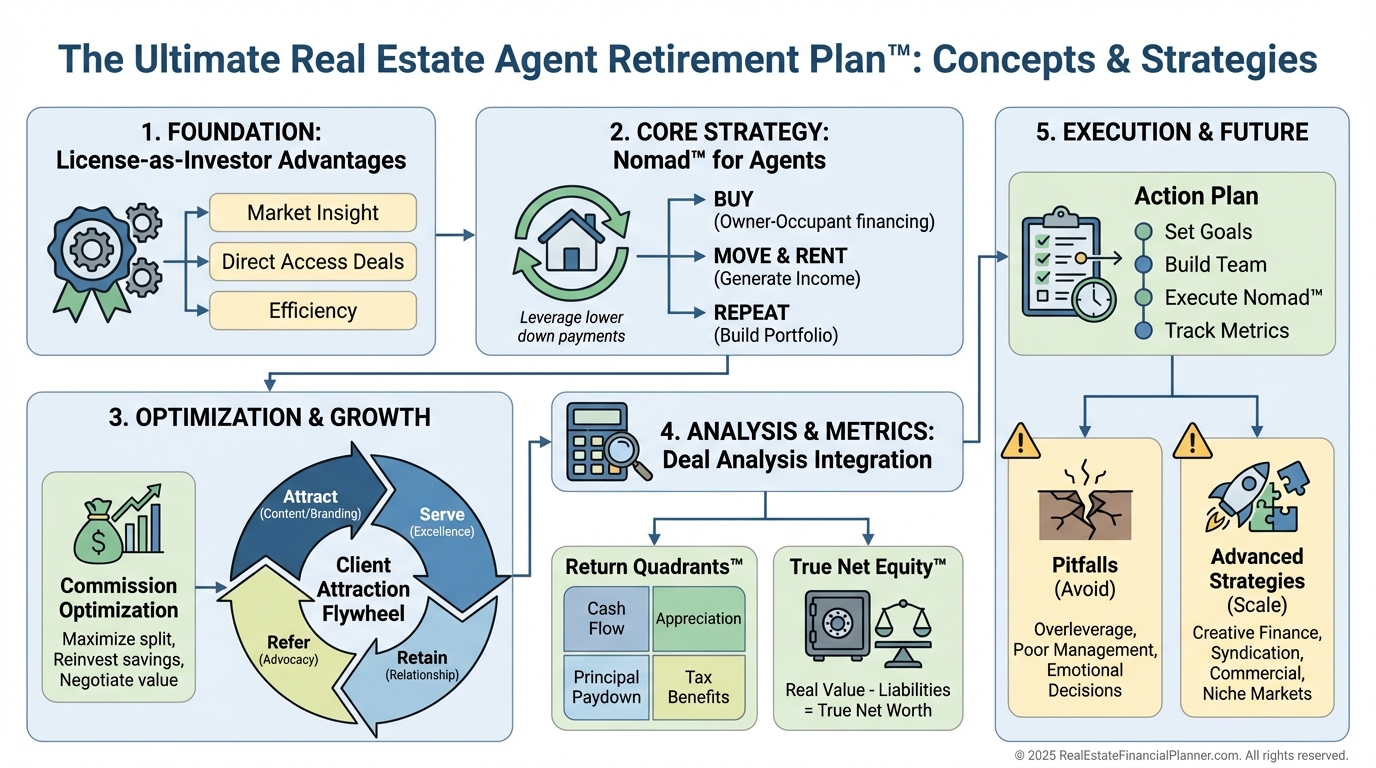

Ultimate Real Estate Agent Retirement Plan™: Turn Your License Into a Self‑Funding Nomad™ Retirement Flywheel

Learn about Ultimate Real Estate Agent Retirement Plan™ for real estate investing.

