Tenants: The Serious Investor’s Playbook for Finding, Screening, and Keeping Five‑Star Residents

Learn about Tenants for real estate investing.

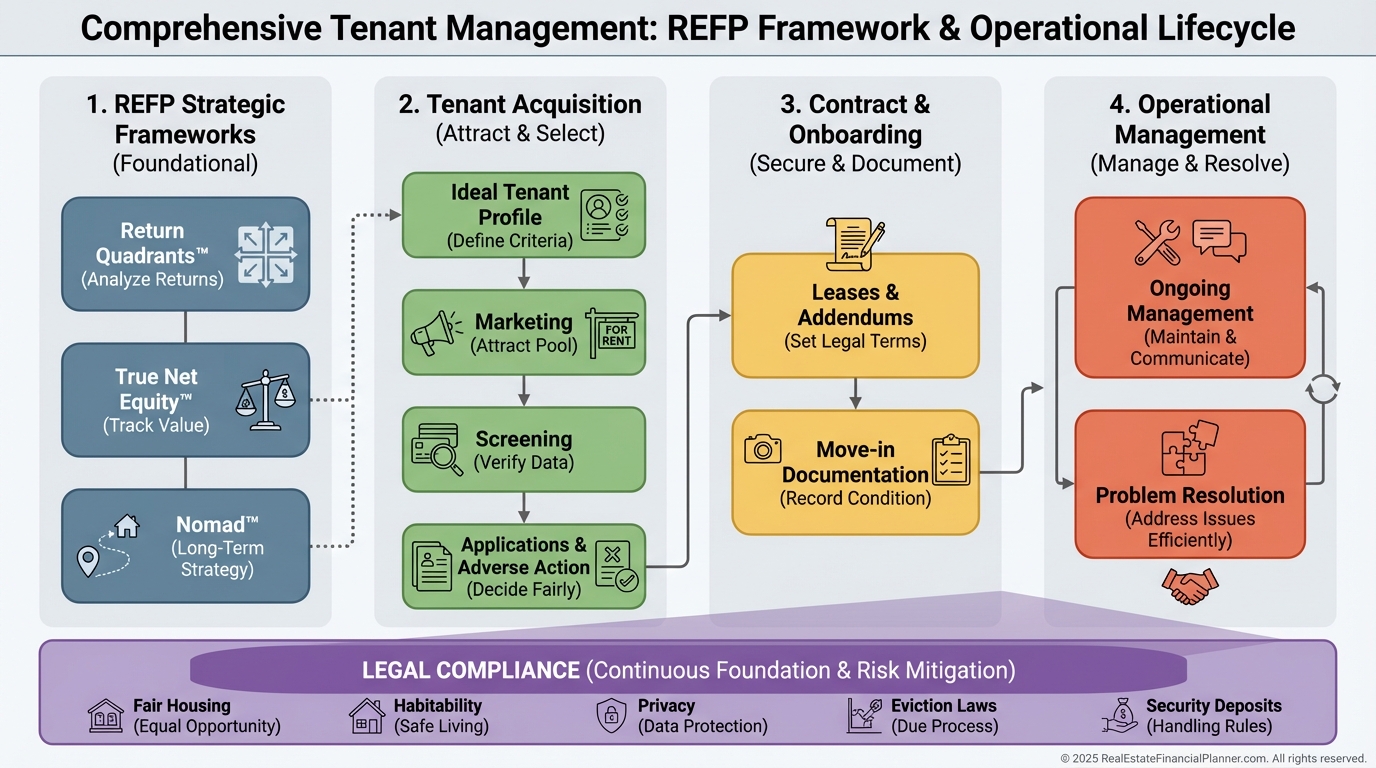

Why Tenants Decide Your Returns

When I help clients dissect why one property thrives and another bleeds cash, the story almost always begins with tenants.

Quality tenants amplify every slice of your Return Quadrants™. Poor tenants erode each one.

