Home Inspector Playbook for Investors: Timing, Negotiation, and Risk Modeling

Learn about Home Inspector for real estate investing.

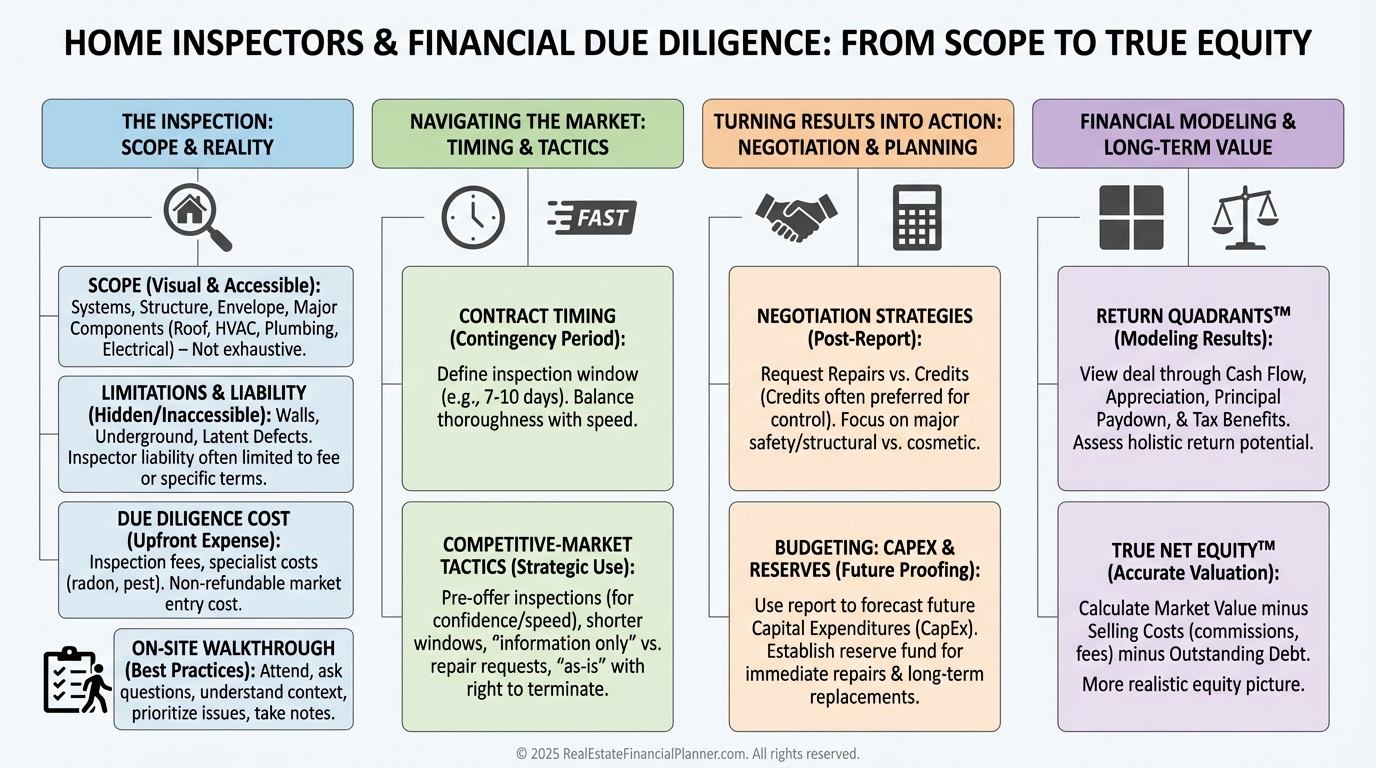

Why I Treat the Home Inspector as a Profit Center

When I help clients analyze deals, I label the home inspector as a due diligence cost and a profit protector.

You pay whether or not you close, but the expected savings and risk reduction usually dwarf the fee.

I’ve paid for three to five inspections before buying a single property.

That’s normal when you’re filtering for safe, profitable acquisitions.

