Delaware Statutory Trusts Explained for Real Estate Investors Who Hate Surprises

Delaware Statutory Trusts sound boring on purpose.

That’s part of what makes them dangerous for the wrong investor.

When I help clients evaluate DSTs, the issue is rarely whether they “work.”

The issue is whether they fit the investor’s goals, timeline, temperament, and need for control.

DSTs solve very specific problems.

They also introduce tradeoffs most investors do not see until it is too late.

This article is about clarity, not promotion.

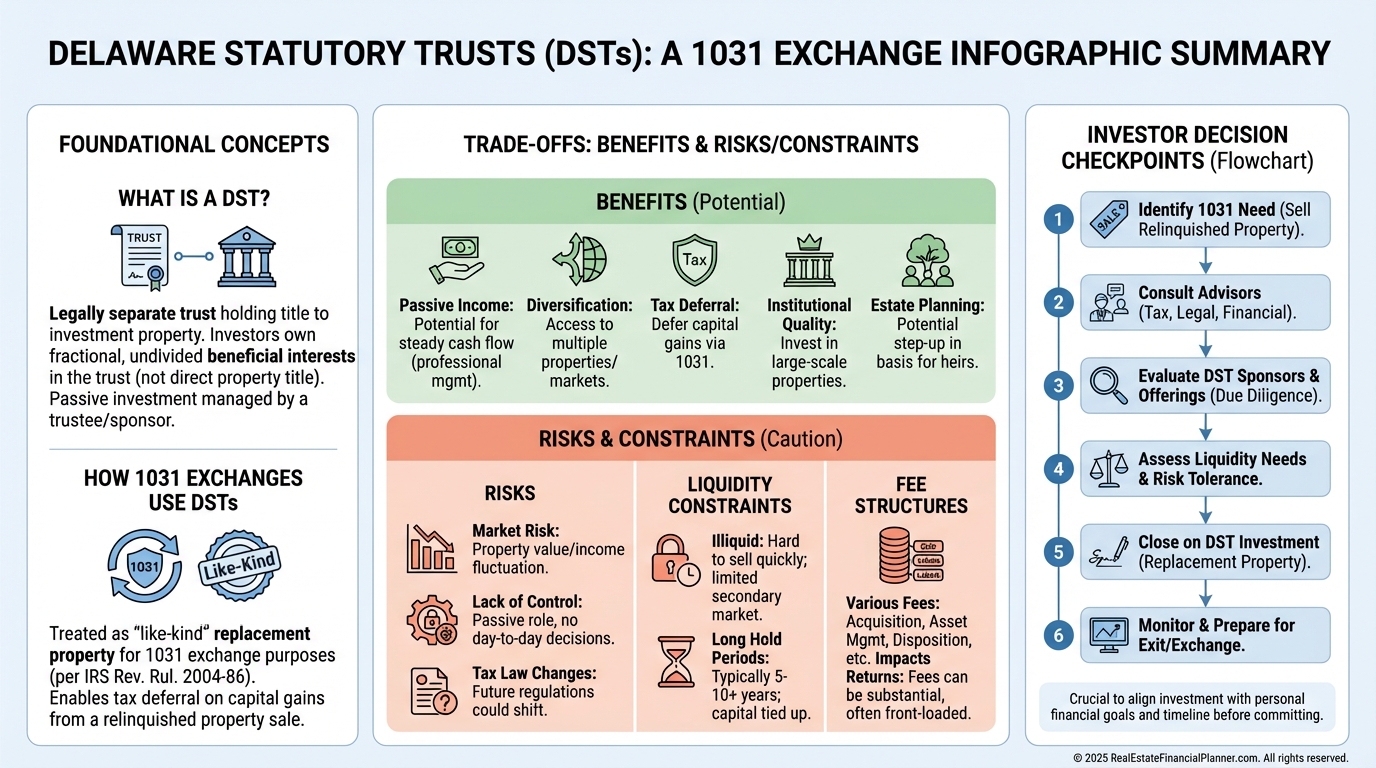

What Is a Delaware Statutory Trust?