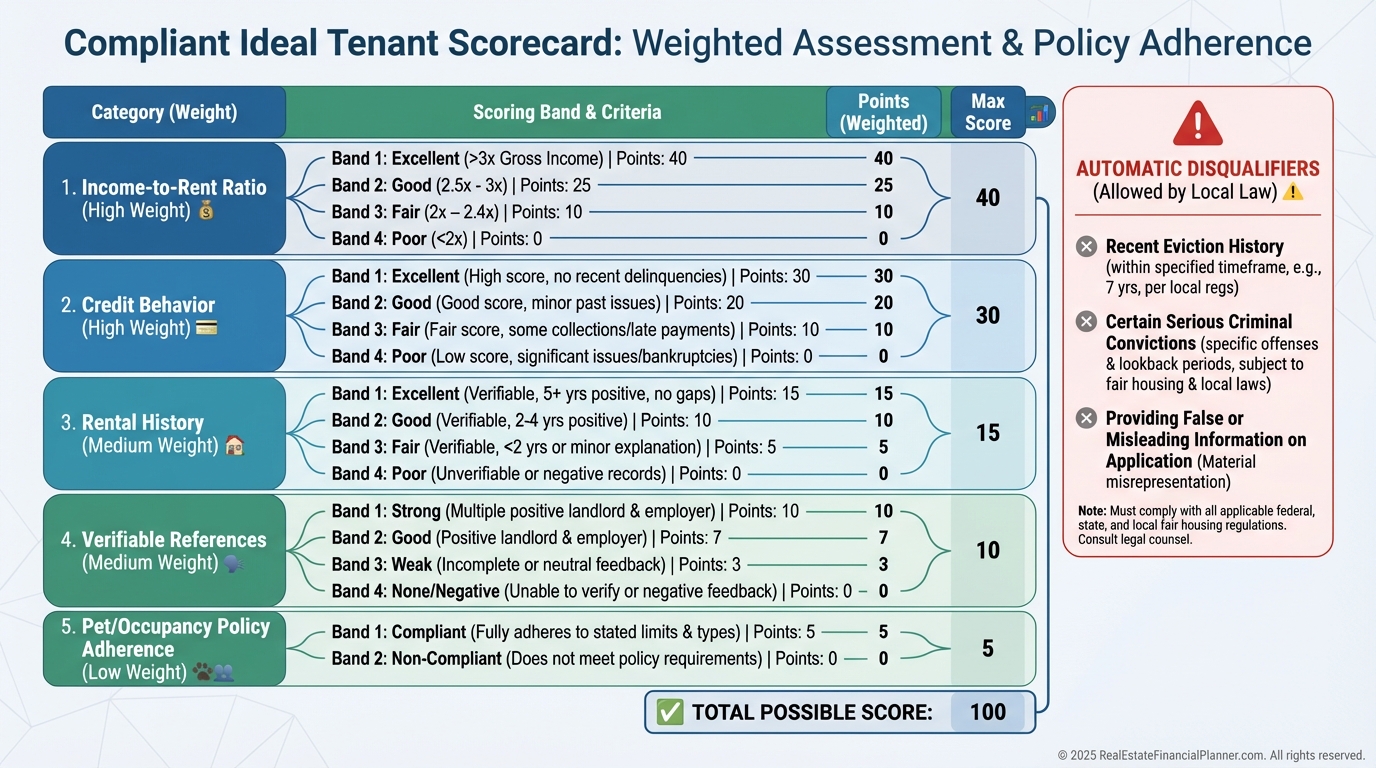

Define Your Ideal Tenant—And Stay Compliant

You’re not profiling people. You’re defining objective, lawful indicators of reliability.

I model four core signals: verifiable income, credit behavior, rental history, and references.

Use a minimum credit standard based on your risk tolerance and local norms. Watch the story in the report: utilization, recent lates, and collections.

Verify rental history with prior landlords you can independently look up, not contacts supplied without context.

Document everything and apply criteria uniformly to comply with Fair Housing and local law. Avoid any protected-class proxies.

Market to Attract the Tenants You Want

Your marketing should filter in the right applicants and filter out the wrong ones.

I lead with crystal-clear photos, an accurate floor plan, and a 60–90 second walk-through video.

List where your ideal renters look. Zillow, Apartments.com, and local channels work well. Avoid channels that bring noise without quality.

Write copy that states standards upfront. Include rent, deposits, pet policy, income criteria, application steps, and availability date.

