Property Taxes Explained for Real Estate Investors

Learn about Property Taxes for real estate investing.

When I help clients underwrite deals, I start with the quiet costs that move values the most: property taxes.

It wasn’t bad luck. It was predictable—and avoidable.

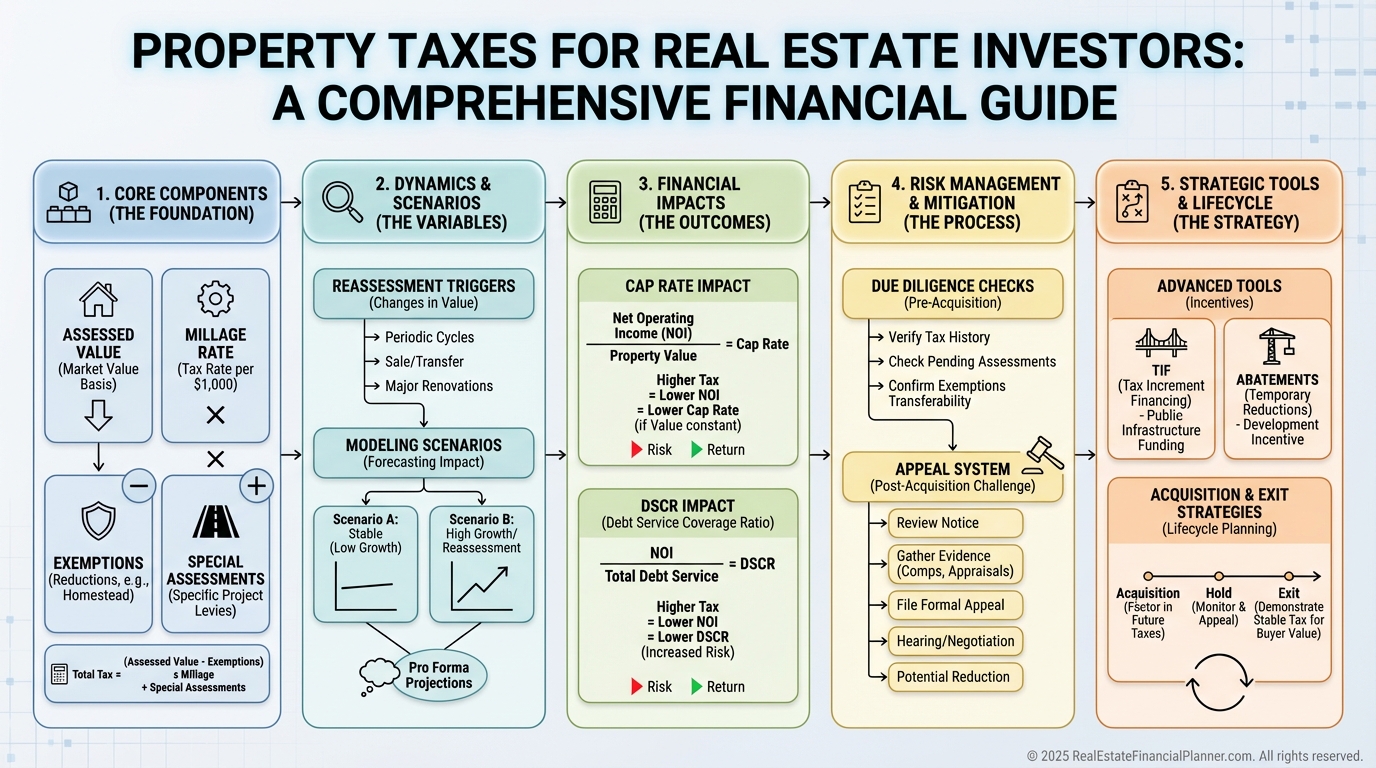

What Property Taxes Really Are (And Why Investors Misread Them)

Property taxes are ad valorem. They’re based on assessed value, not income or sales.

They fund local services, so rates, practices, and exemptions vary city to city—sometimes street to street.

Investors get hurt not because the math is hard, but because they analyze the wrong number at the wrong time.

Assessed value is what the assessor says is taxable. It can trail market value for years.

The tax rate (millage) is applied to that assessed value. One mill is 0.1%.

Exemptions and abatements reduce taxable value or the tax itself. Homestead exemptions rarely transfer to your new rental.

Special assessments get layered on for things like sidewalks, sewers, and lighting districts. They aren’t optional.

