Trustee Playbook for Real Estate Investors: Fiduciary Mastery, Tax Strategy, and Asset Protection

Learn about Trustee for real estate investing.

Why Trustees Matter for Real Estate Investors

When I help clients build portfolios, the quiet lever that consistently prevents lawsuits, tax waste, and family blowups is a well-chosen trustee with the right playbook.

A trustee doesn’t own your properties; they steer them. And that navigation determines whether you create generational wealth or leave heirs an expensive mess.

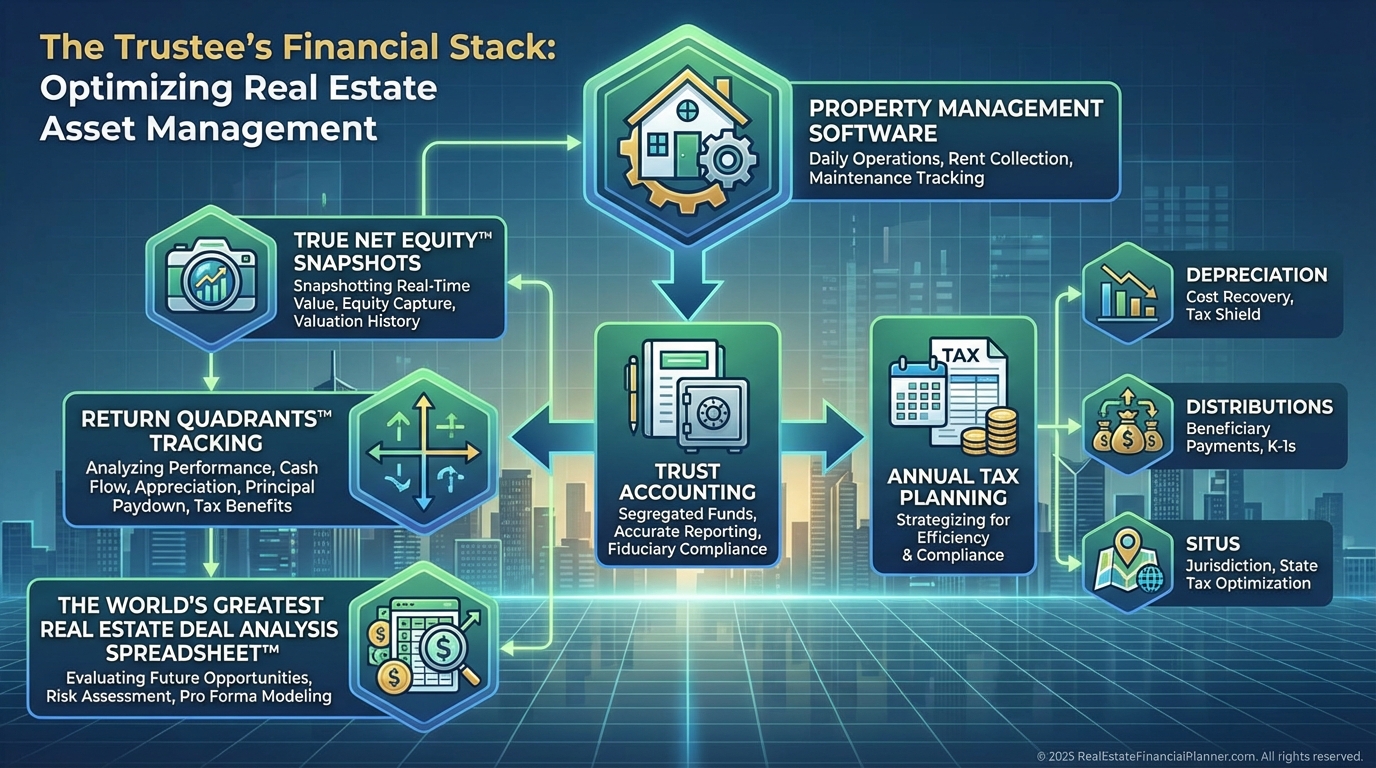

I coach trustees to measure results through the Return Quadrants™ lens: appreciation, cash flow, debt paydown, and tax benefits.

When the trustee protects those four returns while honoring fiduciary duties, portfolios compound cleanly.

