REOs Decoded: The Bank-Owned Buying System Professionals Use for 10–30% Discounts

Learn about REOs for real estate investing.

Most investors scroll past bank-owned listings and leave 10–30% discounts for someone else.

When I help clients run the numbers with The World’s Greatest Real Estate Deal Analysis Spreadsheet™, the confusion turns into clarity fast.

Banks aren’t in the property business. They’re motivated to sell, and their timelines can be your edge—if you know how their system works.

What Are REOs? The Reality Behind “Bank-Owned”

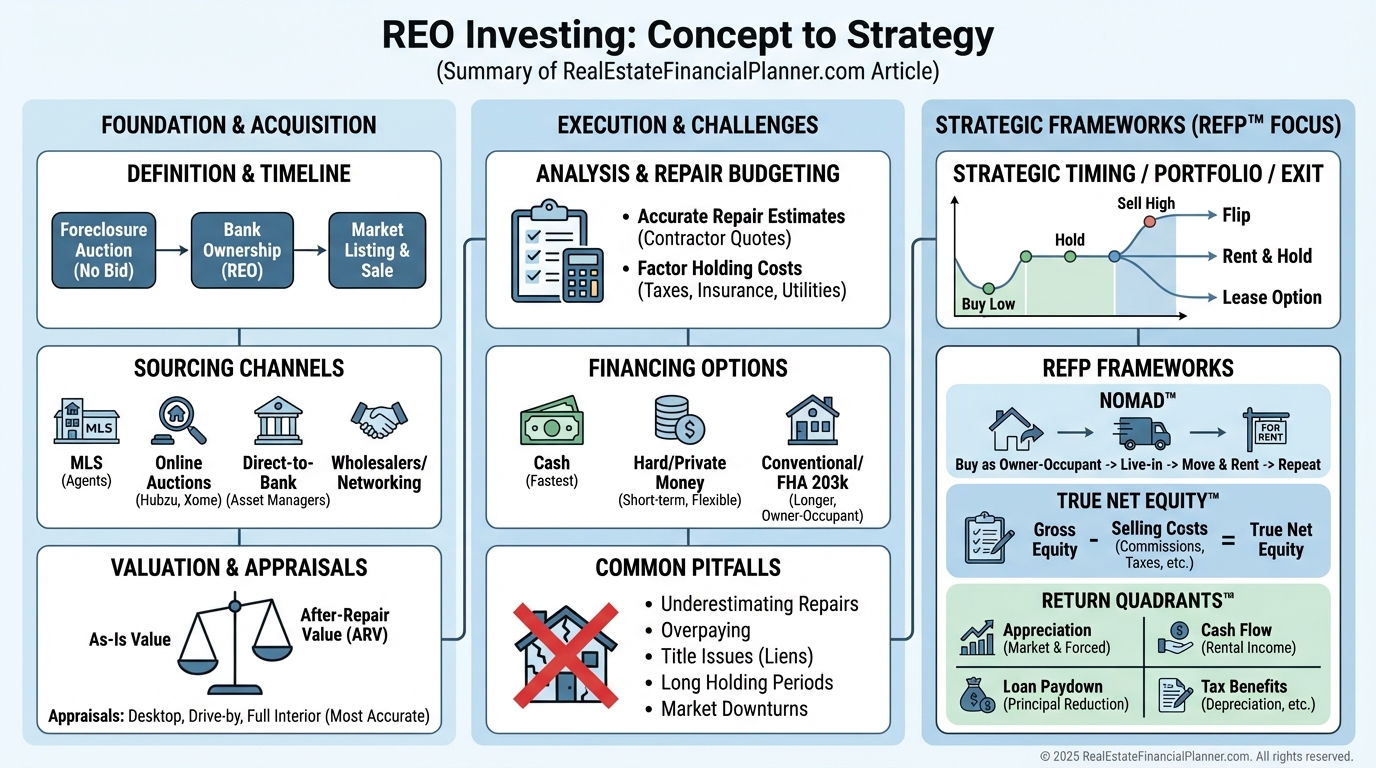

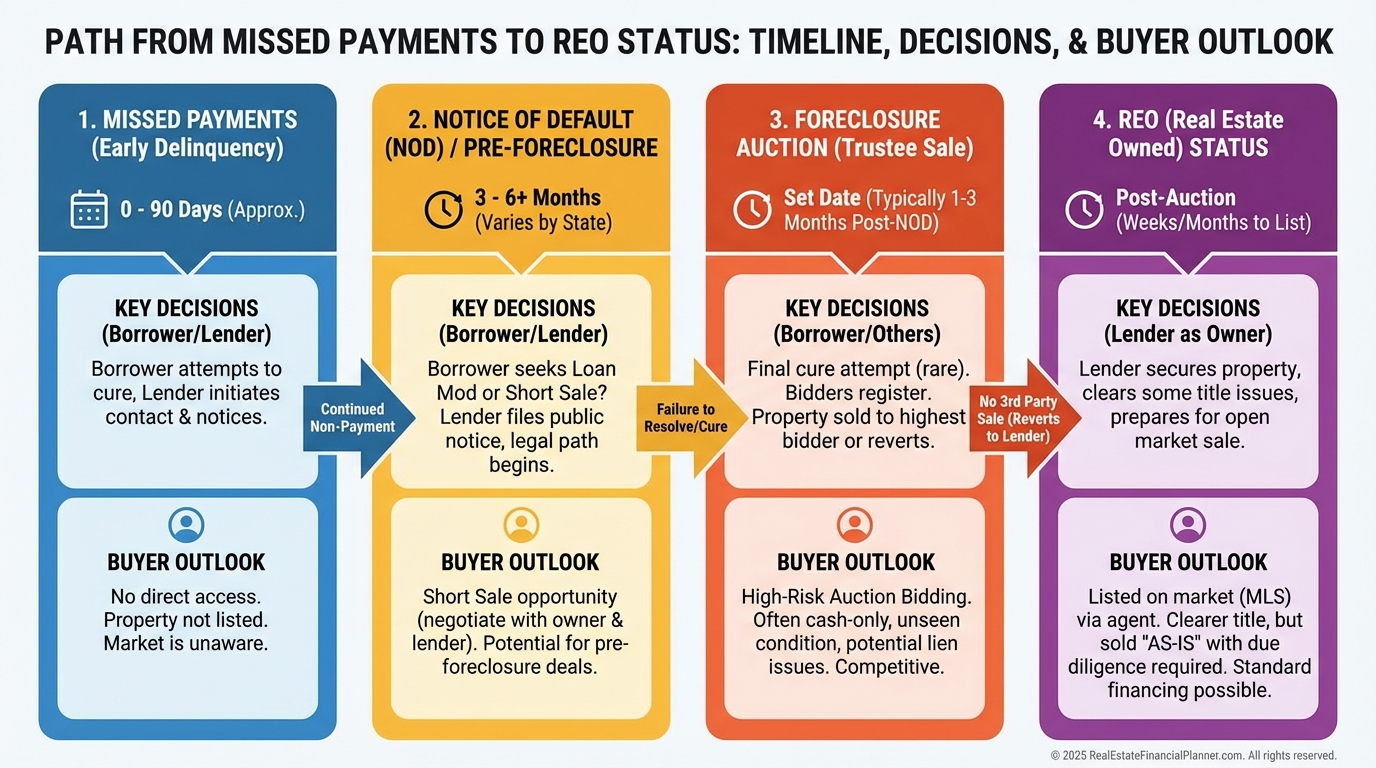

REO stands for Real Estate Owned—properties the lender took back after a failed foreclosure auction.

The sequence is predictable: missed payments, legal foreclosure, courthouse auction, then back to the bank when minimums aren’t met.

Why this matters to you is simple. The bank is now a motivated but procedural seller whose decisions are driven by timelines, reporting, and carrying costs.

