Stop Leaving 75% of Your Returns Behind: Master the Return on Investment Quadrant™

Learn about Return on Investment Quadrant™ for real estate investing.

The Blind Spot Costing Investors Most of Their Return

When I review deals with clients, I often see 75% of the returns ignored.

I made the same mistake early on.

When I rebuilt after bankruptcy, I stopped chasing cash flow alone and started measuring all four Return Quadrants™.

That shift is why my clients now hit their financial independence targets faster and with less risk.

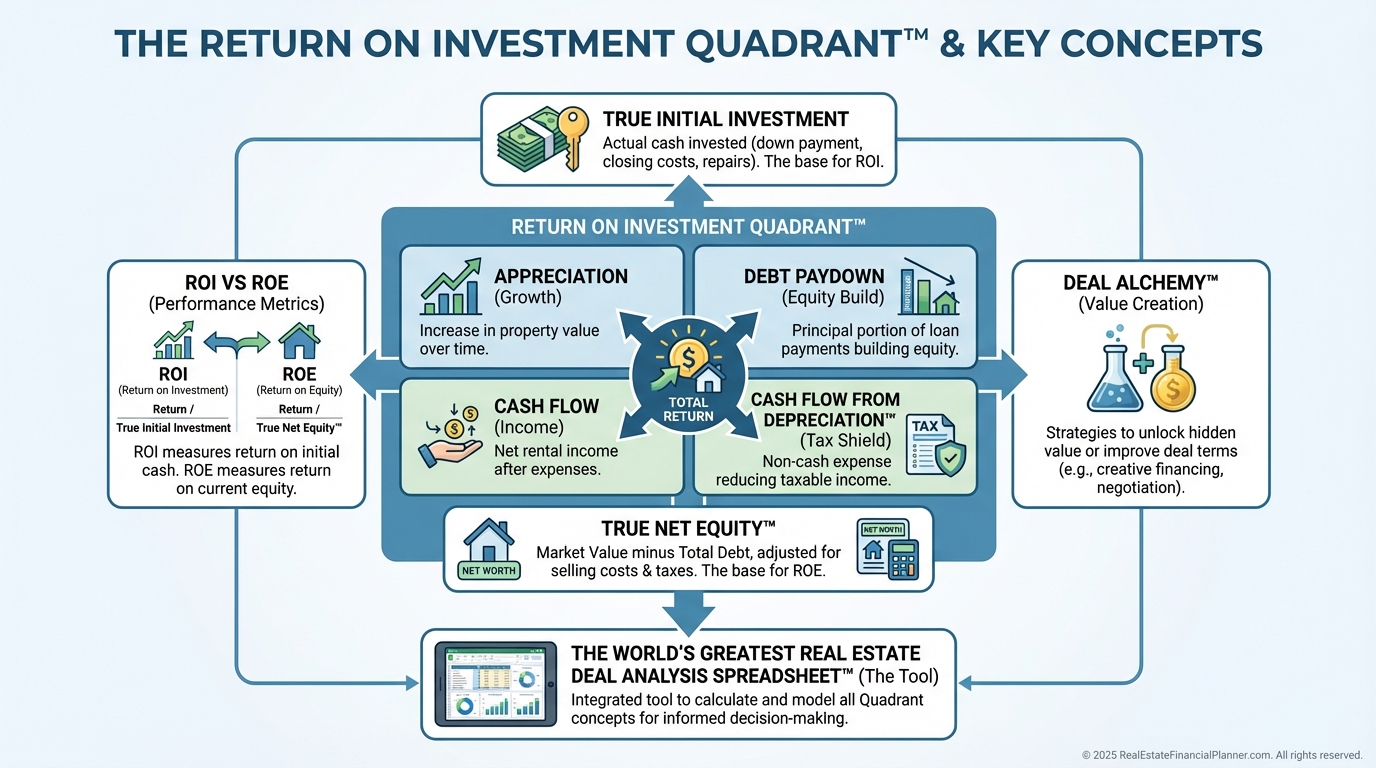

What the Return on Investment Quadrant™ Measures

The Return on Investment Quadrant™ breaks total return into four parts, each divided by your true initial investment.

The four are appreciation, cash flow, Cash Flow from Depreciation™, and debt paydown.

Together, they show where your profit actually comes from.

The Real Estate Financial Planner™ calculates the quadrant for each property at the bottom of the assumptions page.

You get an instant, visual breakdown without manual math.

How I Calculate Each Quadrant With Clients

I use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to model each quadrant with realistic assumptions.

Then I stress-test the levers that move each result.

