Depreciation Recapture Tax: The Silent Profit Killer Most Investors Miss

Learn about Depreciation Recapture Tax for real estate investing.

Depreciation recapture tax is the tax you don’t see coming until the closing statement ruins your day.

When I help clients model exits, this is the number that quietly does the most damage to their True Net Equity™.

During ownership, depreciation feels like free money.

At sale, the IRS shows up with a receipt.

I’ve watched investors celebrate a “six-figure gain” only to realize later that a quarter of their depreciation deductions just disappeared.

That shock is avoidable, but only if you understand this tax from day one.

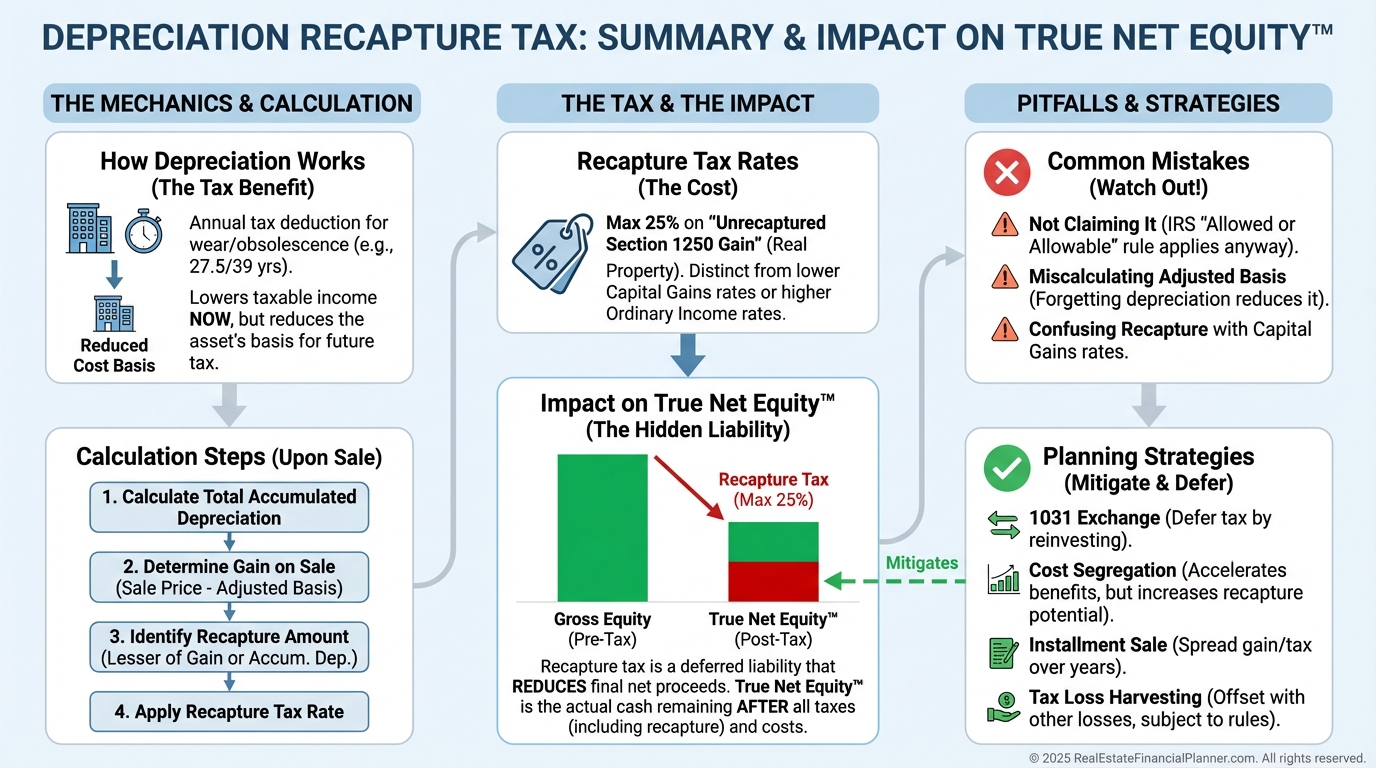

What Depreciation Recapture Really Is

Depreciation recapture is the IRS reclaiming part of the tax benefit you received while owning rental property.

