Wholesaling Real Estate: A Step-by-Step Playbook for Fast, Legal Profits and Lasting Deal Flow

Learn about Wholesaling for real estate investing.

When I help clients choose their first active strategy, wholesaling is the quickest classroom with real checks attached.

You generate cash, build your network, and learn your market faster than any textbook could teach you.

I ran multi-market operations across hundreds of cities before settling into brokerage for a decade.

What I learned is simple: run wholesaling like a business, not a hobby, and it can fund everything else you want to own.

What Is Wholesaling?

You find a flexible seller, put the property under contract or option, and sell your contractual rights to an investor.

Sometimes you close and resell the same day to keep your spread private.

You get paid for solving a timing, certainty, or convenience problem faster than the market can.

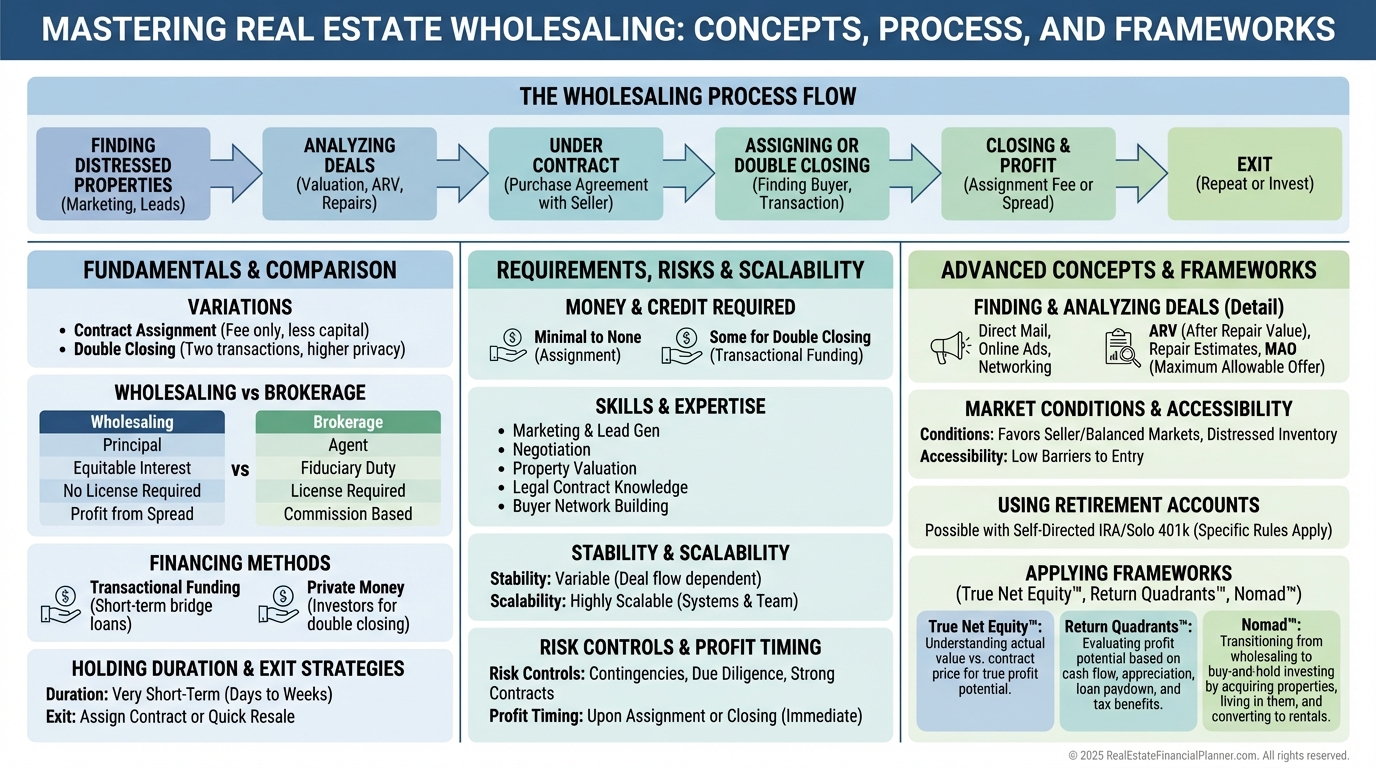