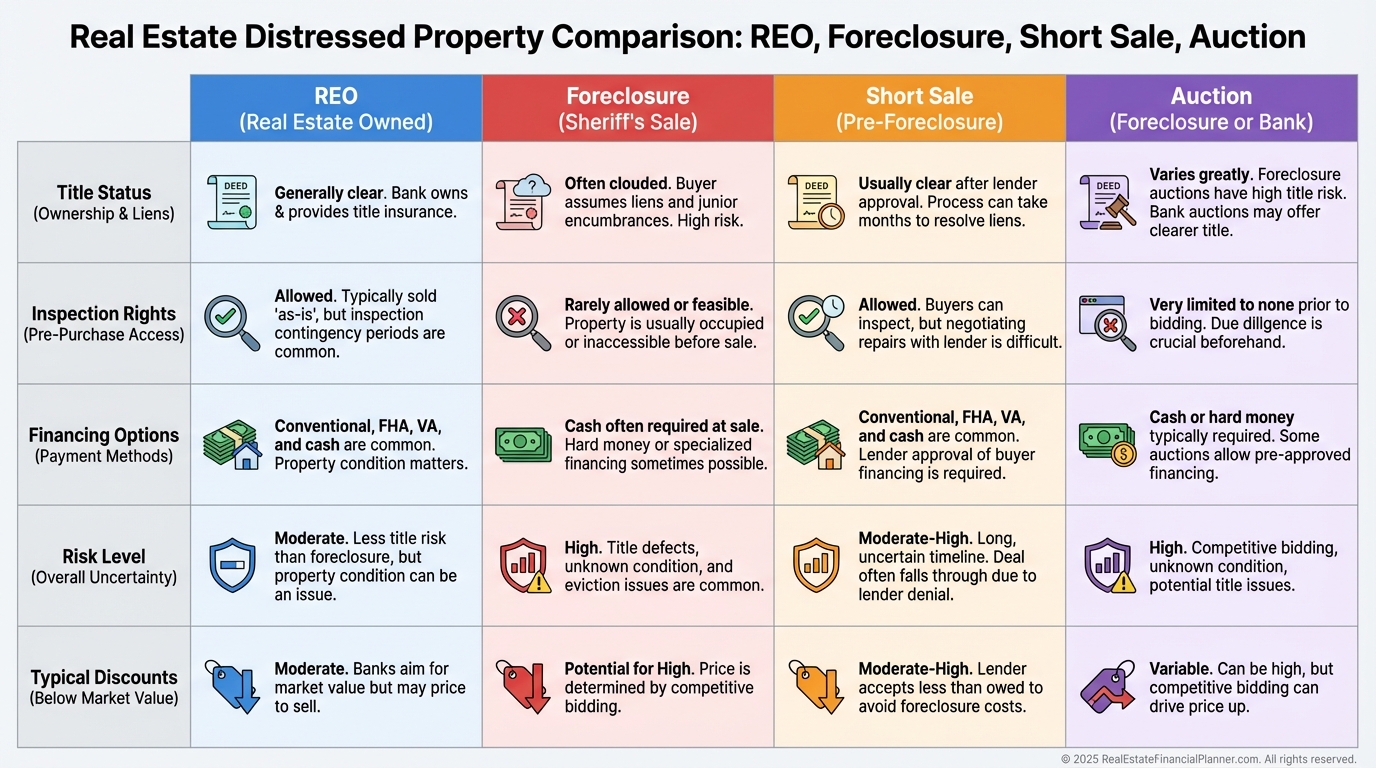

I teach clients to stop conflating terms that look similar but behave very differently at the closing table.

Foreclosures are still in process. Short sales are owner-held and lender-approved. Auctions often require cash and accept risk. REOs are bank-owned and sell through traditional closings with clear title.

