House Hacking: The Step-by-Step Playbook to Live Cheaper, Scale Faster, and Build Wealth with Owner-Occupant Loans

Learn about House Hacking for real estate investing.

What Is House Hacking?

House hacking is buying a home you live in and monetizing the extra space with long- or short-term tenants to offset or eliminate your housing cost.

When I help clients design their first plan, we target properties that keep the payment low, the rent high, and the headaches predictable.

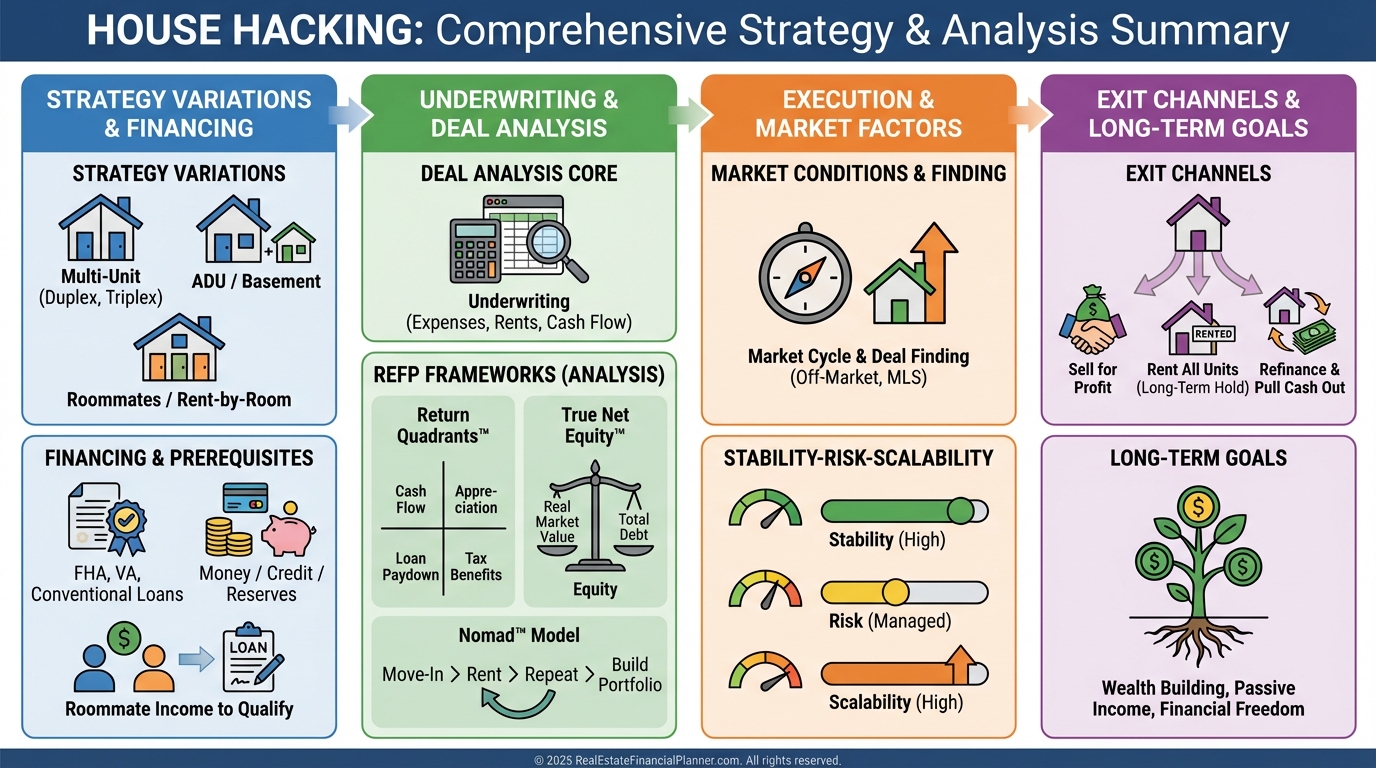

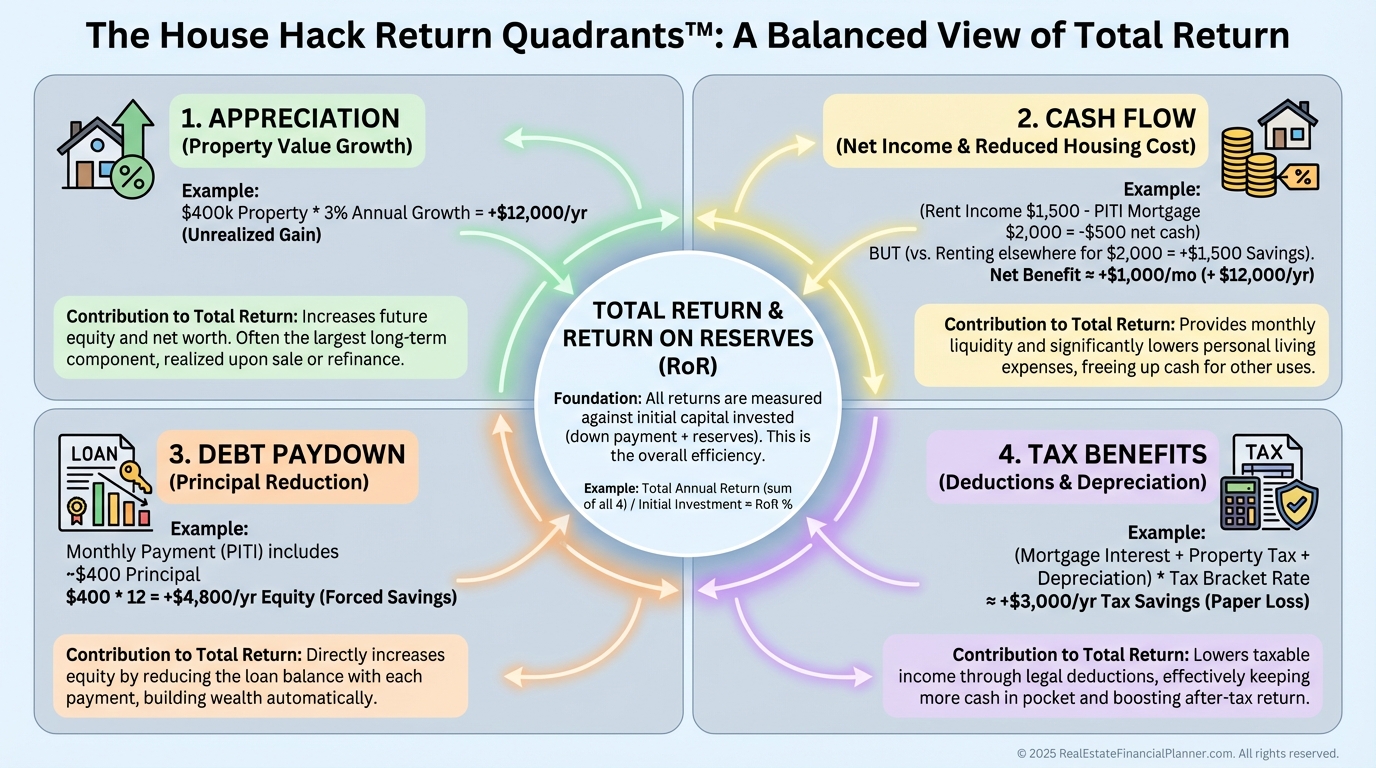

Why It Works: The Return Quadrants™

House hacking taps all four Return Quadrants™—Appreciation, Cash Flow (including reduced housing cost), Debt Paydown, and Tax Benefits—plus a modest return on your Reserves.

You’re not just “saving rent.” You’re converting your largest expense into a multi-angled return engine that compounds over time.

