Multifamily Properties: How Pros Analyze, Finance, and Scale (Without the Single‑Family Trap)

Learn about Multifamily Properties for real estate investing.

The Single-Family Trap (And How to Avoid It)

When I help clients transition from single-family to small apartments, the first thing I do is erase the comp mindset from the whiteboard.

Multifamily lives and dies by income, not “what the neighbor’s house sold for.”

I watched a client overpay on a fourplex years ago by applying the 1% rule instead of the income approach.

It saved me from expensive “looks good on paper” deals that would have bled cash.

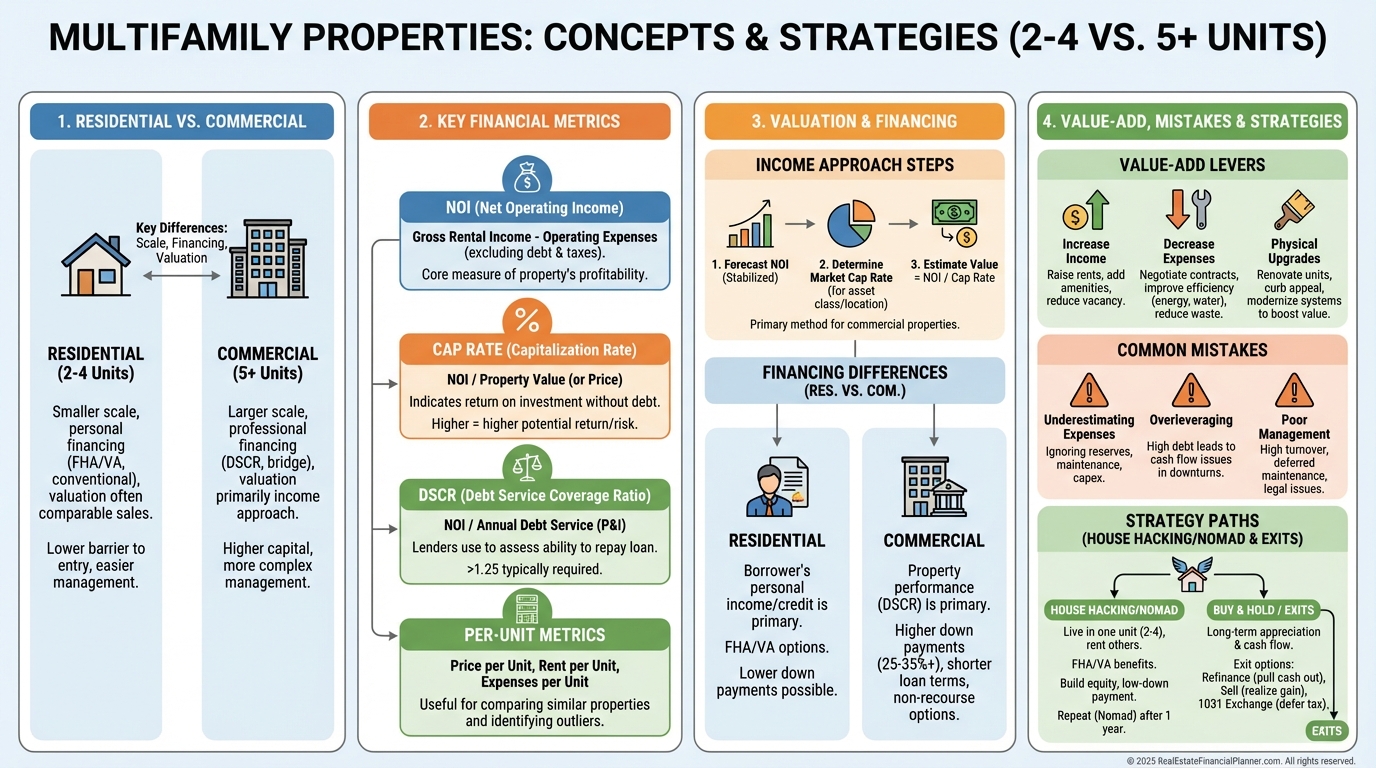

What Counts as Multifamily (And Why 5 Units Changes Everything)

A multifamily property is any residential building with two or more legally separate units.

