Limited Liability Companies for Real Estate Investors: The Complete Playbook for Protection, Taxes, and Scale

Learn about Limited Liability Companies for real estate investing.

When I help clients build durable portfolios, I start with structure before spreadsheets.

An LLC is not a magic shield, but when you run it correctly alongside smart insurance and clean books, it changes your risk-adjusted return dramatically.

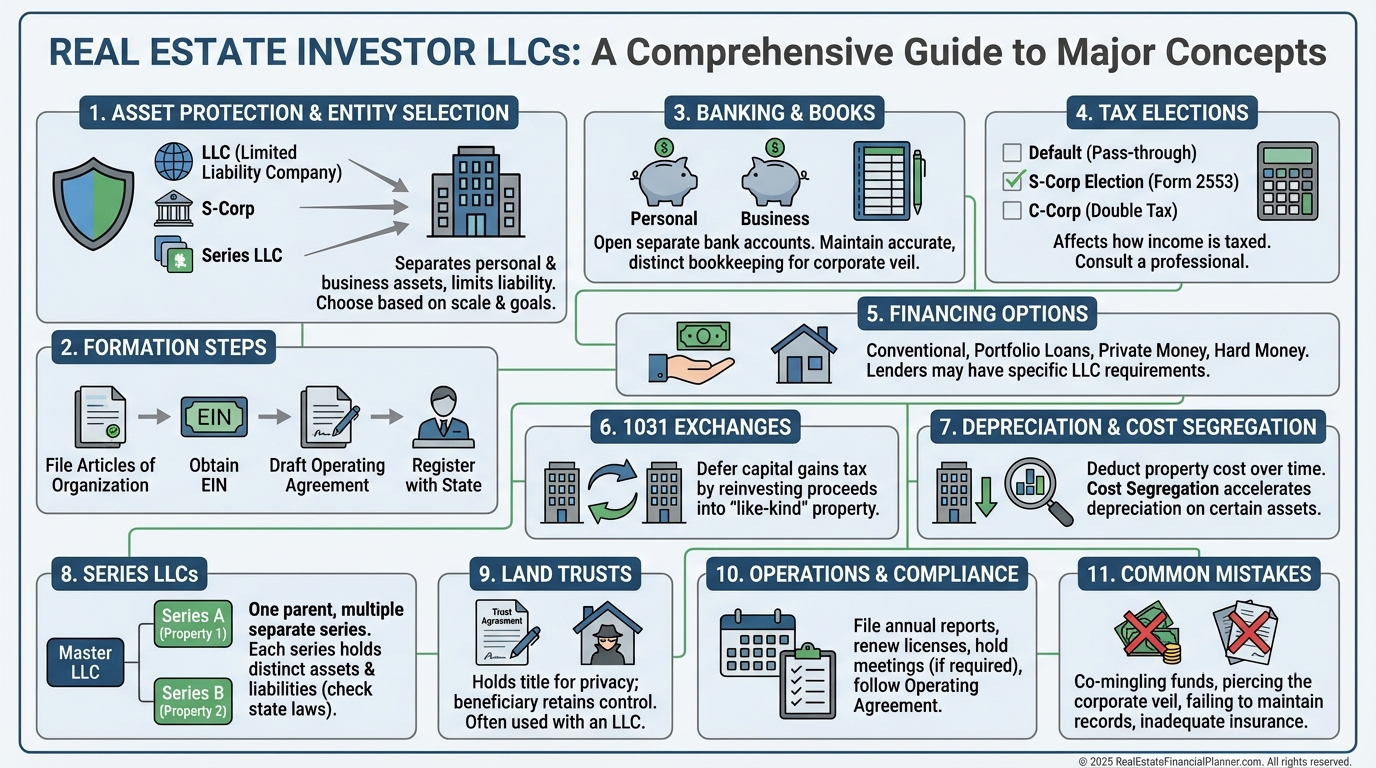

What Is an LLC?

A Limited Liability Company is a flexible business entity that separates your personal assets from your investment activities.

It blends corporate-style liability protection with pass-through tax treatment and simple operations.

For real estate, that separation matters when something goes wrong on-site or in court.

If your tenant sues, their claim usually stops at the LLC’s assets, not your primary home or retirement accounts.

Why Serious Investors Use LLCs

The first benefit is asset segregation by property or by risk profile.

When I model portfolio risk, I prefer to isolate high-liability assets so a single judgment doesn’t cascade through your entire net worth.