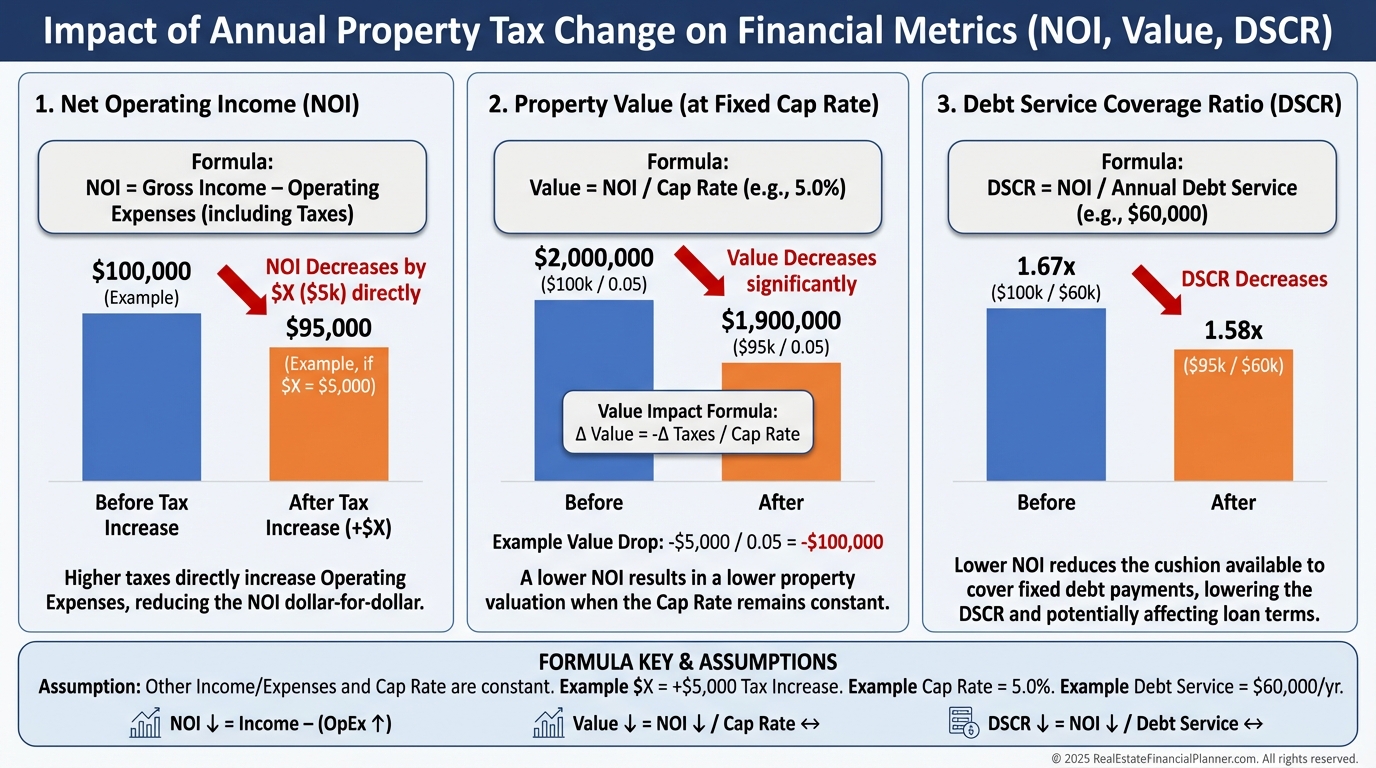

The Investment Math Most People Skip

Every new dollar of annual property taxes reduces NOI by a dollar.

At a 7% cap rate, $1,000 in additional taxes cuts value by about $14,285. The math is brutal and instant.