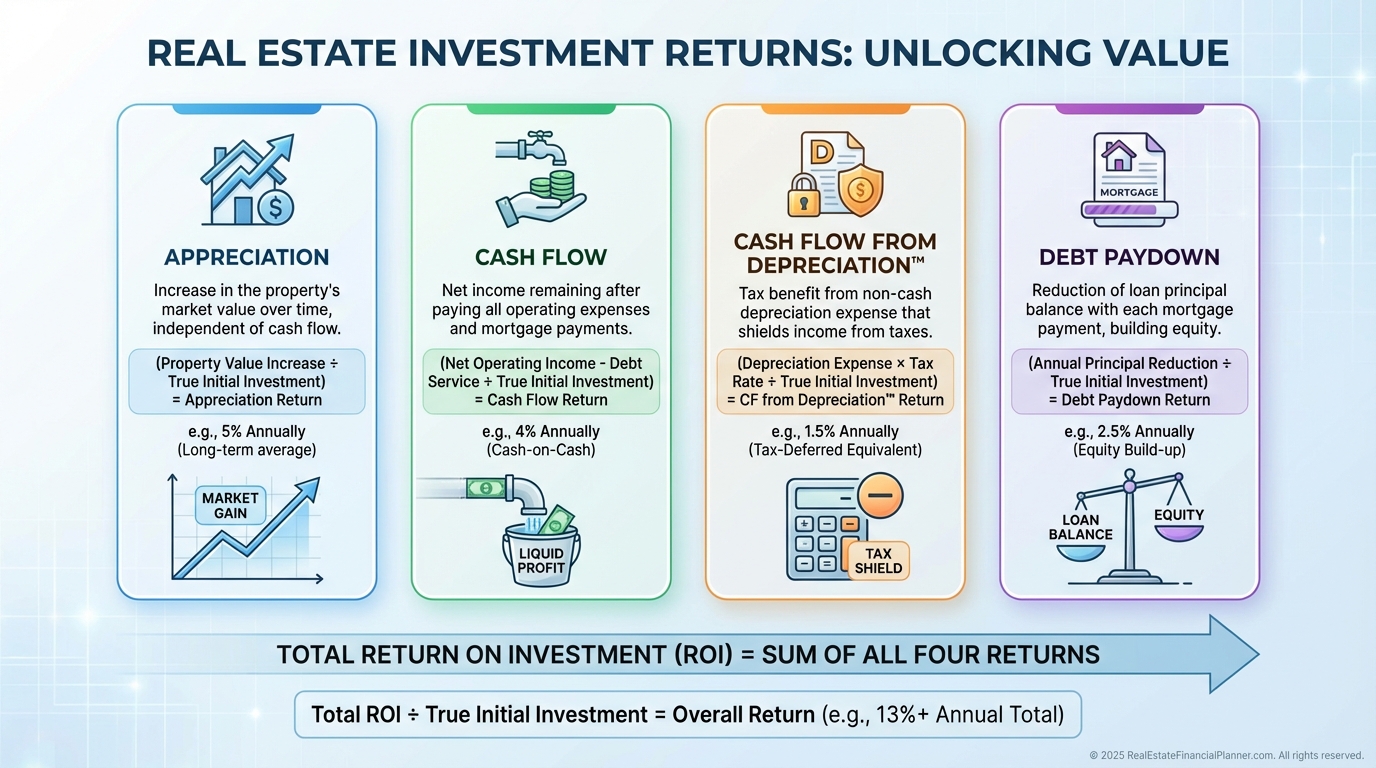

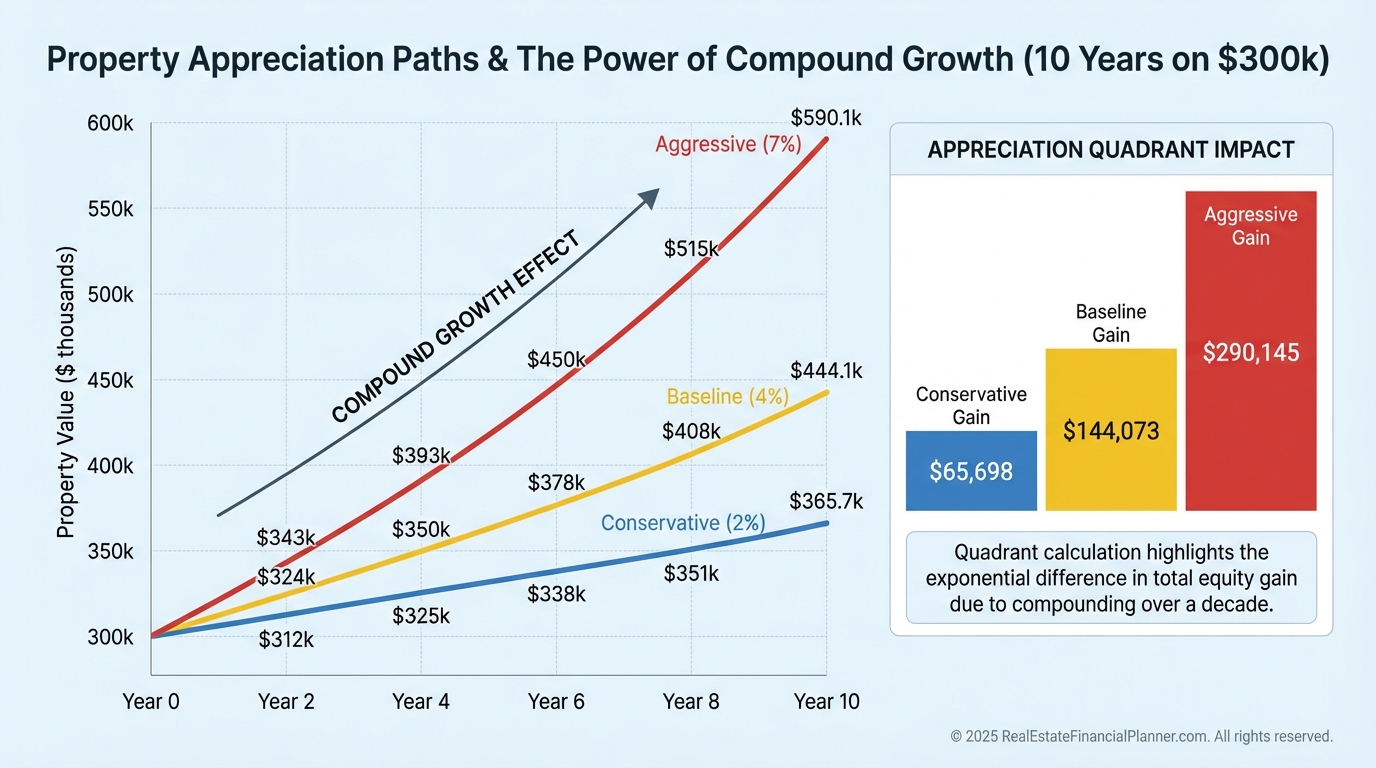

Appreciation

Appreciation is the annual increase in market value plus any forced value from upgrades.

You can’t control the market, but you can select growth corridors and create value intelligently.

I typically model 2–5% annual appreciation for base cases, then run downside and upside scenarios.

A $300,000 property appreciating at 4% gains $12,000 in year one.

Return from appreciation equals $12,000 divided by your true initial investment.