Every year you deduct depreciation, you reduce taxable income at your ordinary income tax rate.

When you sell, the IRS taxes that accumulated depreciation again.

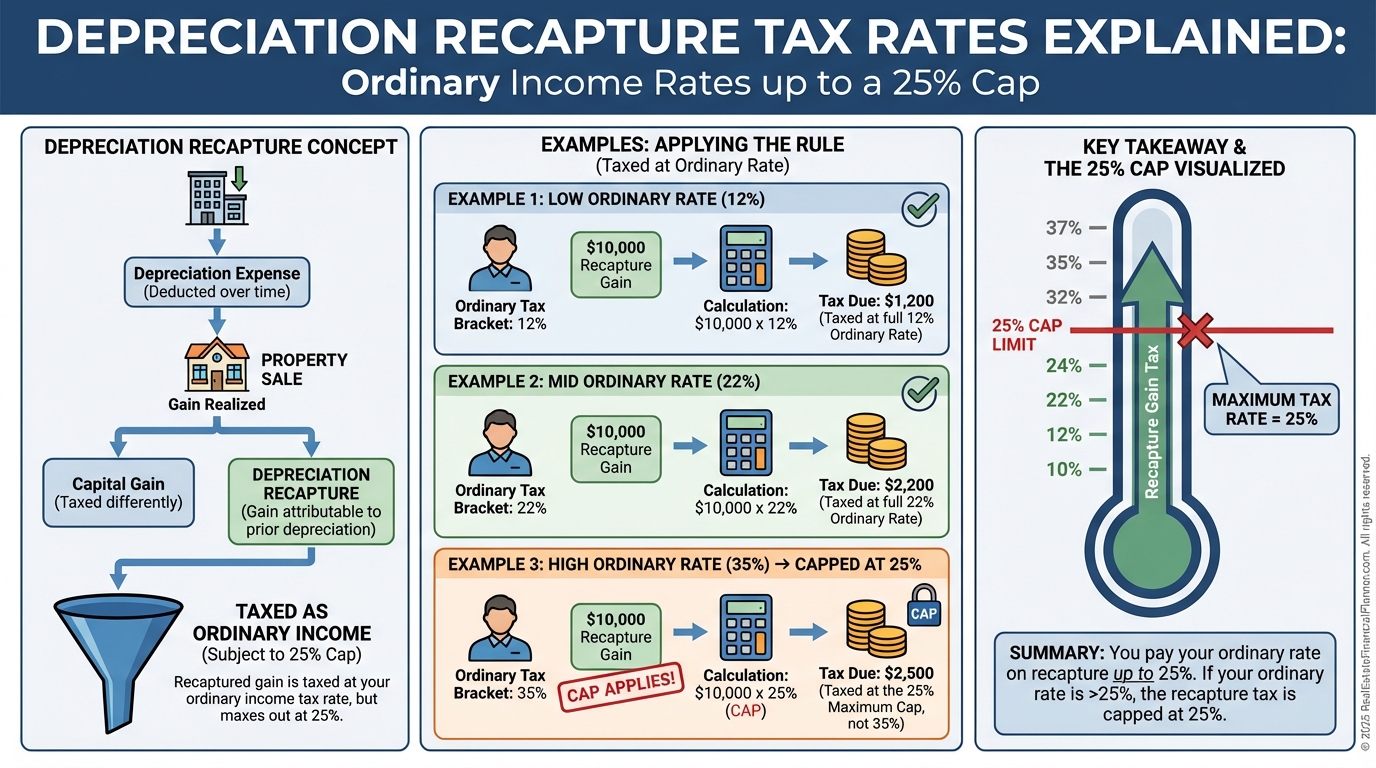

The key detail most investors miss is the rate.

Depreciation recapture is taxed at your ordinary income rate, capped at a maximum of twenty-five percent.

That means it is not always twenty-five percent.

It is “up to” twenty-five percent.

If you sell while in the twelve percent bracket, you pay twelve percent.

If you sell while in the thirty-seven percent bracket, you still only pay twenty-five percent.

This creates a built-in arbitrage that favors high earners during accumulation and retirees during exit.

Why Recapture Feels So Painful

Recapture applies whether or not your property actually lost value.

