Amortization Schedules: The Hidden Engine Behind Real Estate Wealth

Learn about Amortization Schedules for real estate investing.

Most real estate investors know their monthly mortgage payment by heart.

Very few understand what that payment is actually doing for them.

When I help clients analyze rental properties, this blind spot shows up constantly.

They obsess over cash flow but ignore the quiet wealth being built, or wasted, inside their amortization schedules.

I made the same mistake early on.

Before my bankruptcy and rebuild, I tracked payments, not progress.

That changed everything.

Understanding amortization schedules is not trivia.

It is one of the clearest dividing lines between investors who slowly accumulate properties and investors who deliberately compound wealth.

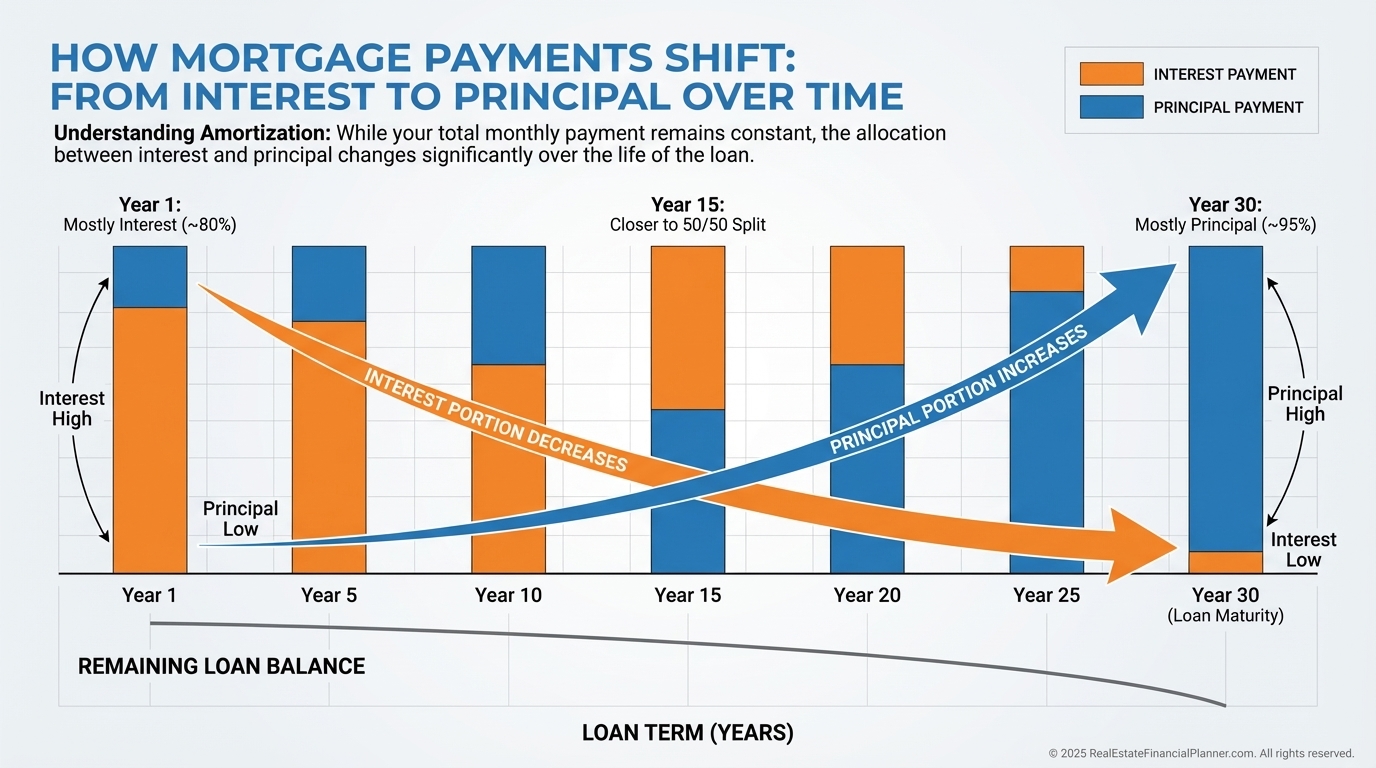

What an Amortization Schedule Really Shows You

An amortization schedule is the full roadmap of your loan.

