Nomad™ by Proxy: Scale Rentals With Owner-Occupant Loans—Without Moving

Learn about Nomad™ by Proxy for real estate investing.

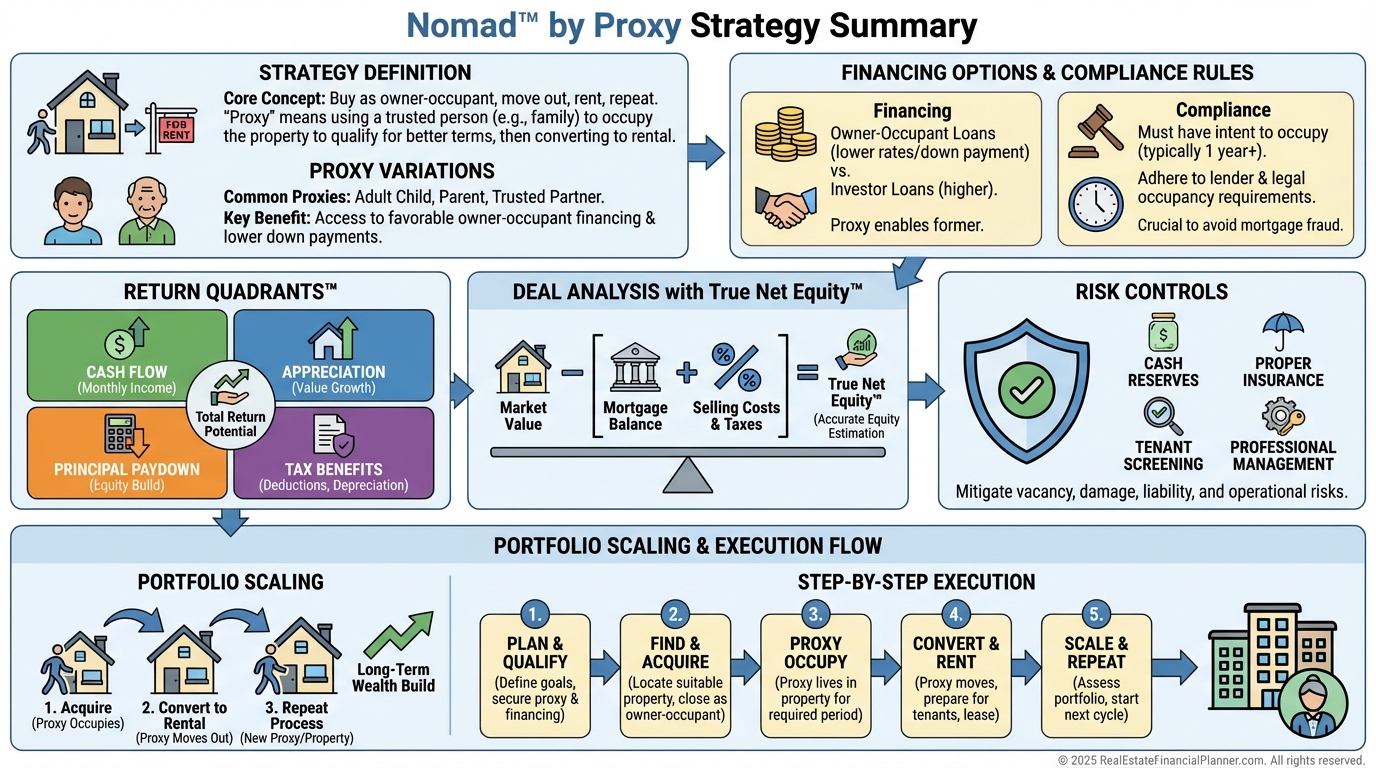

What Nomad™ by Proxy Is (and Why It Works)