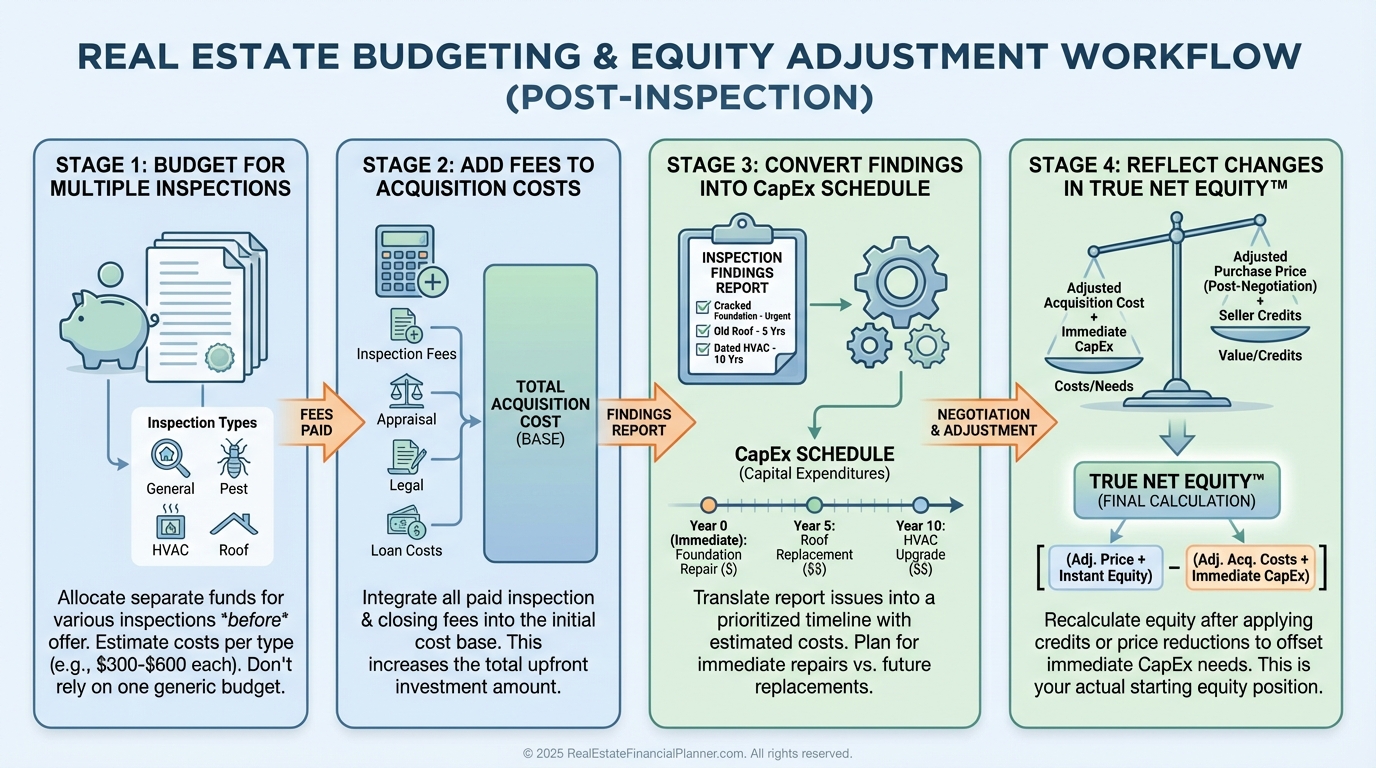

I model inspection fees as an acquisition cost and the findings as adjustments to CapEx, reserves, and negotiation outcomes.

That’s how you turn an “expense” into higher True Net Equity™ on day one.