Each unit needs its own kitchen, bathroom, and entrance.

That’s the simple definition.

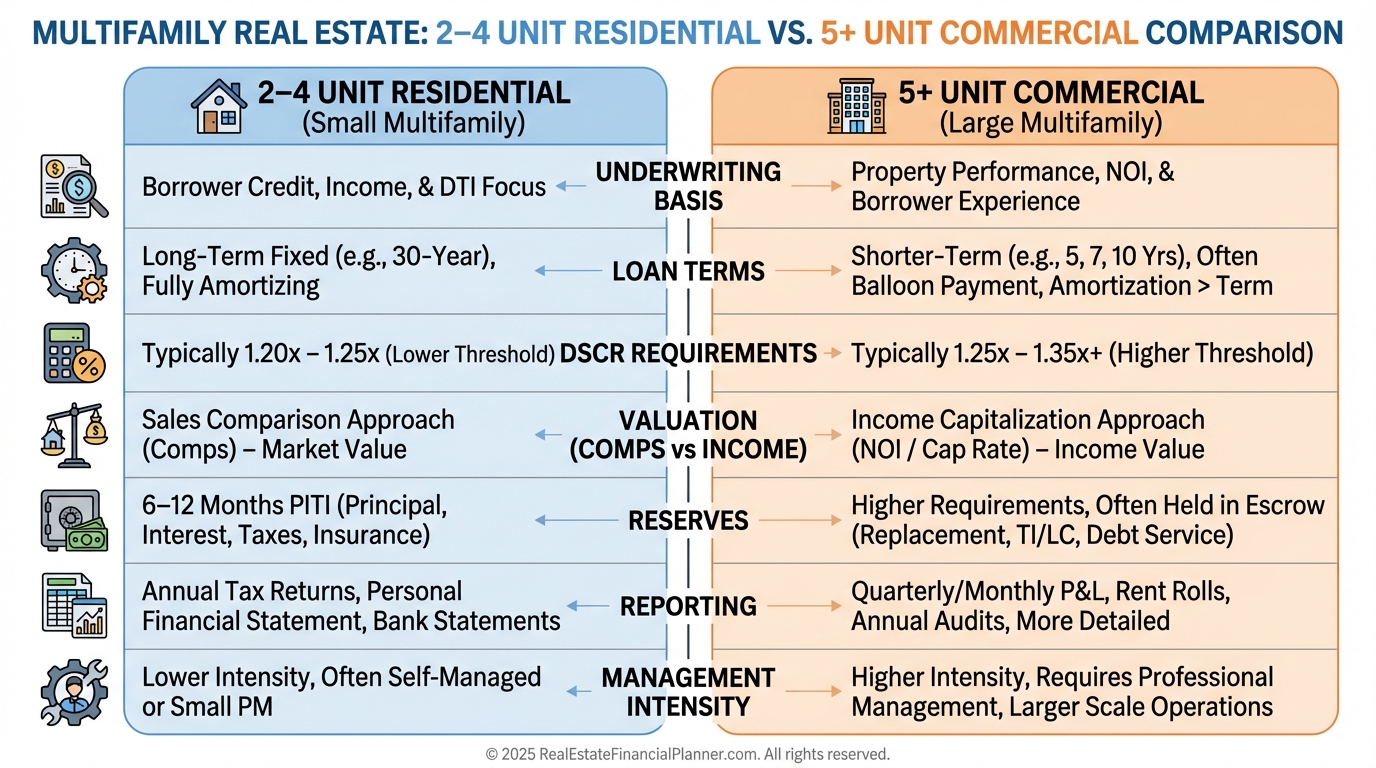

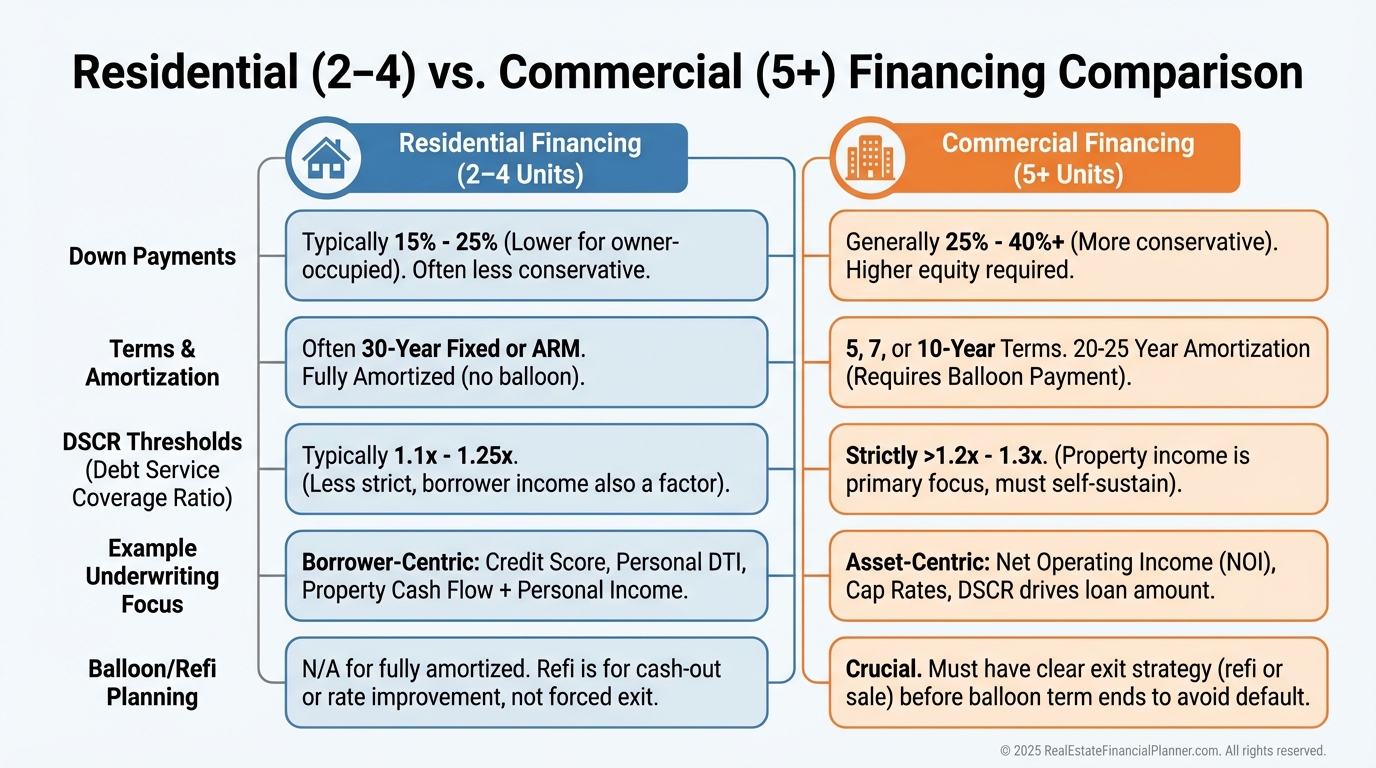

The important definition is regulatory: 2–4 units are residential, and 5+ units are commercial.

Residential multifamily (2–4 units) keeps you in the world of 30‑year fixed loans, owner‑occupant options, and personal income underwriting.

Commercial multifamily (5+ units) shifts everything to property income, DSCR, and shorter terms with balloons.

A fourplex and a five‑unit building can look similar on a drive‑by.

But in underwriting, they behave like different species.

Types of Multifamily Properties

Duplex (2 units) is the on‑ramp.

It’s where many Nomad investors start house hacking with minimal down and immediate training‑wheels management.

With residential financing, it’s still accessible.

Fourplex (4 units) is the capstone of residential lending.