It shows where every dollar of every payment goes, month by month, for decades.

Each payment can include:

Principal: The portion that actually reduces your loan balance and builds equity.

Interest: The cost of borrowing money, front-loaded and slowly declining over time.

PMI: Insurance premiums required at higher loan-to-value ratios.

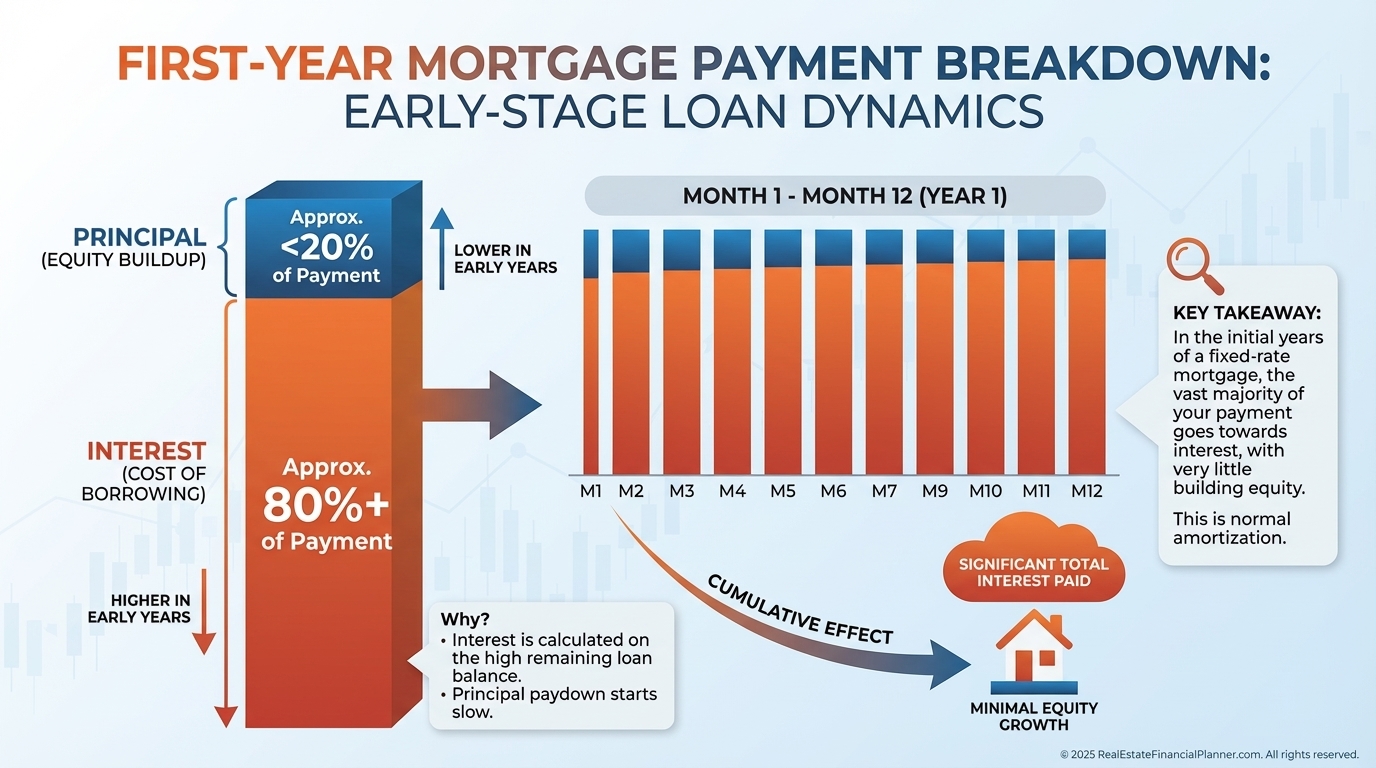

The part most investors miss is not the math.

It is the shape of the curve.

Early on, you are almost entirely paying interest.

