Closing Disclosures: The Final Numbers That Make or Break Your Deal

Learn about Closing Disclosures for real estate investing.

Closing Disclosures Overview

That single habit quietly costs them thousands of dollars over a lifetime of investing.

When I help clients analyze deals, the closing disclosure is one of the first documents I ask for after contract. Not because it’s exciting, but because it’s where assumptions collide with reality.

The closing disclosure is where good deals become average ones, and average deals quietly slip below your minimum thresholds.

I learned this lesson the hard way rebuilding after bankruptcy. Back then, every dollar mattered. I could not afford surprises at closing, because surprises destroyed liquidity, reserves, and sleep.

Closing disclosures are not paperwork. They are the final truth.

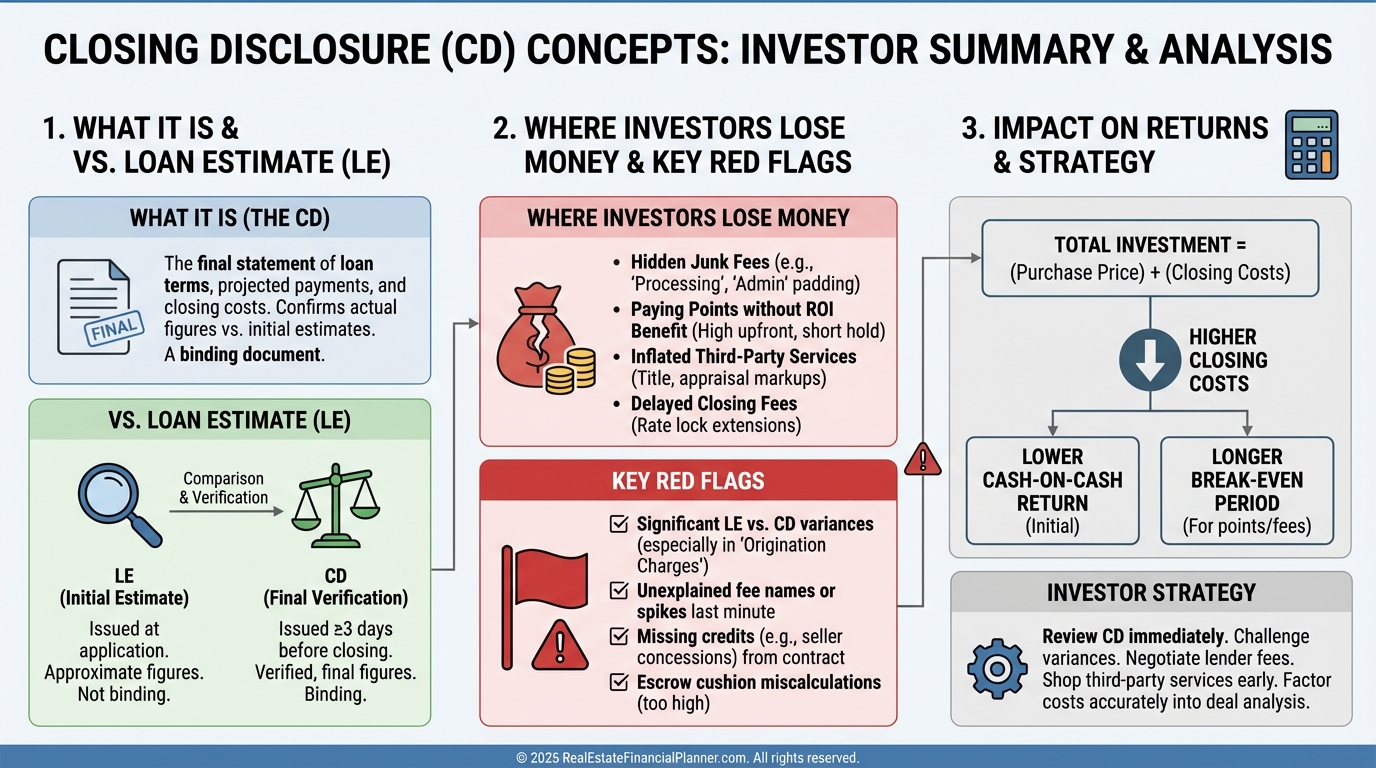

What Closing Disclosures Really Are

A closing disclosure (CD) is the lender’s final accounting of your loan terms and closing costs.

