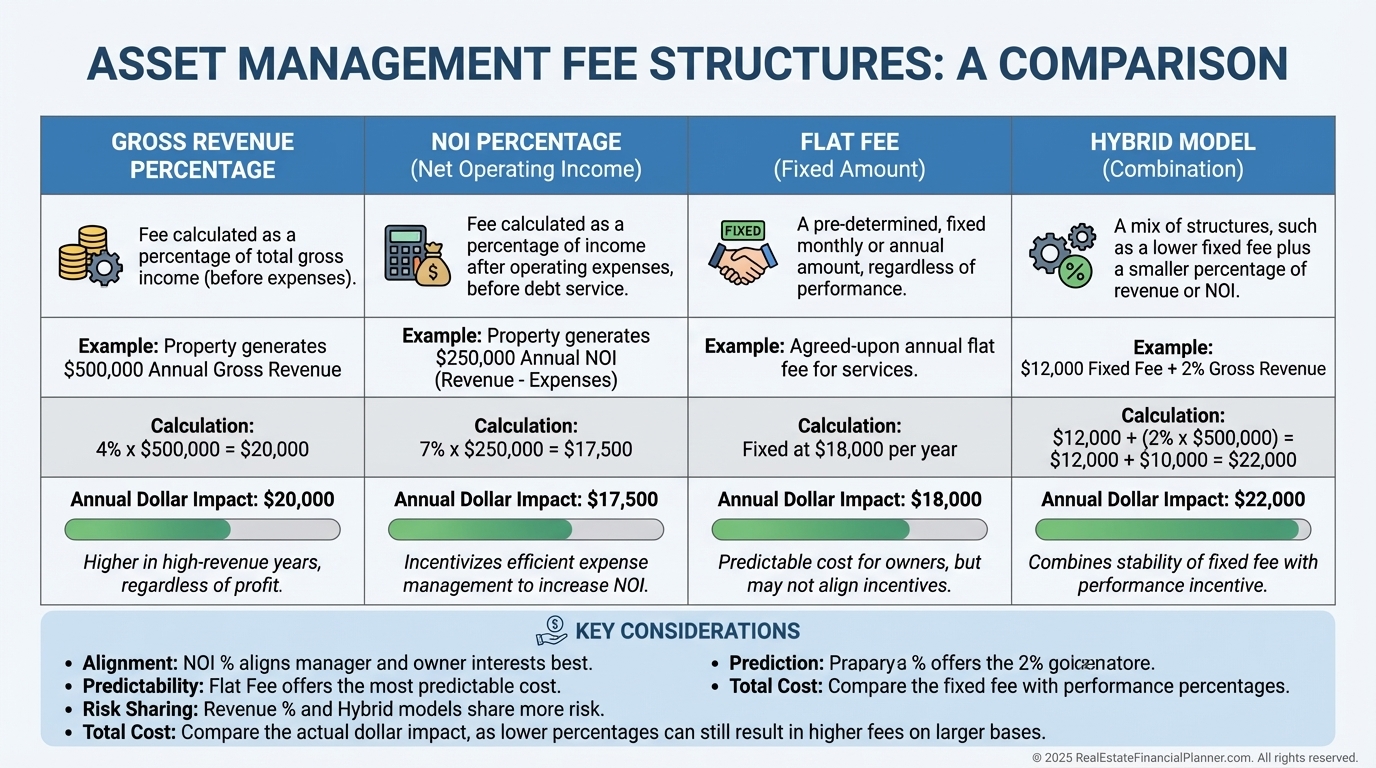

Common Asset Management Fee Structures

Most asset management fees fall into a few predictable buckets.

Percentage of Gross Revenue

Usually one to three percent of collected rent. This is simple and predictable, but it pays the sponsor even if expenses balloon.

Percentage of Net Operating Income

Often three to five percent of NOI. This aligns incentives better but can create tension around expense decisions.

Flat Annual Fee

More common on smaller or very stable assets. Predictable, but it ignores growth and inflation.

Hybrid Models

Lower base fees combined with performance incentives tied to return hurdles or NOI growth.