It’s often the most efficient use of limited investor loan slots, with the most income under 30‑year terms.

Small apartments (5–20 units) sit in the “too small for institutions, too big for amateurs” gap.

Prepared investors who underwrite like pros can extract serious value here.

The Metrics That Actually Drive Multifamily Outcomes

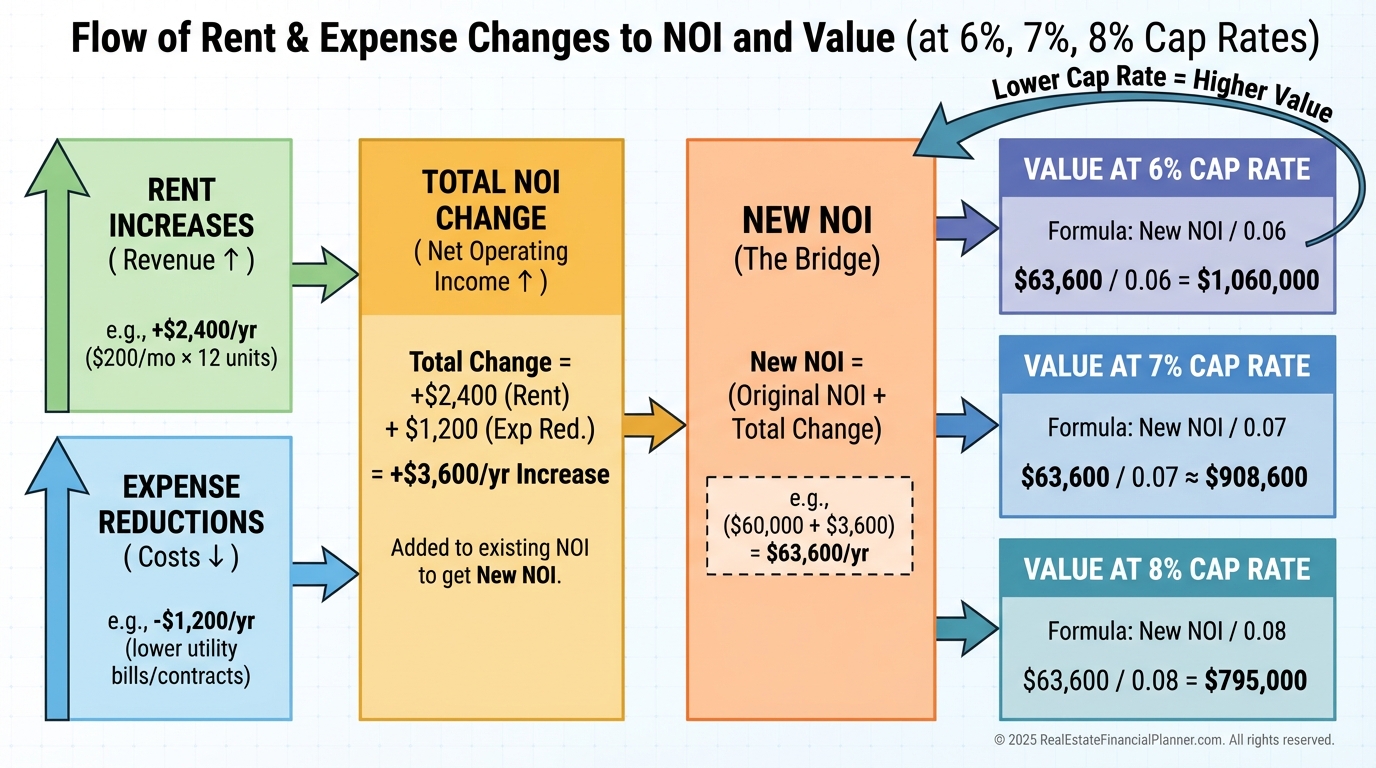

NOI is your north star.

Cap rate translates NOI to value.

At a 7% cap, every $1 of NOI is worth about $14.29 in value.

The DSCR answers a lender’s first question: can this building pay its own loan?

