Disposition Fee Explained: The Exit Cost That Quietly Reduces Your Returns

Learn about Disposition Fee for real estate investing.

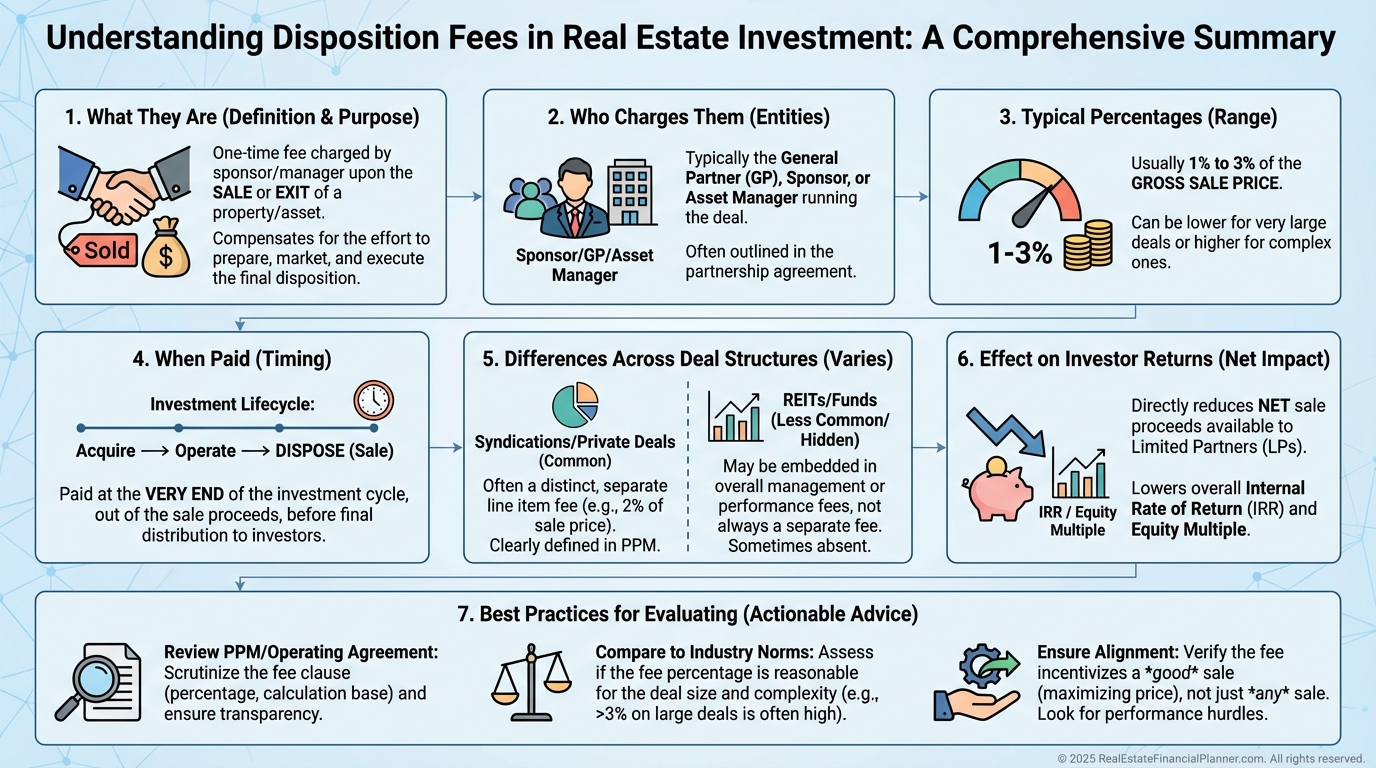

What Is a Disposition Fee?

A disposition fee is an exit fee charged when an investment property is sold.

It is usually paid to the general partner, syndicator, or sponsor responsible for executing the sale.

When I help clients analyze syndications, this is one of the fees most often overlooked.

It feels distant because it shows up years in the future, right when everyone expects to celebrate a win.

Disposition fees are different from acquisition fees and ongoing asset management fees.

They exist solely to compensate the sponsor for planning, marketing, negotiating, and closing the exit.

They are also different from real estate commissions.