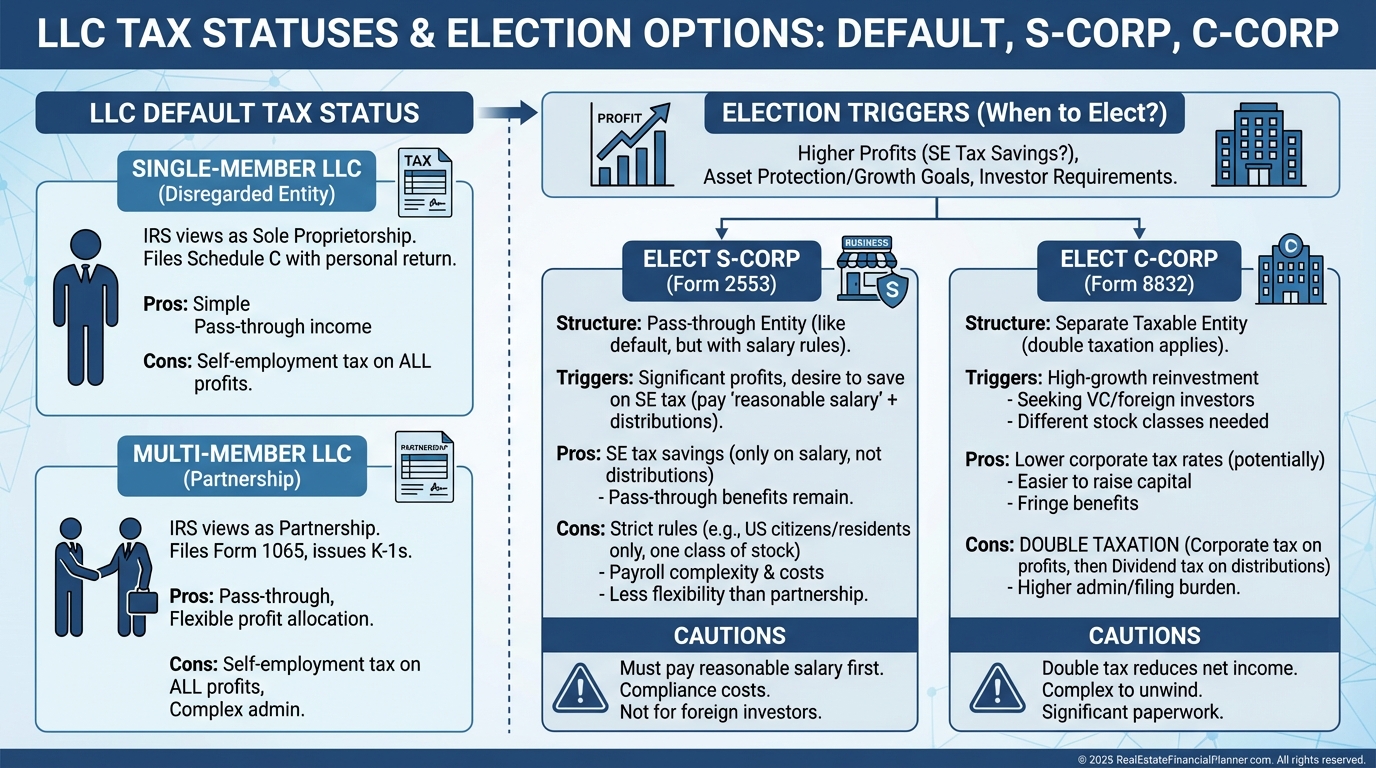

Tax flexibility is the second lever.

Default pass-through status preserves depreciation and expense deductions, while elective S-Corp or C-Corp treatment can optimize specific income streams.

Operational freedom is the third edge.

You can be the manager, hire a manager, or assign defined roles to partners with custom profit splits in your operating agreement.

Privacy is the quiet fourth.

In many states, your LLC name appears on title instead of you, which reduces targeting by contingency-fee attorneys and tire-kickers.