I require 1.25x in my models, even if the lender allows 1.20x, because margin of safety matters.

When I review deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I don’t stop at “it cash flows.”

I stress test for vacancy, cap rate expansion, and rate shocks before I green‑light offers.

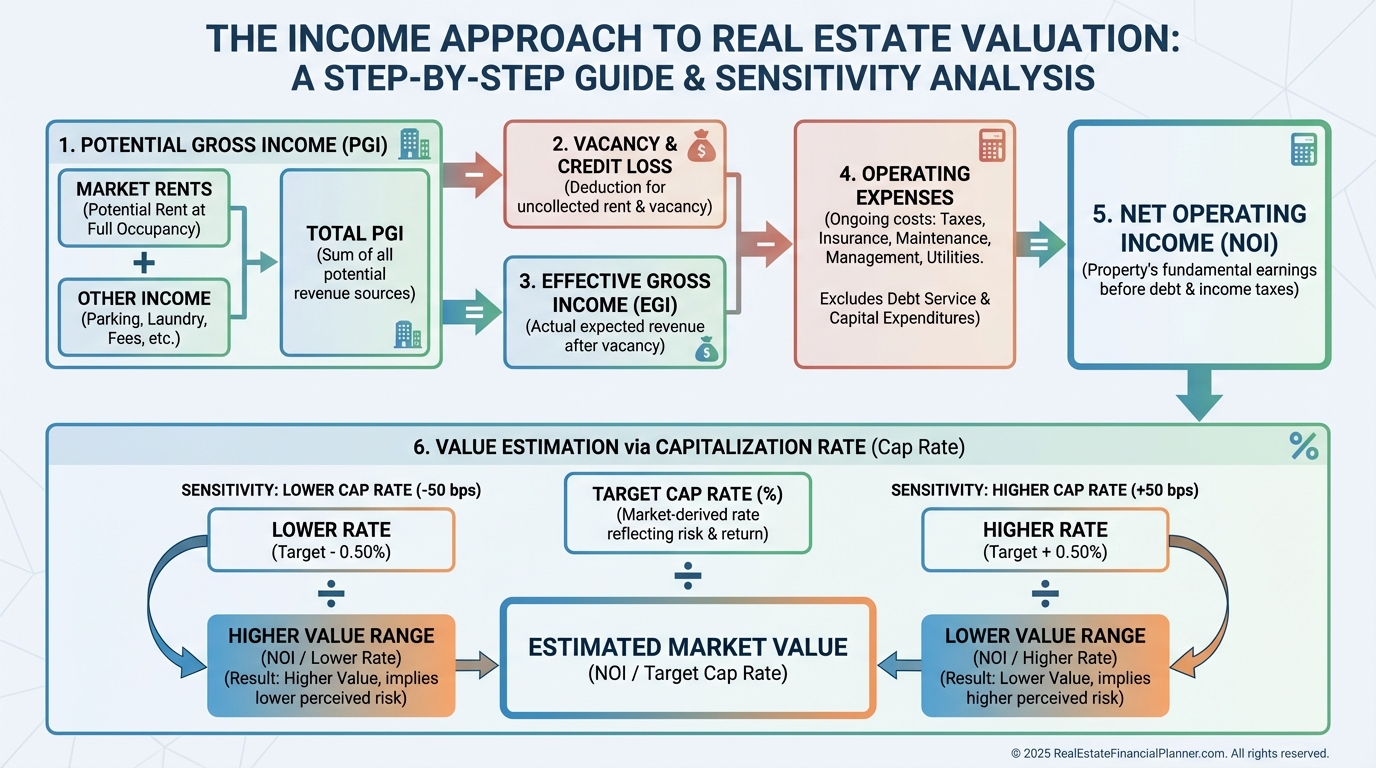

Analyze Multifamily Like a Professional

The income approach is simple to write and easy to get wrong.

Value = NOI ÷ Cap Rate.

Miss NOI or cap selection, and you miss value by tens of thousands.

Start with market rent, not in‑place rent.

If current rents are low, that’s value‑add, not wishful thinking—document it.