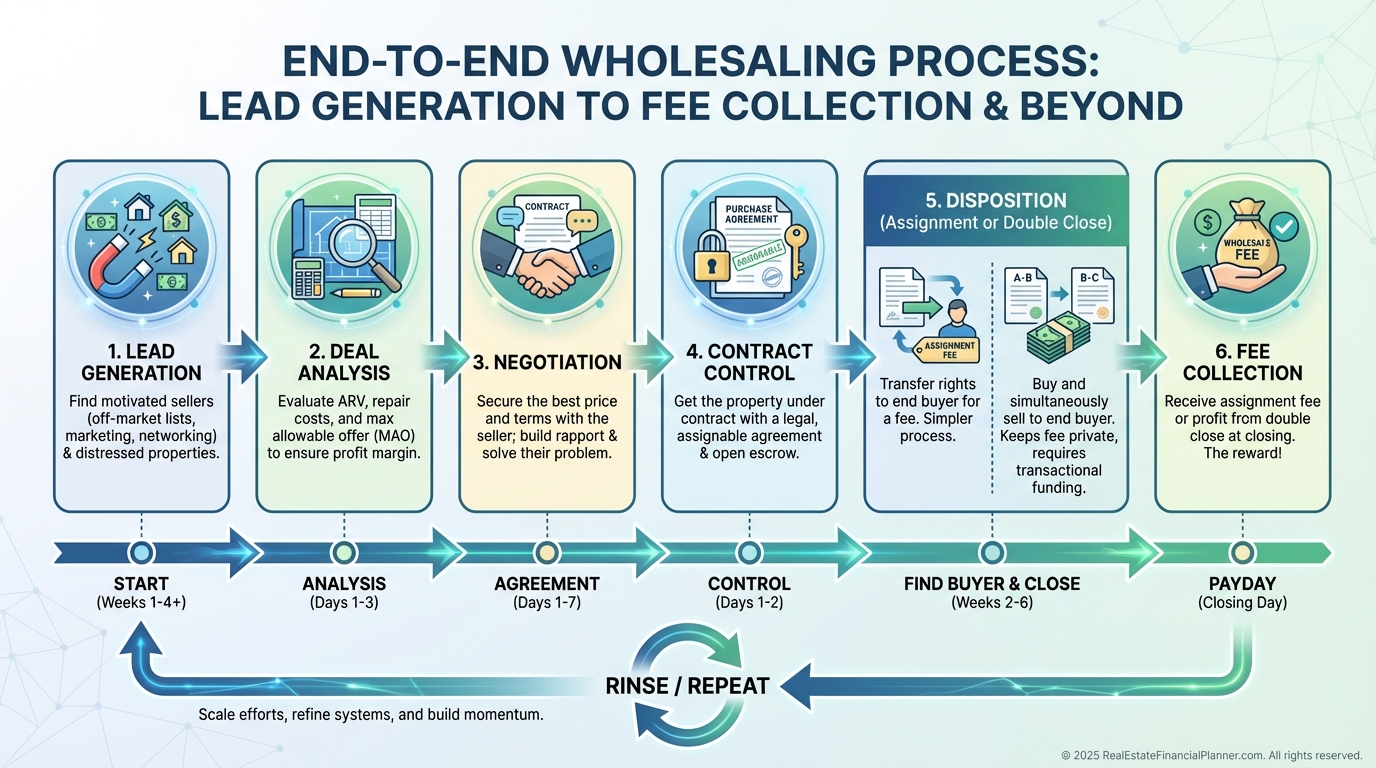

Here’s the flow I model and coach:

•

Find motivated or flexible sellers.

•

Analyze ARV, repairs, days-on-market, and investor exit.

•

Negotiate price and terms the market can close.

•

Control with an assignable contract or option.

•

Disposition via assignment or double close.

•

Collect your fee and redeploy your marketing.

Why Start with Wholesaling?

It creates income you can live on while building capital for rentals, BRRRR, or flips.

You sharpen negotiation, valuations, and local market instincts quickly and profitably.

Variations You Should Know

Classic wholesaling focuses on discounted fixer deals for flippers and BRRRR buyers.

Wholetailing pushes lightly fixed or “as-is clean” properties to retail or near‑retail buyers.

Wholesaling with a license lets you monetize more leads by listing or buyer representation when a deep discount is unlikely.