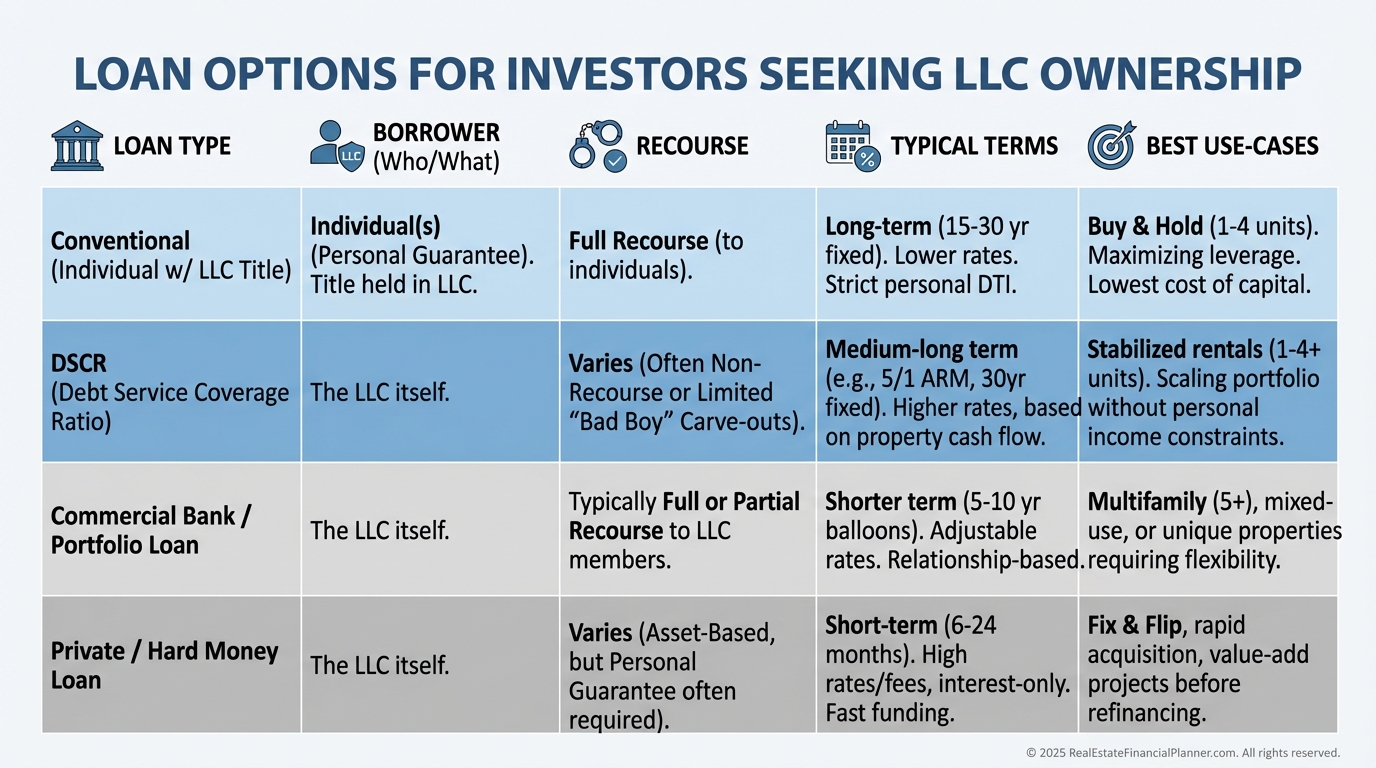

Financing is the fifth, often misunderstood, advantage.

How LLCs Fit Into Your Return Quadrants™

LLCs don’t create profit.

They protect and preserve it, particularly the cash flow and appreciation quadrants, by limiting catastrophic downside.

On taxes, your depreciation and interest deductions still flow through, improving your after-tax cash flow quadrant.

When I evaluate deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I add state fees, entity insurance, and bookkeeping costs to operating expenses so returns stay honest.

