Commercial Lenders Explained: How Pros Finance Income Properties Without Killing Returns

Learn about Commercial Lenders for real estate investing.

Commercial Lenders Overview

Most investors don’t lose deals because the property is bad.

They lose deals because they brought residential thinking into a commercial lending decision.

I’ve seen this repeatedly when helping clients analyze multifamily and mixed-use properties.

They assume financing will work “basically the same” as their last house.

It doesn’t.

Commercial lenders operate in a different universe, with different rules, different risks, and very different expectations.

If you don’t understand how they think, you either overpay, get declined, or structure deals that quietly destroy your returns.

What Commercial Lenders Actually Do

Commercial lenders finance income-producing properties.

They care far less about you and far more about the property.

When I rebuilt after bankruptcy, this shift in mindset mattered more than any credit score trick.

Once I learned to present deals the way commercial lenders think, approvals became predictable instead of stressful.

Commercial lenders ask one core question:

“Can this property reliably pay us back?”

Everything flows from that.

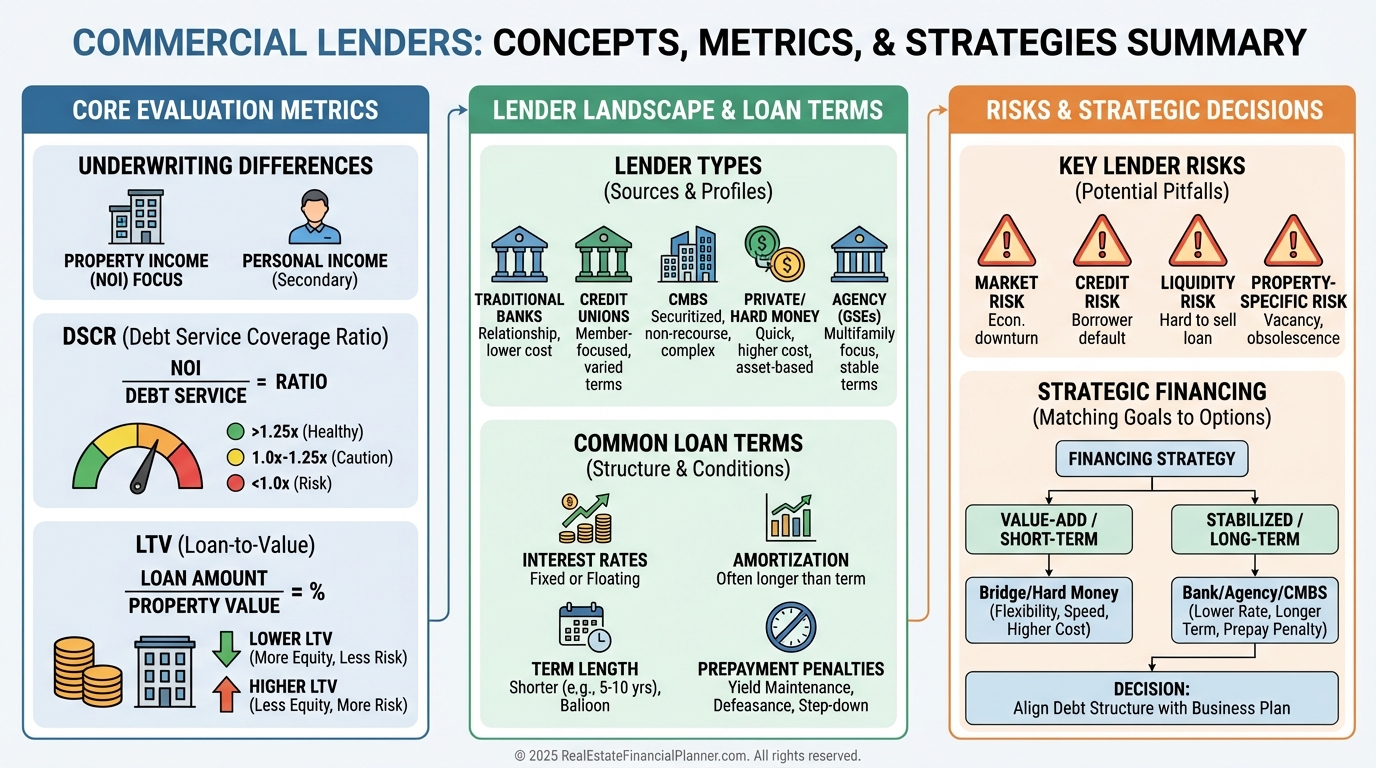

How Commercial Lenders Think About Risk

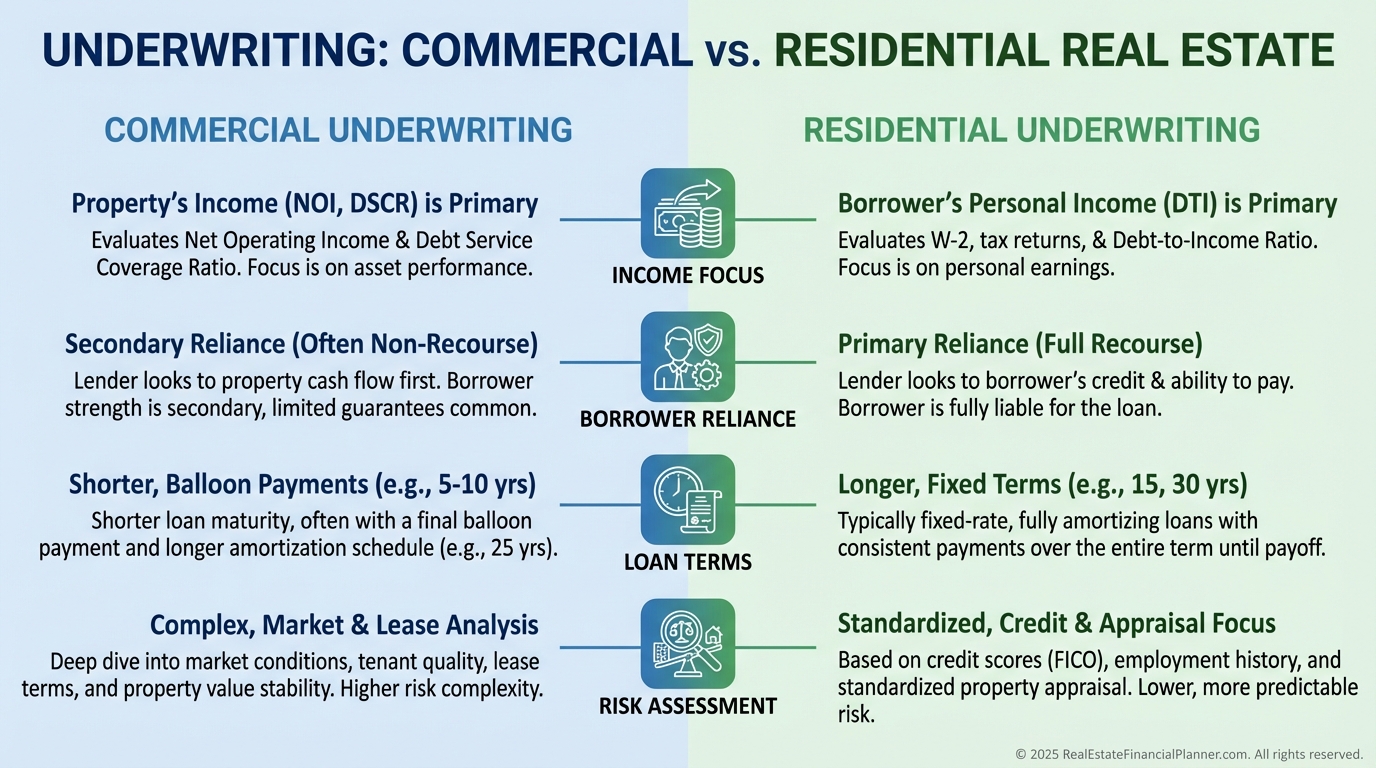

Residential lenders underwrite people.

Commercial lenders underwrite math.

They evaluate:

Net Operating Income, not your salary

Market rents, not optimistic projections

Downside protection, not best-case scenarios

When I model deals in Real Estate Financial Planner™, I always stress-test debt service first.

If the deal barely works at today’s rate, it’s already broken.