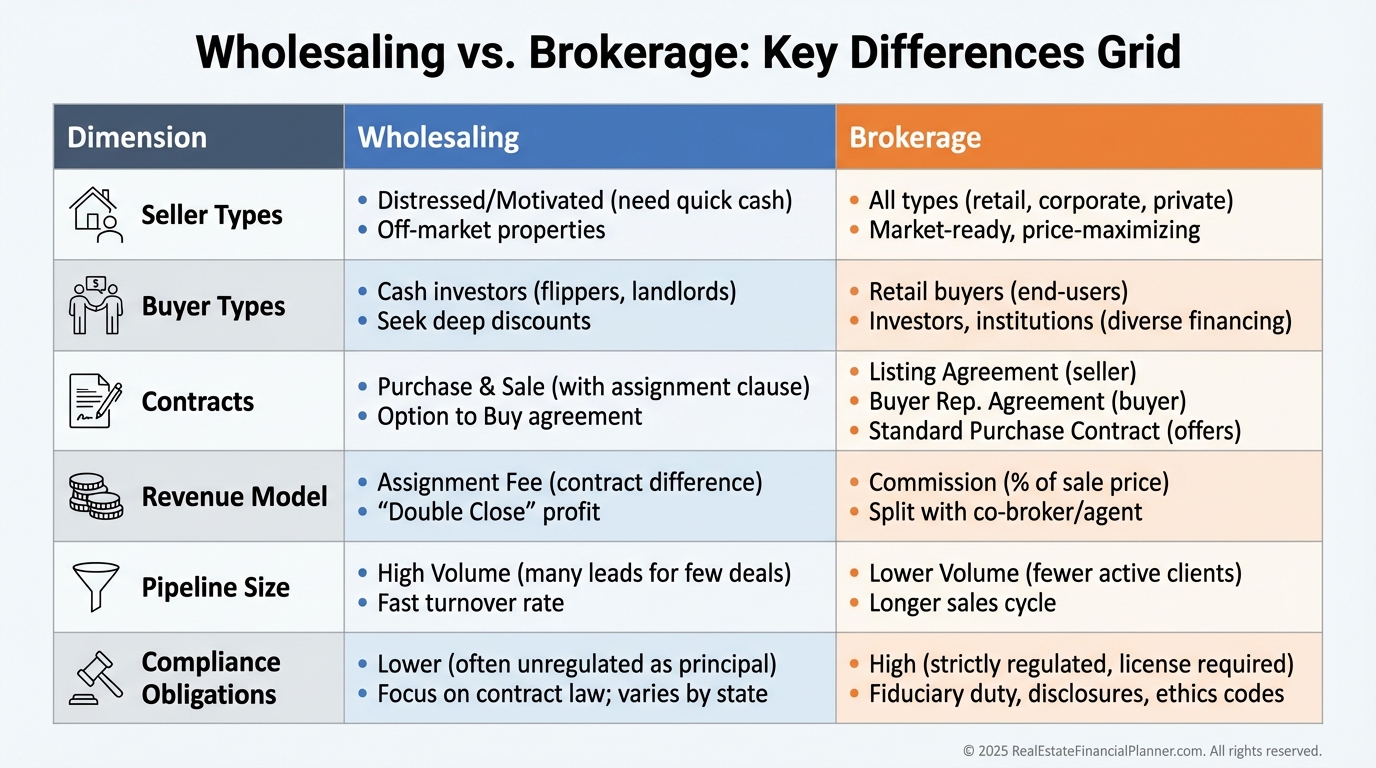

Wholesaling vs Real Estate Brokerage

When I got licensed, I learned you can serve far more people at or near retail while still cherry-picking wholesale opportunities.

Brokerage lets you get paid by representing one side or both, while wholesaling usually requires you to create and place the entire deal.

Both require valuation, negotiation, and sales skills, but they monetize different seller and buyer pools.

Ask yourself:

•

Are there more retail sellers than deep-discount sellers in your market?

•

Are there more retail buyers than investor buyers?

•

Do you want optionality to earn on either side without engineering both sides?

I often advise clients to combine the two.

Monetize retail as an agent and wholesale the small fraction of leads where your speed, certainty, and convenience are worth a discount.