A commission pays a broker to find a buyer.

A disposition fee pays the investment manager for orchestrating the entire exit strategy.

When Disposition Fees Are Charged

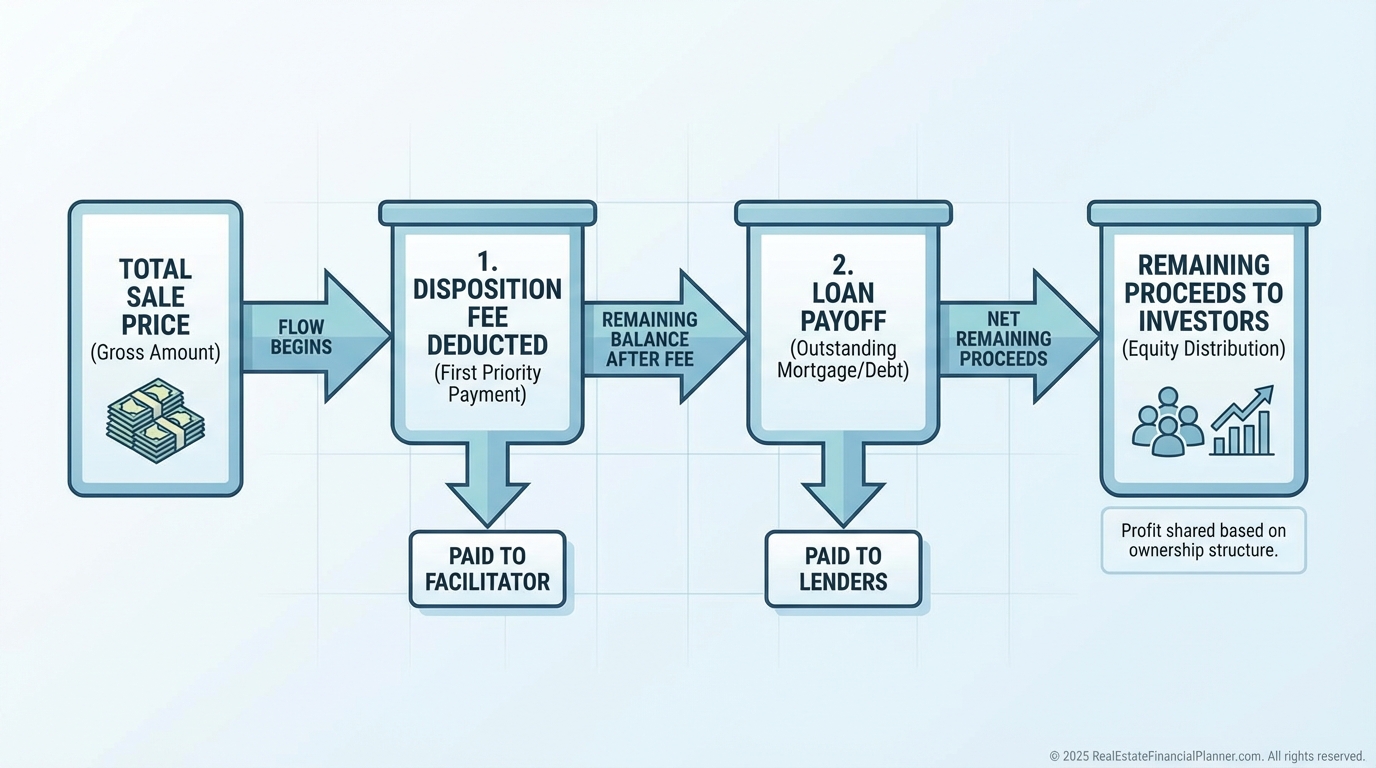

Disposition fees are typically paid at closing.

They come directly out of the gross sale proceeds, before profits are split.

Typical Disposition Fee Structures

Most disposition fees fall into a narrow range.

One percent to three percent of the gross sale price is common.