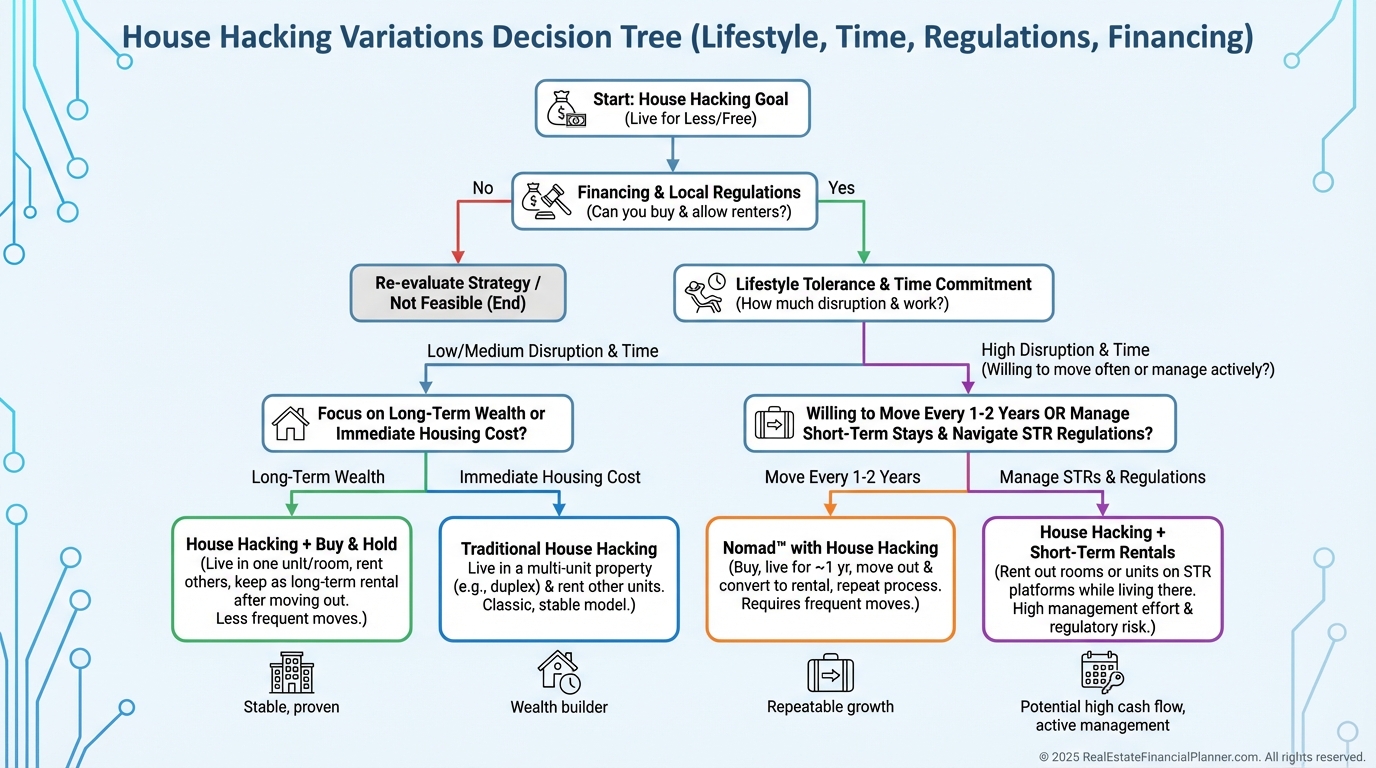

Common Variations (Pick the One That Fits Your Lifestyle)