Your License Is a Wealth-Building Tool

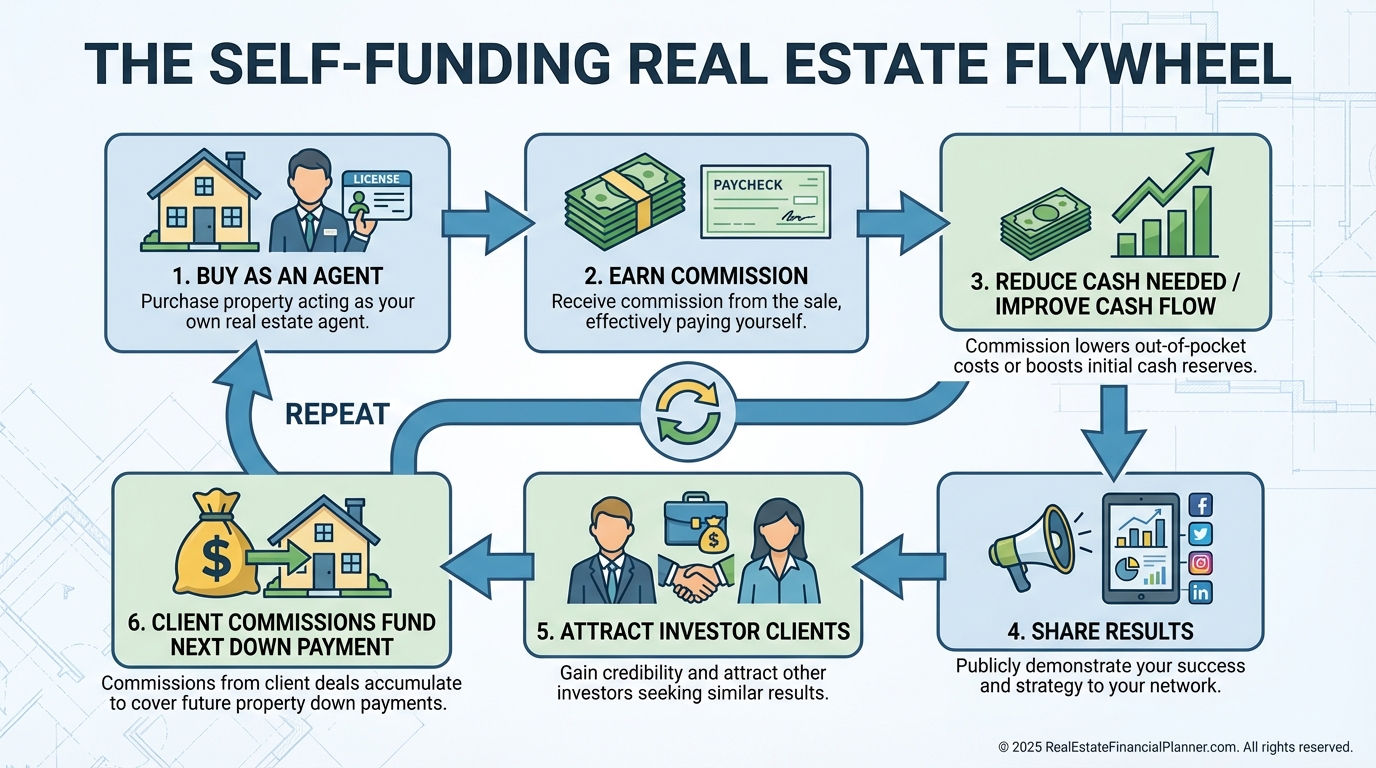

When I help agents switch from “selling houses” to “building wealth,” I start with one truth: your license is a multiplier.

It reduces your down payments, improves your deal flow, and turns your personal portfolio into your most credible marketing.