Add other income.

Laundry, parking, pet fees, storage, RUBS, and utility bill‑backs are real line items.

Apply realistic vacancy.

Use market data, not optimism.

Calculate effective gross income.

Then subtract operating expenses.

Older properties often run 40–50% of gross.

Finally, you have NOI.

Price the deal with your market cap rate range, not a single point.

I model value at the market cap, plus 50 bps and minus 50 bps, so we see upside and downside.

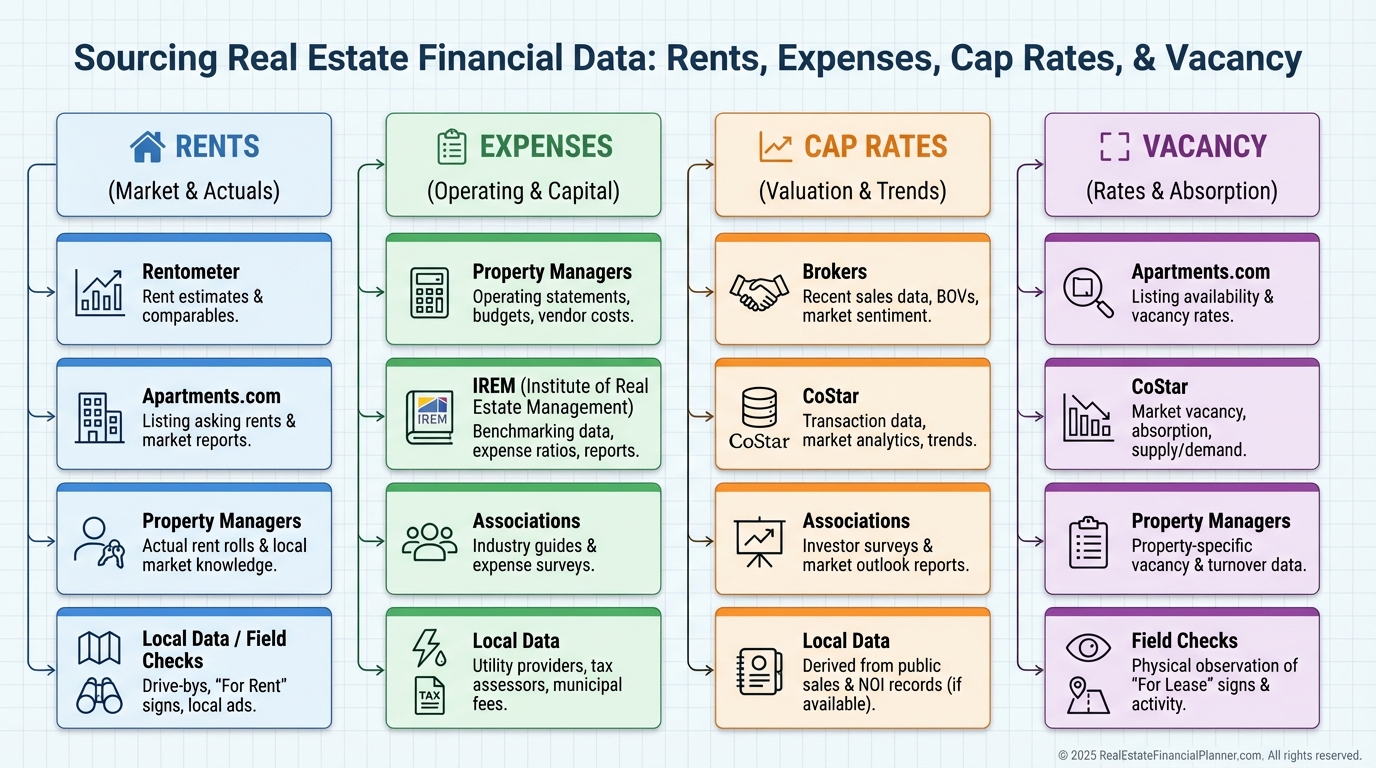

Where I Pull Numbers (So the Math Tells the Truth)

For rent comps, I triangulate Rentometer, Apartments.com, and actual manager quotes.