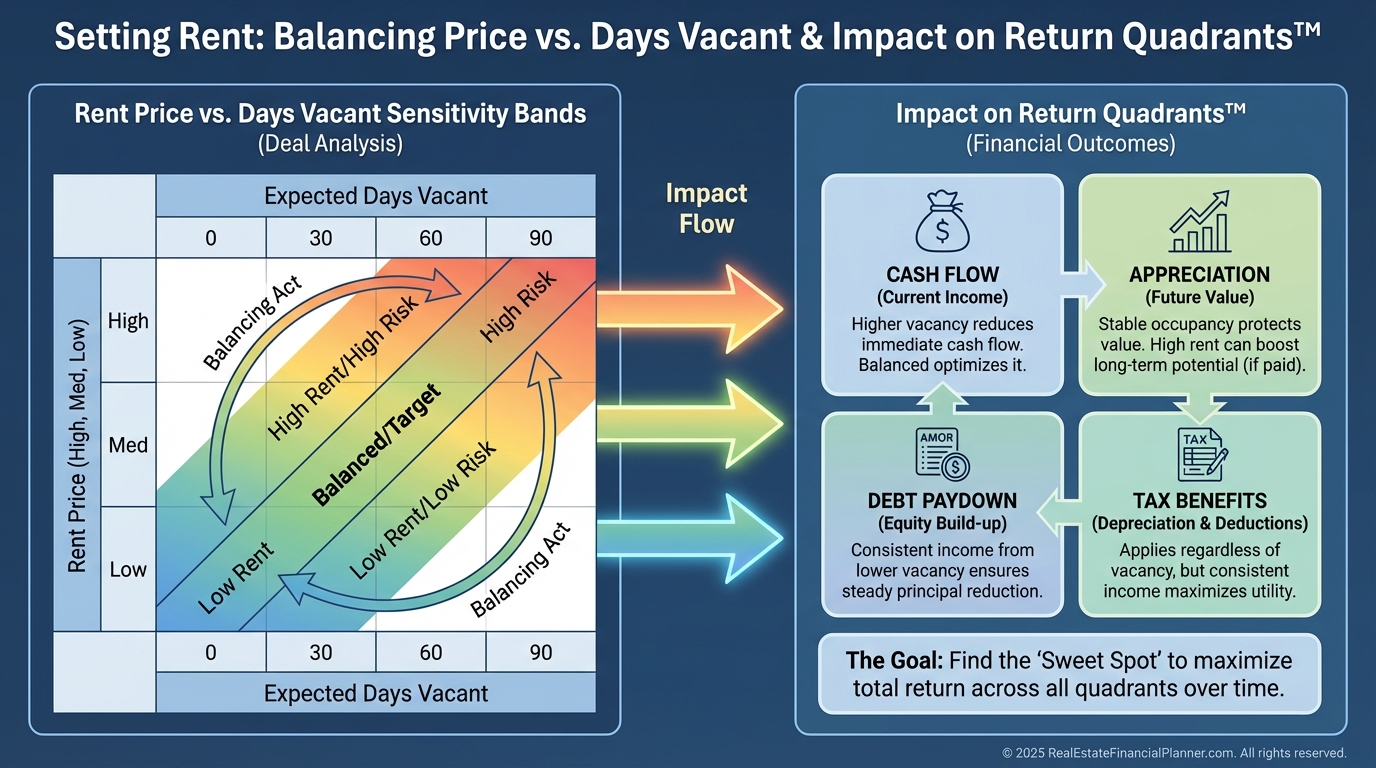

Price to maximize True Net Equity™ over time, not just top-line rent. One extra week vacant can erase an aggressive price.

I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model rent bands against Days Vacant assumptions. We choose the price that maximizes annual net.