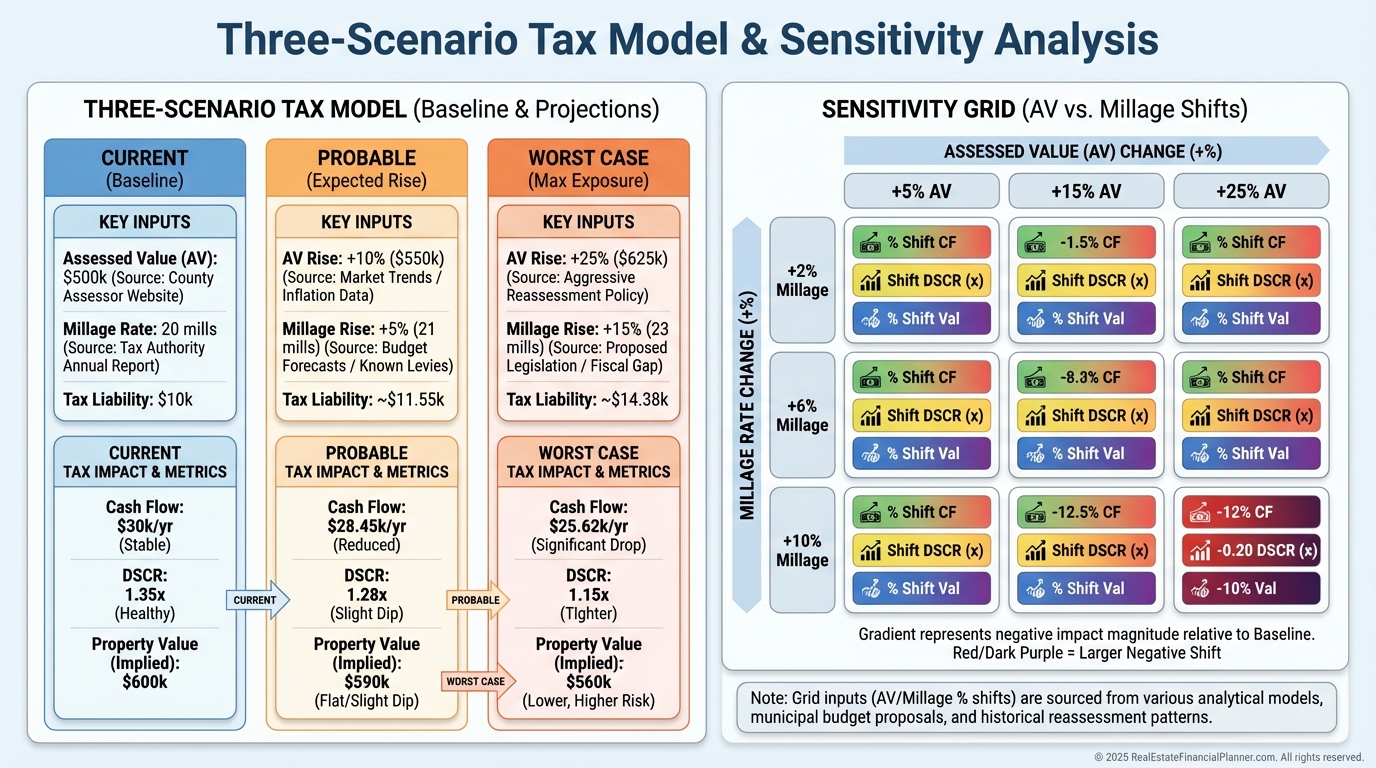

When I rebuilt after the 2008 downturn, I adopted a rule: model taxes three ways before I ever write an offer.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I add Current, Probable, and Worst-Case taxes and watch Return Quadrants™ shift in real time.

Cash Flow drops first. That impacts the total return stack and your True Net Equity™ because lower NOI compresses valuation and later refinance proceeds.