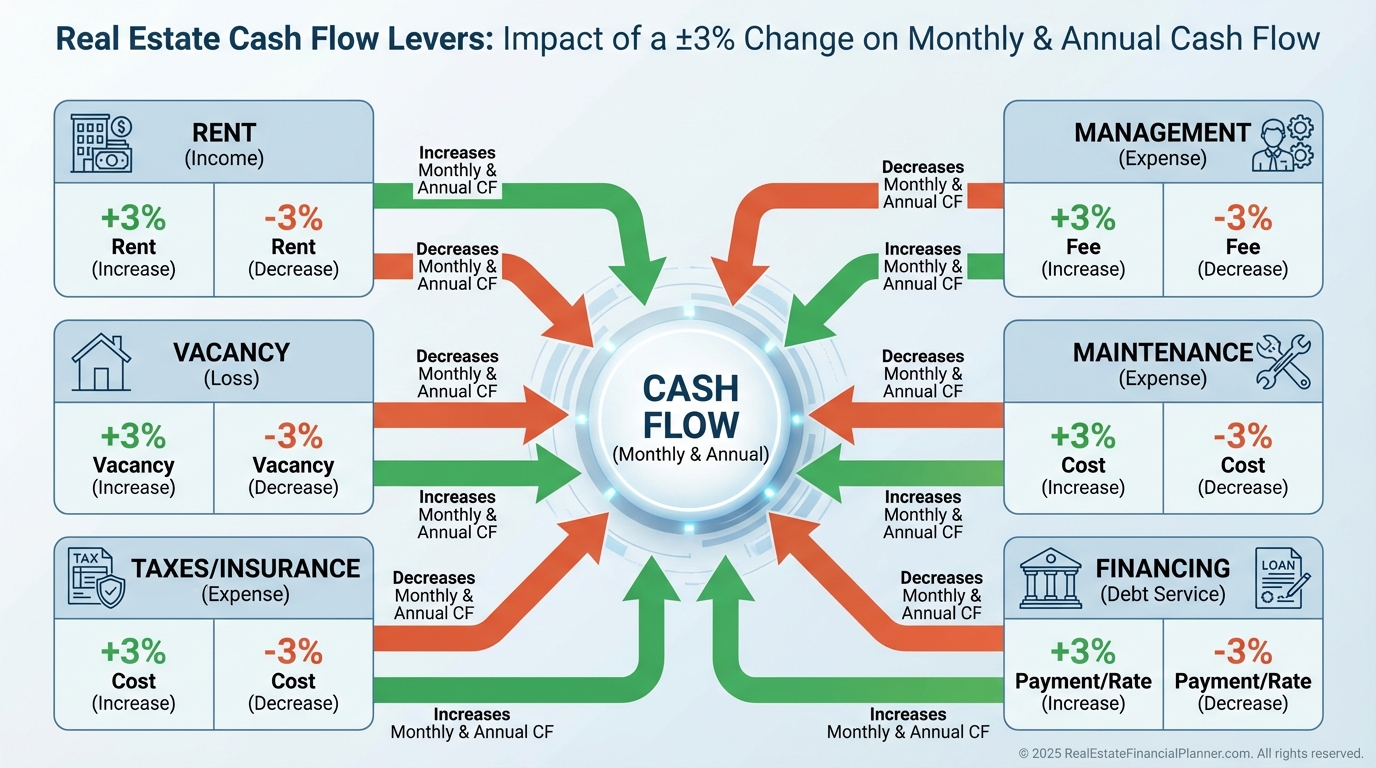

Cash Flow

I model rent, vacancy, taxes, insurance, maintenance, management, HOA, and debt service with sensitivity bands.

Small changes swing outcomes.

A property at breakeven today can become a cash machine as rents rise while your mortgage stays fixed.

What matters is accurate underwriting and enough reserves to hold through the turn.