Commercial vs Residential Underwriting

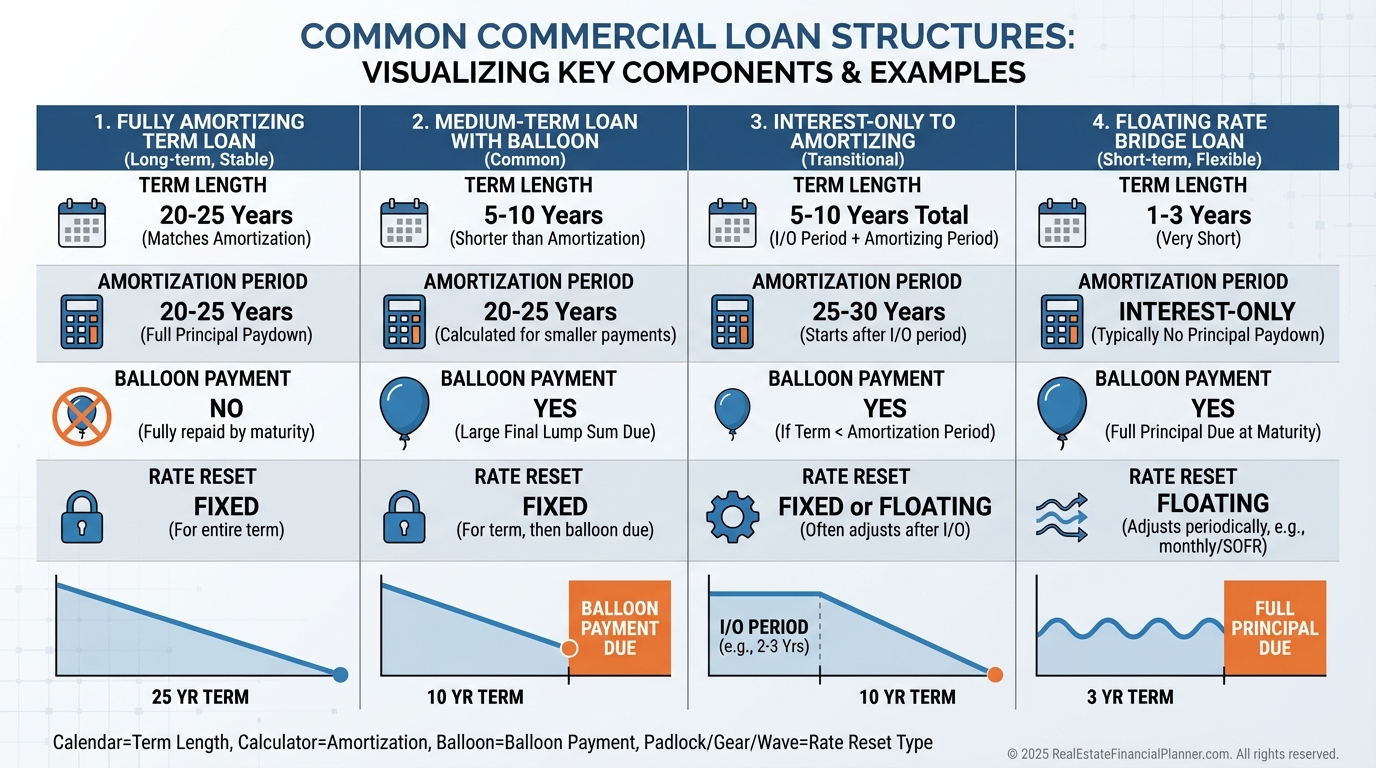

Common Commercial Loan Structures

Commercial loans rarely look like thirty-year fixed mortgages.

That surprises many investors the first time.

Typical structures include:

Five- to ten-year terms

Balloon payments at maturity

Adjustable or hybrid interest rates

This matters enormously when planning exits.

When I analyze returns, I never assume the loan magically disappears.

I plan for refinance risk, rate risk, and equity risk using Return Quadrants™ and True Net Equity™.

