Why a Real Estate–Savvy CPA Can Make or Break Your Investment Returns

Learn about CPA for real estate investing.

A Certified Public Accountant (CPA) is one of the most misunderstood members of a real estate investor’s dream team.

Most investors think a CPA’s job is to file their taxes once a year.

That mindset quietly costs them tens of thousands of dollars over their investing lifetime.

When I help clients analyze deals or review portfolios, one of the first questions I ask is who their CPA is and how involved they are before decisions get made.

The difference between a generic CPA and a real estate–savvy CPA shows up everywhere: cash flow, risk, flexibility, and long-term wealth.

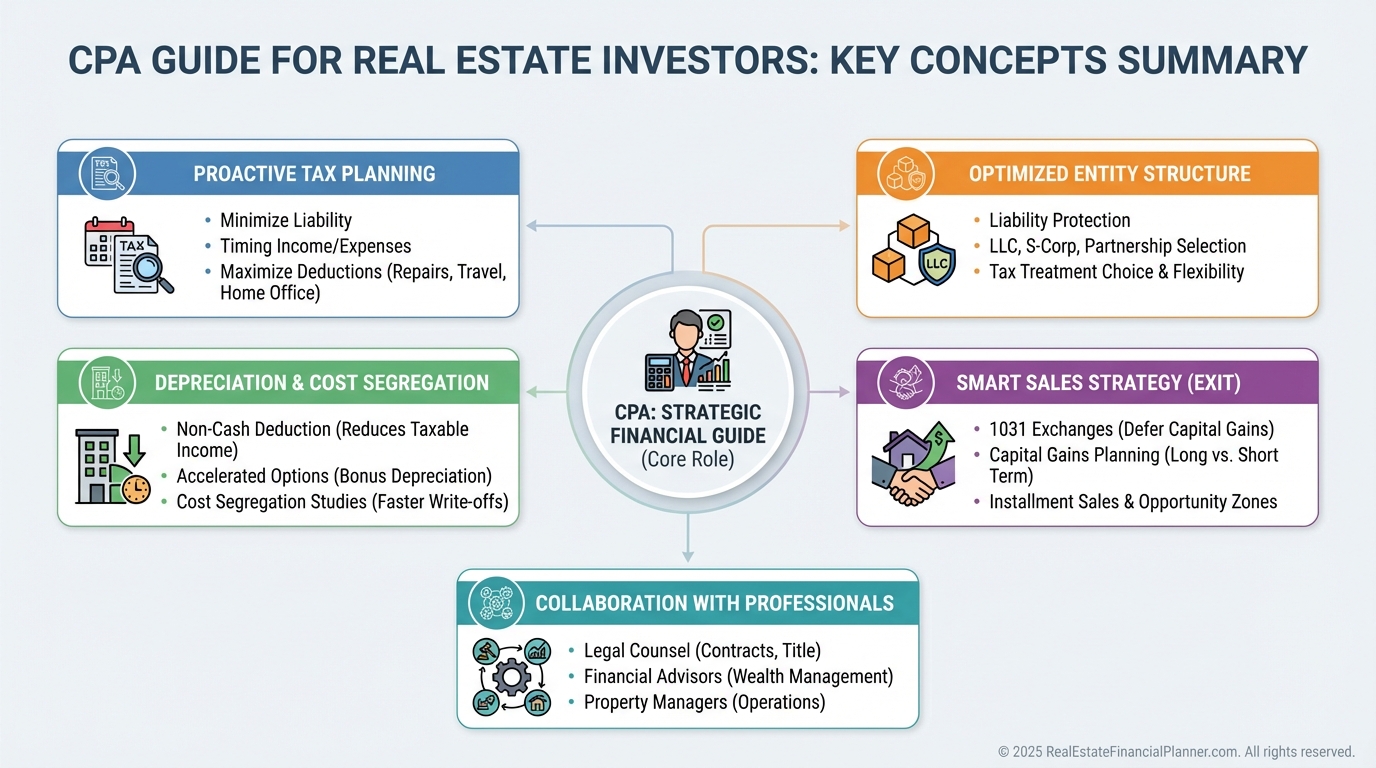

What a CPA Really Does for Real Estate Investors