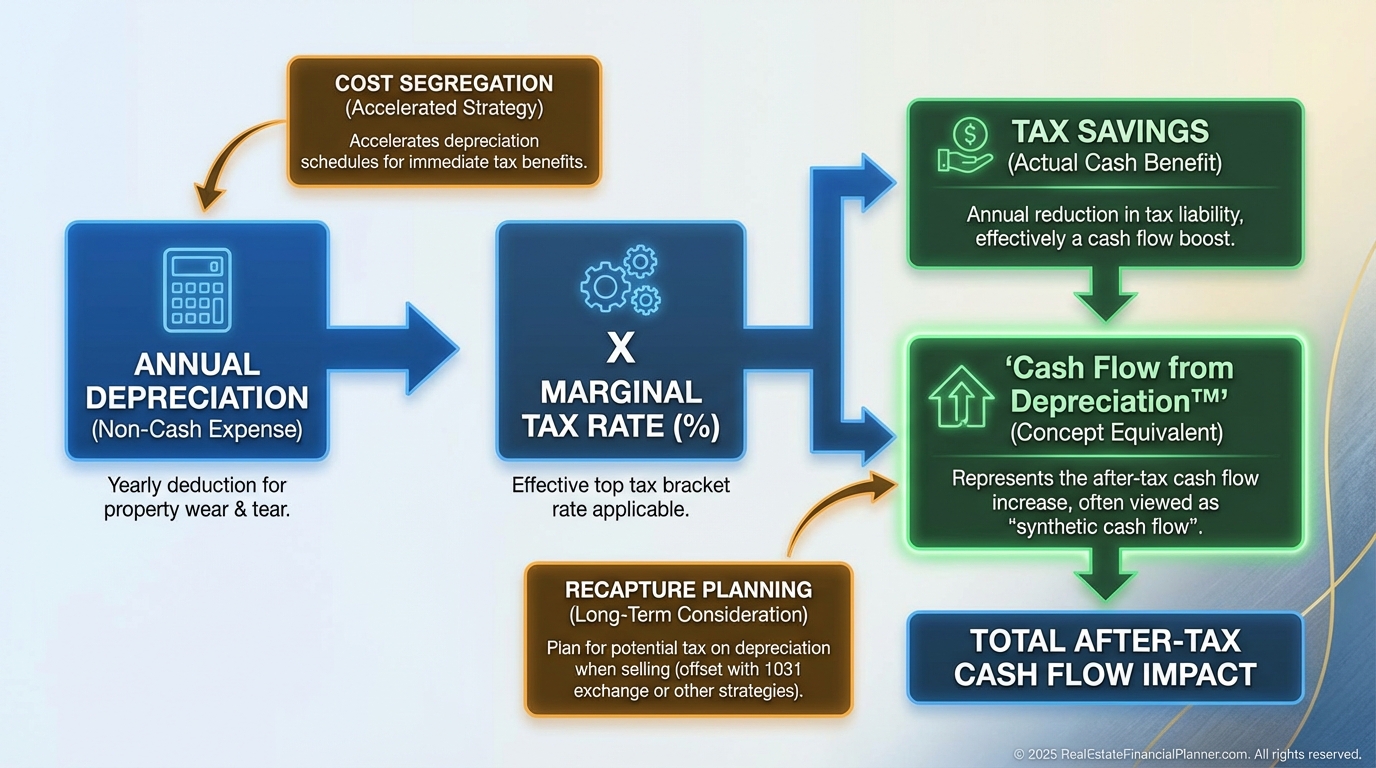

Cash Flow from Depreciation™

Cash Flow from Depreciation™ turns a paper loss into real after-tax cash.

For residential property, the IRS allows straight-line depreciation over 27.5 years on the building, not the land.

On a $300,000 property with a $250,000 depreciable basis, the annual deduction is about $9,090.