What a Great Home Inspector Actually Does

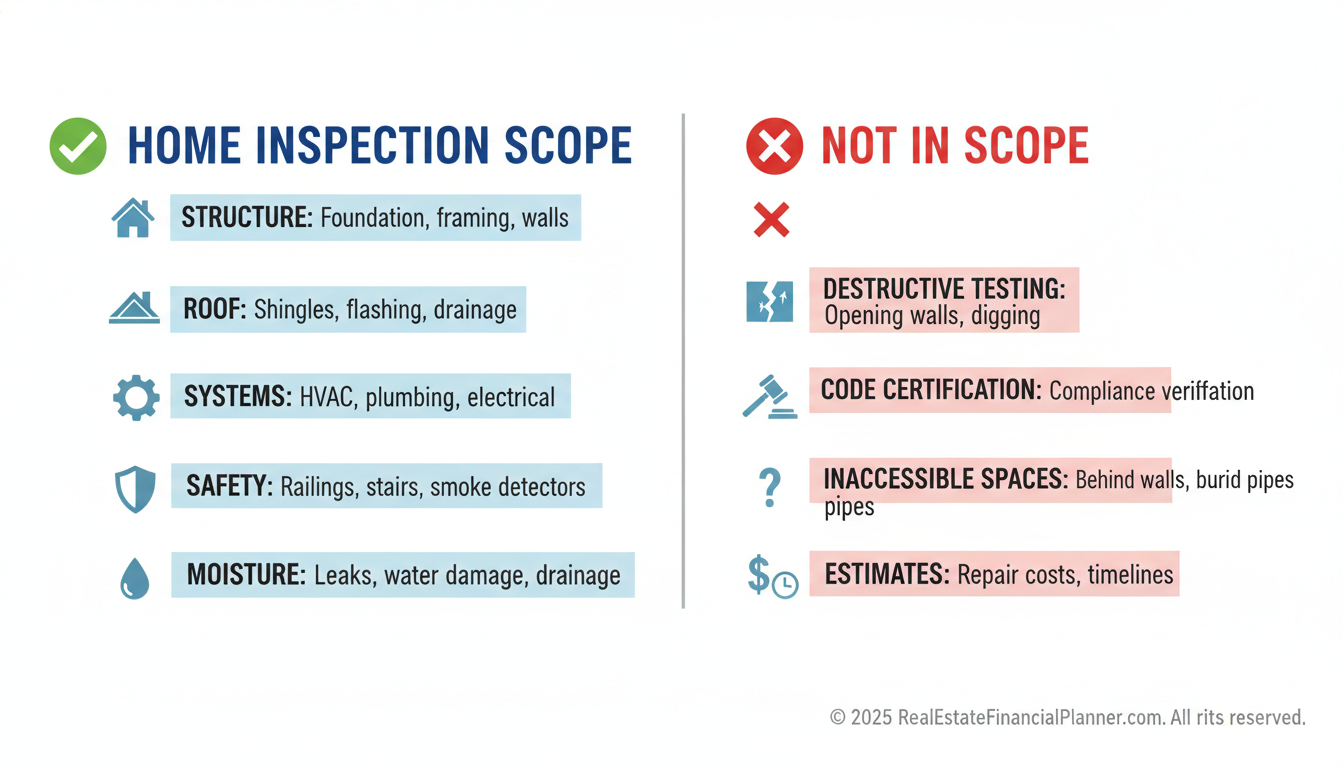

A great home inspector gives you a systems-level snapshot of current condition and likely near-term failures.