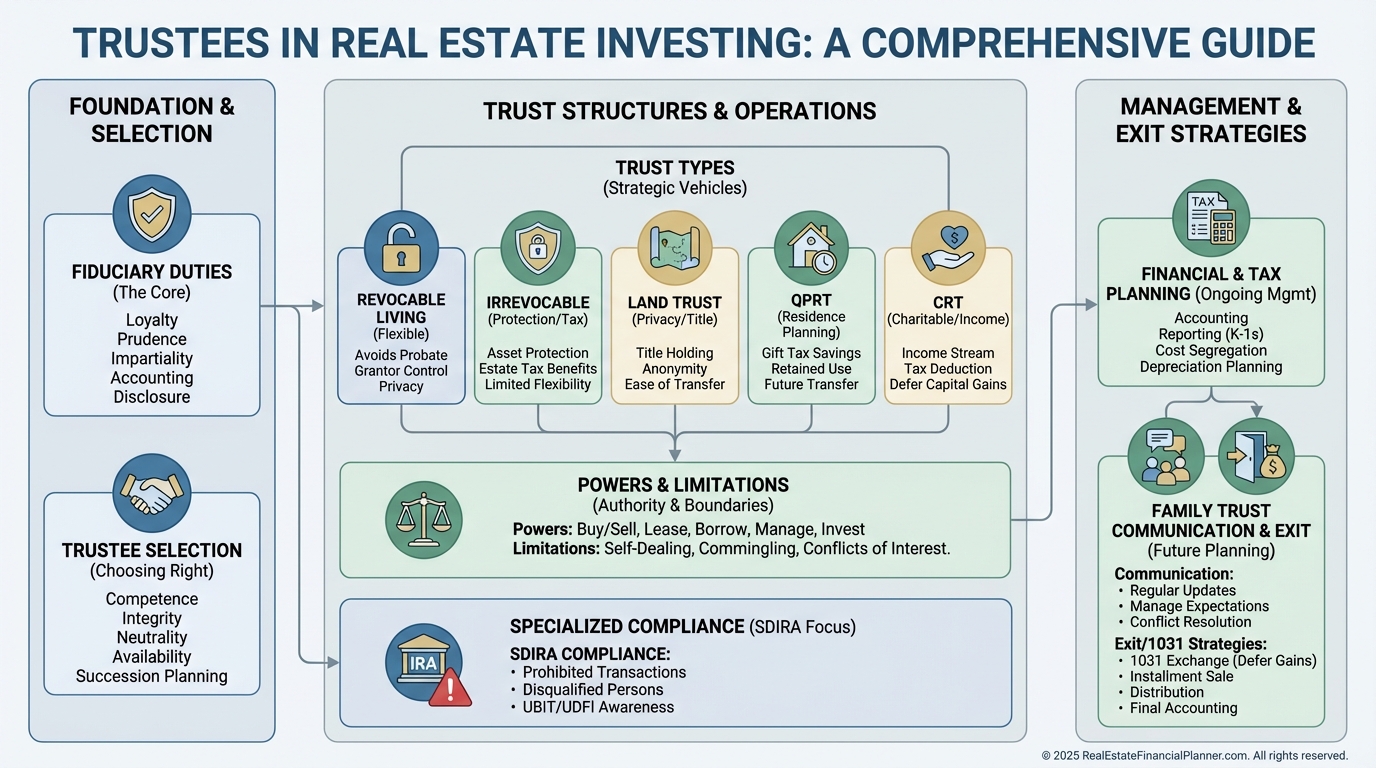

What a Trustee Is (and Is Not)