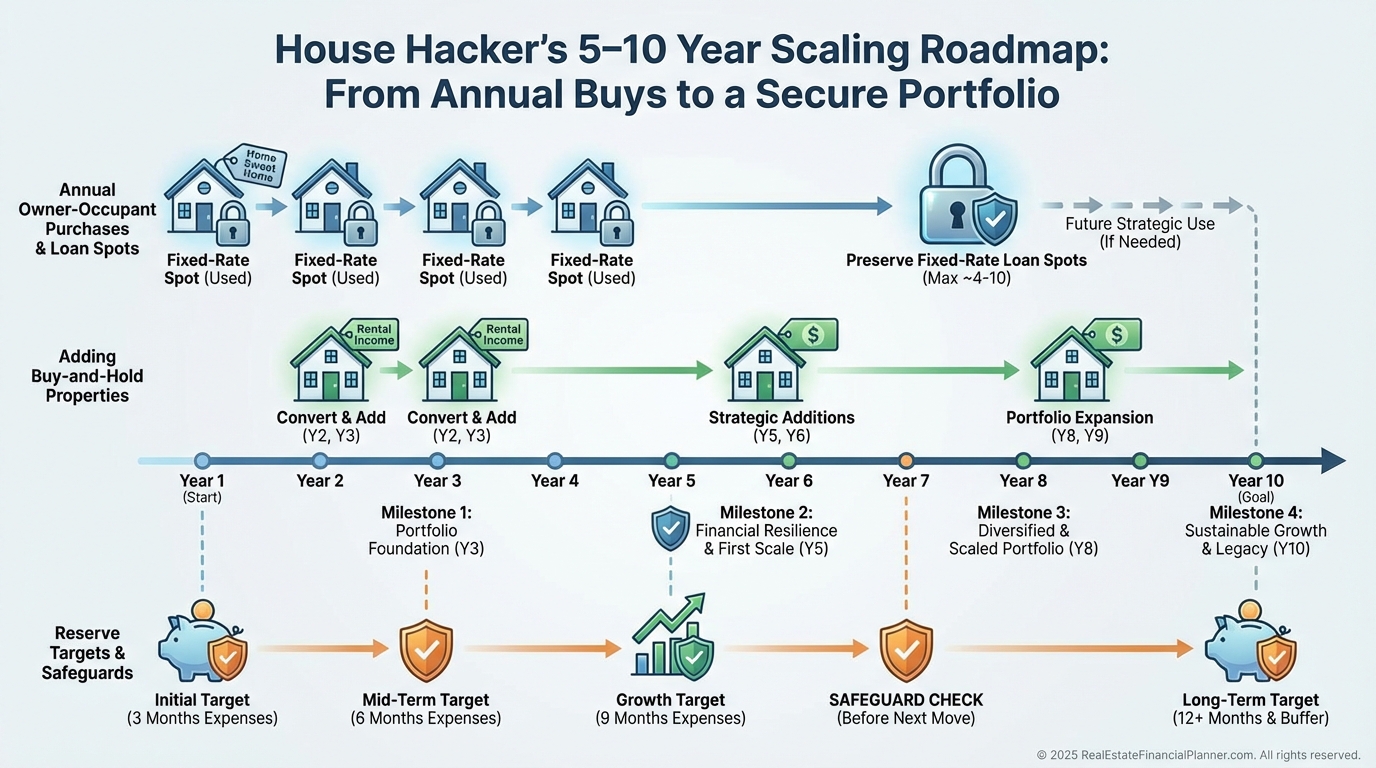

Nomad™ with House Hacking: Move once per year into a new owner-occupant property you can house hack today and rent fully tomorrow.

House Hacking + Traditional Buy & Hold: While living in your house hack, add separate investor loans for long-term rentals to accelerate scale.

House Hacking + Short-Term Rentals: Rent spare rooms or a separate unit nightly for higher income if regulations permit and you want a more active model.

When I model these choices for clients, I compare not just cash flow, but True Net Equity™ growth and loan spot usage over 10 to 20 years.

