Real Estate Depreciation: The Most Misunderstood Return Investors Rely On

Learn about Depreciation for real estate investing.

Most investors hear about depreciation early, then mentally file it under “CPA stuff” and move on.

That’s a mistake.

When I help clients analyze deals, depreciation often makes the difference between a mediocre investment and one that quietly compounds wealth year after year.

It’s also one of the most misunderstood returns in real estate.

Depreciation looks like a paper loss, but it behaves like real money.

That contradiction is exactly why it’s so powerful.

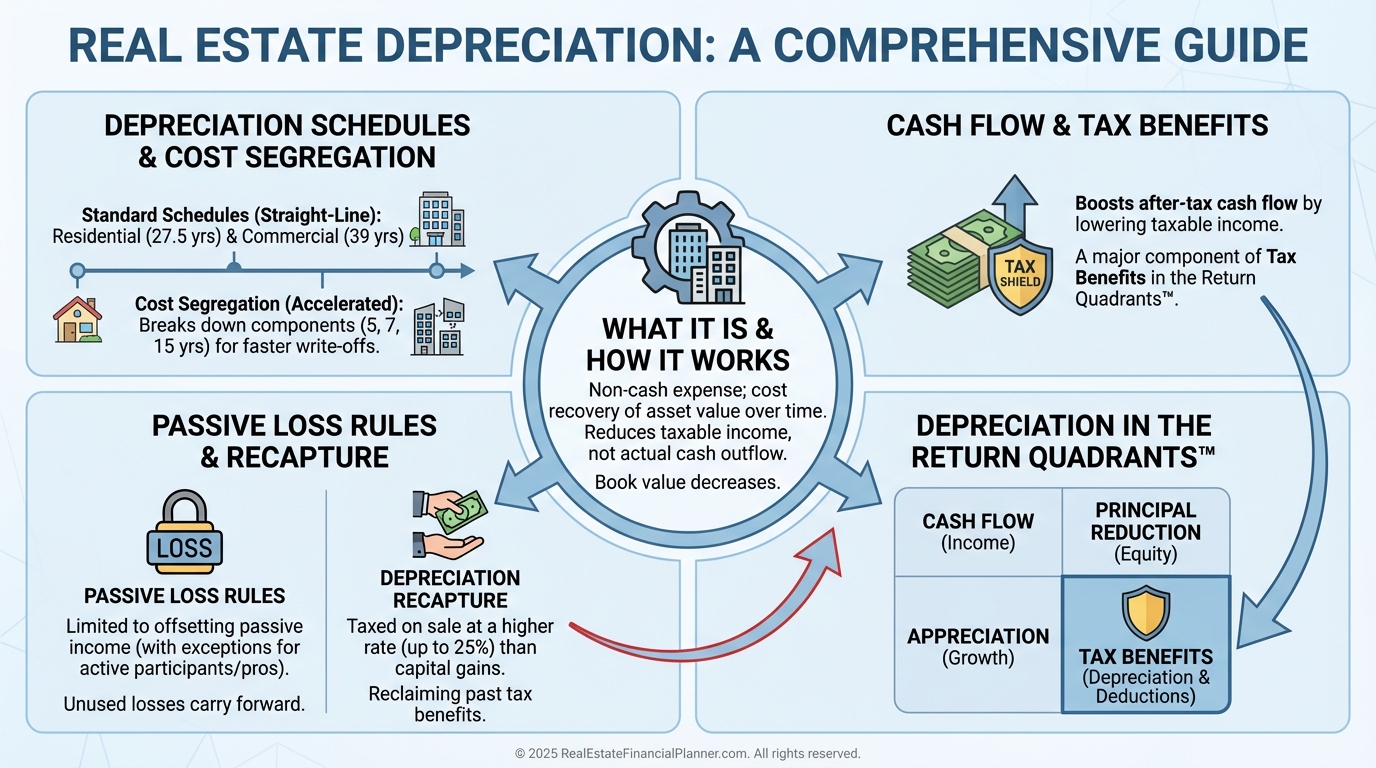

What Real Estate Depreciation Really Is

Real estate depreciation is a tax deduction that allows you to recover the cost of an investment property over time.

The IRS assumes buildings wear out, even when market values rise.

That assumption creates a rare advantage.

