Grantor Playbook: Use Trusts to Protect Rentals, Cut Taxes, and Transfer Wealth

Learn about Grantor for real estate investing.

Why Grantor Status Matters for Small Portfolio Owners

Most investors don’t fail from a bad deal; they fail from bad structure.

When I help clients clean up ownership after an accident, lawsuit, or death, the missing piece is often the grantor trust they meant to “get to later.”

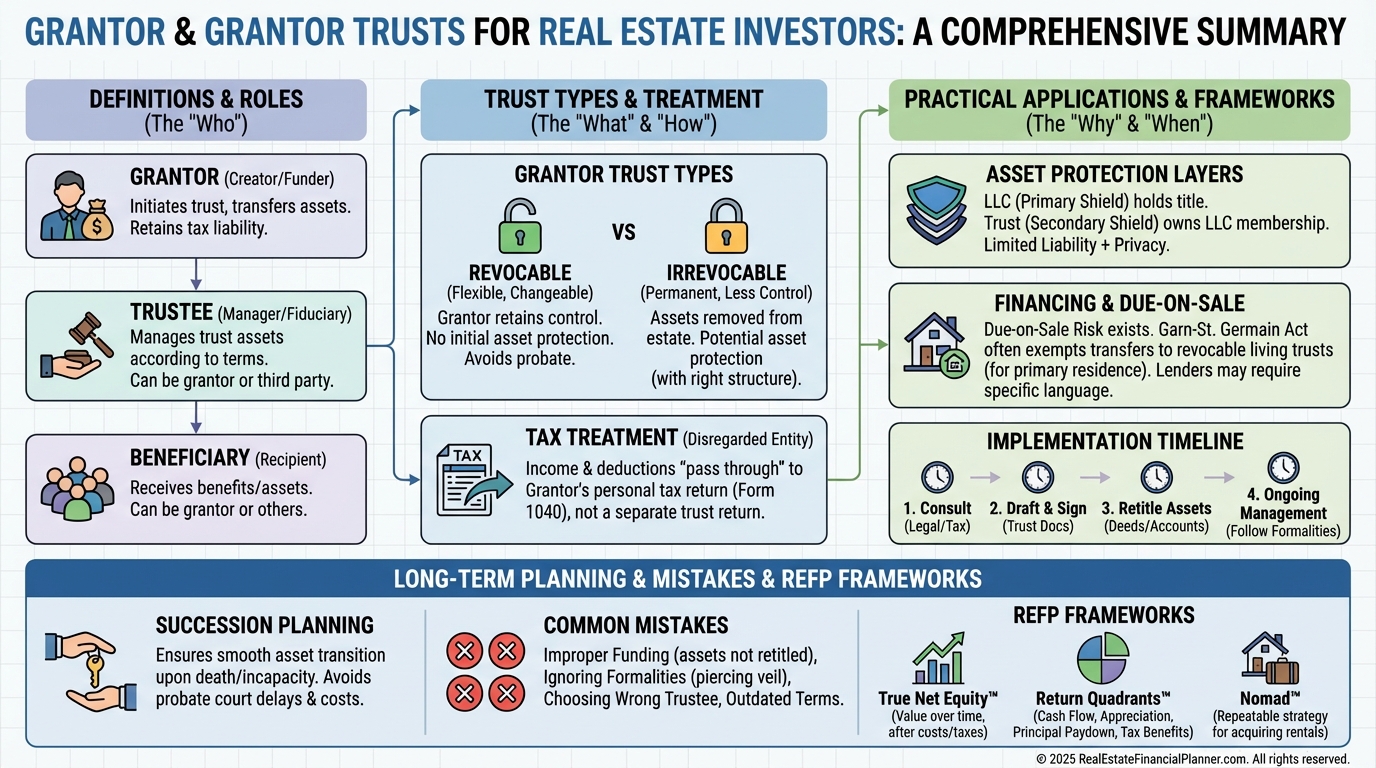

