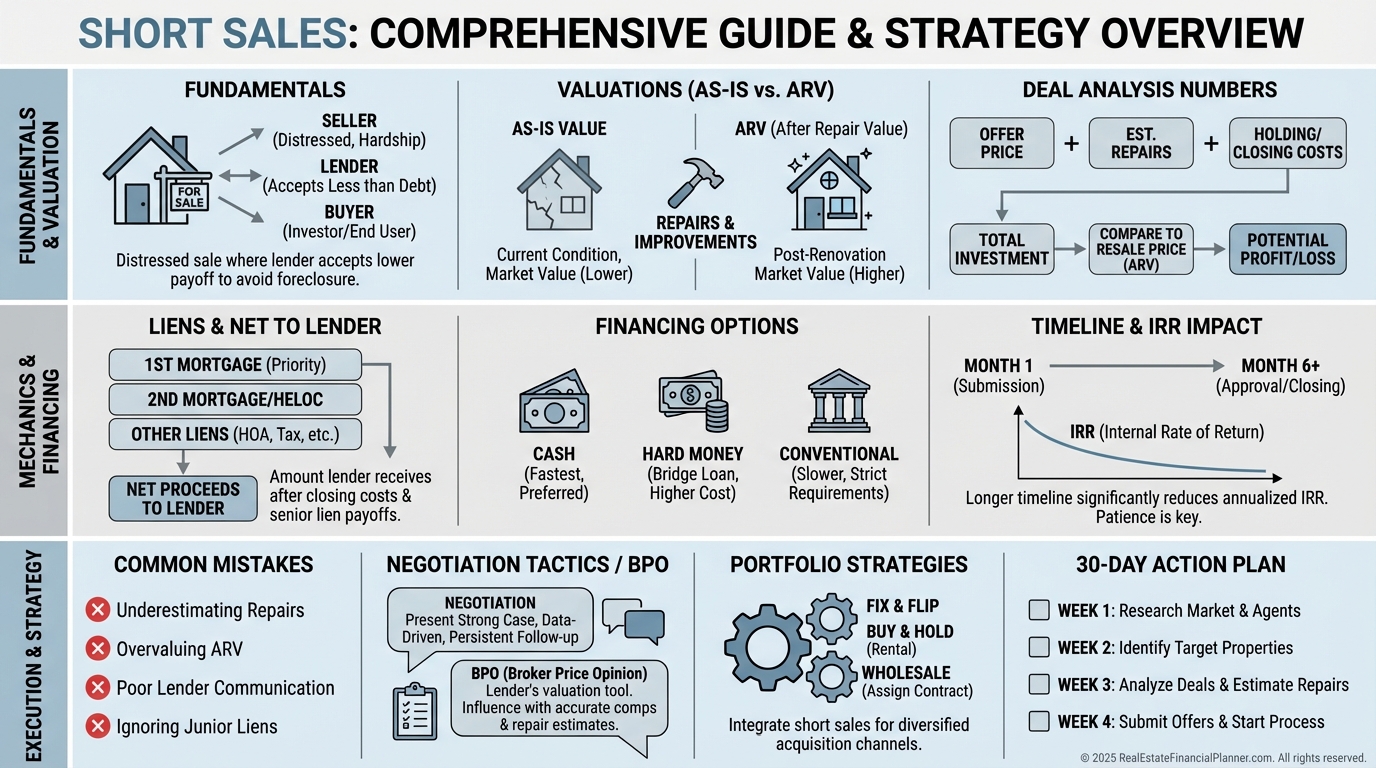

Short Sales for Real Estate Investors: The 2025 Playbook for Instant Equity and Smarter Deals

Learn about Short Sales for real estate investing.

I still meet investors who think short sales are “a 2008 thing.”

They quietly walk past 20–40% instant equity because the process feels slow and opaque.

When I help clients model these deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, the numbers usually change their minds.

The key is replacing folklore with a repeatable process.

You do that by underwriting like a lender, managing the timeline like a project, and negotiating to the lender’s net—not your ego.

