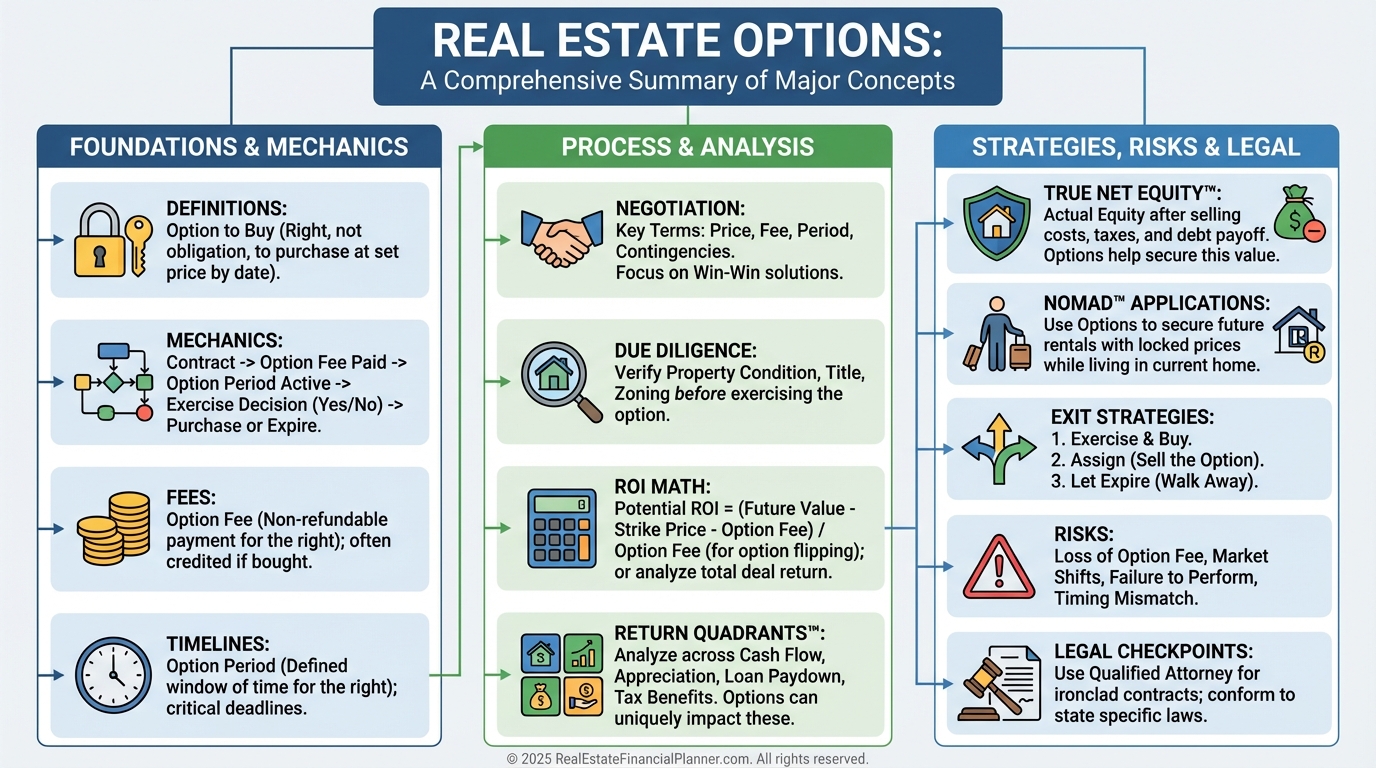

Real Estate Option: Control Property With Less Cash and More Exit Strategies

Learn about Real Estate Option for real estate investing.

Why Real Estate Options Belong in Your Toolkit

When I help clients break into investing with limited cash, a well-structured real estate option is often the first lever we pull.

It lets you control a deal now and decide later, with your maximum risk pre-defined.

I like options because they buy time, certainty, and access.

You can line up financing, confirm zoning, test demand, or even presell your exit.

What Is a Real Estate Option?

A real estate option gives you the right, but not the obligation, to purchase a property at an agreed strike price within a fixed time.

You pay an option fee for that right, and if you walk away, the seller keeps the fee.

It’s controlled commitment: you fix price today and decide later based on facts, not hope.

