Opportunity Zones: Tax-Smart Real Estate Investing Guide

Learn about Opportunity Zones for real estate investing.

Opportunity Zones, Right Now

When I help clients evaluate Opportunity Zones, I start with what’s true today—not brochure promises from 2018.

The program still offers powerful benefits, but the rules and timelines matter more than ever in 2025.

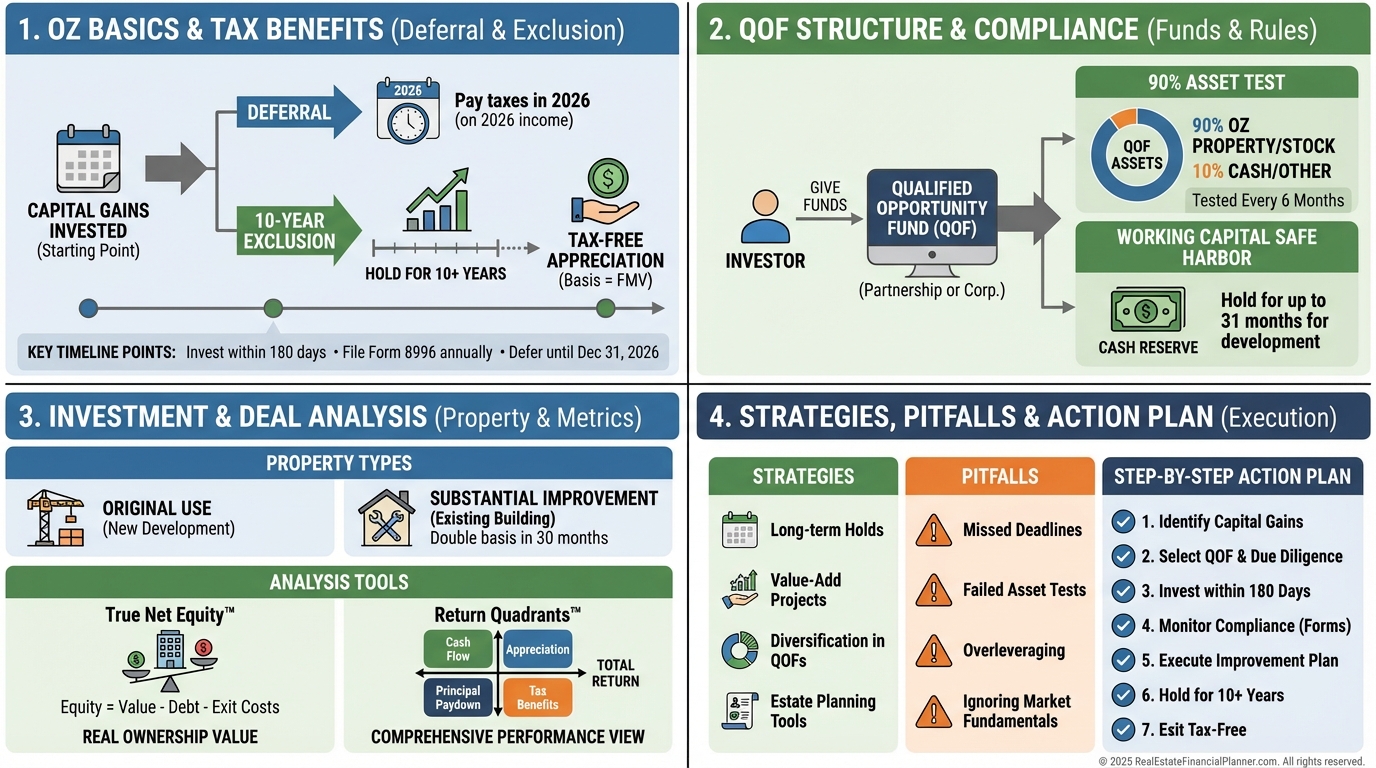