What Short Sales Are (and What They’re Not)

A short sale is a lender-approved sale where the property sells for less than the total debt owed.

“Short” refers to the payoff, not the timeline.

The seller still holds title, so you are negotiating with both the homeowner and the lender.

That dual approval is why your offer must make sense against the bank’s foreclosure alternative.

Here’s how it contrasts with other paths I walk clients through.

•

Foreclosure: The bank already owns it. In a short sale, the owner does.

•

REO: After foreclosure. Short sales are pre-REO and usually in better condition.

•

Traditional sale: Only buyer and seller. Short sale adds lender approval to the critical path.

•

Pre-foreclosure: A stage, not a strategy. A short sale is one possible exit during that stage.

Short sales directly influence your Return Quadrants™.

You can buy equity on day one, improve cash flow by lowering basis, and preserve DSCR for future loans.

The True Net Equity™ you capture is what matters, not a vanity discount.

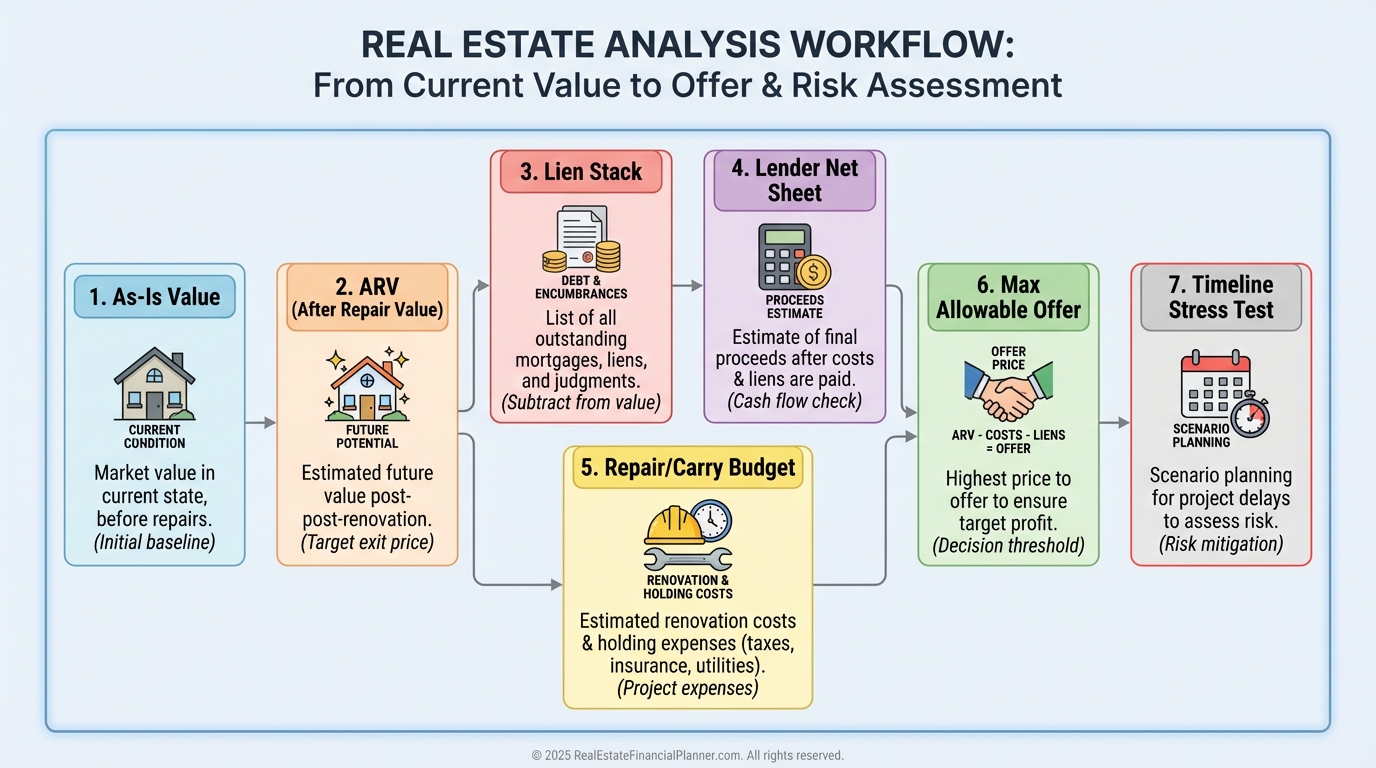

The Investor’s Model: How I Analyze a Short Sale

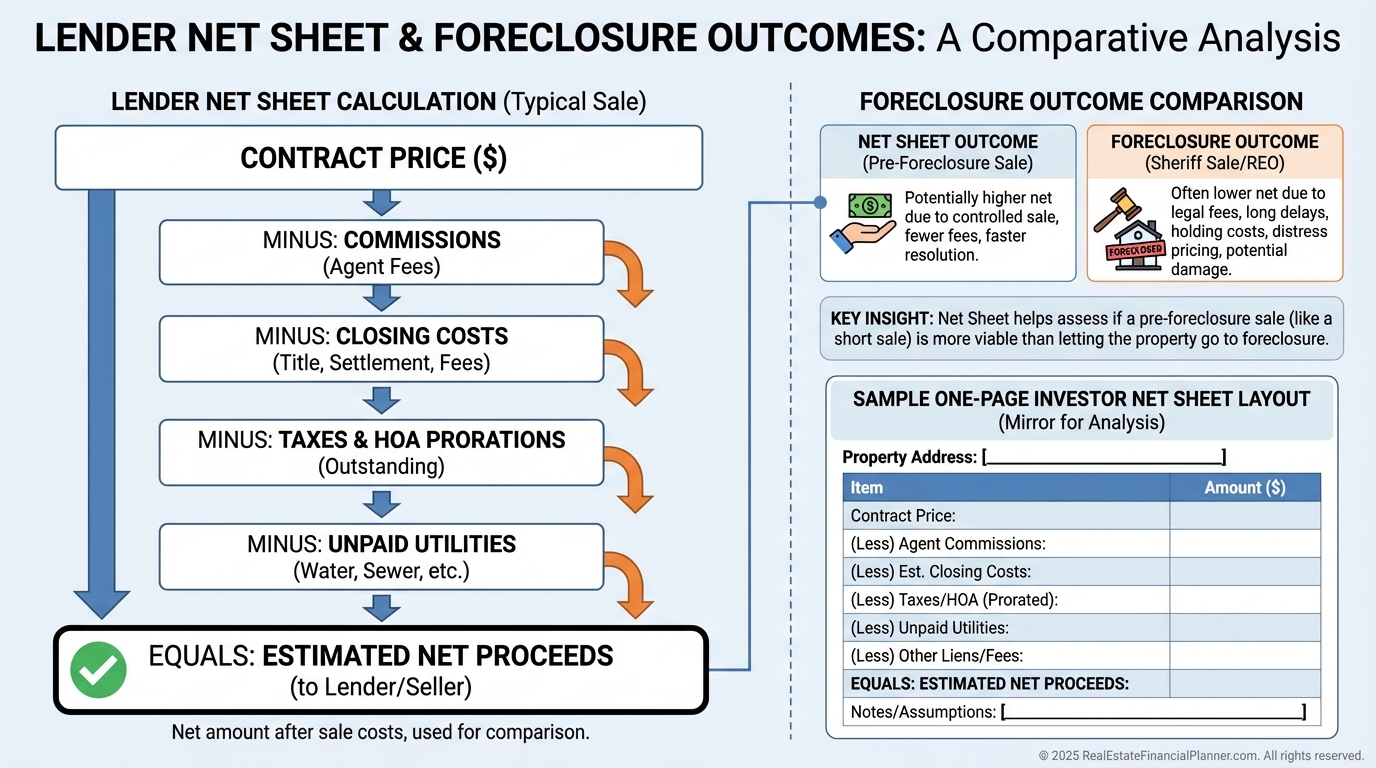

I start with value, debt stack, and the bank’s net.