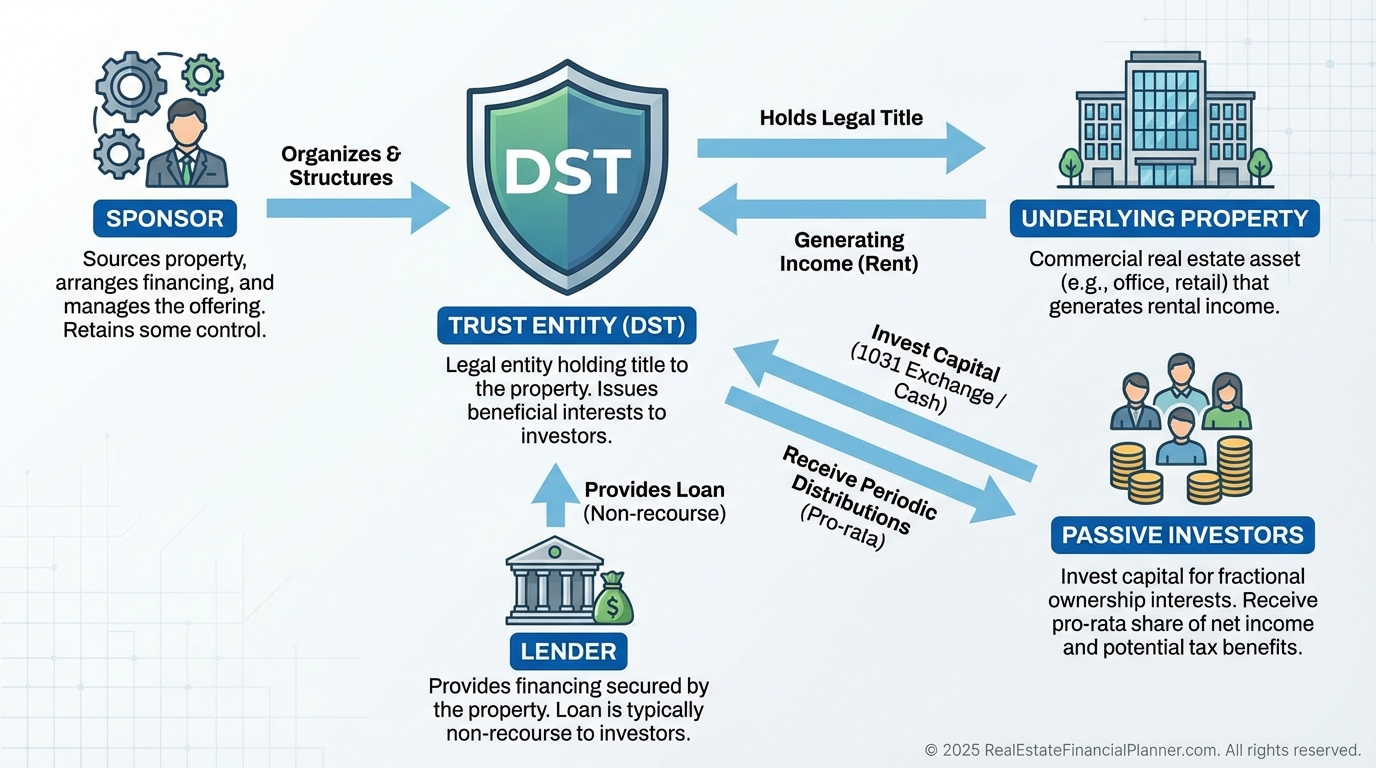

A Delaware Statutory Trust is a legal structure that allows multiple investors to own fractional interests in institutional-grade real estate.

You are not buying a property directly.

You are buying a beneficial interest in a trust that owns the property.

From the IRS’s perspective, that interest can qualify as replacement property in a 1031 exchange.

That single feature is why DSTs exist.

Why Investors Use Delaware Statutory Trusts

Most DST investors are coming out of a sale.

Often it is a highly appreciated property.

Sometimes it is a property they are tired of managing.

Sometimes it is a forced sale due to divorce, partnership disputes, or health.

When I rebuilt after bankruptcy, flexibility mattered more than tax deferral.

For many of my clients today, tax deferral is the primary objective.

DSTs are commonly used when:

•

The 1031 exchange clock is tight

•

The investor wants passive ownership

•

Replacement property values must be precise

•

The investor wants diversification across markets

DSTs can absorb exchange proceeds quickly and cleanly.

That convenience is not free.