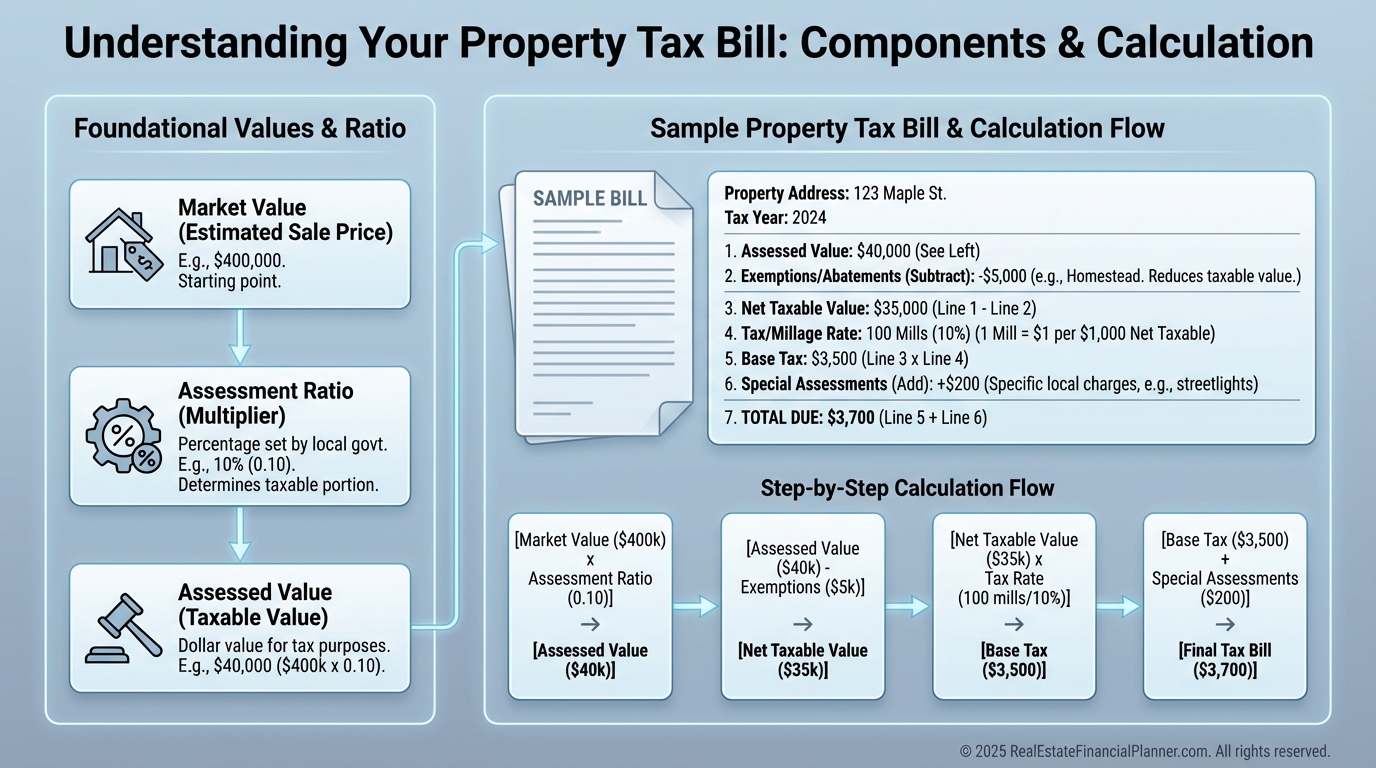

How to Calculate and Project Property Taxes Like a Pro

The formula looks easy: Tax = (Assessed Value × Tax Rate) + Special Assessments.

The skill is finding accurate inputs and projecting the next assessment event.

Start with the assessor’s site for assessment history and exemptions. Confirm actual paid bills with the tax collector.

MLS data often shows owner-occupied bills. Title reports are current-year snapshots but may miss imminent reassessments.

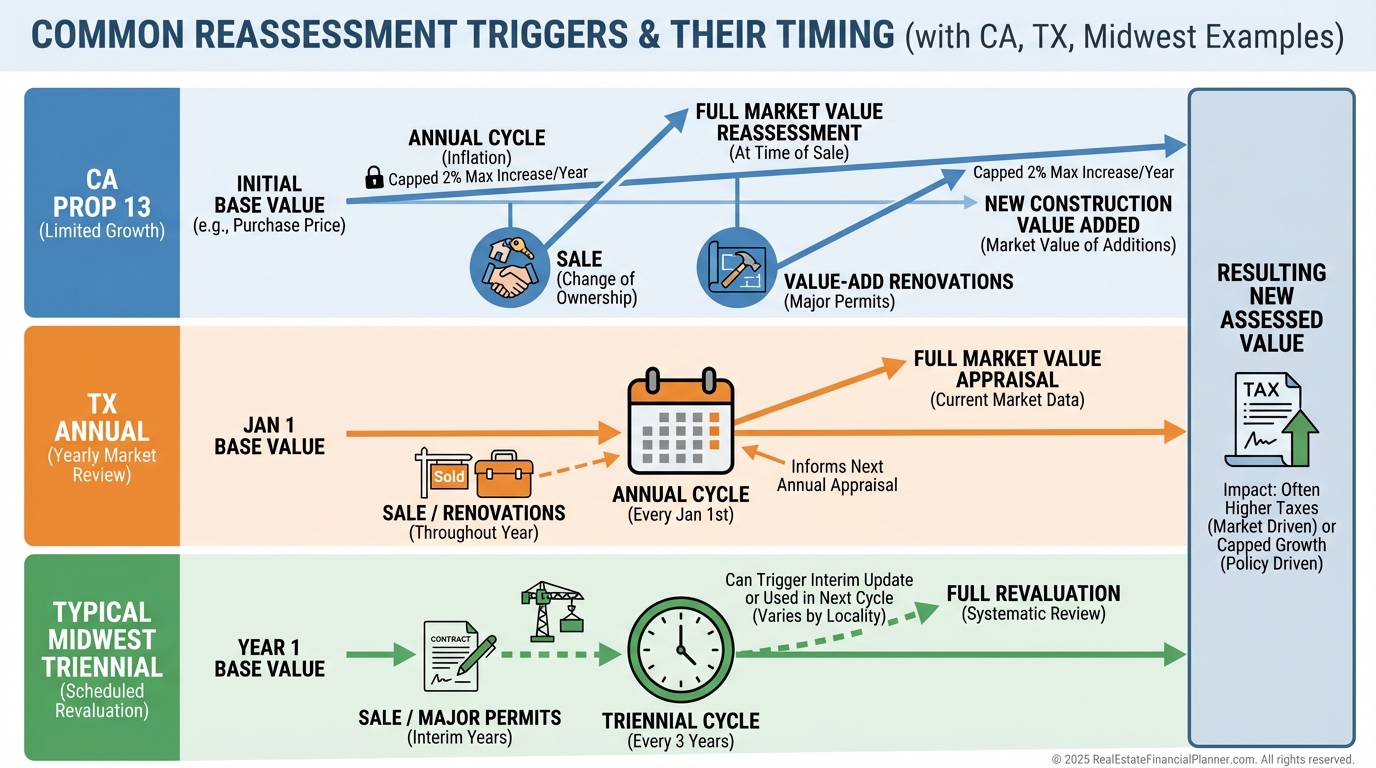

Know your triggers. Some jurisdictions reassess at sale, when you pull permits, or on a county cycle.

