Cost Segregation: How Smart Investors Pull Cash Forward Legally

Learn about Cost Segregation for real estate investing.

Why Cost Segregation Changes the Math

When I help real estate investors analyze deals, taxes are almost always the most misunderstood return component.

Most investors focus on appreciation and cash flow.

Very few understand how depreciation actually works, or how powerful it can be when used intentionally.

Cost segregation is one of those tools that feels “too good to be true” until you understand the mechanics and see it modeled correctly.

It is not a loophole.

It is not aggressive tax planning.

It is simply applying IRS rules the way they were written.

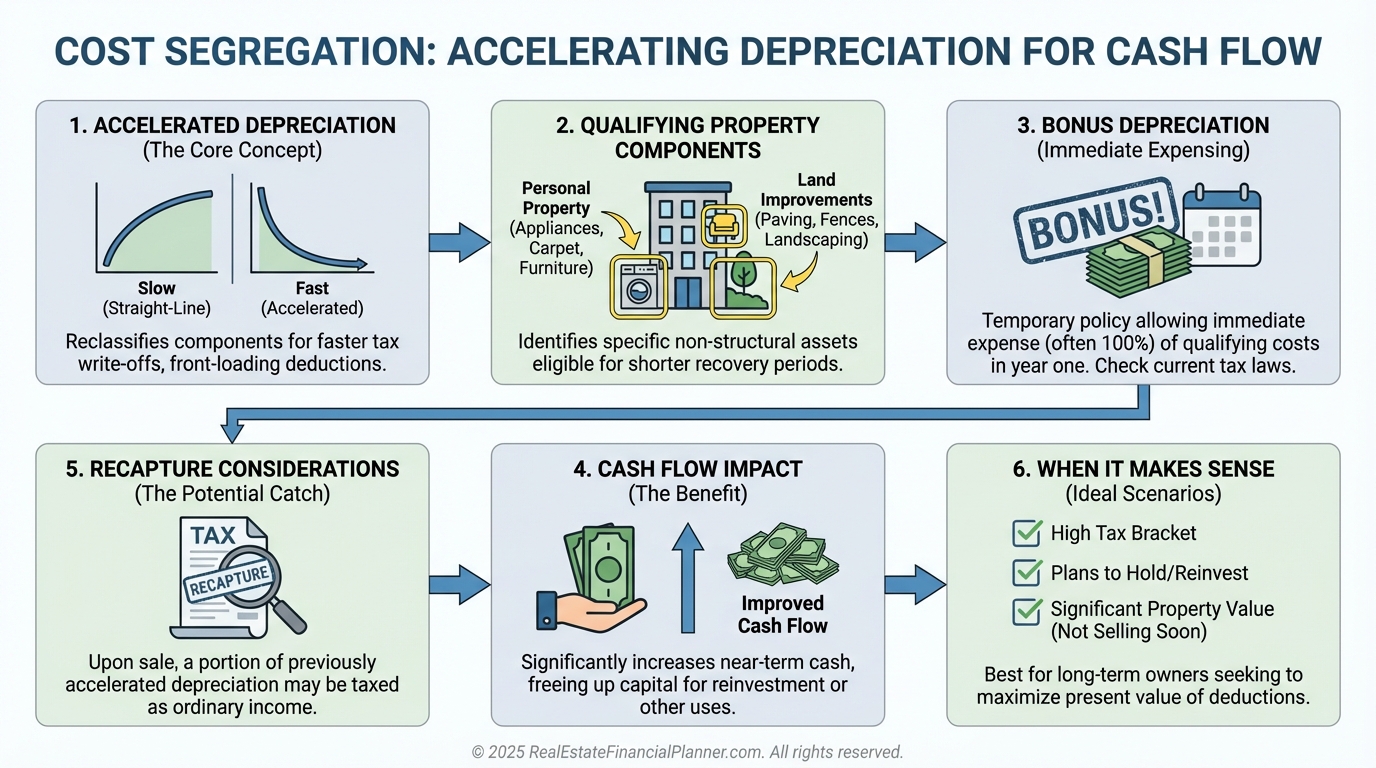

Cost segregation allows you to move depreciation forward in time.

That timing shift alone can dramatically change your cash flow, your ability to reinvest, and how quickly your portfolio compounds.

