Subject To Real Estate: How Smart Investors Structure, Analyze, and Protect These Deals

Learn about Subject To for real estate investing.

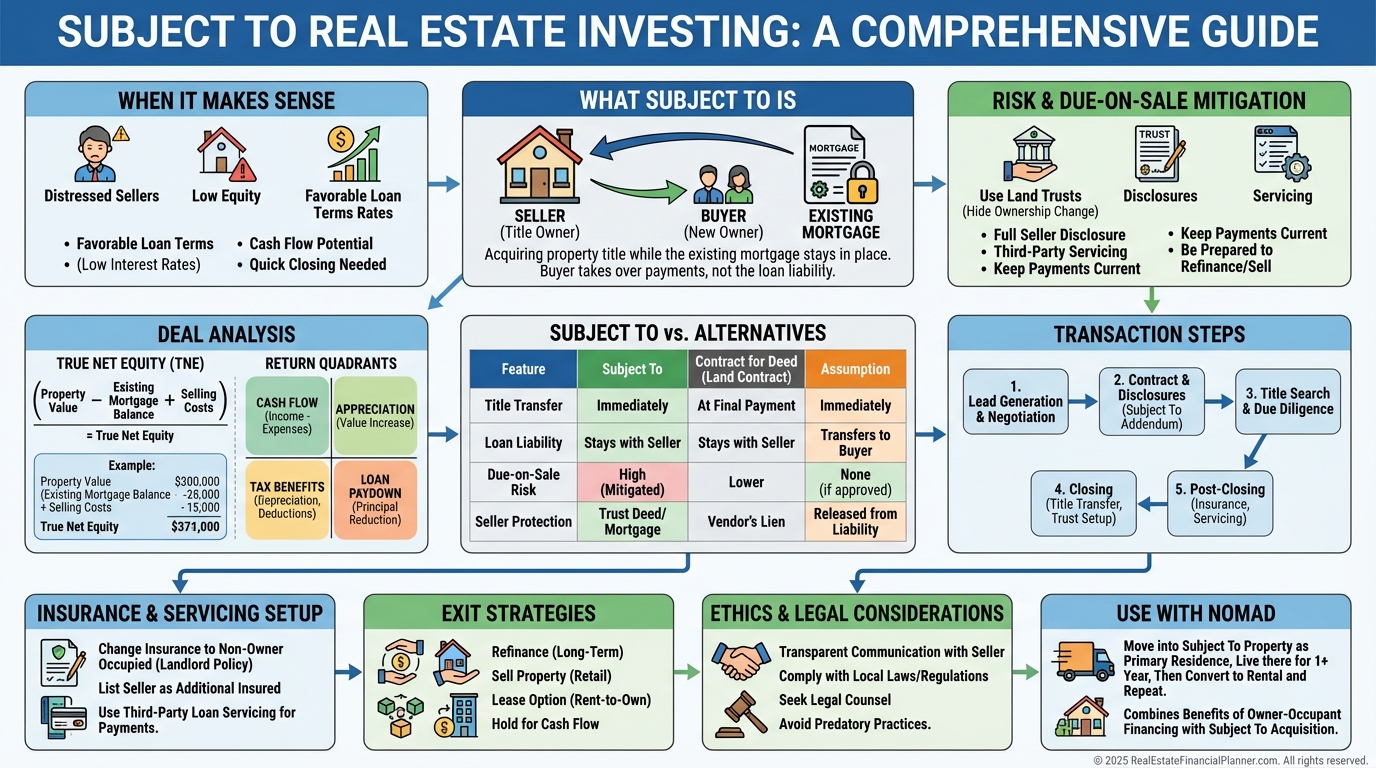

Why Subject To Belongs in a Serious Investor’s Toolkit

When I help clients scale in tight credit markets, Subject To is often the bridge between a good lead and a great acquisition.

