Negative Cash Flow in Real Estate: Causes & Solutions

Learn about Negative Cash Flow for real estate investing.

Why Investors Fear Negative Cash Flow

Negative cash flow triggers a visceral “no” for most investors, and I understand why.

When I help clients, I start by reframing it as a financing choice, not a failure.

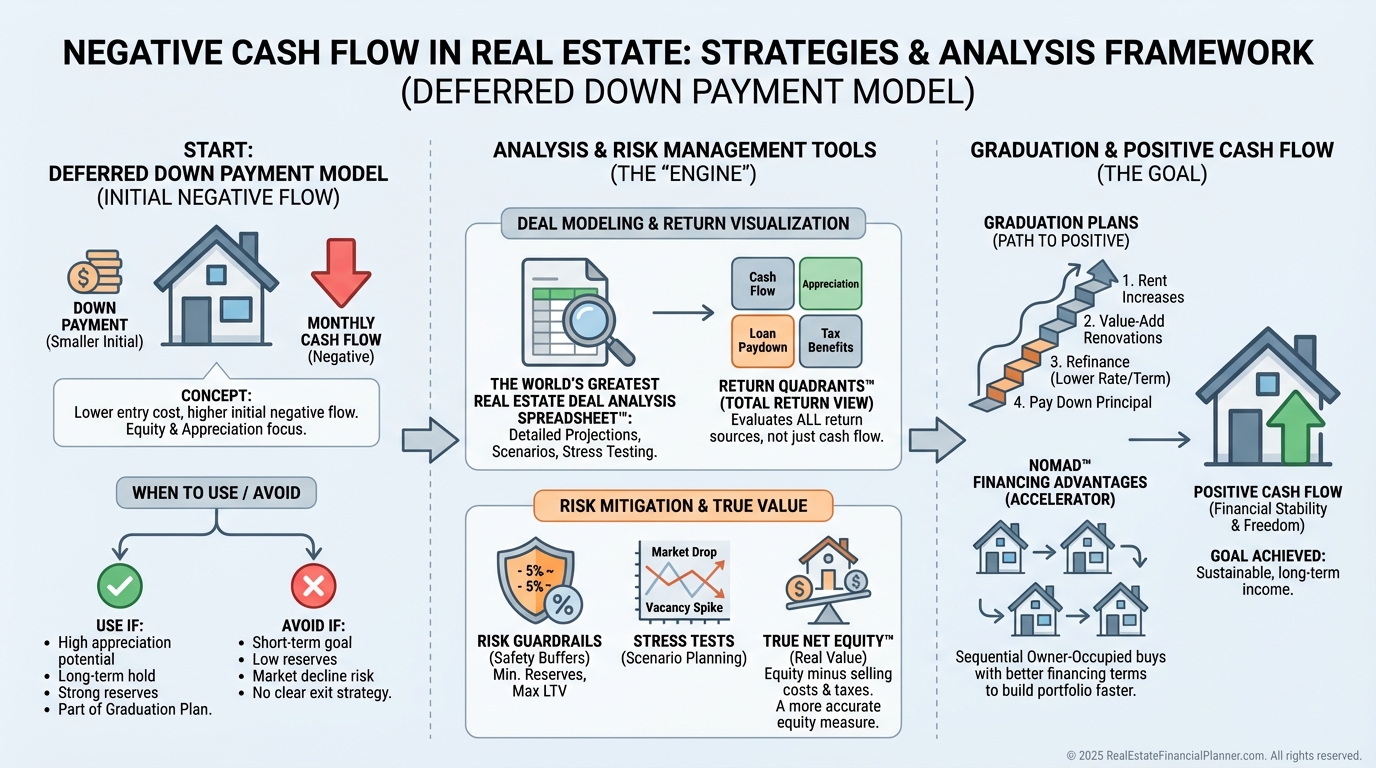

The Core Reframe: The Deferred Down Payment

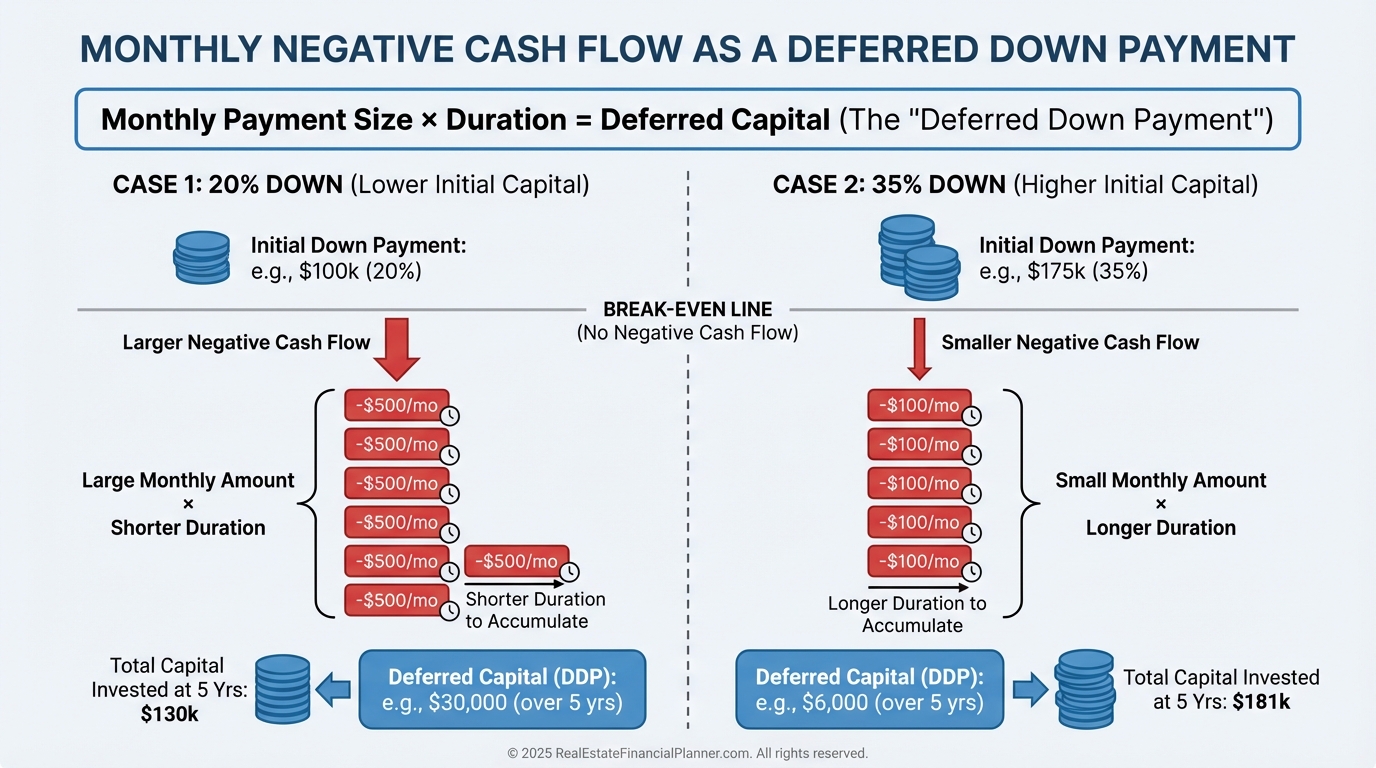

Here’s the lens that changes behavior fast: negative cash flow is a deferred down payment.

If you had put more down, you wouldn’t be writing a monthly check.

Let’s quantify it. On a $400,000 rental with $2,500 rent, 20% down may leave you at negative $300 per month after all expenses.

At 35% down, you’re likely positive. The “gap” is simply capital you chose not to put down upfront.

When I model this, I multiply the monthly shortfall by the months I expect the shortfall to persist.

That total is the deferred piece of the down payment, paid in installments.