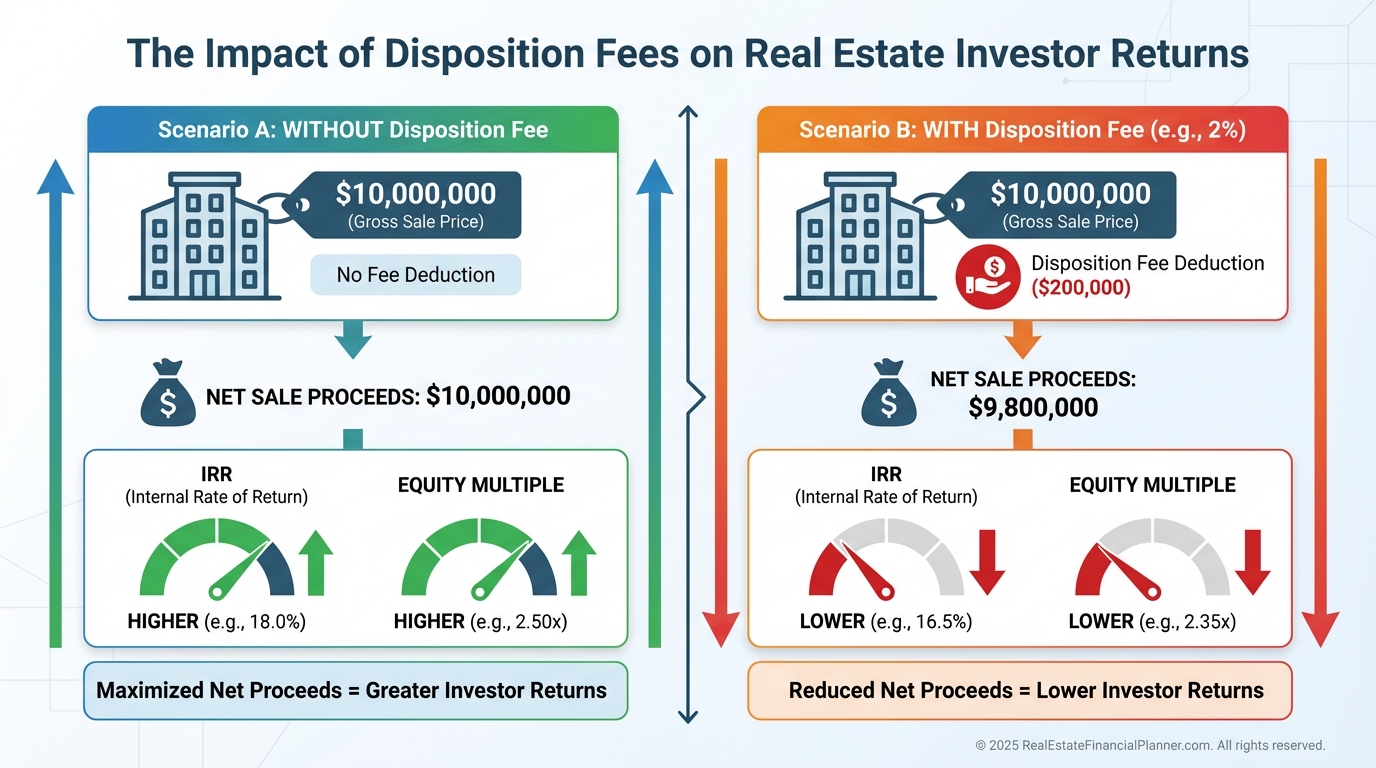

On a $10 million sale, a two percent disposition fee equals $200,000.

That money is gone before investors see a single dollar of profit.

Some sponsors use flat percentages.

Others use tiered structures or performance-based formulas tied to return hurdles.

When I model deals inside Real Estate Financial Planner™, I always test multiple fee scenarios.

Small percentage changes at exit can materially change whether a deal meets an investor’s goals.

