Loss Assessment Coverage: The Small Policy That Saves Investors From Big HOA Bills

Learn about Loss Assessment Coverage for real estate investing.

The 30-Day $15,000 Surprise Investors Miss

Her unit was undamaged. The community pool and clubhouse weren’t.

When I see that, I don’t just worry about cash flow. I worry about forced sales, damaged credit, and busted Return Quadrants™ for years.

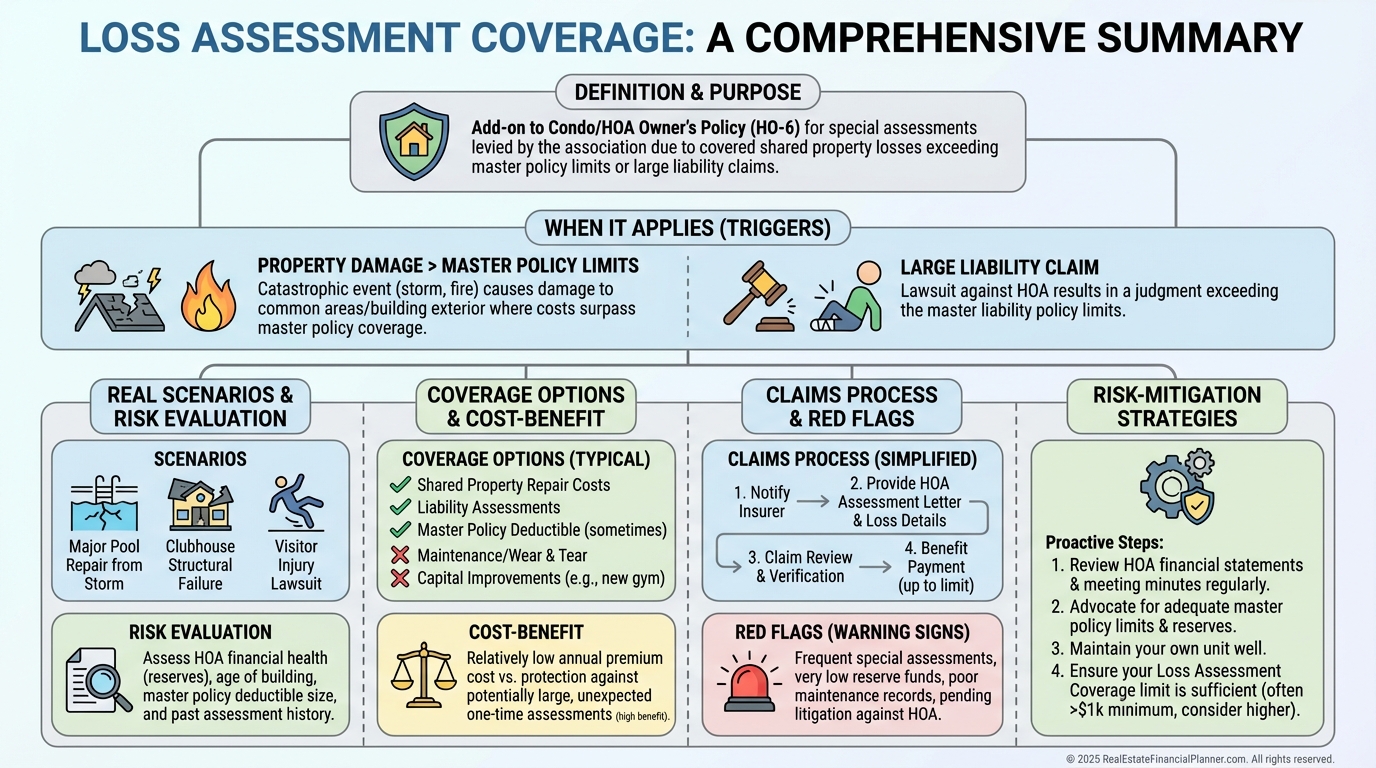

What Is Loss Assessment Coverage?