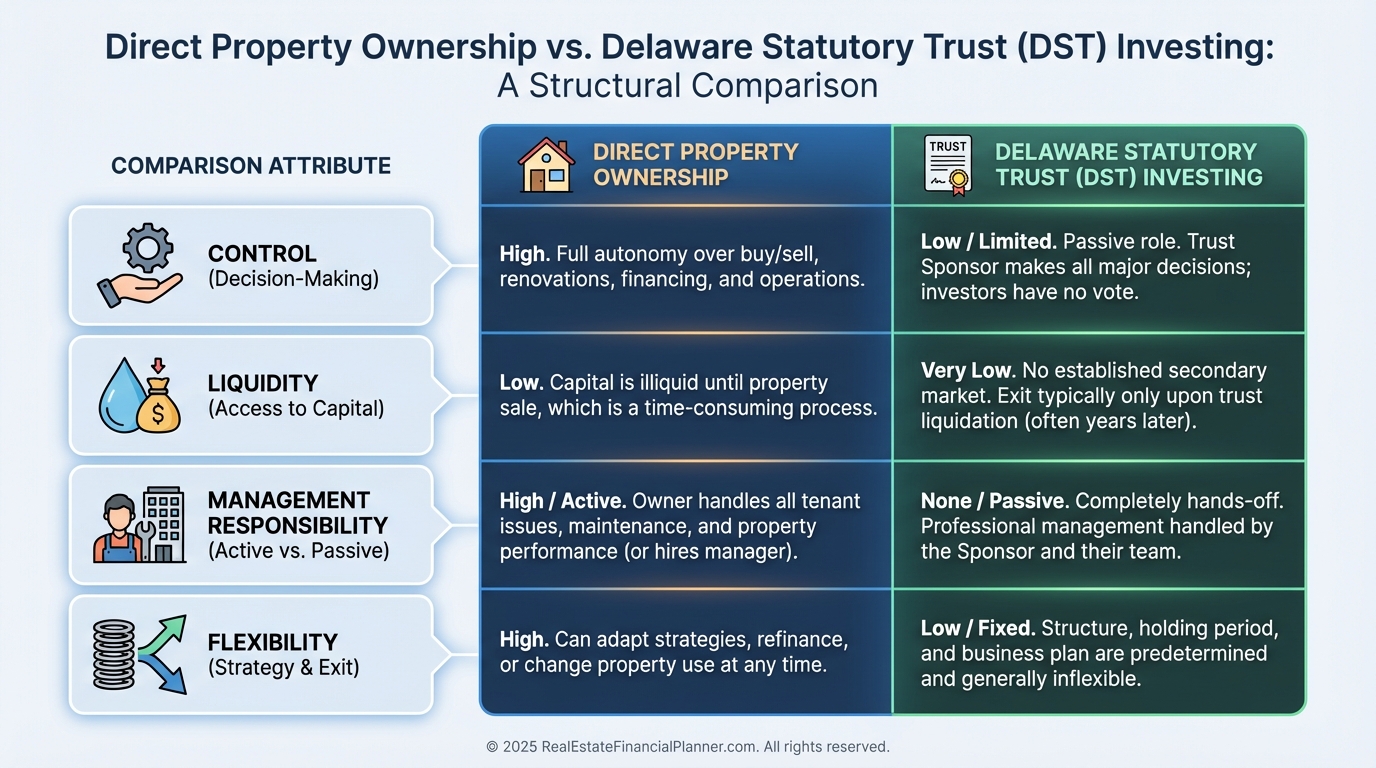

What You Give Up With a DST

The first thing you give up is control.

You do not choose tenants.

You do not refinance.

You do not sell early because the market feels “frothy.”

When I analyze real estate, I look at optionality.

DSTs intentionally remove it.

The second thing you give up is liquidity.

Most DSTs have a projected hold period of five to ten years.

That is not a suggestion—it is a lock.

If your life changes, the DST does not care.