At a 24% marginal rate, that saves roughly $2,182 in taxes.

I show clients both with and without cost segregation, then plan recapture strategy in advance.

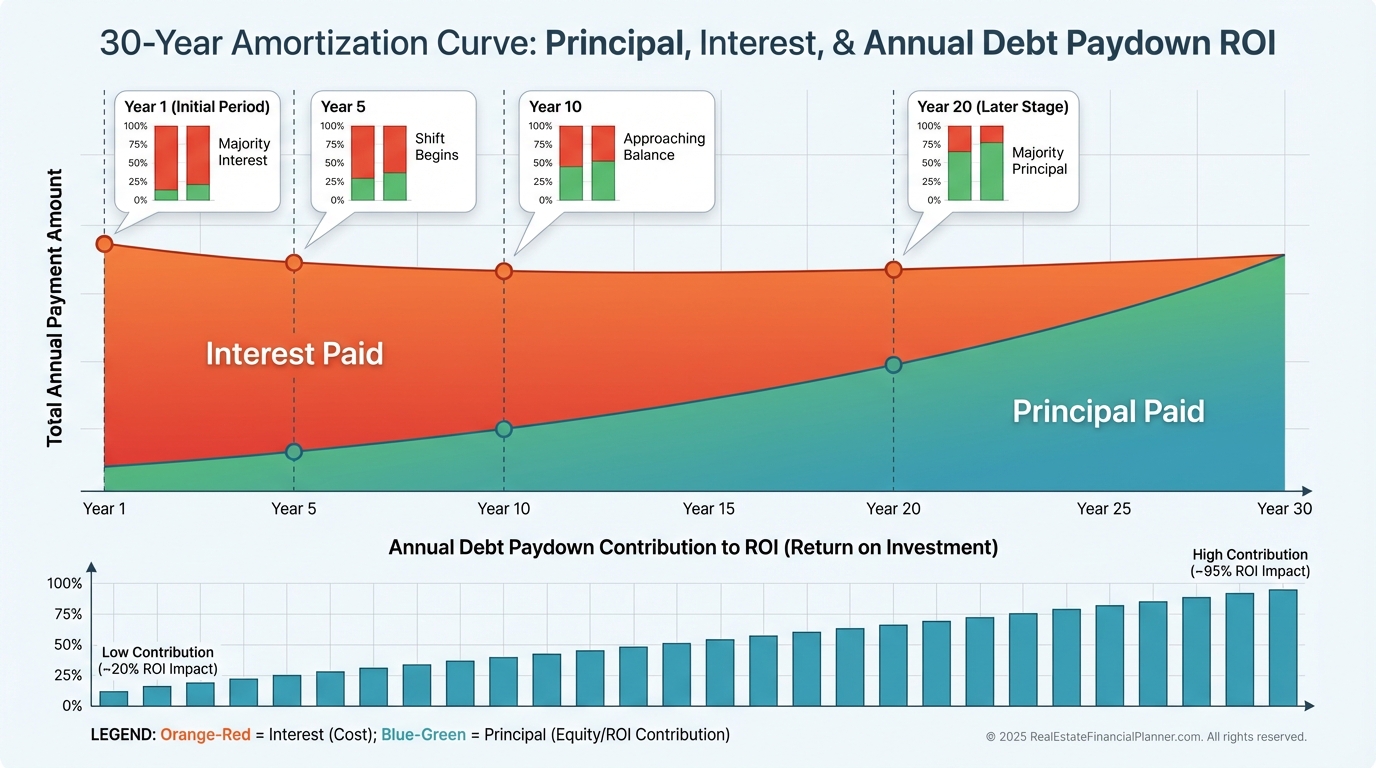

Debt Paydown

Debt paydown is the automatic principal reduction built into your mortgage payment.