What Cost Segregation Actually Is

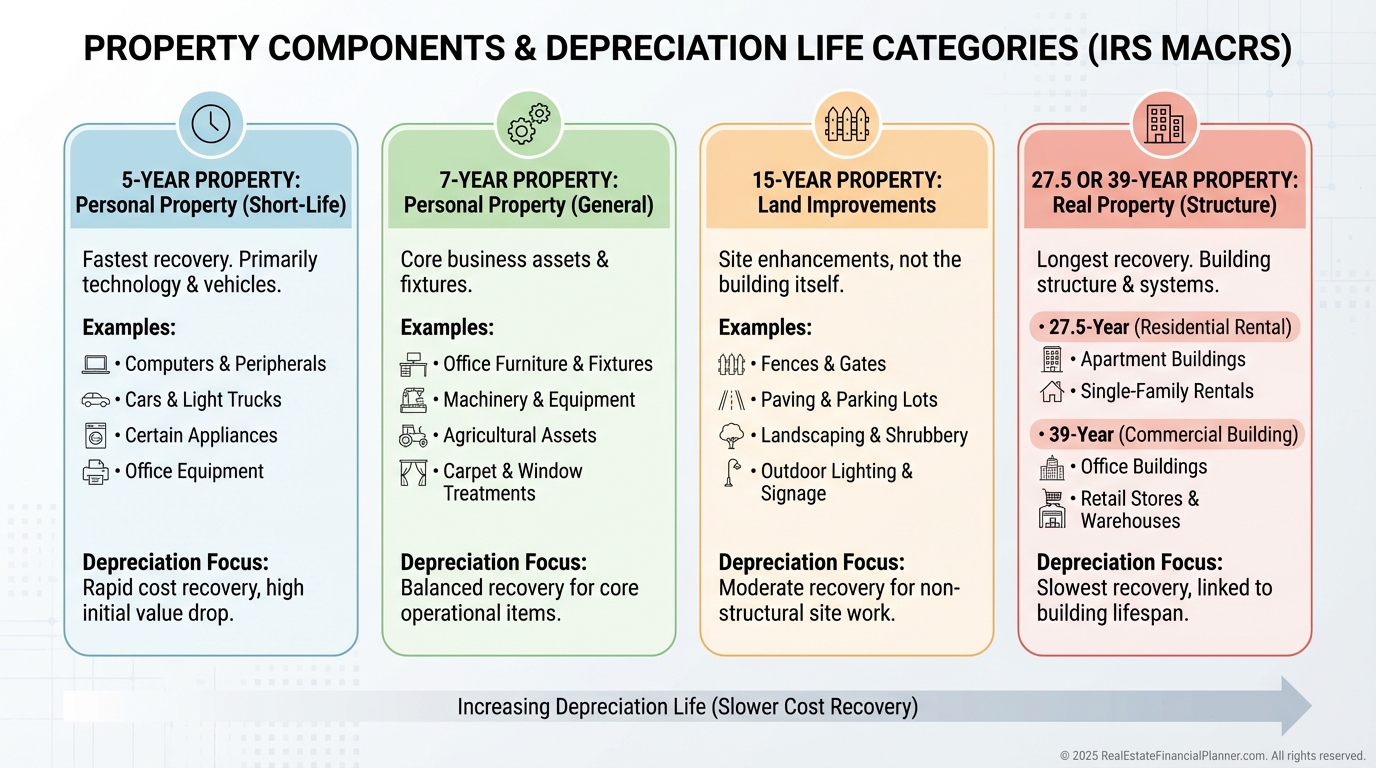

Cost segregation is the process of breaking a property into components and depreciating those components over their actual useful lives instead of lumping everything into one long schedule.

A normal residential rental depreciates over 27.5 years.

Commercial property depreciates over 39 years.

But the IRS does not consider everything inside a building to be “the building.”

Certain items wear out faster.

Those items are allowed to depreciate faster.

That is the entire concept.

Examples include:

Five-year property like appliances, flooring, certain wiring, and lighting.

Seven-year property such as furniture and some fixtures.

Fifteen-year property including parking lots, sidewalks, fencing, and landscaping.

Long-life property which remains on the standard schedule.