I’ve had clients sell at a loss and still owe depreciation recapture tax.

That moment changes how investors think about “paper deductions.”

Recapture is also separate from capital gains tax.

It comes off the top first.

Many investors calculate capital gains and stop there.

That single mistake can overstate net proceeds by tens of thousands of dollars.

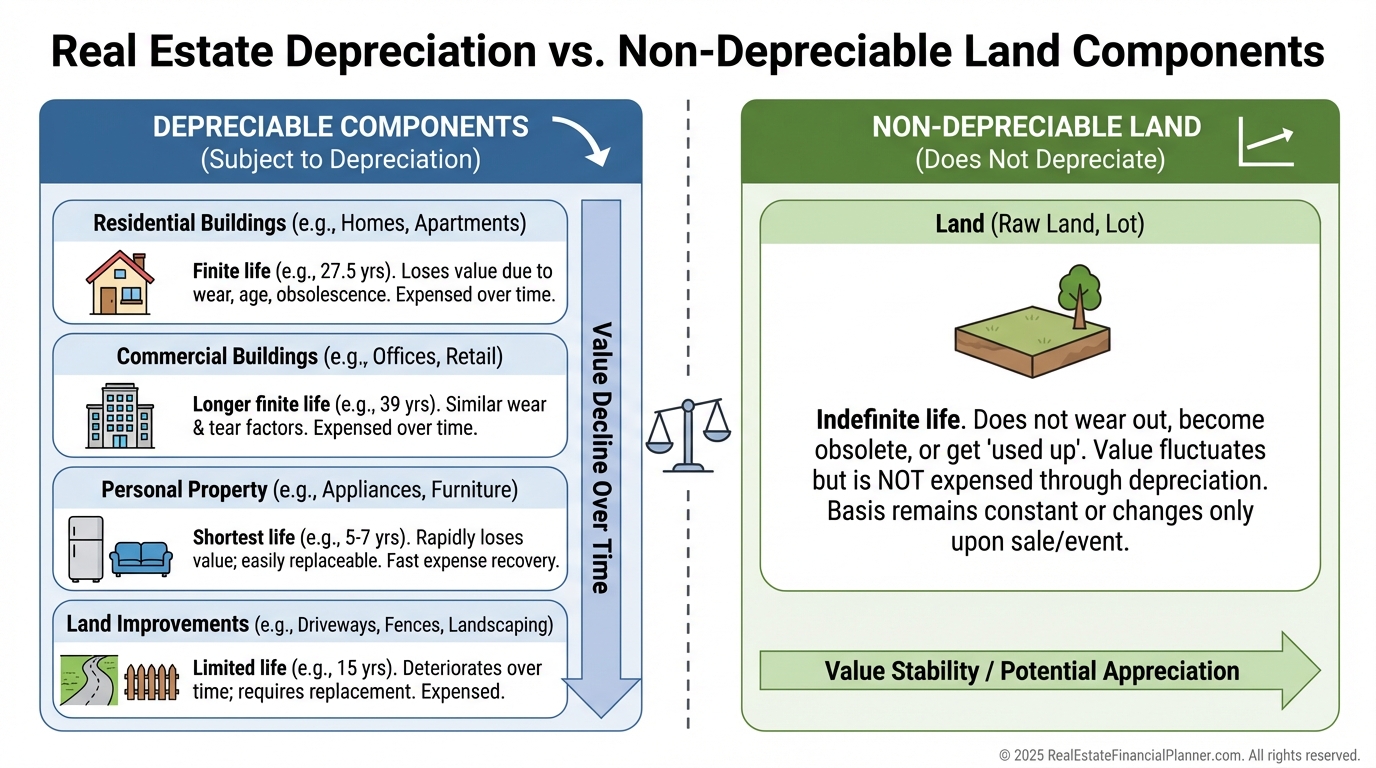

The Depreciation Foundation You Must Understand

Depreciation exists because the IRS assumes buildings wear out over time.

Land does not depreciate.

Here is how the IRS treats different components.

Residential Property depreciates over twenty-seven and a half years.

Commercial Property depreciates over thirty-nine years.

Personal Property from cost segregation depreciates over five, seven, or fifteen years.

Land Improvements often depreciate over fifteen years.