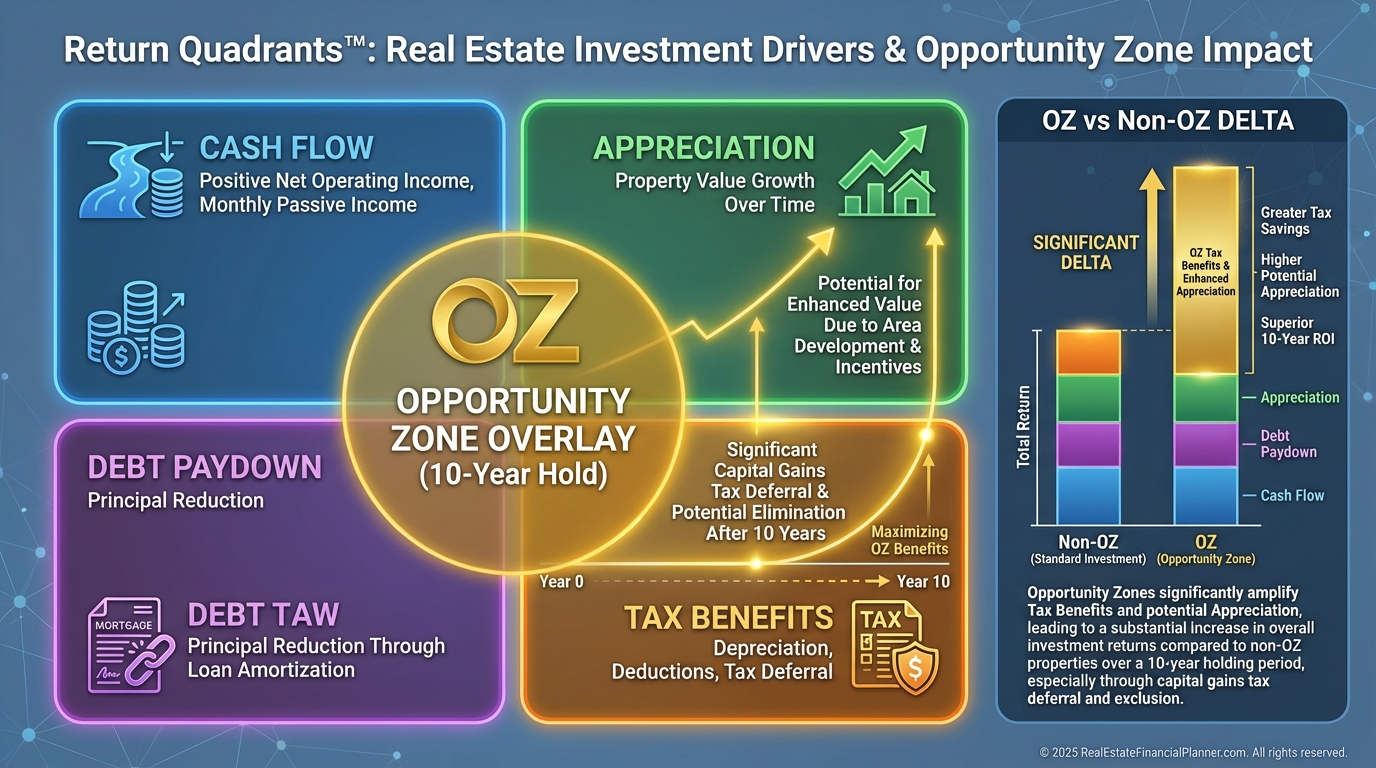

Three levers drive returns: deferring tax on an existing capital gain, holding for 10 years to eliminate future appreciation, and structuring the fund correctly so you qualify.

If you get the timing wrong or the structure sloppy, the tax tail can wag—and ruin—the deal.

The Three Tax Benefits (What Still Applies in 2025)