Your property can increase in value while simultaneously producing a deductible expense.

No cash leaves your pocket.

Yet your taxable income goes down.

When I rebuilt after bankruptcy, depreciation was one of the few returns I could count on regardless of market noise.

It showed up every year, on schedule, without requiring appreciation or rent growth.

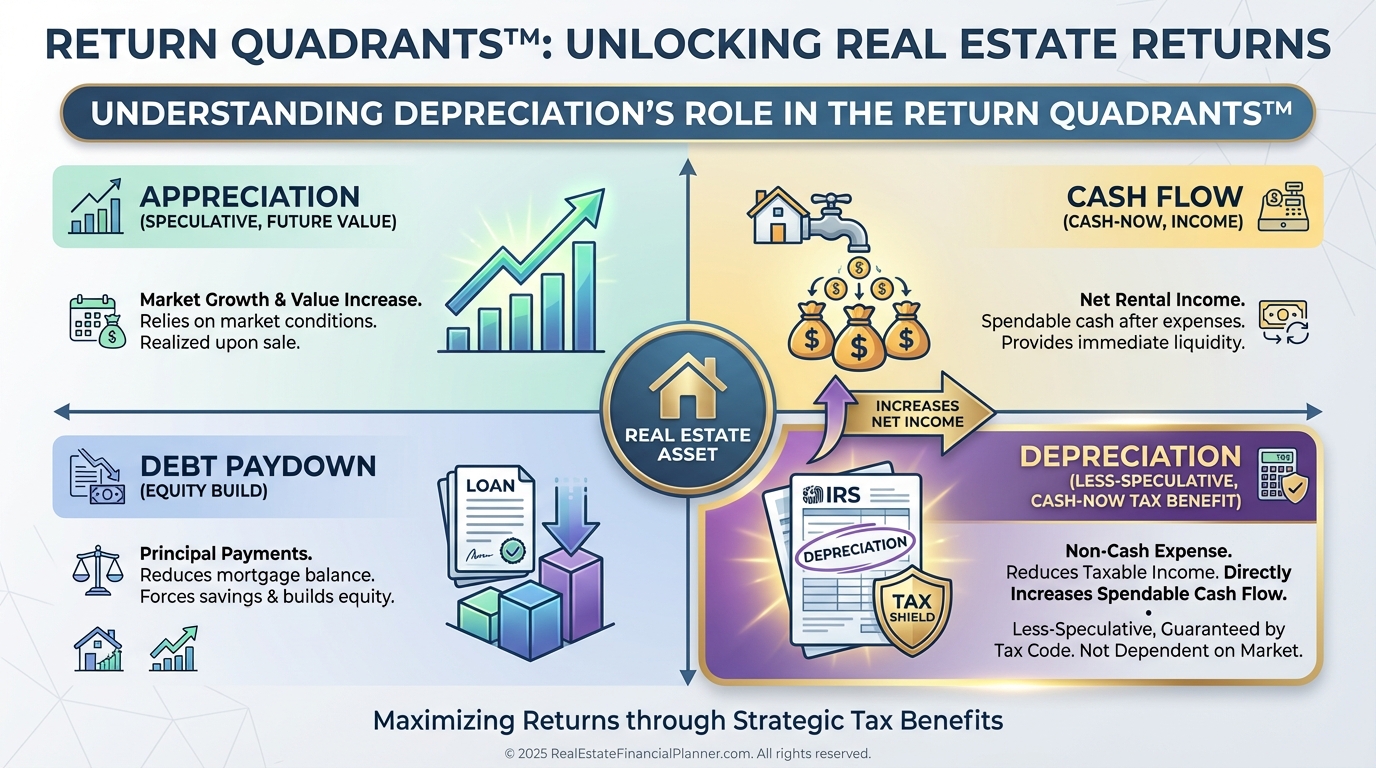

Within the Return Quadrants™, depreciation lives in the Tax Benefits quadrant.

It is both less speculative and cash-now.

That combination is rare.