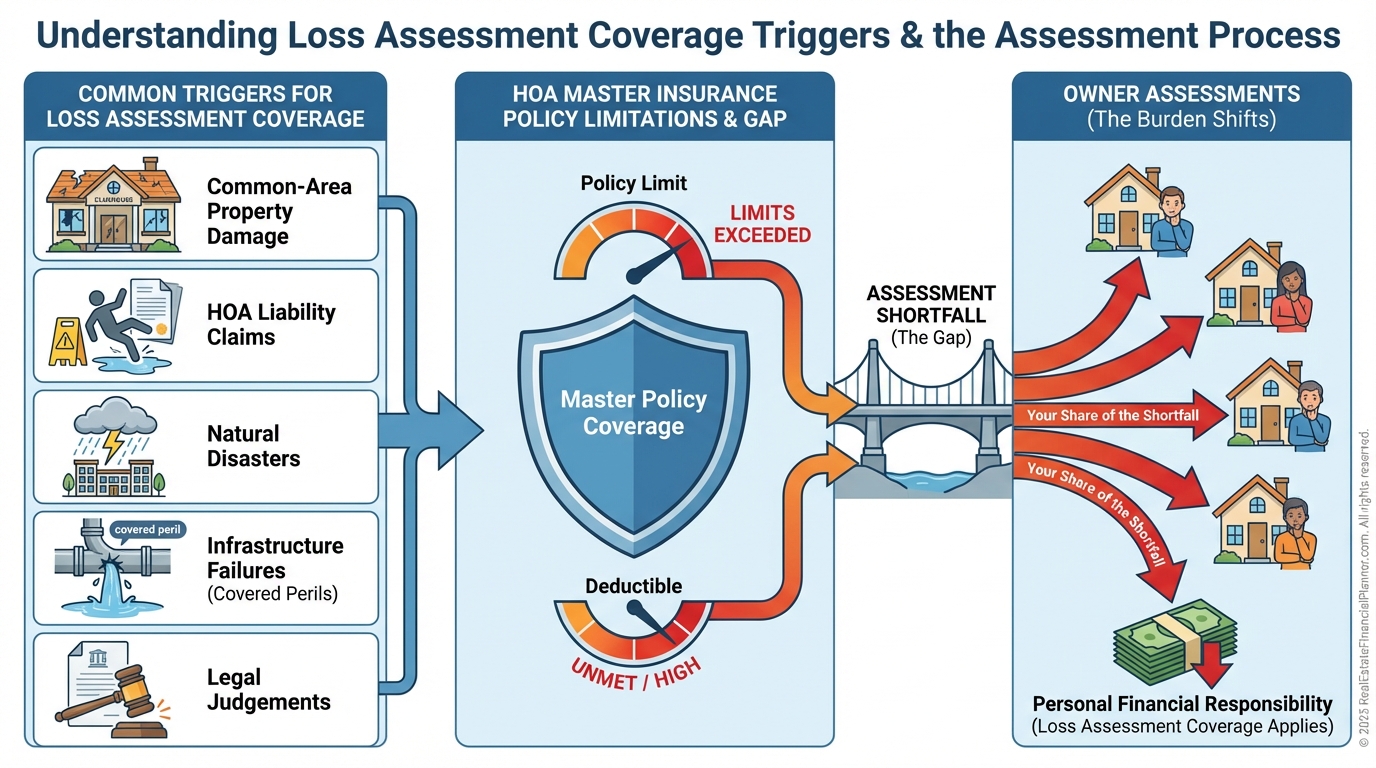

Loss assessment coverage pays your share when the HOA assesses owners for property damage or liability claims that exceed the master policy or fall under its deductible.

It’s a low-cost endorsement or standalone policy that fills the exact gap most landlord and homeowner policies ignore.

When I audit a client’s insurance, I treat this as a mandatory line item for any property tied to an HOA.

When It Applies: Triggers I Model For Clients

Common-area property damage from covered perils, like roofs, elevators, pools, and garages.

HOA liability claims after injuries on common property once the HOA’s liability limit is exhausted.

Natural disasters where the master policy excludes the peril or deductibles are massive.

Sudden infrastructure failures tied to a covered peril.

Legal judgments against the HOA, including some D&O shortfalls tied to bodily injury or property damage.