Later, the same payment aggressively builds equity.

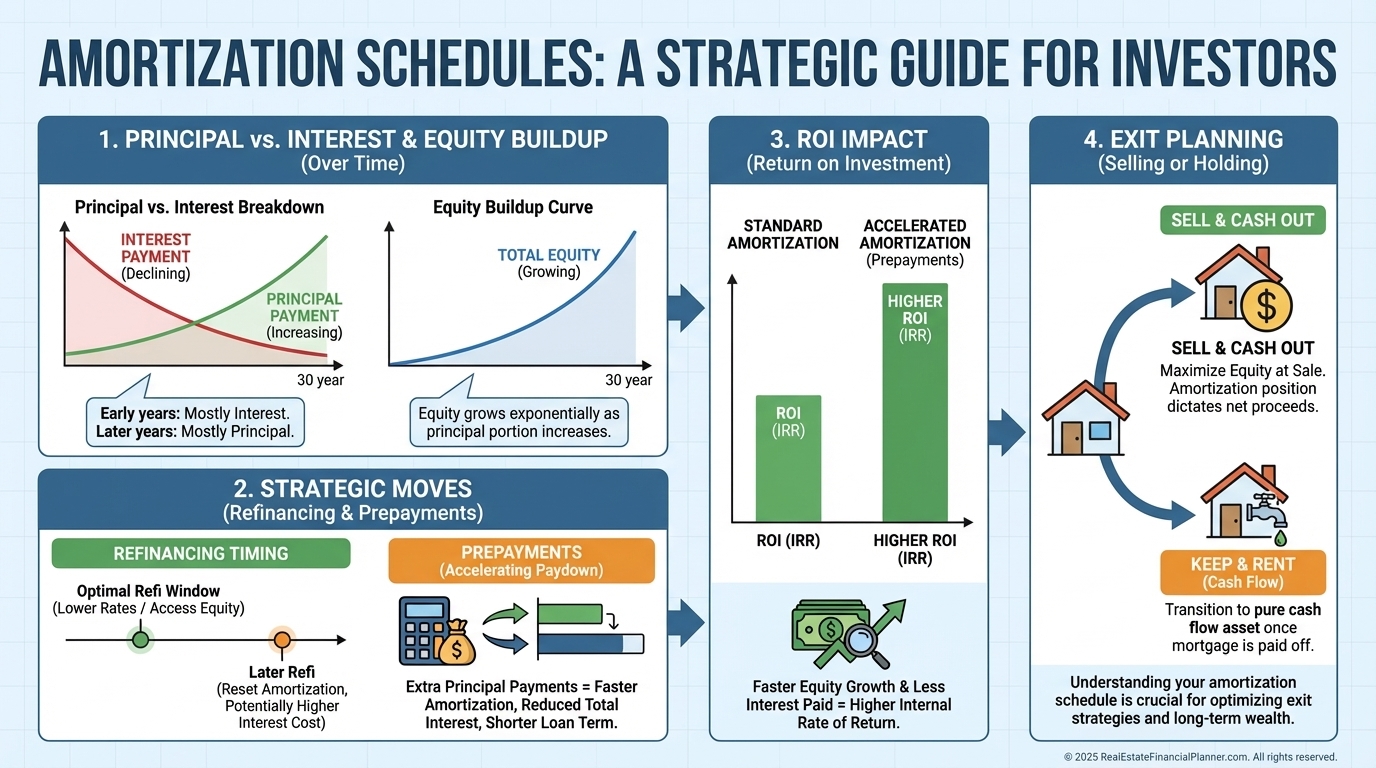

Why Amortization Schedules Matter More Than Your Payment Amount

Two investors can have the same monthly payment and wildly different outcomes.

The difference is where they are on the amortization curve.