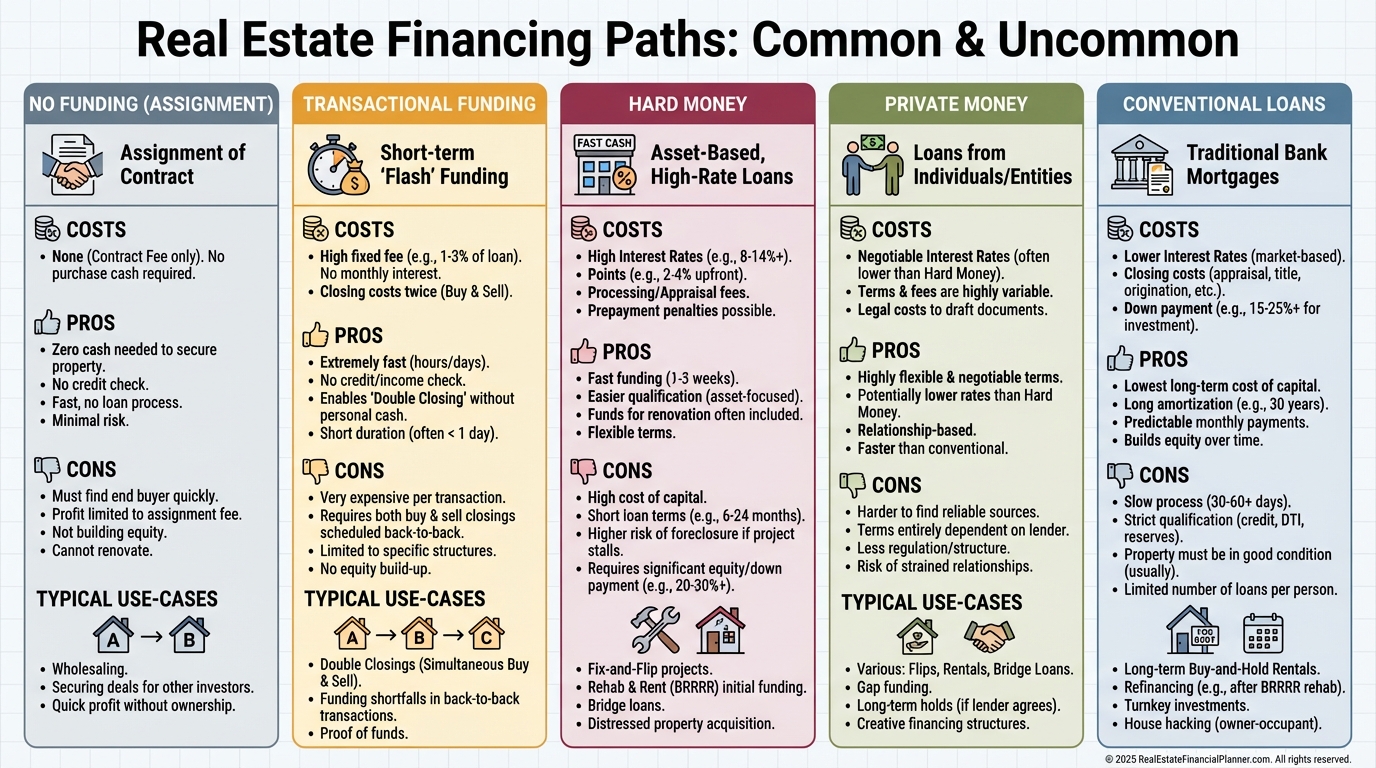

Financing Wholesale Properties

Most assignments require no financing because you never buy the property.

Double closes often use transactional funding, sometimes called “dough for a day.”

Less common is closing with hard money, private money, or conventional funds when your title company or seller requires it.

When I map financing, I weigh speed, disclosure, costs, and risk of the buyer backing out.

If protecting the spread matters, I lean double close with transactional funding.

If the title attorney allows assignments and the buyer is solid, I assign and avoid funding altogether.