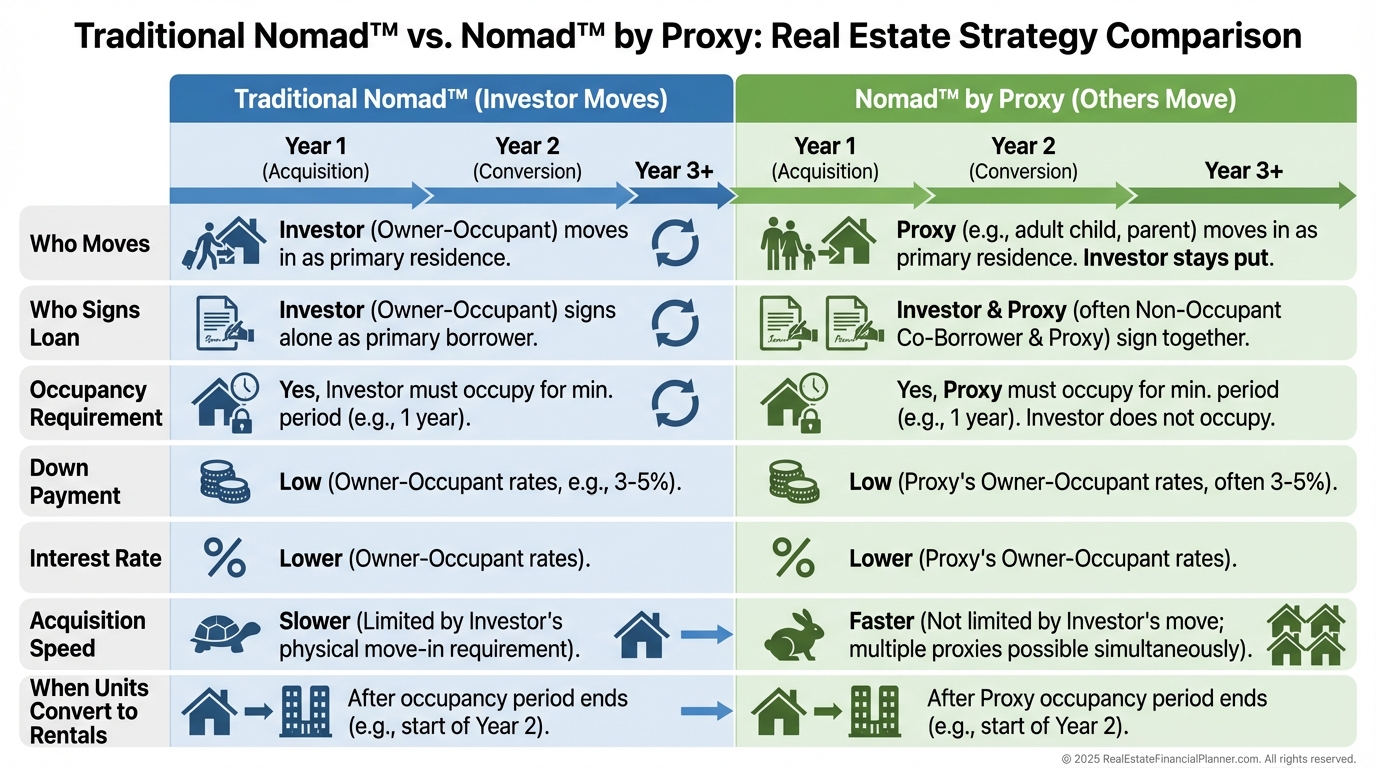

When I help clients who love the math of Nomad™ but hate moving every year, we use Nomad™ by Proxy.

You still leverage owner-occupant financing and convert homes to rentals after at least one year, but a proxy lives in the property instead of you.

You keep your address. Your proxy occupies, satisfies the lender’s owner-occupant requirement, and then moves to the next property.

The key unlock is financing. Owner-occupant loans often offer better rates and lower down payments than investor loans, which can improve cash flow and accelerate acquisition.

The Compliance Rule You Cannot Break

Owner-occupant loans require the occupying borrower to live in the property for about 12 months. Your proxy must be the person occupying, and if they’re on the loan, they will sign an occupancy affidavit.

When I model this for clients, the first check is compliance alignment: the occupant is the borrower who certifies occupancy. Lenders do verify. Misrepresenting occupancy is loan fraud.

We also document responsibilities in writing: who lives there, who pays what, who is on the deed and loan, and the plan after 12 months.