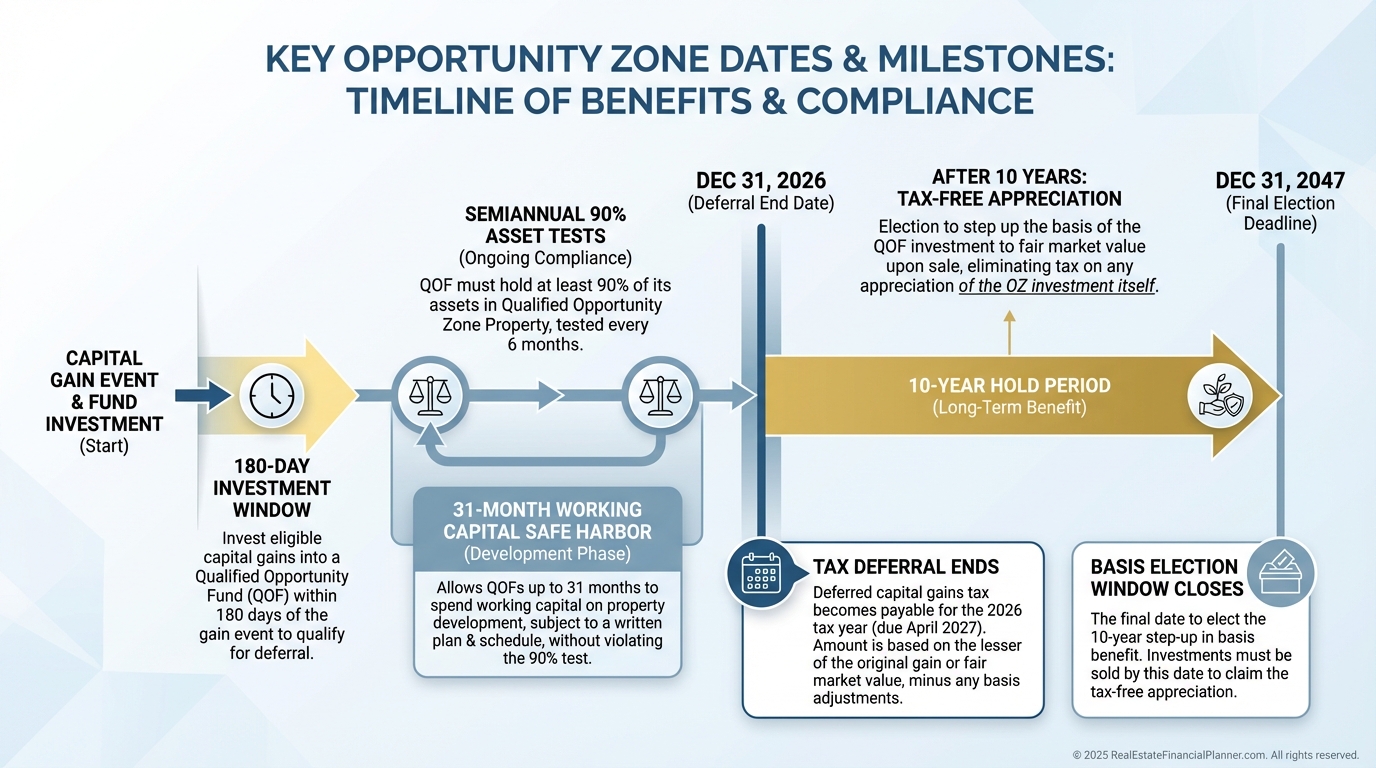

Deferral: Invest eligible capital gains into a Qualified Opportunity Fund (QOF) within your 180-day window and defer that tax bill until December 31, 2026 (generally due April 2027).

Step-up reduction: The 10% and 15% basis step-ups required 5- and 7-year holds by 12/31/2026, so new 2025 investments will not qualify for those reductions.

10-year exclusion: Hold your QOF investment for 10+ years and you can exit with zero federal capital gains tax on appreciation inside the QOF by making the basis step-up election.

When I rebuilt after bankruptcy, I learned the hard way: the tax benefit should amplify a good deal, not rescue a bad one.

So I model after-tax returns as the truth and treat pre-tax returns as a checkpoint.