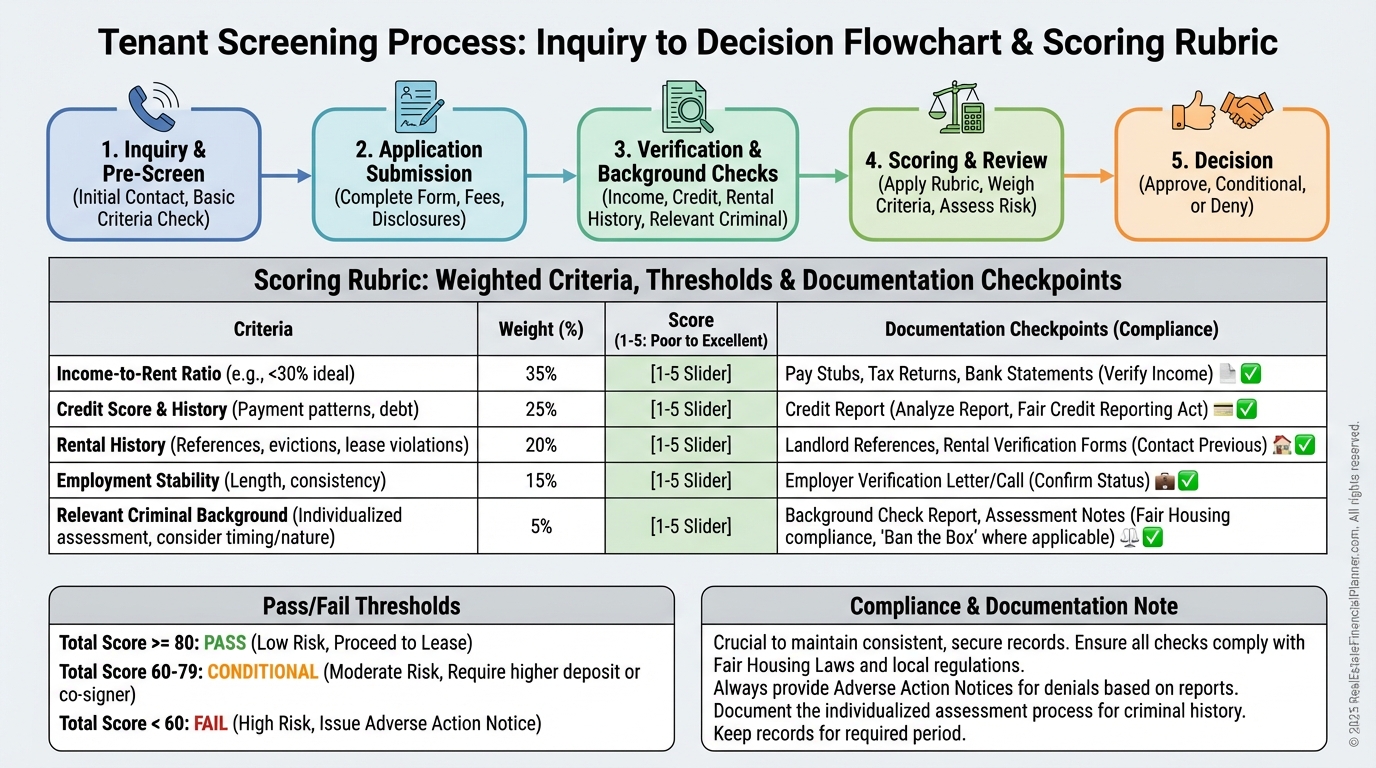

A Screening System That Holds Up in Court

Pre-screen before showings. Ask about timing, occupants, pets, income, and whether they accept your published criteria.

Use a written, consistent screening policy. Then follow it precisely for every applicant.

I review credit, background where permitted by law, eviction records, income verification, and rental history. I look for patterns, not perfection.

Score applicants with a rubric. Decide in writing before you see any one person’s result. Consistency protects you and clarifies decisions.

Always comply with federal, state, and local Fair Housing rules. Some areas regulate background checks, source of income, and application fees.