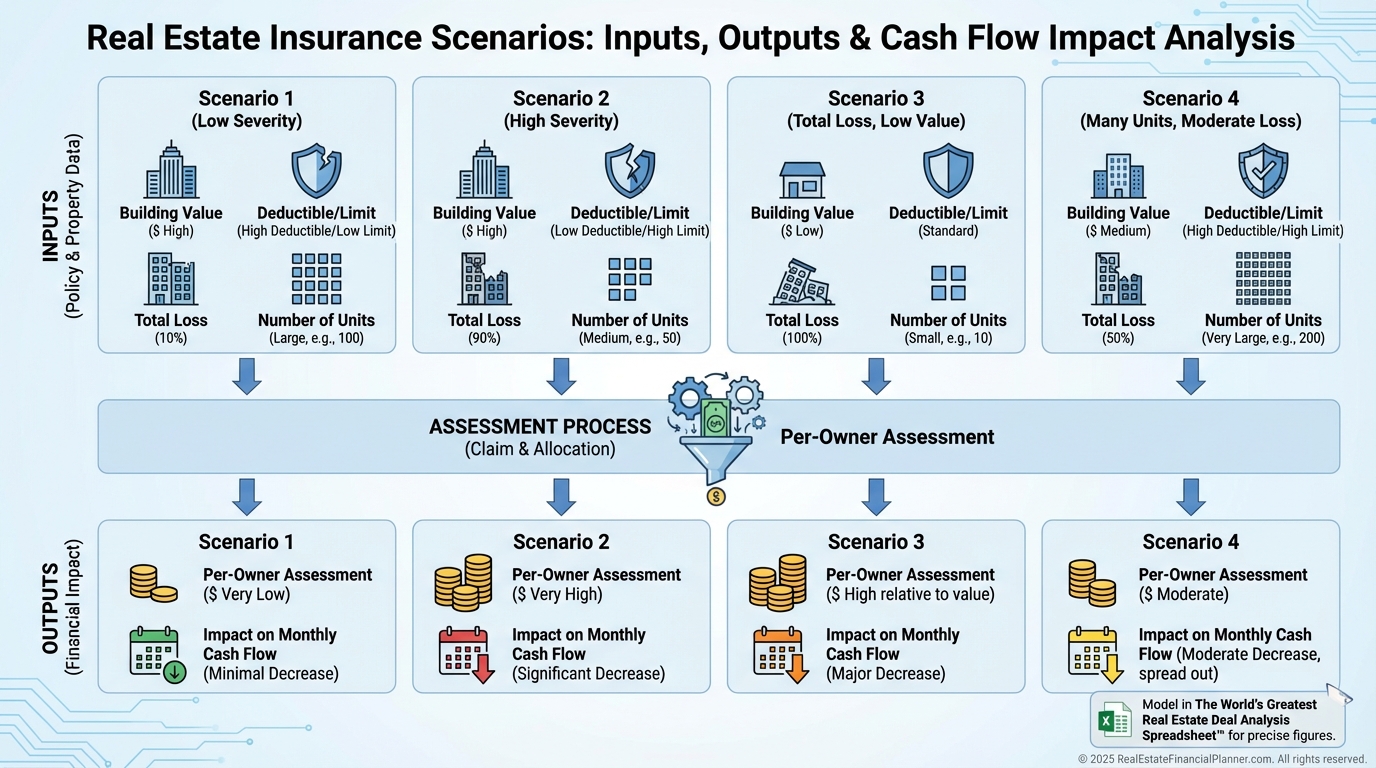

Real Scenarios With Numbers You Can Plug Into The Spreadsheet

When I help clients with The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I test an “assessment shock” line in year one and again in year five.

Storm damage with a 2% wind deductible on a $10M building equals a $200,000 deductible spread across 50 units. Your share: $4,000.

Poolside injury with a $3M settlement and only $1M HOA liability leaves $2M spread across 100 units. Your share: $20,000.

Earthquake excluded on the master policy with $1.5M repairs across 50 units. Your share: $30,000.

Fair Housing violation with $250,000 total legal plus settlement and $100,000 of D&O coverage. Forty units share the $150,000 gap. Your share: $3,750.

When I add a $20,000 hit in the spreadsheet, properties that looked fine on cash flow turn negative and crush True Net Equity™ if you’re forced to sell.