Land is never depreciable.

When I rebuilt after bankruptcy, depreciation was one of the tools that allowed me to stabilize cash flow.

But I tracked every dollar, knowing I would pay for it later.

For a two hundred seventy-five thousand dollar residential building, annual depreciation is ten thousand dollars.

After ten years, that is one hundred thousand dollars subject to recapture.

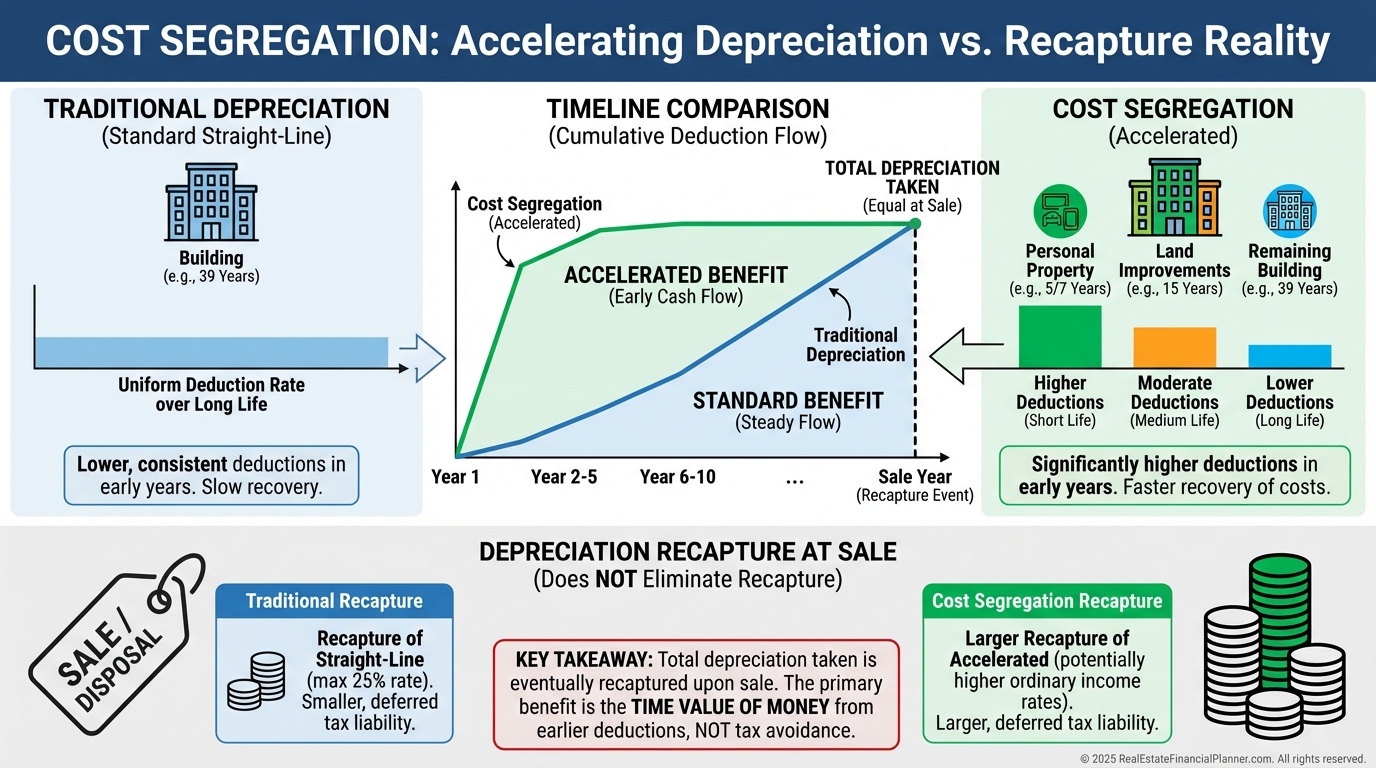

Cost Segregation Changes Timing, Not the Bill

Cost segregation accelerates depreciation into earlier years.

This improves early cash flow and after-tax returns.

It does not eliminate recapture.

If you sell early, cost segregation can actually increase the size of your recapture hit.

That is why I always model exit timing before recommending aggressive acceleration.