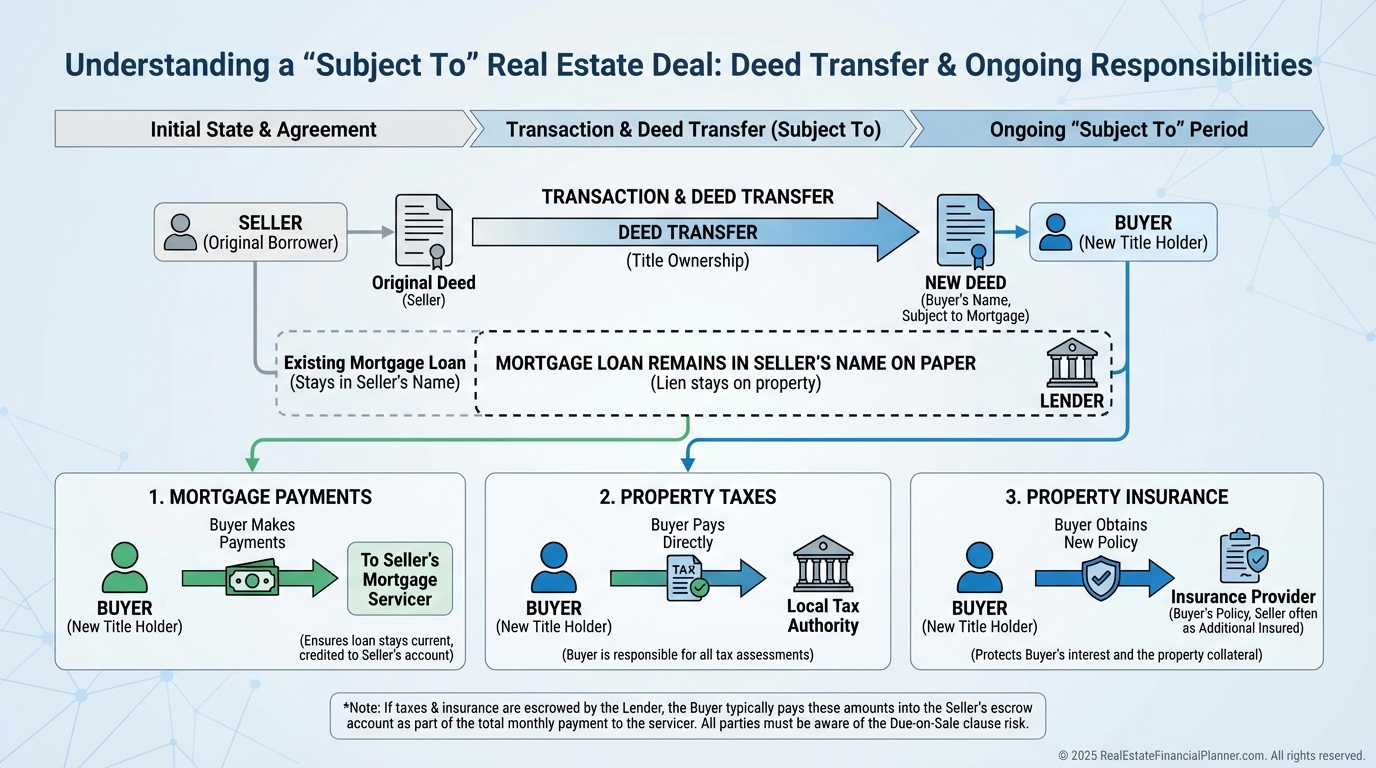

It lets you take title now while the seller’s existing loan stays in place, often at a rate you can’t recreate today.

You own the property and make the payments.

The loan remains in the seller’s name until you refinance, pay off, or sell.

That separation is the power—and the risk—you must manage with precision.

When Subject To Makes Sense

For sellers, I look for urgency plus a solvable math problem.

Common triggers include little or no equity, behind on payments, job relocation, divorce, or needing a quick, certain close.

For buyers, I look for three edges: low fixed rate, payment below market rent, and minimal capital to control the asset.