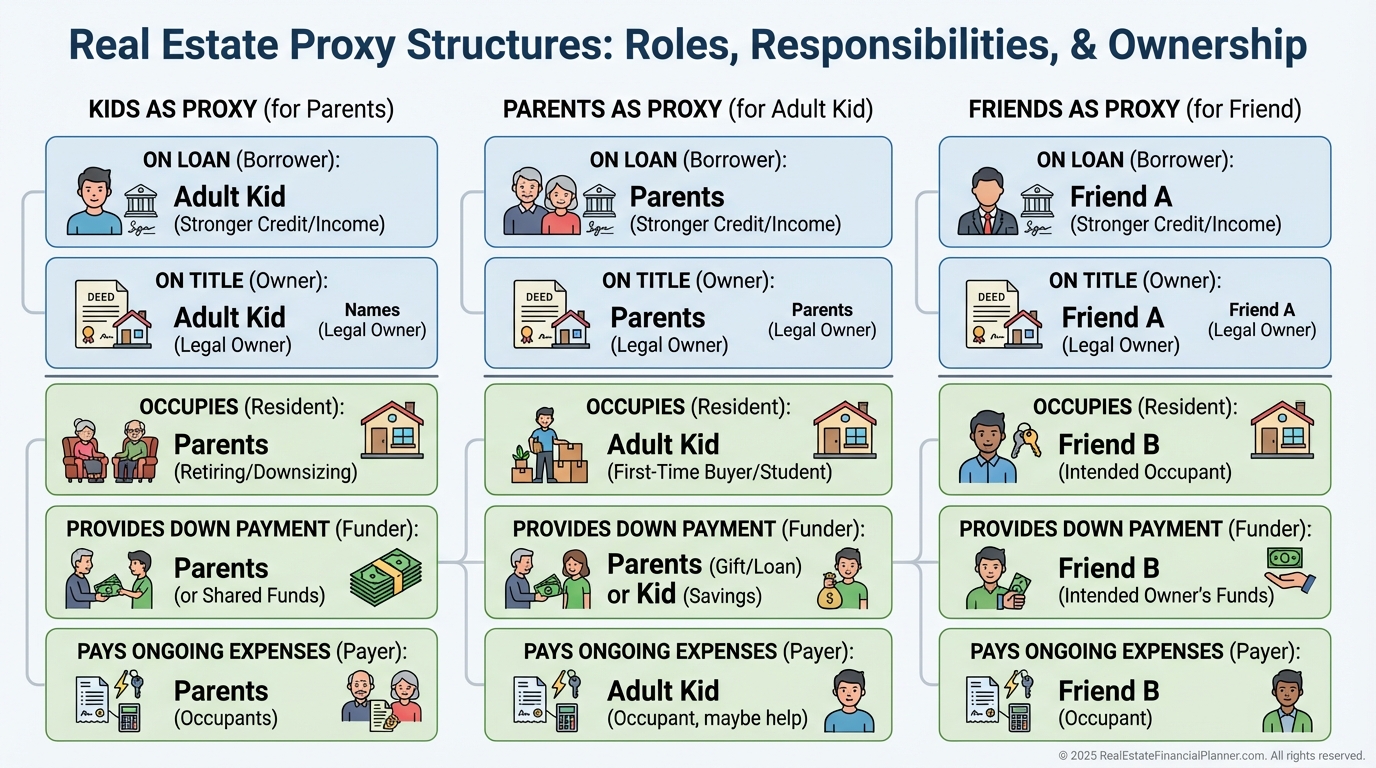

Common Nomad™ by Proxy Variations

Parents with college kids as proxy. Parents qualify and provide the down payment; the child lives there, collects roommate rent, and moves each year.

Kids with parents as proxy. Adult child investor provides funds; parents want to be closer to family and live in each property for a year, then move to the next.

Friends as proxy. Partners invest together; the more mobile friend lives in each property to secure owner-occupant financing.

You as proxy for someone else. You can also be the mover if another partner is funding or qualifying.