Typical Commercial Loan Structures

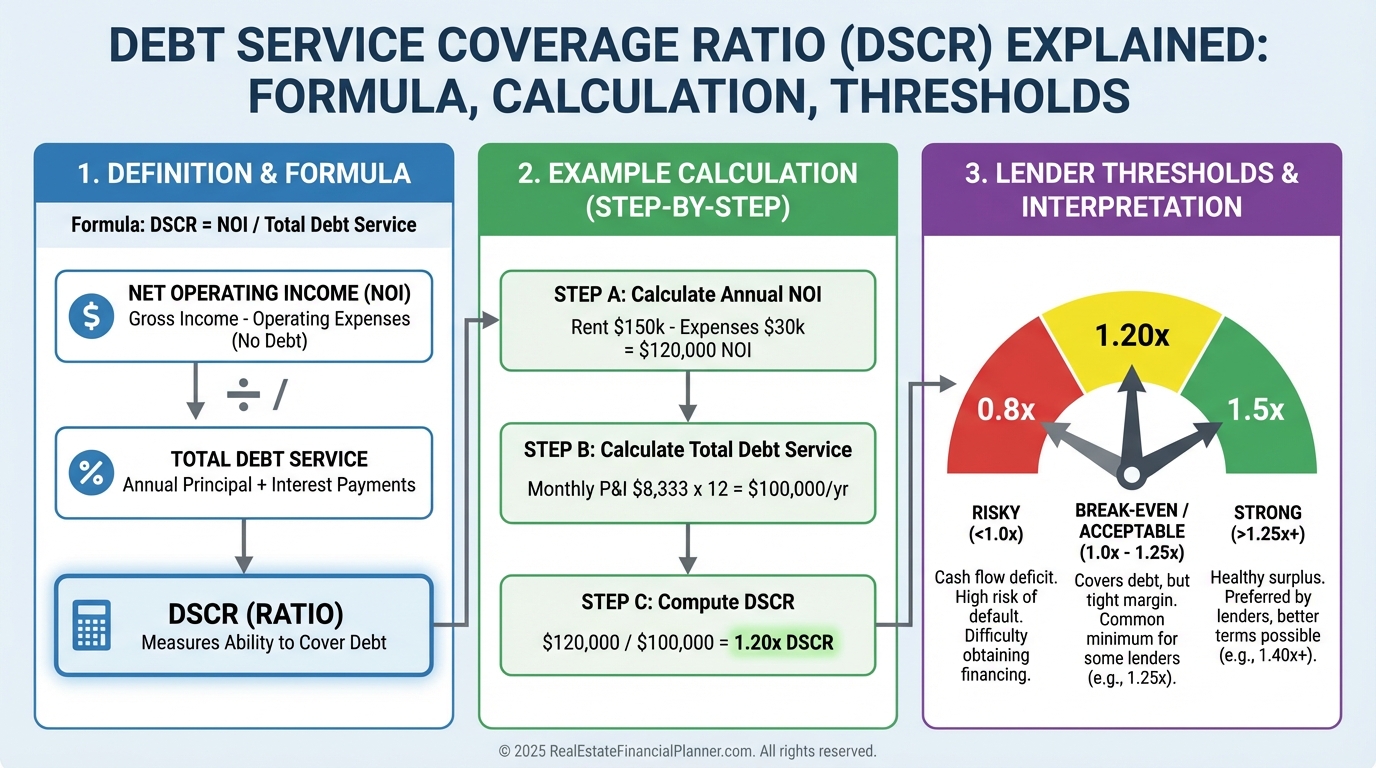

Debt Service Coverage Ratio Is the Gatekeeper

If commercial lending had one king metric, it would be DSCR.

DSCR measures how safely a property pays its mortgage.

Most lenders want at least 1.20 to 1.25.

When I review deals with clients, DSCR is the first calculation we lock down.

If it’s weak, nothing else matters.

How DSCR Works

Pushing leverage too far to “make the numbers work” almost always backfires.

Higher payments reduce DSCR and trigger worse terms or outright declines.