What Is a Grantor? Simple Definition with Real Estate Examples

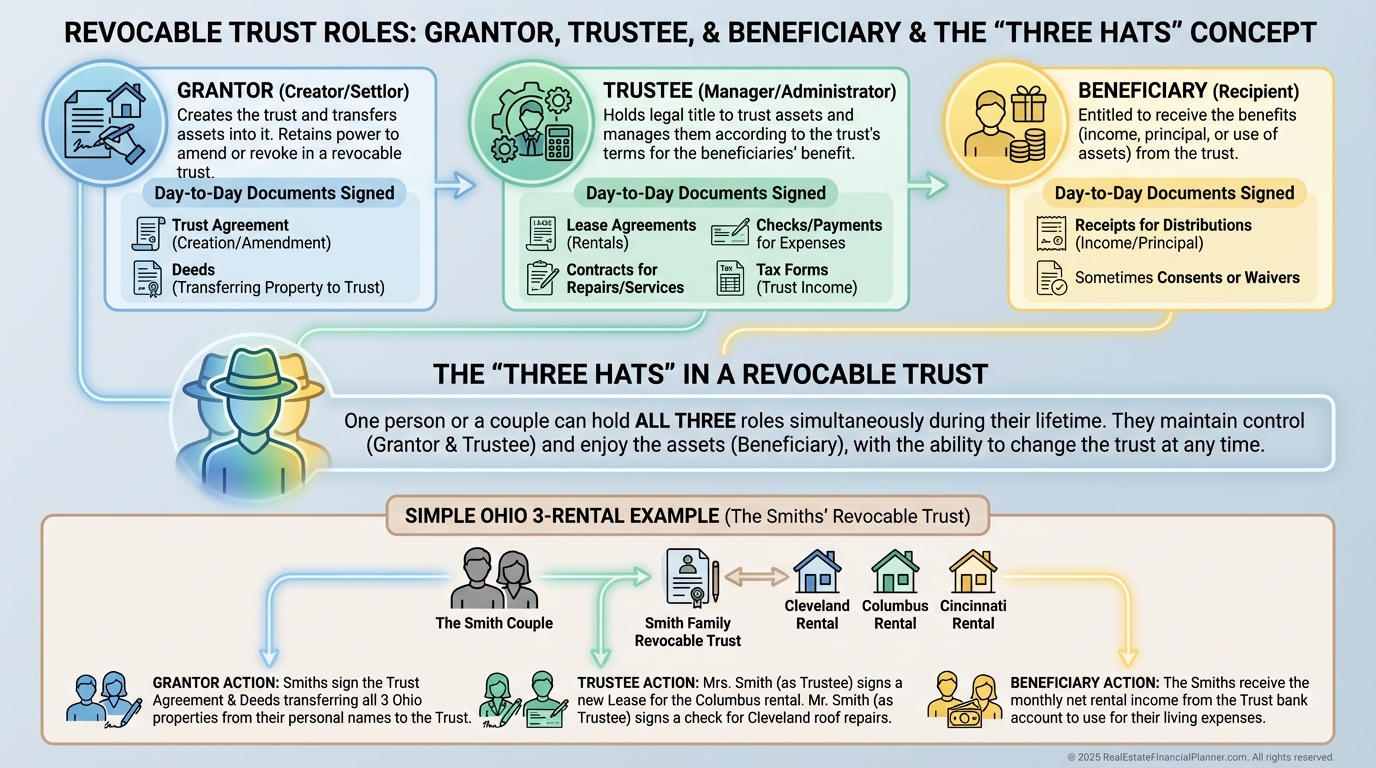

A grantor is the person who creates a trust and transfers property into it.

If you place your duplex into your revocable living trust, you are the grantor, and you can also be trustee and beneficiary while you’re alive.

In practice, I often see couples serve as co-grantors, co-trustees, and primary beneficiaries, keeping full operational control with documented authority.