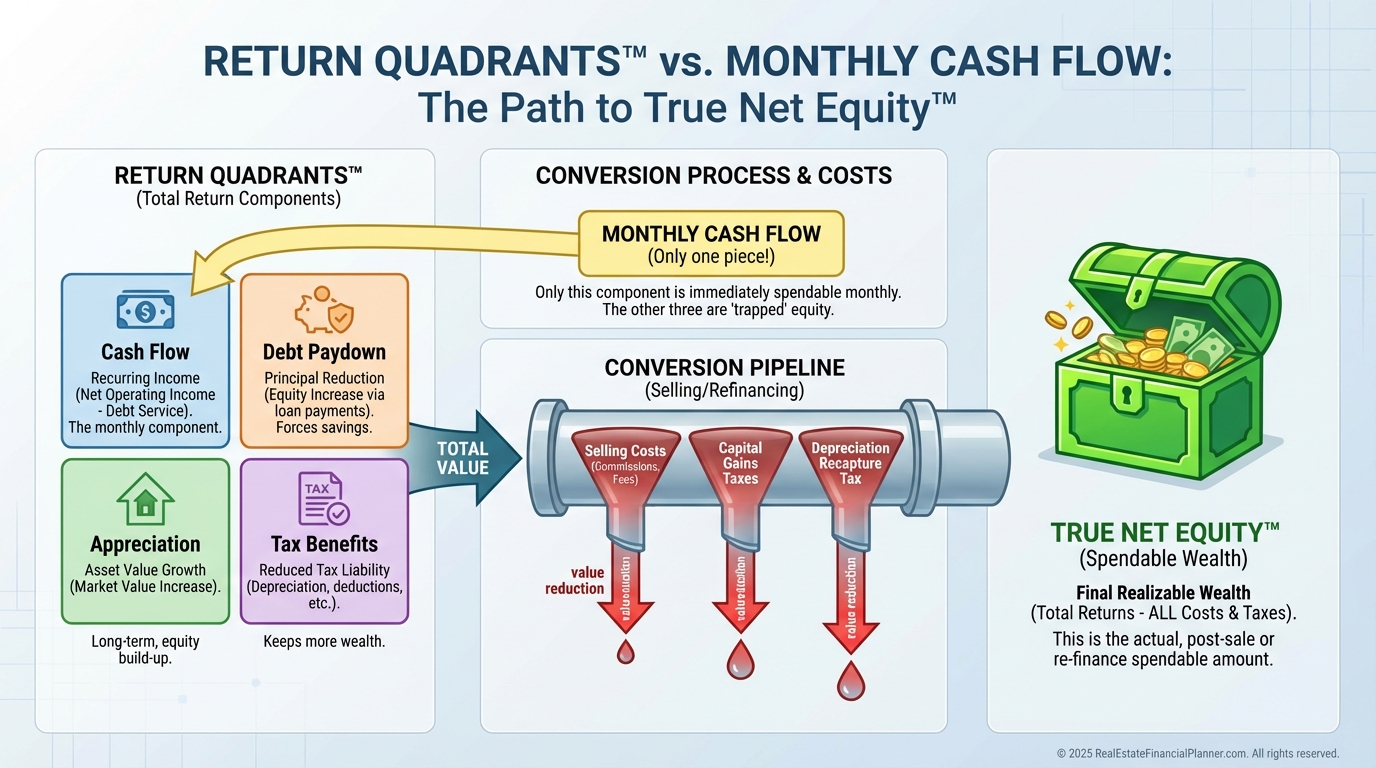

Modeling It Right: Return Quadrants™ and True Net Equity™

I never decide based on cash flow alone. I decide using Return Quadrants™: Cash Flow, Appreciation, Debt Paydown, and Tax Benefits.

Then I convert paper profit to reality with True Net Equity™ by subtracting selling costs and taxes to see what I could actually keep.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ lets me toggle down payment, rate, and rent to see which quadrant is doing the heavy lifting.

I also set a “cash flow neutral” point and measure how far below it I am, in dollars and time.

When Negative Cash Flow Can Be Smart

I accept strategic negative cash flow when another quadrant compensates with high confidence.

Here are the patterns I look for:

•

Appreciating submarkets with supply constraints and job growth

•

Clear value-add where rents increase upon completion

•

Ability to refinance to a lower rate within a reasonable window

•

Strong wage growth supporting future rent increases

•

Tax benefits that materially offset the monthly check (verified with a CPA)

•

Nomad™ house-hack variants that reduce payment and improve terms

When I rebuilt after a rough market cycle, I used negative cash flow on a duplex I could quickly reposition.

I forced rent growth with targeted improvements and refinanced once debt markets normalized.

When To Walk Away

I pass when investors are hoping, not modeling.