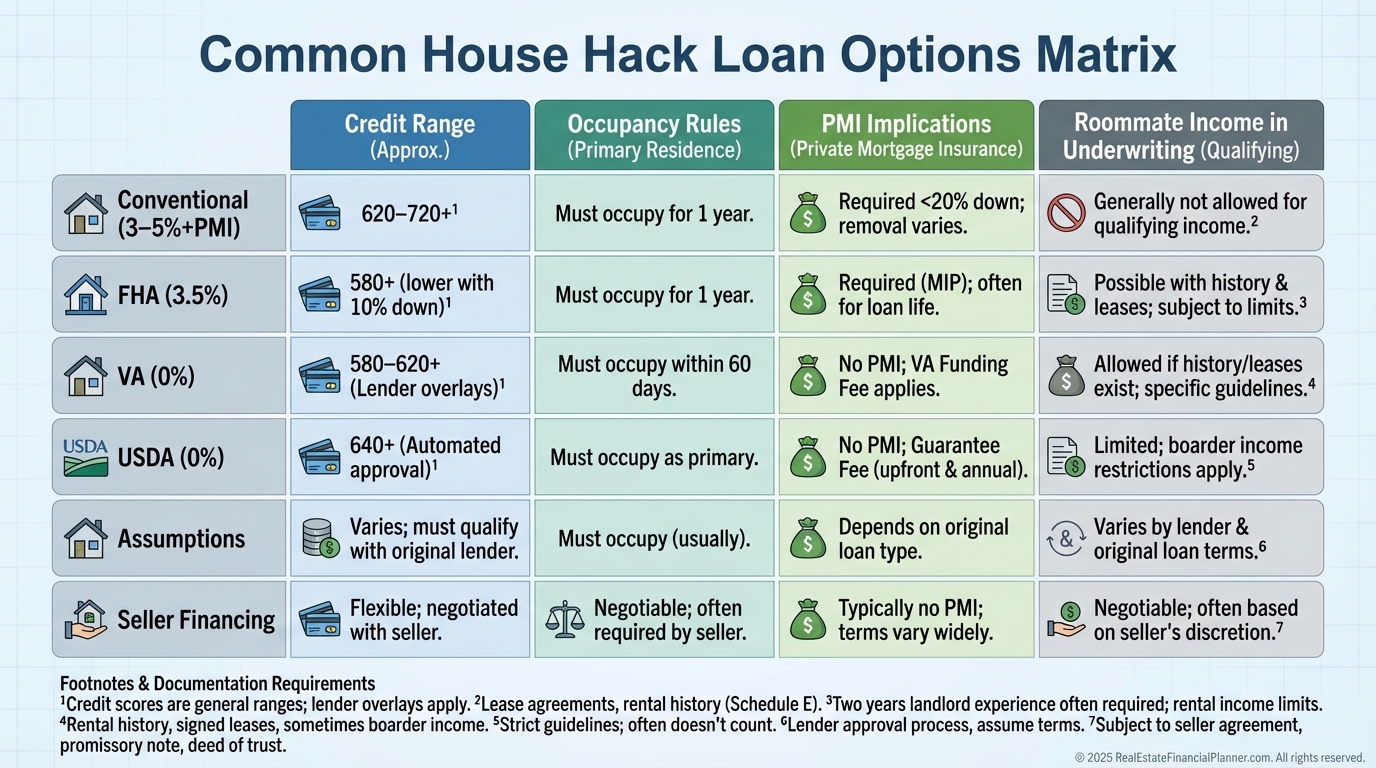

Financing Playbook (Owner-Occupant Advantages)

Conventional loans can go as low as 3–5% down with PMI, often at better rates than investor loans.

FHA allows 3.5% down and is more forgiving on credit and debt-to-income (DTI). VA and USDA offer 0% down for eligible borrowers or eligible rural locations.

Yes, PMI adds cost, but getting in sooner can beat waiting years to save 20% when prices and rents are rising.

Less common but powerful: seller financing, loan assumptions on low-rate mortgages, and larger down payments to eliminate PMI and improve cash flow.

Critical warning: owner-occupant loans require you to move in and typically live there for at least one year. Misrepresenting occupancy is loan fraud.

Using roommate income to qualify: for your primary, Fannie Mae allows adding boarder/roommate income to your gross income while counting the full PITIA as a liability. Lenders will want a lease or rent history to document it.

Underwriting the Deal (James’s Checklist)