A cost segregation study identifies these components and reallocates your purchase price accordingly.

Why Pulling Depreciation Forward Matters

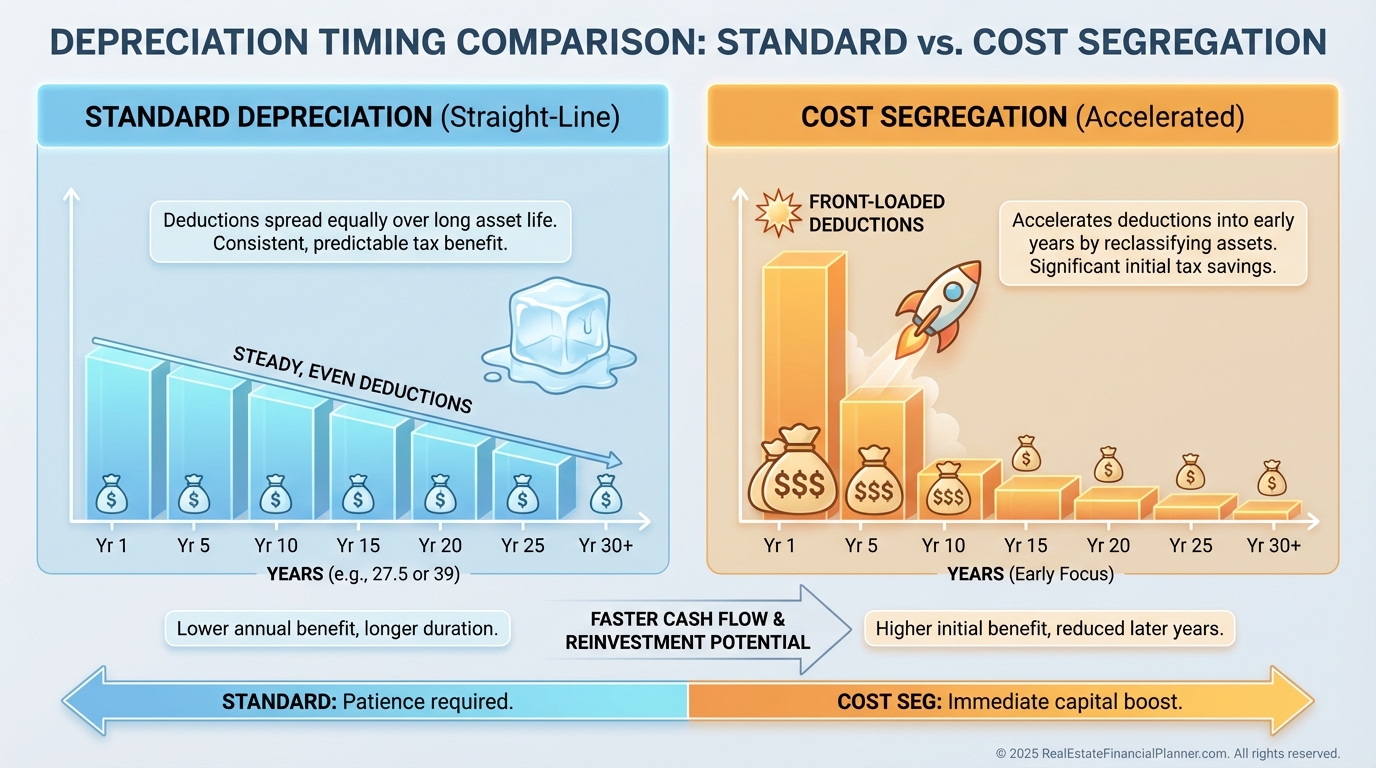

When I rebuilt after bankruptcy, I became painfully aware of the time value of money.

Cash today is not the same as cash ten years from now.

Cost segregation does not increase total depreciation.

It changes when you get it.

Pulling depreciation forward creates three real-world effects:

Immediate tax savings

Higher early-year cash flow

More capital available to reinvest

Those dollars often fund the next down payment, reserves, or debt paydown.

That is how portfolios accelerate quietly.