Holding: How Long You “Own” Control

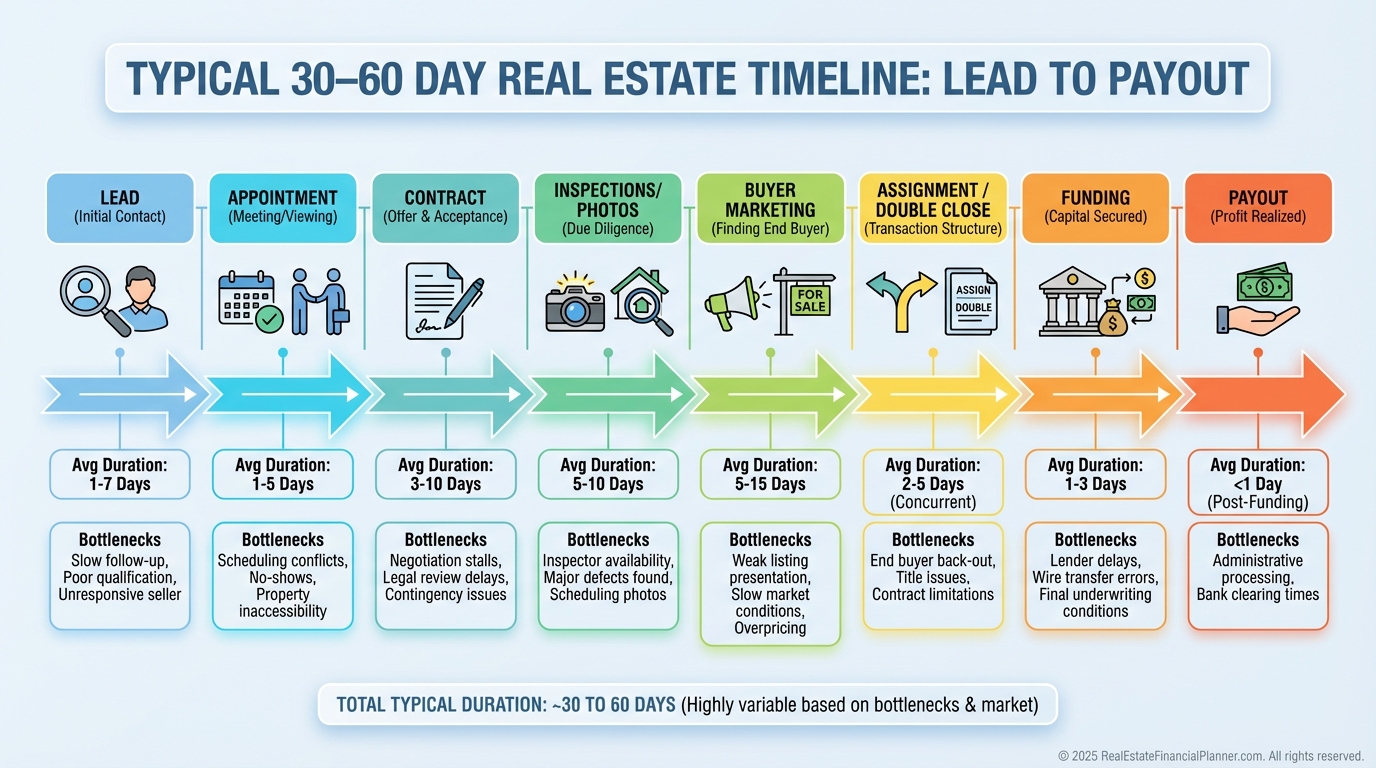

Your “hold” is usually the option or contract period, commonly 30–60 days.

Wholesaling is active, so while one deal is under contract, your marketing must already be working on the next two.

Exit Strategies and Buyer Financing

Two main exits get you paid.

Assign your contract and disclose your fee, or double close to keep your spread private.

Your end buyer may use cash, hard money, private money, or investor‑grade conventional financing.

Maintain a segmented buyer list by criteria, funding speed, and price range.

Investor or Entrepreneur?

Wholesaling is real estate entrepreneurship.

You invest time and systems more than capital to convert inefficiencies into cash.

Many of my clients use wholesaling profits to buy rentals, accelerate Nomad™, and stack wealth.

Money Required

Marketing brings deals to you or you hunt them down with sweat.

You will often post earnest money or an option fee.

Budget for dispositions marketing as well.

Less commonly, you need down payment and closing costs for a double close or a forced close.

Transactional funding can bridge same‑day A‑to‑B and B‑to‑C.

Credit Required

Assignments typically require no credit.

Some transactional funders check credit; others don’t.

If you close with conventional financing, plan for 640+ scores and full documentation.

Being an agent requires no credit; it requires competence and compliance.

Skills That Pay You Here

You must find, analyze, and negotiate deals the market wants.

You estimate repairs, timeline, and resale value.

You present deals in the language of your buyers and their lenders.

And you sell twice—once to the seller for the contract, and once to the buyer for the exit.

Stability vs Activity

As Shane Parrish points out, some strategies require active stability.

Wholesaling is one of them, because contracts expire.

Build redundancy into your pipeline so one slow week does not starve your business next month.

Can You Scale?

Deal flow limits scale more than capital does.

The good news is you recycle small amounts of capital quickly and can grow marketing in measured steps.

Many pros use wholesaling as the cash engine and rentals as the wealth flywheel.