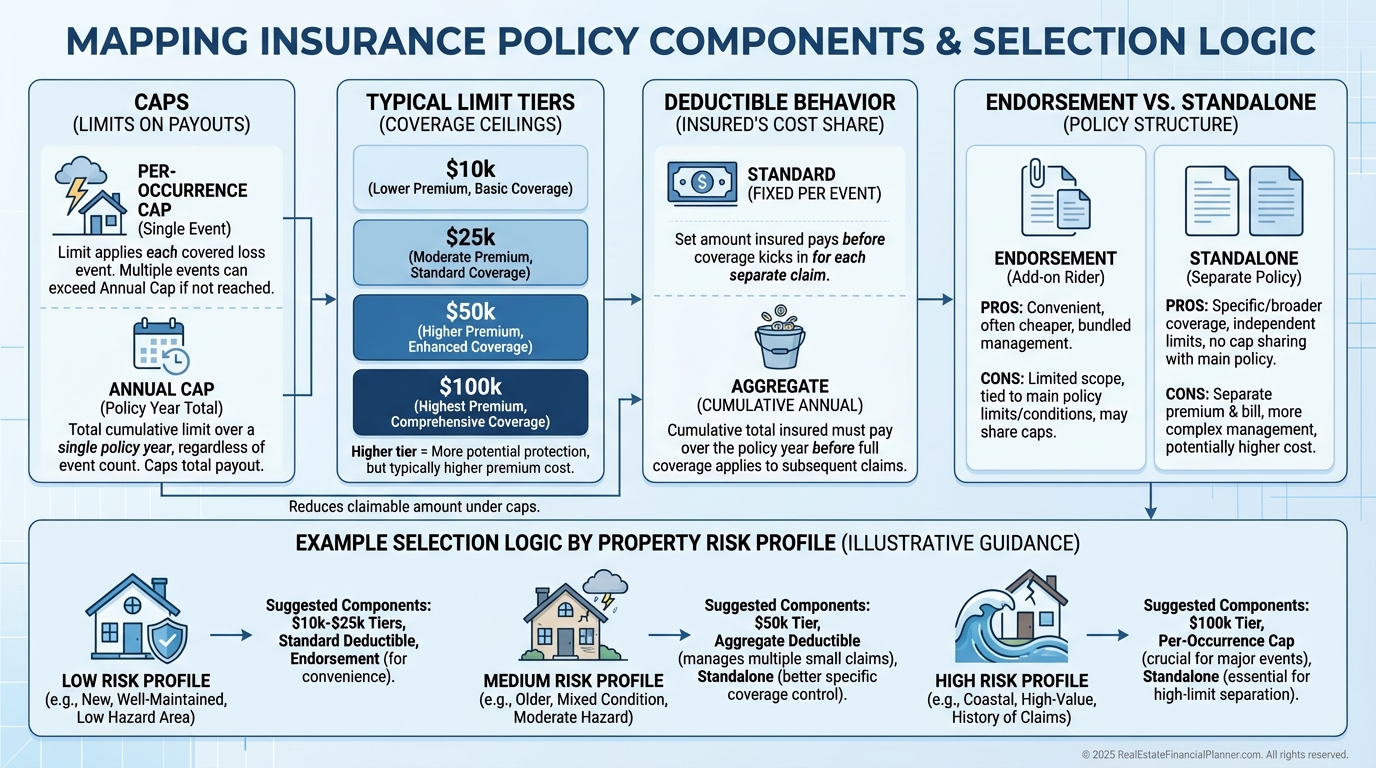

Coverage Limits, Options, And How I Choose

Typical loss assessment endorsements range from $10,000 to $50,000, with some carriers offering $100,000.

Check whether limits are per occurrence and whether there’s an annual cap. In storm-prone areas, I avoid tight annual caps.

Deductibles are usually $250–$1,000. Some carriers waive it when the assessment is solely the HOA’s deductible.

I prefer endorsements for simplicity and price, but I’ll use standalone policies when the HOA is older, coastal, or underinsured and we need bigger limits.