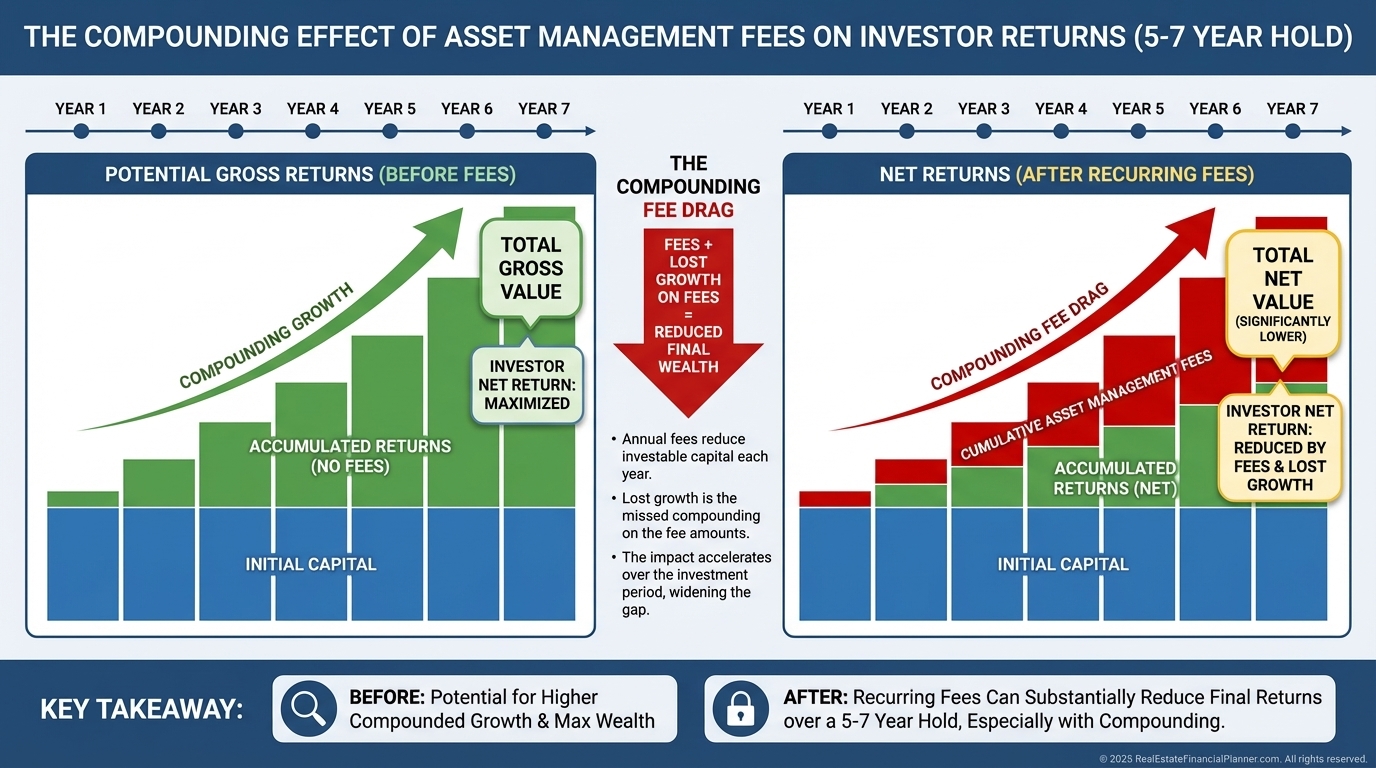

When I model these in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, even a half-percent difference shows up clearly over a five- to seven-year hold.

Small percentages matter when they repeat every year.