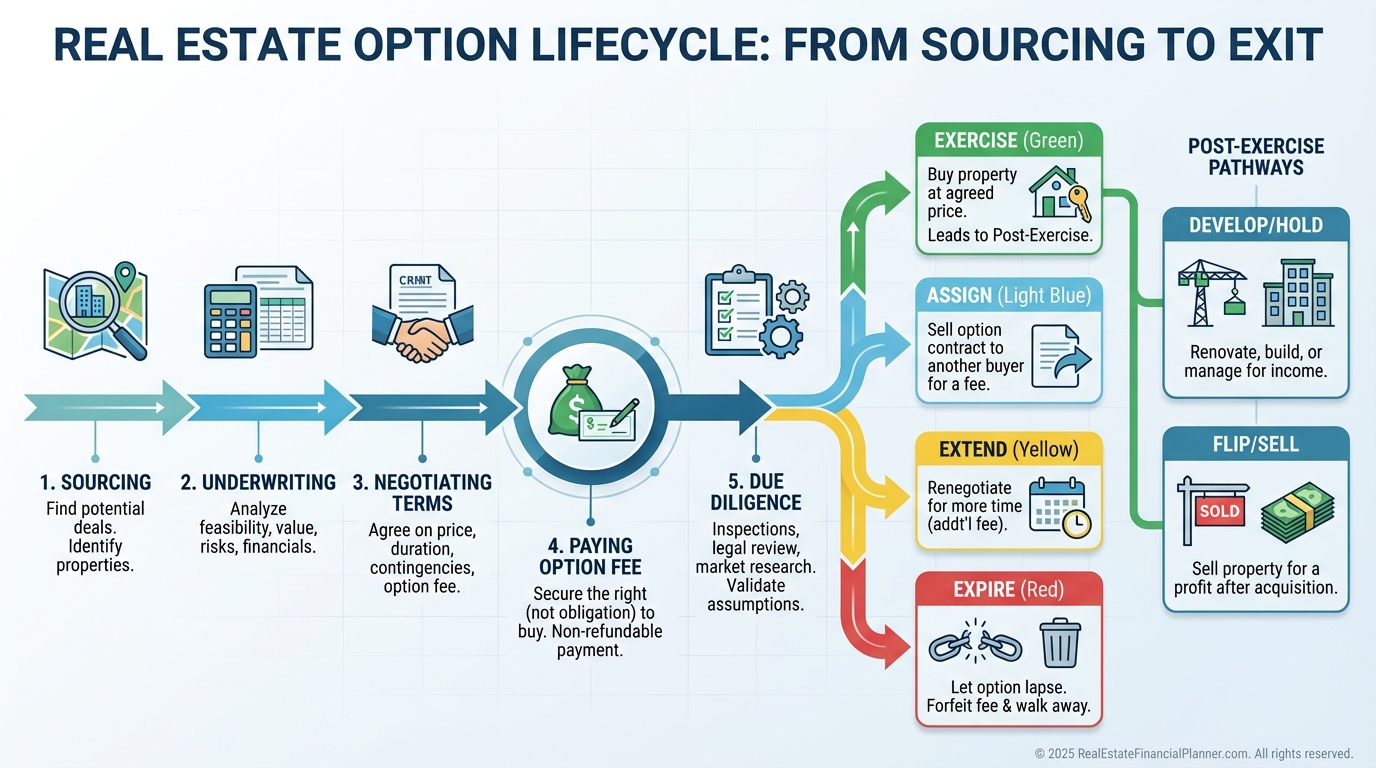

How a Real Estate Option Works

•

You and the seller agree on price, timeline, and terms.

•

You pay a non-refundable option fee.

•

You complete due diligence and line up financing or a buyer.

•

You either exercise, assign, extend, or let it expire.

I tell clients to think in plays, not a single outcome.

We pre-plan at least three exits before sending the first draft of the agreement.