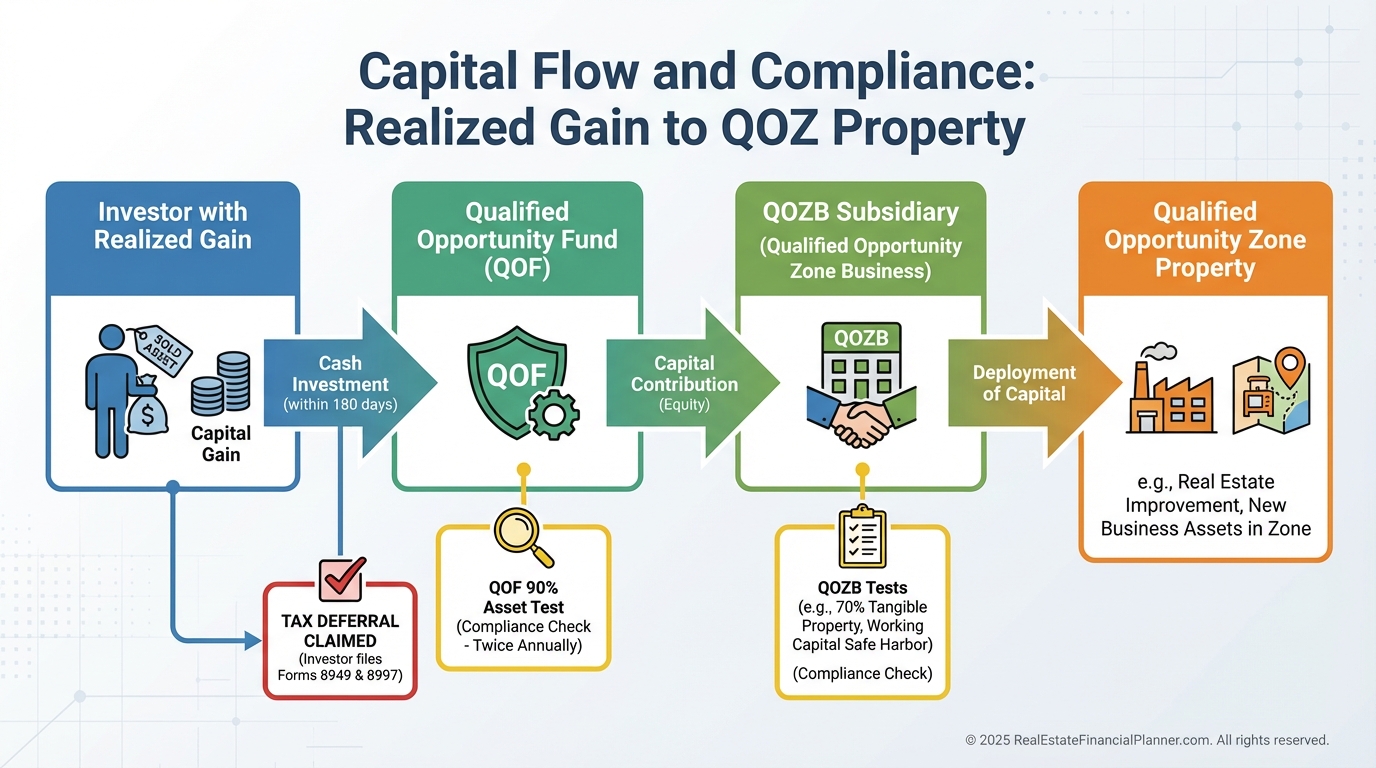

How the Money Must Flow

Your gain comes from almost any source—stocks, real estate, a business sale—and gets contributed to a QOF.

The QOF typically invests into a lower-tier Qualified Opportunity Zone Business (QOZB) that owns and improves the real estate.