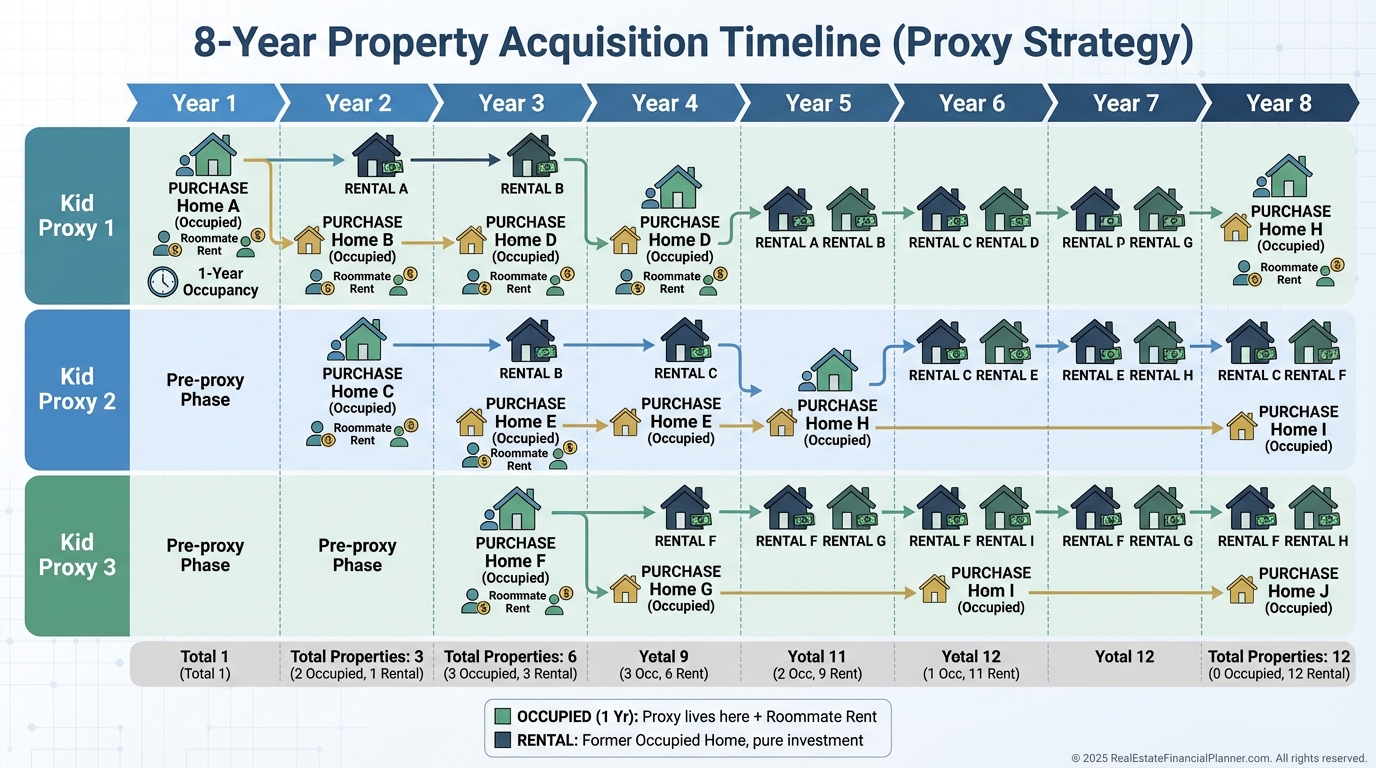

The College-Kid Example That Scales Fast

When I map this out with parents and three college-age kids spaced two years apart, it’s common to buy one new home each school year and rotate the occupant.

House-hack each property with roommates to offset the mortgage. Then, after 12 months, convert to a rental and buy the next.

In eight years, it’s possible to acquire up to 12 properties using 5% down each time, sometimes with your kids managing roommate turnovers. That’s leverage working for retirement, not against it.

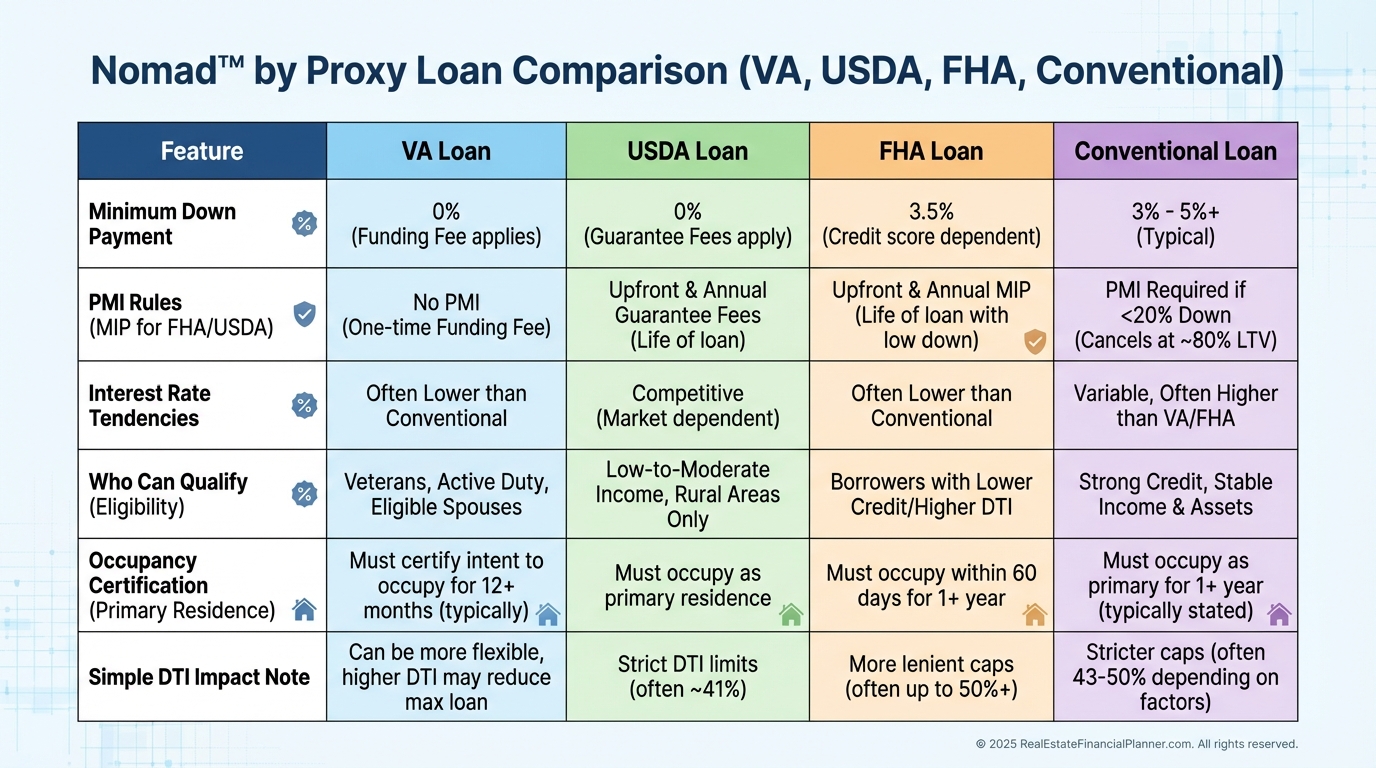

Financing That Makes Nomad™ by Proxy Possible

The most common path is owner-occupant loans with your proxy as an occupying borrower. Better rates and lower down payments drive the math.

I verify three things before writing an offer. We can document occupancy, we can qualify for debt-to-income across multiple properties, and we have adequate reserves.