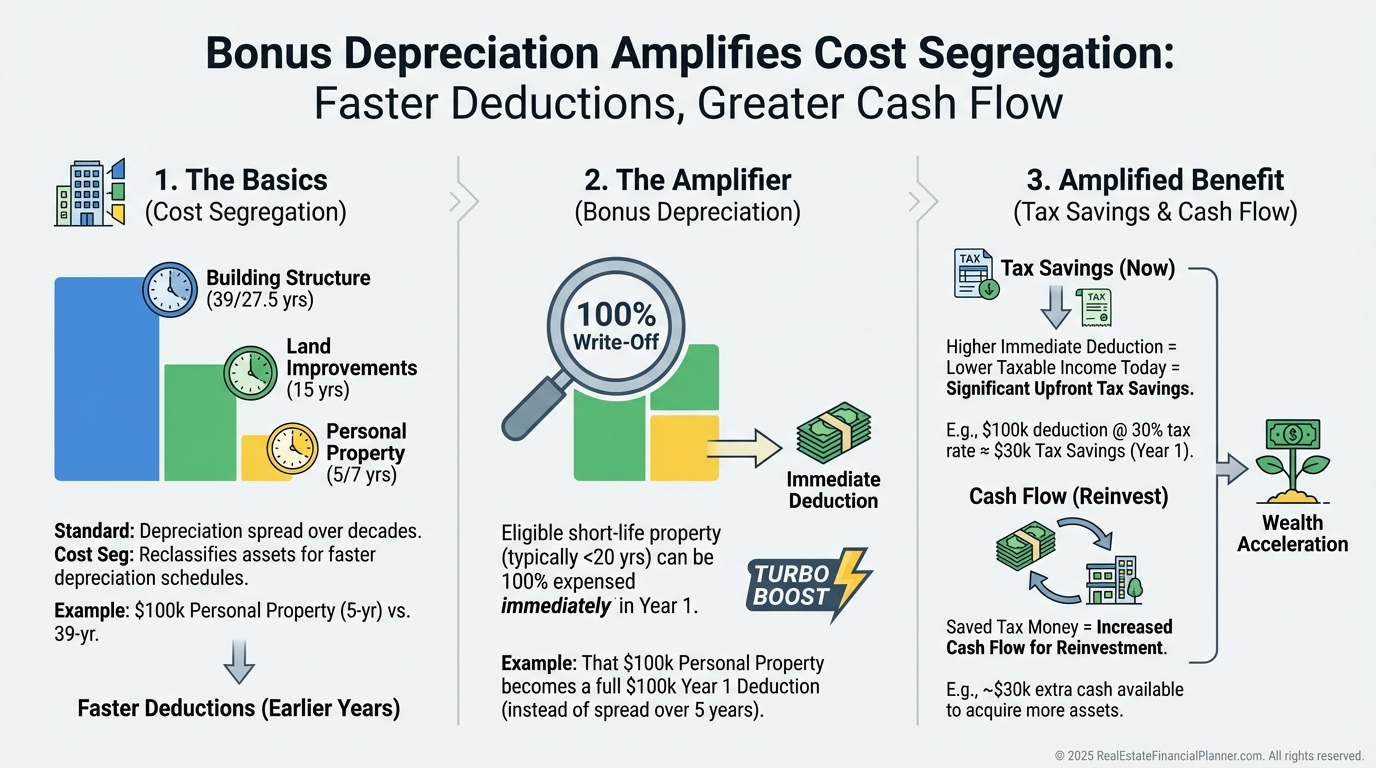

Bonus Depreciation Supercharges the Strategy

Cost segregation becomes far more impactful when bonus depreciation is layered on top.

Bonus depreciation allows certain components to be written off faster, sometimes immediately.

The percentage has been phasing down, but even reduced levels still produce meaningful results.

This is where investors often misjudge the opportunity.

They see the phase-down headlines and assume the strategy is no longer worth it.

That is rarely true when the numbers are modeled correctly.