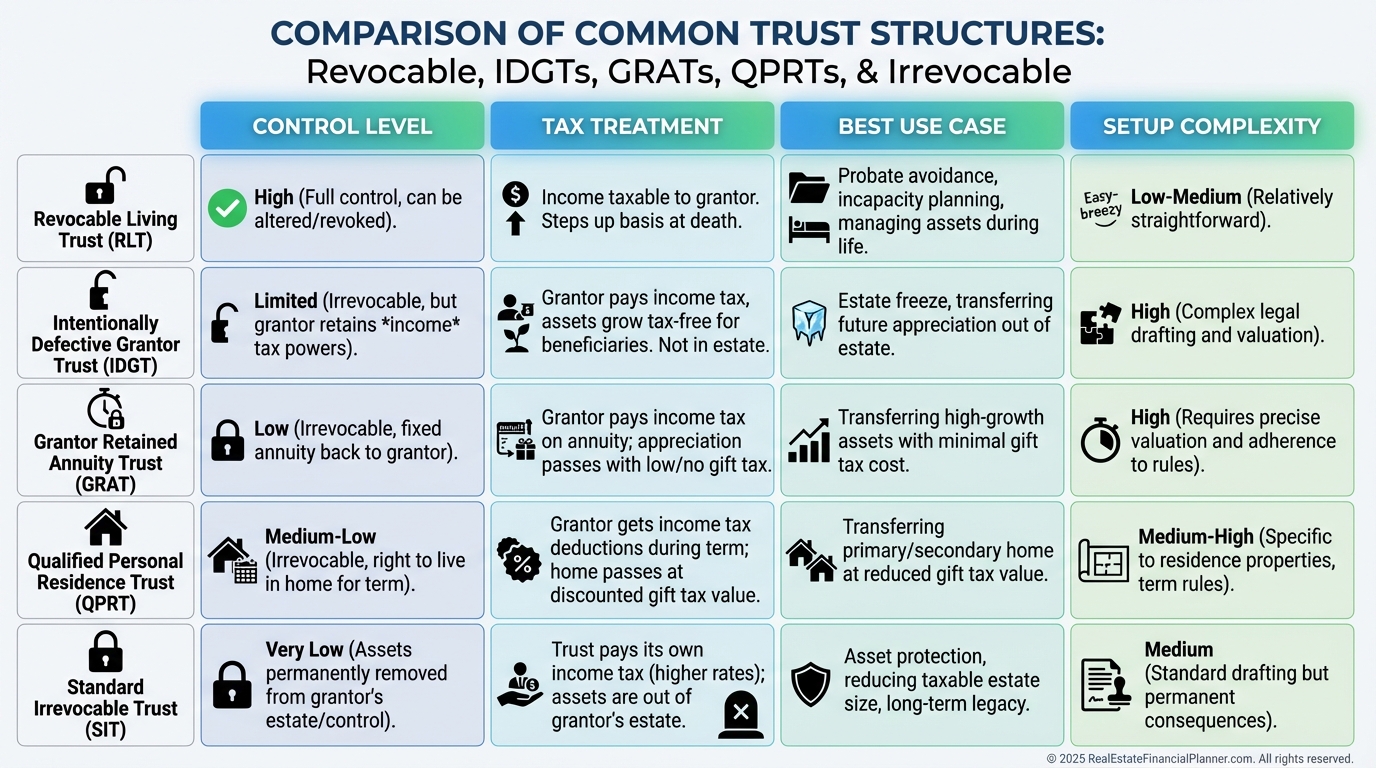

Types of Grantor Trusts You’ll Actually Use

Revocable living trusts are the workhorse for mom-and-pop investors who want control, probate avoidance, and clean succession.

For growth and estate tax planning, I model scenarios where clients add an IDGT to shift appreciation outside the taxable estate while keeping income taxes on their personal return.

GRATs can work for properties with predictable appreciation, while QPRTs are niche but useful for a personal residence you expect to convert to a rental later.