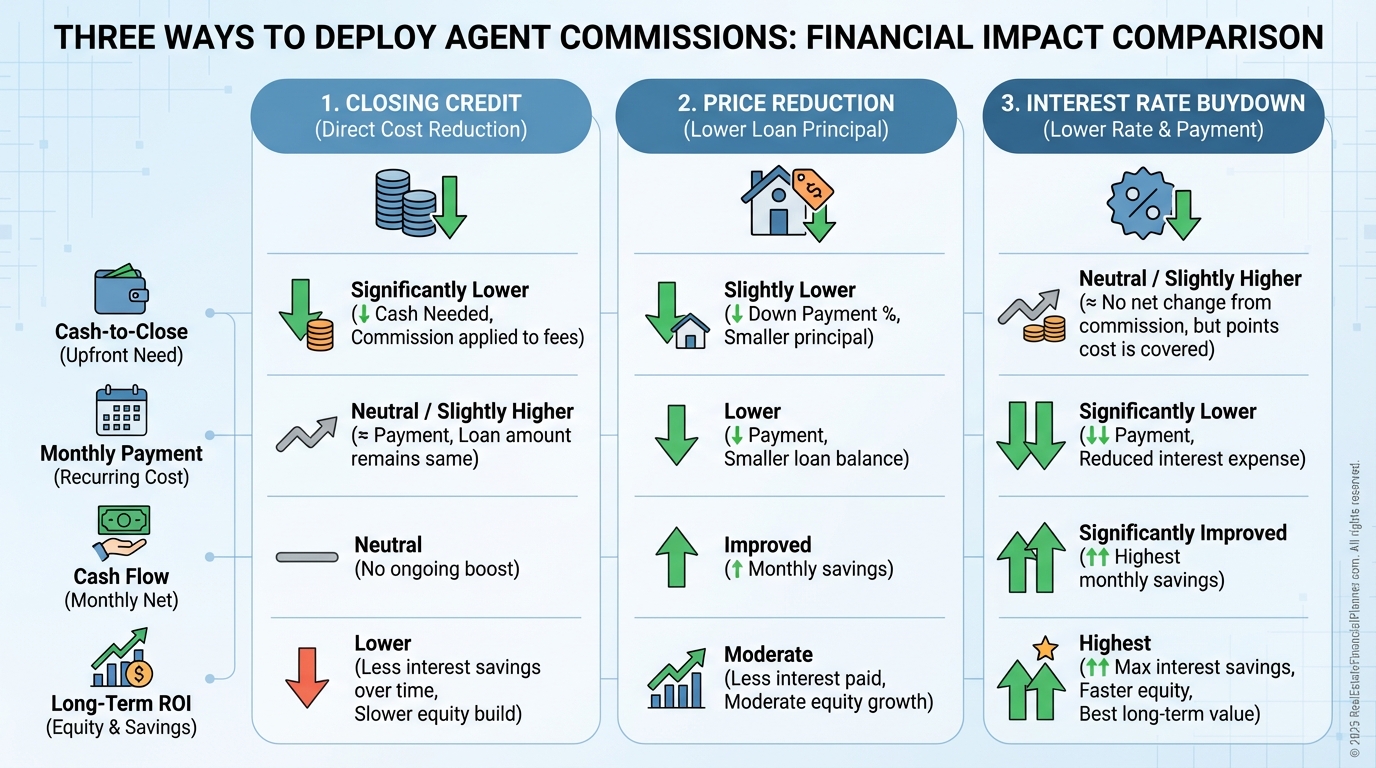

A 3% commission on a $250,000 purchase is $7,500 you don’t have to save.

You can take it as a credit, reduce price to improve cash flow, or allocate it to rate buydown for lifetime savings.

How Commissions Change the Math

Most investors must save 100% of every down payment.

Agent-investors redirect earned commissions to close gaps, shorten timelines, and improve cash-on-cash returns.