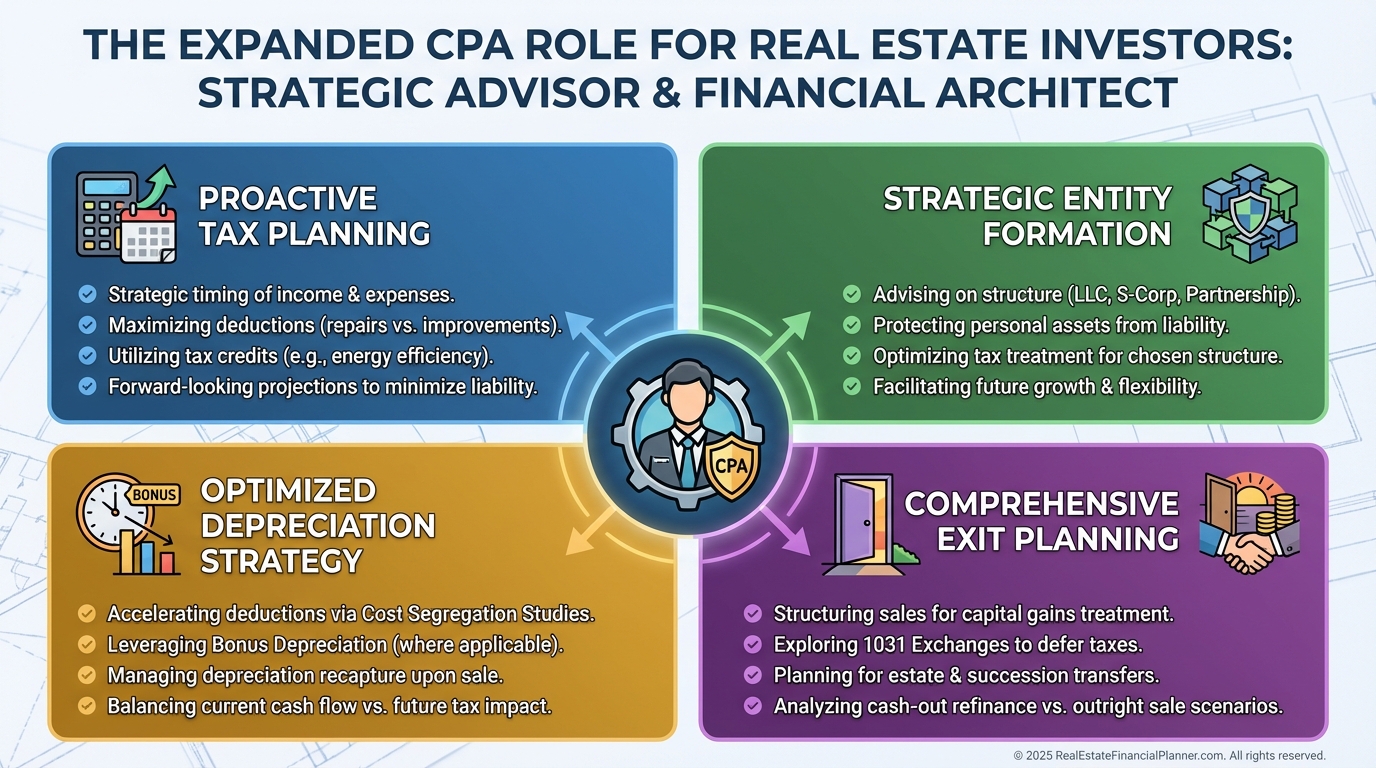

A good CPA is not reactive.

They are proactive, strategic, and involved before you sign contracts, refinance properties, or sell assets.

Their real value comes from planning, not paperwork.

Tax Planning and Entity Structure

This is where most investors either win quietly or lose invisibly.

Your CPA helps determine how you hold property: personally, in an LLC, in multiple entities, or within partnerships.

I have seen investors create unnecessary LLCs that added cost and complexity without delivering real protection or tax benefits.

I have also seen investors skip basic planning and accidentally expose themselves to avoidable taxes when they sold.

A real estate CPA looks ahead, not just backward.