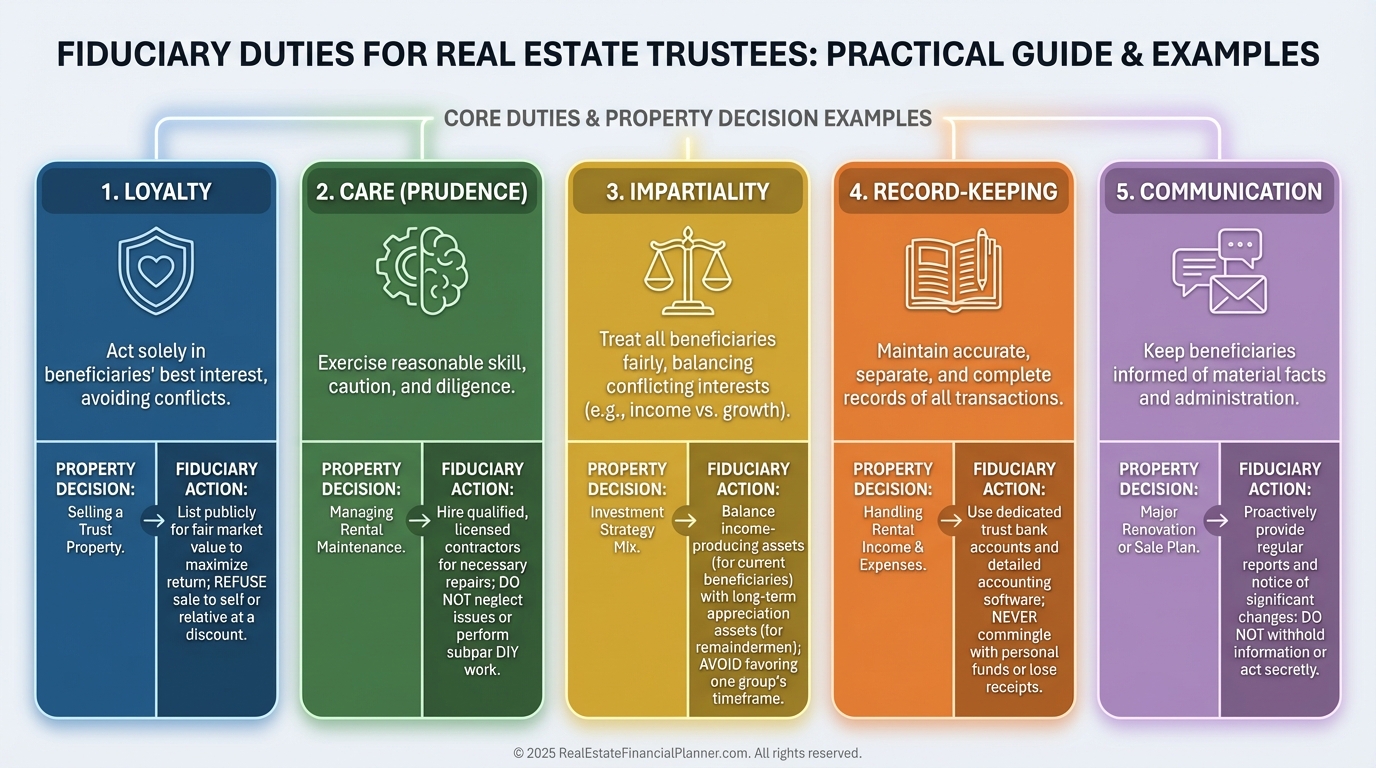

A trustee is the person or entity holding legal title and managing assets for beneficiaries under the trust document and state law.

They are a fiduciary first, investor second. Every decision must benefit beneficiaries, not the trustee.

When I evaluate a trustee candidate, I look for three traits: discipline with money, calm under pressure, and willingness to document everything.

For families wanting continuity, I often pair a detail-oriented family member with a corporate co-trustee. Personal context plus professional process wins.