Where the Deals Hide: Sourcing Bank-Owned Inventory

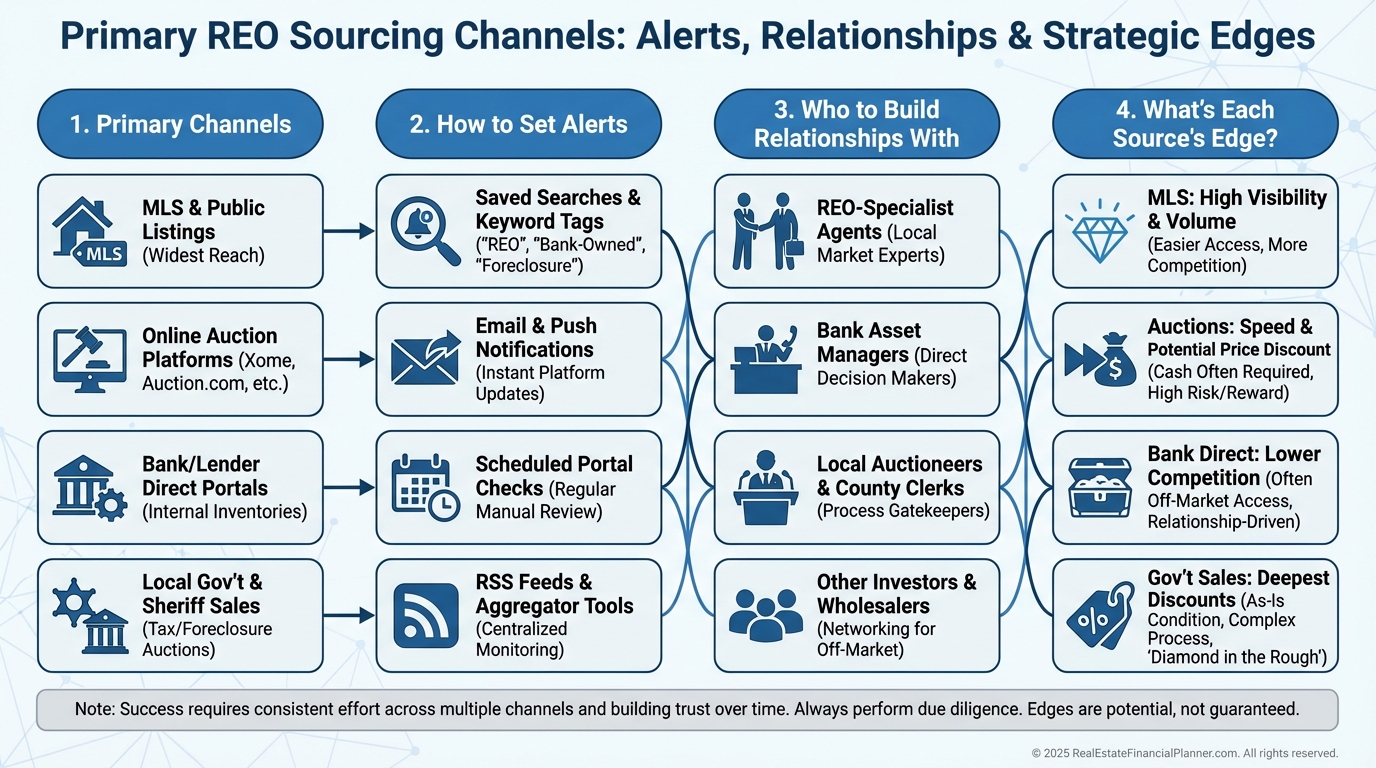

I set clients up with multi-channel alerts because no single source catches everything.

Start with bank portals for major lenders. Some listings show up there before the MLS.

Asset managers are powerful gatekeepers. When I consistently close cleanly, they circulate pocket opportunities my way.

The MLS still matters. Use keywords like “REO,” “bank-owned,” and “corporate owner,” then save the search and get instant alerts.

Don’t overlook government sellers like HUD, Fannie Mae HomePath, and Freddie Mac HomeSteps. They often publish incentives and allow renovation loans.

If you’re willing to owner-occupy for a year (Nomad™), HUD’s owner-occupant first-look can be a quiet competitive advantage.

How I Analyze REOs So We Don’t Overpay

REOs require slightly different assumptions than retail buys, and that’s where investors either win or bleed out.