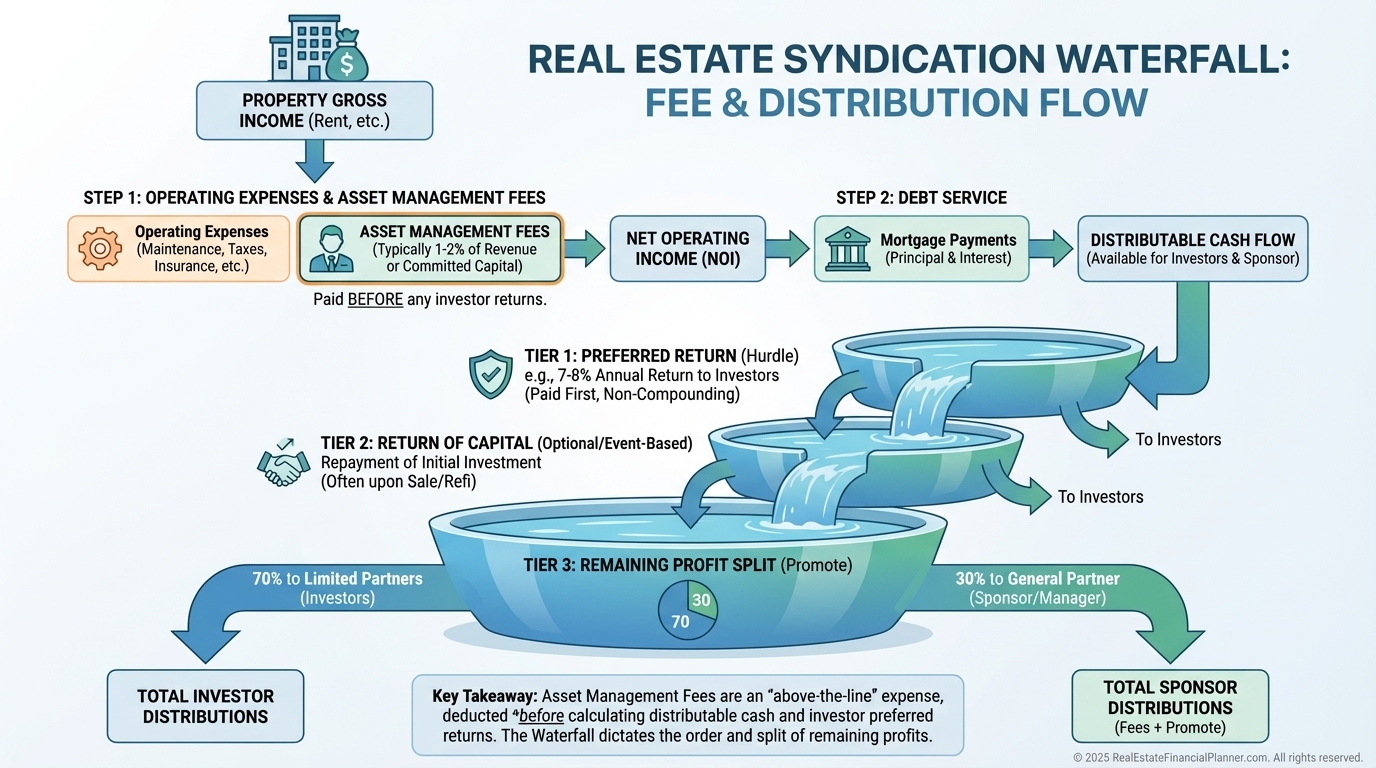

How Fees Flow Through Syndication Waterfalls

This is where many investors get tripped up.

Asset management fees are typically paid before investor distributions are calculated. That means they reduce cash flow before preferred returns are considered.

In practical terms, an advertised eight percent preferred return does not mean what most people think it means.

The property must first generate enough cash flow to pay all fees. Only then do investor distributions begin.

This is why I always tell clients to focus on net returns after all fees, not headline numbers.