Creative options exist. Assumable mortgages can be a win in high-rate environments, and lease-option exits can generate an option fee to help fund the next down payment.

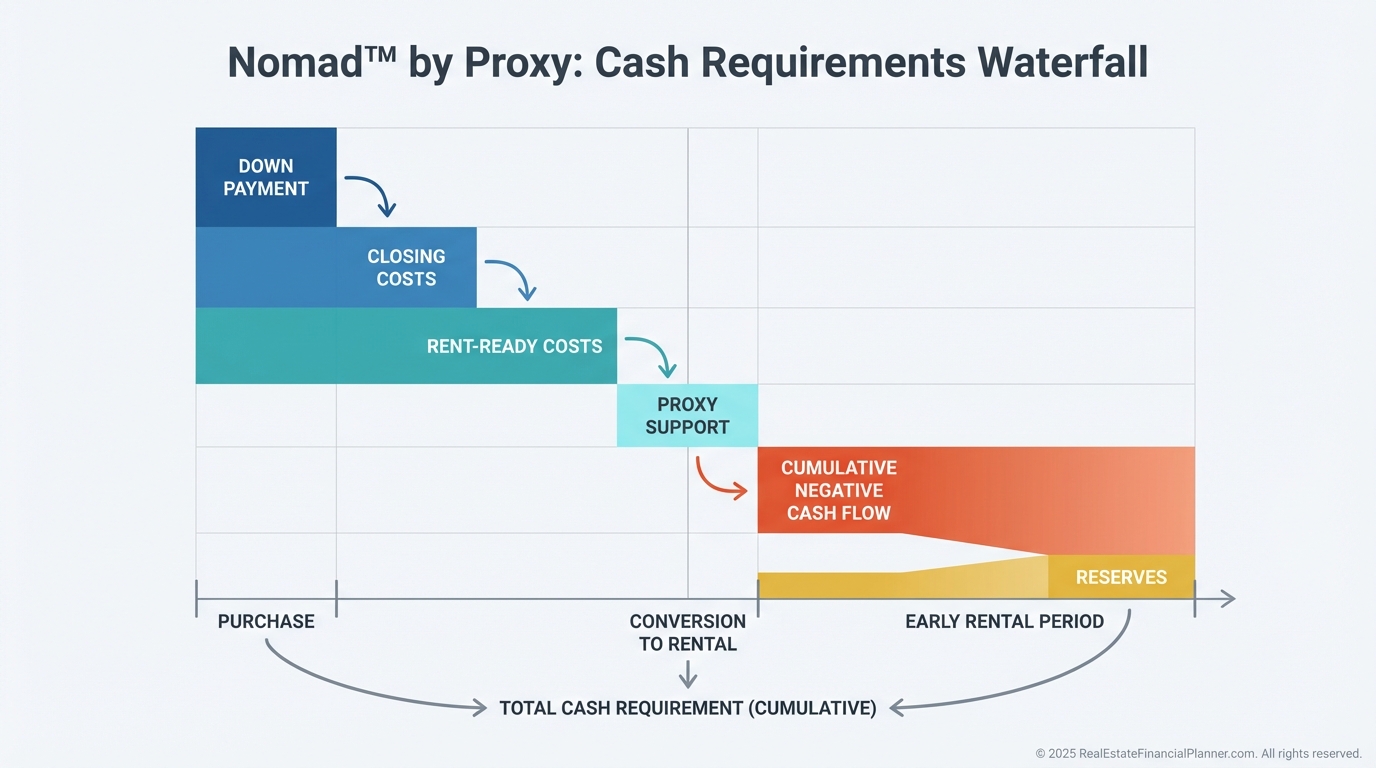

Money You’ll Need (and When)

Plan for five buckets. Down payment, closing costs, rent-ready costs, potential support for the proxy’s year in residence, and reserves.

If you use small down payments, expect the possibility of initial negative cash flow. I treat this as a deferred down payment and set aside the Cumulative Negative Cash Flow up front, so we control risk on day one.

I recommend a minimum of six months’ expenses in reserves per property. Twelve months if you are relying on a friend or family member as a proxy.

Credit and Qualifying

Most conventional owner-occupant loans want a 620+ middle score. FHA and VA may dip to 580 for the qualifying borrower.

We ladder purchases by watching DTI. Better rates and PMI pricing come with higher scores, which directly improves cash flow and helps you qualify for the next loan.

If you’re buying cash, no credit is needed—but you also don’t need a proxy because there’s no owner-occupant financing involved.

Holding and Management

Nomad™ by Proxy is hands-off at first. Your proxy lives in the home, and you prepare systems for the eventual conversion.

After 12 months, things get more active. You transition to full tenant placement, property management, and asset optimization.

When I help clients, we calendar major milestones: proxy move-out, make-ready, rent target adjustments, and renewal pricing. Consistency wins.