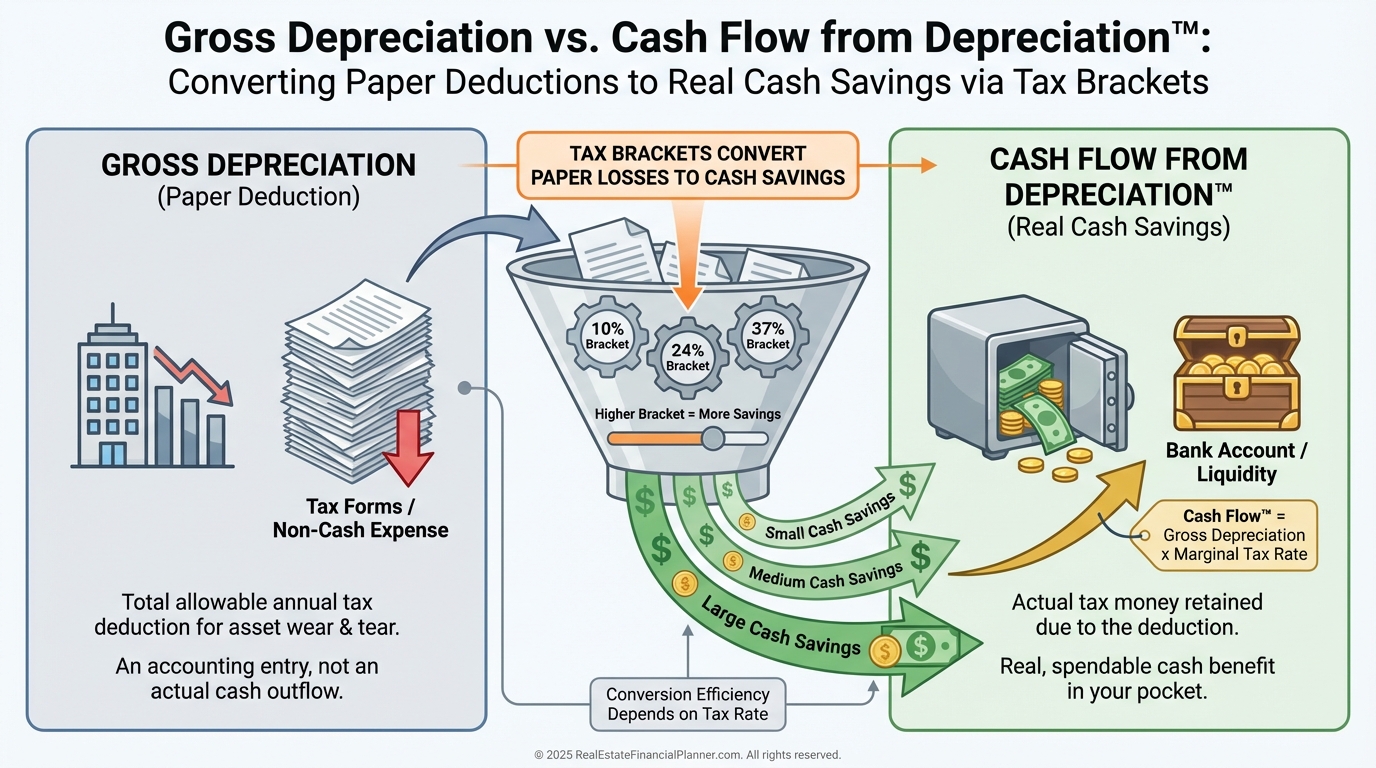

Gross Depreciation vs Cash Flow from Depreciation™

Most investors stop at the deduction.

I care about the cash.

Gross depreciation is the dollar amount you deduct.

Cash Flow from Depreciation™ is what that deduction actually saves you in taxes.