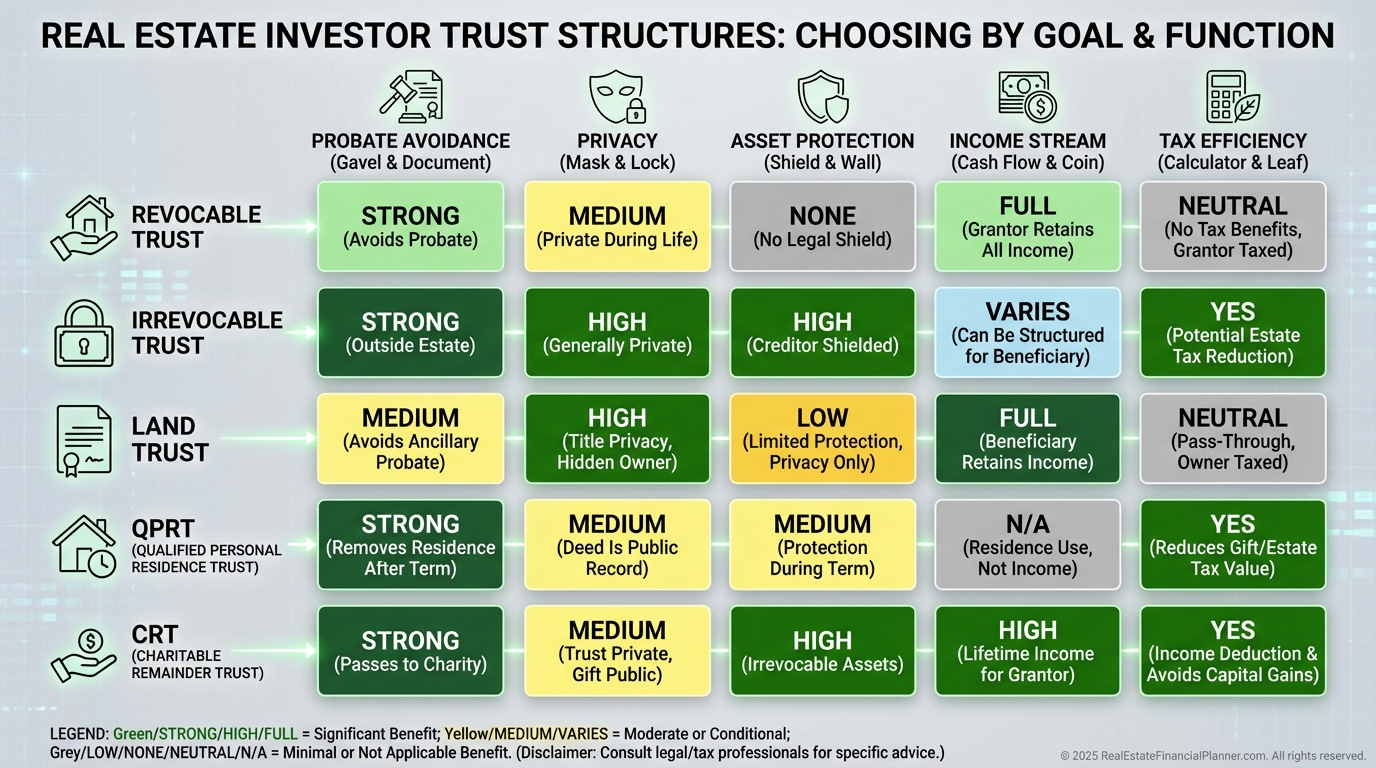

Choosing the Right Trust Structure

Trust structure dictates taxes, privacy, and control. Pick it on purpose, not by default.

Revocable living trusts simplify probate and maintain privacy but do not protect from your personal creditors while you’re alive.

Irrevocable trusts trade flexibility for protection and estate-tax leverage.

Land trusts can add privacy and transfer simplicity where recognized.

QPRTs can freeze the value of a residence for estate purposes while you keep living there for a term.

CRTs can turn appreciated equity into lifetime income and a charitable legacy while avoiding immediate capital gains.

When we model options, I always run True Net Equity™ before-and-after for each structure. That shows what you really own after selling costs, loans, and taxes today, not just paper equity.