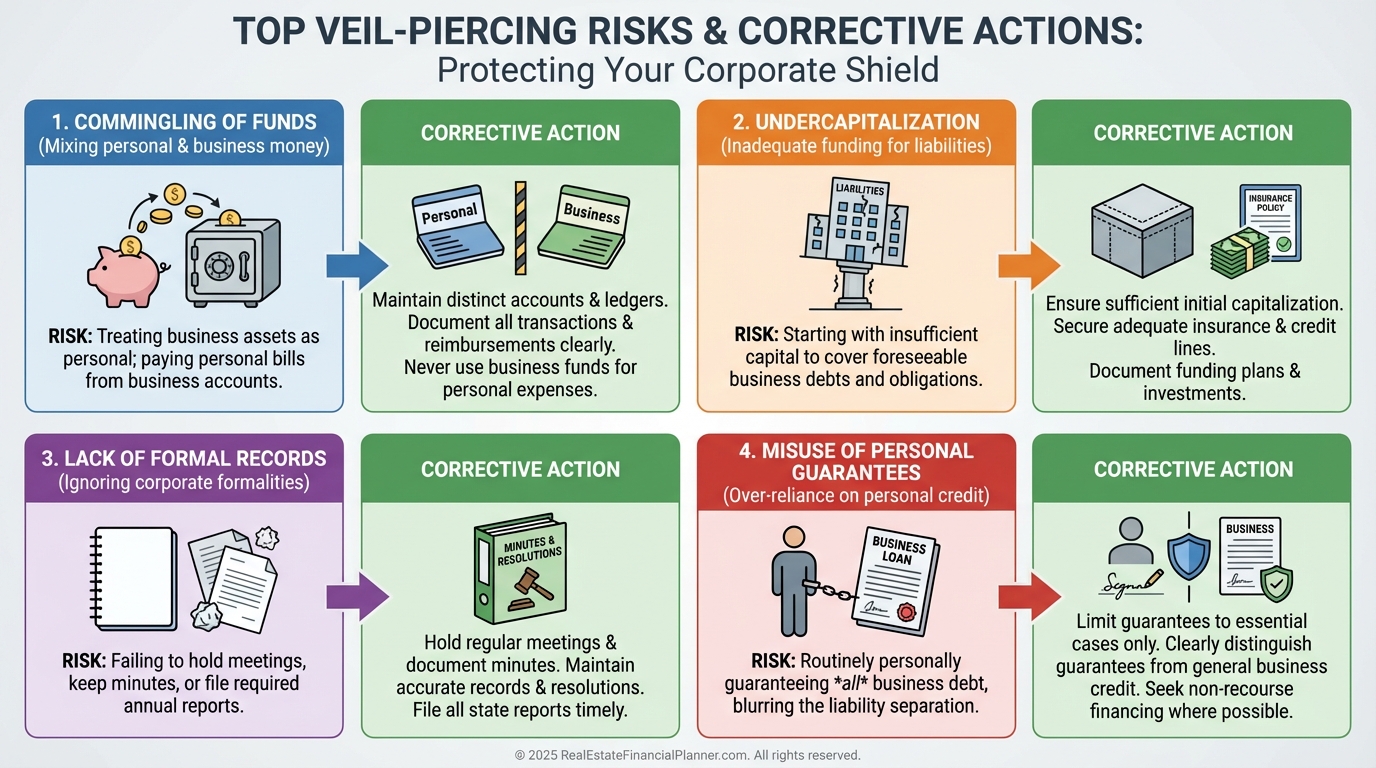

Limitations You Must Respect

LLCs can be pierced if you commingle funds, undercapitalize, or treat the entity like a personal piggy bank.

Courts call this the “alter ego” problem, and I warn clients it’s the fastest way to lose your shield.