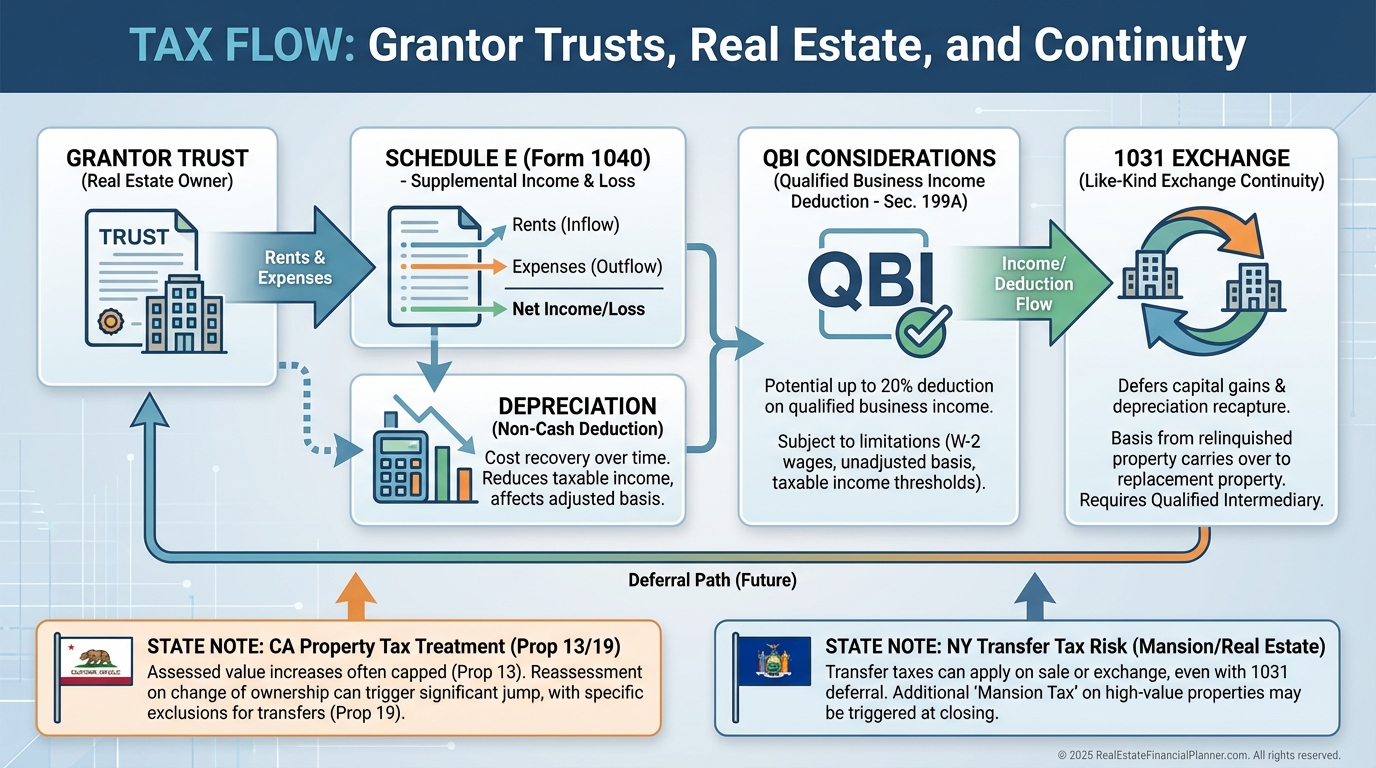

Taxes: How the IRS Sees Your Rentals in a Grantor Trust

For income tax, a grantor trust is ignored, so income, expenses, and depreciation still hit your Schedule E.

You keep the same Return Quadrants™—cash flow, appreciation, debt paydown, and tax benefits—because the trust doesn’t break the economics, it clarifies ownership.

When we model exits, I use True Net Equity™ to estimate after-tax, after-cost proceeds, then decide whether a 1031 exchange or debt paydown snowball adds more value.

1031s generally work cleanly with grantor trusts because the taxpayer is the same person; the key is consistent ownership from relinquished to replacement.

State rules vary, so I confirm with local counsel before transfers; California often allows transfers to a revocable trust without property tax reassessment, while New York may impose transfer tax.

Asset Protection: What Trusts Do (and Don’t) Shield

Revocable trusts are great at avoiding probate and organizing authority, but they are not bulletproof liability shields.

If risk is elevated—student housing, short-term rentals, or environmental history—I discuss moving higher-risk assets into separate LLCs or, in some cases, an irrevocable trust.