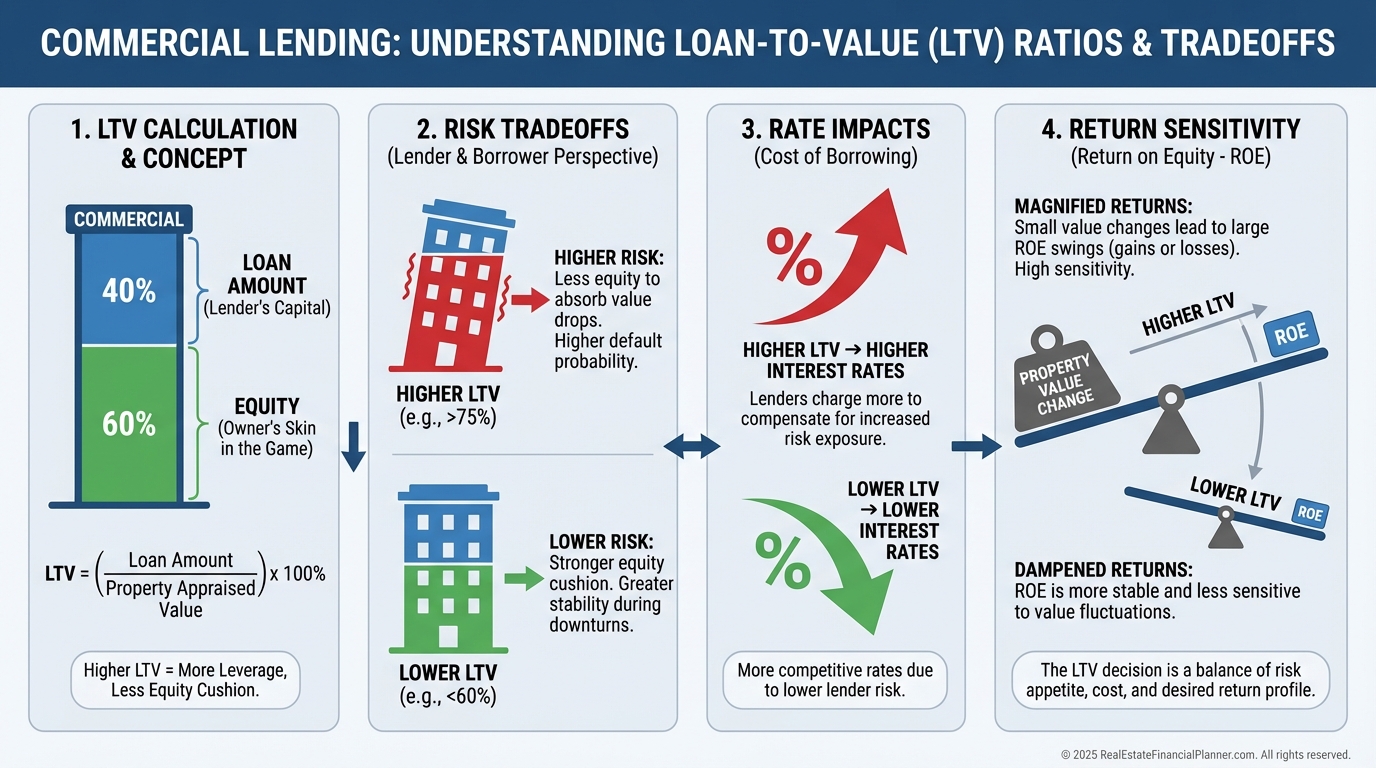

Loan-to-Value and Why More Leverage Isn’t Better

Commercial lenders typically cap LTV between 65 and 80 percent.

That range is not arbitrary.

Lower LTV means:

Lower interest rates

Stronger lender confidence

Better refinance flexibility

When I run sensitivity analysis, I often find that a slightly larger down payment improves long-term cash flow and IRR.

Leverage should be optimized, not maximized.