Subject To shines when it preserves scarce cash and speed matters.

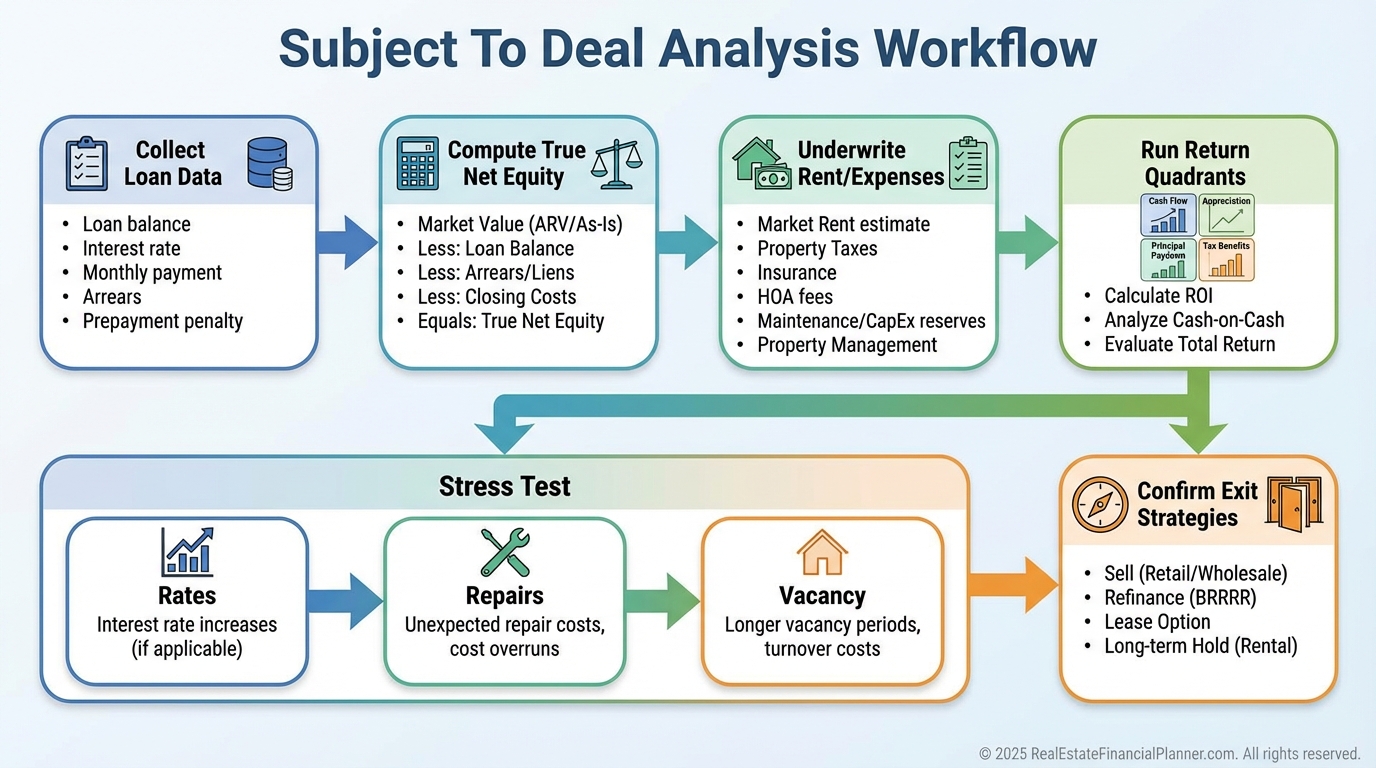

What I Check Before I Say Yes

I start with the loan.

Finally, I underwrite exit options on day one so we’re never trapped by optimism.