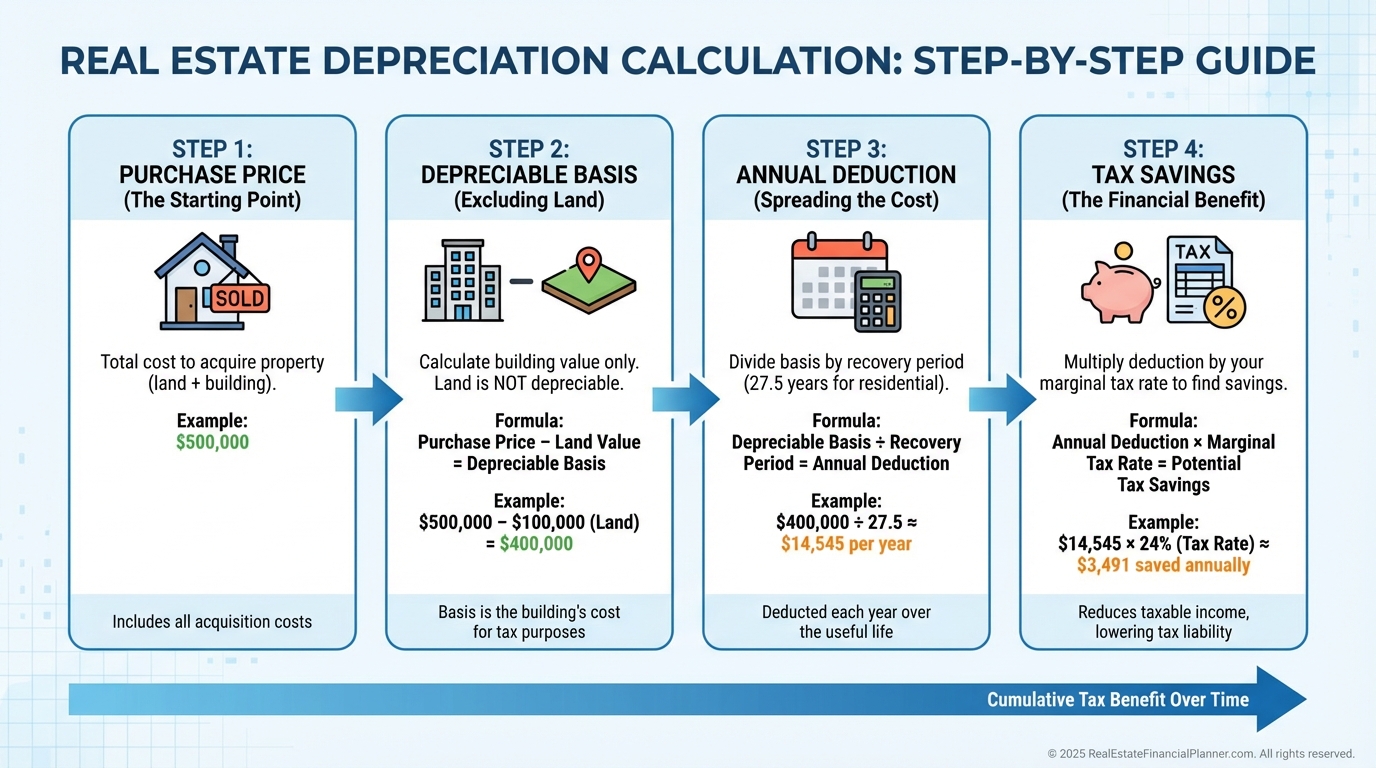

If you claim $12,000 in depreciation and your marginal tax rate is 24%, your Cash Flow from Depreciation™ is $2,880.

That is spendable money that stays with you.

I model this explicitly because returns that do not improve cash flow tend to get overvalued.

Returns that quietly improve cash flow tend to get ignored.

What Can and Cannot Be Depreciated

Land does not depreciate.

Buildings and improvements do.

This distinction matters more than most investors realize.

When I review deal analyses, one of the first things I check is the land-to-improvement allocation.

If that split is sloppy, every depreciation number downstream is wrong.

Your depreciable basis generally includes:

Many investors use the county assessor’s ratio as a starting point.

It is not perfect, but it is defensible.