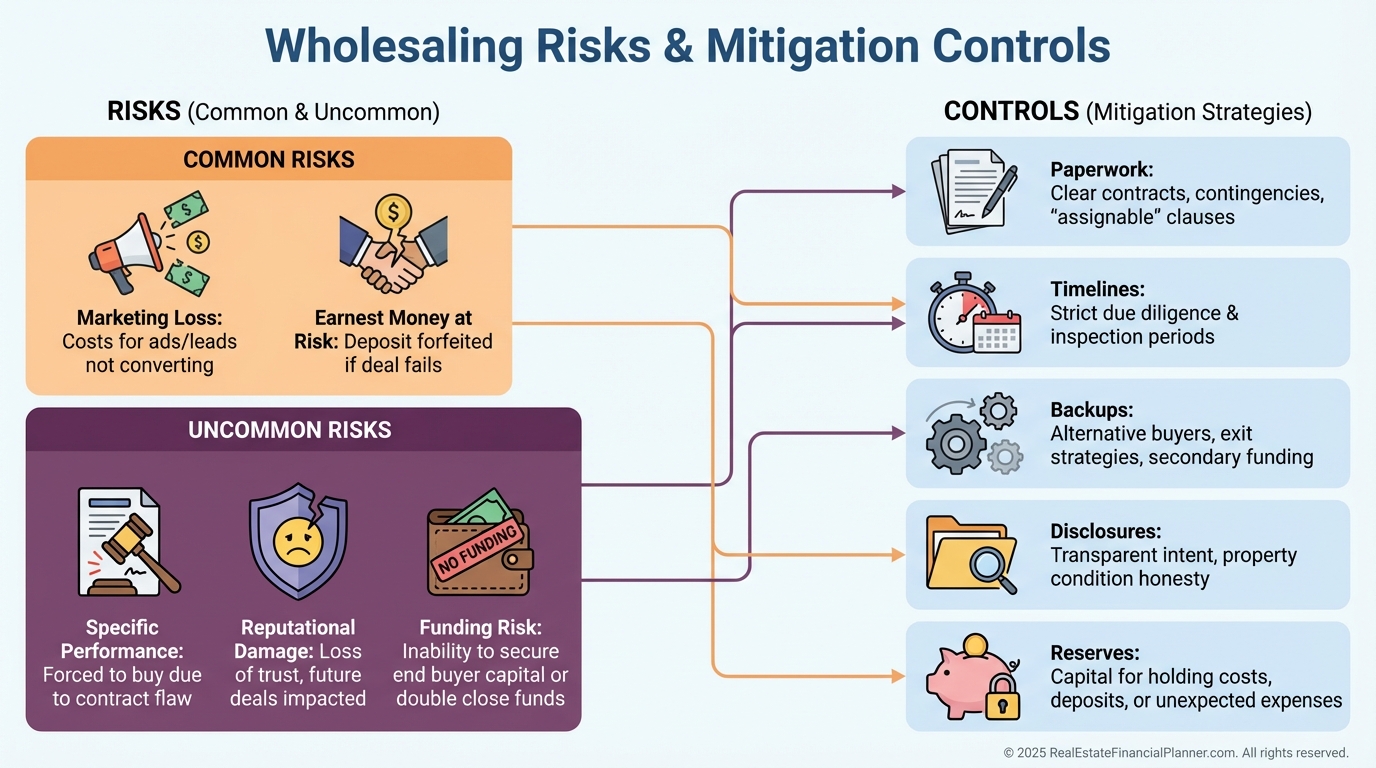

Risk Exposure and Controls

Your main risks are marketing losses, lost earnest money or option fees, compliance mistakes, and reputation hits.

Less common but real is credit and liquidity risk if you close and your buyer fails.

I mitigate by using attorney-reviewed paperwork, conservative inspection windows, backup buyers, and clear seller disclosures.

Profit Speed and How Much to Charge

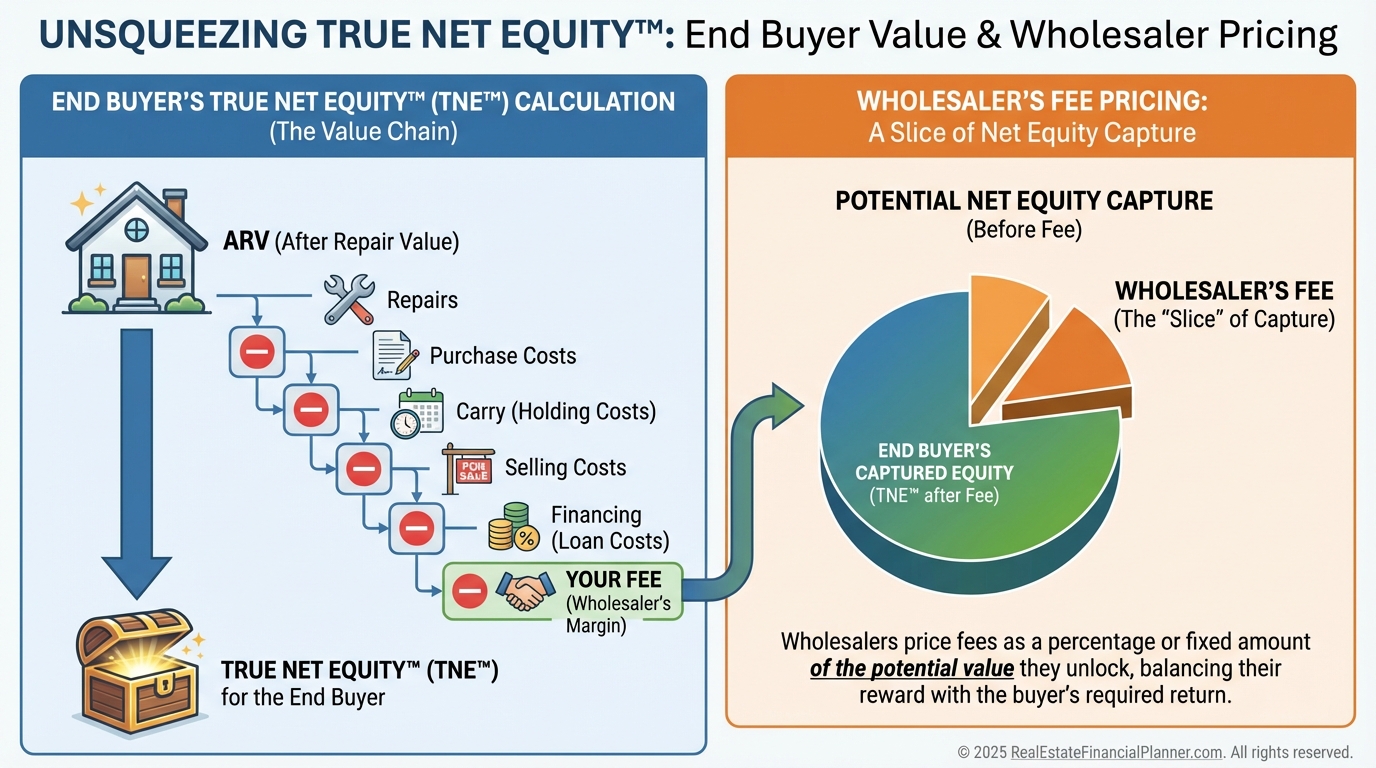

With rentals we teach Return Quadrants™: appreciation, cash flow, debt paydown, and tax benefits plus returns on reserves.