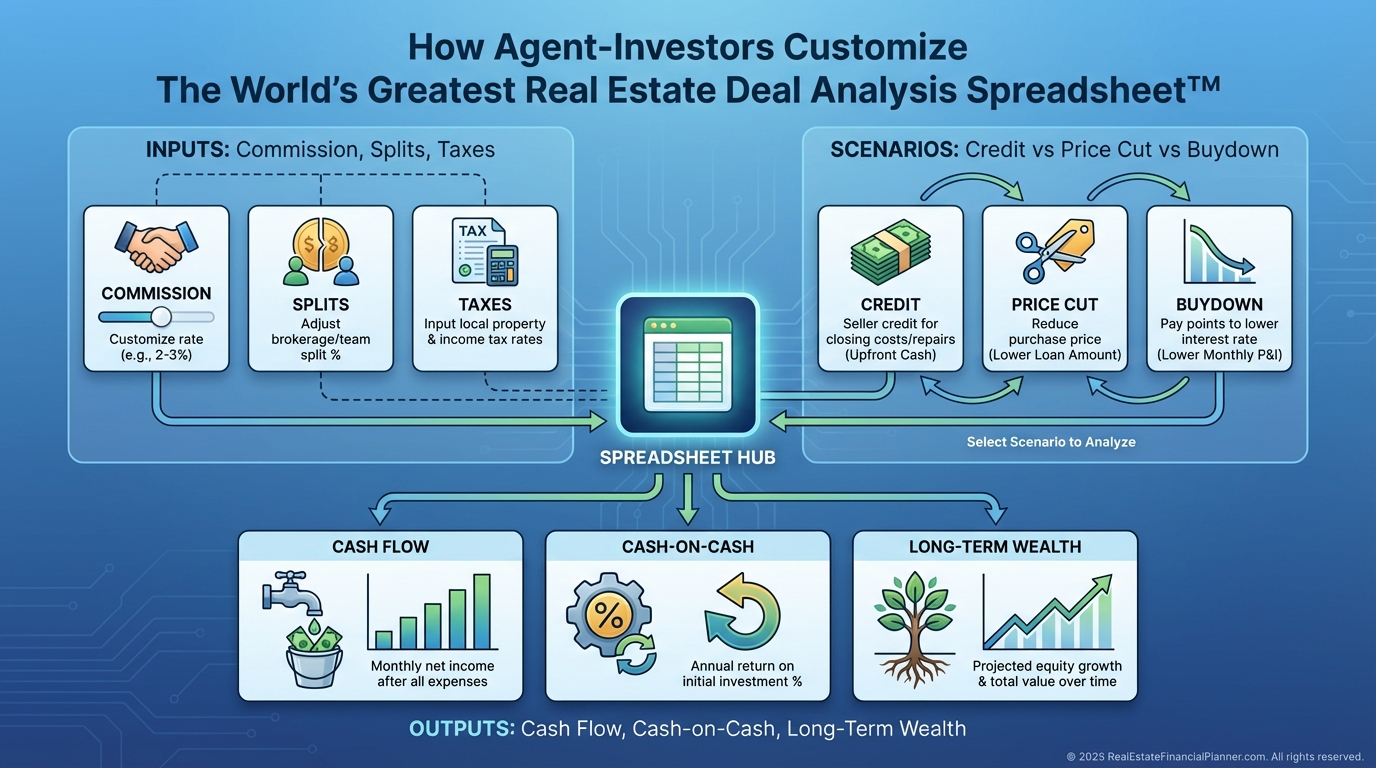

When I model this in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I compare three paths: take the commission as a closing credit, use it to reduce price, or buy down the rate.

I pick the path that maximizes long-term Return on True Net Equity™, not just year-one cash flow.