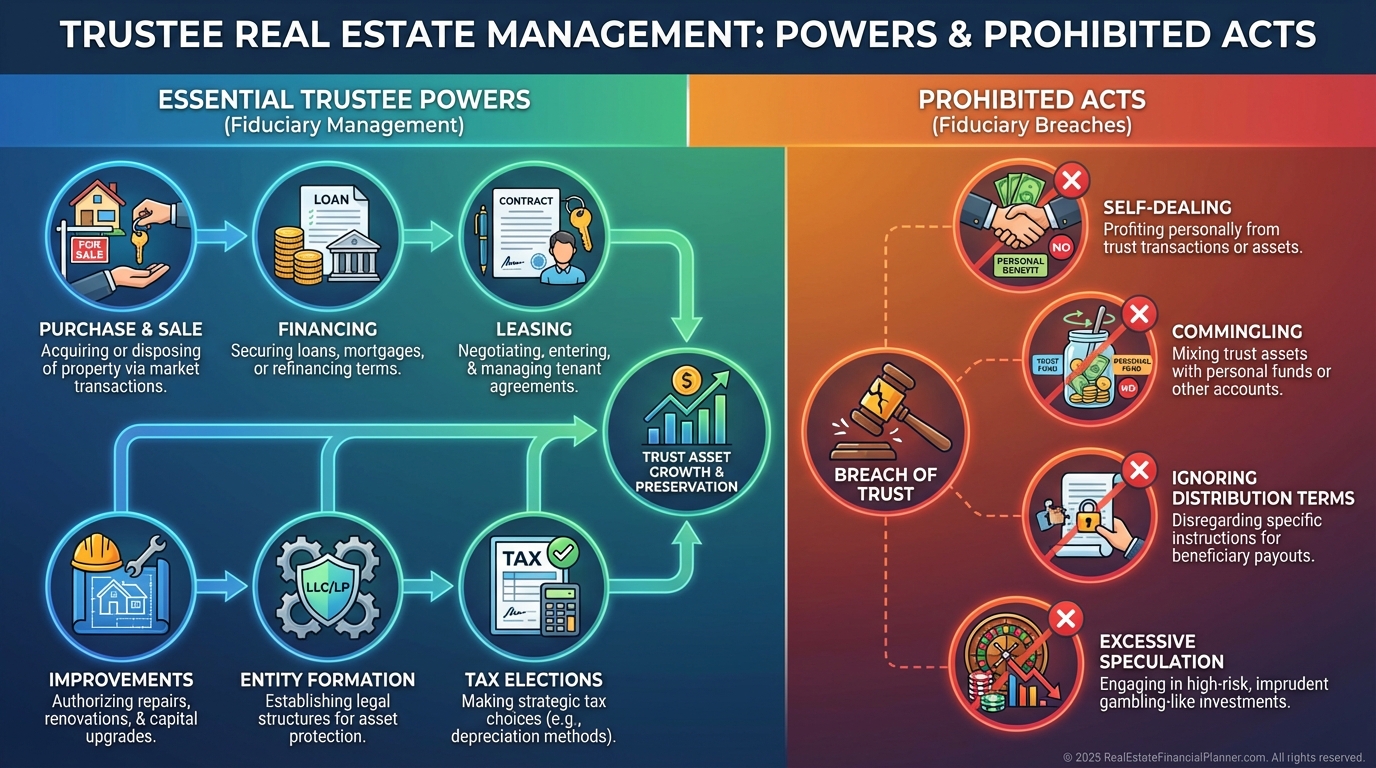

Trustee Powers You Must Authorize (and Lines They Must Not Cross)

Trustees need explicit powers to run real estate well. If it’s not granted, assume it’s restricted.

State law matters. California often grants broad default powers in the Probate Code unless limited. Florida generally wants the powers spelled out.

Even with broad powers, trustees cannot self-deal, commingle assets, ignore mandatory distributions, or speculate beyond the trust’s standards.

When I review drafts, I highlight unclear language that could trap a future sale, refinance, or 1031 exchange.

Financial Management: Systems, Analysis, and Taxes

Trustees win or lose in their systems. Sloppy accounting is a fiduciary breach in slow motion.

Use property management software plus trust accounting, and keep trust assets separated from personal finances at every step.

I track acquisitions and performance using The World’s Greatest Real Estate Deal Analysis Spreadsheet™ because it mirrors how trustees must think: cash flow today, capital needs tomorrow, and tax outcomes each year.

I also monitor the Return Quadrants™ per property and for the entire trust. If cash flow sags while debt paydown and appreciation spike, we plan reserves or refinance.

Trust taxes compress quickly. In 2025, trusts hit the top federal bracket at just $15,200 of taxable income.

I reduce that bite with timing of deductible expenses, targeted income distributions to beneficiaries in lower brackets, careful depreciation planning (including cost segregation when appropriate), and, when suitable, selecting trust situs in a lower-tax state.

Mom-and-Pop Reality: Self-Trustee or Professional?

I tell small investors to start by estimating time. Expect 5–10 hours per month for basic administration with a small portfolio.

Serving as your own trustee keeps costs down and speeds decisions. It also increases your exposure if you cut corners.

Professional trustees shine when you have multi-state holdings, thorny family dynamics, or specialized assets like development or triple-net commercial.

If your hourly value exceeds trustee fees, outsource. Still appoint a family co-trustee to preserve context and beneficiary trust.

Insure the role. I recommend errors and omissions coverage, D&O liability, a fidelity bond, and an umbrella policy sized to your equity and risk.

Common failure points I see: commingling funds, undocumented decisions, skipped annual minutes, poor beneficiary communication, and deferred maintenance masked as “risk management.”