You receive it at least three business days before closing for most residential transactions.

This document replaced the HUD-1 and Good Faith Estimate for residential deals and standardized how costs are disclosed.

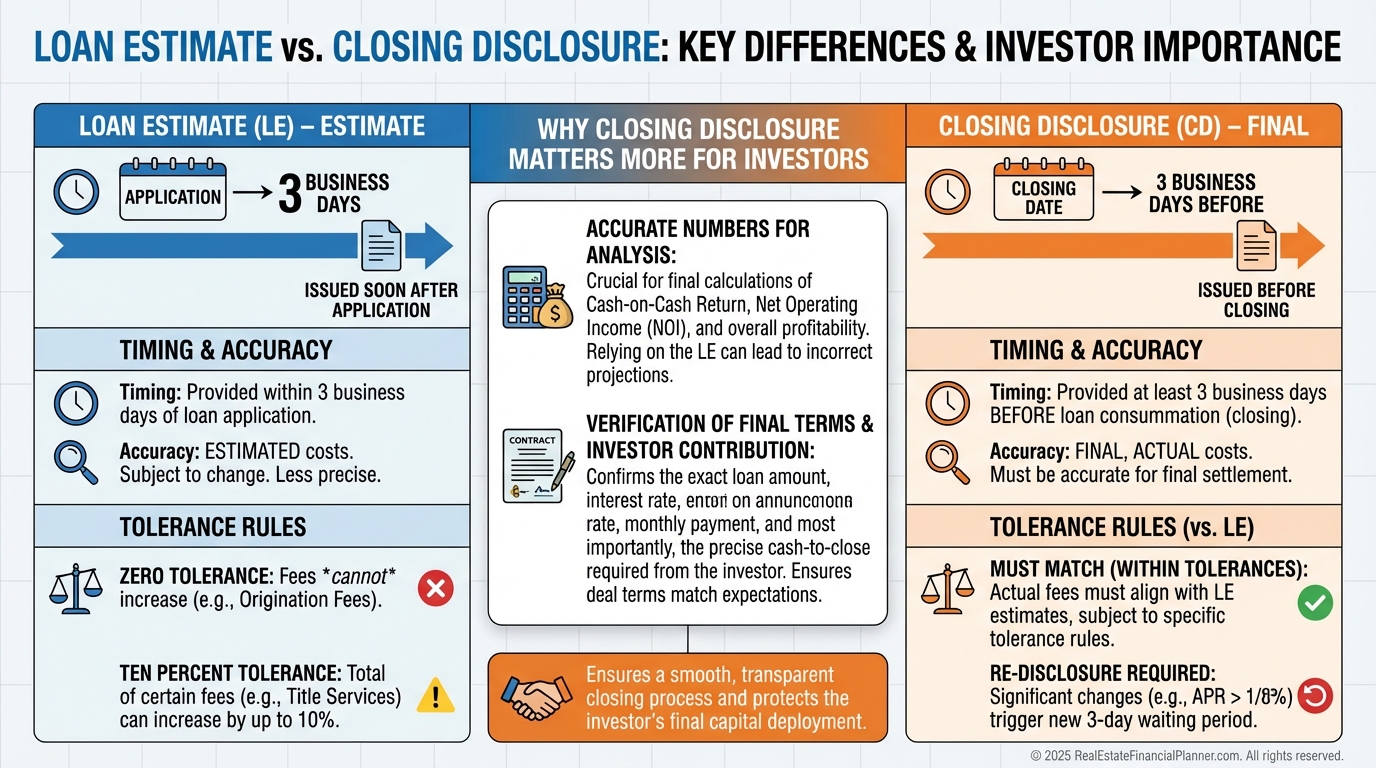

The key difference is simple.

The loan estimate shows what might happen.

The closing disclosure shows what will happen.