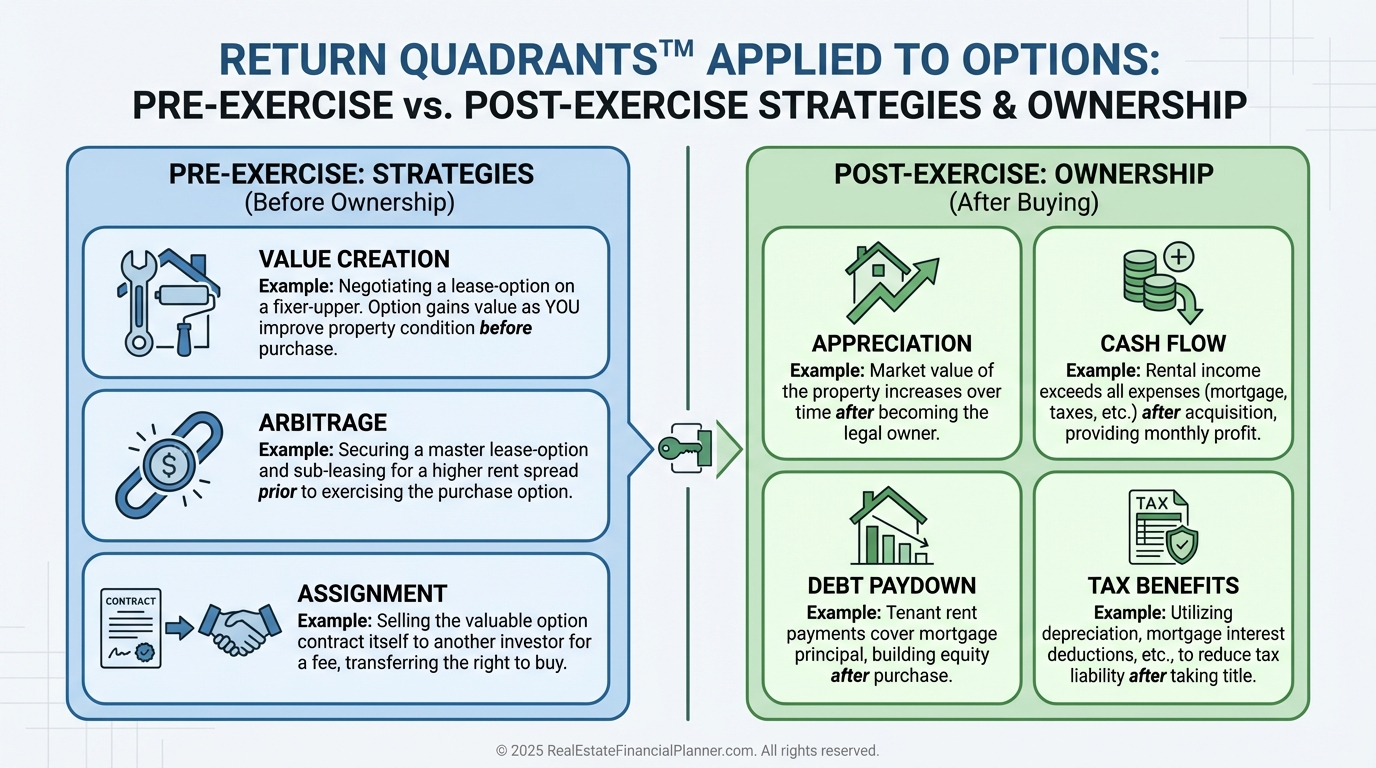

Where Options Fit in Your Overall Strategy

Options pair well with our Return Quadrants™ and True Net Equity™ frameworks.

Pre-exercise, you’re speculating on appreciation or creating value via entitlements, design, or marketing.

Post-exercise, the property returns shift to the four quadrants: appreciation, cash flow, debt paydown, and tax benefits.

When I model this for clients, I compare “option-and-flip,” “option-then-rent,” and “assign-the-option.”

We score each on speed, risk, capital intensity, and True Net Equity™ created.