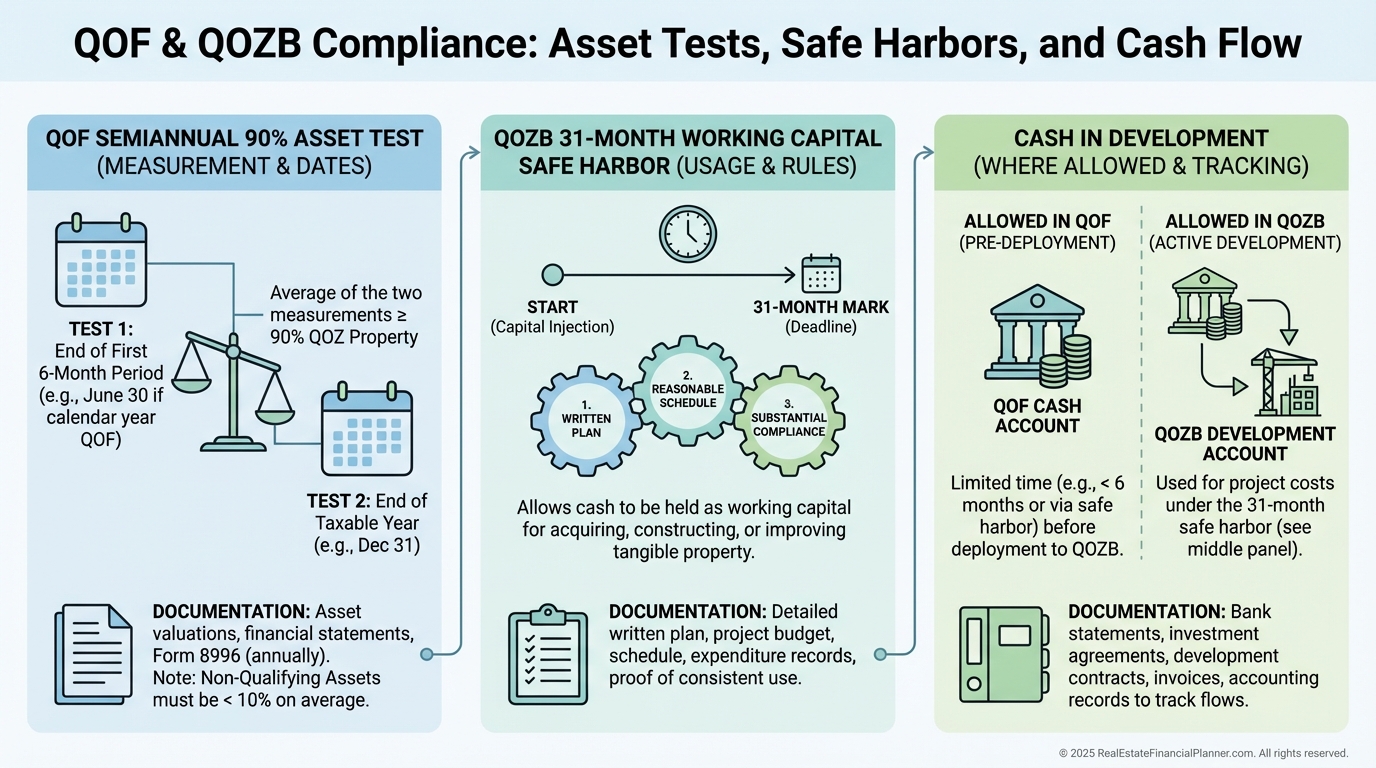

That two-entity structure is how you access the 31-month working capital safe harbor and stay compliant with the 90% asset test at the QOF level.

Underwriting the Deal (Not the Tax Code)