California’s Prop 13 caps annual increases but resets at sale. Texas may cap homestead increases but not investor property.

Assessment ratio analysis is your edge. If similar properties sit at 80% of market and your target is at 60%, your post-purchase jump is telegraphed.

Case Study: The Fourplex That Lost 23k in Value

Tom bought a fourplex at $320,000. Taxes showed $3,200 annually. He verified the bill—true for the seller.

The last sale was 2008 at $180,000, and the assessment lagged. After Tom’s purchase, the assessor reset to ~$315,000. At 1.6%, taxes became ~$5,040.

NOI fell by $1,840. At an 8% cap, value dropped ~$23,000. His return slid from 8% to ~7.4%. All from ignoring the obvious trigger.

Build Taxes Into Your Deal Model Before You Offer

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, I add three scenarios for every property:

Current Taxes: What the seller pays today.

Probable Reassessment: Based on your contract price and local methodology.

Worst Case: Full market value plus removal of exemptions and special assessments.

I also build a sensitivity table. +/− 10% in assessed value and +/− 0.2% in millage tells me the range of outcomes.

If a deal only works under today’s bill, I pass or price in the reality.

Valuation and Financing Effects You Can’t Ignore

Lenders escrow taxes. A $300 monthly tax increase often requires $3,600 extra at closing to fund escrow.

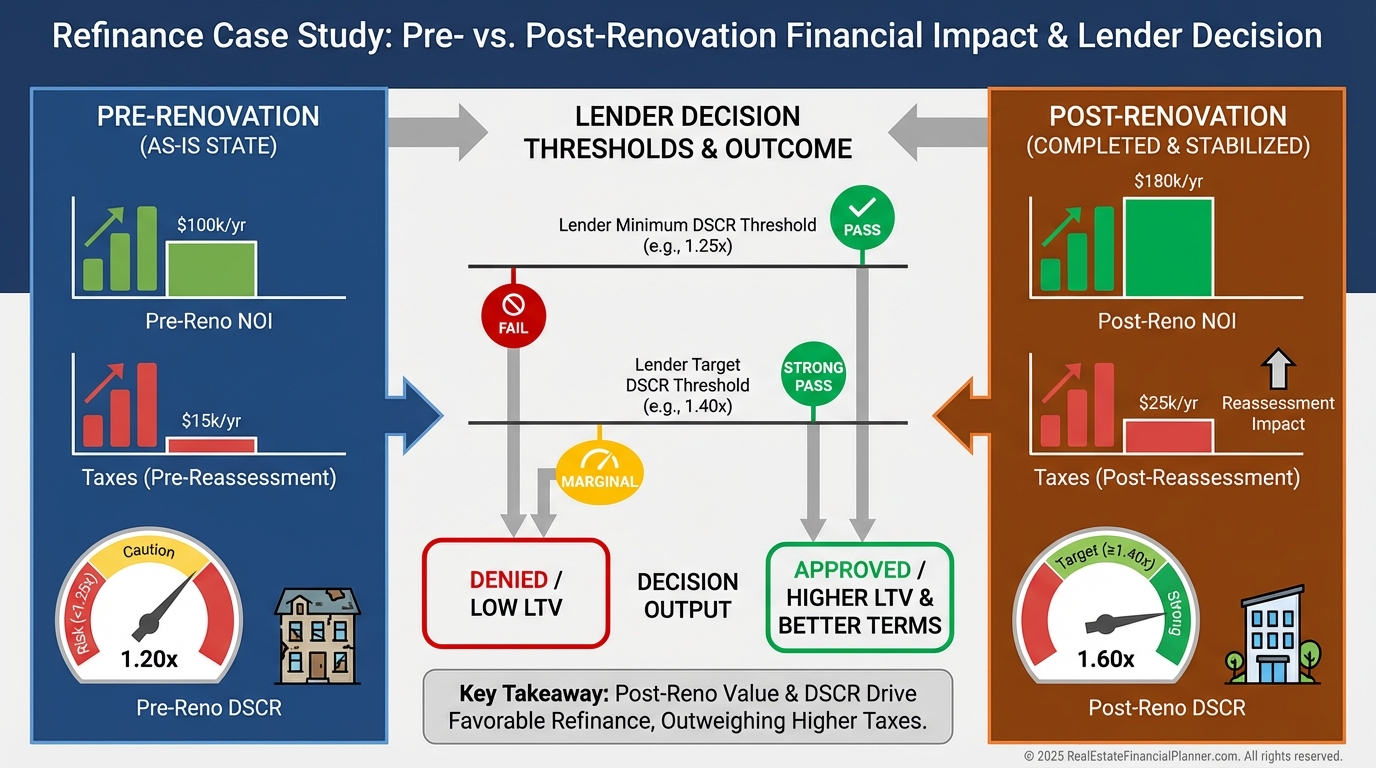

That same $300 cuts DSCR and can kill a refinance.