Loan Estimate vs Closing Disclosure

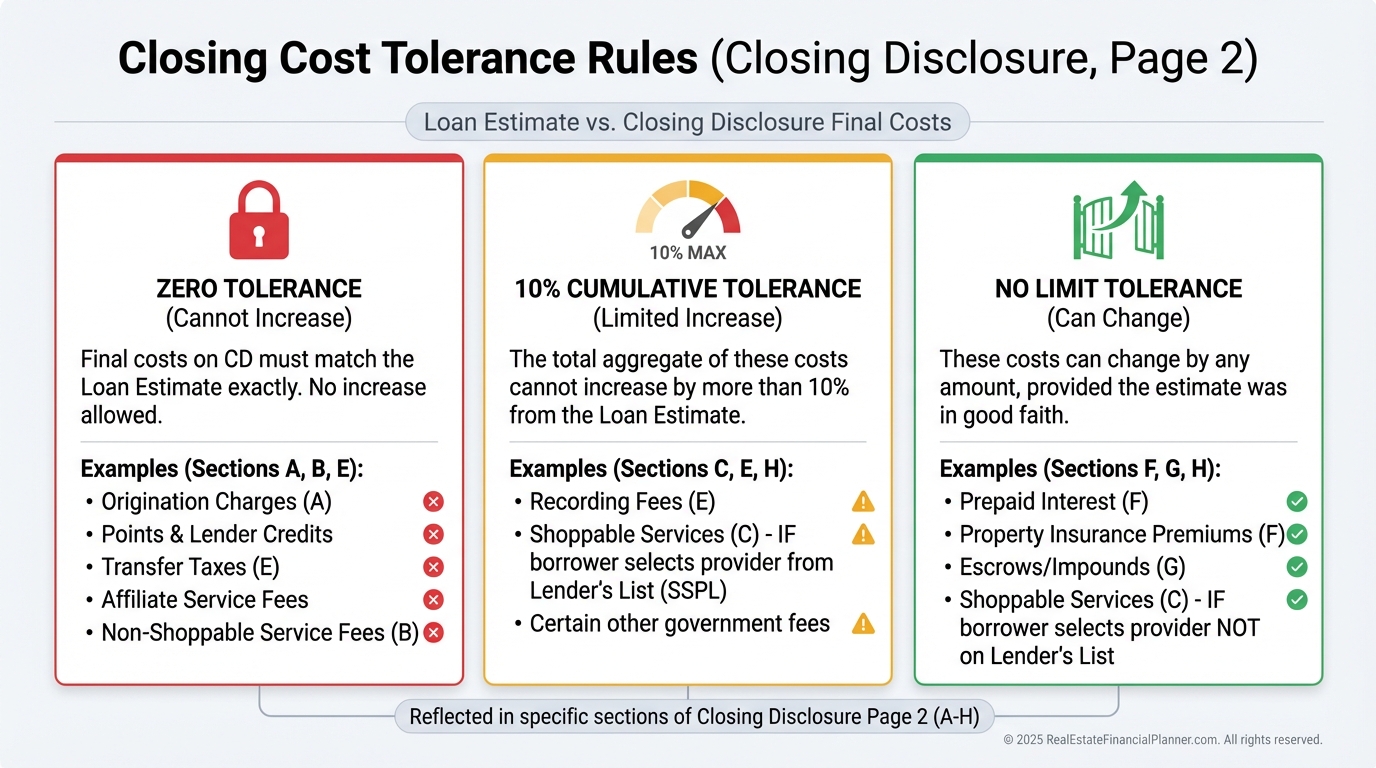

Federal rules limit how much certain fees can change between the loan estimate and the closing disclosure.

Some fees cannot change at all.

Some can increase only within strict limits.

Others have no limit.

If you do not know which is which, you lose leverage.

Why Investors Get Burned by Closing Disclosures

When I review closing disclosures with investors, the mistake is almost always the same.

They analyze deals using estimates.

They commit emotionally to the deal.

They skim the final numbers.

That is backwards.

Imagine Sarah, a duplex buyer who calculated a strong cash-on-cash return based on estimated costs.

Her closing disclosure revealed several small fees she never questioned.

Those “small” fees pushed her below her return threshold.

The deal still closed.

Her standards quietly slipped.

That is how portfolios drift off course.