How Long to Hold

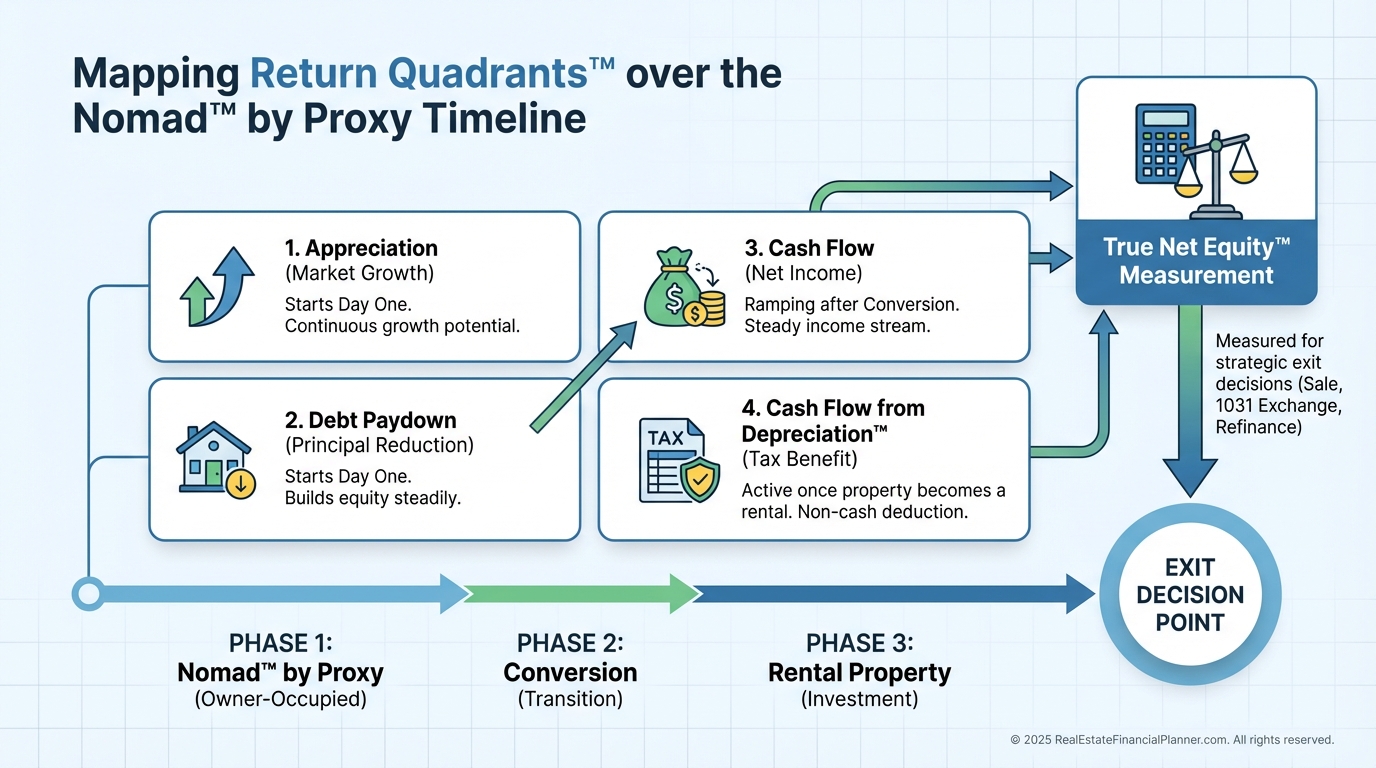

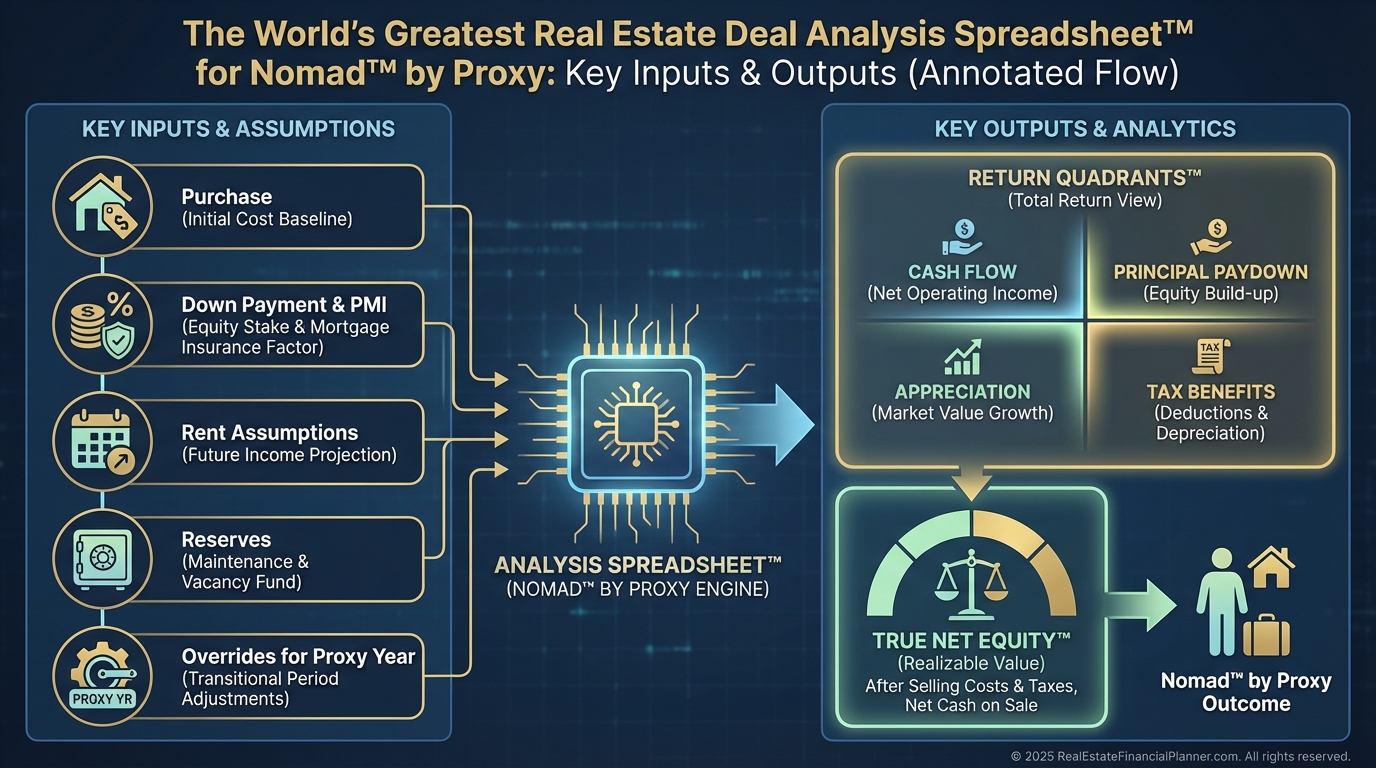

Most clients aim to hold long-term and let the Return Quadrants™ compound: appreciation, cash flow, debt paydown, and tax benefits.

As retirement nears, we prune. Sell underperformers, 1031 into better assets, or simplify into fewer doors with better net cash flow.

This is where True Net Equity™ matters. We model what you’d actually walk away with after selling costs, depreciation recapture, and taxes, not just gross equity.

Exit Channels and Exit Financing

A lease-option exit can be powerful. The non-refundable option fee can seed the down payment for your next purchase.

Buyers will use owner-occupant loans, investor loans, cash, or rent-to-own financing structures. Or you can simply never sell and let the portfolio pay you for decades.

Investor vs Entrepreneur

Nomad™ by Proxy leans toward investor behavior. You invest capital, design agreements, and manage risk while your proxy does the moving.

If you’re the mover, you’ve added entrepreneurial effort. Either way, once the proxy moves out, landlording skills matter.

Skills That Make This Work

Deal analysis so you buy right. Financing literacy so you qualify repeatedly.

Property management so units stay occupied and maintained. And relationship management so the proxy arrangement remains smooth and equitable.

When I coach clients, we put all expectations in writing. Who moves, who pays, when we convert, how we split returns, and how we unwind if someone wants out.