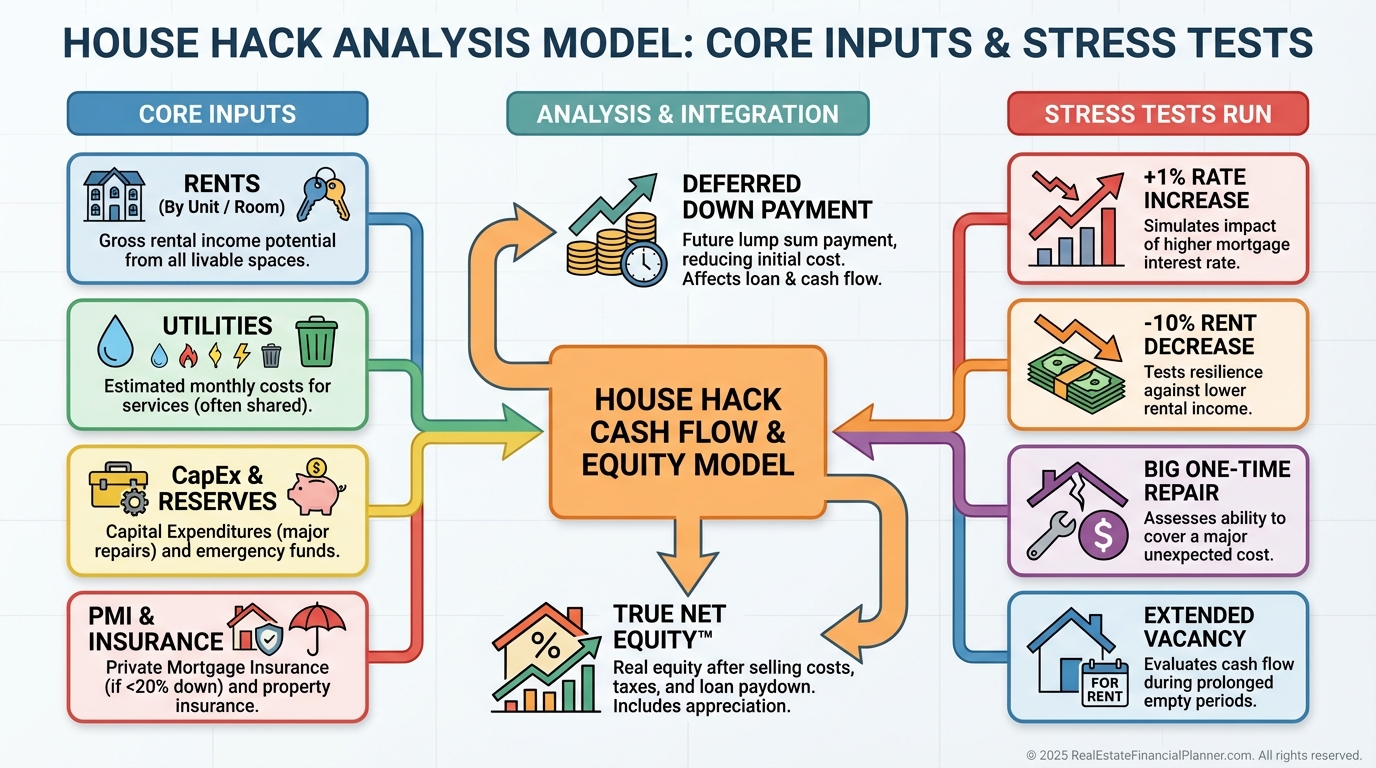

I run every property through The World’s Greatest Real Estate Deal Analysis Spreadsheet™ available at RealEstateFinancialPlanner.com/spreadsheet.

I verify market rent by unit and by room, then haircut it for vacancy, concessions, and seasonality if doing short-term rentals.

I treat negative cash flow as Deferred Down Payment. If you put more down, it likely disappears; if you put less down, budget for it up front as Cumulative Negative Cash Flow.

I track True Net Equity™ each year—equity minus transaction costs, disposal costs, and depreciation recapture tax—so we know what you’d really net if you sold.

Then I stress test: +1% to rates at refi, −10% to rents for six months, surprise $5K repair, and a 60-day vacancy. If the plan survives, you’re safer.

Money, Credit, and Reserves

Plan for down payment, closing costs, rent-ready work, furnishings/locks if doing short-term rentals, and at least 6–12 months of full expenses in reserves.

Typical credit minimums are around 620 for Conventional and 580 for FHA/VA, but better scores reduce rate and PMI.

If you lack perfect credit, pair up with a strong-credit partner while you handle operations, or simply wait and polish your score. Time invested here pays you for decades.

How Active Do You Want This To Be?

Roommates in a single-family is moderately active. A duplex with one neighbor is similar.

Short-term rentals amplify income and workload. Expect guest messaging, cleaning, and dynamic pricing.

You can hire property managers for separate units, but room-by-room management is trickier. Either way, you still manage the manager.