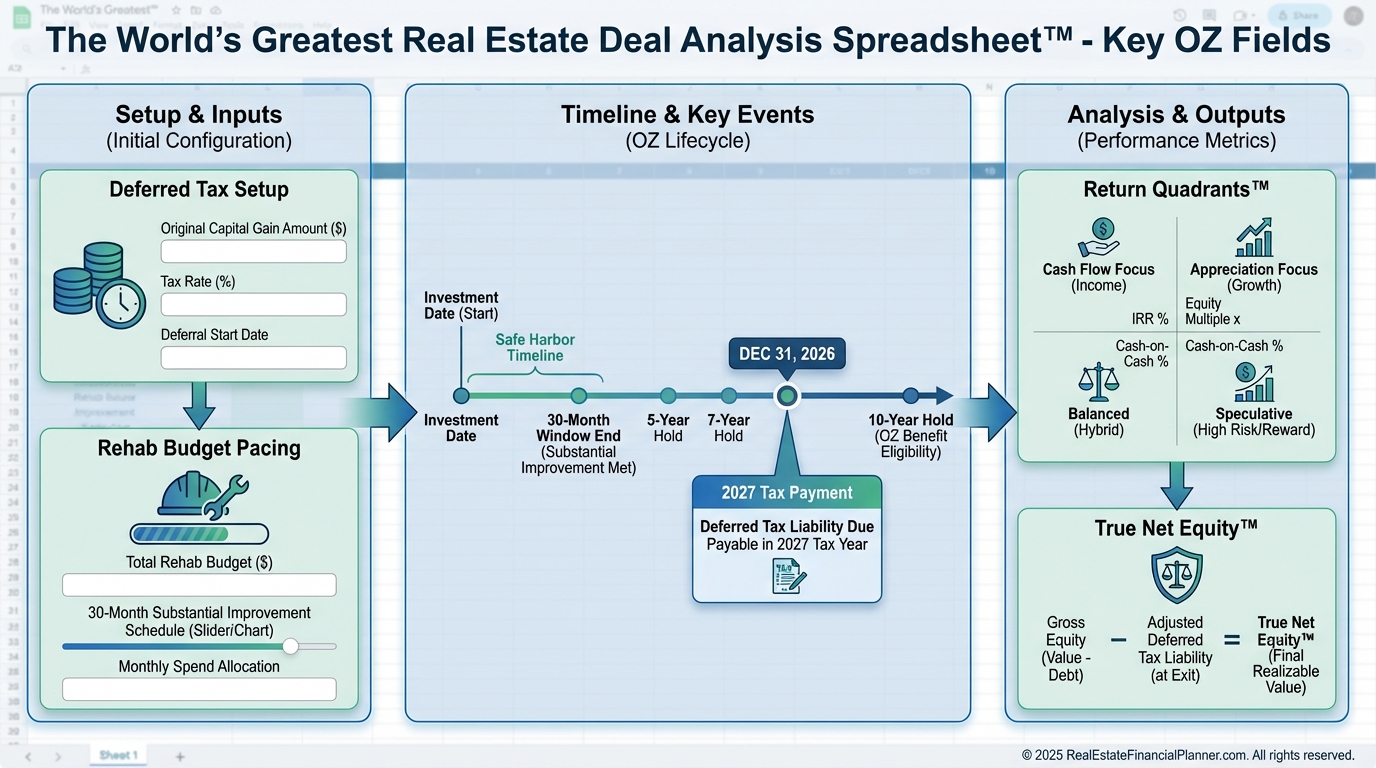

When I review OZ deals for clients, I run them through The World’s Greatest Real Estate Deal Analysis Spreadsheet™ with an OZ lens.

I add the deferred tax due in 2027 to the liabilities stack so True Net Equity™ reflects reality.

I then compare two scenarios in the Return Quadrants™: an identical project outside an OZ versus inside, both under the same conservative assumptions.

If the OZ version only wins because we juiced appreciation or cut CapEx unrealistically, we walk away.

What Makes a Zone Investable

I look for zones next to momentum—transit, universities, medical hubs, or institutional master plans.

Public investment is a tell—streetscapes, water lines, transit stations.

So is private commitment—cranes, building permits, and lenders comfortable with takeout.

Local incentives that stack with OZ benefits—tax abatements, fee waivers, density bonuses—can tip a good deal into great.

One more filter: a clear 10-year story for jobs, incomes, and housing demand.

The Compliance Backbone You Can’t Ignore

QOFs self-certify on IRS Form 8996; there’s no pre-approval.

The 90% asset test hits twice per year, pushing you to deploy quickly.

Use a QOZB to access the 31-month working capital safe harbor for development and rehab.