Then I model the timeline drag on returns.

Here’s the exact sequence I ask clients to follow.

•

Determine as-is market value via recent sold comps, adjusted for condition and location.

•

Estimate ARV with conservative comp selection.

•

Build a preliminary net sheet to the lender: sale price minus agent commissions, transfer taxes, title/escrow, unpaid taxes, HOA, and seller credits (usually none).

•

Price your max offer off the lender’s net vs. foreclosure proceeds and costs.

•

Add your repair scope, carry, and contingency.

•

Stress test with 3, 6, and 9-month timelines to see IRR compression.

When I rebuilt after a rough downturn, I learned to make the bank’s decision easy.

I show them in writing that my net beats their foreclosure path on time and dollars.

Here’s a simple case study I recently reviewed with a client.

•

As-is value: $250,000

•

First mortgage: $290,000

•

Second mortgage: $35,000

•

Needed repairs: $25,000

•

Offer price: $195,000

•

Total in: $220,000

•

Equity after repairs (True Net Equity™): about $30,000 after closing costs and reserves

On paper, it’s 78% of value.

But the bank compares my net to six-plus months of foreclosure costs, legal fees, and market risk.

We help them say yes by documenting that math.

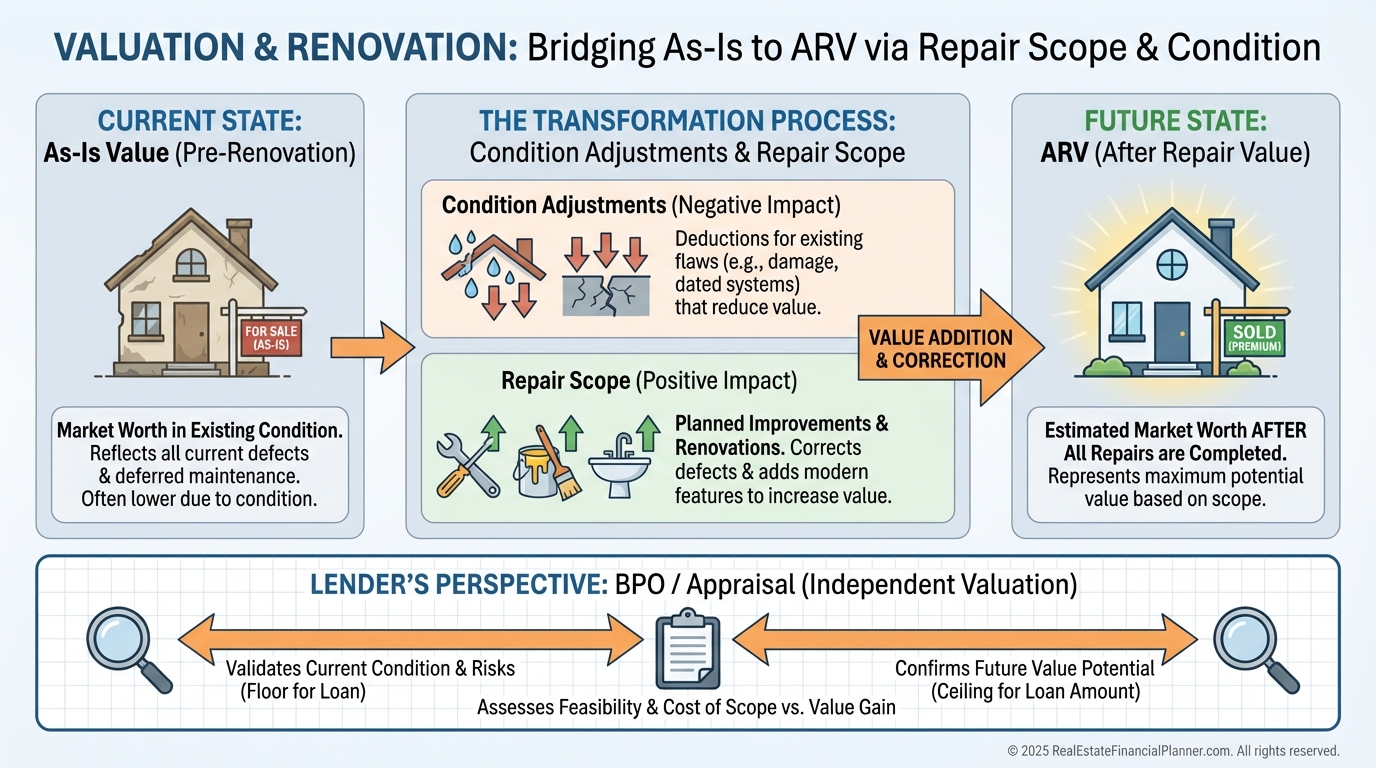

Valuation, ARV, and What the Bank Will Believe

You value two things in parallel: today’s as-is and tomorrow’s ARV.

Lenders lean on a BPO or appraisal that looks like retail value, not “distress comps only.”

I ask agents to include clean retail comps plus a few distressed comps for context.

That keeps the BPO honest without looking manipulative.

I also separate cosmetic from system-level repairs.

That lets me show the BPO agent why the subject is worth less than the sparkling comp down the block.

In the Spreadsheet, I always run two valuations.

As-is for acquisition safety and ARV for exit clarity.

Then I plug both into Return Quadrants™ to see where the deal truly pays: equity at buy, cash flow after stabilization, debt paydown, and tax benefits.