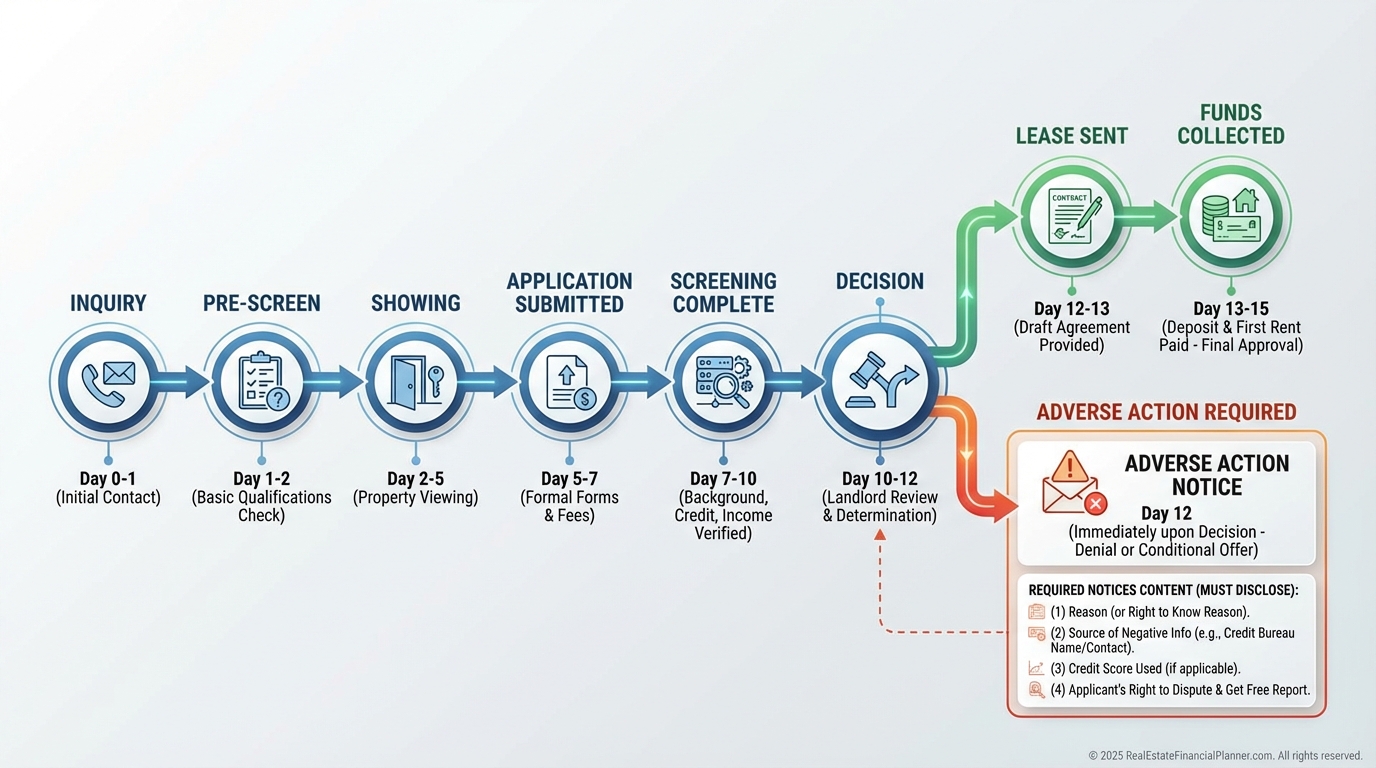

Applications, Communication, and Adverse Action

Make it easy to apply. I use online applications with e-consent for background checks and secure document upload.

Set expectations. I send a timeline email within 24 hours outlining steps, required docs, and decision windows.

Decide based on your rubric. If you deny or conditionally approve because of credit or reports, send proper adverse action notices with required disclosures.

When I have multiple qualified applicants, professionalism and responsiveness are tie-breakers. Those behaviors correlate with long-term success.

Draft a Lease That Manages Risk

Your lease should read like a standard operating manual for living in your property.

I specify rent, due date, late fees, grace period, and payment methods. I include security deposit terms aligned with state law.

Define occupants, pet policy, maintenance responsibilities, and right of entry with required notice. Clarity reduces conflict.

I track expirations, rent steps, and renewal triggers in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to prevent missed increases or holdovers.

A strong lease protects True Net Equity™ by minimizing damage risk, turnover costs, and legal exposure.