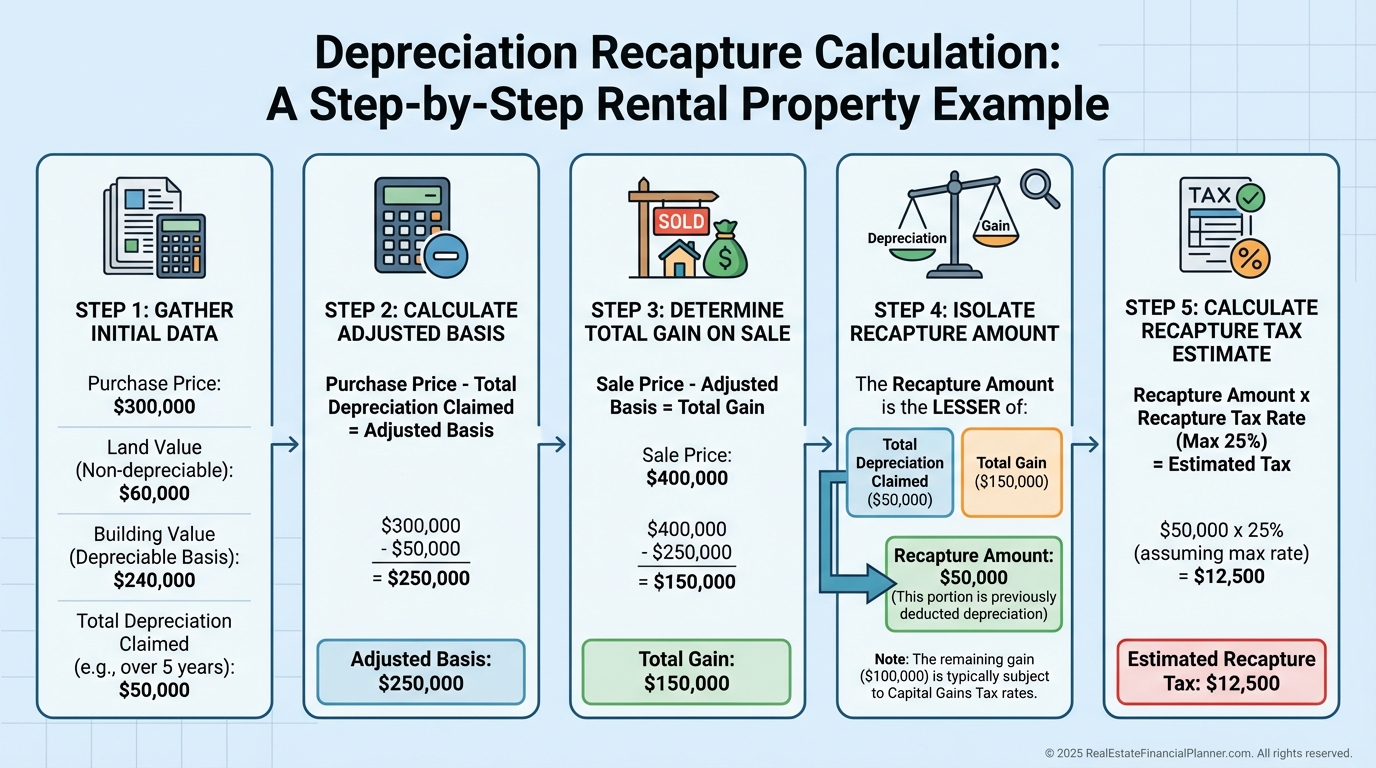

How to Calculate Depreciation Recapture

The math is simple.

The consequences are not.

Total depreciation claimed multiplied by your recapture rate equals your recapture tax.

When I review deals using The World’s Greatest Real Estate Deal Analysis Spreadsheet™, this number feeds directly into True Net Equity™.

Seeing equity shrink by fifteen to twenty-five percent after taxes changes behavior fast.

Common mistakes include missing improvements, misclassifying property types, and ignoring partial-year depreciation.

Those errors compound over time.