LTV Tradeoffs in Commercial Lending

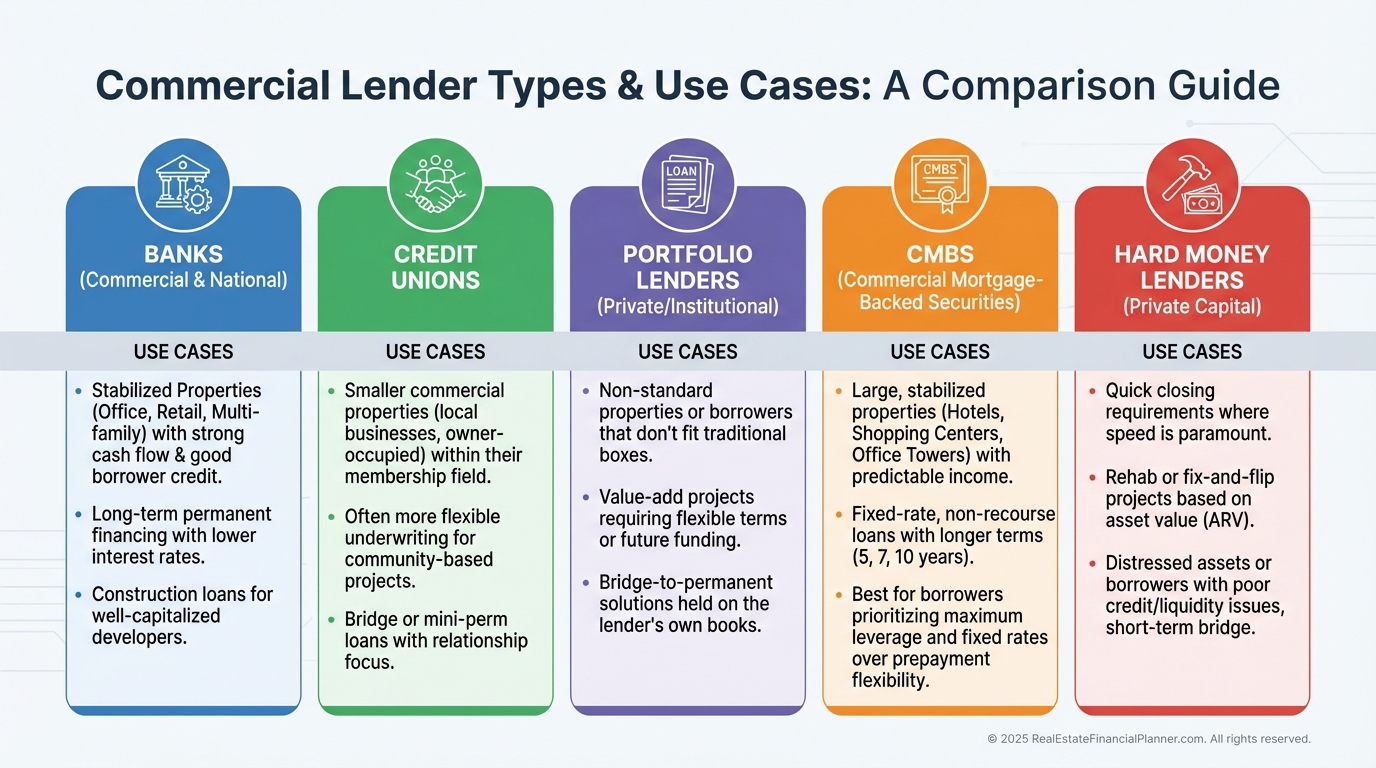

Types of Commercial Lenders You’ll Encounter

Not all commercial lenders are interchangeable.

Choosing the wrong one wastes time and kills deals.

Common categories include:

Local and regional banks

Credit unions

CMBS lenders

When advising clients, I match the lender to the deal, not the other way around.

A stabilized eight-unit property and a heavy value-add project should never use the same lender.

Types of Commercial Lenders

Borrower Strength Still Matters, Just Differently

Commercial lenders do care about you, just not the way residential lenders do.

They look at:

Net worth relative to loan size

Liquidity and reserves

Relevant experience

When I rebuilt my portfolio, liquidity mattered more than income.

Cash cushions protect lenders from surprises.

This is why draining reserves for a down payment often hurts approvals instead of helping them.