What Disposition Fees Are Supposed to Cover

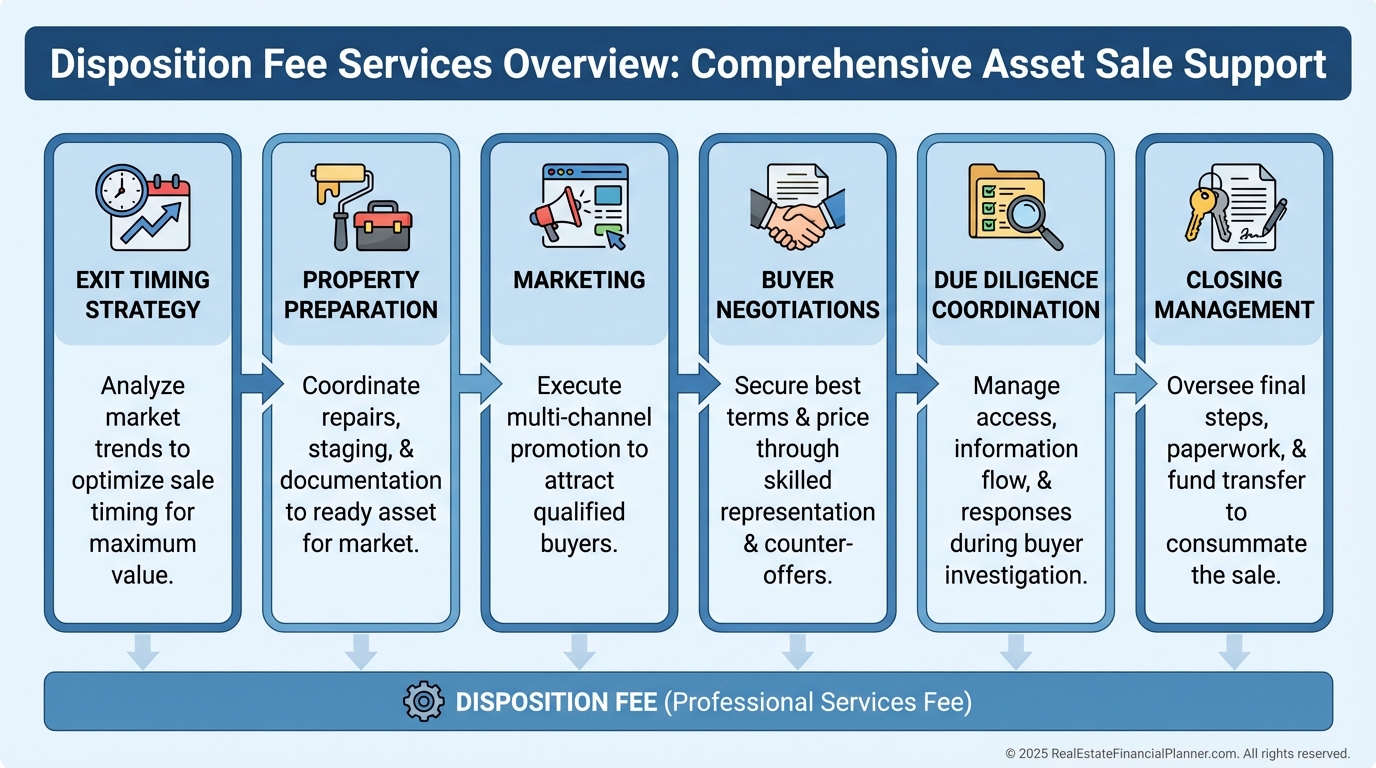

Disposition fees are meant to compensate real work.

That work usually starts long before the property goes on the market.

It often includes exit timing analysis, coordinating repairs or upgrades, overseeing marketing, negotiating buyer terms, managing due diligence, and closing logistics.

The problem is not that disposition fees exist.

The problem is when the fee is disconnected from value delivered.