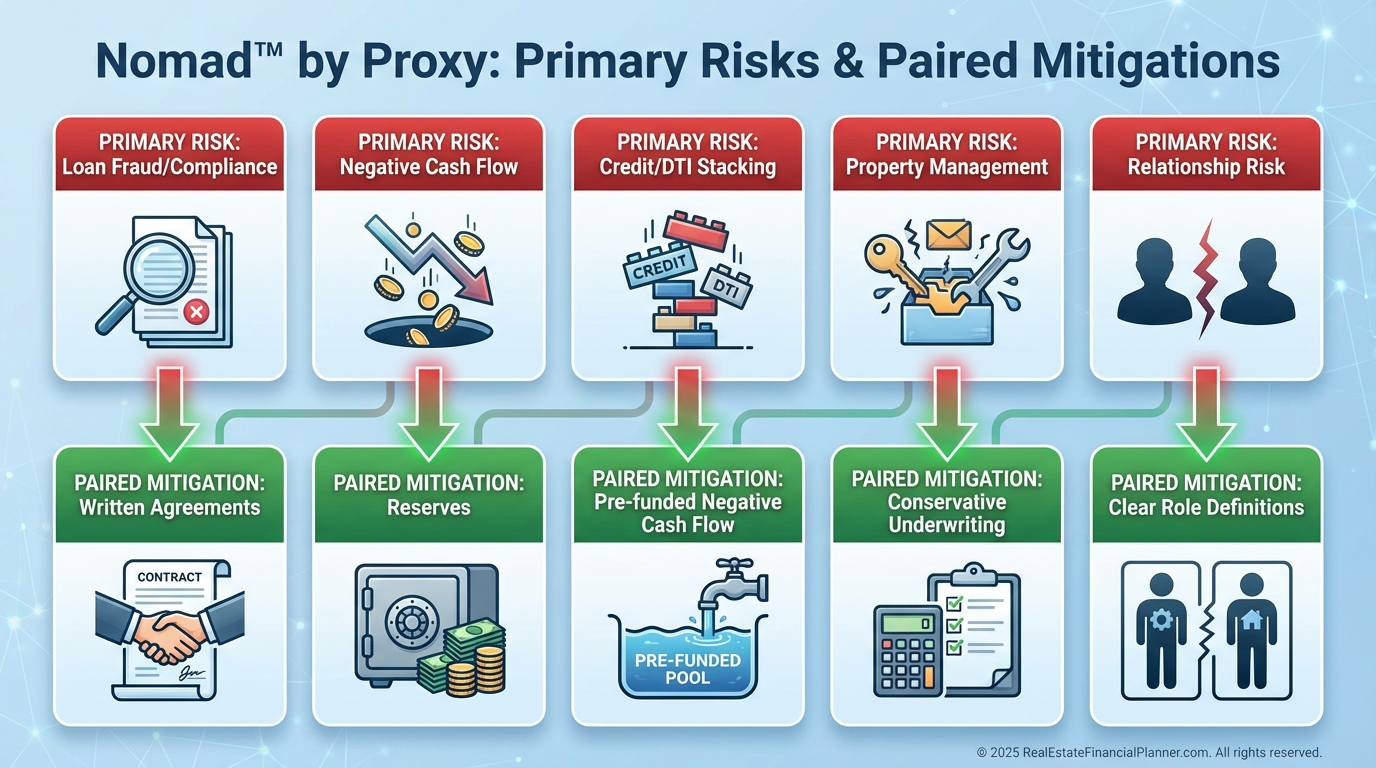

Risk, Honestly Assessed

Leverage amplifies results. Small down payments can increase returns and volatility.

Negative cash flow is possible in year one. We pre-fund it.

Credit risk grows with each loan. We automate payments and monitor reserves.

Relationship risk is real with family and friends. Written agreements, disclosures, and clean accounting protect both sides.

Loan fraud is zero-tolerance. The occupant must honor the 12-month rule.

Profit Speed and Size

You earn appreciation and debt paydown from day one. Cash flow and tax benefits (Cash Flow from Depreciation™) typically begin after conversion to rental.

Because you can acquire more properties faster, portfolio-level returns can compound sooner. That’s the quiet power of Nomad™ by Proxy.

We track returns as Cash-on-Cash and Return on Equity. Then we decide where equity is lazy and reposition for better yield.

Finding Deals That Fit

The MLS will get you most of the way there. Layer FSBO searches, networking, and targeted marketing in your best neighborhoods.

Wholesalers can work if the proxy is handy and the property needs love. Always underwrite condition, rent potential, and your exit.

Strong student rental corridors can shine for the college-kid variation. But confirm local rules for occupancy limits and rental licensing.

Analyzing Deals the REFP Way

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™. It’s free and purpose-built for Nomad™ and Nomad™ by Proxy.

Download it at: https://RealEstateFinancialPlanner.com/spreadsheet

I model conservative rents, realistic maintenance, and reserves. Then I use the overrides to reflect the proxy’s occupancy year, any discounted rent, and our negative cash flow set-aside.

We also split returns in the overrides if partners share proceeds differently. That way everyone sees their slice clearly.

Market Conditions and Availability

Ideal markets combine solid rent-to-price ratios, steady appreciation, and rising rents. Owner-occupant rates help, but the deal still needs to pencil.

Challenging markets demand more capital or creativity. In tougher cycles, I use assumptions, lease-option exits, or larger down payments to stabilize cash flow.

Always confirm local regulations for occupancy, licensing, and short-term rental restrictions. The plan must work both during the proxy year and after conversion.

Accessibility and Scaling Pace

With a solid proxy, acquisition speed can jump. You’re no longer bound to moving once a year.

Still, we don’t outrun safety. Reserves, cash-flow buffers, and DTI discipline set the real speed limit.

If you adopt lease-option exits, option fees can fund new down payments. That reduces the friction of scaling.

Retirement Accounts: Know the Rules

Self-directed retirement accounts cannot rent to disqualified persons. That includes you, your spouse, your parents, grandparents, kids, grandkids, and their spouses.

That restriction makes most family-proxy setups incompatible with owning in a retirement account. Some investors withdraw funds and pay taxes/penalties because the expected returns justify it, but you must model carefully with your CPA.

The 7-Point Execution Checklist I Use With Clients

•

Confirm a compliant occupant-borrower plan for 12 months

•

Pre-fund Cumulative Negative Cash Flow and 6–12 months of reserves

•

Underwrite with the REFP spreadsheet and document True Net Equity™

•

Put proxy agreements in writing: roles, money, timeline, exit

•

Choose financing that supports repeatability and DTI management

•

Calendar conversion milestones and management handoffs

•

Review annually for lazy equity and reposition as needed

Put those pieces together and you have a strategy that compounds quietly while you sleep in your own bed. That’s Nomad™ by Proxy done right.