If two sources agree and a property manager disagrees, I ask why.

For expenses, I use IREM benchmarks, local owner cohorts, and manager pro formas.

If a seller shows 28% expenses on a 1960s building, I assume missing line items until proven otherwise.

For cap rates, I call three active commercial brokers and ask for closed deals, not listings.

CoStar is great if you have access.

LoopNet asking caps run hot—discount them.

Vacancy comes from apartment associations, city data, and windshield surveys.

I still drive the neighborhood counting “For Rent” signs.

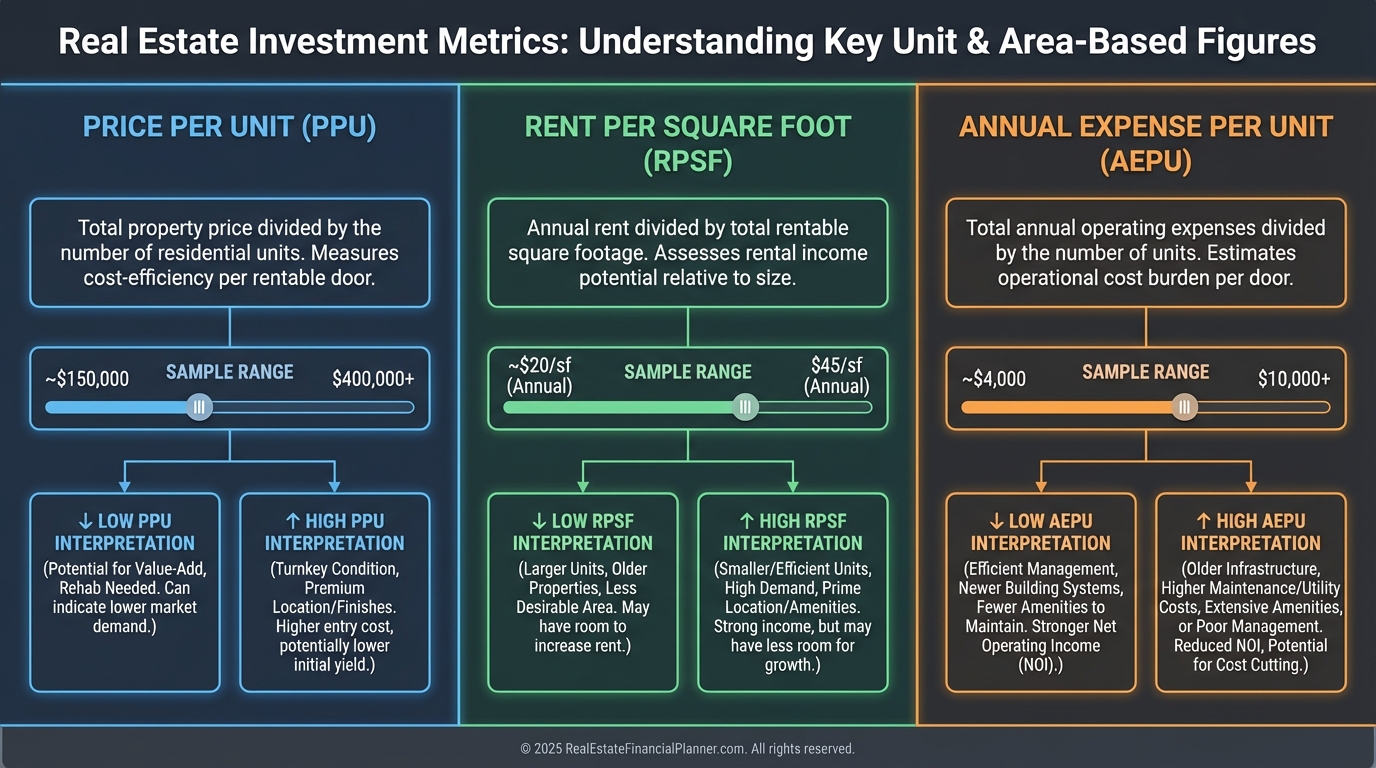

Per‑Unit Shortcuts That Catch Problems Fast

Price per unit lets you compare across listings quickly.