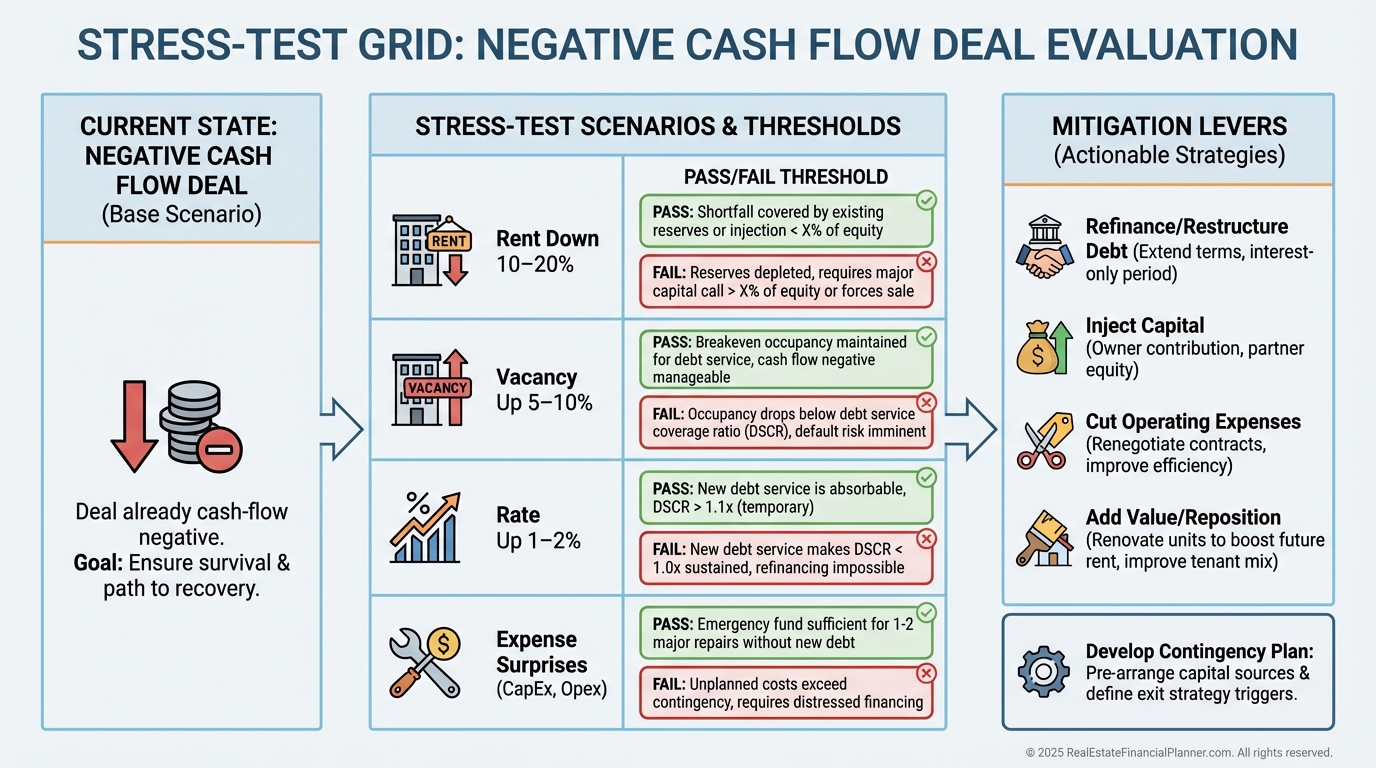

Avoid negative cash flow if:

•

You don’t have 12–18 months of the shortfall set aside

•

Your non-rental income won’t cover 3x the monthly deficit

•

The only thesis is “prices go up”

•

The portfolio is already over-leveraged

•

You won’t survive a 10% rent drop or a surprise big CapEx

When I see thin margins plus deferred maintenance, I recommend moving on fast.

The spreadsheet’s sensitivity tabs make that call objective.

The Mechanics: Why Negative Cash Flow Happens

Most shortfalls trace to a few inputs.

I check these first:

•

Payment too high for local rent ceiling

•

Taxes and insurance underestimated or trending up

•

Professional management not priced into the pro forma

•

Vacancy and turn costs under-modeled

•

HOA dues or utilities eating yield

•

Old systems creating maintenance drag

Fix the inputs, and you often fix the cash flow story.