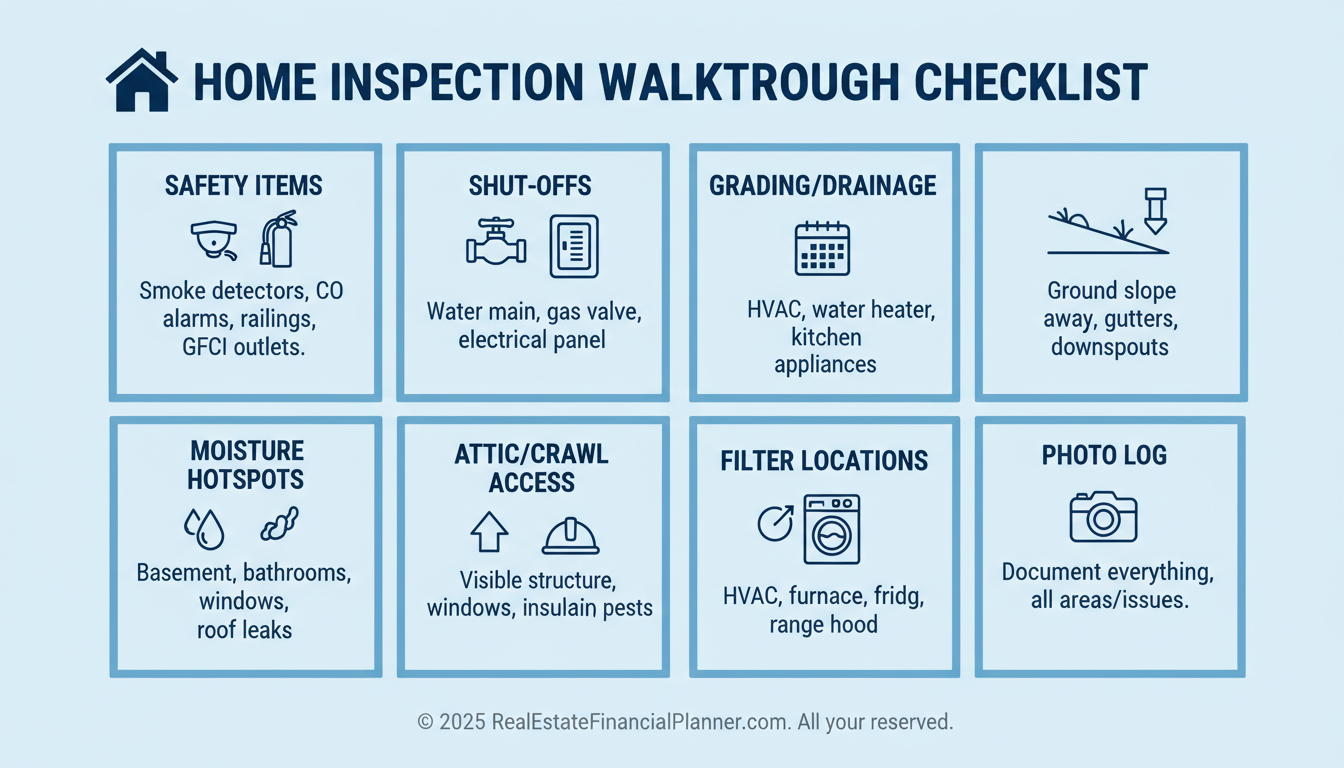

They visually evaluate structure, roof, exterior, interior, electrical, plumbing, HVAC, insulation/ventilation, and safety items.

They don’t perform destructive testing, warranty future performance, or guarantee code compliance.

They deliver a written report with photos, severity ratings, and recommendations, usually within 24–48 hours.

When I review reports, I tag items as Safety, Function, Life Expectancy, or Cosmetic so I can model impacts precisely.

Limitations, Liability, and How I Hedge That Risk

Inspectors are human and limited by access and conditions.

Snow on a roof, locked crawlspaces, or a parked car hiding foundation cracks can obscure issues.

Most contracts cap their liability at the inspection fee.

Read your agreement so you know what “misses” are covered and what’s excluded.

To hedge, I layer specialized inspections when risks are hinted but not confirmed.

I’ll order sewer scopes, roof evaluations, structural engineer opinions, mold and radon tests, chimney inspections, or HVAC diagnostics as needed.

If something’s inaccessible, I negotiate for access or a re-inspection window to reduce blind spots.