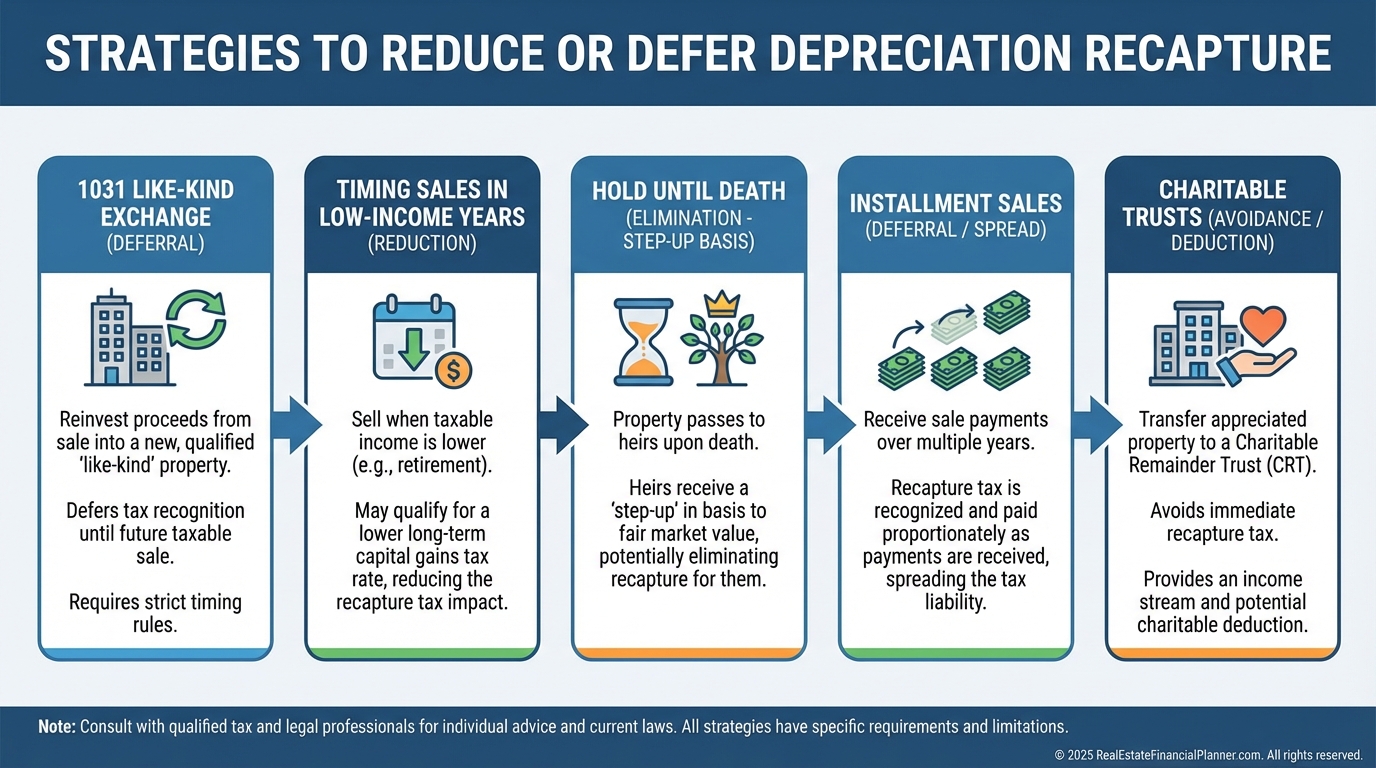

Strategies That Reduce the Damage

You cannot wish depreciation recapture away.

You can plan around it.

A 1031 exchange defers recapture indefinitely.

Holding until death eliminates it entirely through step-up in basis.

Engineering low-income years before selling can cut the rate in half.

That planning alone can save five figures on a single property.

Skipping depreciation is never the answer.

The IRS recaptures “allowed or allowable” depreciation whether you claimed it or not.