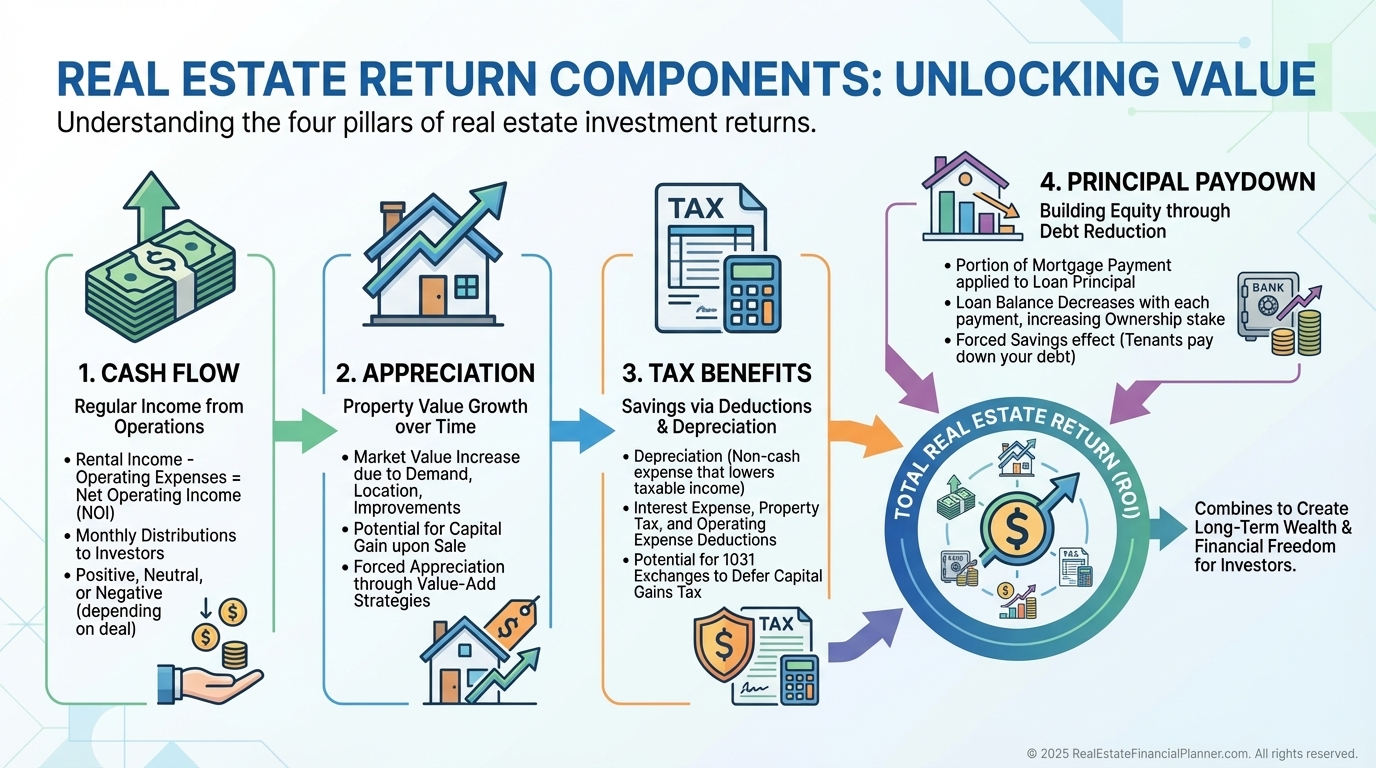

When I review deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, principal paydown is always modeled as a return.

Ignoring it understates your performance and distorts decisions.

Amortization directly affects:

Cash-on-Cash Return through payment size.

Return in Dollars Quadrant™ via principal paydown.

Return on Equity Quadrant™ as equity grows but efficiency declines.

True Net Equity™ when planning exits or refinances.

If you only track cash flow, you are flying blind.

A Simple Example That Changes How You See Debt

Imagine buying a $275,000 duplex with twenty percent down.

Your first payment barely dents the loan balance.

That is not a flaw.

It is how long-term debt works.

What matters is knowing when the shift happens and planning around it.