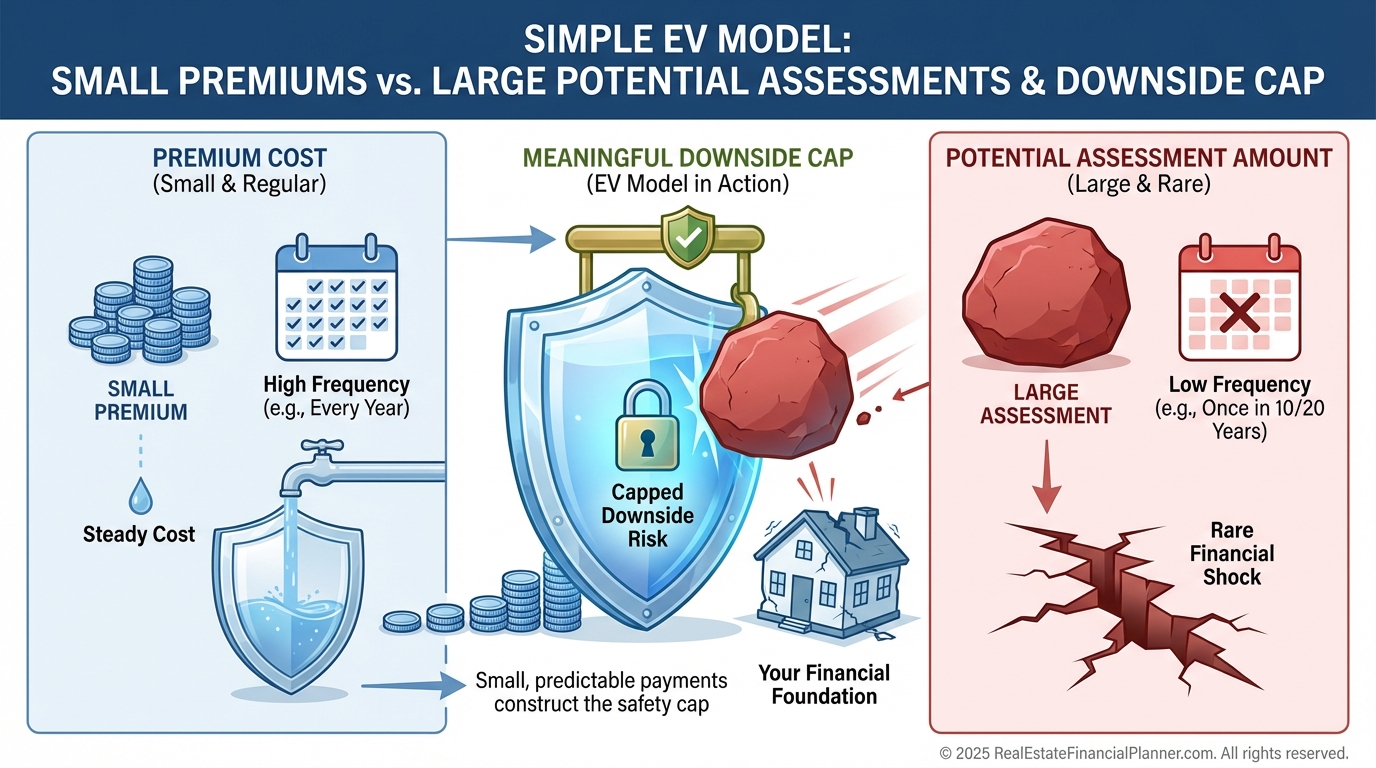

Cost-Benefit: A Quick Breakeven You Can Trust

If $25,000 of coverage costs $100 per year, you’re paying 0.4% of the potential loss.

If there’s even a 1-in-20-year chance of a big assessment, expected value favors buying it.

In my client models, the premium barely moves cash flow while massively reducing variance in the Return Quadrants™.