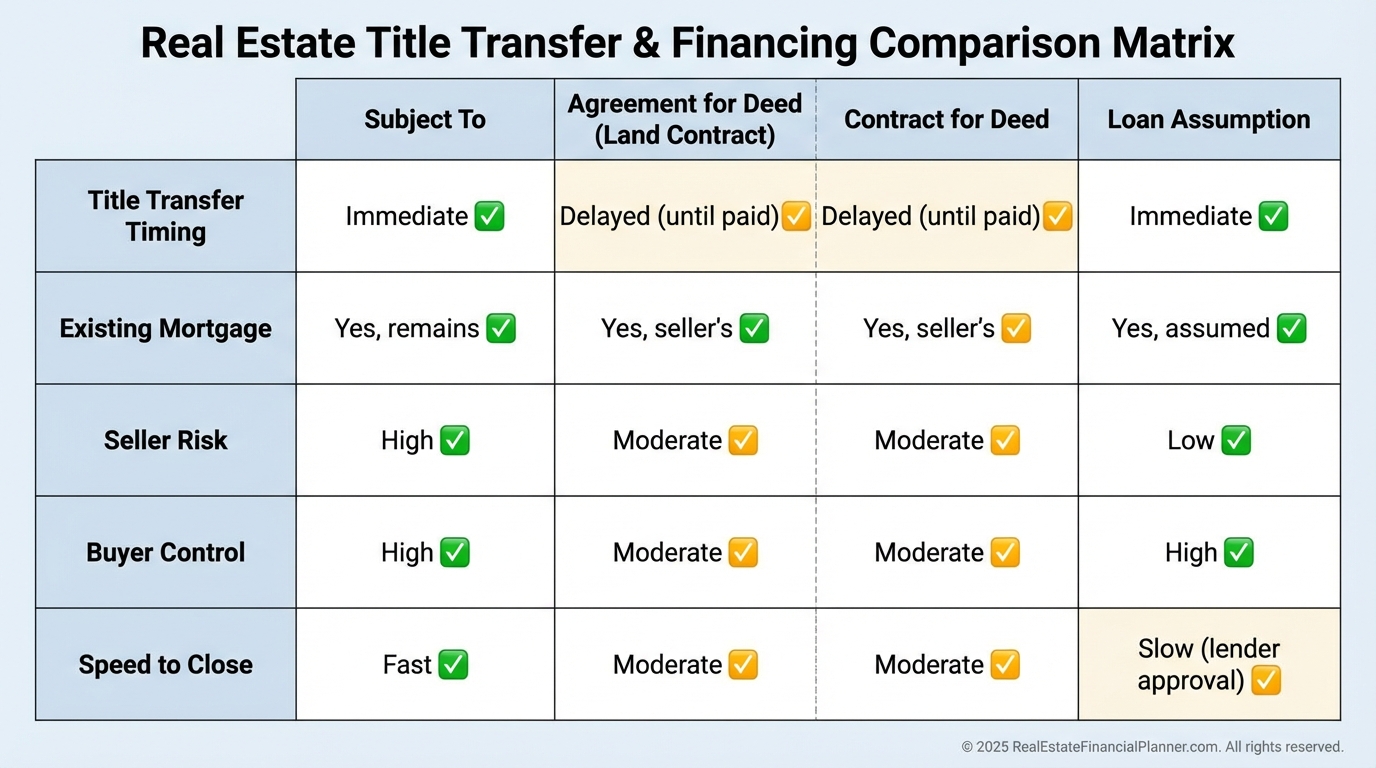

How Subject To Compares to Other Creative Financing

Agreement for Deed (Land Contract) keeps title with the seller until payoff.

It’s easier for the seller to reclaim if the buyer defaults, but it limits the buyer’s control to refinance or sell quickly.

Bond for Deed is a regional label similar to Agreement for Deed.

Mechanics and implications largely mirror Land Contracts.

Contract for Deed creates a new seller-financed note and payment schedule.

There’s no existing loan involved; the seller acts like the bank with fully negotiable terms.

Traditional Assumption is different from Subject To.

With a formal assumption, the lender approves you and releases the seller, which isn’t typical on most conventional loans.