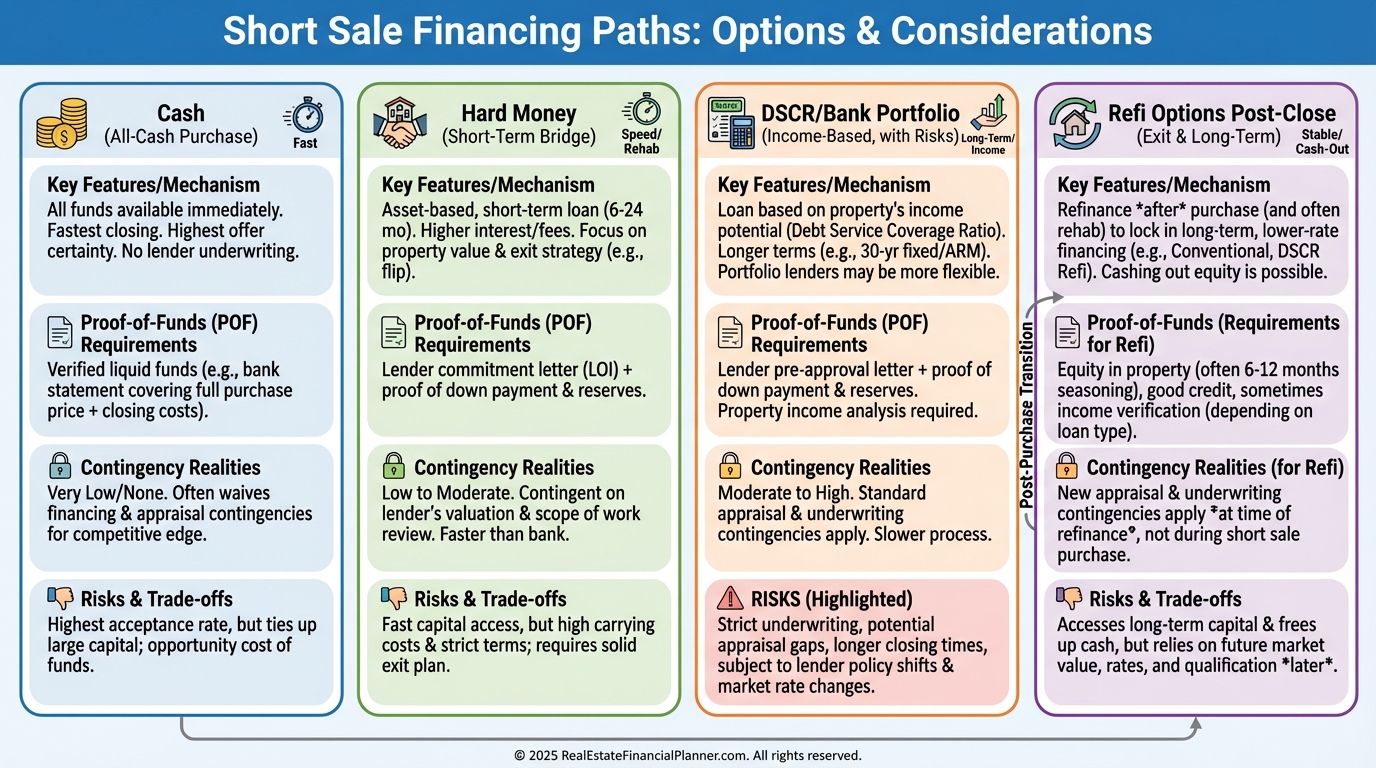

Financing That Actually Closes

Traditional lenders hate moving targets.

Short sales are moving targets.

Cash is king, and flexible hard money is a close second.

If you must use a loan, underwrite your own deal as if you had to close with cash anyway.

Submit proof of funds, not a pre-approval letter.

Plan for “as-is, no credits, no repairs,” and treat inspections as information only.

Most lenders prohibit assignments, so plan to close in your entity and exit with a flip or BRRRR-style refi.

When clients ask if they can use FHA, I explain timing.

Yes, owner-occupants can close with FHA after approval, but the bank’s timeline must match your lender’s.

If you’re using Nomad™, be patient and line up a lender who understands short sales.