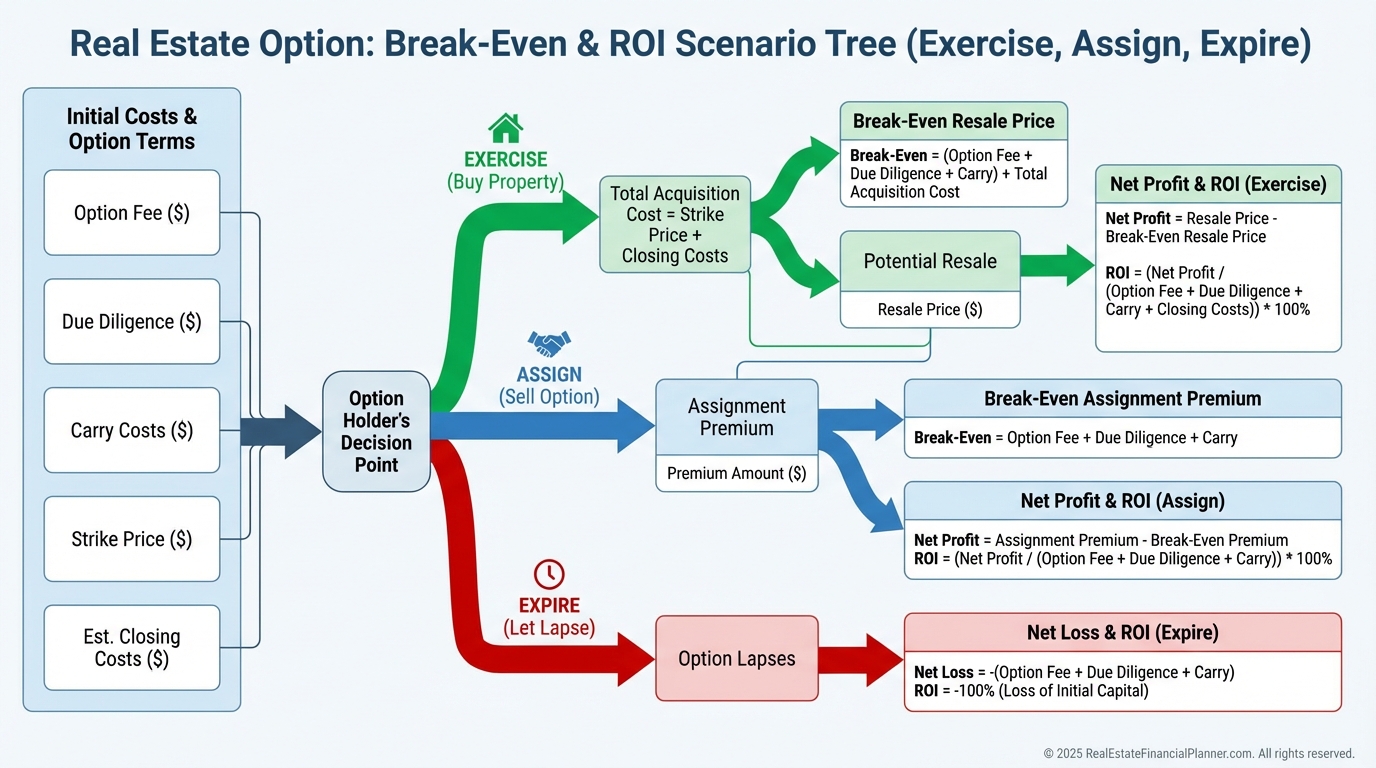

The Option Math That Protects You

I insist on knowing the break-even before writing the check for the option fee.

Here’s a simple way to think about it.

•

Strike price: $400,000

•

Option fee: 1.5% ($6,000)

•

Due diligence + carrying during option: $2,000

•

Expected closing + resale costs if you flip: 8% of resale

If you plan to flip post-exercise at $440,000, total costs might be $6,000 + $2,000 + 8% of $440,000 ($35,200) = $43,200.

Your gross spread is $40,000, so you’re short by $3,200.

You either need a better price, more time to market, or a different exit like assignment.

I model three sensitivities for clients: price, time, and financing.

If two move against you, we don’t sign.