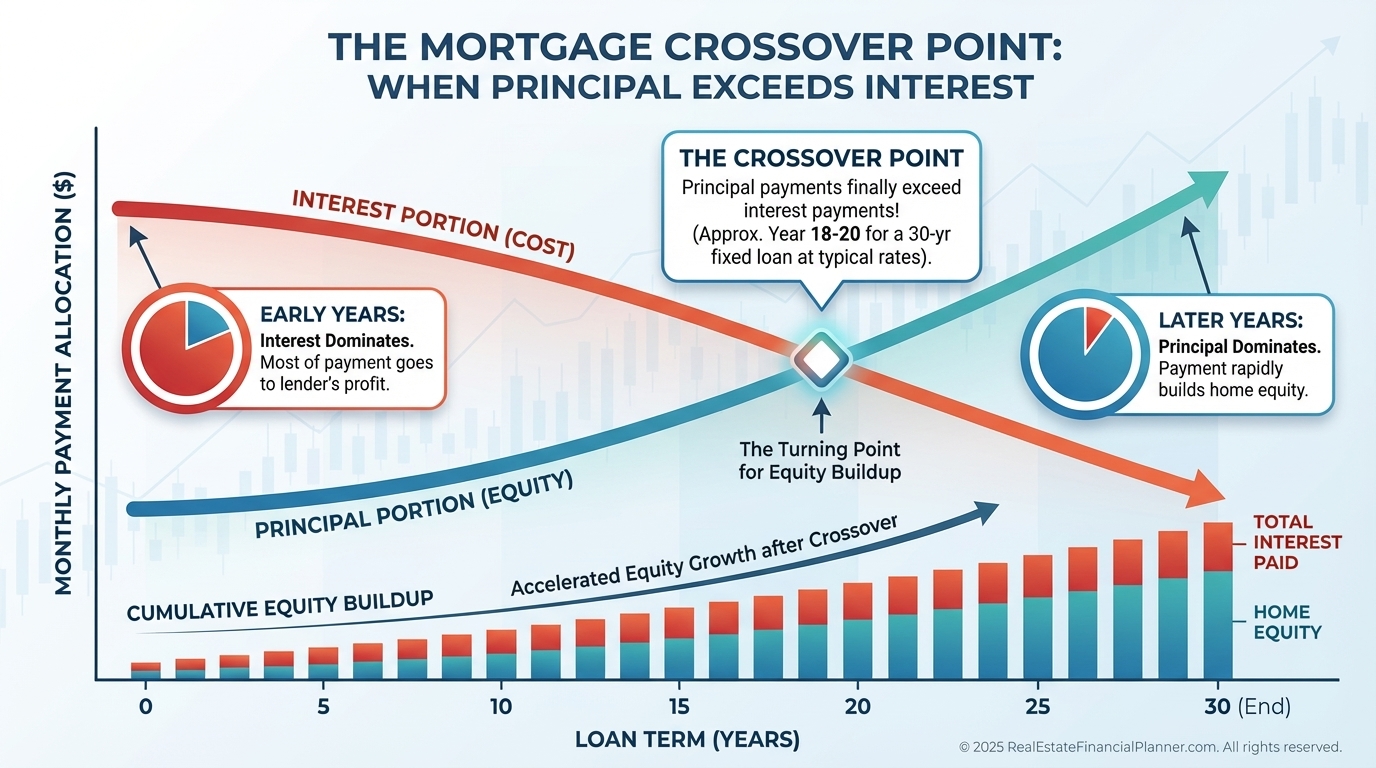

The Crossover Point Most Investors Never Look For

At some point, principal overtakes interest in your payment.

On a thirty-year loan, this often happens between years eight and twelve.

This moment matters.

It affects refinancing decisions, hold strategies, and opportunity cost.

Refinancing just before this crossover can destroy years of compounding.

When I run refinance scenarios for clients, this is one of the first things I check.