Wholesaling doesn’t earn those; your fee is a transaction cost the buyer pays to capture their future returns.

I price fees using True Net Equity™—the investor’s equity after repairs, purchase costs, selling costs, carrying, and financing.

A rule of thumb is ~10% of the investor’s net equity capture, but I prefer pricing by value delivered and deal difficulty.

Most checks arrive 30–60 days after you get the contract.

Front-load your marketing so the pipeline keeps paying you every month.

Finding Deals That Actually Close

FSBOs are fertile.

Some are “hidden” sellers who will sell for convenience if you ask the right questions.

Listed properties, auctions, REOs, and tax sales can work, but you often must close before you can resell.

Networking with other wholesalers can fill gaps in your pipeline or help you move your deals.

Analyzing Deals the Way Buyers Do

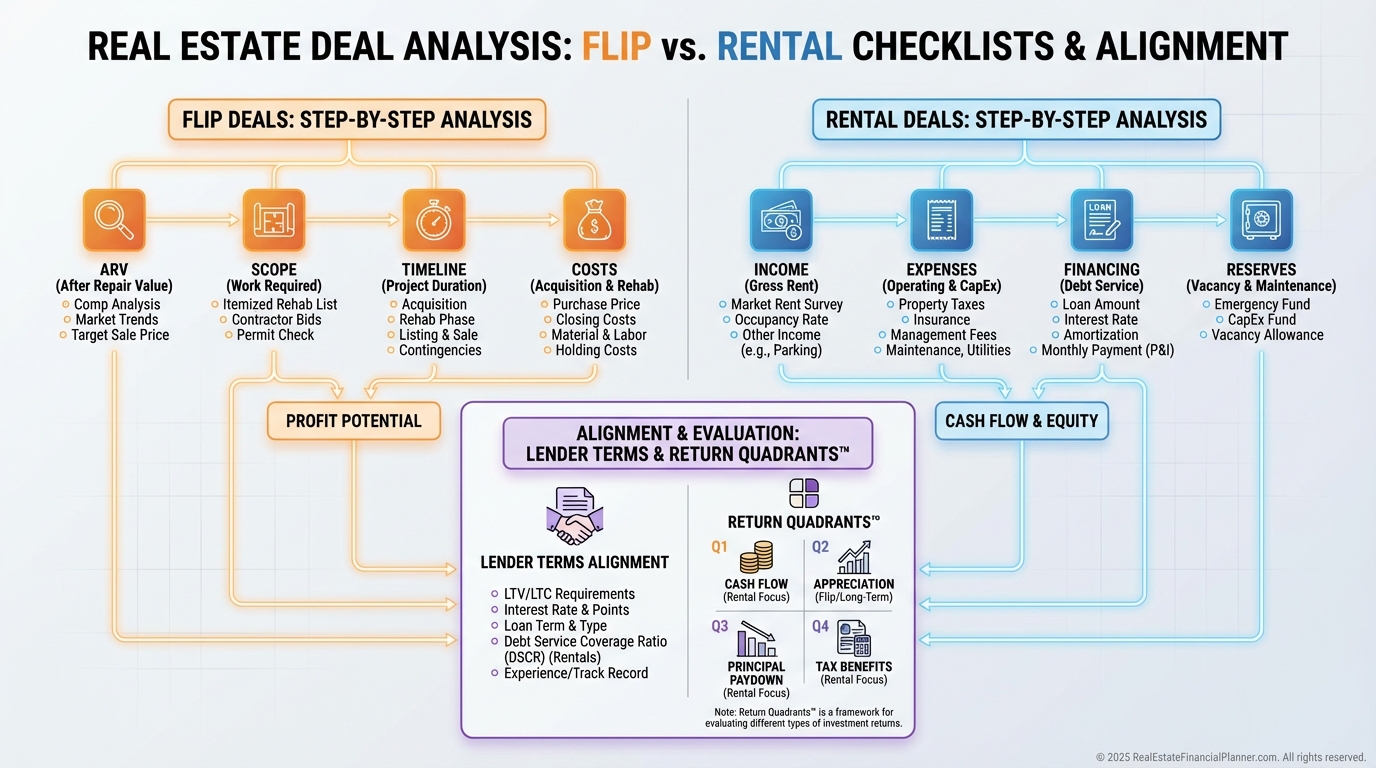

For flips, confirm ARV using tight comps, renovation scope, holding time, and closing costs.

For rentals, underwrite using our World’s Greatest Real Estate Deal Analysis Spreadsheet to align with investor financing and reserves.