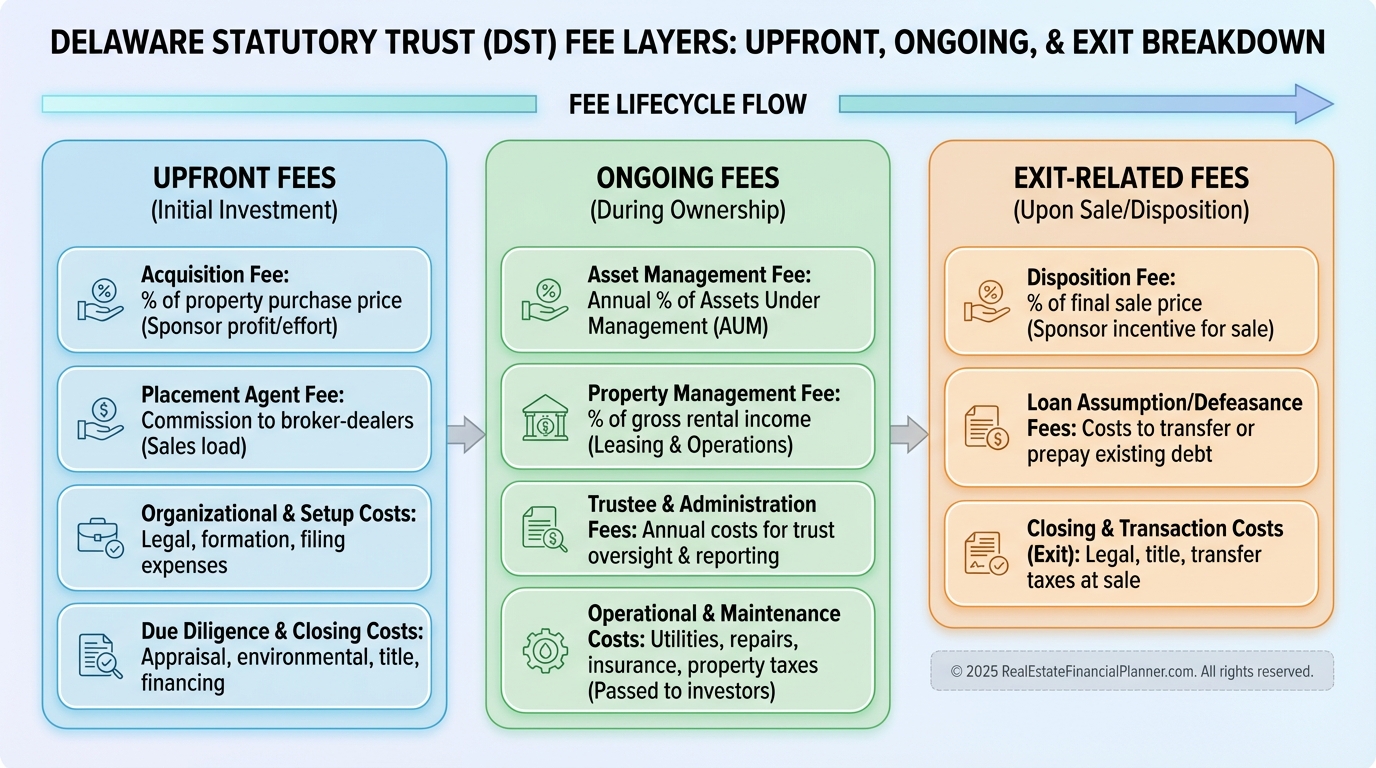

The Fee Stack Most Investors Miss

DST marketing materials emphasize yield.

They rarely emphasize layers of fees.

When I review DST offerings with clients, we look for:

•

Financing spreads

•

Internal sponsor incentives

These fees are not illegal.

They are simply easy to overlook when the focus is tax deferral.

How DSTs Fit Into the Return Quadrants™

DSTs tend to produce predictable cash flow.

They also tend to mute upside.

Appreciation is capped by structure and timing.

Debt paydown exists, but you do not control leverage decisions.

When I evaluate DSTs, I compare them to a stabilized bond-like real estate equity position.

This is not a criticism.

It is a classification.

For investors prioritizing stability over growth, that can be appropriate.