Special Case: Self-Directed IRA Real Estate

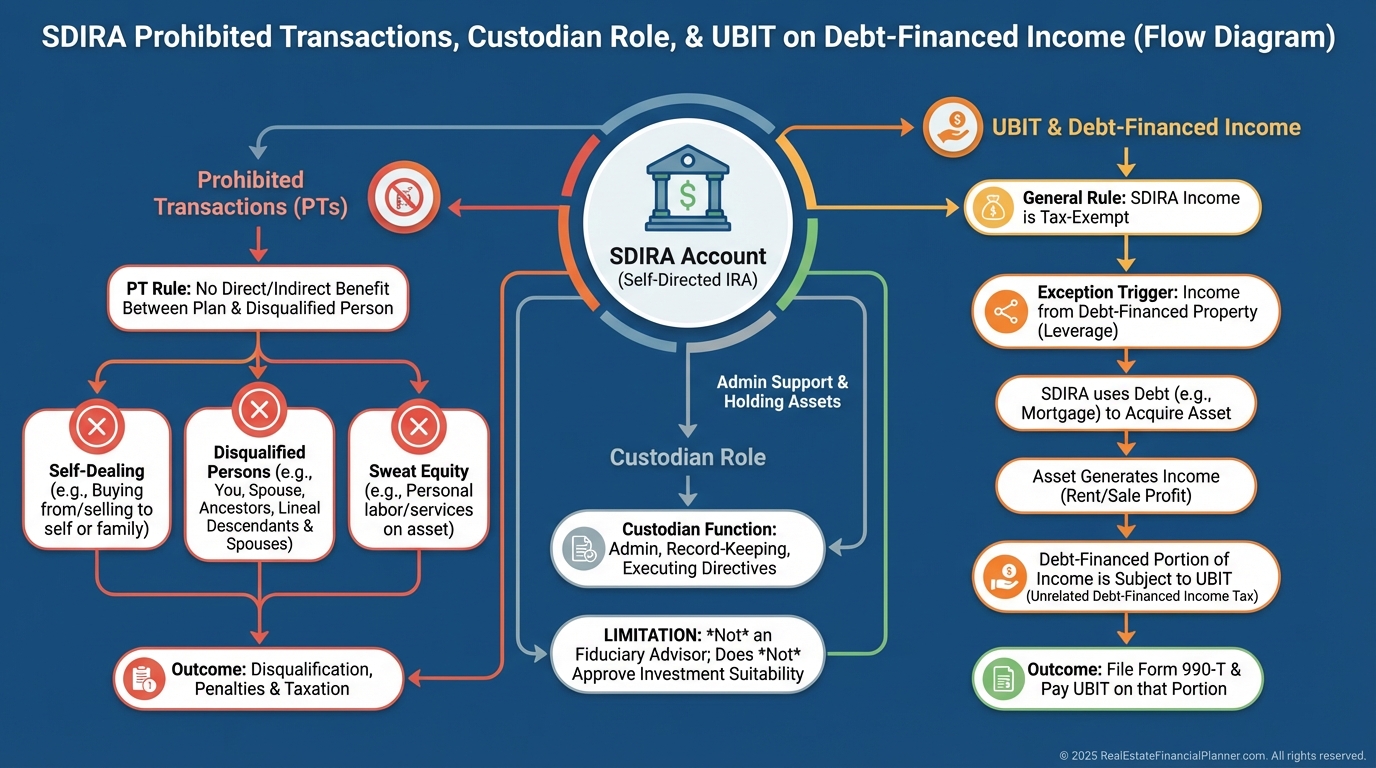

SDIRAs are powerful but unforgiving. The custodian executes your directions; they don’t give investment advice.

Prohibited transactions are the minefield. No personal use, no deals with disqualified persons, and no sweat equity.

Debt-financed deals can trigger UBIT on the leveraged portion. That’s not a reason to avoid leverage; it’s a reason to model it precisely.

I model leveraged SDIRA deals two ways: with UBIT and without leverage. If the after-tax Return Quadrants™ still beat alternatives, we proceed with eyes open.

Family Trust Dynamics: Communication that Prevents Conflict

In family trusts, silence breeds suspicion. I schedule quarterly statements, one annual strategy meeting, and ad hoc updates for major events.

When beneficiaries feel heard, trustees get latitude to act.

I like clear written policies for common issues, a mediation clause, optional advisory committees for big decisions, and independent appraisals when emotions run hot.

Succession is a process, not a paragraph. Train successors early, document property histories and key relationships, and draft emergency protocols for incapacity.