On a $240,000 loan at 7% over 30 years, year-one principal reduction is about $2,411.

By year ten, annual principal reduction exceeds $5,000.

I treat this as a reliable, clockwork return that compounds your net worth whether or not the market cooperates.

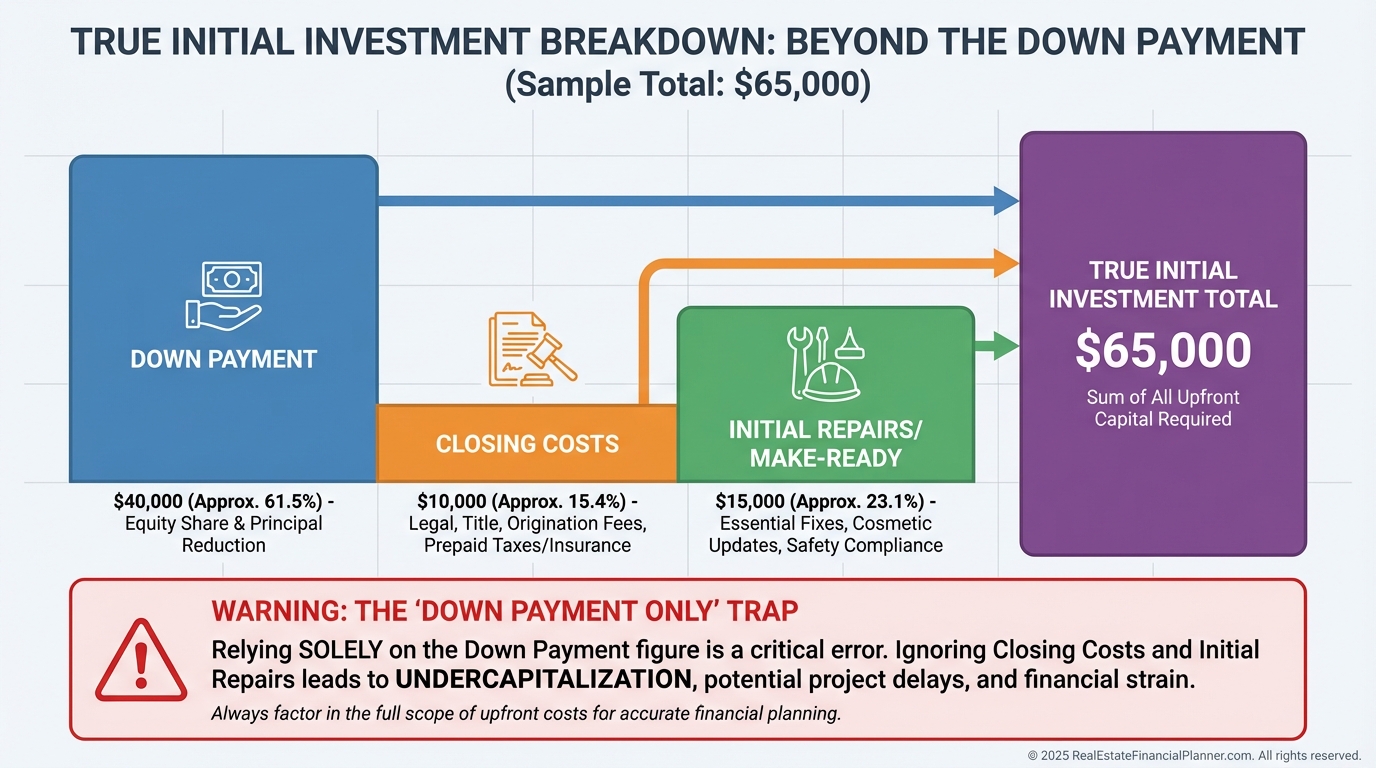

The Denominator Most Investors Get Wrong

Use true initial investment, not just your down payment.

That means down payment plus closing costs plus immediate make-ready.

If you ignore closing costs, your returns look inflated and your decisions get worse.

The Spreadsheet and the Real Estate Financial Planner™ both track this consistently across scenarios.

Worked Example: Year 1 ROI Quadrant™

Purchase price is $300,000.

You put 20% down ($60,000) and pay $5,000 in closing costs for a $65,000 true initial investment.

Year one, we model 4% appreciation for $12,000.

You net $300 per month in cash flow for $3,600.

Depreciation saves $2,182 in taxes at a 24% marginal rate.

Debt paydown reduces principal by about $2,411.

Total dollar return is $20,193.

Return on Investment Quadrant™ equals $20,193 divided by $65,000 for about 31%.