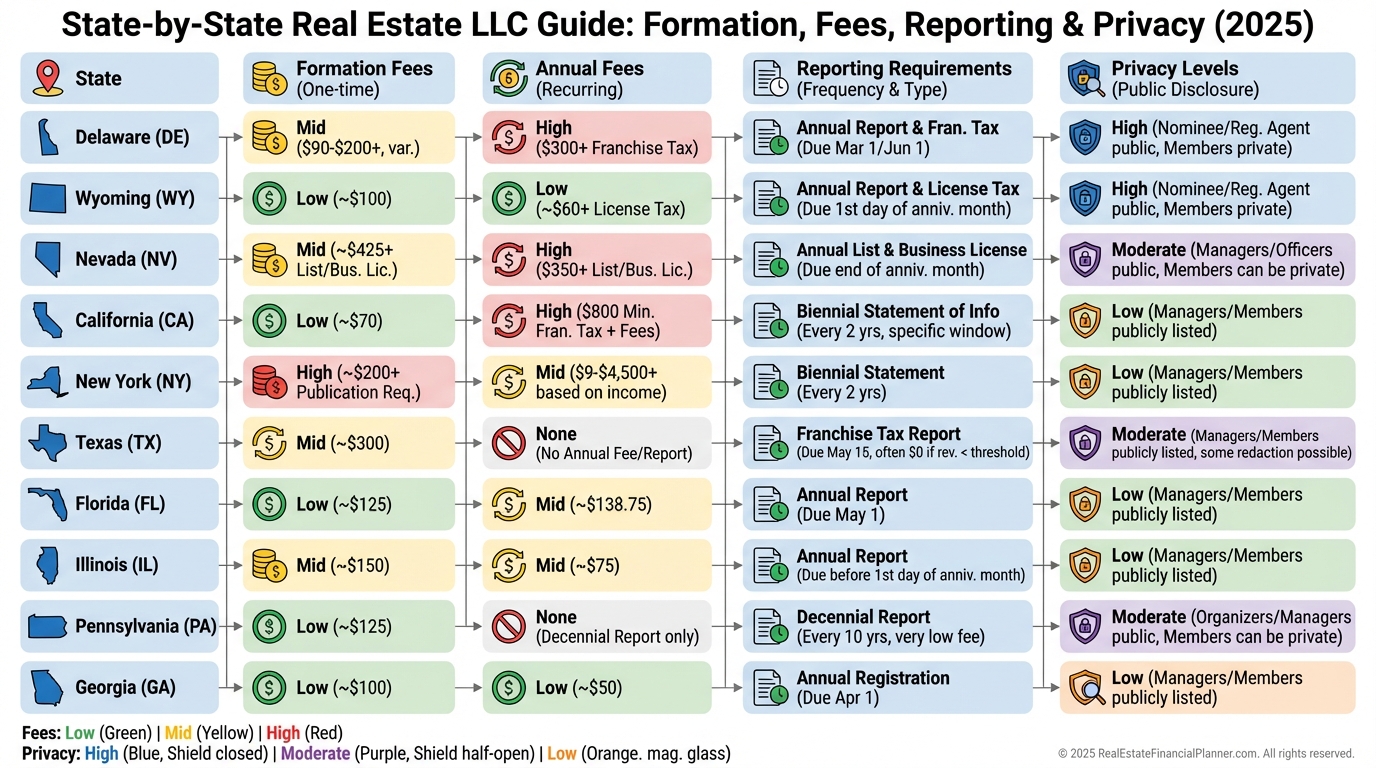

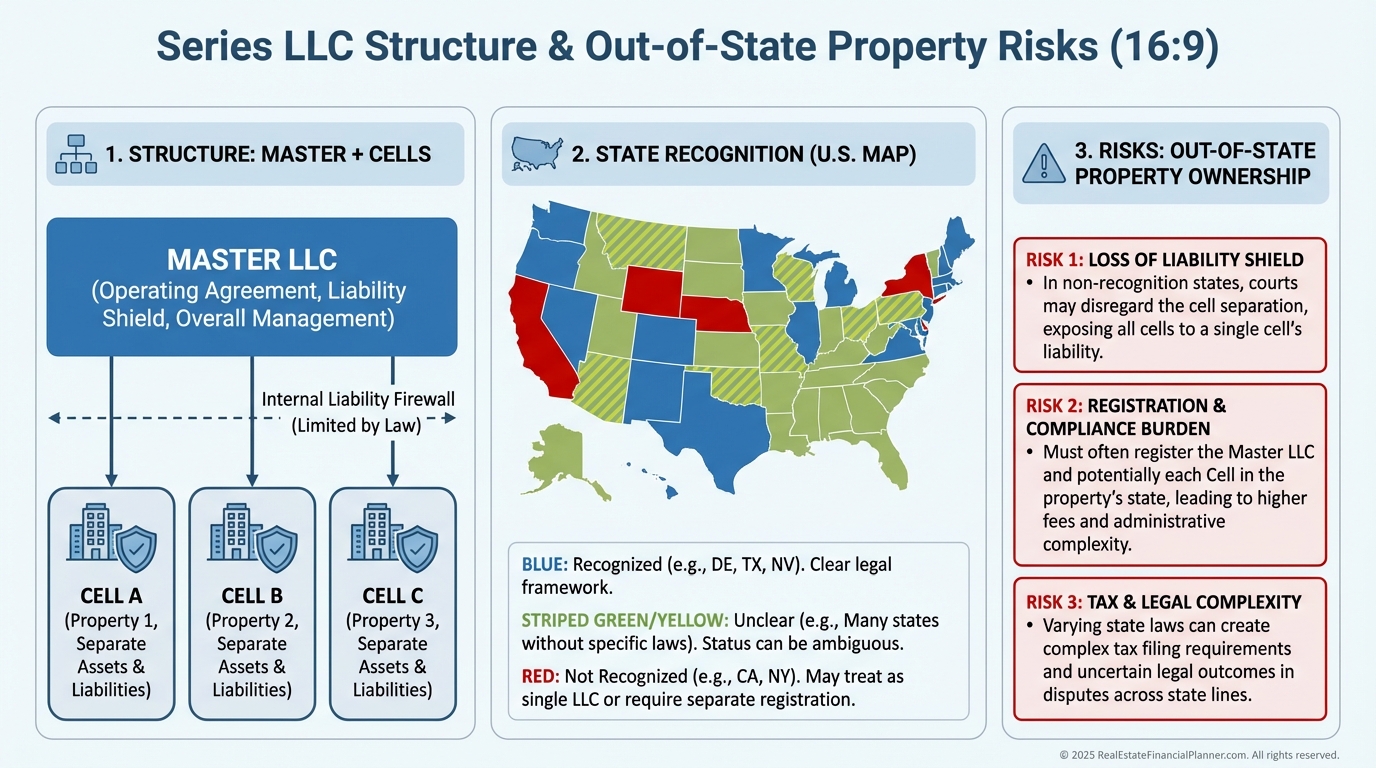

State rules vary widely on fees, reporting, and privacy.