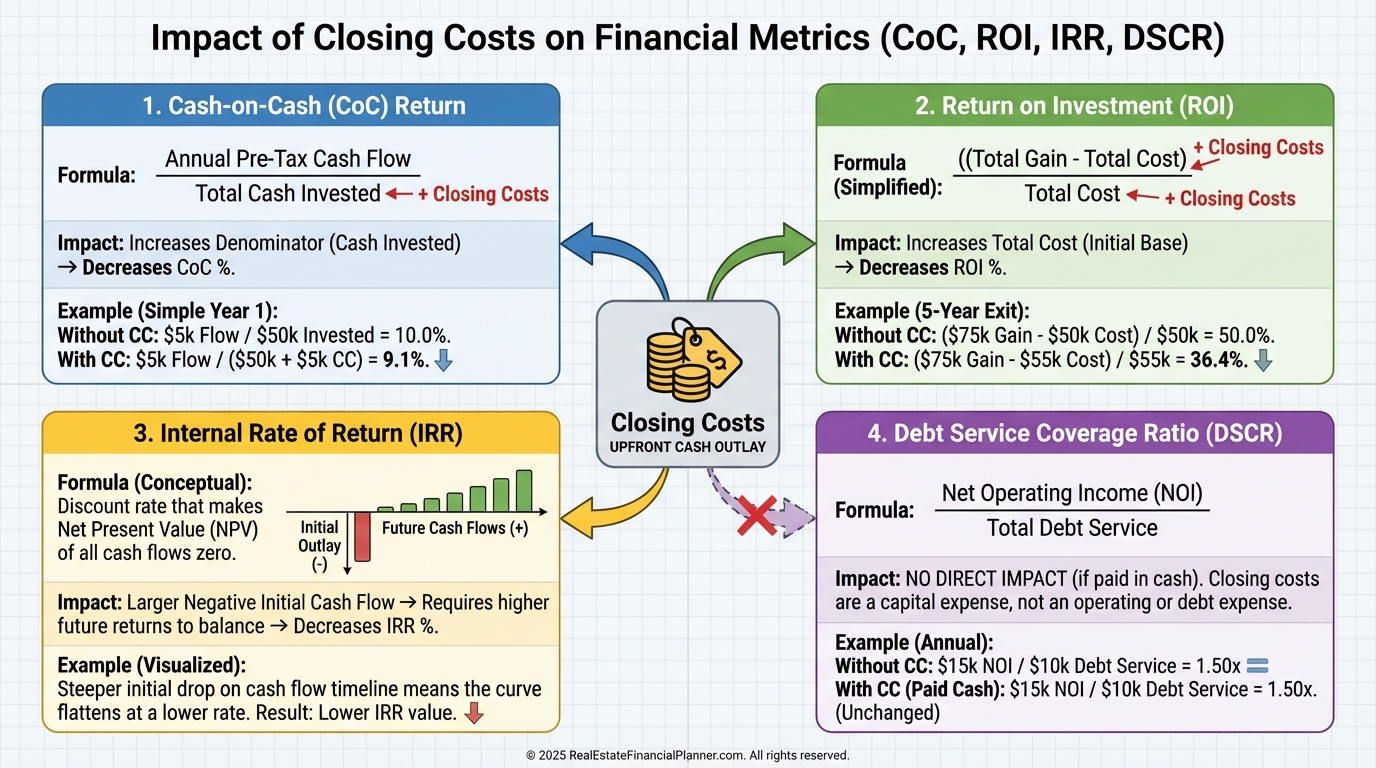

How Closing Disclosures Feed Your Returns

Every return metric depends on your true cash invested.

Closing costs directly affect:

Cash-on-cash return

Return on investment (ROI)

Internal rate of return (IRR)

Debt service coverage ratio (DSCR)

How Closing Costs Affect Returns

In Real Estate Financial Planner™ analysis, closing costs increase your denominator.

That means your returns fall even if income stays the same.