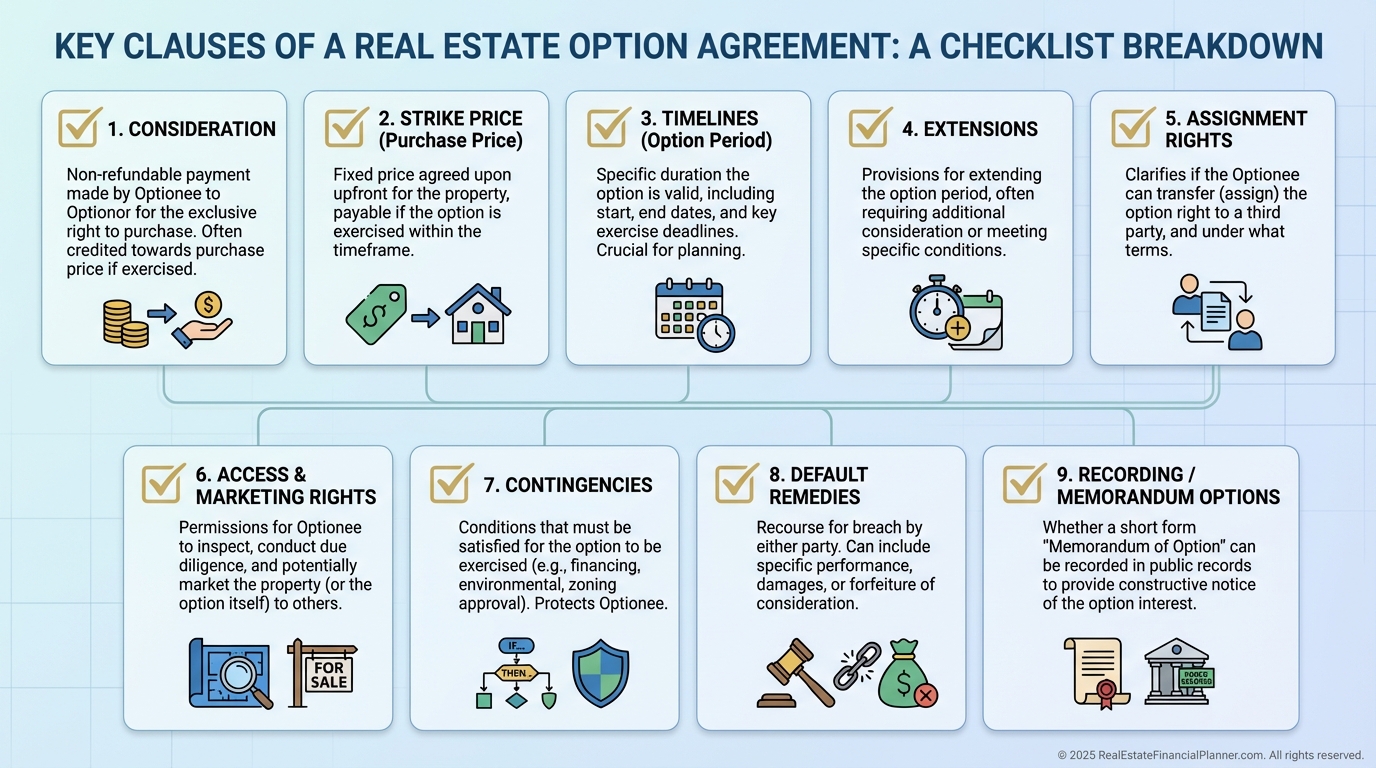

Anatomy of a Strong Option Agreement

When I review drafts, I look for five pillars.

•

Parties and property clarity

•

Consideration (option fee) and how it’s handled

•

Strike price and permissible adjustments

•

Option period, extensions, and notice to exercise mechanics

•

Rights during the option: access, marketing, assignment, recording, and specific performance vs. liquidated damages

Add inspection, title, and financing contingencies you actually intend to use.

Define who pays what, when, and how escrow holds money and documents.