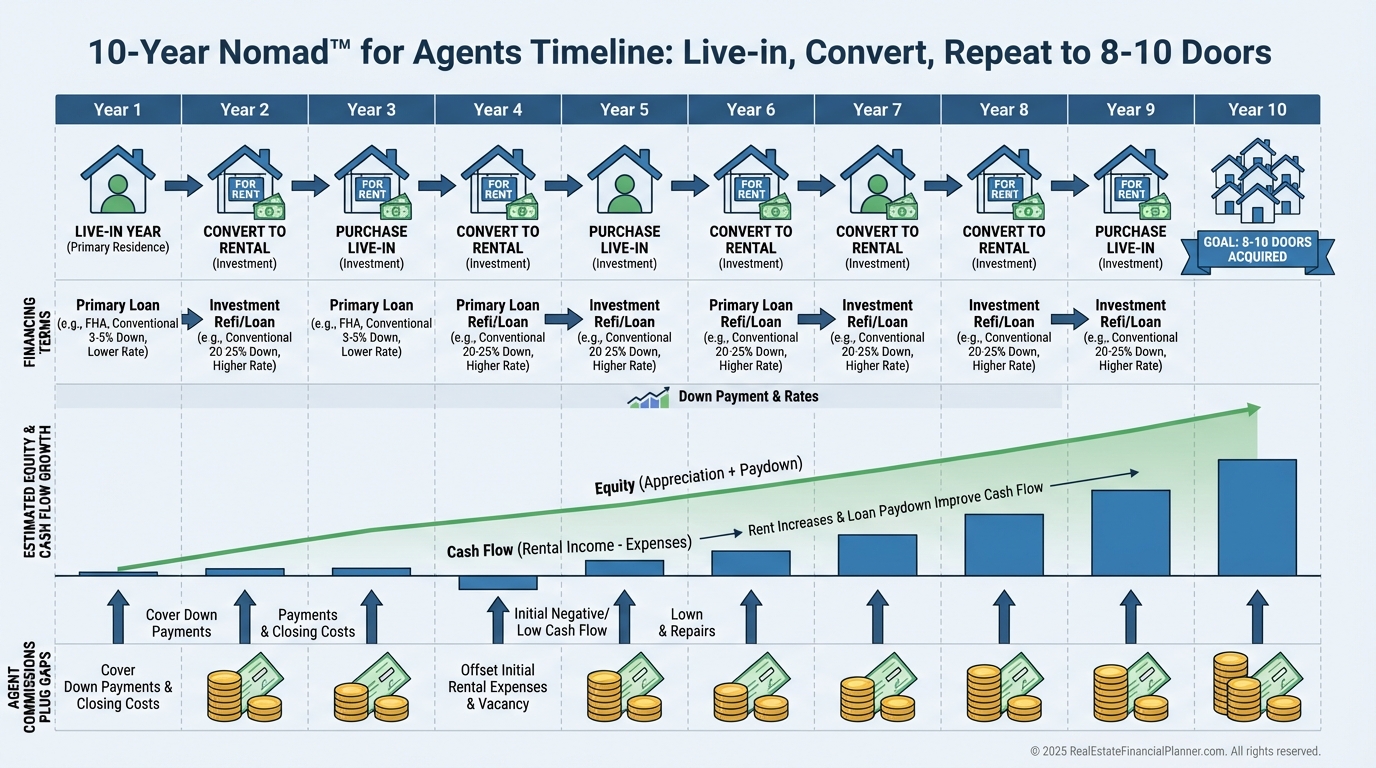

Nomad™ for Agents: Simple, Repeatable, Powerful

Nomad™ means you buy as an owner-occupant, live there a year, convert to a rental, and repeat.

Owner-occupant financing plus your commission creates a supercharged accumulation plan without heroic saving.

When I rebuilt after a rough year early in my career, I returned to this simple cadence and eliminated the noise.

I set automated searches, moved once a year, and stacked properties with favorable terms and low down payments.