What’s inexpensive in Wyoming may be costly in California, and multi-state ownership adds filing complexity.

Transferring financed properties can implicate due-on-sale clauses.

Enforcement is uncommon for transfers to a wholly owned LLC, but I always tell clients to discuss the plan with their lender and insurance agent.

Selling membership interests is harder than selling corporate stock.

If you expect to bring in partners later, your operating agreement must address admissions, buy-sells, and valuation mechanics.

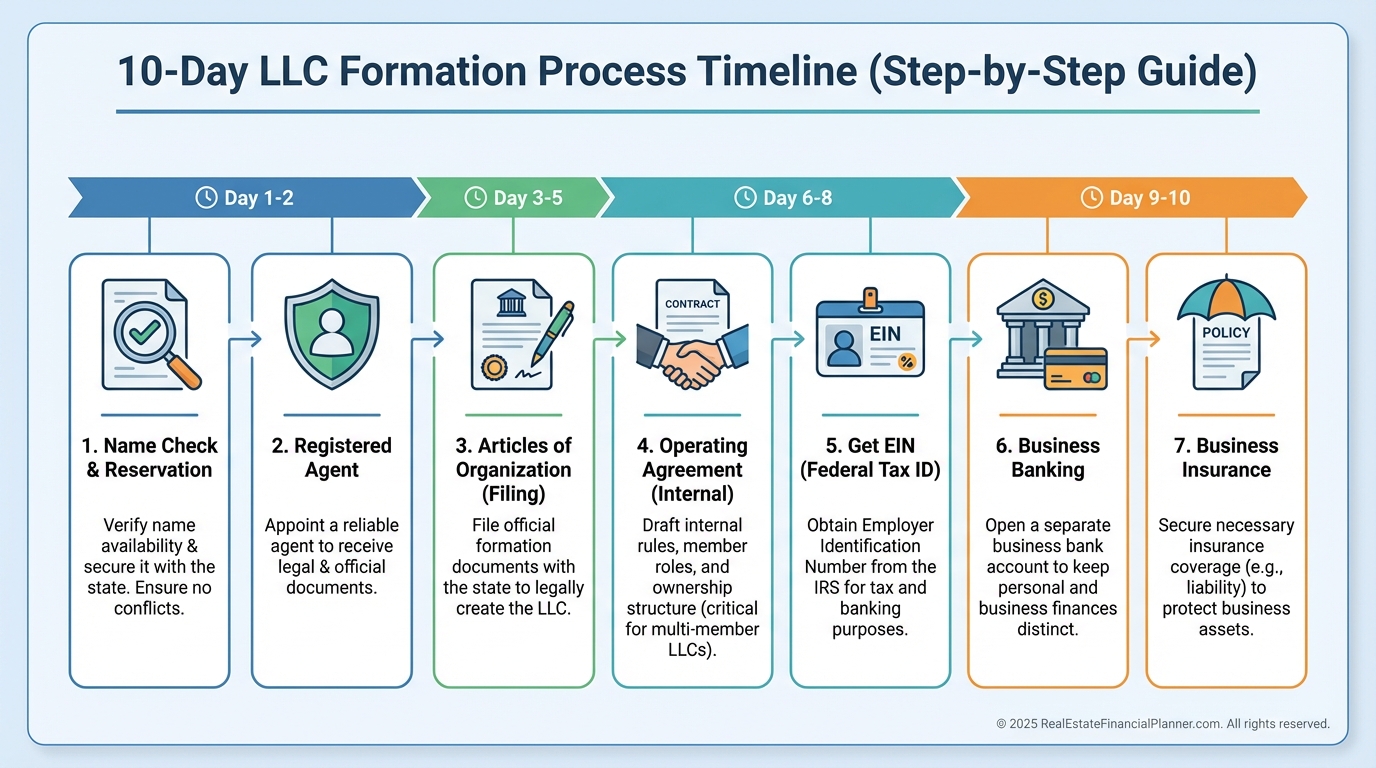

Setting Up Your Real Estate LLC

Form where you operate.