Buyers discount high-tax properties. Smaller pools. Longer marketing times. Required returns go up.

Example: The Triplex Refinance Trap

Her permits triggered reassessment from $175,000 to $255,000. Taxes rose from $2,400 to $3,900.

That extra $125/month dropped DSCR from 1.28 to 1.19. Her 75% LTV cash-out stalled. $40,000 stayed in the deal until she raised income.

The Most Expensive Property Tax Mistakes

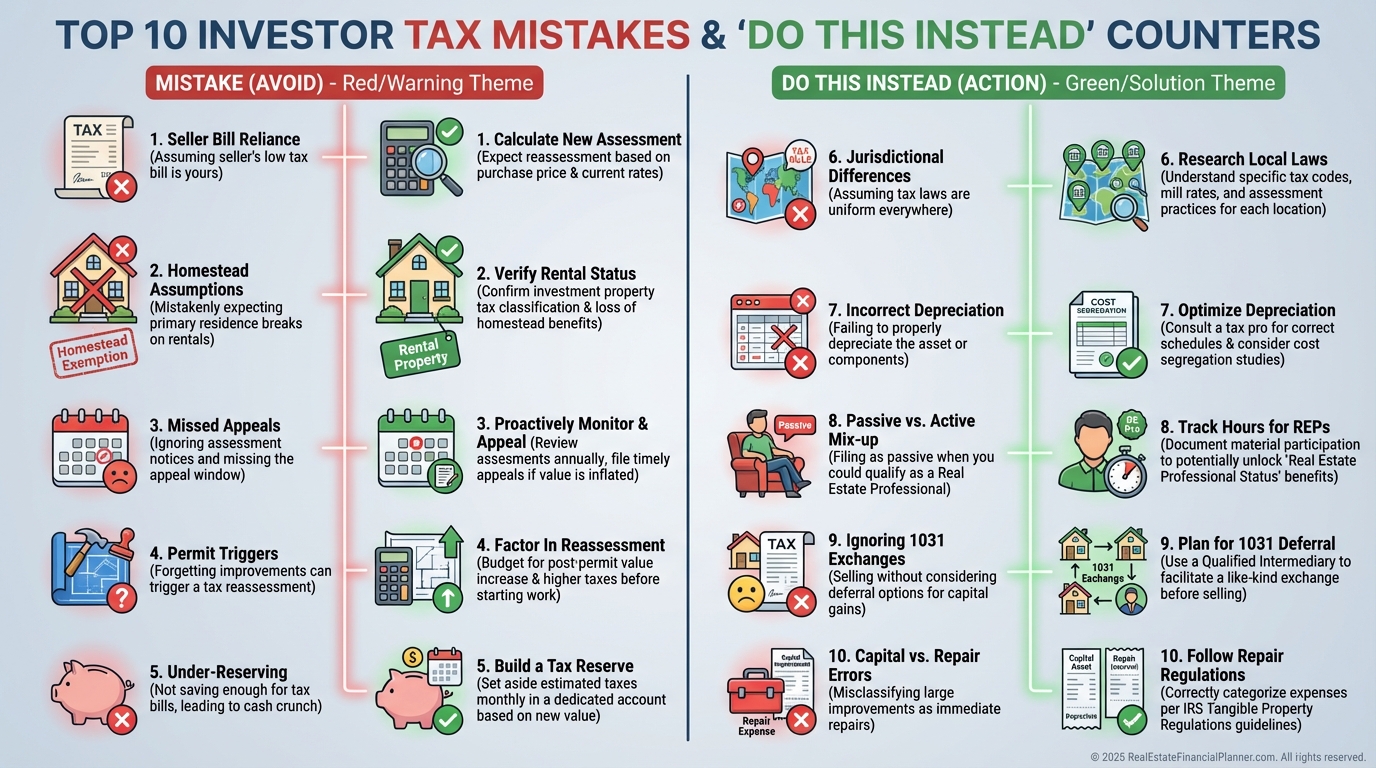

Pre-purchase, investors trust the seller’s bill as if it’s theirs. It almost never is.

They miss homestead removal. They miss appeal windows. They assume their home market’s rules apply everywhere.