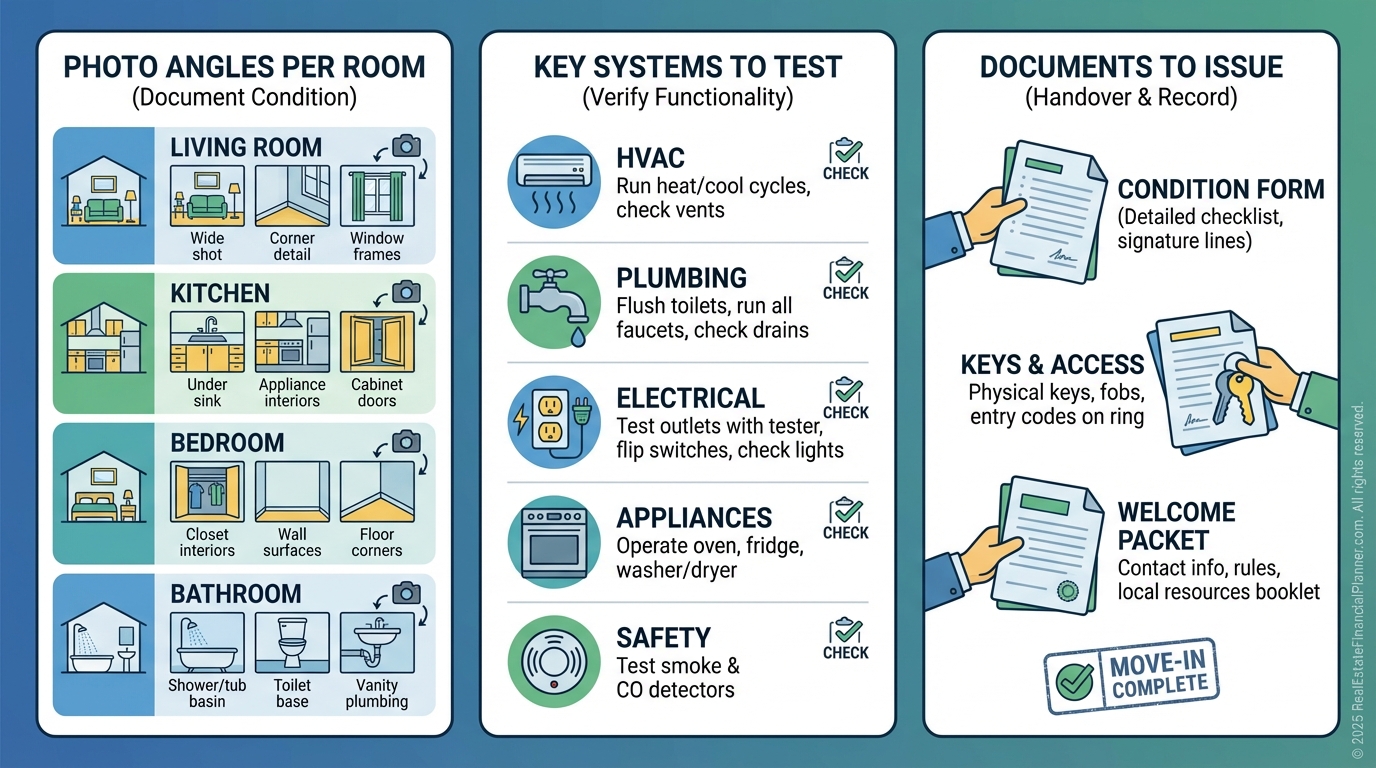

Move-In: Document Everything

Move-in sets the tone and locks in the baseline condition.

I perform a room-by-room walkthrough with date-stamped photos and video. Tenants sign off on a condition report.

Provide a welcome packet with contact info, maintenance steps, trash and utility details, and how to pay rent.

Change or rekey locks, test smoke/CO alarms, and confirm all work orders are closed. Small misses here become disputes later.