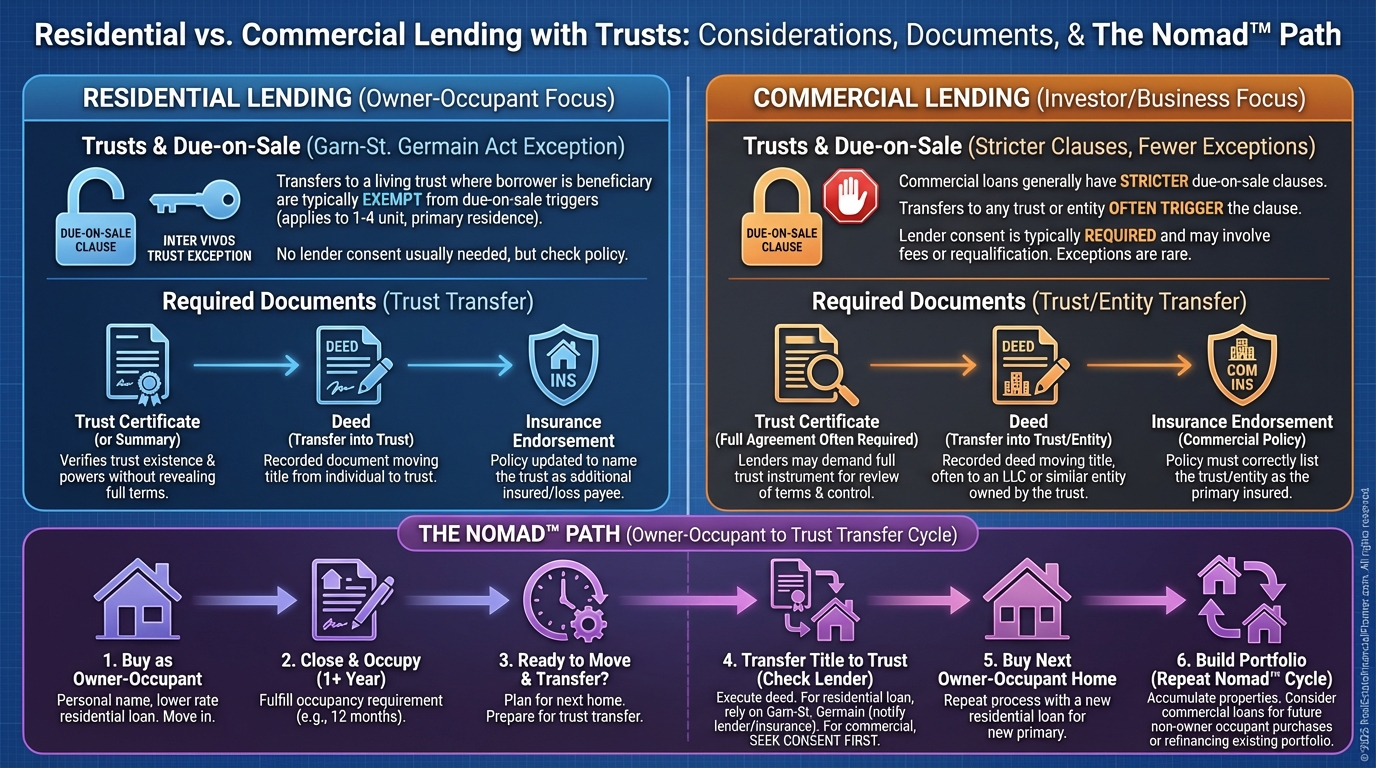

Financing and the Due-on-Sale Problem

Most residential lenders allow transfers to a revocable trust if borrower, occupancy, and insurance remain intact.

I confirm with the lender, record a deed to the trust, and keep an insurance endorsement naming the trust and the lender correctly.

Commercial loans are different; expect personal guarantees and case-by-case underwriting on trust-owned assets.

For Nomad™ investors, I close as owner-occupant to get best terms, season the loan as required, then deed to the revocable trust with lender notice.

Common Mistakes I See (and How to Avoid Them)

Commingling is the fastest way to weaken your plan—open separate bank accounts and track all trust income and expenses cleanly.

Paperwork gaps hurt in court and with lenders, so I always re-title property, update insurance, and refresh leases with correct ownership.

DIY templates miss multi-state issues; if you own outside one state, hire counsel to avoid conflicting rules and surprise transfer taxes.

Ignoring financing terms can trigger acceleration; I read the note and the due-on-sale clause before recording any deed.