Operating, they underbudget 3–5% annual increases. They pull permits blind to triggers. They never appeal creeping assessments.

Strategically, they cluster in one high-tax district and take portfolio-level risk. When millage moves, five roofs catch the same storm.

They treat taxes as fixed instead of managed.

Sophisticated Strategies That Create Real Alpha

When I negotiate, I price using post-purchase taxes.

“Your taxes will rise about $1,500 after sale. At 7% cap, that’s $21,000 in value. Let’s reflect that in the price.”

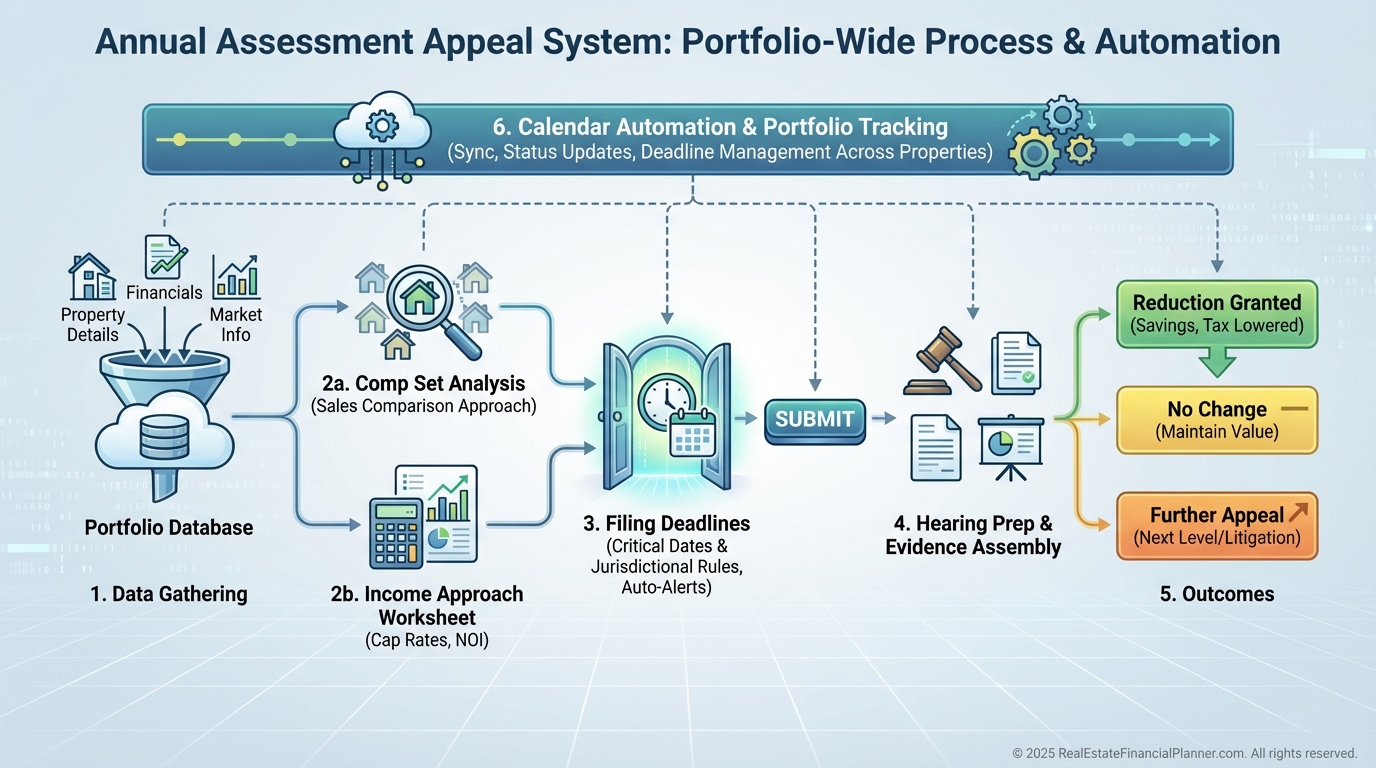

I diversify jurisdictions to dampen policy risk. I calendar appeals. I track assessment ratios like comps.

Entity strategy matters. In some places, certain transfers or refinances can trigger reassessment. Work with local counsel to structure intelligently.