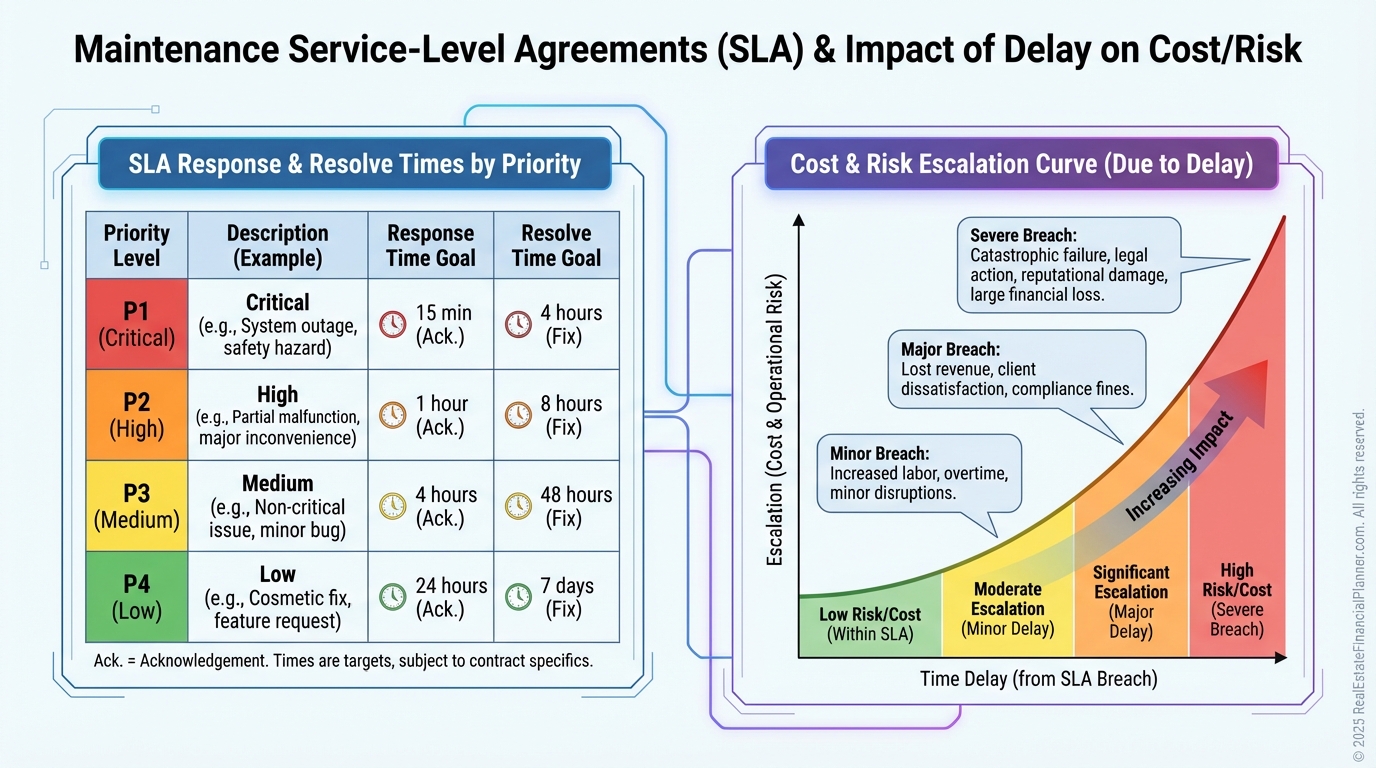

Manage Like a Pro: Communication, Maintenance, Inspections

Proactive communication prevents problems and encourages renewals.

I respond within one business day, send seasonal reminders, and give advance notice before any service.

Use a simple maintenance portal. Triage by urgency, dispatch reliable vendors, and follow up until resolved.

Schedule periodic inspections as allowed by law. I focus on safety, leaks, filters, and any early wear patterns.

Fast, respectful service increases renewal rates, which boosts cash flow and shrinks turnover losses. That’s a quiet win in your Return Quadrants™.