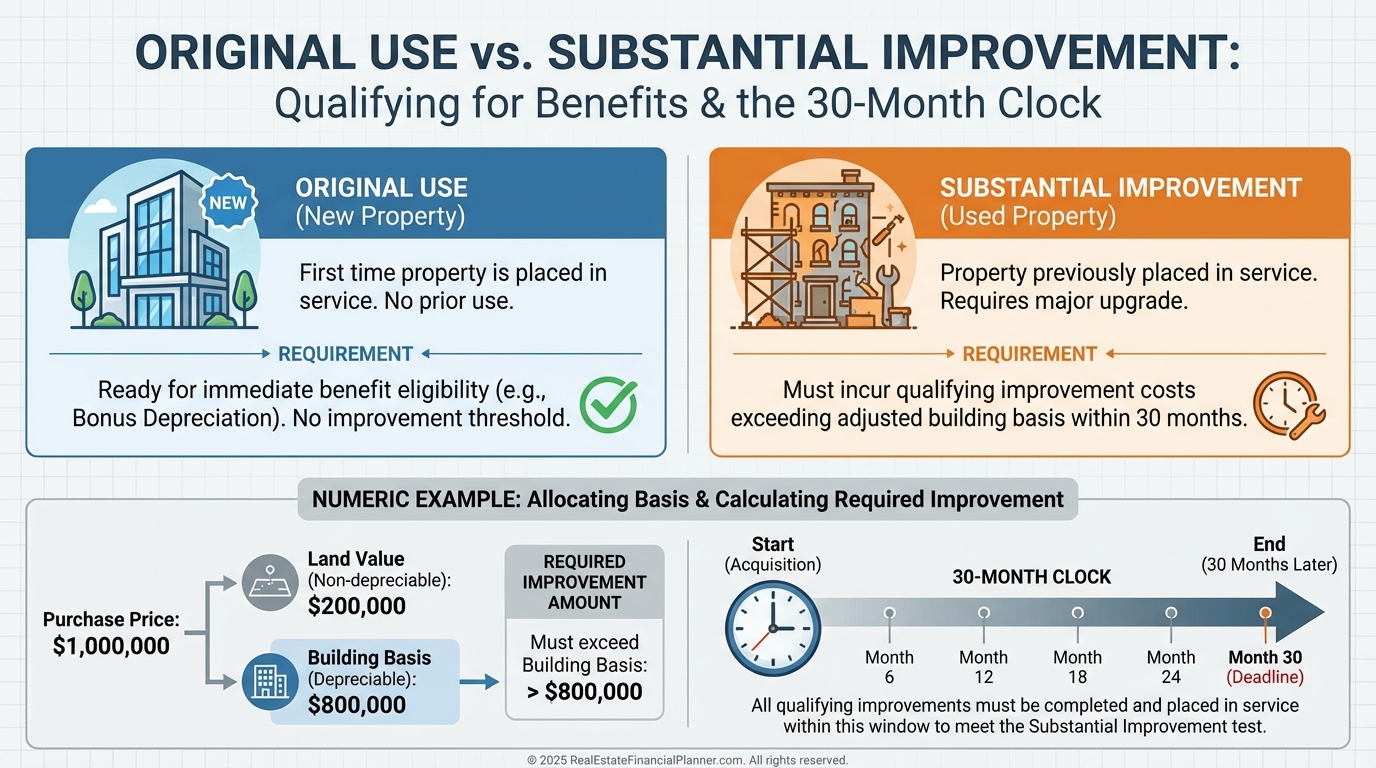

Original use requires starting with new construction or first use; otherwise, substantial improvement applies—you must invest at least the building’s basis (excluding land) in 30 months.

Related-party rules and anti-abuse standards are real; structure arms-length deals and document everything.

Strategies That Fit the OZ Box

Ground-up multifamily or mixed-use maximizes value creation and easily satisfies original use.

Heavy value-add can work, but only when building basis is a meaningful share of the purchase price and you can execute improvements within the window.

Build-to-rent in growth corridors pairs well with a 10-year hold.

Office is tough unless you have credit tenants and public-private support; consider flexible, convert-ready layouts.

Land banking by itself doesn’t qualify; you need to start substantial improvement on schedule.

When I model strategies, I compare stabilized Year 3–4 cash-on-cash to long-hold IRR with the OZ basis step-up election after Year 10.

If the only way it pencils is by selling early, it’s not an OZ deal.

Case Study: Modeling What Actually Matters

A client had a $2.2M stock gain and a 180-day clock.

We targeted a $9.5M, 80-unit infill site in an OZ with a new BRT line under construction.

Total project cost: $21.8M, 62% LTC construction debt, 38% equity, using a QOF → QOZB structure.

Conservative underwriting: 0.0% Year 1 rent growth, 2.5% thereafter, 6.00% exit cap, 10% contingency, and we carried the 2027 tax bill explicitly in the cash flow.

Pre-tax IRR penciled at 12.1%.

After-tax IRR, with the 10-year OZ basis election and full depreciation recapture modeling, landed at 16.9%.

Return Quadrants™ showed the lift came from tax treatment and stabilized operations, not wishful appreciation.

The 180-Day Rule Nuances (Don’t Miss This)