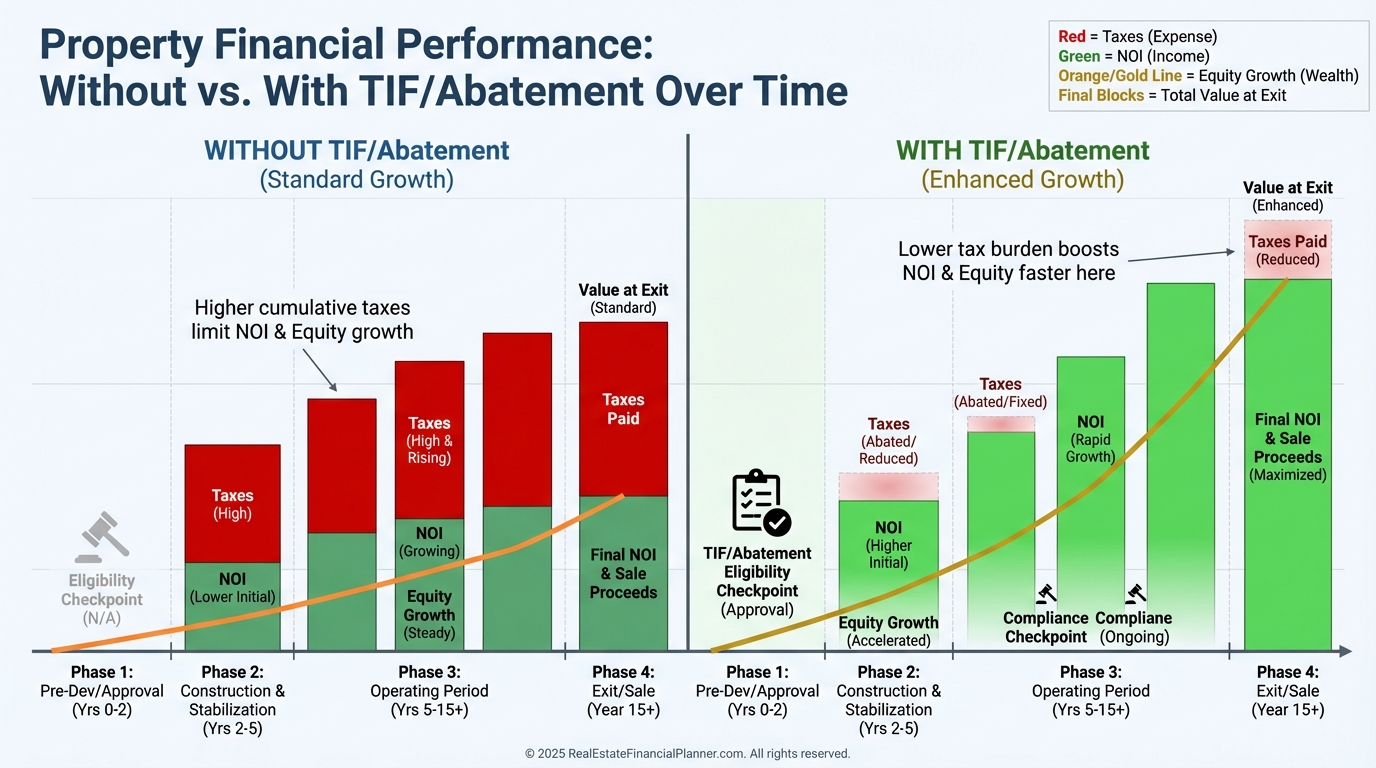

Advanced tools amplify returns. TIF districts can freeze your base value. Abatement programs can offset improvement value for 5–15 years.

Success Story: The Small Apartment Edge

Jennifer bought small apartments in three Ohio markets. Her edge was property tax management.

She appealed annually with a consultant, brought rent rolls and comps, and tracked every sale.

Over three years, she drove aggregate assessments 18% below purchase prices. On a 12‑unit, she cut the assessment from $575,000 to $470,000.

At a 3.8% rate, that saved ~$4,200 a year. At a 7% cap, she created about $60,000 in value from tax management alone.

How Property Taxes Touch Return Quadrants™, True Net Equity™, and Nomad™

On the Return Quadrants™, taxes hit Cash Flow directly. Lower cash flow reduces total return and slows reinvestment.

By compressing NOI, higher taxes can reduce appreciation-based valuation and limit leverage, echoing into amortization gains.

Nomad™ investors face a special trap. When a property shifts from homestead to rental, exemptions often vanish. Your tax bill can jump the year you move out. Budget for it before you buy, not after you move.

Your Action Plan: Own Your Property Tax Outcome

•

Pull assessor and tax collector data for every property and target.

•

Model three tax scenarios in The World’s Greatest Real Estate Deal Analysis Spreadsheet™.

•

Build a +/− sensitivity grid for assessed value and millage.

•

Calendar all appeal windows. Create an annual appeal workflow.

•

Underwrite acquisitions with post-purchase taxes, not the seller’s bill.

•

Diversify jurisdictions at the portfolio level.

•

Explore TIF/abatements where you invest; model their payoff timelines.

Every $1,000 you permanently remove from annual taxes adds roughly $14,000+ in value at a 7% cap.

Manage property taxes as actively as you manage debt, maintenance, and management. That discipline compounds across deals, across cycles, and across decades.