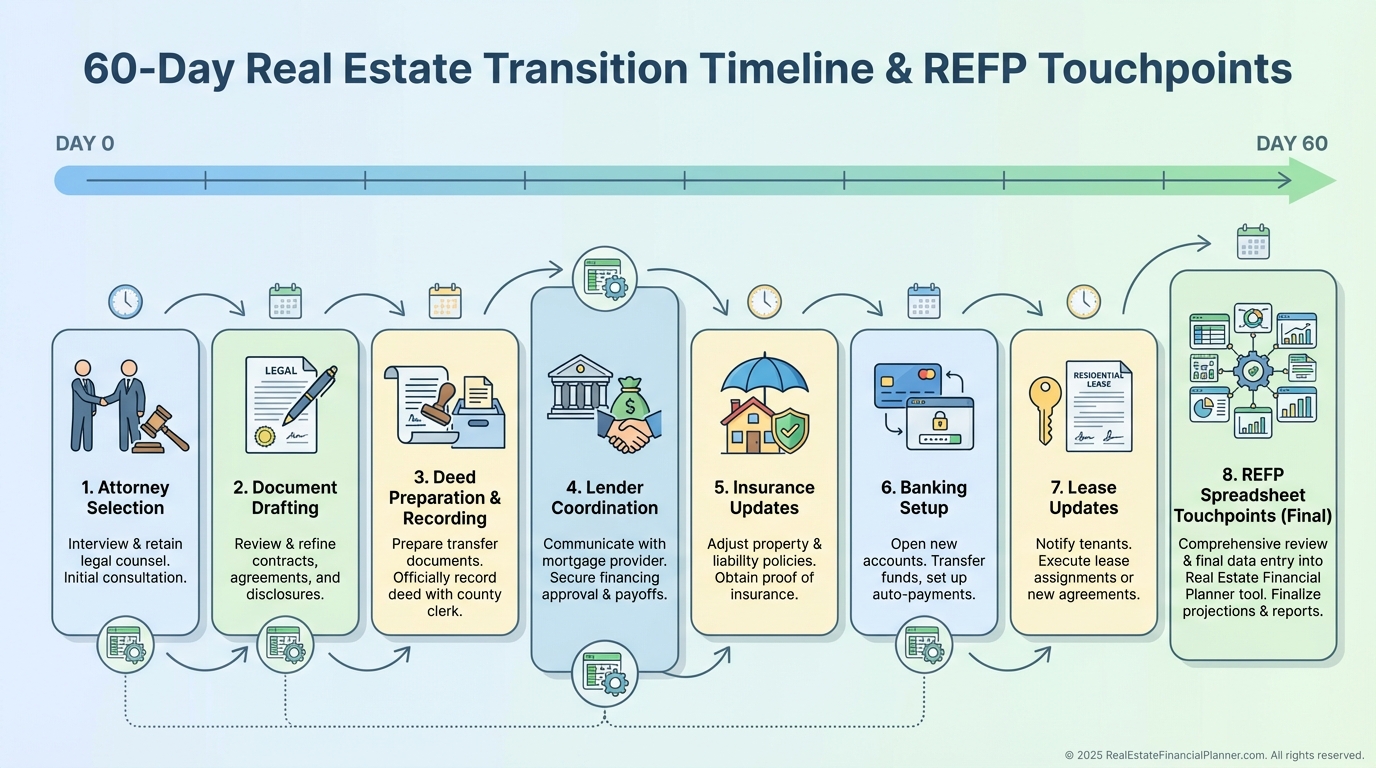

Practical Implementation: A 30–60 Day Plan

Week 1–2: Inventory properties, loans, insurance, and beneficiaries, then choose structure with an attorney who understands both real estate and estate planning.

Week 2–4: Draft trust, review funding plan, order deeds, and prepare lender notifications where needed.

Week 4–8: Record deeds, update insurance and leases, open trust bank accounts, and update your property file checklist.

I mirror these changes in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ so capex, insurance, and debt service reflect trust ownership and any new premiums or terms.