Holding Periods and Exits

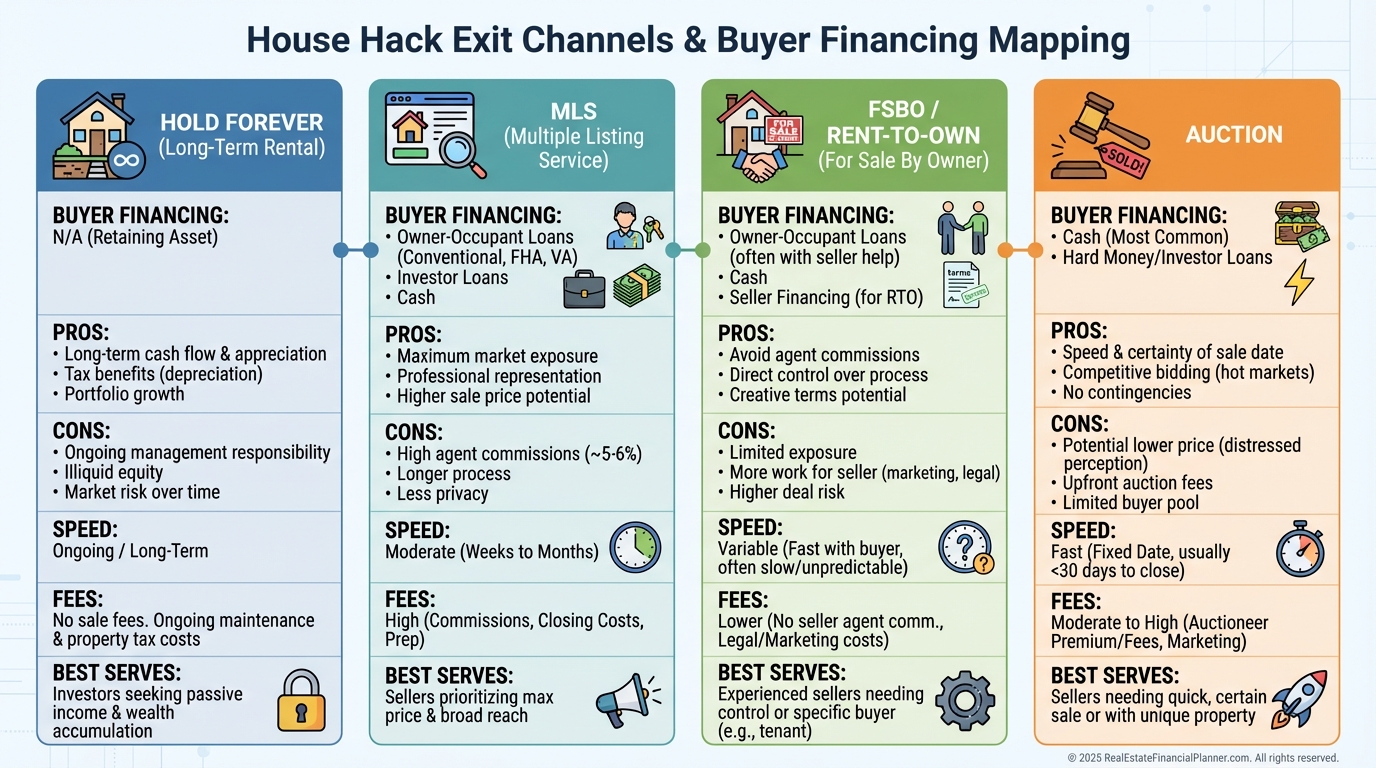

Most clients keep house hacks for 20+ years or indefinitely. The amortization snowball and rent growth improve results with time.

Common exit paths include listing on the MLS, selling FSBO or as a rent-to-own, and occasionally auction. Many simply hold forever.

Your buyer will bring conventional, FHA/VA (if they’ll occupy), investor loans, or cash. You don’t control their financing, but knowing it helps you negotiate.

Risk Management and Stability

House hacking is actively stable—you must work to maintain performance. That includes tenant screening, lease enforcement, and regular maintenance.

Key risks: rate changes, rent softening, price declines, roommate/tenant issues, and regulatory changes for short-term rentals.

Mitigate with conservative underwriting, ample reserves, strong insurance, house rules, and diversification over time.

Scalability (One Property a Year—And More)

You can buy one owner-occupant house per year under most guidelines, using just 3–5% down and preserving cash for the next move.

Stack in parallel strategies—traditional buy and hold or a 10% down second-home loan for a legally compliant vacation STR—if your time and reserves support it.

I also model loan spot usage so you don’t waste your limited fixed-rate loan slots on suboptimal deals.