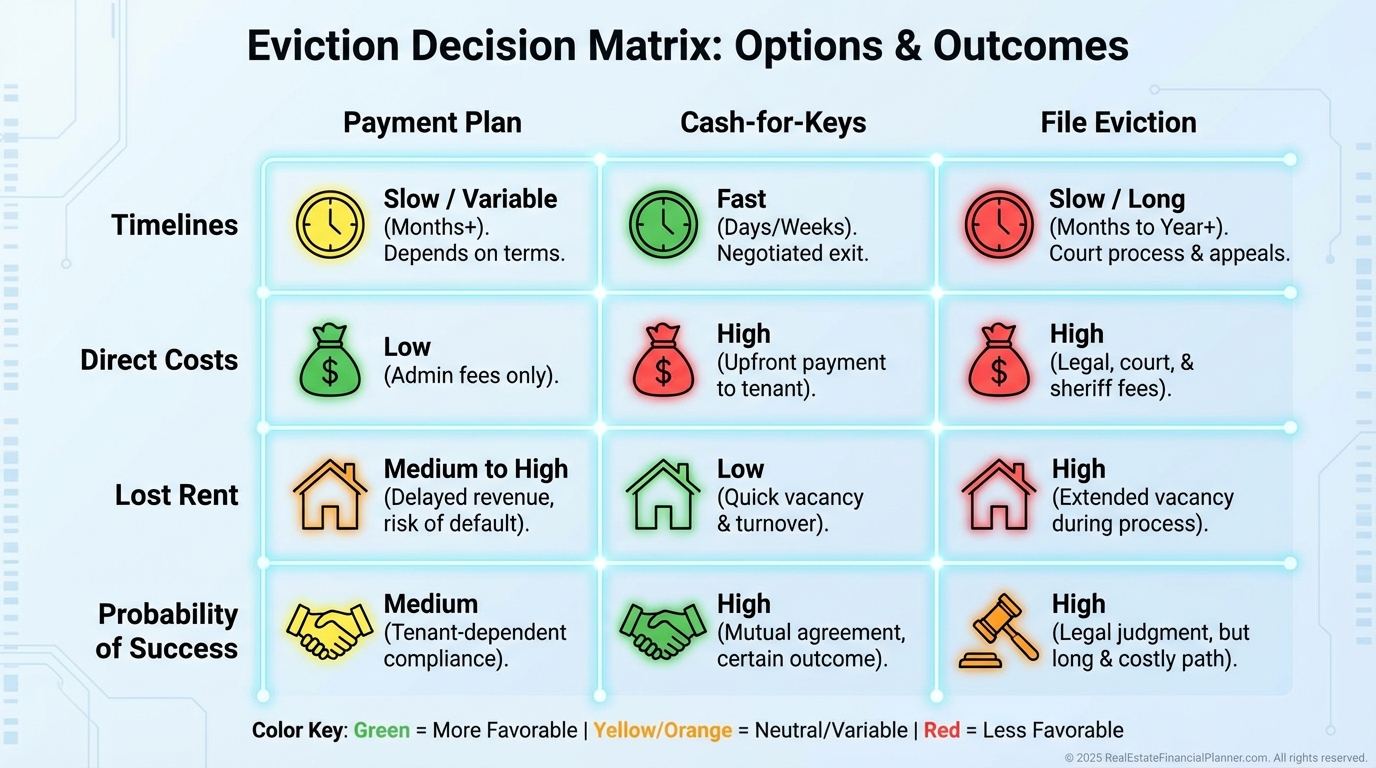

Spot Problems Early and Act Legally

Late rent, neighbor complaints, unauthorized occupants, or resistance to inspections are early signals.

Document everything. Keep a timeline with copies of notices, emails, photos, and invoices.

Send compliant notices immediately. Often, clarity plus consequences solves the issue fast.

If problems persist, consider payment plans, cure agreements, or cash-for-keys before filing. When you must file, use a local attorney.

I model the eviction path in the spreadsheet to compare costs of file-now vs. negotiate-now. Choose the option that preserves cash and time.

Metrics That Predict Renewal

Track what you can manage.

I watch days-to-lease, on-time payment rate, average response times, maintenance tickets per unit, and renewal acceptance rate.

Set quarterly targets. Tighten the bottleneck that costs you the most in vacancy or reputation.

Use True Net Equity™ to see how reduced turnover protects your equity, not just your monthly cash flow.

Nomad™ investors, this matters even more. If you house hack, your “roommate-tenants” need the same systems and documentation.

Putting It All Together

Tenants are the lever that makes your portfolio simple and profitable.

Start with one upgrade: a documented screening rubric or a better move-in checklist. Then add the next system.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to price rent, model vacancy, and schedule renewals.

Do this consistently and your reputation starts marketing for you. Your best tenants will stay, and they’ll send their friends.