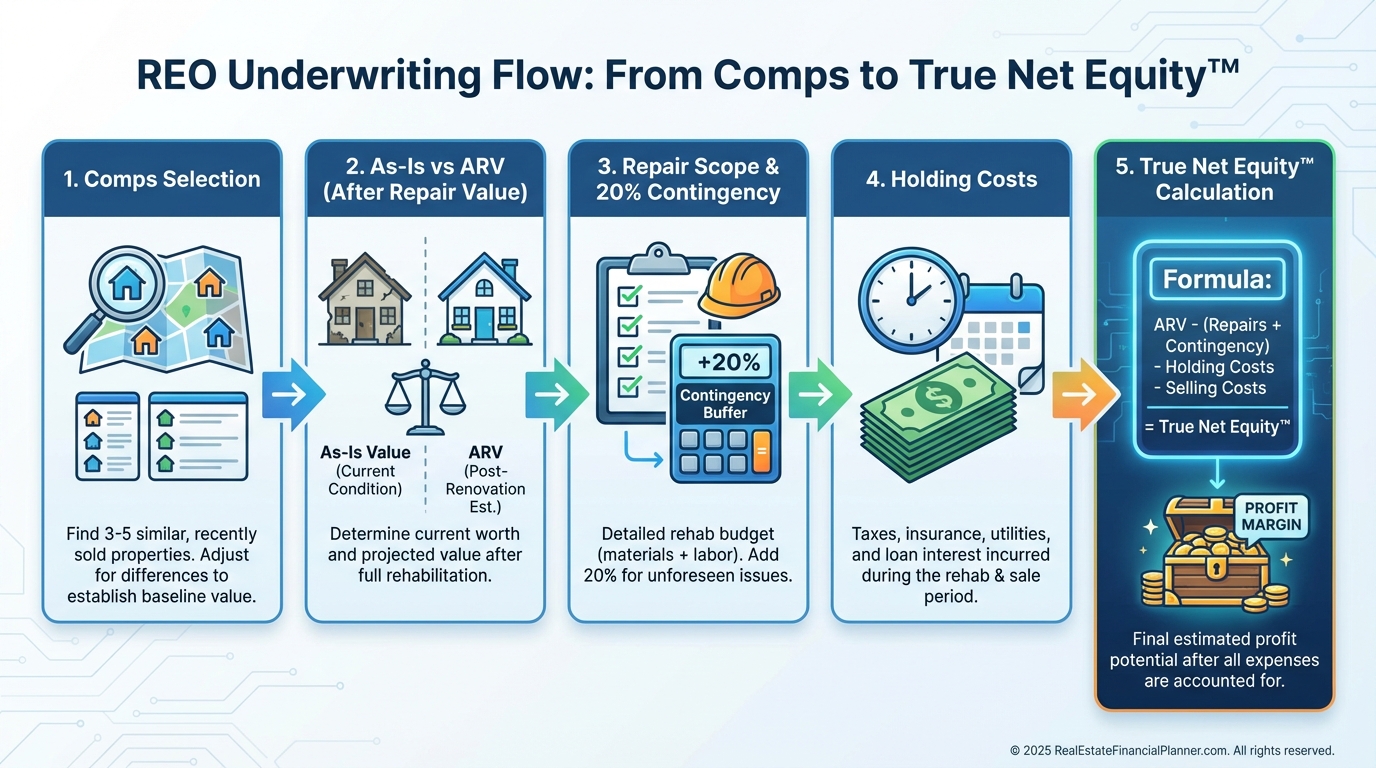

Step one: price the asset as-is, not as-hoped. I anchor comps with other distressed or REO sales, not retail flips.

Step two: build a repair budget that reflects vacancy damage. I add a 20% contingency because I expect to find the thing we didn’t find.

Step three: model holding costs properly. Vacant utilities, insurance, taxes, HOA arrears, and city fees can surprise you if they’re not in the spreadsheet.

Step four: use Days on Market strategically. Banks tend to soften after 60–90 days and especially at quarter-end.

When I rebuilt after bankruptcy, I bought a tired HUD duplex and used a renovation loan to combine purchase and repairs. The budget was honest, the numbers were conservative, and the deal still penciled.

I run True Net Equity™ before I write an offer. That means ARV minus selling costs, minus remaining repairs and make-ready, minus payoff and closing costs—what you’d actually keep if you had to sell right after stabilizing.

Example:

•

Listed at $180,000.

•

ARV from renovated comps: $225,000.

•

Repairs: $28,000 plus 20% contingency = $33,600.

•

Closing + holding: $8,400.

•

Target profit cushion: $25,000.

I’d write around $158,000. If the bank counters to $165,000 but covers some arrears, we still hit our Return Quadrants™ targets for cash flow, appreciation, debt paydown, and tax benefits.

Valuations, Appraisals, and Neighborhood Effects

Appraisers often need “as-is” reports for distressed assets. I order pre-offer opinions when margin is tight.

REO clusters can depress area values short-term. That’s a risk if you need an appraisal to hit a number today.

It’s also an opportunity. If you can renovate the worst three houses on the block, you can reset comps for the next appraisal.

When I see five or more distressed sales within a few blocks, I map a six- to nine-month stabilization plan and coordinate contractors to stage the improvements.

I measure progress through Return Quadrants™ so clients see more than just cash flow. Debt paydown and forced appreciation often dwarf month-one income.

Financing REOs Without Losing the Deal

Banks love certainty. Give them a fast, clean closing, and you’ll win more offers—even with financing.