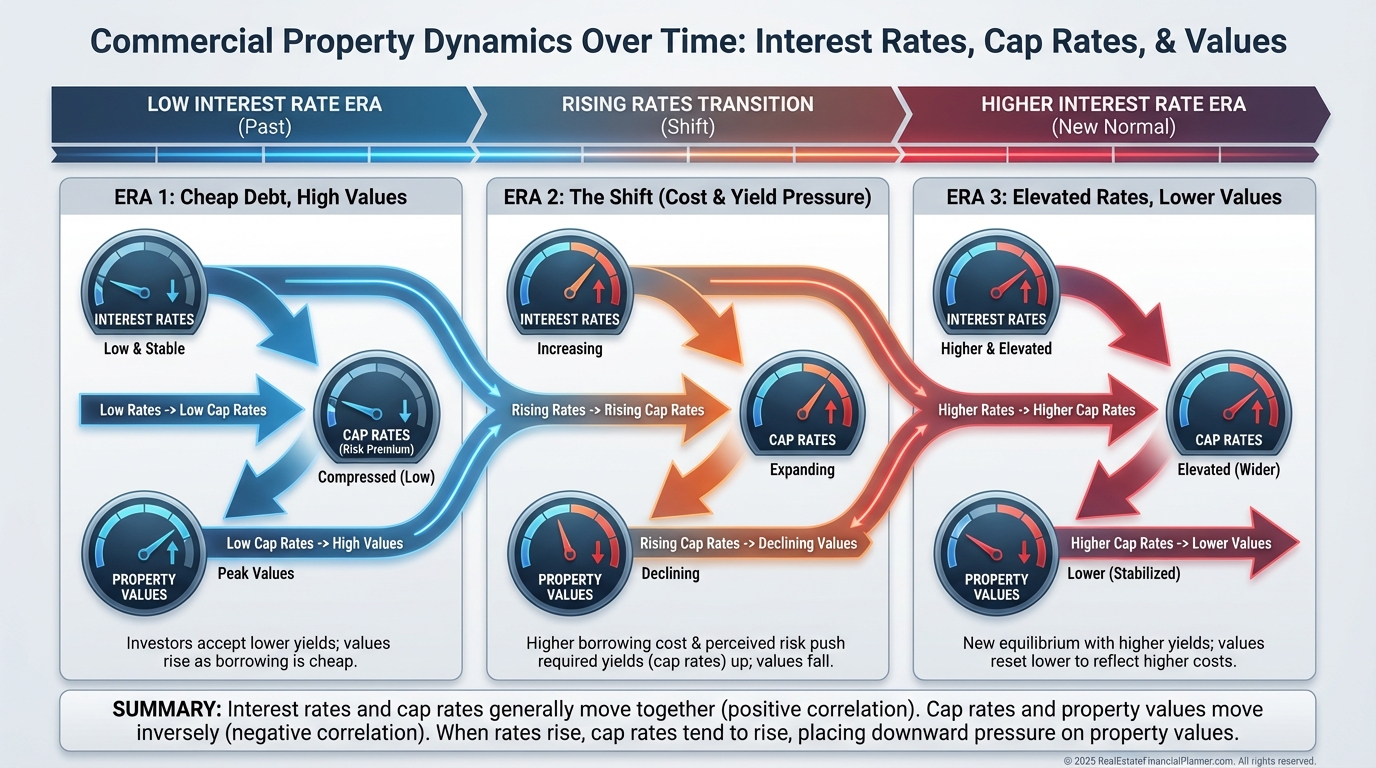

How Financing Shapes Property Values

Commercial lending conditions directly influence prices.

When rates rise and DSCR tightens, buyers disappear.

Prices soften.

When credit loosens, leverage floods back in.

Prices inflate.

Understanding this cycle lets you act while others freeze.

Interest Rates, Cap Rates, and Values

Mistakes I See Investors Make Repeatedly

Most commercial loan failures are preventable.

The most common ones include:

Applying after going under contract

Using unrealistic rent growth assumptions

Ignoring prepayment penalties

Not understanding recourse exposure

I always model worst-case exits before recommending a loan.

If the numbers only work in perfect conditions, the deal is lying to you.

Strategic Use of Commercial Lending

The best investors treat lenders as long-term partners.

That means:

Starting with smaller deals

Communicating early and honestly

Structuring loans around exit plans

Assumable loans, flexible prepayment schedules, and relationship pricing create real value.

Financing is not a footnote. It is part of the investment itself.

Commercial Lending Is a Skill, Not an Obstacle

Commercial lenders aren’t trying to stop you.

They’re trying to get repaid.

Once you learn how they think, financing stops being mysterious.

It becomes another lever you control.

Every professional investor I know eventually realizes this:

The deal is only as good as the financing attached to it.

Master commercial lending, and you stop hoping deals close.

You start expecting them to.