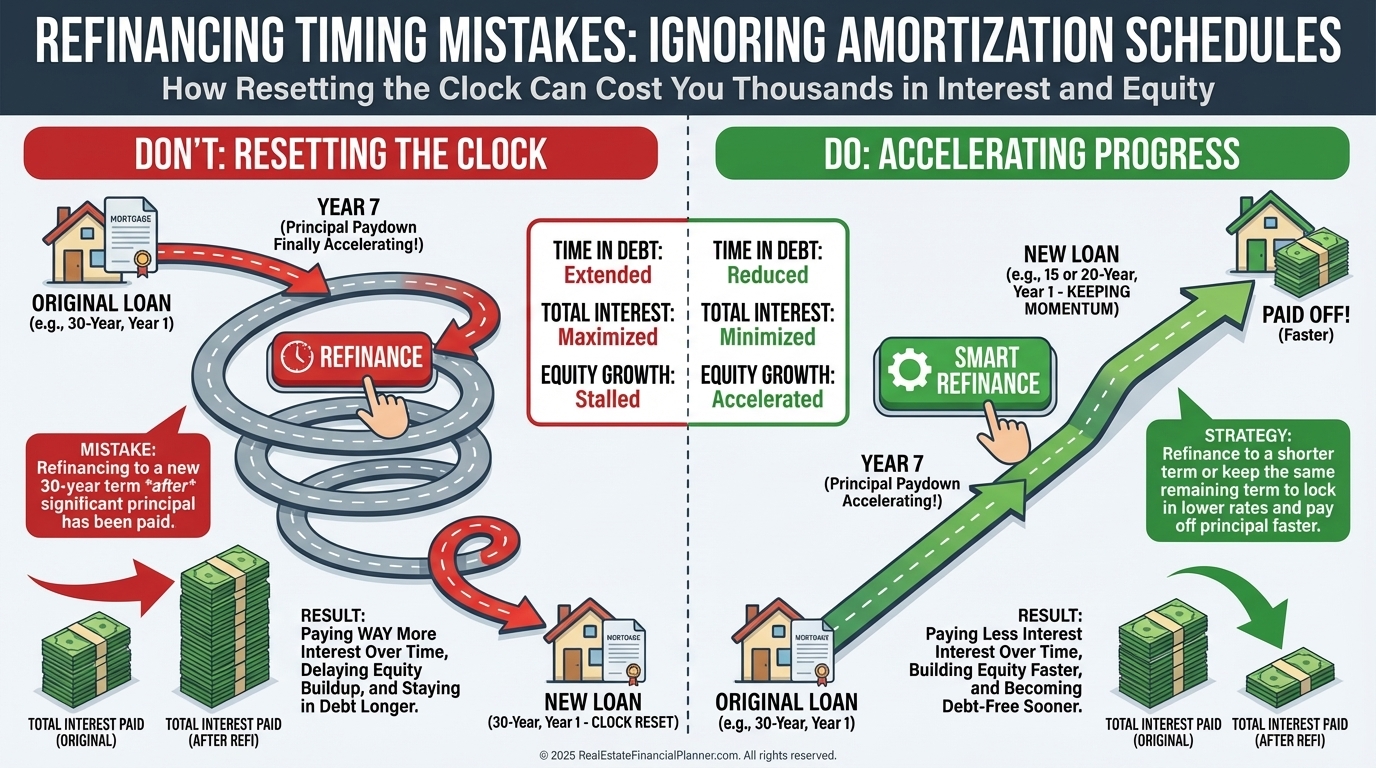

Amortization and Refinancing Mistakes I Warn Clients About

Most refinancing mistakes are not rate mistakes.

They are timing mistakes.

Investors refinance without checking:

How much principal acceleration they are giving up.

Whether PMI could already be removed.

How much True Net Equity™ is actually accessible.

Whether a recast beats a refinance.

An amortization schedule answers these questions cleanly.

Ignoring it can cost tens of thousands over a portfolio.

Why Principal Paydown Is a Real Return

Principal paydown does not show up in your bank account.

That does not make it imaginary.

A property that breaks even on cash flow but pays down six thousand dollars per year in principal is still producing a meaningful return.

Pretending otherwise leads investors to sell winners and keep underperformers.

This is why I teach returns as components, not a single number.

Amortization feeds directly into long-term wealth, whether you notice it or not.