The Timeline: Longer Than You Want, Shorter Than You Fear

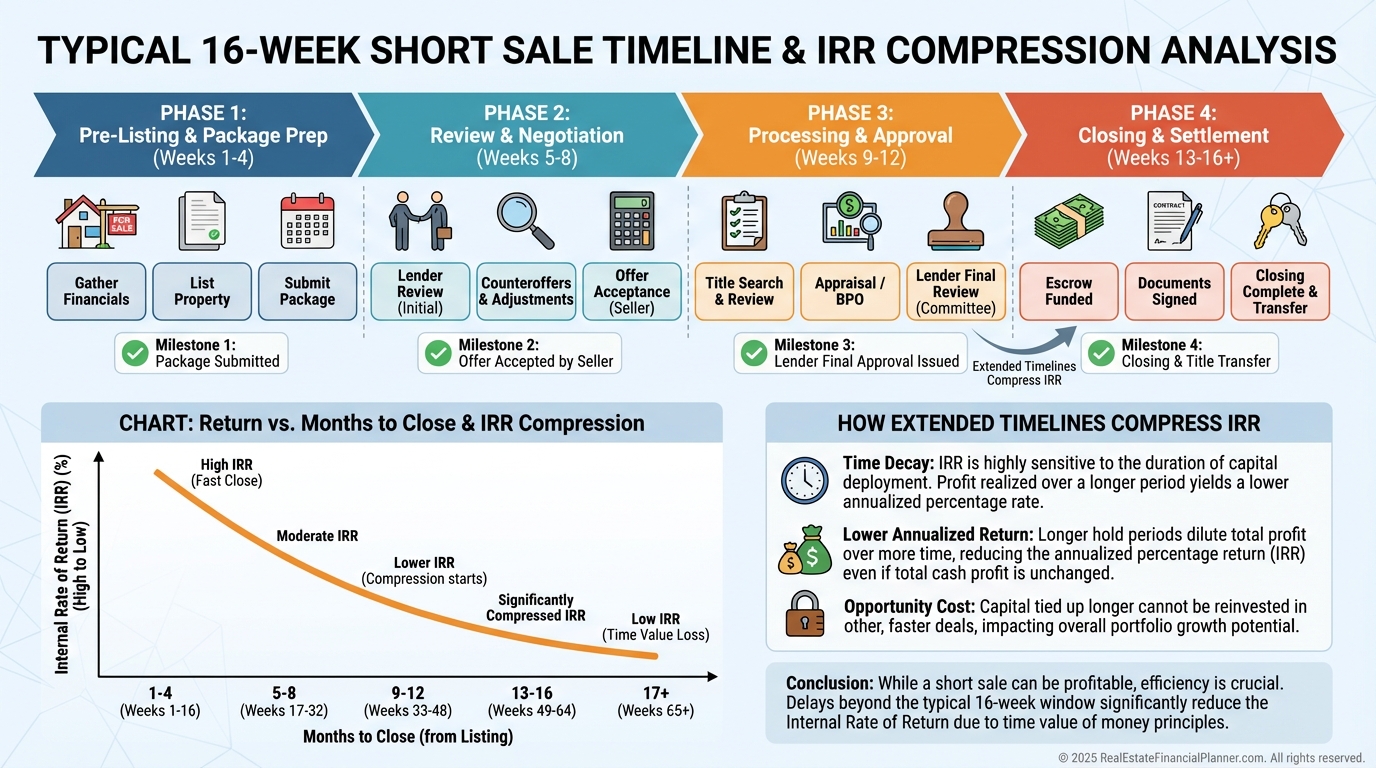

I teach clients to budget 3–6 months and be pleasantly surprised if it lands sooner.

Your IRR shrinks as time expands, even when equity looks great.

That’s why I always model multiple closing dates.

A simple weekly cadence keeps files moving.

•

Week 1–2: Submit full offer package with net sheet and proof of funds.

•

Week 3–6: Lender requests docs; BPO scheduled; you collect lien releases.

•

Week 7–10: Negotiator assigned; value reconciled; preliminary approval.

•

Week 11–16: Junior liens finalized; final approval and closing scheduling.

Add buffers for HOA estoppels, tax liens, and file “timeouts.”