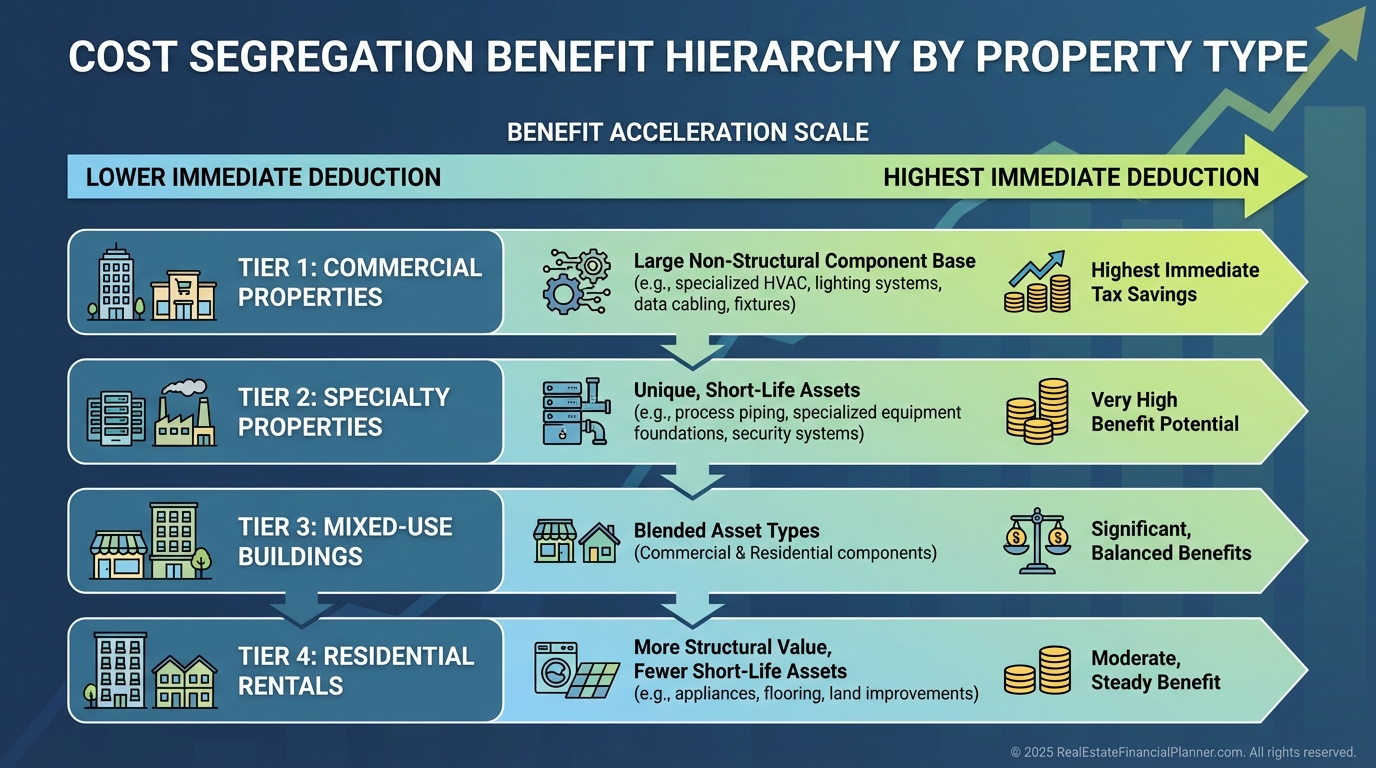

Which Properties Tend to Benefit Most

Not every property needs a study.

When I run scenarios inside Real Estate Financial Planner™, a few patterns show up consistently.

Cost segregation tends to make the most sense when:

The property value is roughly $500,000 or higher.

You expect to hold the property for at least five years.

You are in a moderate or high tax bracket.

Early-year cash flow matters to your strategy.

It can still work below those thresholds, but the margin of benefit narrows.