Exit Strategies, 1031s, and Distributions

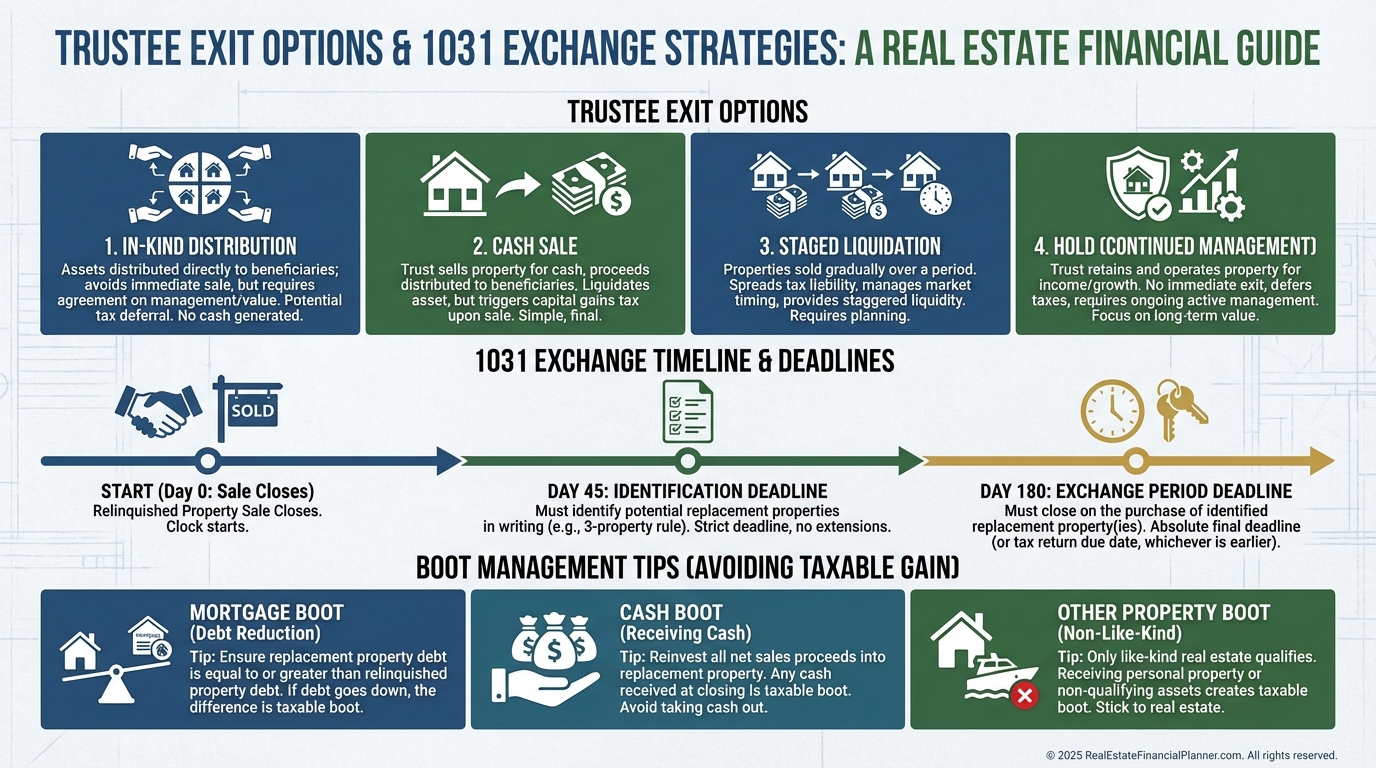

Every hold has a finish line. Trustees balance market timing, beneficiary needs, and taxes.

For 1031s inside a trust, I confirm the same trust entity holds both relinquished and replacement property and that the trust allows exchanges without extra approvals.

I set calendar reminders for identification and closing deadlines and plan boot management to limit taxable gains.

When distributing, I compare outcomes for in-kind property distributions, sales with cash distributions, staged liquidations, or continued trust ownership.

I calculate True Net Equity™ by property and by beneficiary scenario before recommending the path.

Putting It All Together

A great trustee blends fiduciary discipline with investor savvy and family diplomacy.

Model decisions with True Net Equity™ and the Return Quadrants™, document your process, and communicate on a predictable cadence.

Use professionals where complexity or conflict justifies the cost. And use systems—especially The World’s Greatest Real Estate Deal Analysis Spreadsheet™—to replace memory with math.

Do this well and your trust becomes a durable engine for your Nomad™ moves, your buy-and-hold portfolio, and your family’s peace.