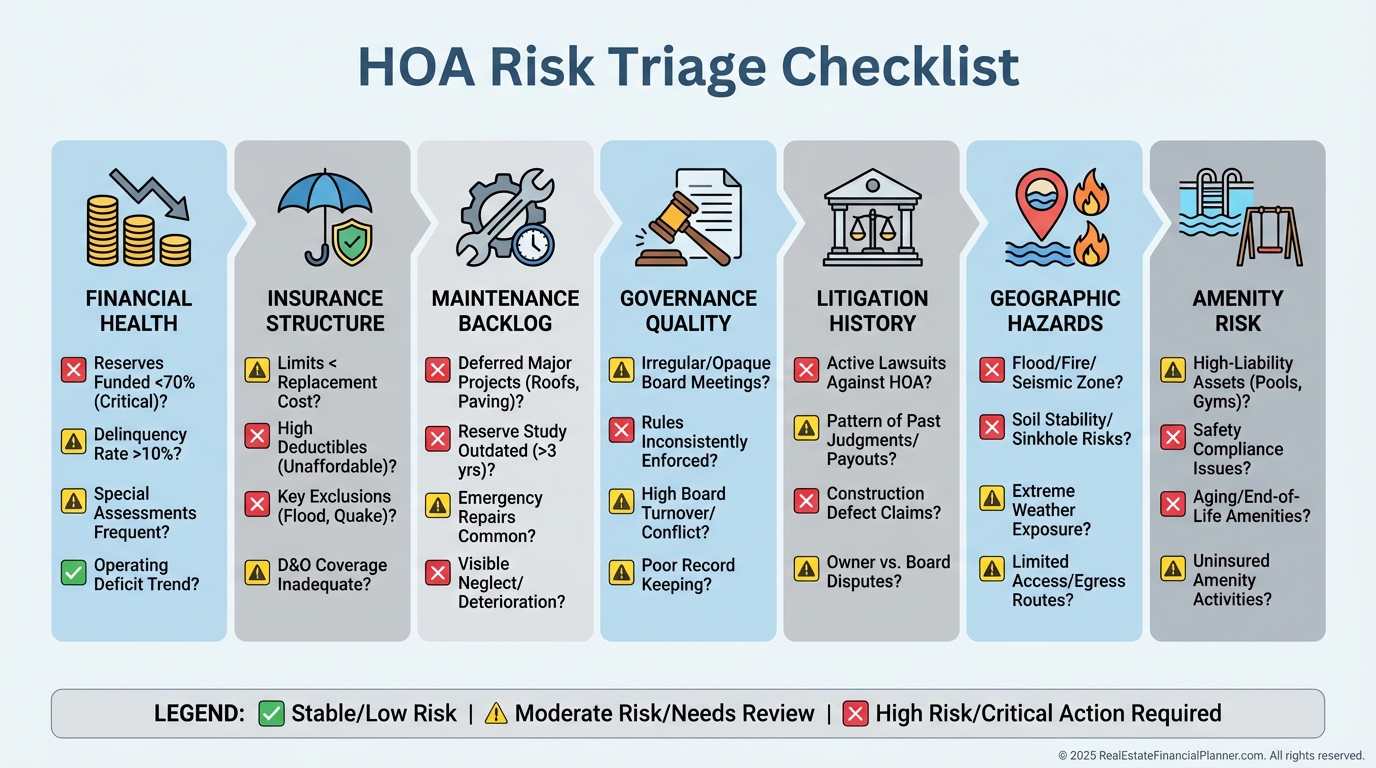

How I Evaluate HOA Risk Before I Make An Offer

I request the reserve study, budget, and audited financials. Reserves under 30% of recommended levels make me increase coverage and lower offer price.

I read three years of meeting minutes. I flag deferred maintenance, litigation hints, and rising deductibles.

I map geographic risks: wind, hail, wildfire, flood, and earthquake. I compare the master policy to the local hazards.

I assess amenities. Pools, elevators, and garages add liability and capital load.

Then I adjust the deal. I add an “Assessment Reserve” line, increase loss assessment coverage, and recalc True Net Equity™ with a stress test.