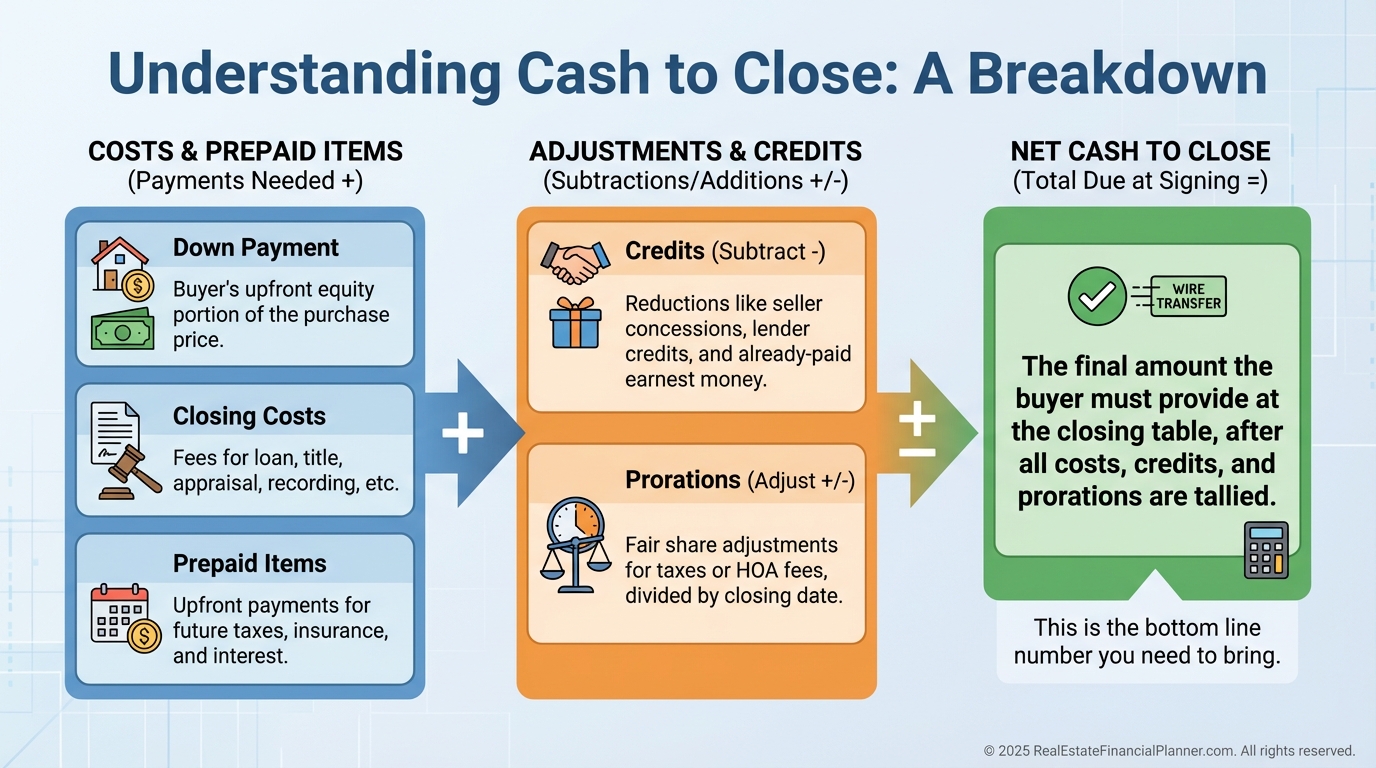

True Cash Invested equals:

Down payment

Plus all closing costs

Plus immediate repairs

Miss one of those, and your numbers lie to you.

How to Read a Closing Disclosure Like an Investor

You do not need to memorize the entire document.

You need to know where risk hides.

Page One: Loan Terms That Kill Cash Flow

This page confirms your interest rate, loan type, and projected payments.

I always check:

Rate matches the lock

Fixed versus adjustable terms

Payment changes over time

Prepayment penalties

A prepayment penalty can erase profits on a flip or delay refinancing for years.

Page Two: Where Fees Multiply

This is where most money leaks out.

I scan for:

Origination charges that should not increase

Third-party fees that quietly balloon

Vague line items with generic labels

Page Two Fee Tolerance Rules

If you do not challenge vague fees, no one else will.

Page Three: Cash to Close Reality Check

This page answers one question.

How much cash leaves your account.

I verify:

Earnest money credited correctly

Seller credits applied properly

Prorations make sense

Nothing is double-counted

Cash to Close Breakdown

This is where liquidity surprises happen.

The Three-Day Rule Most Investors Misunderstand

The three-day window is for review, not negotiation.