The Real Estate Financial Planner™ displays this breakdown at the bottom of the property assumptions.

You can compare properties, financing options, and timelines side by side without reworking formulas.

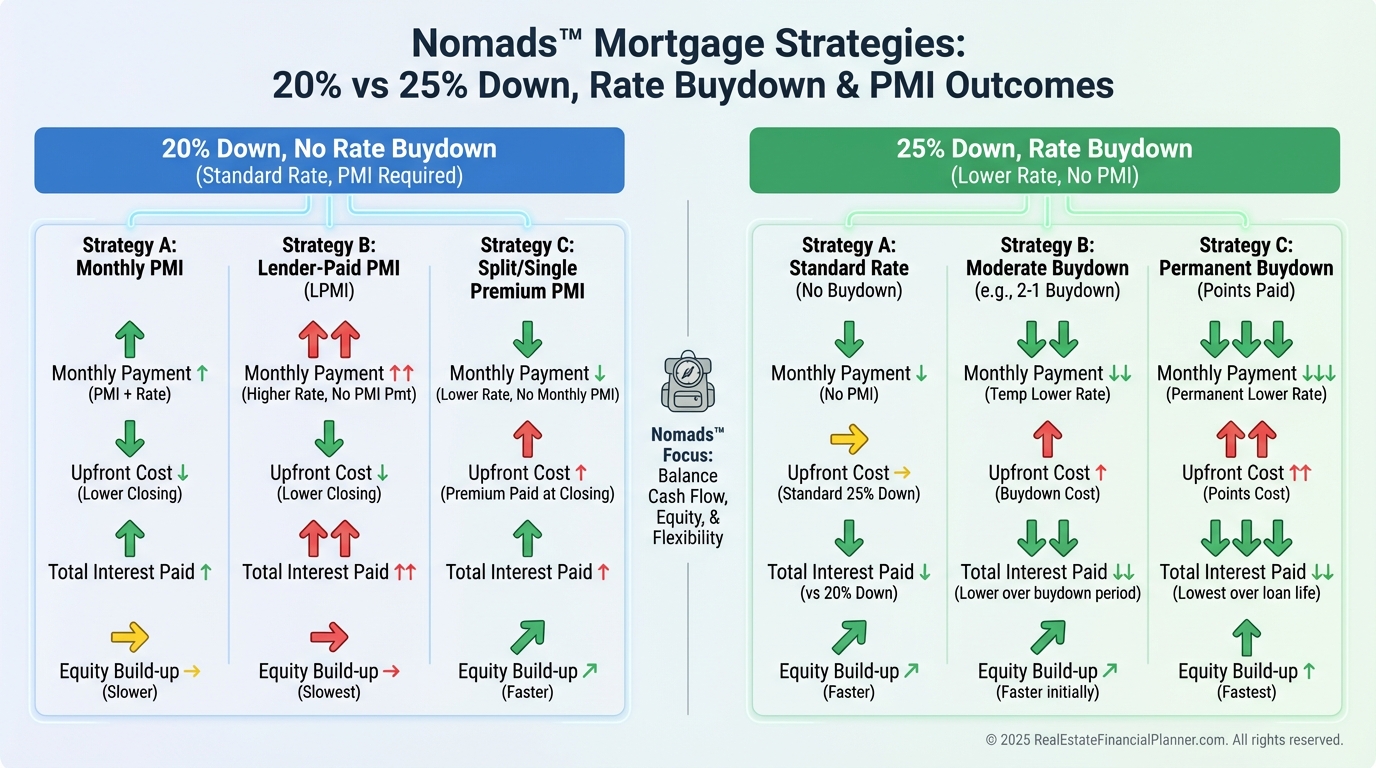

Advanced Deal Alchemy™: How Pros Shift the Quadrants

When I help clients, we engineer returns to match goals, risk, and timeline.

We don’t accept the deal the market hands us.

•

20% vs 25% down changes leverage, PMI, rate, and cash flow.

•

Rate buydowns trade upfront cash for monthly savings.

•

PMI Strategies for Nomads™ can maximize acquisition speed with controlled cash outlays.

•

Rent optimization balances price, concessions, and tenant quality to reduce vacancy and maintenance.

•

Rolling upgrades into financing can create immediate forced appreciation with minimal impact on payment.

I model each choice in the Spreadsheet, then we confirm the best path in the Real Estate Financial Planner™ against your plan to achieve financial independence.