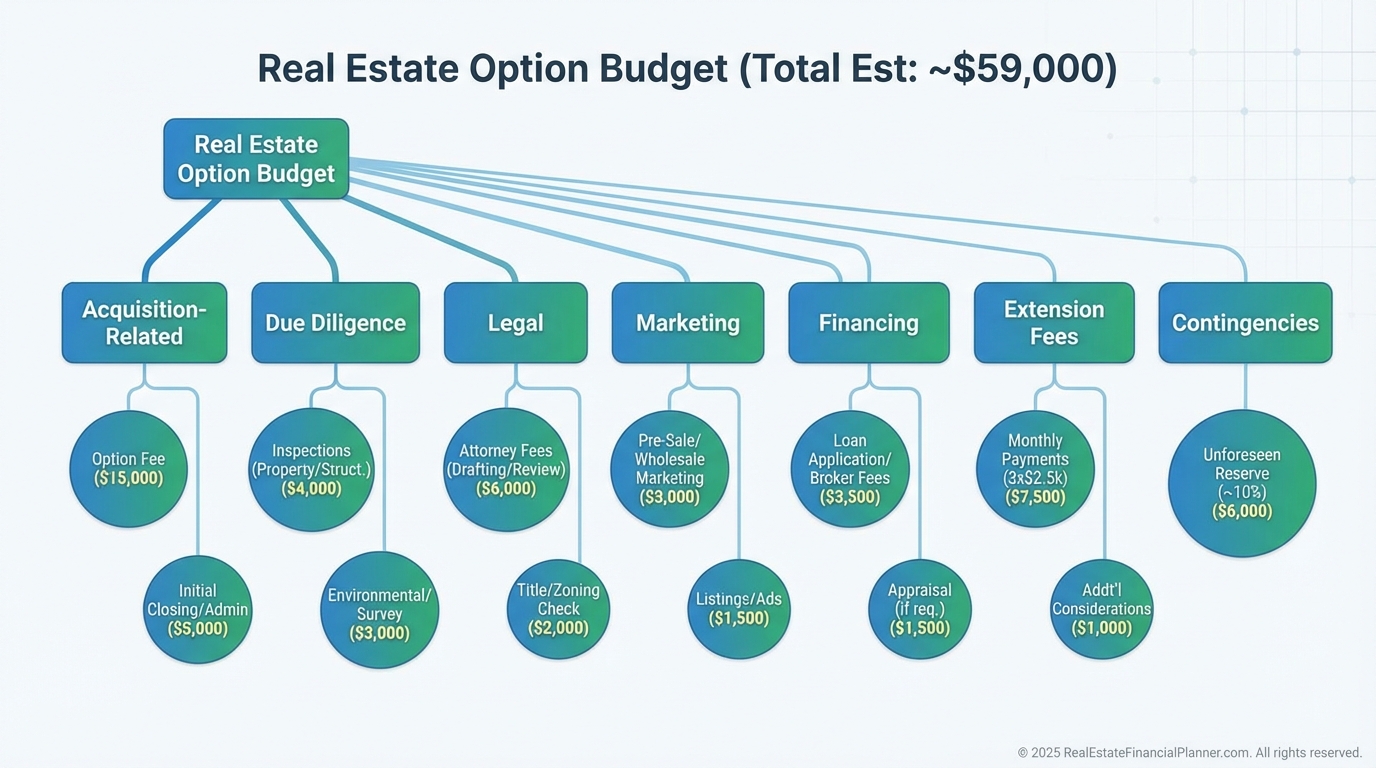

Costs You Must Budget Upfront

Don’t let small leaks sink the boat.

I build a single-sheet budget before we negotiate the option fee.

•

Option fee

•

Legal review and drafting

•

Inspections, surveys, environmental checks

•

Appraisal or broker price opinion

•

Preliminary title and endorsements

•

Marketing and earnest money for your end buyer, if assigning

•

Financing quotes and rate lock fees, if exercising

We also model a contingency reserve for delays.

If you can’t fund the work to de-risk the deal, the option is an expensive lottery ticket.

Using True Net Equity™ to Decide If You Exercise

True Net Equity™ is the value you can actually access after all costs to sell or refinance.

If exercising creates $60,000 of gross equity but only $20,000 of True Net Equity™, I usually advise clients to assign the option instead.

If you’re running a Nomad™ plan, you might exercise, live in the property for a year to capture owner-occupant financing benefits, then move and convert to a rental.

In that case, we underwrite True Net Equity™ today and expected Return Quadrants™ over the first 60 months.

Finding Optionable Properties

I hunt where inefficiencies live.

•

Off-market owners with timing challenges

•

Land with zoning or entitlement upside

•

Distressed properties needing prehab, not full rehab

•

New construction inventory where builders value certainty

•

Sellers trading time for price

When I rebuilt after a rough market cycle, I focused on value creation during the option period itself.

Entitlements, creative design, and superior marketing can be worth more than raw appreciation.