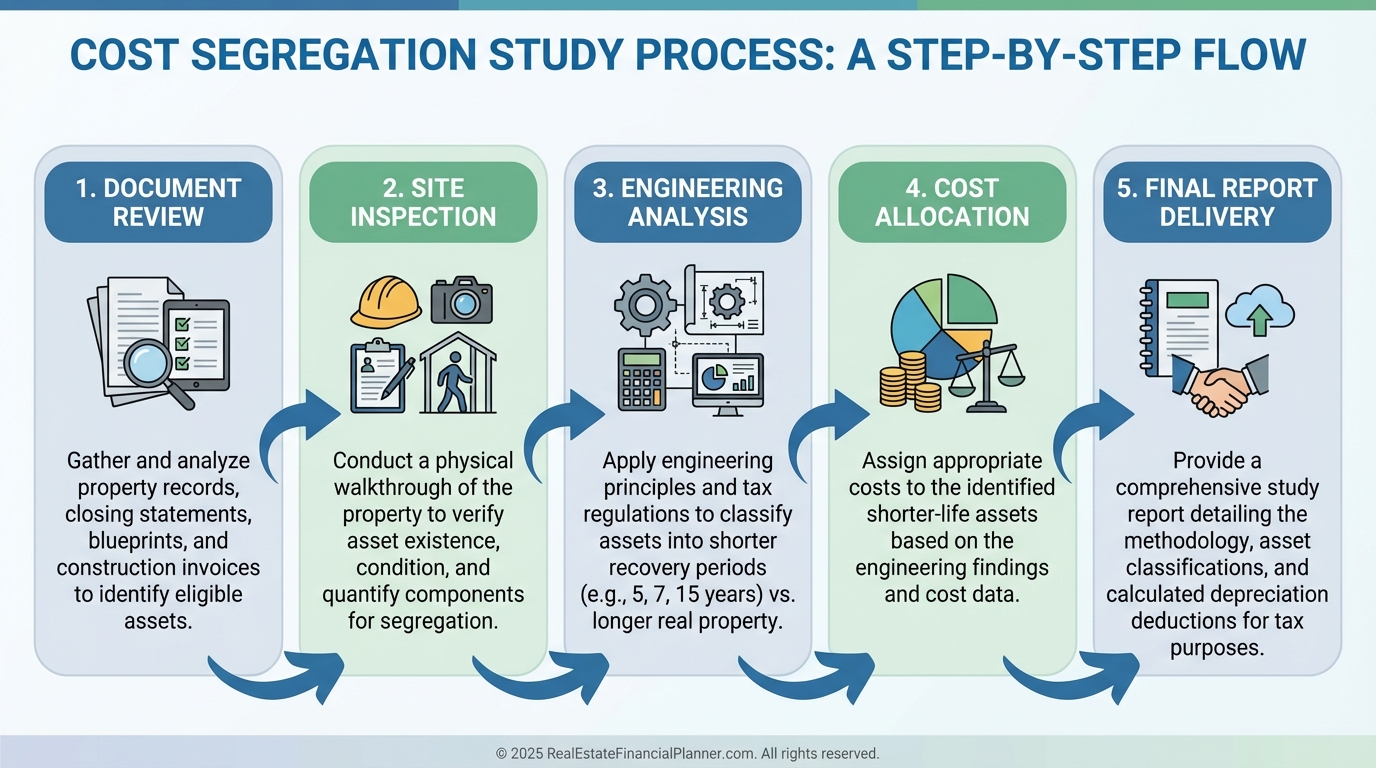

How the Study Process Actually Works

A proper cost segregation study is engineering-based.

This is where investors get into trouble by cutting corners.

A legitimate study includes:

A physical inspection.

Engineering calculations.

Detailed documentation.

A defensible report your CPA can stand behind.

The study fee is not the cost.

The real cost is doing it wrong and losing the deduction later.