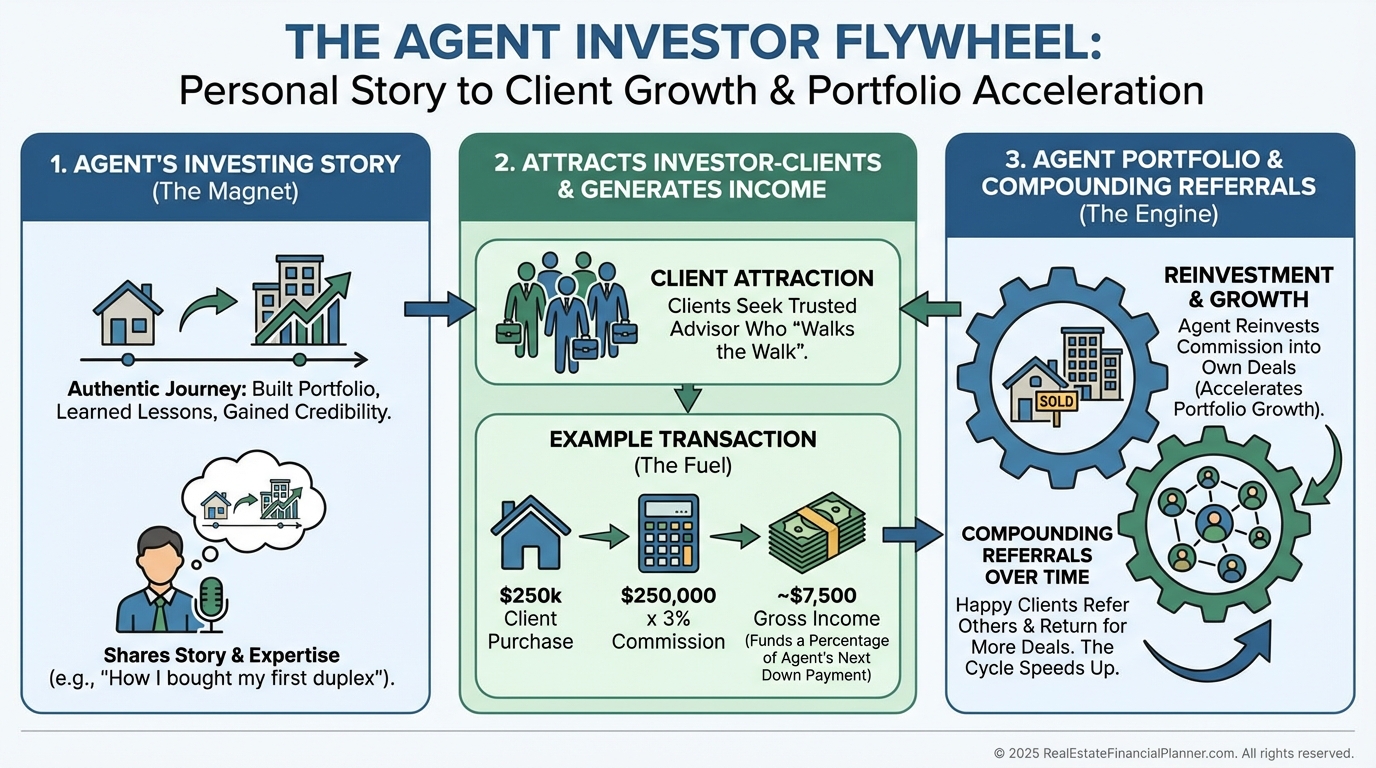

The Client Attraction Multiplier

When you can say “I’m doing this now” and show real numbers, at least one client will ask you to help them do the same.

That one client’s commission often covers a meaningful slice of your next down payment.

On a $250,000 client purchase at 3%, you earn roughly $7,500.

That can equal ~15% of a $50,000 down payment, and two clients can fully fund it.

Optimize Your Commission Strategy

I never guess whether a price reduction, closing credit, or rate buydown is best.

I model each scenario and let the numbers choose.

Price reductions compound through lower payments and better cash flow.

Rate buydowns can dominate if you’ll hold long-term and finance costs are high.

Visibility, Access, and Speed Are Your Edge

You see deals sooner, understand pricing faster, and control your transaction cadence.

That is unfair advantage if you treat it like a system, not a hobby.

Then we pair each profile with lender terms and a written negotiation plan so execution is repeatable.

Integrate The World’s Greatest Real Estate Deal Analysis Spreadsheet™

I add agent-specific fields for commission, split, taxes, and how I’ll deploy those dollars.

Then I run side-by-side scenarios for price reduction vs credit vs buydown to compare five-, ten-, and twenty-year outcomes.

For clients, I flip to Presentation Mode with simplified inputs and real numbers from my portfolio.

It turns skepticism into momentum because they see what I own and how it performs.