Finding and Selecting Deals

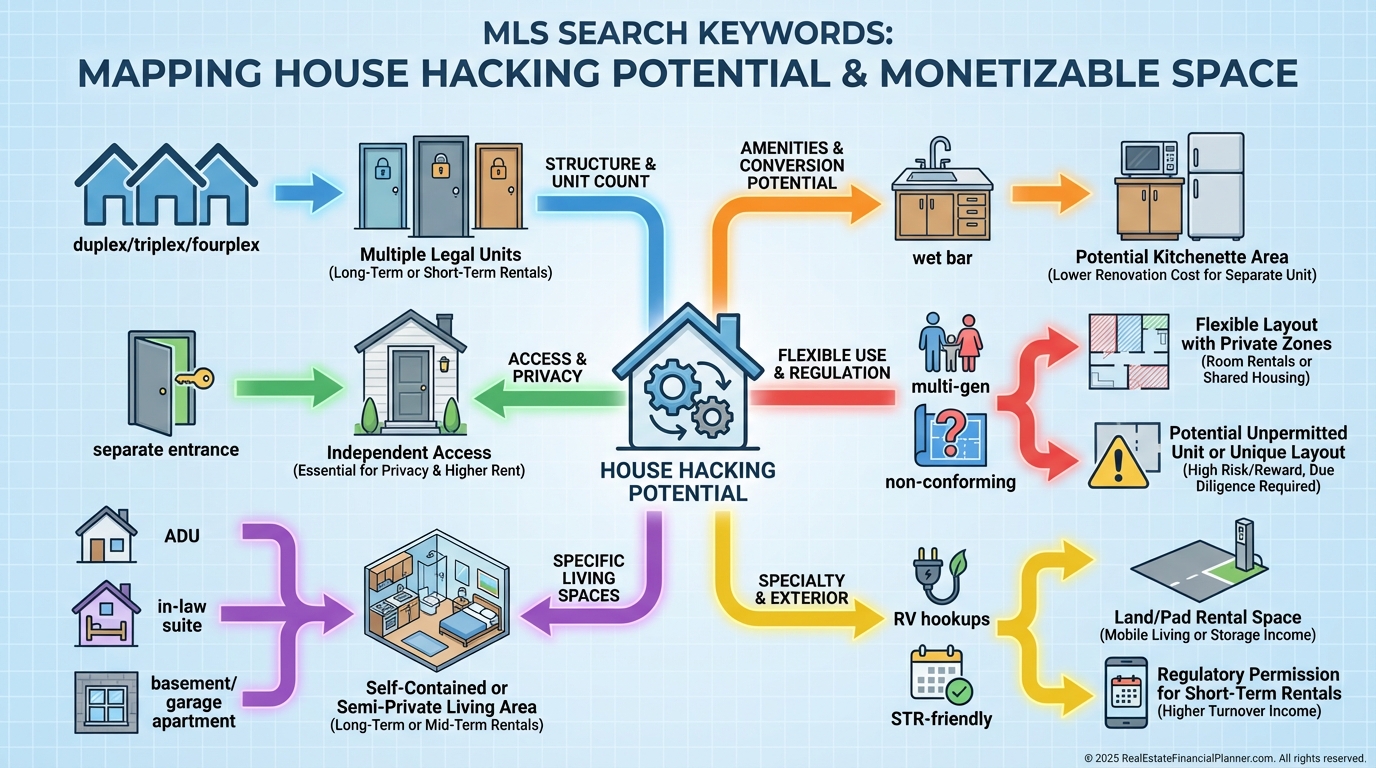

Start with the MLS. Then add FSBO outreach and relationships with wholesalers who source small multi-family and ADU-friendly lots.

In walkthroughs, I check separate entrances, sound transfer, parking, laundry splits, lock-off options, and egress for safety and compliance.

When I write offers, I negotiate for rent-ready repairs, seller concessions toward closing costs or rate buydowns, and access before closing to pre-market rooms.

Search terms that often reveal hidden house hacks: duplex/triplex/fourplex, ADU, in-law suite, separate entrance, basement/garage apartment, wet bar, multi-gen, non-conforming (for roommates), RV hookups, and STR-friendly wording.

Market Conditions and Availability

Ideal markets offer decent price-to-rent ratios, rising rents, and strong long-term fundamentals. Challenging markets have high prices, weak rents, or strict STR rules.

Interest rates can make or break your cash flow. As an owner-occupant, your rate is often better than an investor’s—use that edge.

If initial cash flow is thin, budget Deferred Down Payment up front and let rent growth close the gap over time.

Using Retirement Accounts

Self-directed retirement accounts generally cannot buy owner-occupied properties without triggering prohibited transactions.

House hacking and retirement funds don’t mix. Use owner-occupant financing and keep the retirement account for other investments.

Quick Example (Numbers You Can Adapt)

You buy a $525,000 up/down duplex at 5% down with a 6.5% rate and PMI. PITIA is about $3,950/month.

You live upstairs and rent the lower unit for $2,300. You also rent a spare bedroom for $900.

Your net housing cost is roughly $750/month after modest utilities and maintenance reserves. Next year, when you move out Nomad™-style, rent your unit for $2,400 and convert the spare bedroom into the full unit.

On the Return Quadrants™, you collect appreciation, debt paydown on a 30-year fixed, tax benefits via depreciation (when it’s a rental), and increasing cash flow as rents rise and PMI eventually drops.

Your 30-Day Action Plan

•

Get pre-approved with a lender who understands house hacking, roommate income, and occupancy rules.

•

Define your target: roommates vs. duplex/ADU vs. STR, along with your time tolerance.

•

Set reserve targets (6–12 months of total expenses) and a Deferred Down Payment buffer if needed.

•

Build your search using MLS keywords and alerts, and walk 6–10 candidate properties.

•

Analyze each with the REFP spreadsheet, including stress tests and True Net Equity™.

•

Write strong offers with inspection, rent-ready asks, and seller credits for rate buydowns.

•

Draft house rules and leases before closing so you can market rooms/units immediately and collect deposits in advance.