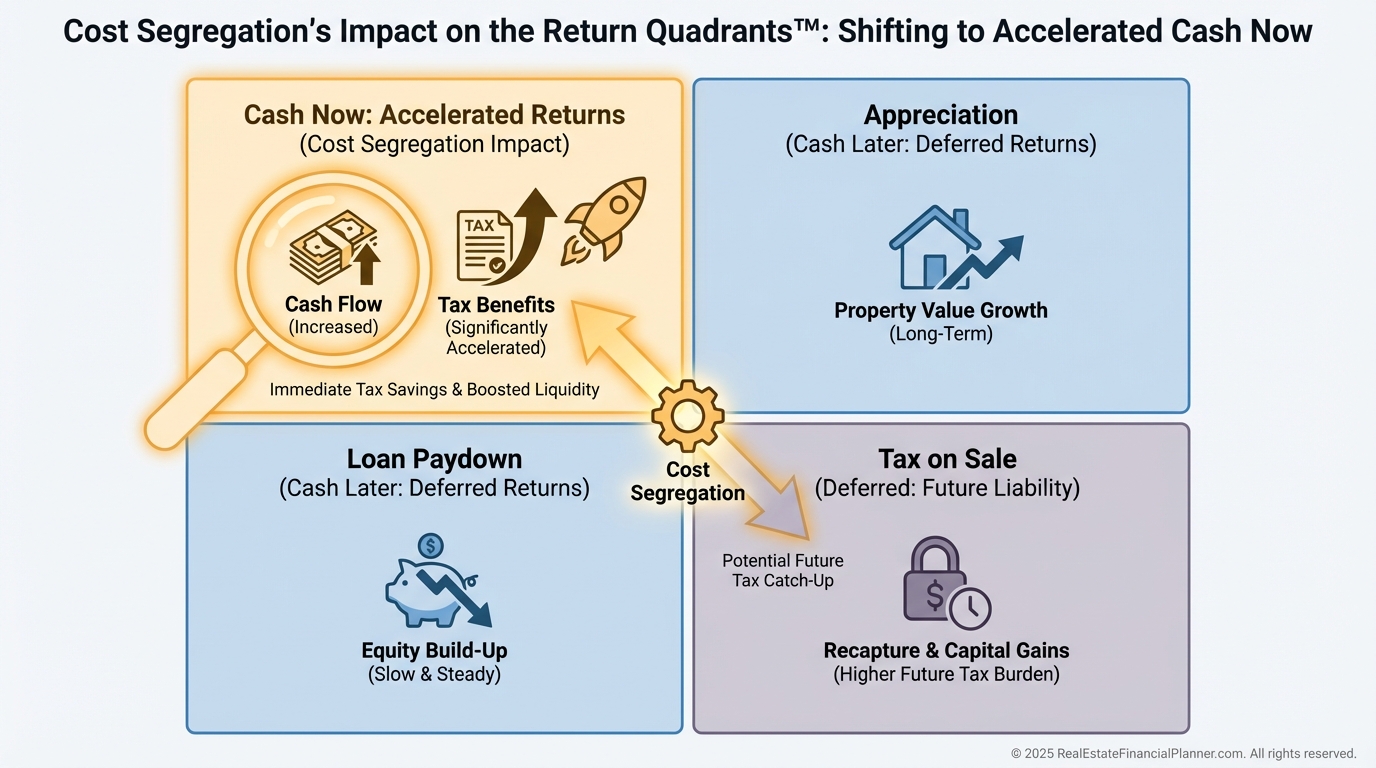

How This Fits Into Real Returns, Not Just Tax Savings

Inside the Return Quadrants™, depreciation shows up on the “Cash Now” side of the model.

It does not change appreciation.

It does not change debt paydown.

It improves spendable cash flow.

When I model cost segregation against True Net Equity™, the pattern is consistent.

You are not creating free money.

You are reallocating returns across time.

That distinction matters when making long-term portfolio decisions.

Recapture, Sales, and Reality Checks

Yes, depreciation is recaptured when you sell.

That scares people away unnecessarily.

What matters is:

The tax rate difference.

The time value of money.

What you did with the savings in the meantime.

If tax savings funded another property, reserves, or debt reduction, the strategy often still wins by a wide margin.

Cost segregation does not eliminate taxes.

It gives you control over timing.

Common Mistakes I See Investors Make

The biggest mistake is ignoring cost segregation entirely.

The second biggest mistake is implementing it without modeling.

Other frequent errors include:

Using non-engineering providers.

Failing to coordinate with a CPA.

Running the study after filing returns.

Not understanding state tax conformity.

Cost segregation should never be a default checkbox.

It should be a modeled decision.

When I Recommend Cost Segregation

I usually recommend cost segregation when:

The first-year benefit materially improves cash flow.

The investor plans to keep acquiring properties.

The portfolio strategy values reinvestment speed.

If the benefit is marginal, I skip it.

Clarity beats complexity.

Final Thoughts

Cost segregation is not about gaming the system.

It is about understanding how the system already works.

When used intentionally, it can dramatically improve early returns, reduce financial stress, and accelerate portfolio growth without increasing risk.

The key is modeling first, executing second, and documenting everything.

That is how real investors use cost segregation as a tool instead of a gimmick.