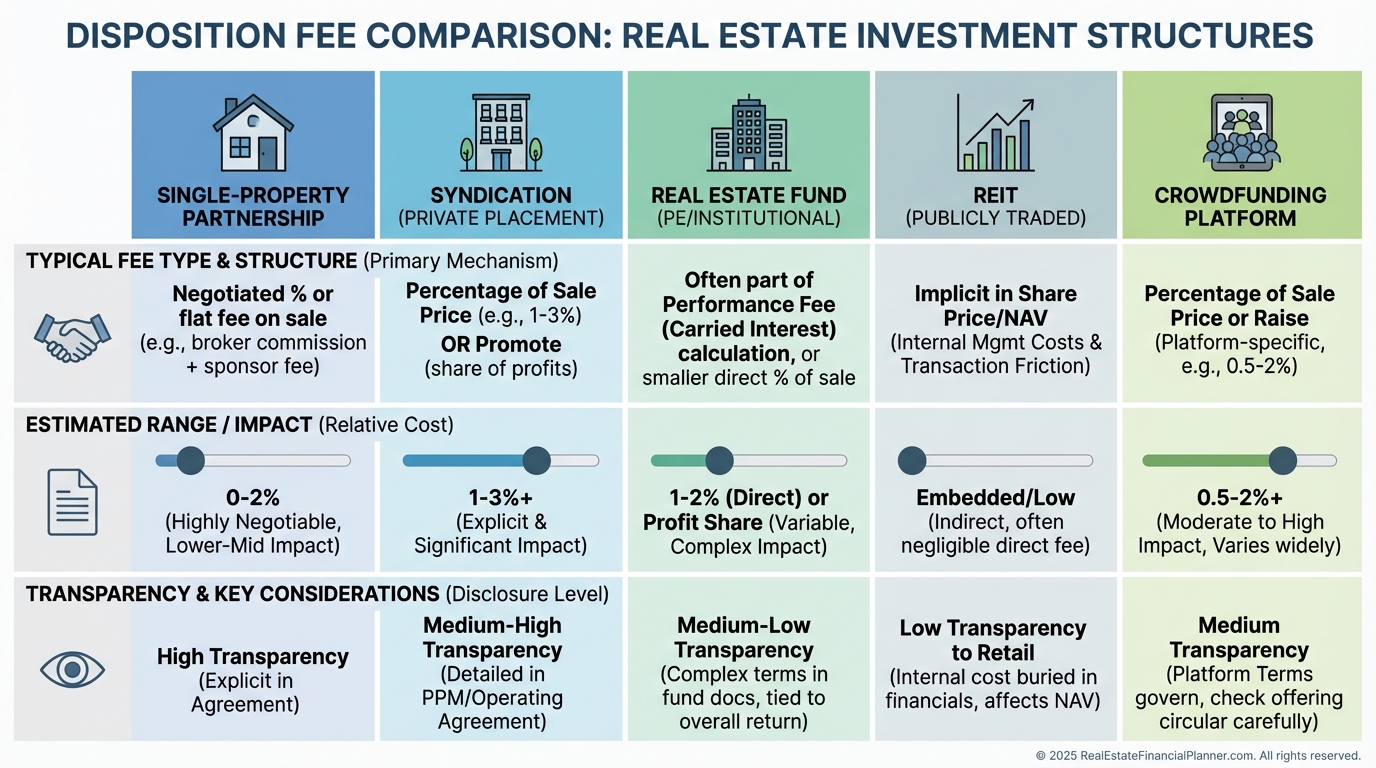

Disposition Fees Across Deal Types

Disposition fees show up differently depending on the investment structure.

In single-property partnerships, the fee may be negotiated directly.

In syndications, it is usually baked into the operating agreement and non-negotiable for small investors.

REITs and funds may charge them at the portfolio level.

Crowdfunding platforms sometimes layer platform fees on top of sponsor fees.

How Disposition Fees Affect Returns

Disposition fees reduce sale proceeds.

That directly reduces equity multiple and IRR.

When I rebuilt my investing strategy after bankruptcy, I became obsessive about modeling exits correctly.

That experience taught me that exit math is where optimism goes to die.

Disposition fees also interact with leverage.

The higher the leverage and the shorter the hold, the more painful the fee becomes.

Disposition Fees and True Net Equity™

Disposition fees reduce what I call True Net Equity™.

That is the equity you can actually walk away with after all costs of accessing it.

Many investors track appreciation but ignore friction costs.

Disposition fees are one of the largest friction costs at exit.

If you plan to recycle capital into your next deal, this matters even more.

You cannot reinvest money that never reaches your pocket.

Negotiating and Evaluating Disposition Fees

In large syndications, individual investors usually cannot negotiate disposition fees.

What you can negotiate is whether you invest at all.