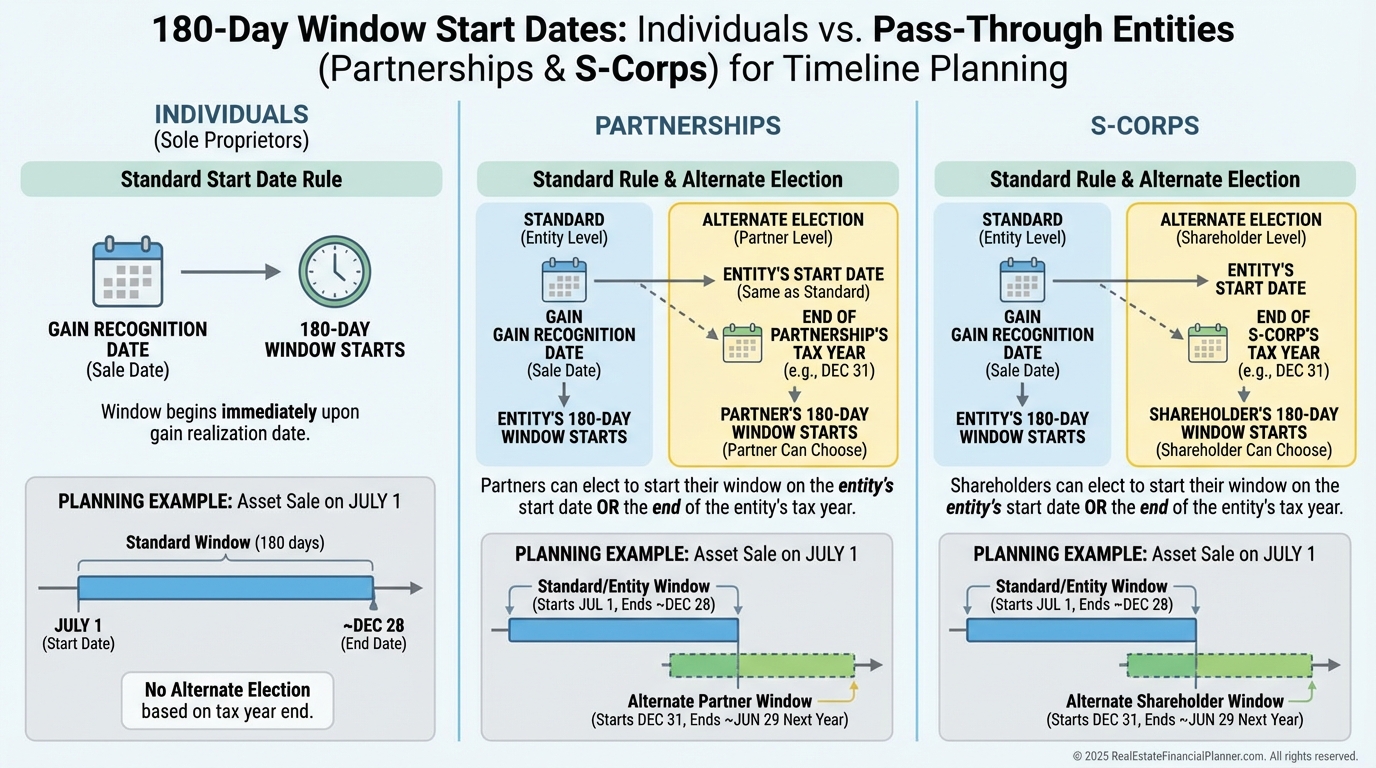

For personal gains, the 180-day window starts the day you realize the gain.

For pass-through K‑1 gains, you may have multiple choices, including starting on the entity’s year-end or the K‑1 issuance date.

I always have clients confirm the correct window with their CPA and then I anchor project milestones backward from that date.

Common Pitfalls I See (And How We Avoid Them)

Chasing bad dirt for good taxes.

Missing the 90% test because cash sat at the QOF instead of the QOZB.

Buying from a related party without recognizing the prohibition.

Underestimating total development time and blowing the safe harbor clock.

Ignoring the 2027 tax payment in your pro forma, which overstates True Net Equity™.

Not having a real 10-year exit thesis and liquidity plan for limited partners.

How I Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™

I turn on OZ-specific modeling: deferral through 2026, the 2027 cash outflow, and the 10-year basis election.

I calculate True Net Equity™ annually, subtracting deferred tax liabilities and realistic costs of sale.

I stress test with ±100 bps on exit cap, slower lease-up, and higher operating expenses.

The deal only graduates if after-tax returns still clear our hurdle.

Stacking Strategies With Your Portfolio

If you run the Nomad™ strategy for owner-occupying and moving up annually, keep it separate from your QOF investments.

QOF assets must be investment property; owner-occupied housing won’t qualify.

You can still house hack near a zone to learn the submarket and pipeline relationships, then let the QOF acquire the larger projects.

Your 2025 Action Plan

•

Inventory your gains and confirm your 180-day deadline with your CPA.

•

Shortlist OZ submarkets with visible public and private catalysts.

•

Decide single-asset QOF for control or a diversified multi-asset QOF for risk management.

•

Map the compliance calendar: 90% test dates, safe harbor plan, construction milestones, and permit timelines.

•

Underwrite conservatively in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and compare OZ vs. non-OZ.

•

Paper the structure with experienced OZ counsel; file Forms 8949, 8997, and 8996 correctly.

•

Start with one great project, execute cleanly, then scale.

If Congress extends or modifies the program, we adapt.

Until then, we play the board in front of us with disciplined underwriting and airtight compliance.

The upside is real for investors who respect the rules and the math.