Common (Expensive) Mistakes I See

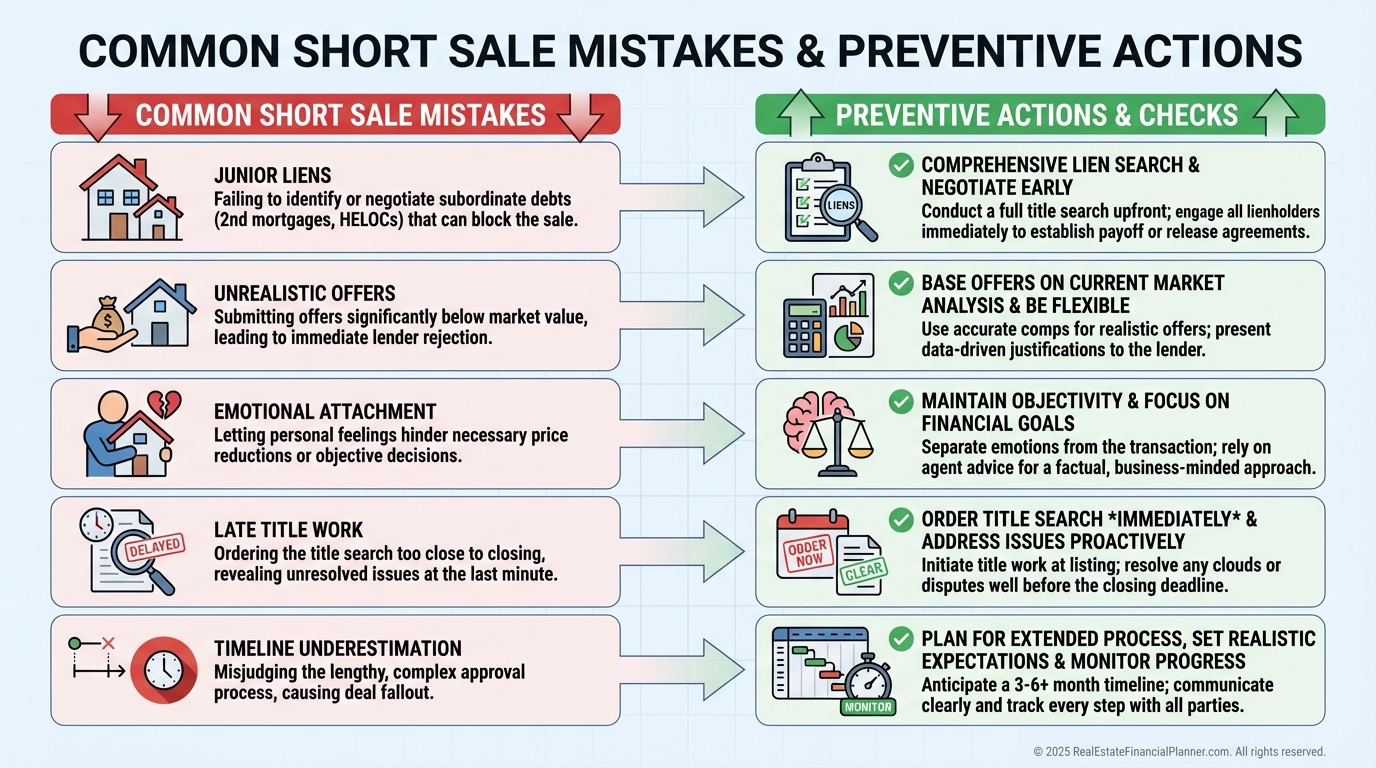

The biggest killer is ignoring junior liens.

Every lienholder must agree, and one stubborn second can sink the deal.

The second failure is lowballing without a lender net sheet.

If your offer isn’t framed as “better than foreclosure,” it reads as noise.

Third, investors get emotionally attached around month four.

I coach clients to set a walk-away number on day one and stick to it without flinching.

Fourth, they skip the early title search.

That’s how “surprise” IRS liens appear late and ruin a quarter of your year.

Fifth, they assume a 30-day flip timeline.

Short sales are slow going in and fast coming out—plan the opposite of a hot retail flip.

Here’s a true story.

A client offered $180,000 on a $240,000 as-is value with $265,000 owed.

Month four, a $40,000 IRS lien popped.

That deal died because title wasn’t pulled upfront.

We updated our checklist the same day.

Negotiation Levers You Can Actually Pull

Your leverage lives in the lender’s math.

I always include a one-page net sheet and a short “why this beats foreclosure” memo.

I show days-to-close, your proof of funds, and a clean inspection report used to price the offer.

I also prepare the listing agent to influence the BPO with accurate comps and defect photos.

That keeps expectations realistic.

Escalation clauses can help, but pre-set a hard ceiling based on your True Net Equity™.

If the bank counters above your maximum, you let it go and move on.

Portfolio Strategies With Short Sales

Buy-and-hold works beautifully when you buy below market and refinance after stabilization.

Your DSCR improves, and you unlock capital to roll into the next property.

Flips can pencil better because your margin is baked in at acquisition, not dependent on perfect ARV.

Just plan for a longer pre-close and a normal post-close rehab.

House hackers can use Nomad™ with short sales to acquire a deal at a discount with low down.

Live in it one year, move out, and repeat.

I model these in Return Quadrants™ so clients see where each strategy pays today and over five years.

Action Plan: Your First 30 Days

Week 1: Set saved MLS searches for “short sale/subject to lender approval,” and pull public record debt for each lead.

Week 2: Build a repeatable underwriting pack—comps, repair template, preliminary net sheet, proof of funds.

Week 3: Submit three to five offers you can actually close and calendar weekly check-ins with listing agents.

Week 4: Order early title on the top two and line up financing or cash for an uncertain close date.

Track everything in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Then, measure your True Net Equity™ and IRR under 3, 6, and 9-month timelines before you commit.

Your edge is patience plus a clean, lender-friendly file.

Others avoid the complexity.

You profit from it.