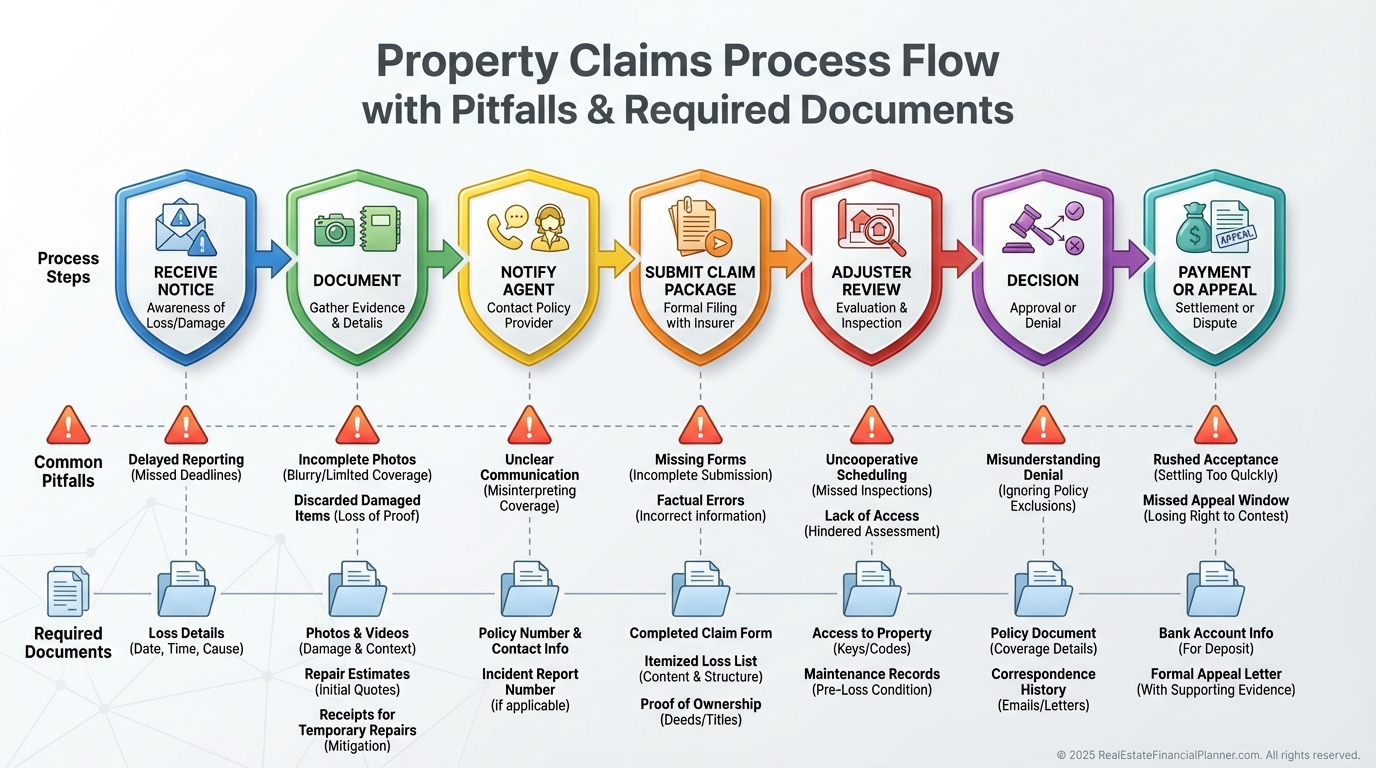

Claims: What To Do The Day The Letter Arrives

Save the assessment notice, board resolution, engineer’s reports, and the HOA master policy certificate.

Call your agent immediately. Ask whether the carrier pays the HOA directly or reimburses you after payment.

Submit everything. Typical timelines run 30–60 days after a complete file.

Most denials I see involve uncovered perils, assessments below your deductible, or missing documents. Close the gaps before you file.