Subject To vs these options boils down to three levers: who holds title, whether a new loan is created, and how fast you can control the asset.

The REFP Way to Analyze Subject To

I model every deal in The World’s Greatest Real Estate Deal Analysis Spreadsheet.

Then I pressure-test it with True Net Equity and Return Quadrants.

True Net Equity is what the seller really has after costs to sell, arrears, fees, and any concessions.

It answers whether a Subject To solution actually makes the seller whole or if we need cash at close.

Subject To can tilt these quadrants because the interest rate and payment are inherited, not negotiated new.

Here’s my baseline checklist before I write an offer.

•

Loan terms: balance, rate, P&I, escrow, ARM caps, PMI, prepayment penalties

•

Equity: value, True Net Equity after costs and arrears

•

Cash needs: reinstatement, repairs, reserves, holding costs

•

•

Returns: pre- and post-stress Return Quadrants

•

Exits: refinance, resale, or long-term hold viability

When I Say No

I pass when the payment exceeds realistic rent plus reserves.

I pass when repairs or arrears consume all free cash and leave no margin.

I pass when the only path to profit is appreciation speculation or a refinance guess.

Discipline is a moat; optimism is not a strategy.

Structuring the Agreement

I use a simple framework: price, possession, promises, protections.

Price includes what you’ll pay now and later, including reinstatement and any seller cash.

Possession clarifies move-in, keys, and transfer timing.

Promises include who pays what and when—loan, taxes, insurance, HOA, and utilities.

Protections include disclosures, authorizations, and remedies if either side defaults.

Consider a wrap (AITD) if you want your own note and servicing overlay.

A wrap mirrors the underlying loan and can clarify remedies and reporting while you still honor the original mortgage.