Significant changes restart the clock and delay closing.

That means your leverage is before the closing disclosure is issued.

Once it arrives, your job is to verify, not renegotiate everything.

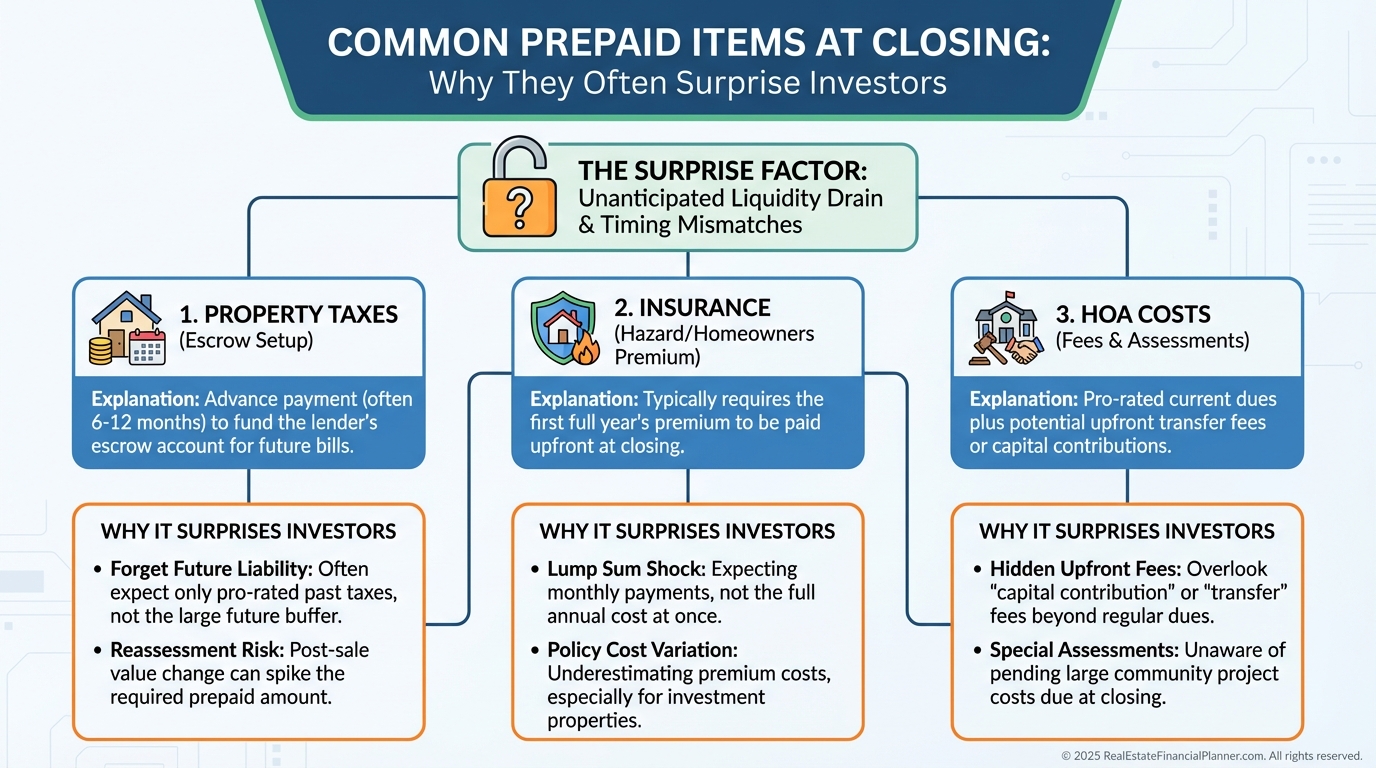

Prepaid Items That Blow Up Budgets

Many investors underestimate prepaid costs.

Property taxes

Insurance premiums

HOA transfers and reserves

These are not “fees.”

They are cash outflows.

Prepaid Items Investors Miss

When investors tell me a deal “ran out of cash,” this is usually why.