Model What Actually Drives Wealth: Return Quadrants™ and True Net Equity™

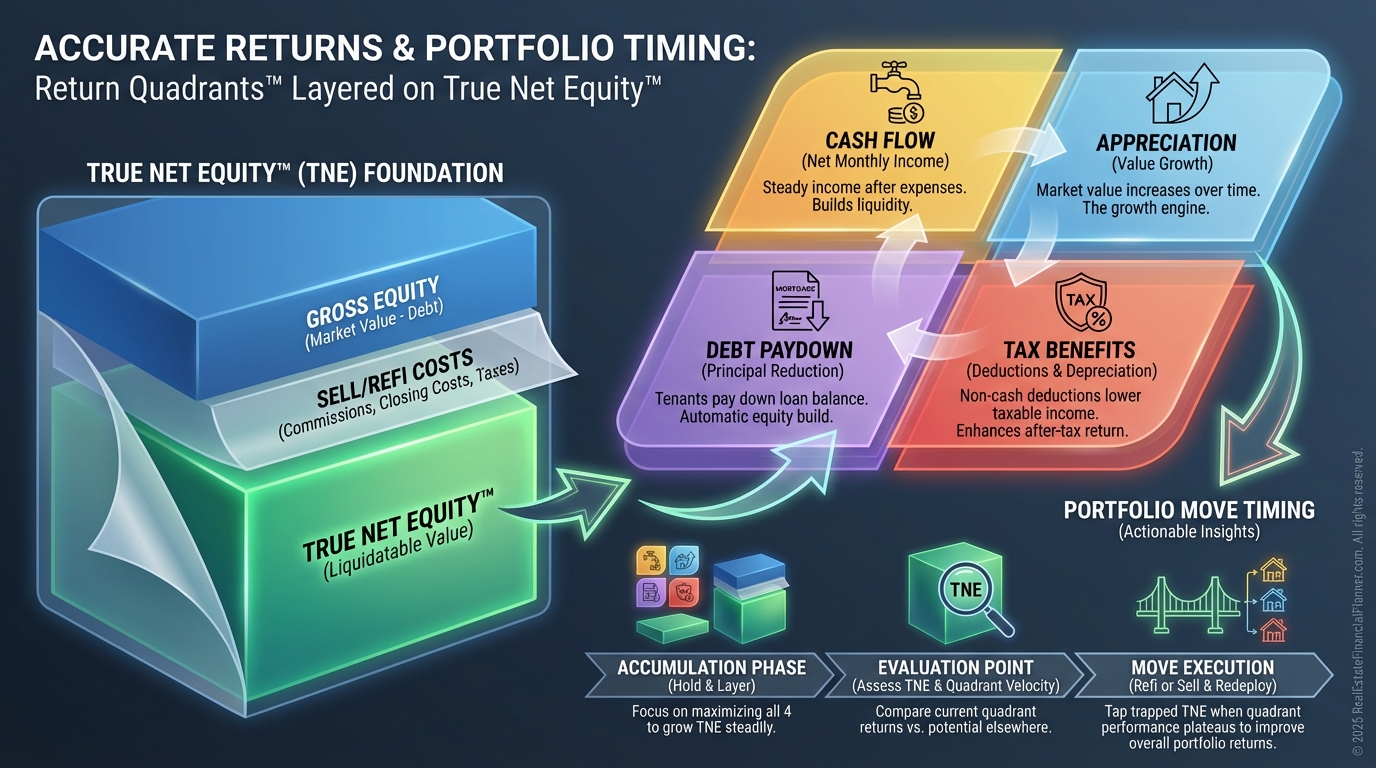

I teach agents to evaluate all four Return Quadrants™: cash flow, appreciation, debt paydown, and tax benefits.

We compare those returns against True Net Equity™ so we’re measuring yields on equity you could actually access after costs to sell or refinance.

This prevents the common trap of celebrating “paper equity” that can’t fund the next down payment.

When the return on True Net Equity™ drops, I consider a 1031, a sell-and-upgrade, or a rate/term refi.

Build While You Serve: Content and Credibility

Every clean turn, repair ticket, and lease-up is content that educates your sphere.

When I walk units on turnover day, I record short clips and capture before/after photos with rent deltas and maintenance notes.

I disclose my ownership when relevant and share the actual numbers.

That transparency builds trust and produces steady inbound investor leads.

The Self-Funding Retirement System

Year 1, buy your first Nomad™ home, learn landlording, and document everything.

Year 2, your first investor client often appears and their commission funds most of your next down payment.

By Year 4 or 5, well-selected rentals can cover basic living expenses.

From then on, commissions become pure acquisition fuel and the flywheel accelerates.

Advanced Plays When You’re Ready

House hack a small multi so the other units cover the mortgage while your commission reduces cash-in.

Use your agent access to find off-market value-add deals that still comp.

Partner with capital-rich clients where you bring sourcing, analysis, and management for an equity split.

Once your plate is full, build a team that handles transactions while you focus on portfolio growth.

Pitfalls I Help Agents Avoid

Over-leveraging because money is “easy” is how good plans unwind.

I also keep strict ethical walls between my purchases and client opportunities, with full disclosure if interests overlap.

Your reputation is worth more than any single door.