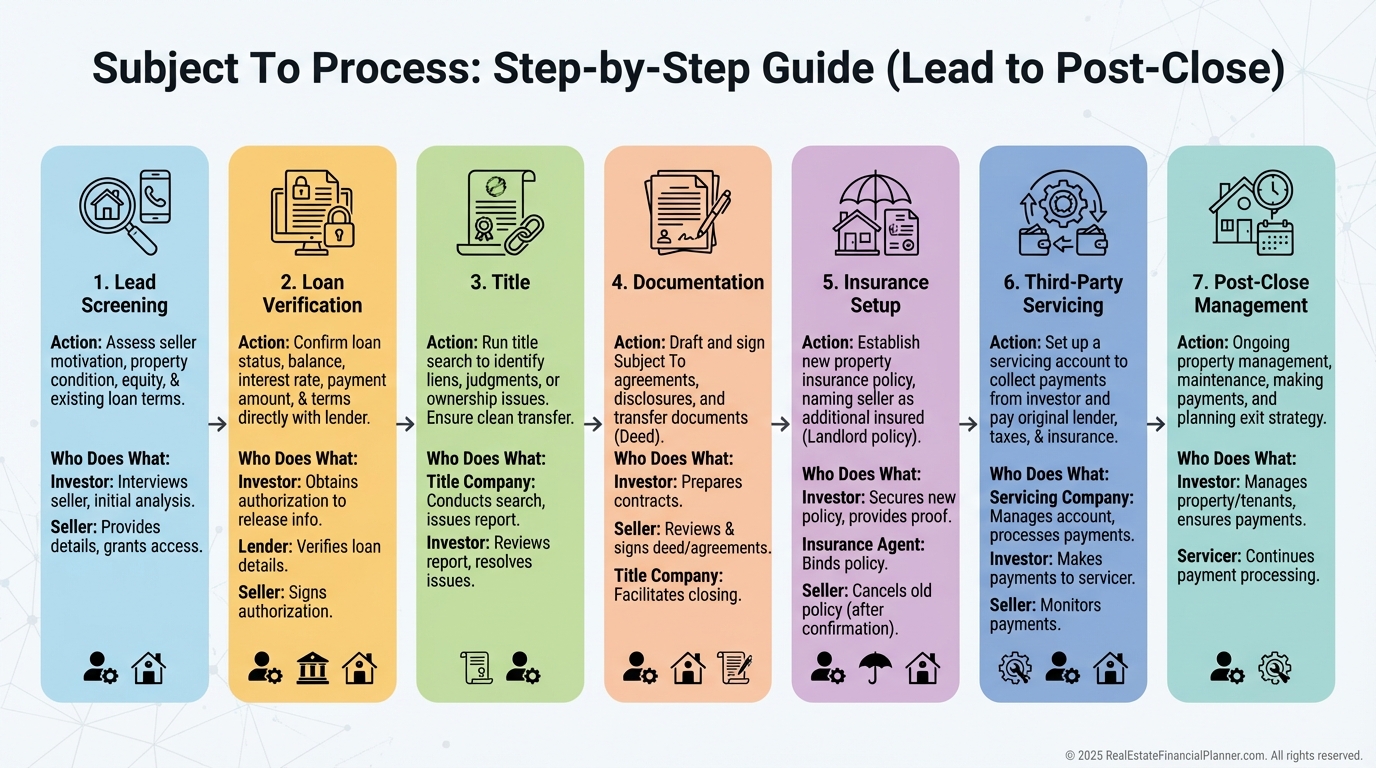

The Transaction Process I Walk Clients Through

•

Get written authorization to speak with the loan servicer.

•

Order title work and verify all liens, judgments, and HOA status.

•

Draft purchase agreement with Subject To addenda and full disclosures.

•

Set up proper insurance naming the lender, seller, and you as insureds/loss payees.

•

Establish third-party servicing to collect from you and pay the lender, with escrow for taxes/insurance.

•

Document communication protocols and emergency procedures with the seller.