It’s a flag, not a valuation.

Rent per square foot exposes underperforming layouts or unit mixes.

Annual expense per unit benchmarks operational health.

If your target is 50% higher than peers, expect deferred maintenance or sloppy management.

Financing and Valuation Transform at Five Units

For 2–4 units, conventional loans want 20–25% down for non‑owner occupants.

Lenders usually count 75% of rent toward your qualifying income.

Owner‑occupants can use FHA at 3.5% down or VA at 0% down and live in one unit.

For 5+ units, lenders care about the building’s DSCR, not your W‑2.

Expect 20–30% down, 5–10 year terms, 25–30 year amortization, and potential balloons.

Plan your refinance or exit the day you write the offer.

I model DSCR at current rates and at +200 bps.

If it breaks, I renegotiate or pass.

The Multiplication Effect That Builds Wealth Faster

Here’s why the pros graduate to multifamily.

Every $1 of sustainable NOI growth multiplies into value at the cap rate.

Raise rents by $50 on four units, and you’ve created $2,400 in annual NOI.

At a 7% cap, that’s about $34,286 in value.

Trim $100 per month in owner‑paid utilities, and you’ve created $17,143 in value.

You can’t do that with single-family comps.

In our Return Quadrants™ framework, these improvements push cash flow now and equity via forced appreciation.

When I review deals with clients, we also track True Net Equity™—the equity you could actually keep after selling costs, depreciation recapture, and capital gains.

Created value is real only when measured net of friction.

Common Errors That Quietly Kill Deals

Using gross rent multiplier as valuation.

It’s a screening tool, not a pricing tool.

Underestimating expenses.

On older buildings, I budget 40–50% unless detailed, verifiable records prove otherwise.

For roofs, HVACs, and water heaters, multiply by the number of units.

Deferred maintenance is not linear.

Self‑management overconfidence.

Four leases mean four renewal cycles, four sets of maintenance calls, and four opportunities for fair housing mistakes.

Good management often pays for itself in vacancy saved and rents achieved.

Thin reserves.

I hold six months of operating expenses plus $1,500–$2,000 per unit in maintenance reserves.

Vacancies cluster and furnaces fail in pairs.

Ignoring balloon risk.

If rates jump or caps expand at refinance, DSCR can fail.

Model cap rate expansion of 50–100 bps and a rate shock of +200 bps before you buy.

Strategy Paths That Accelerate Results

House hack your way up.

Live in a duplex, then a triplex, then a fourplex—stacking units while learning management with low down payments.

The Nomad™ approach adds a repeatable rhythm: buy owner‑occupied each year, live there 12 months, move, and keep as a rental.

You accumulate doors with better financing and lower risk.

Install RUBS where appropriate.

If utilities are owner‑paid, bill back a fair share by square footage or occupants.

Add storage, pet rent, and reserved parking.

These are small, durable increases to NOI.

Optimize unit mix over time.

In some submarkets, converting an oversized 1‑bed into an efficient 2‑bed is a material rent jump.

Document everything.

Sophisticated buyers pay for proven NOI, not stories.

Exit Options That Keep You in Control

Sell stabilized to another investor once you’ve improved NOI and tightened operations.

In the right markets, consider condo conversions after studying local rules and economics.

Offer seller financing to expand your buyer pool while creating an income stream and potential tax deferral.

Or refinance and hold.

With fixed debt and rising rents, time is your partner.

When I coach clients, we map exits before acquisition so we never negotiate from a corner.

Your Next Step

Pick a submarket and a building size.

Pull rents, expenses, cap rates, and vacancy from three sources each.

Underwrite five deals this week in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

Stress test DSCR and cap rates.

If the numbers hold and the story makes sense, write the offer.

The difference between amateurs and professionals in multifamily isn’t courage.

It’s underwriting.