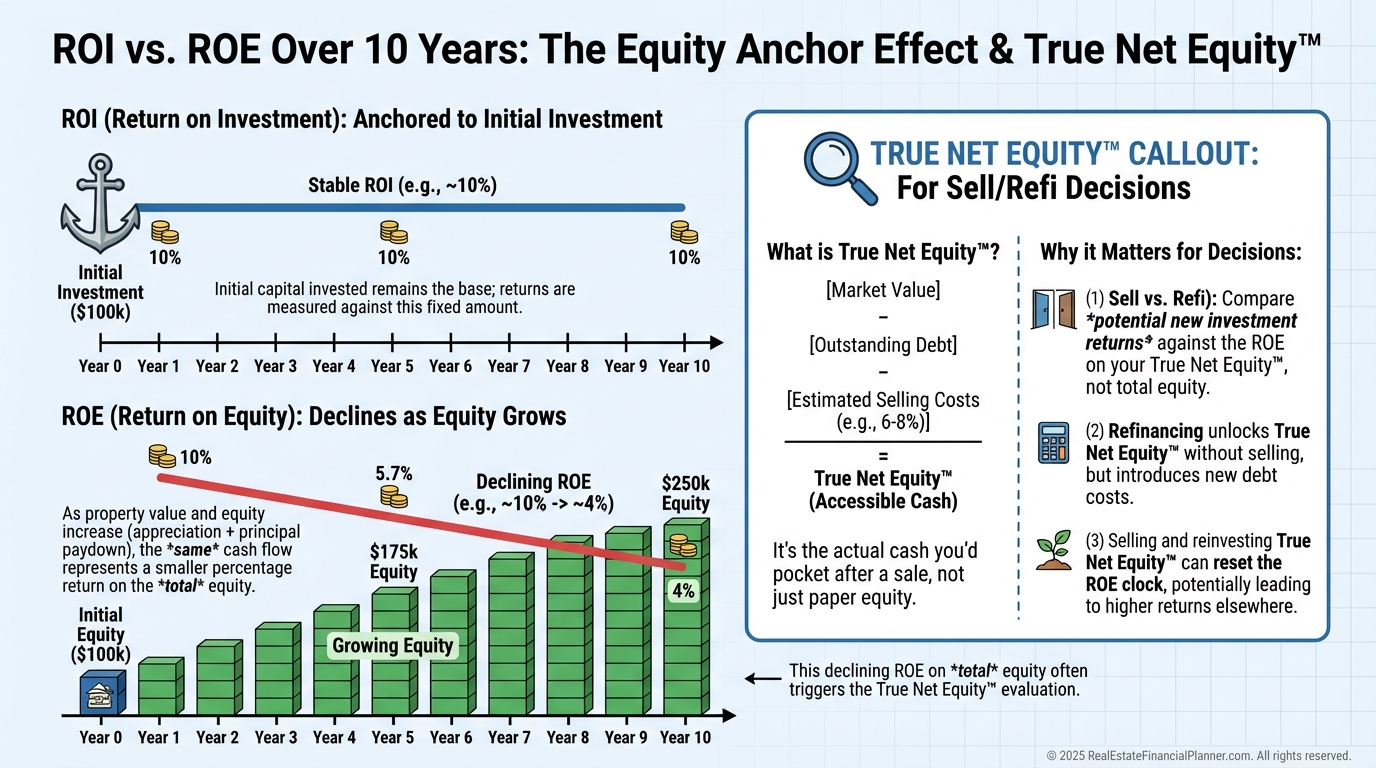

ROI vs ROE: When to Hold, Sell, or Refi

Return on Investment Quadrant™ uses your initial cash in the deal.

Return on Equity Quadrant™ uses your current equity.

As equity grows, ROE often falls even when dollars increase.

That’s why great properties sometimes become poor uses of capital.

When I coach clients, we compare ROI vs ROE, then consider a 1031 exchange, refi, or a sell-and-redeploy move.

We also check True Net Equity™ to account for transaction costs, capital gains, depreciation recapture, and selling expenses.

Guardrails I Use to Prevent Costly Mistakes

I never accept pro forma rents without local comps and vacancy trends.

I underwrite taxes as if they reset on sale when applicable.

I verify depreciation basis with a land/building allocation that matches the closing disclosure.

I run sensitivity tests for rent, interest rate, and maintenance.

If a deal only works at the rosiest assumptions, it’s not a deal.

Your Action Plan With REFP Tools

Download The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and run your current property through the four quadrants.

Open the Real Estate Financial Planner™ and view the Return on Investment Quadrant™ at the bottom of your property assumptions.

Model two or three strategic changes using Deal Alchemy™ and compare outcomes.

Check your older properties using the Return on Equity Quadrant™ and True Net Equity™.

Decide whether to hold, refi, 1031, or sell and redeploy.

If you want help, watch the classes on Beyond Cash Flow and Deal Alchemy™, then schedule time to build your plan to financial independence.