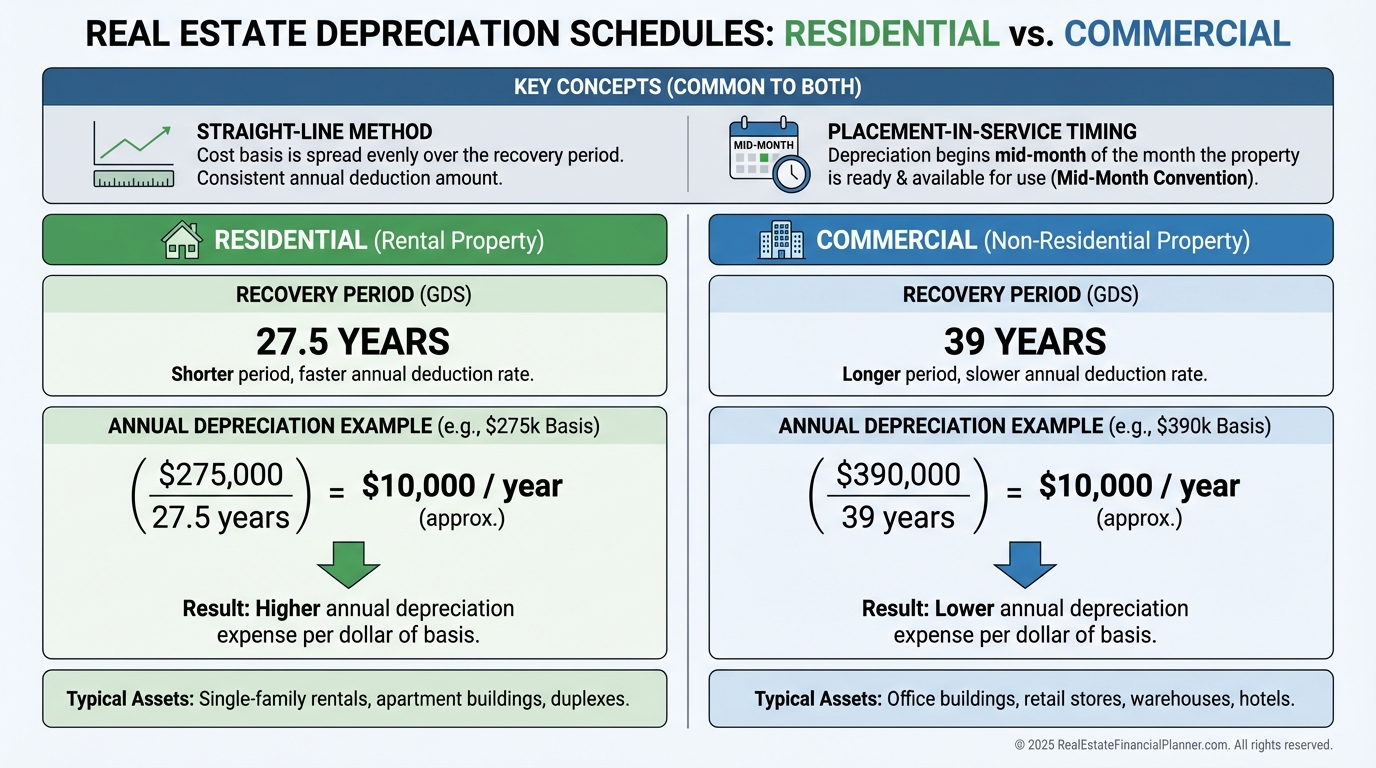

Depreciation Schedules That Apply to Real Estate

Residential rental property depreciates over 27.5 years.

Commercial property depreciates over 39 years.

Both use straight-line depreciation for the building itself.

That consistency is helpful.

Predictability matters when you are planning long-term cash flow.

Depreciation begins when the property is placed in service.

That means ready and available for rent.

Not when the first tenant moves in.

That timing error alone costs investors deductions every year.