If the property is in Ohio, form in Ohio or register your out-of-state LLC as foreign in Ohio.

I only use Delaware/Wyoming for specific privacy or holding company designs that justify the extra filings.

Choose a durable name.

Avoid hyper-specific names like “123 Main Street LLC” if you plan to scale; “Smith Properties LLC” ages better.

File Articles of Organization online with your state.

Select member-managed if you’ll run it, or manager-managed if you want the flexibility to appoint management later.

Draft a real estate–specific operating agreement.

I include capital call rules, acquisition approval thresholds, refinance and sale decision rules, dispute resolution, and transfer restrictions.

Get an EIN from the IRS.

It’s free and required for banking, payroll (if any), and most lenders.

Open a dedicated bank account the same week.

I keep a Minutes & Resolutions folder and document any capital contributions, loans to the LLC, acquisitions, refinances, and major contracts.

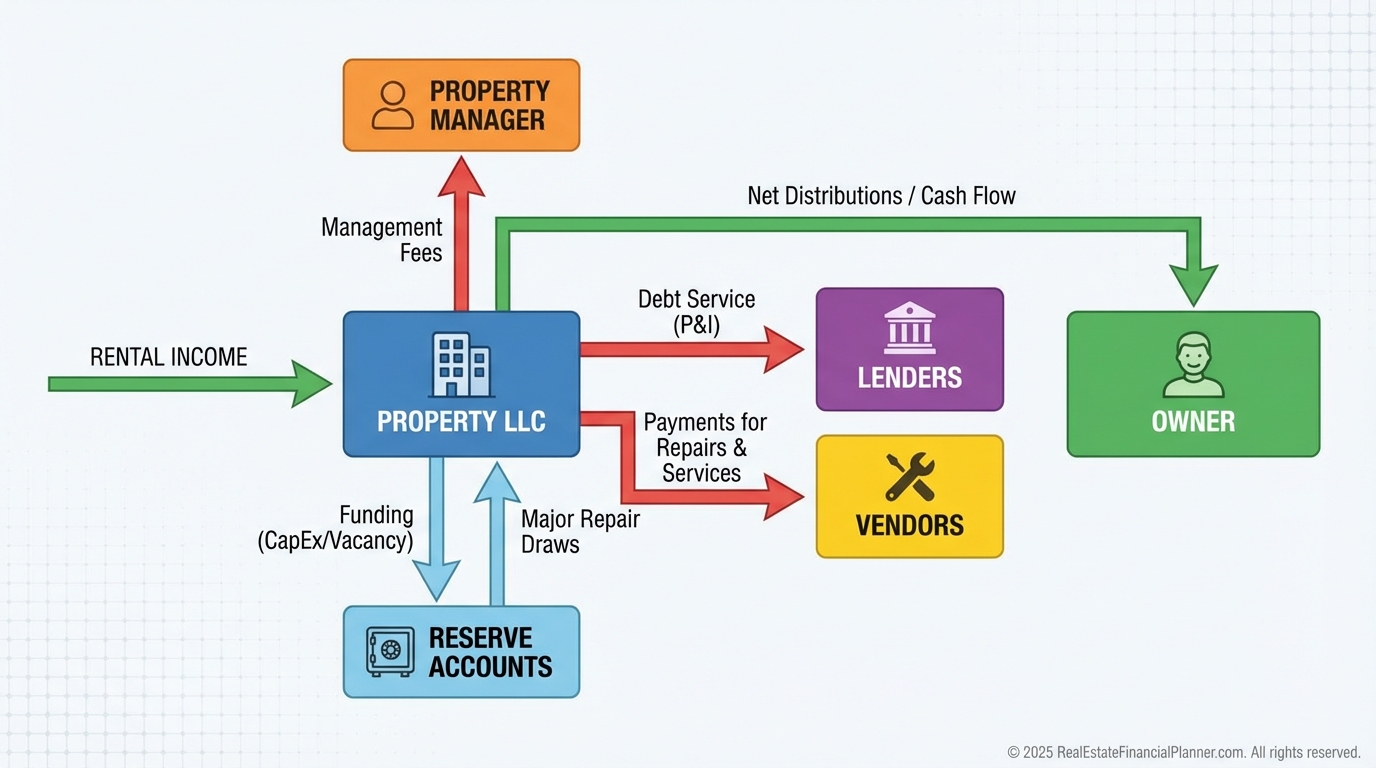

Banking, Books, and Clean Separation

Never pay personal bills from the LLC, and never pay LLC bills from your personal account.