Red Flags I Won’t Ignore

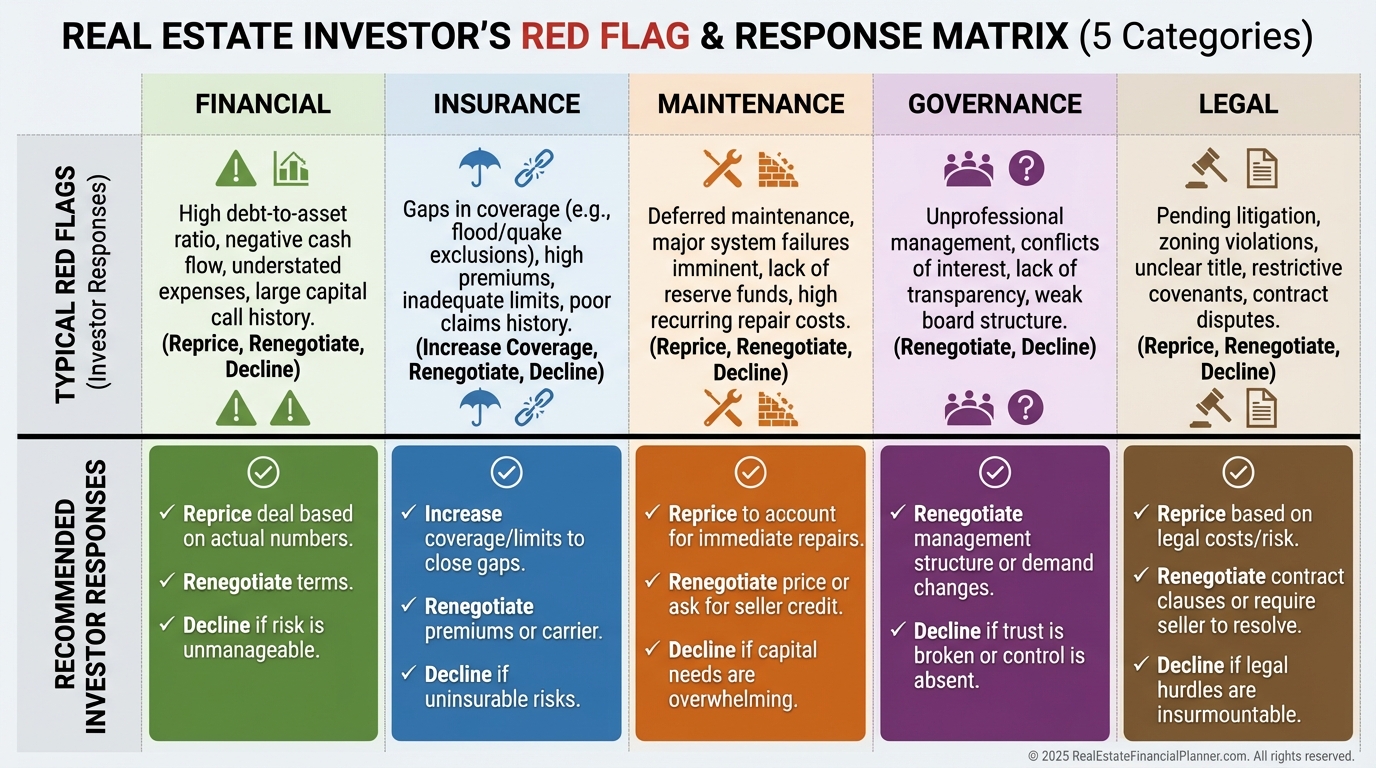

Financial: reserves below 10% of annual budget, no recent reserve study, high delinquencies, or repeated special assessments.

Insurance: big deductibles, low liability limits, excluded local perils, or D&O gaps.

Maintenance: code issues, life safety defects, liens, or original components past useful life.

Governance: high board turnover, unprofessional management, contentious meetings, or discriminatory rules.

Legal: active lawsuits, construction defects, Fair Housing complaints, or vendor disputes.

When I see multiple flags, I either buy maximum coverage, reprice aggressively, or walk.

Alternative Risk Management For Portfolio Builders

Self-insure small shocks by setting aside $100–$200 per HOA unit per month in an “Assessment Reserve.”

Diversify across HOAs, geographies, and construction ages so one assessment can’t crater your entire portfolio.

Negotiate responsibility for pre-closing events. It doesn’t always stick, but I ask every time.

Join the board or a committee. Early information beats late insurance.

I often combine a higher deductible, higher-limit policy with self-insurance. Premium savings feed the reserve.

Investor Tips: Operationalizing This In Your Model

In the Deal Analysis Spreadsheet, add two lines: “Loss Assessment Premium” and “Assessment Reserve.”

Model a shock of $10,000–$25,000 in year one and again in year five. If the deal still works, your plan is resilient.

For Nomad™ buyers moving into a condo before converting to a rental, I set coverage to at least $25,000 from day one. New buildings still face defect claims.

Review coverage annually. If the HOA hikes deductibles or trims coverage, increase your limits and re-run Return Quadrants™.

Ask your agent to read the master policy. Don’t guess. Verify.

Final Recommendations

Treat loss assessment coverage as essential, not optional, for any HOA property.

It’s the cheapest way I know to cap a tail risk that can force sales and erase True Net Equity™ overnight.

Buy the right limit, build a small reserve, and keep your documentation tight.

That’s how you stop a $15,000 letter from becoming a $150,000 mistake.