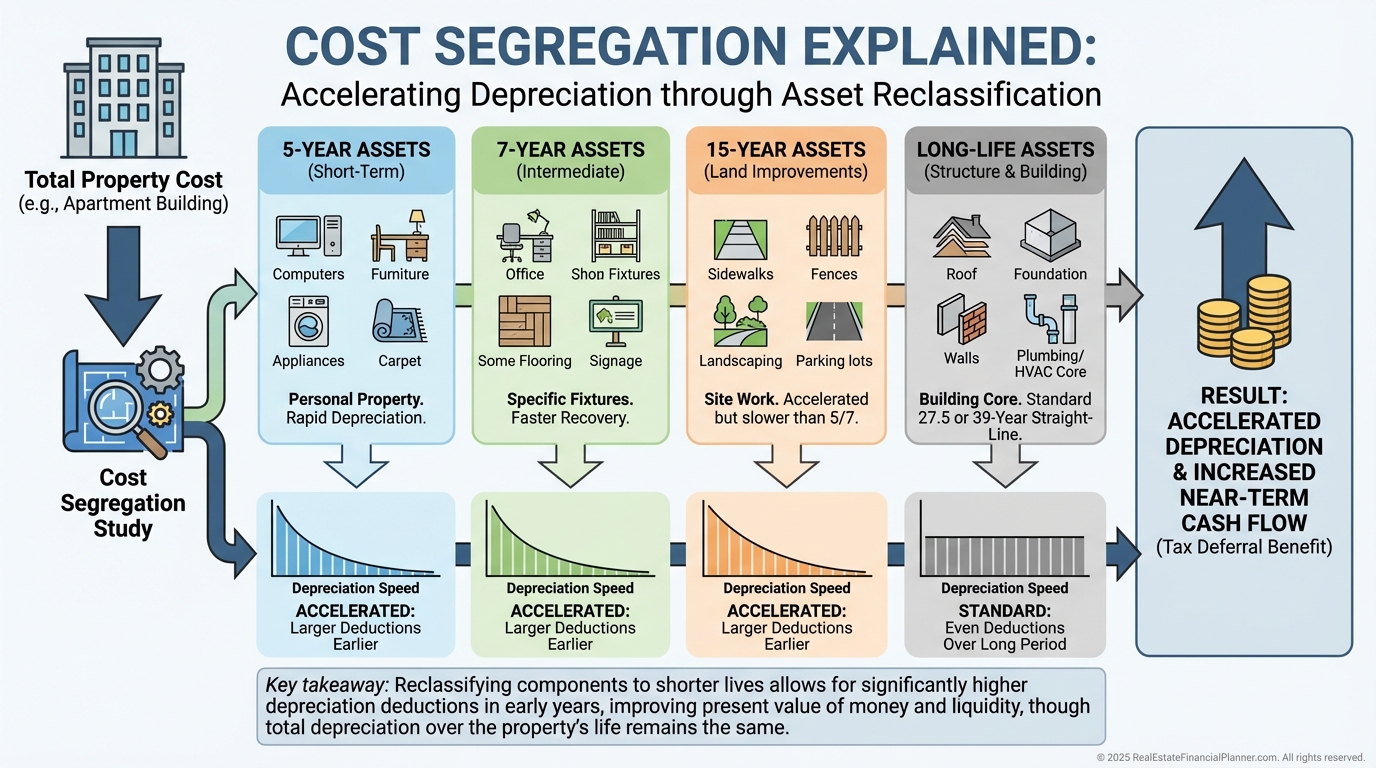

Cost Segregation and Accelerated Depreciation

Straight-line depreciation is only the starting point.

Cost segregation reclassifies parts of a property into shorter-life assets.

Five-year property includes appliances, flooring, and certain fixtures.

Seven-year property includes equipment and furniture.

Fifteen-year property includes site improvements like paving and fencing.

This does not create deductions out of thin air.

It accelerates deductions you were already entitled to.

When I see investors skip cost segregation on qualifying properties, it is usually out of habit, not math.

Bonus depreciation has made acceleration even more powerful, though it is now phasing down.

Timing matters.

How I Calculate Depreciation in Practice

I always start with conservative inputs.

Overstated depreciation creates false confidence.

Understated depreciation creates upside.

The steps are simple but must be consistent.

Determine depreciable basis.

Apply the correct recovery period.

Convert deductions into Cash Flow from Depreciation™ using real tax rates.

Then I plug the result into the Return Quadrants™.

That is where depreciation stops being abstract and starts competing with cash flow and appreciation.

Passive Loss Rules and Why They Matter

Depreciation does not always reduce taxes immediately.

Passive activity loss rules matter.

High-income investors often discover this too late.

Losses may be suspended instead of lost.

They accumulate and release later.

Real estate professional status changes the equation entirely.

When clients qualify, depreciation can offset W-2 income.

That is powerful, but the rules are strict.

I never assume eligibility.

I verify hours, participation, and documentation.

Depreciation Recapture Is Not a Surprise If You Plan for It

Depreciation recapture scares people who did not model it.

It should not.