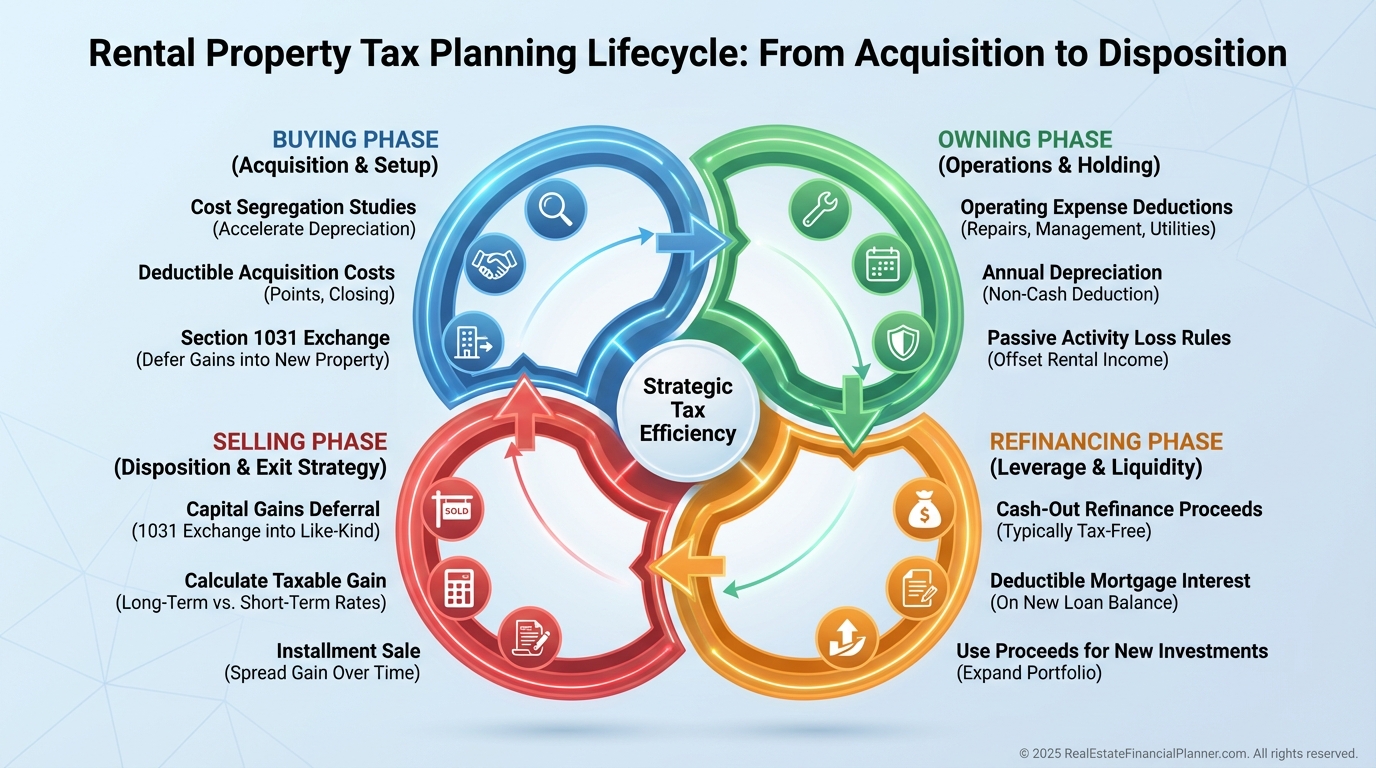

They think about depreciation timing, future sales, refinancing plans, and how today’s decision impacts your True Net Equity™ later.

Tax Preparation That Reflects Reality

Real estate taxes are not plug-and-play.

Rental income, capital improvements, depreciation schedules, partial-year ownership, and cost segregation all introduce nuance.

Your CPA ensures income and expenses are reported correctly, depreciation is tracked accurately, and mistakes that trigger audits are avoided.

When portfolios grow, accuracy stops being optional.