Download it here:

https://RealEstateFinancialPlanner.com/spreadsheet

When I package deals, I show buyers the same numbers their lender will see.

That’s how you build credibility and repeat buyers.

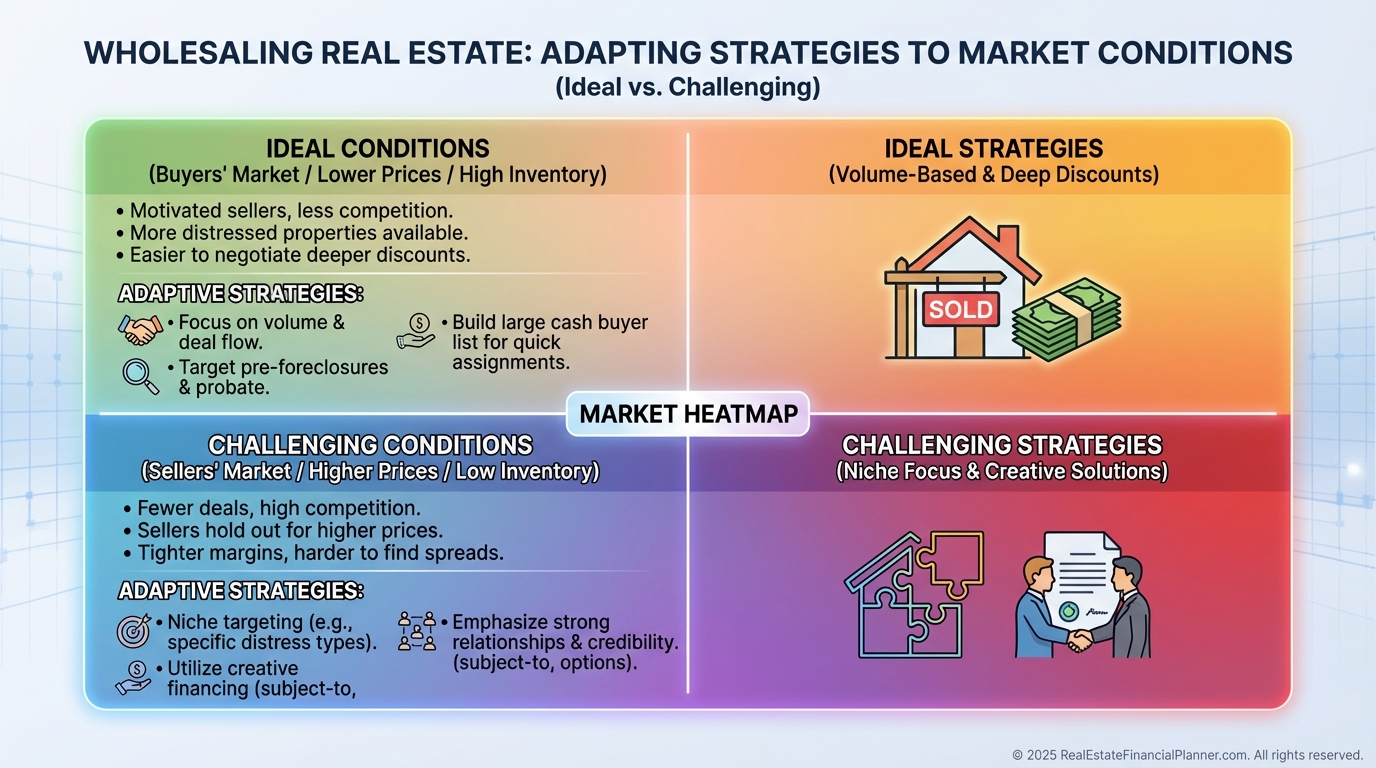

Market Conditions: Tailwinds vs Headwinds

Wholesaling shines when retail demand is softer, properties need work, cash-flowing rentals pencil, and investor demand is healthy.

It is harder when retail buyers bid everything up and investors thin out.

I adjust by targeting more value-add properties, sharpening repair estimates, and improving buyer list velocity.

Accessibility and Availability

Fix-and-flip deals are easier to find than perfect BRRRR deals that also cash flow.

If deals seem everywhere, they may be hard to move at your price.

I sometimes advise expanding to adjacent markets or getting licensed to monetize retail leads with Nomad™ buyers while you wait for deep discounts.

Using Retirement Accounts

Can you wholesale in a self-directed account?

Yes, but it’s uncommon because wholesaling is an active business with prohibited transaction rules to navigate.

If you go this route, get specialized custodial and legal guidance.

Final Advice from the Trenches

I model conservative numbers, insist on clean paperwork, and keep backup buyers.

I avoid weak titles, shaky sellers, and buyers who ghost.

I warn clients that reputation is the compound interest of this business, and I calculate everything as if I will need to defend it to a lender, an attorney, and a future you.