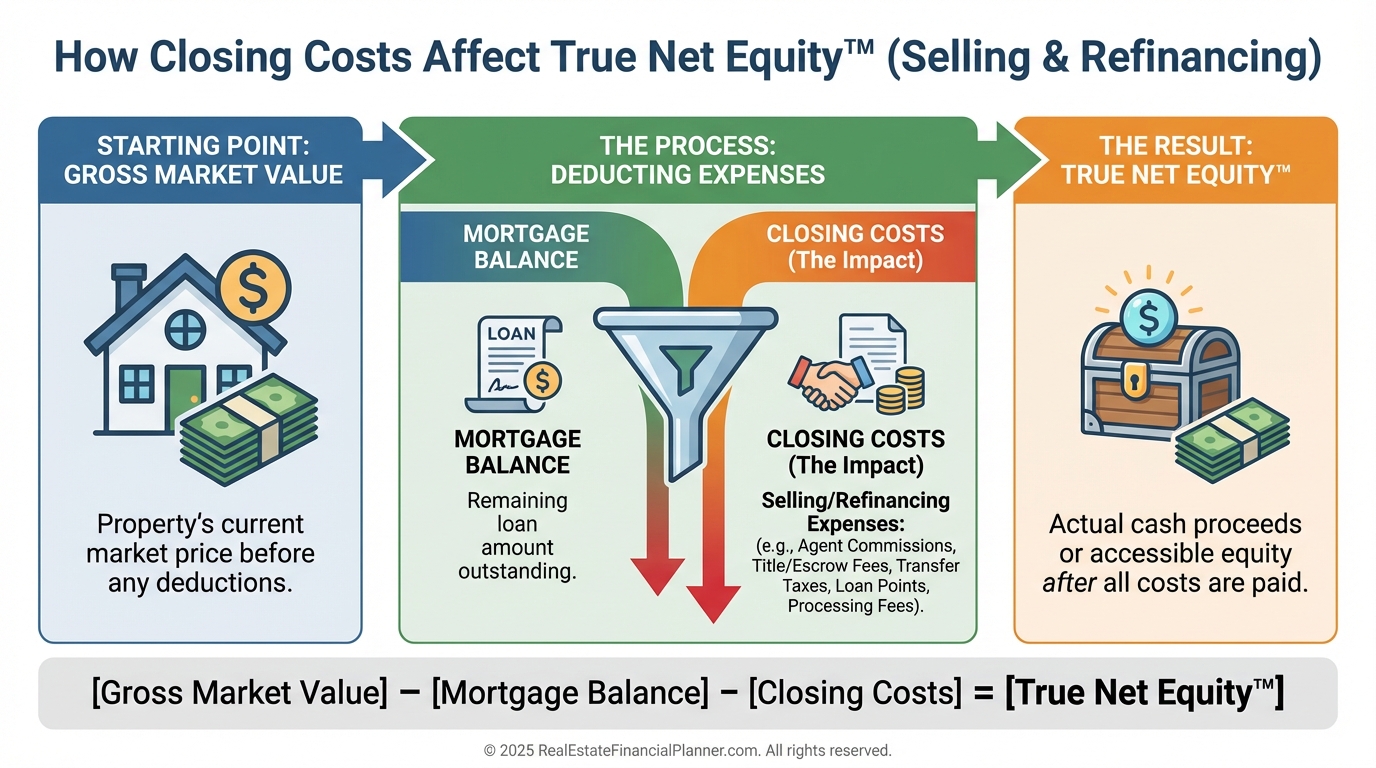

Closing Disclosures and Exit Planning

Closing disclosures matter on the way out, too.

They document cost basis.

They inform capital gains calculations.

They predict future selling costs.

When I model exits using True Net Equity™, I rely on historical closing data, not guesses.

Closing Costs and True Net Equity™

Ignoring closing disclosures makes equity look larger than it really is.

Strategic Uses of Closing Disclosure Mastery

Professional investors use closing disclosures to gain advantages.

They standardize assumptions.

They negotiate volume discounts.

They time closings to reduce prepaid interest.

They choose financing structures that minimize friction.

Over dozens of deals, this discipline compounds.

Final Thought

The difference between amateur and professional investors is rarely intelligence.

It is attention.

Closing disclosures reward investors who slow down at the most important moment.

Before your next closing, do one thing.

Compare your original analysis to the final closing disclosure line by line.

That gap is where your future performance lives.