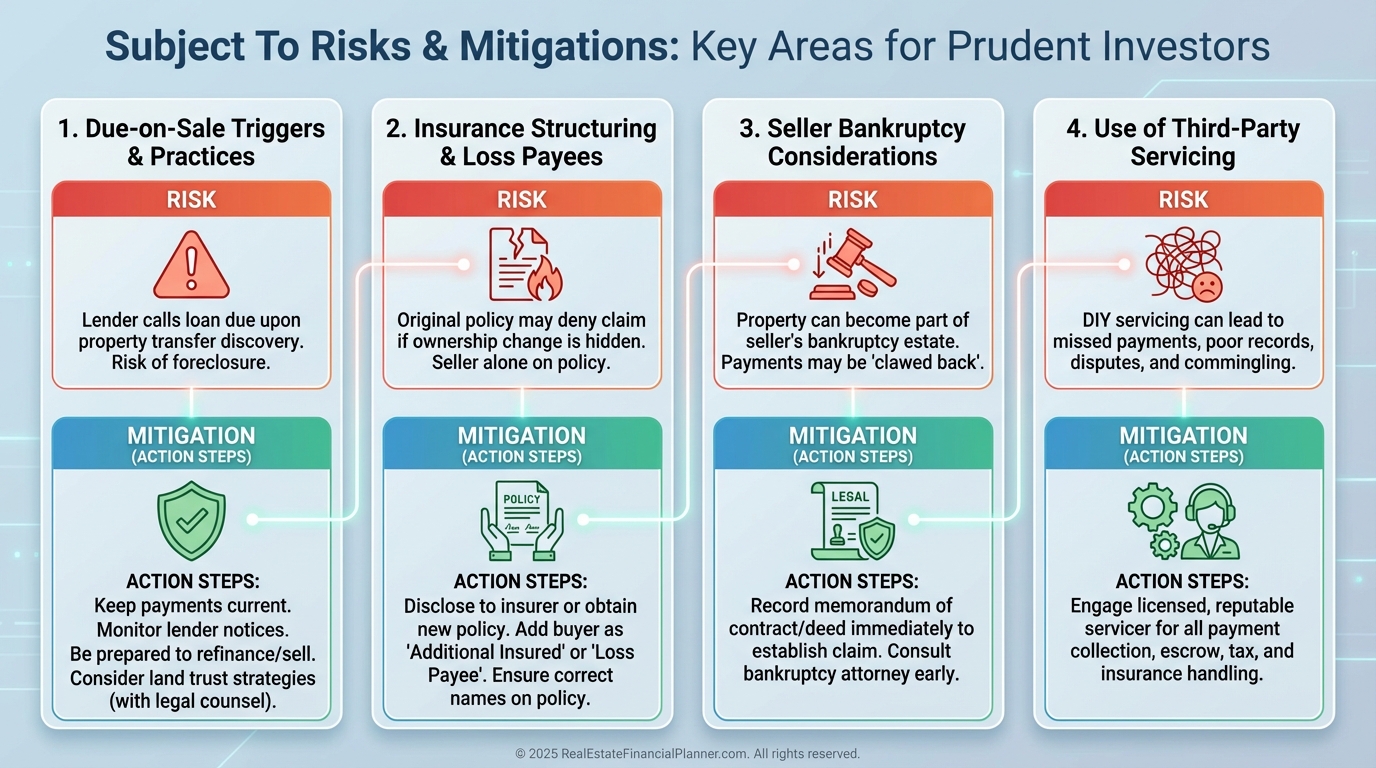

Critical Risks and How I Mitigate Them

The due-on-sale clause allows the lender to call the loan due if title transfers.

I don’t assume they won’t; I manage it.

I keep payments current via third-party servicing, maintain proper insurance with the lender as loss payee, and ensure taxes are paid.

I avoid triggering lender mail audits by aligning mailing addresses thoughtfully and never misrepresenting occupancy.

Insurance must reflect the true structure.

Often that means a landlord policy for you with the seller named as additional insured and the lender as mortgagee, while keeping the lender’s requirements satisfied.

Seller bankruptcy can pull the property into the estate.

I disclose this risk, add contact covenants, and document default remedies that survive bankruptcy where permissible.

Always work with a local attorney to ensure compliance with state-specific rules.

What About Ethics and Compliance?

I require full written disclosure that the loan stays in the seller’s name.

I give the seller a clear, plain-English summary of what happens if either side defaults.

I never coach sellers to stop communicating with their lender.

I avoid owner-occupant buyers where Dodd-Frank and state laws create additional compliance burdens for seller financing.

For investor acquisitions, I still run everything through counsel.

Your reputation is an asset class; protect it.