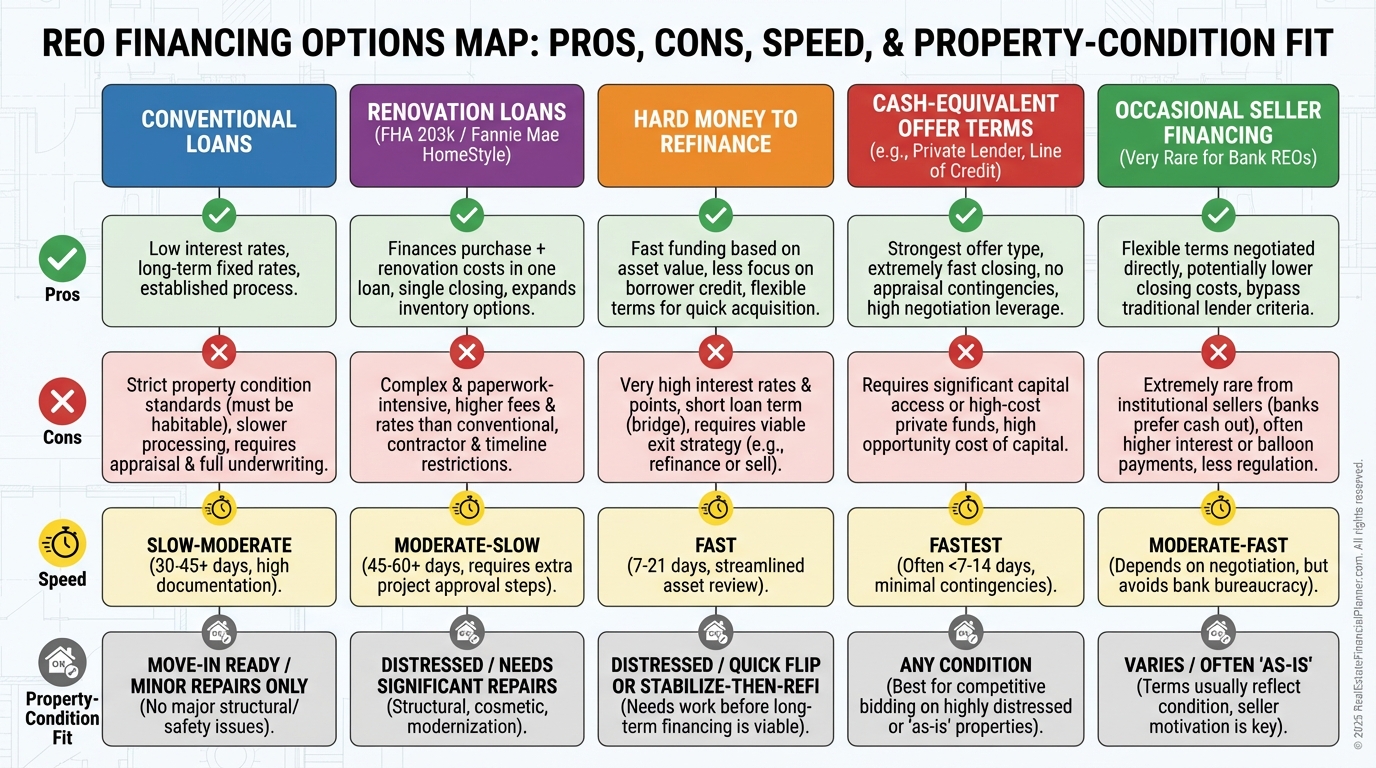

Conventional loans work if the property meets minimum standards. If not, pivot.

Renovation loans like FHA 203(k) and Fannie Mae HomeStyle can fund purchase plus repairs in one note. That levels the playing field with cash buyers.

Hard money can bridge you to a refinance. Just model the higher carrying costs and rate risk in the spreadsheet.

If you’re using financing, mimic cash. Shorten timelines after appraisal and underwriting, tighten contingencies, and show strong proof of funds for down payment and reserves.

On aged inventory, I’ve negotiated seller financing with small banks that wanted the carrying costs gone by quarter-end.