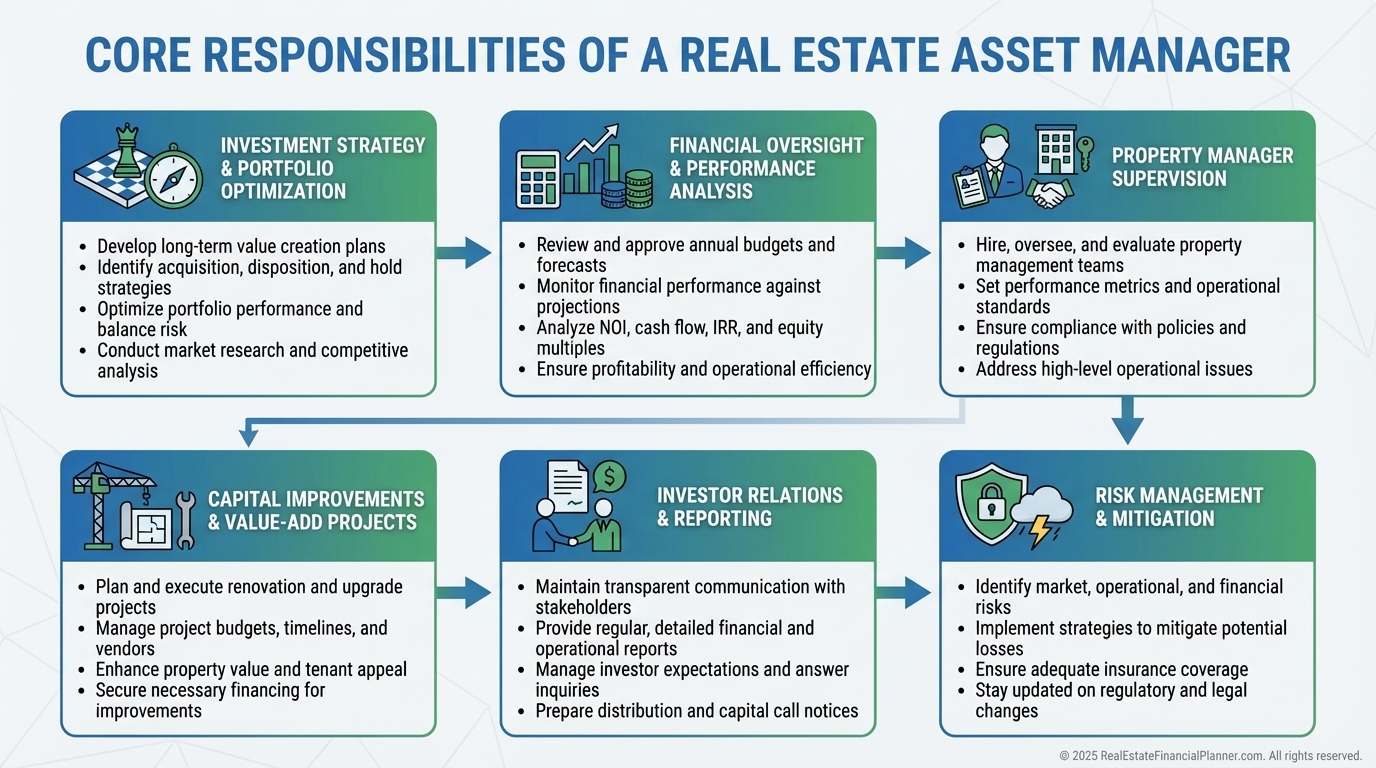

What Asset Managers Should Actually Be Doing

A real asset manager earns their fee through ongoing, active work.

That includes strategic planning, budget oversight, refinancing decisions, supervising property managers, managing capital improvements, and communicating with investors.

It also includes risk management.

When I rebuilt my own portfolio after bankruptcy, avoiding bad decisions mattered more than chasing upside. Good asset management protects downside first and upside second.

If a sponsor cannot clearly articulate what decisions they are responsible for, that’s a problem.

Red Flags I Warn Clients About

Not all fees are created equal.

Here are issues I flag immediately when reviewing deals.

Asset management fees above two percent of gross revenue without a complex business plan

Charging both asset management and property management fees for the same work

Fees based on metrics the sponsor can influence directly

Heavy front-loaded fees that reward transactions instead of performance

Fees should align incentives. If they don’t, returns suffer.

Modeling the True Impact on Returns

This is where REFP frameworks matter.

I don’t look at fees in isolation. I look at how they affect cash flow, equity growth, and returns on True Net Equity™ over time.

An asset management fee reduces cash flow today.

That reduction changes reinvestment ability.

That affects long-term wealth.

This is why I always model fees explicitly instead of assuming market averages.

Taxes and Timing Matter Too

Asset management fees reduce taxable operating income.

That helps investors in higher ordinary income brackets.

However, frequent fee collection also reduces working capital.

That can limit flexibility during market stress or opportunity windows.

Timing matters just as much as amount.

The Real Question You Should Ask

The question is not whether an asset management fee exists.

The question is whether the value created exceeds the cost.

I’ve invested in higher-fee deals that made sense and rejected lower-fee deals that didn’t. What matters is alignment, transparency, and execution.

If you don’t model fees, you’re guessing.

If you don’t ask hard questions, you’re trusting marketing.

Neither is a strategy.