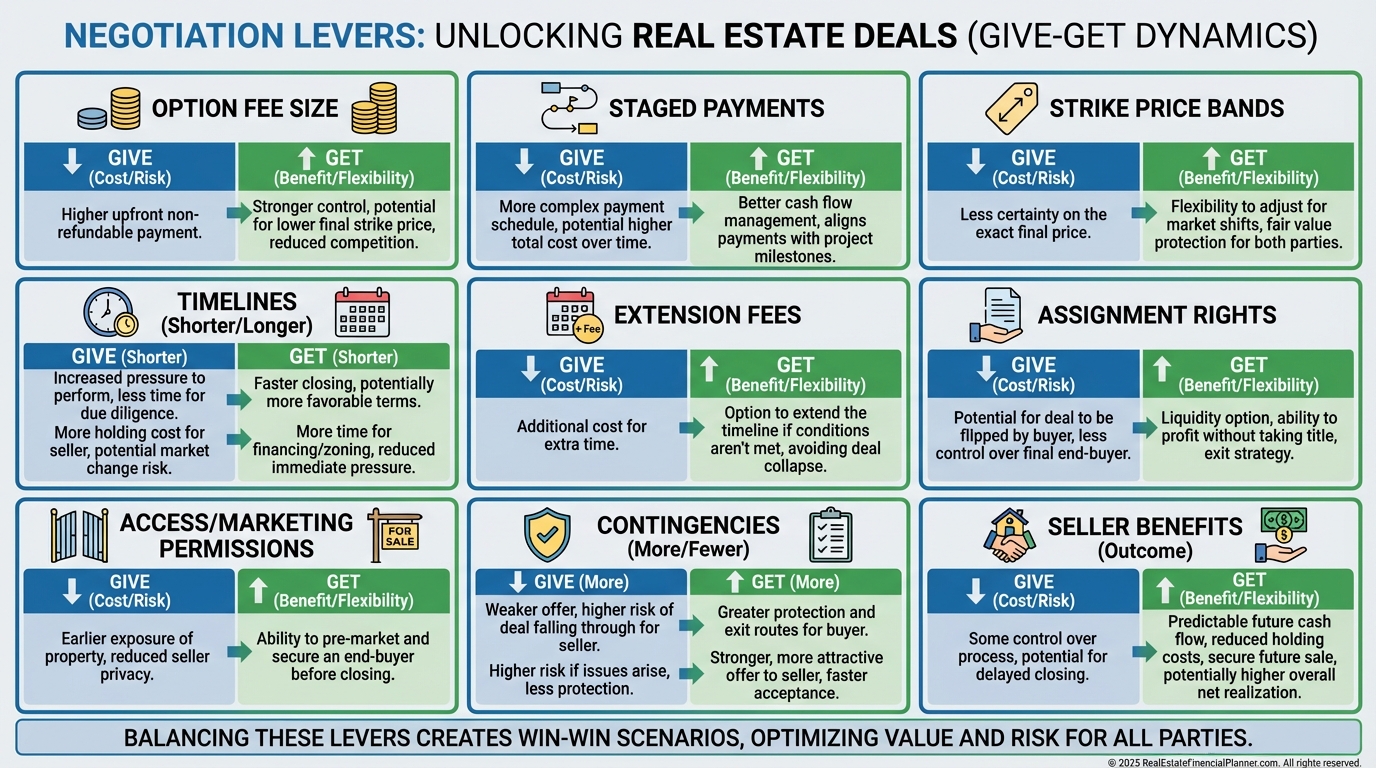

Negotiating Your Advantage

I rarely lead with the option fee.

I lead with the seller’s outcome: speed, certainty, or convenience.

Negotiation levers I use include longer option periods, staged option payments, extensions for a price, and explicit marketing and access rights.

Sometimes a slightly higher strike price buys you generous assignment rights.

I’ll trade paper profit for real control.

Due Diligence That Actually Reduces Risk

I use a two-pass checklist.

Pass one is fast, cheap, and decisive.

Pass two is deep, confirmatory, and ready-to-close.

•

Title search, liens, and survey conflicts

•

Zoning, use, and density checks

•

Physical inspections and scope pricing

•

Rent comps or resale comps validated by third parties

•

Lender term sheet and timeline verification

•

HOA, utilities, and municipal constraints

The option period should be long enough to finish both passes without rushing.

Option-Like Agreements to Understand

These are not identical, but thinking this way sharpens your deal sense.

•

Listing agreements resemble options on commission, with a time window to produce a buyer

•

Purchase contracts with extended inspection periods function like short options if you can exit by forfeiting earnest money

•

Wholesaling often uses an option or a contract treated like one to find the end buyer

•

Option-auction blends an option with an immediate marketing blitz to sell via auction dynamics

•

Some lenders exchange cash for future listing rights, which mimics an option on a service outcome