Common REO Mistakes I See Weekly

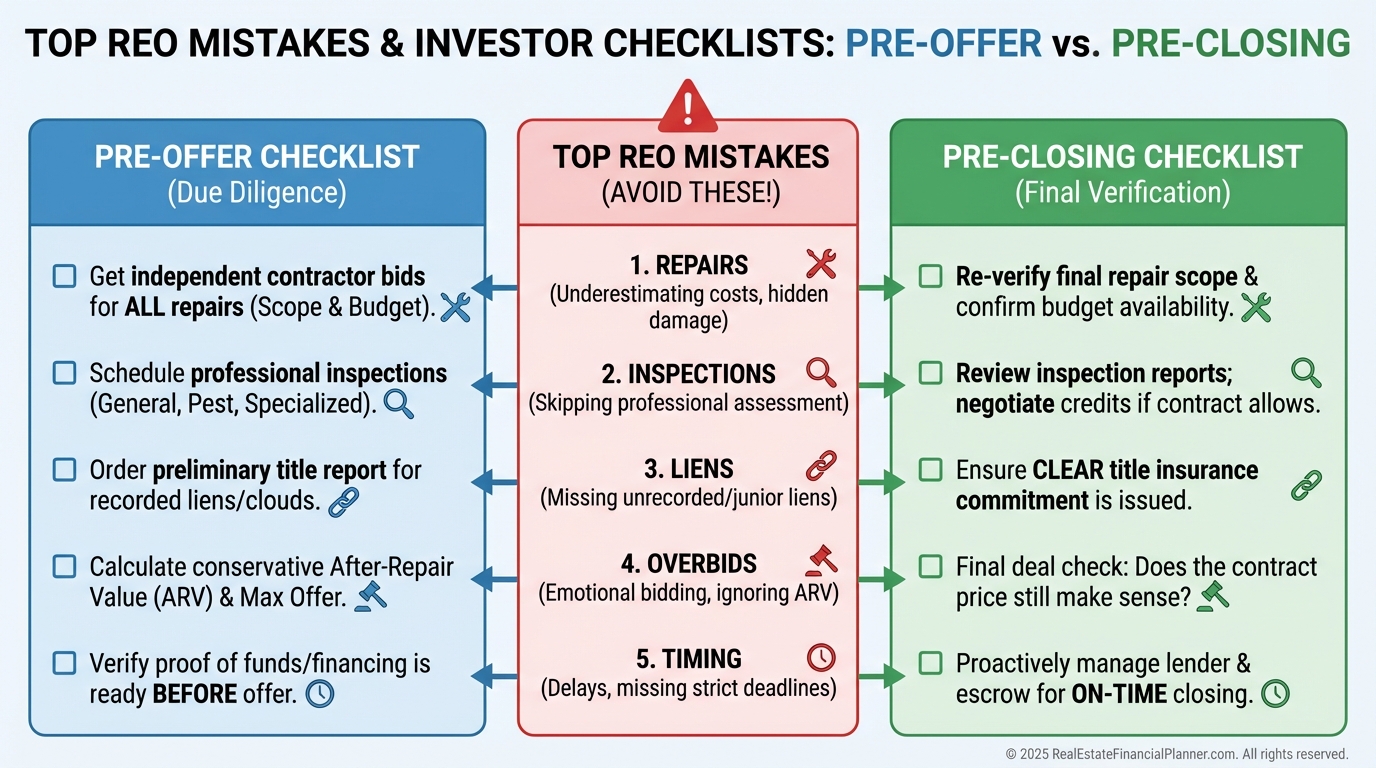

Underestimating repairs. Vacant houses breed hidden problems—freeze damage, mold, theft of copper and HVAC.

Skipping inspections. “As-is” means the bank won’t fix it, not that you can’t look.

Ignoring carrying and back charges. Always check taxes, liens, HOA estoppels, utilities, fines, and permits.

Overbidding in a frenzy. I set a walk-away price and stick to it, even if it means losing the house.

Assuming foreclosure cleared everything. IRS liens and some municipal obligations can survive. Buy title insurance and read the prelim carefully.

Timing blind spots. Banks get flexible near quarter-end and year-end. Winter can mean less competition and more water damage—plan accordingly.