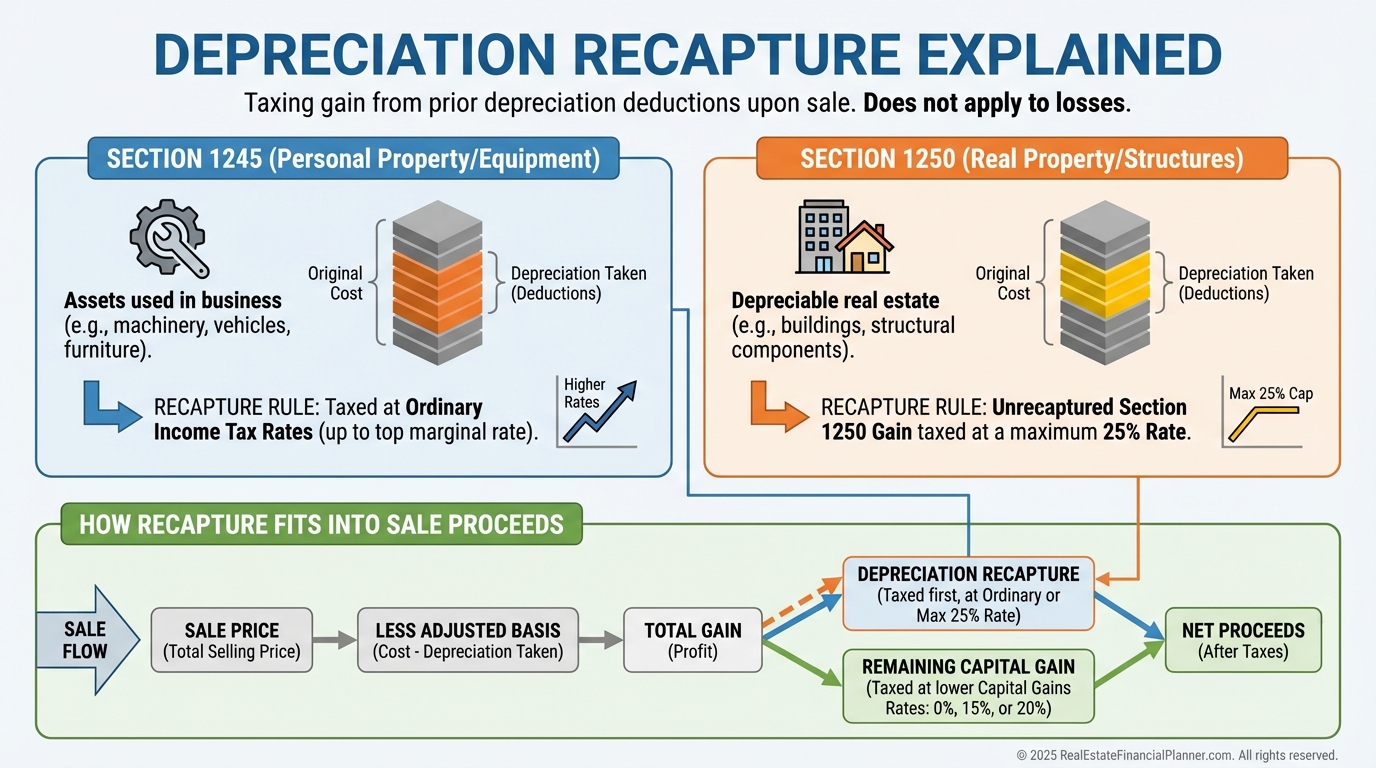

Recapture is the price you pay for decades of tax deferral.

Section 1250 recapture on buildings is capped.

Section 1245 recapture applies to accelerated components.

When I analyze exit scenarios, recapture is always included.

Ignoring it inflates returns.

Accounting for it creates realistic confidence.

Where Depreciation Fits in the Return Quadrants™

Depreciation anchors the least exciting quadrant.

That is exactly why it matters.

It shows up when appreciation stalls.

It shows up when rents flatten.

It shows up even when markets feel uncomfortable.

In the Return in Dollars Quadrant™, depreciation is cash saved.

In the Return on Investment Quadrant™, it often adds two to five percent annually.

Those numbers compound quietly.

Final Thoughts on Depreciation

Depreciation is not exciting.

That is its advantage.

It rewards patience, consistency, and accurate modeling.

When investors ignore it, they underprice good deals.

When they misunderstand it, they overestimate bad ones.

When they respect it, depreciation becomes a stabilizing force across an entire portfolio.

It is not just a deduction.

It is one of the most reliable returns you will ever earn in real estate.