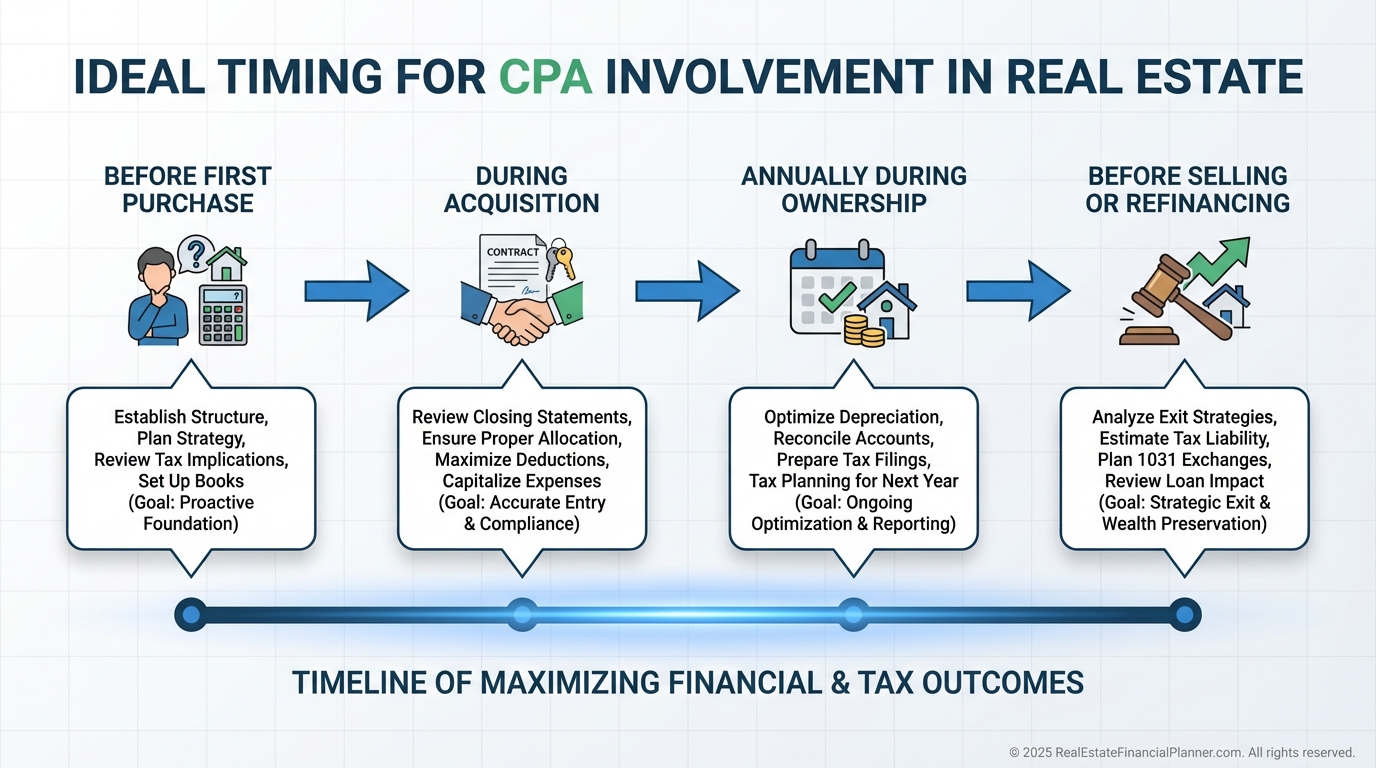

When You Should Involve a CPA

Too many investors bring in a CPA after damage has already been done.

That is backwards.

You want a CPA involved before you buy your first investment property.

They help you structure ownership correctly from day one, which is much harder to fix later.

You also want ongoing guidance throughout the year, not just in March or April.

After purchases, refinances, or sales, your CPA helps interpret the tax consequences and adjust strategy.

I rebuilt everything after bankruptcy, and one lesson stuck permanently: clean structure early prevents painful cleanup later.