Strategic Uses: Timing, Portfolio Design, and Exit Plans

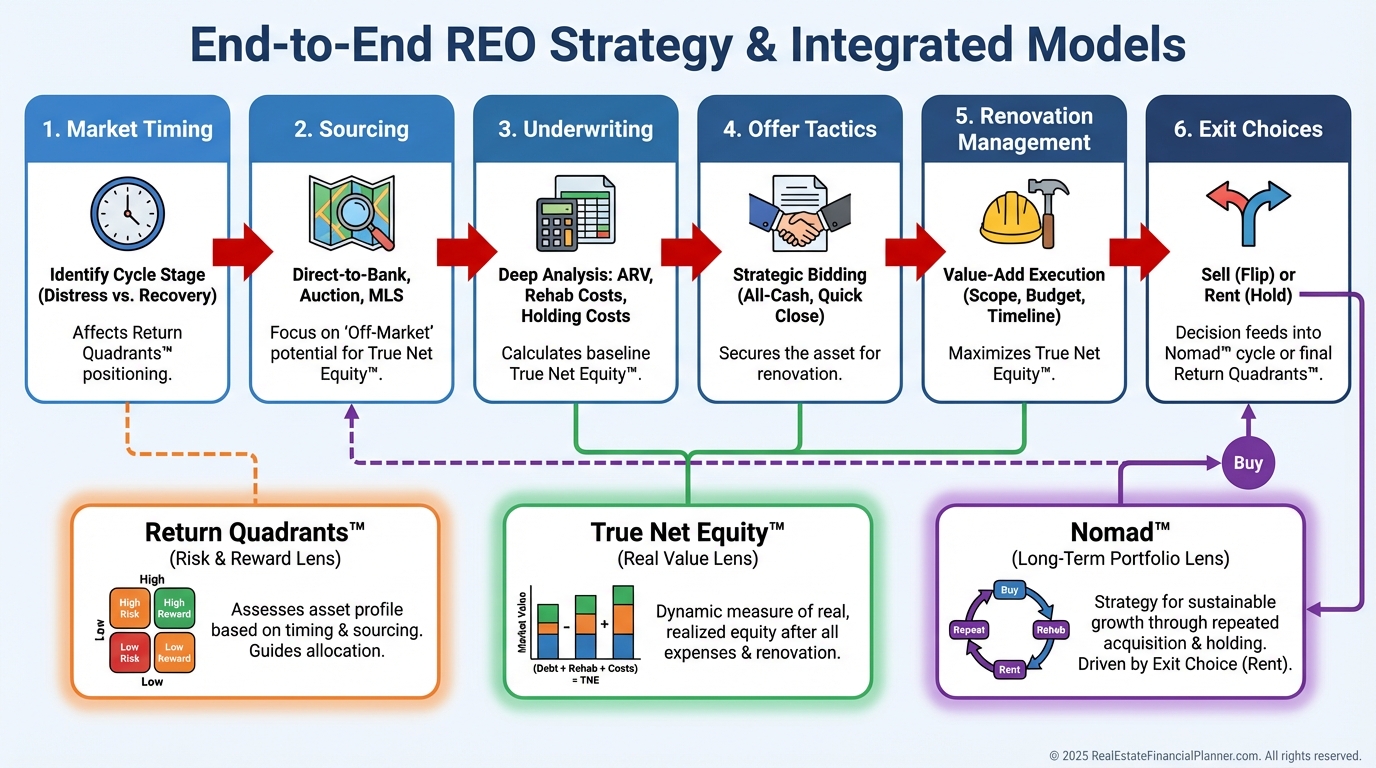

REO inventory grows 12–18 months after economic shocks. I advise clients to line up capital and lending relationships before the wave hits.

Seasonally, March–June brings inventory and competition. November–February brings fewer buyers and more negotiation.

Quarter-ends matter. The last 2–3 weeks of Q1, Q2, Q3, and especially Q4 are prime for price adjustments.

Pick a lane for portfolio design. Geographic concentration helps you own the comps. Property-type specialization sharpens your renovation and rent predictions.

For exits, match the play to the market.

•

Quick turn: light cosmetic work in strong demand pockets.

•

Buy and hold: stabilize, refinance, and harvest Return Quadrants™ over time.

•

Wholesale: assign contracts that don’t fit your box but fit someone else’s.

Nomad™ can be powerful here. Live in the property for a year with low-down, renovate with a 203(k), then convert to a long-term rental and repeat.

I track every project’s True Net Equity™ at stabilization so we know whether to sell, refi, or hold.

Your Next Three Moves

Set alerts on major bank portals and government sites for your target property types.

Interview two to three REO-savvy agents and one local asset manager contact; choose based on responsiveness and close-rate history.

Get pre-approval letters ready for both conventional and renovation loans, plus a hard-money backup. Speed wins.

Then run your first three opportunities through The World’s Greatest Real Estate Deal Analysis Spreadsheet™ with conservative ARVs, a 20% repair contingency, and a realistic timeline.

Make one offer this week. Learn, adjust, and write a better offer next week.

The investors who master this system don’t need perfect markets. They need a repeatable process and the discipline to stick to it.