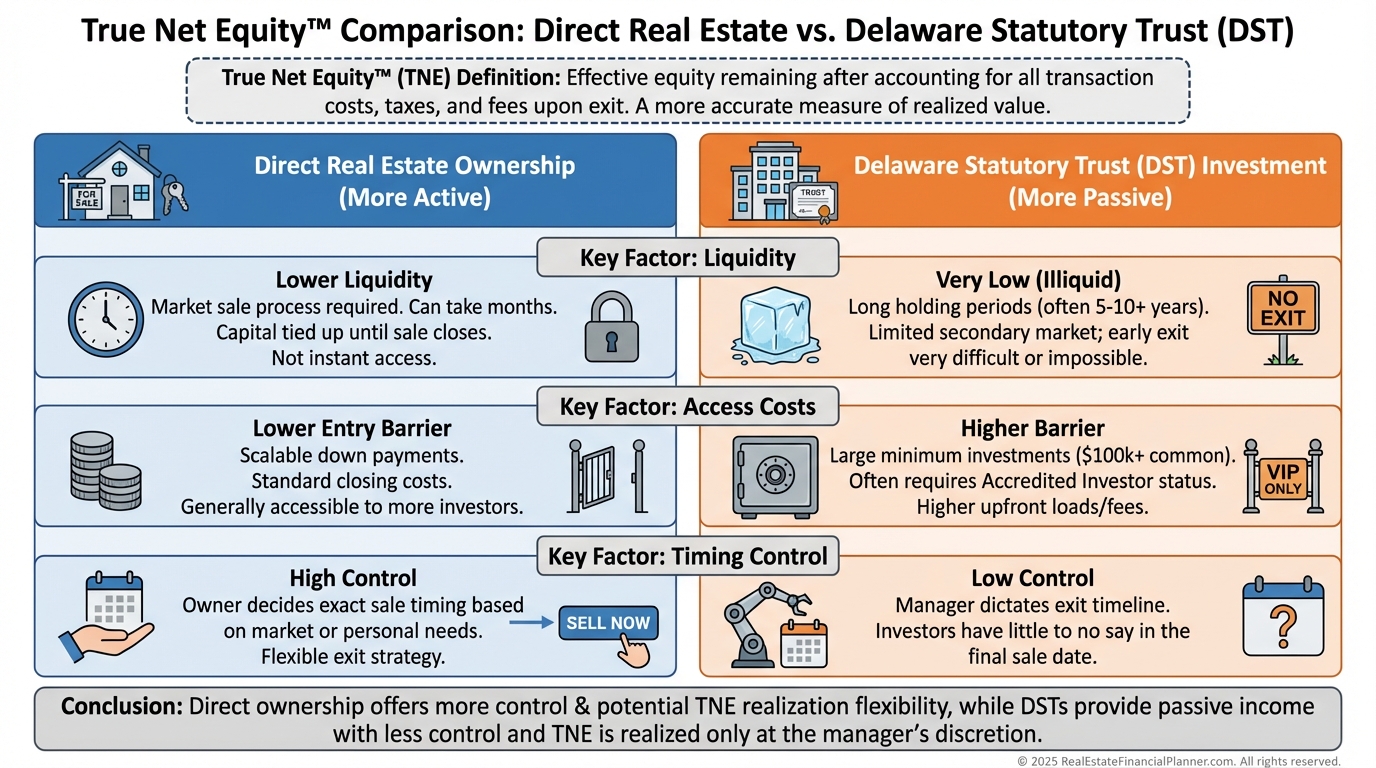

DSTs and True Net Equity™

One of the most common mistakes I see is ignoring exit friction.

DST exits are sponsor-controlled.

You do not negotiate commissions.

You do not time the market.

When I apply a True Net Equity™ lens, DST equity is often less accessible than investors expect.

That does not make it bad.

It makes it illiquid.

Common DST Mistakes I Warn Clients About

When DSTs go wrong, the pattern is consistent.

•

Using DSTs without a clear exit strategy

•

Over-allocating net worth to illiquid vehicles

•

Ignoring sponsor track record

•

Treating projected returns as guaranteed

DSTs are not magic.

They are tools.

Used correctly, they reduce stress.

Used blindly, they create it.

Who Delaware Statutory Trusts Are Best For

DSTs tend to work best for investors who:

•

Are already financially independent

•

Prioritize tax deferral over control

•

Want passive income without decisions

•

Understand and accept illiquidity

They are often a poor fit for investors still accumulating aggressively.

When flexibility matters, I usually steer clients elsewhere.

The Bottom Line

Delaware Statutory Trusts are neither scams nor saviors.

They are specialized structures designed for specific problems.

When you understand what you are giving up, you can decide whether the trade is worth it.

That decision should be made before the 1031 clock starts ticking.