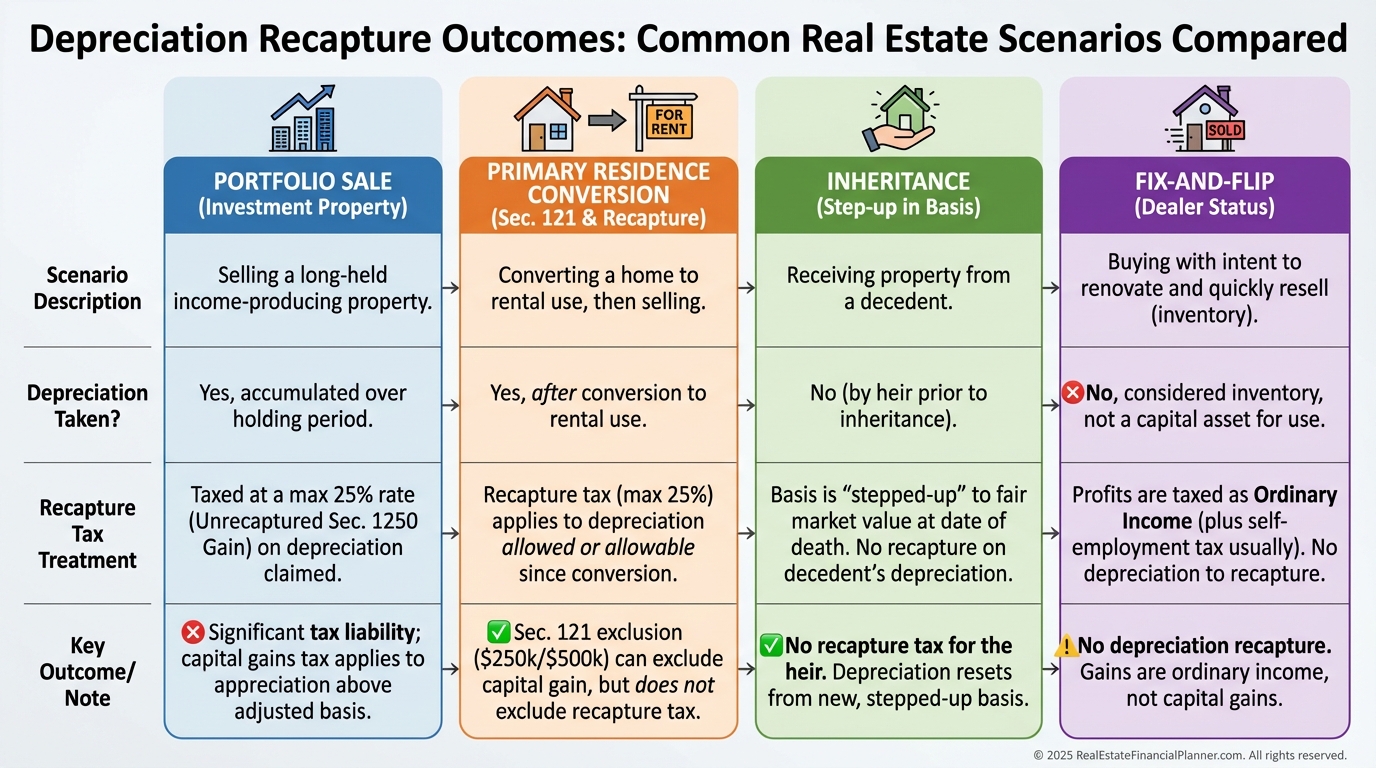

Real-World Decision Points Investors Miss

Selling multiple properties in one year often locks you into the twenty-five percent cap.

Spacing sales across years keeps more money working for you.

Converting rentals to primary residences removes capital gains tax but not recapture.

That distinction matters more than most investors realize.

Inherited property wipes out recapture entirely.

This is why real estate is such a powerful generational wealth tool.

The Mistakes That Cost the Most

Ignoring recapture when negotiating sales prices is the most expensive error I see.

The second is poor record-keeping.

State-level recapture catches investors off guard, especially in high-tax states.

Multi-state portfolios require extra modeling.

Confusing capital gains with recapture leads to underestimating taxes every time.

The order matters.

Making Recapture Part of Your Strategy

Smart investors plan for recapture at acquisition, not exit.

When I analyze deals, I never stop at pre-tax returns.

After-tax cash flow and after-tax equity are what fund your future.

Shorter holds require more caution with accelerated depreciation.

Longer holds almost always benefit from taking everything available.

Depreciation recapture is not a flaw in real estate investing.

It is the cost of converting ordinary income into long-term wealth.

The investors who understand it keep more of what they earn.