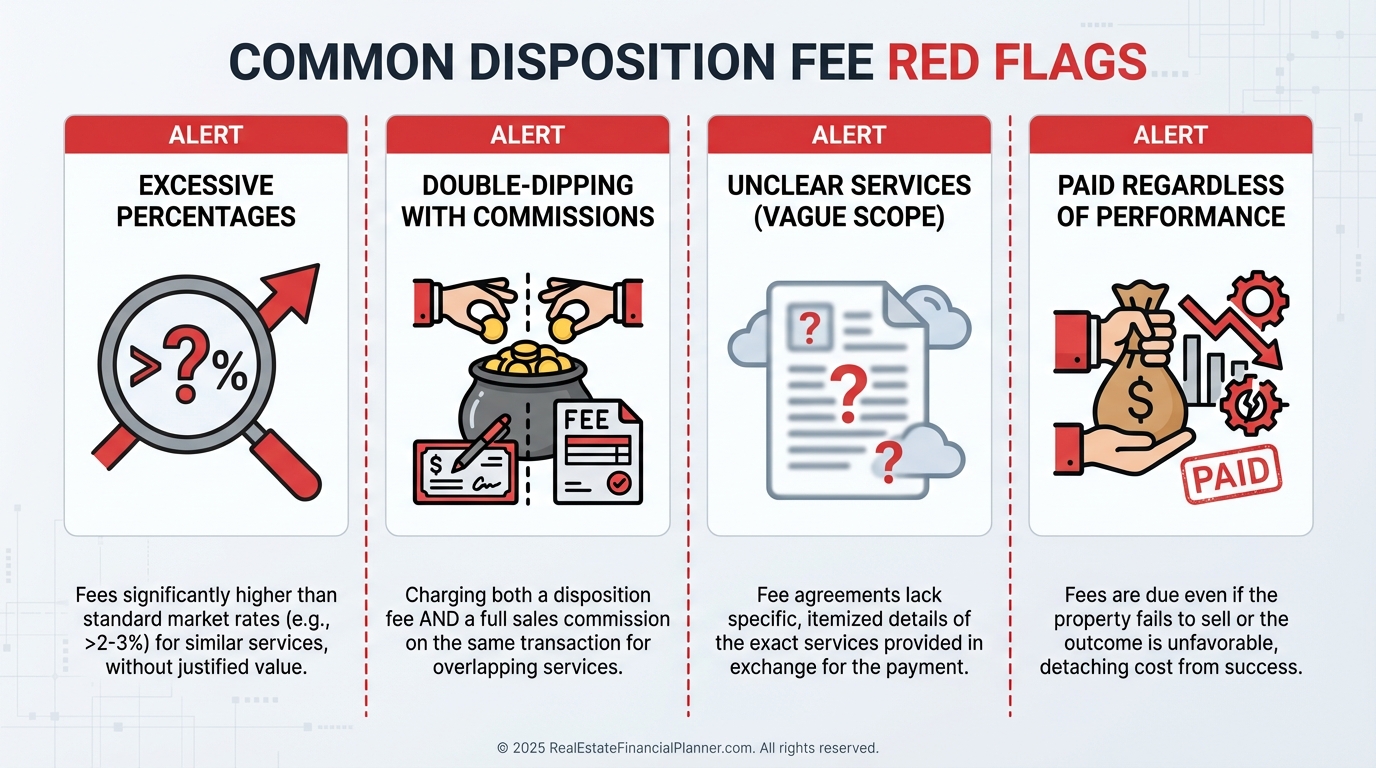

Red flags include fees above three percent with no explanation, double-dipping with full brokerage commissions, or vague language about what the fee covers.

In smaller partnerships, disposition fees can sometimes be tied to performance.

That alignment is usually healthier for investors.

Best Practices for Investors

Always model disposition fees explicitly.

Never assume they are immaterial.

Compare total fee load, not individual line items.

A lower disposition fee does not mean a better deal if other fees are higher.

Keep your focus on net returns and capital velocity.

Exit math determines how fast you can move on to the next opportunity.

When I help investors choose between deals, the winning deal is often the one with the cleanest exit, not the flashiest projections.

Final Thoughts

Disposition fees are easy to ignore because they live at the end of the deal.

That is exactly why they deserve extra scrutiny.

If you want to invest like a professional, you must think like one at the exit.

That means understanding disposition fees, modeling them honestly, and deciding whether the value delivered justifies the cost.