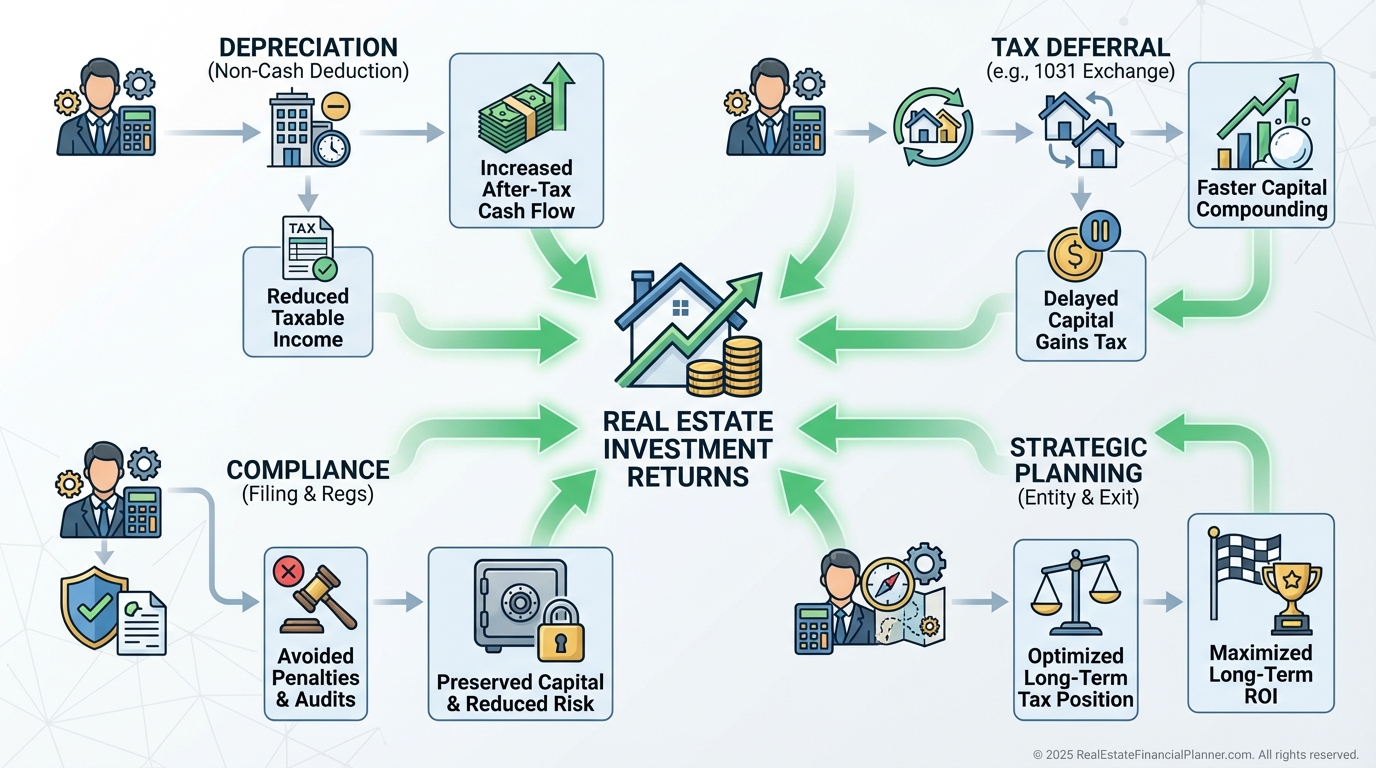

Why a CPA Is Critical to Long-Term Returns

A CPA directly impacts your returns, even if they never touch your spreadsheet.

Maximizing Legal Tax Advantages

Depreciation alone can dramatically change cash flow.

Layer in cost segregation, timing strategies, and intelligent use of deductions, and the difference becomes massive.

I often model deals where two investors buy identical properties, but one keeps significantly more money simply because their CPA planned ahead.

Avoiding Expensive Mistakes

Missed filings, incorrect depreciation, and poorly planned sales trigger penalties, audits, and surprise tax bills.

A good CPA reduces friction and uncertainty.

They help you sleep at night.

Supporting Strategic Decisions

CPAs help answer questions investors rarely ask early enough.

Should you sell or refinance?

Should you 1031 exchange or reset depreciation?

How does this decision affect your Return on Equity versus your Return in Dollars?

These answers shape your portfolio trajectory.

Key Areas Where CPAs Add Outsized Value

Planning for Sales and Exits

Selling without a plan is one of the fastest ways to destroy True Net Equity™.

A CPA helps you evaluate capital gains, depreciation recapture, and deferral strategies like 1031 exchanges.

They help you compare the math, not the emotions.

Structuring Partnerships Correctly

Joint ventures fail more often from bad structure than bad properties.

A CPA helps define profit splits, contributions, and tax reporting so partnerships stay clean and defensible.

Coordinating With Your Full Dream Team

Your CPA should work closely with your attorney and bookkeeper.

When those three are aligned, your investing business runs smoothly.

When they are not, small errors compound quietly.

The Bottom Line on CPAs and Real Estate Investing

A CPA is not a commodity.

They are a strategic partner.

The right CPA helps you keep more of what you earn, avoid mistakes you never see coming, and make better long-term decisions with confidence.

If your CPA only talks to you once a year, you are underutilizing one of the most powerful tools in your investing business.