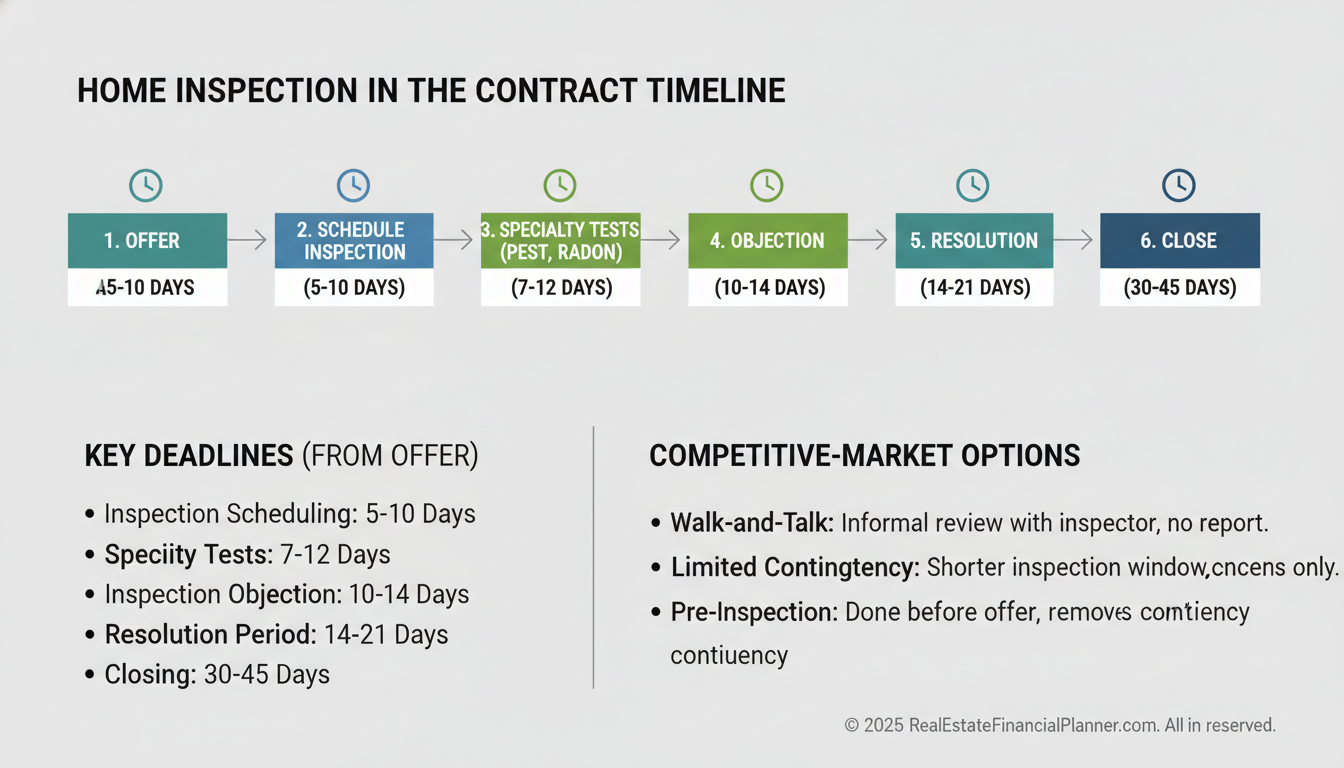

When to Involve the Home Inspector in Your Contract Timeline

Bring the inspector in as soon as your offer is accepted and you’re inside your due diligence window.

Schedule early so you have time for follow-up specialists and negotiation.

I track inspection-objection and inspection-resolution deadlines religiously.

It gives me room to pivot if new information emerges.

In competitive seller’s markets, I’ll sometimes do a “walk-and-talk” pre-offer with an inspector for a quick risk read.

Or I’ll write a tight inspection contingency focused on major defects to stay competitive without flying blind.

For Nomad™ buyers planning to move in, I push for owner-grade diligence because you’ll live with the results daily.