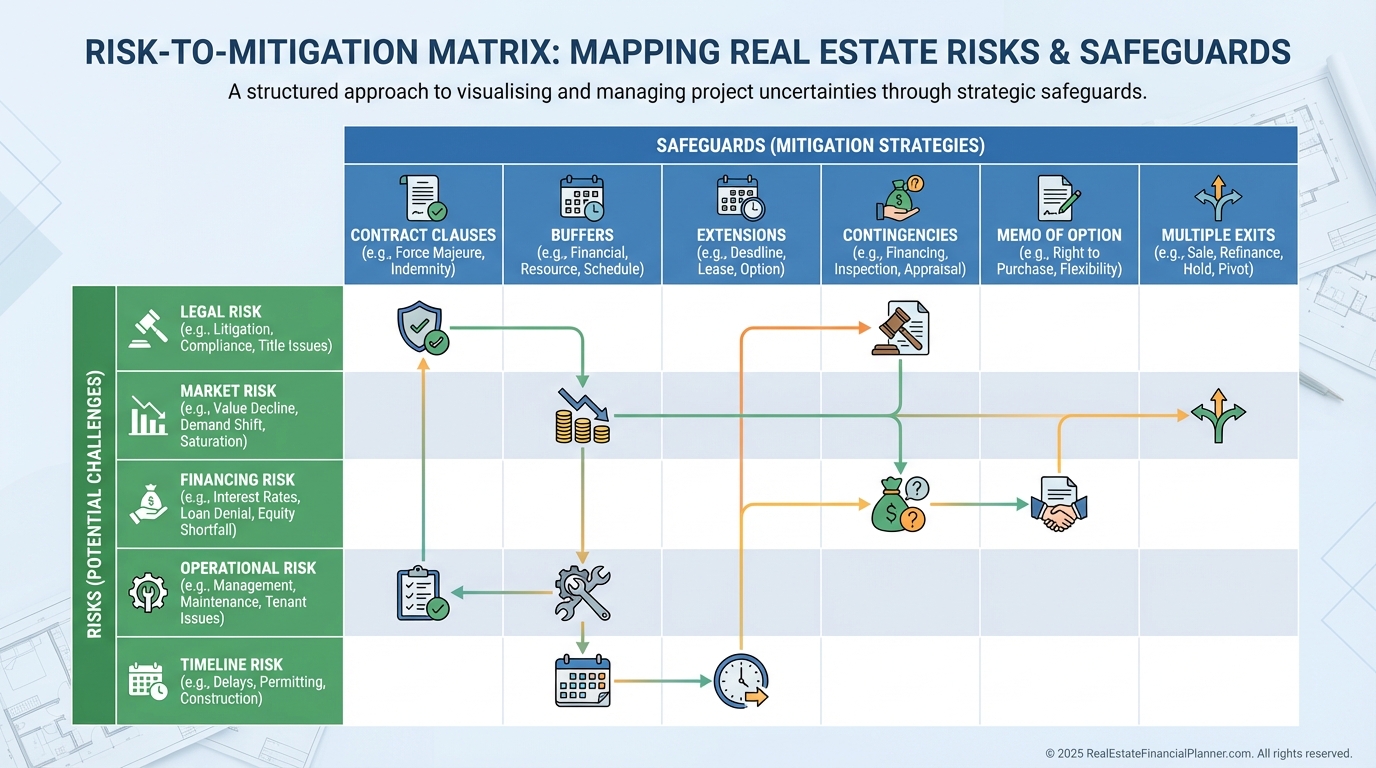

Managing Legal and Market Risk

Your option is only as good as the paper behind it.

I have counsel bless assignment language, marketing rights, access, remedies, and recording a memorandum of option when appropriate.

We comply with local statutes, HOA rules, and brokerage regulations.

We protect the timeline with reminders and hard calendar holds.

We protect the downside with modest fees, flexible extensions, and multiple exits.

What Happens Next — Your Four Exits

You can exercise and close.

You can assign the option to a better-capitalized buyer.

You can negotiate an extension to finish due diligence or marketing.

Or you can let it expire and treat the option fee as tuition for what you learned.

When I help clients choose, we compare each exit using Return Quadrants™ projections and the True Net Equity™ likely to be realized.

Speed, certainty, and capital at risk decide the winner.

Lease-Options and Legal Cautions

If you’re selling on a lease-option, treat it like a hybrid.

You’re a landlord now and a potential seller later.

Many states restrict or heavily regulate these arrangements.

Have your attorney draft or approve your documents before you use them.

We provide sample structures for education only.

Do not use any template without competent legal review.

Quick Checklist Before You Sign

•

Deal passes break-even and sensitivity tests

•

Option period long enough for two-pass due diligence

•

Assignment and marketing rights are explicit

•

Calendar reminders for notices and deadlines are set

•

Exit scoring favors at least two workable strategies

•

Cash reserved for due diligence and potential extension

When these boxes are checked, I’m comfortable wiring the option fee.

That’s when control becomes opportunity.