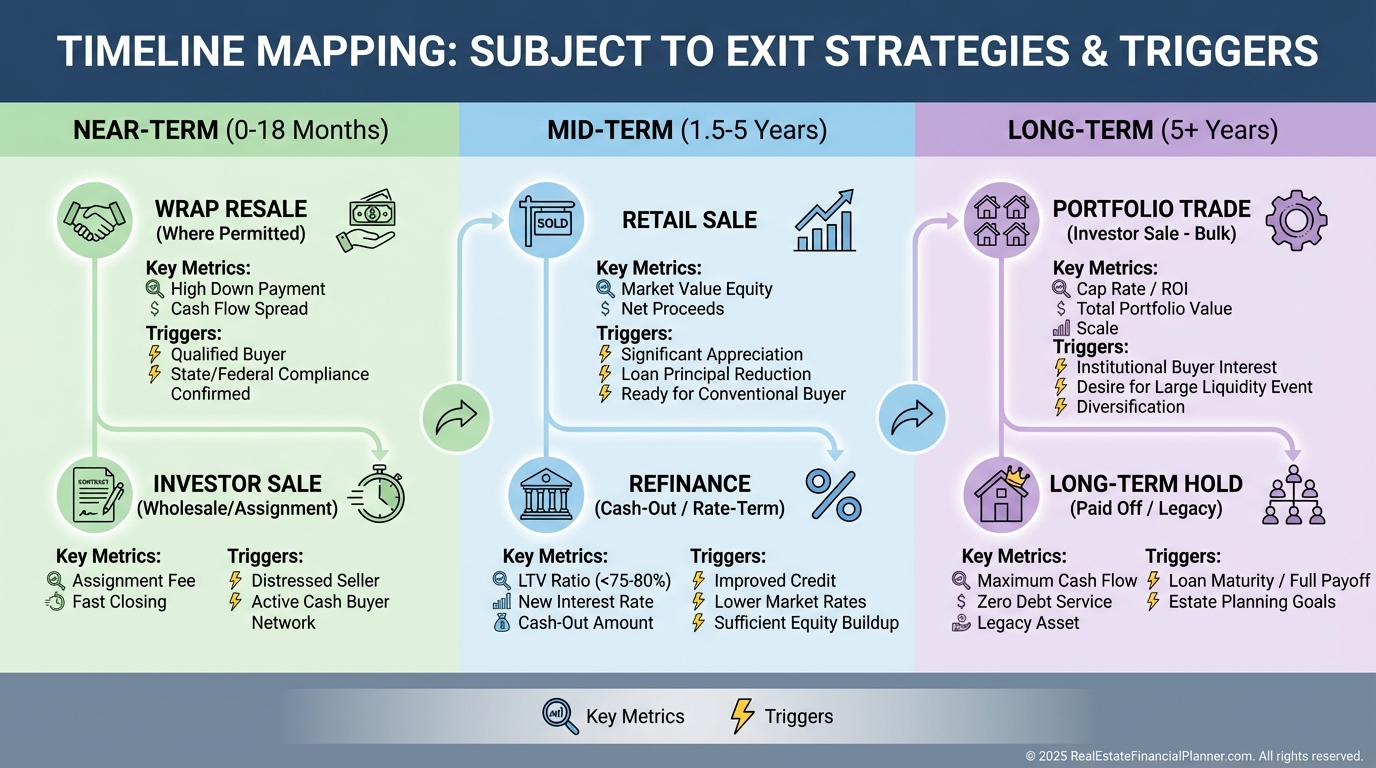

Exit Strategies I Model Before Closing

Sell retail if equity improves through appreciation or value-add.

Sell to another investor if a portfolio trade unlocks better returns.

In some cases, you can novate to a new buyer or structure a wrap resale, subject to state law and your attorney’s guidance.

I ladder these exits by time horizon so I’m never reliant on a single door opening.

Using Subject To with REFP Strategies

With Nomad, your primary path is owner-occupant financing, but Subject To can add rentals without consuming new loan slots.

I still model DTI, reserves, and Return Quadrants to avoid starving the core Nomad plan.

If you’re building a portfolio, Subject To can accelerate unit count while preserving cash.

I track blended portfolio interest rate and stress test vacancies so growth doesn’t outpace prudence.

A Quick Decision Framework You Can Steal

•

Is the inherited interest rate and payment materially better than today’s financing?

•

Does conservative rent minus expenses produce positive cash flow with reserves?

•

Do you have the cash to reinstate, repair, and hold six months?

•

Are at least two exit strategies viable without relying on perfect refi conditions?

•

Does the seller benefit clearly when measured by True Net Equity and timeline?

If yes across the board, move to contract with speed and precision.

Common Pitfalls I Warn Clients About

Hoping appreciation will bail out a thin deal is a tax on impatience.

Underinsuring or mislabeling occupancy can void claims and anger lenders.

Skipping third-party servicing invites missed payments and broken trust.

Ignoring HOA liens or utility balances can blow up your pro forma overnight.

These are avoidable with checklists and professional help.

Final Word

Subject To is not a trick; it’s a tool.

Used with transparency, math, and management, it creates real wins for sellers and durable returns for you.

Used casually, it concentrates risk you don’t see until it’s expensive.

When I underwrite with the spreadsheet, validate with True Net Equity, and read my Return Quadrants under stress, I sleep at night.

Do the same, and you’ll earn both deals and reputation.