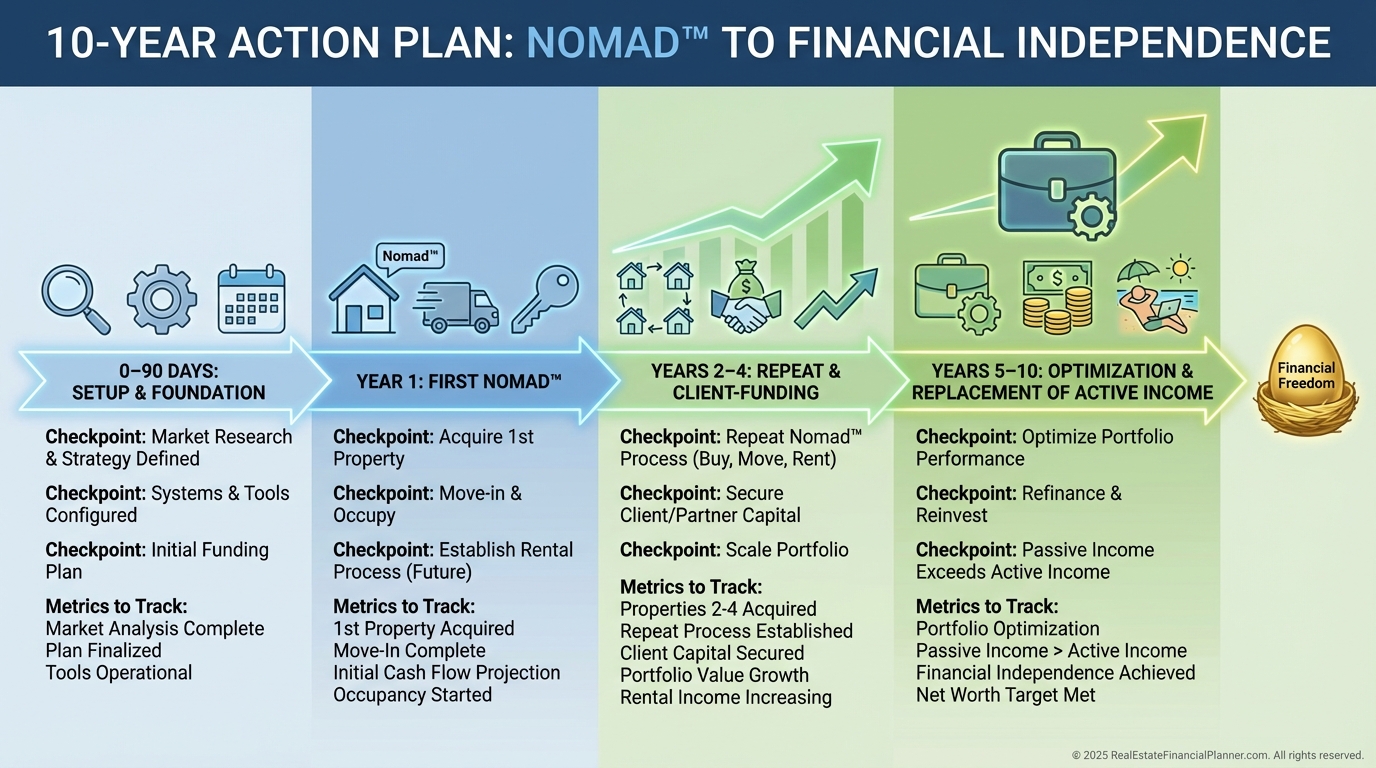

Your 10-Year Action Plan

First 90 days, get pre-approved, analyze five deals a week, and write three offers.

First 12 months, close your first owner-occupant Nomad™, document the process, and host one investor workshop using your numbers.

Years 2–4, convert the first home to a rental, buy the next, and let client commissions fund down payments on schedule.

Years 5–10, prune underperformers using True Net Equity™, optimize loans, and keep stacking properties until passive income replaces active commissions.

When you combine your license, Nomad™, disciplined analysis, and clear ethics, the retirement plan funds itself while you serve clients.

Start with one home and one honest case study, and let the data invite the next client who helps pay for the next door.

That is the Ultimate Real Estate Agent Retirement Plan™ in practice.