I set up bill pay directly from the entity, and I reimburse mileage and expenses with documented expense reports.

Use bookkeeping software or a well-structured spreadsheet per entity.

Each property should roll up to its LLC P&L so your CPA can tie numbers to returns and K-1s cleanly.

For multi-entity owners, consider a simple intercompany ledger.

If your management company bills the property LLC, issue invoices and pay them like any third party.

Taxes: Defaults, Elections, and Real Estate Nuance

Single-member LLCs are disregarded by default and flow to Schedule E.

Multi-member LLCs file Form 1065 and issue K-1s, with profits and losses passing through.

Depreciation is your best friend.

Cost segregation can accelerate deductions, but I only order a study when the benefit outweighs fees given hold period and tax bracket.

The S-Corp election does not change liability protection.

It changes how income is taxed and is usually best for active business income like property management or flipping, not long-term rental income.

Some investors use a separate S-Corp management company to capture reasonable salary and distributions while the rental LLCs remain pass-through.

When I model taxes in Return Quadrants™, I separate pre-tax cash flow from after-tax cash flow to express the true impact from depreciation and elections.

Don’t forget QBI Section 199A.

Many rental activities qualify under safe harbor rules; document hours, contemporaneous records, and separate books to protect the deduction.

Financing With LLCs

Conventional loans are generally written to people, not LLCs, for 1–4 unit properties.

If you plan to own in an LLC, ask your lender about DSCR, portfolio, or commercial options from day one.

Many DSCR lenders close directly to the LLC with personal guarantees.

That keeps title and insurance aligned, which prevents messy post-closing transfers.

For Nomad™ investors, you’ll usually buy owner-occupied in your personal name.

After you convert to a rental, coordinate with your lender and insurer before any LLC transfer to avoid due-on-sale or insurance gaps.

1031 Exchanges and Entity Coordination

The same taxpayer must sell and buy.

A single-member LLC disregarded to you is the same taxpayer, so exchanges are straightforward.

For multi-member LLCs, keep members aligned through the exchange or use planned “drop-and-swap” or “swap-and-drop” strategies with counsel.

I model exchange timing and replacement debt in the Spreadsheet to see impacts on cash flow, True Net Equity™, and Return on Equity over time.

Insurance: Your First Line, LLCs As Your Second

Maintain robust property coverage and a personal umbrella policy.

Name the LLC as the insured and confirm property manager and lenders are listed correctly.

Umbrella limits are inexpensive per dollar of coverage.

I buy as much as my carrier will sell me that still cash flows in the deal analysis.

Advanced Structuring at Scale

Series LLCs can separate properties into internal “cells” while filing once at the parent.

They are powerful but not universally recognized across states, so crossing borders can dilute protection.

Land trusts can add privacy by holding title while your LLC is the beneficiary.

They are not liability shields; think of them as a privacy layer that pairs with your LLC.

Spousal or family multi-member structuring can improve continuity and, in some states, enhance charging order protection.

Coordinate with your estate plan so operating agreements and beneficiary designations play well together.

Common Mistakes That Pierce Protection

Commingling funds is the biggest unforced error.

Maintain separate accounts and document every transfer with a memo and resolution.

Inadequate capitalization invites problems.

Keep reasonable reserves in the LLC so it can meet obligations without emergency owner bailouts.

Sloppy documentation kills credibility.

Keep signed leases, vendor contracts, management agreements, and inspection reports in the entity’s files.

DIY legal templates without tailoring to real estate can backfire.

Use a real estate attorney to customize your operating agreement, especially for partners and 1031 planning.

Your 30–60–90 Day Implementation Plan

In 30 days, form the LLC, open banking, update insurance, and move leases to the entity.

Document your initial capitalization and create your resolutions folder.

In 60 days, clean your books, connect your CPA, and add recurring state fees, entity insurance, and bookkeeping to your deal analysis.

Update your Return Quadrants™ with after-tax cash flow impacts.

When I rebuilt after a setback, systems like these turned anxiety into predictable action.

Final Guidance

LLCs are one tool in a layered defense.

When paired with the right loans, insurance, and clean operations, they let you scale without betting the farm.

Run the numbers.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, include every entity-related dollar so your decisions reflect reality, not optimism.

Then hire a real estate attorney and a tax pro who live in this world.

Those fees are small compared to the assets you’re protecting and the taxes you’ll legally avoid.

This is education, not legal or tax advice.

Build your team, build your systems, and then build your portfolio with confidence.