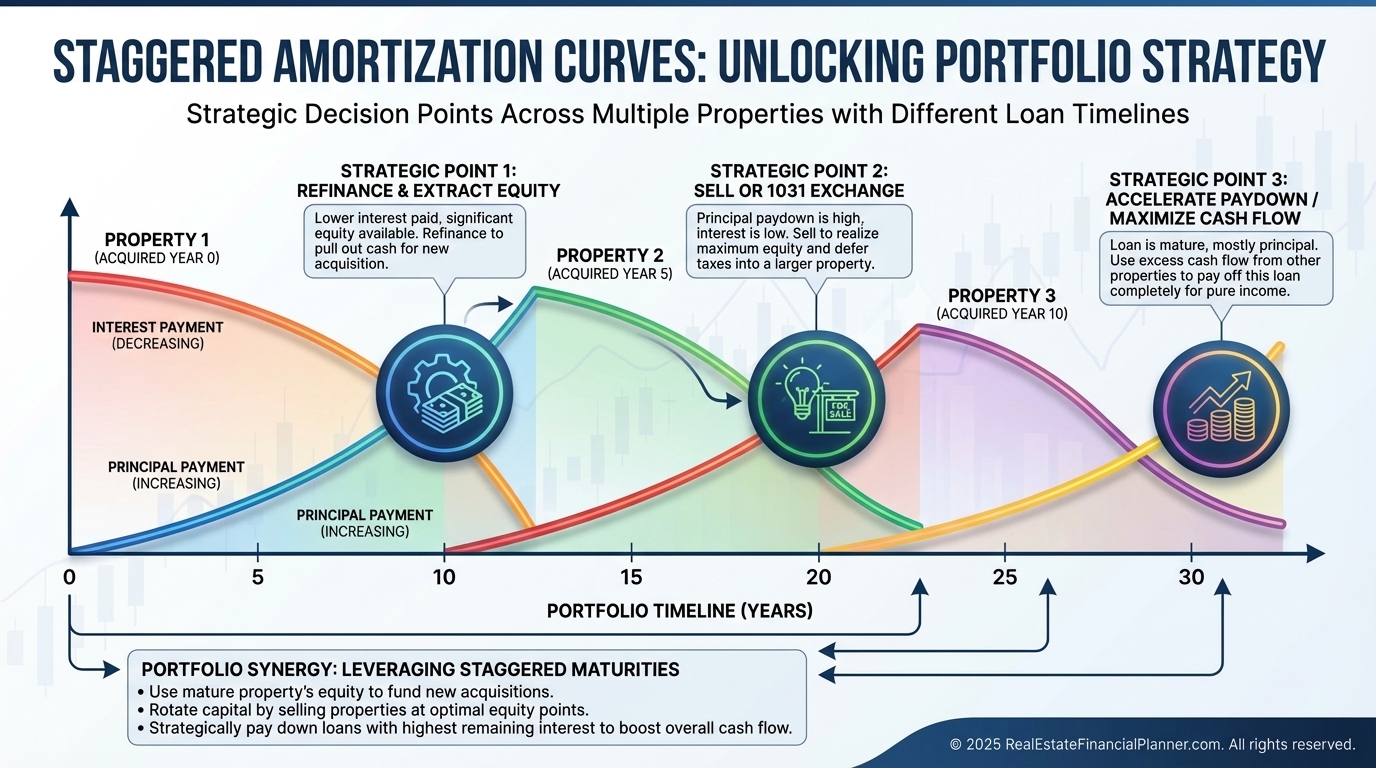

Strategic Uses Most Investors Never Model

Once you understand amortization schedules, strategy changes.

You can:

Time cash-out refinances before equity efficiency collapses.

Decide which property to pay down first based on remaining interest drag.

Plan exits based on equity curves, not gut feelings.

Coordinate 1031 exchanges with maximum rollable equity.

This is especially powerful with Nomad™ strategies, where multiple overlapping loans create staggered amortization curves across a portfolio.

Turning Payments Into a Wealth-Building System

The moment you stop asking, “What is my payment?”

And start asking, “What is my loan doing for me?”

Everything changes.

Amortization schedules turn debt from a liability into a planning tool.

They reveal when to hold, when to refinance, when to sell, and when to redeploy capital.

Most investors never look.

That is why those who do quietly outperform.