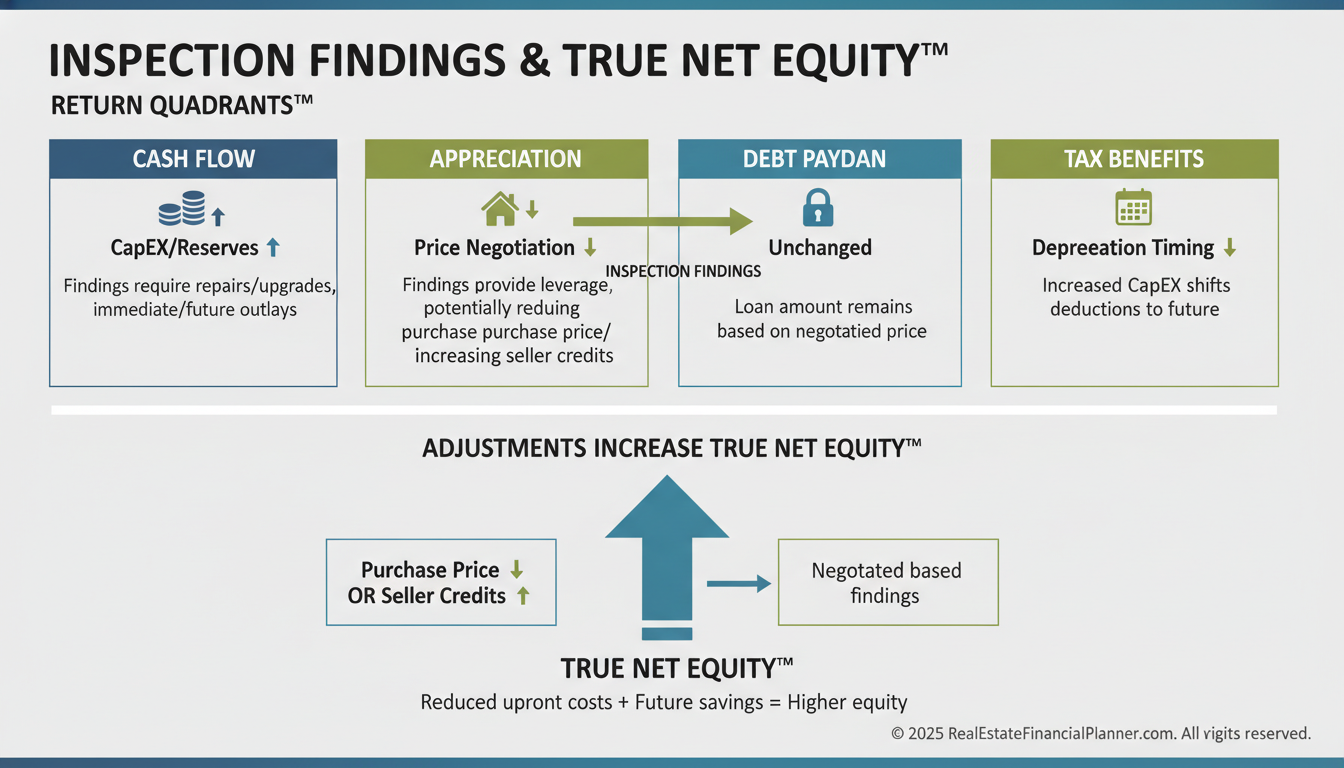

How Inspections Drive the Return Quadrants™

Inspections impact the Return Quadrants™ by shifting costs and risks between cash flow, appreciation, debt paydown, and tax benefits.

Deferred maintenance increases CapEx and reduces cash flow until cured.

Major issues can justify a price reduction, increasing your True Net Equity™ on day one.

When I model deals, I add near-term CapEx for items with remaining life under five years.

I adjust purchase price or request seller credits, then re-run returns to see if the deal still meets my thresholds.

That clarity prevents me from buying cash flow mirages that implode in year one.

Negotiating with the Report

I negotiate with specifics, not outrage.

I attach report pages, photos, and licensed bids with clear cost-to-cure ranges.

For health and safety, I push for repair or strong credits.

For wear-and-tear, I aim for fair credits or adjust my offer.

If the fix is uncertain, I prefer price reductions over repairs so I control scope and quality post-closing.

A simple script works: “Based on the attached inspector findings and bids, we request a $7,800 price reduction or $7,800 seller credit to address X, Y, and Z.”

Following the Inspector: Field Mentorship in 90 Minutes

When I rebuilt after bankruptcy, I treated every inspection as paid mentorship.

I shadowed, listened, and photographed labels and serial numbers.

I ask where shut-offs are, how to maintain systems, and what warning signs look like before failure.

I record “monitor” items and set calendar reminders for seasonal checks.

I take any repair cost guess from an inspector as a placeholder, then verify with licensed contractors.

Budgeting for Multiple Inspections Without Losing Momentum

I budget upfront for multiple inspections per acquisition.

If an inspection is $500 and I expect three misses before one close, I earmark $2,000 per buy.

I add that to my acquisition cost in the deal analysis so the Return Quadrants™ reflect reality.

If the report saves me from a $15,000 mistake, the $500 was an excellent trade.

I also grow my CapEx schedule from the report: roof in 5 years, water heater in 2, furnace tune-up now.

Those line items feed my reserves plan and help me sleep.

Special Situations and Advanced Tactics

Tenant-occupied properties may limit access.

I write for re-inspection rights or holdbacks if key areas are blocked.

For condos and HOAs, I pair the inspection with a deep dive on docs, budgets, and reserves.

On new construction, I order pre-drywall, pre-close, and 11-month warranty inspections.

Rural homes may need well, septic, and water-quality tests.

In cold climates, plan for de-winterization and re-winterization fees so systems can be tested correctly.

Decision Rules I Use After Every Inspection

Green light: issues are minor or fully priced into my offer.

Proceed and set CapEx reserves.

Yellow light: material items exist, but price or credits can cure.

Negotiate with bids attached.

Red light: structural movement, pervasive moisture/mold, unsafe electrical, or big unknowns I cannot price.

Terminate and redeploy capital.

I keep a one-page summary of findings, costs, and my go/no-go rule tied to my minimum True Net Equity™ and cash-on-cash thresholds.

Action Checklist

•

Schedule inspection day one of your due diligence.

•

Read and understand the inspector’s contract and limitations.

•

Shadow the inspector and document locations of all shut-offs.

•

Order specialty inspections when risk hints appear.

•

Convert findings into a CapEx plan and reserves schedule.

•

Negotiate with attached report excerpts and licensed bids.

•

Re-run your Return Quadrants™ and True Net Equity™ before deciding.

•

If risk is unpriceable, cancel and move on.