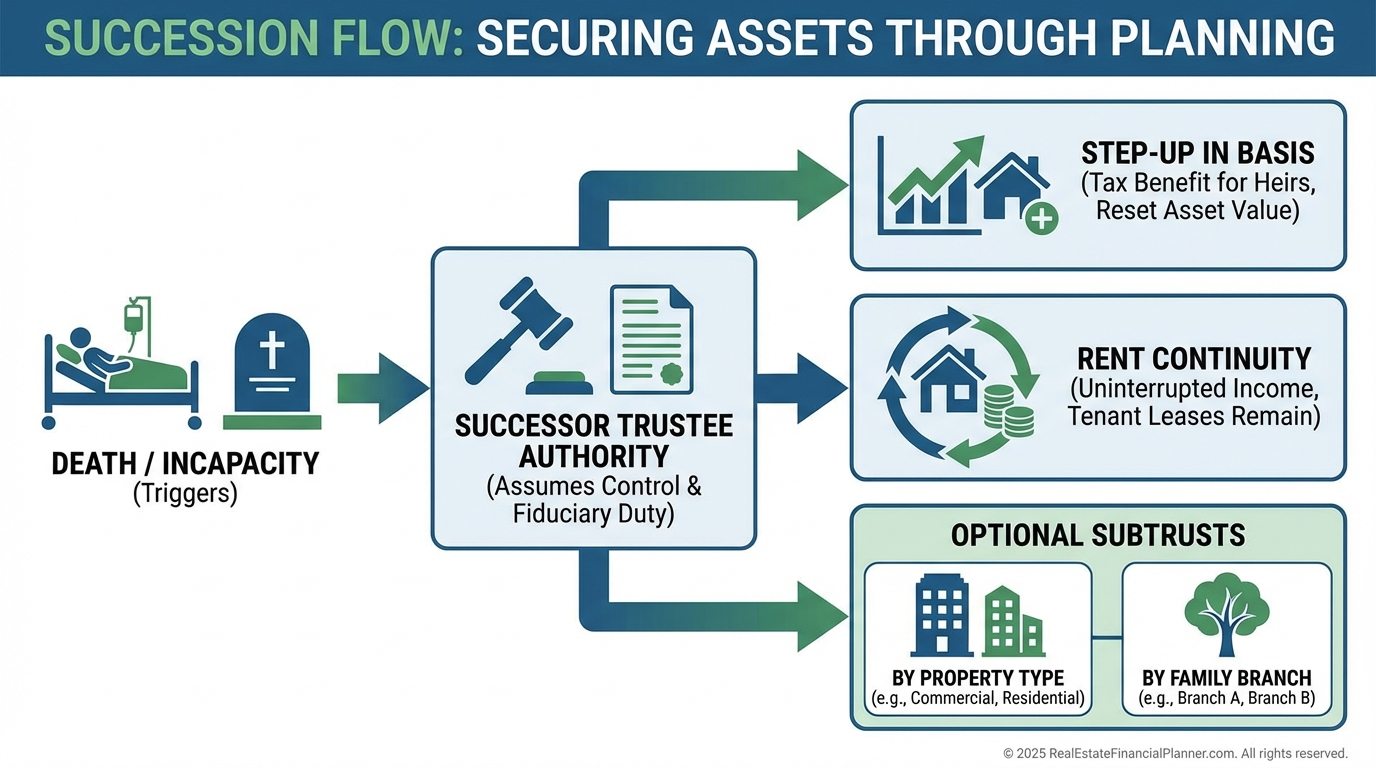

Succession Planning Without Court Drama

Trusts sidestep probate so rent keeps flowing and bills get paid by the successor trustee without court delays.

Revocable grantor trusts typically secure a step-up in basis at death, often wiping out decades of appreciation for capital gains purposes.

When I map family dynamics, I sometimes split assets into subtrusts by property type or heir to prevent one problem asset from freezing the whole portfolio.

When to Call in the Pros

If your holdings exceed $2–3 million, assets span multiple states, or your family tree is complex, bring in specialized counsel.

High-liability assets like STRs, student housing, or older industrial buildings deserve extra planning and more insurance.

Bring It Together with REFP Tools

I underwrite trust-owned deals exactly like any other using Return Quadrants™ and stress-testing for vacancy, capex, and rate shocks.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to keep your assumptions consistent across entities and trust structures.

Final Thoughts and Next Steps

You don’t need twenty doors to justify a trust; two is plenty if you want clean control and a fast handoff.

Start with a revocable living trust, keep clean books, coordinate with lenders and insurers, and add sophistication as your portfolio grows.

Schedule a consult, map your 60-day plan, and update your analysis in the Spreadsheet so your structure supports—not sabotages—your returns.