If you can’t fix them, you need a better deal or a bigger down payment.

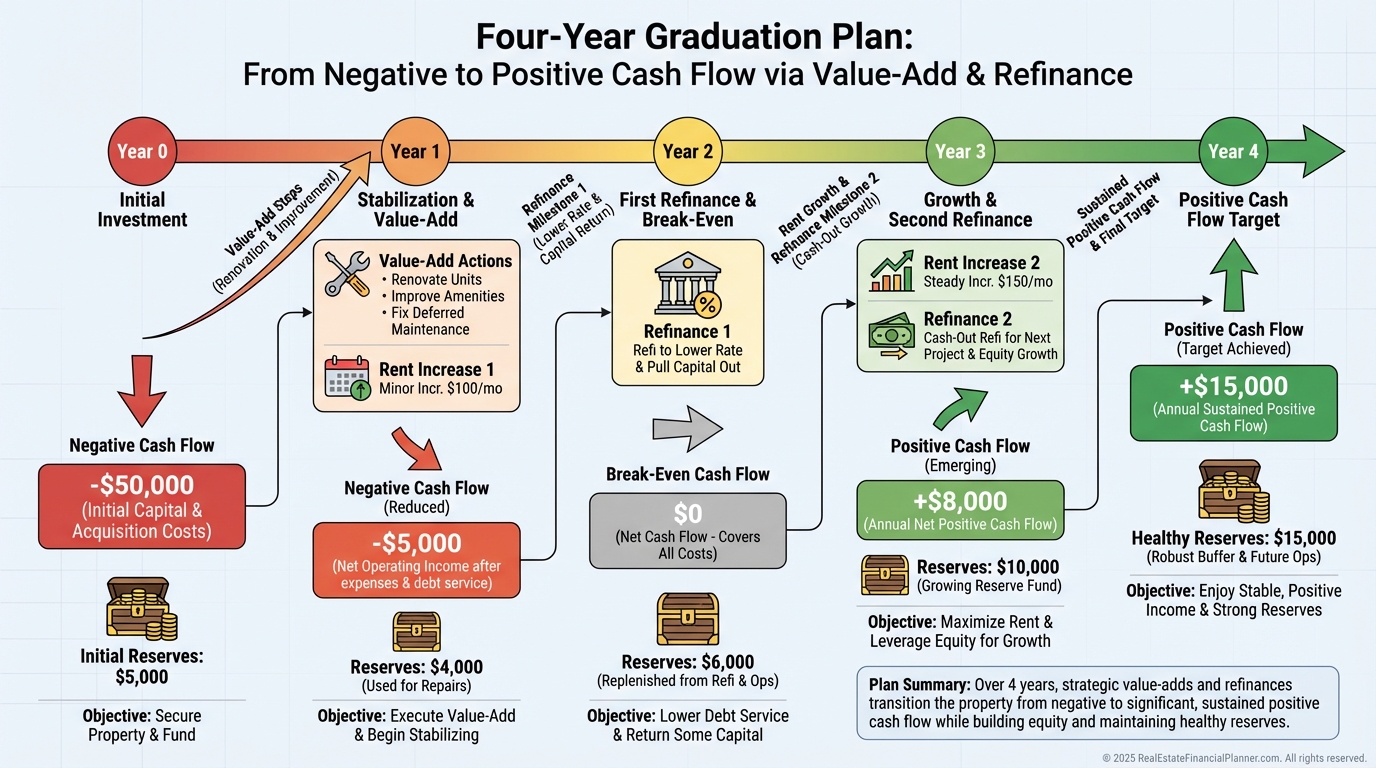

Managing The Drip: Turning Red To Black

A negative today can be a positive tomorrow if you plan the turn.

Here’s the “graduation plan” I map for clients:

•

Set aside 12–18 months of the deficit in a dedicated account before closing

•

Execute targeted improvements that justify rent increases

•

Implement planned annual rent bumps tied to market data

•

Watch the rate market and refinance thresholds

•

Explore short-term, mid-term, or by-the-room options if zoning allows

•

Optimize taxes with a real estate-savvy CPA

I track actuals vs pro forma monthly in The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and adjust the plan, not my discipline.

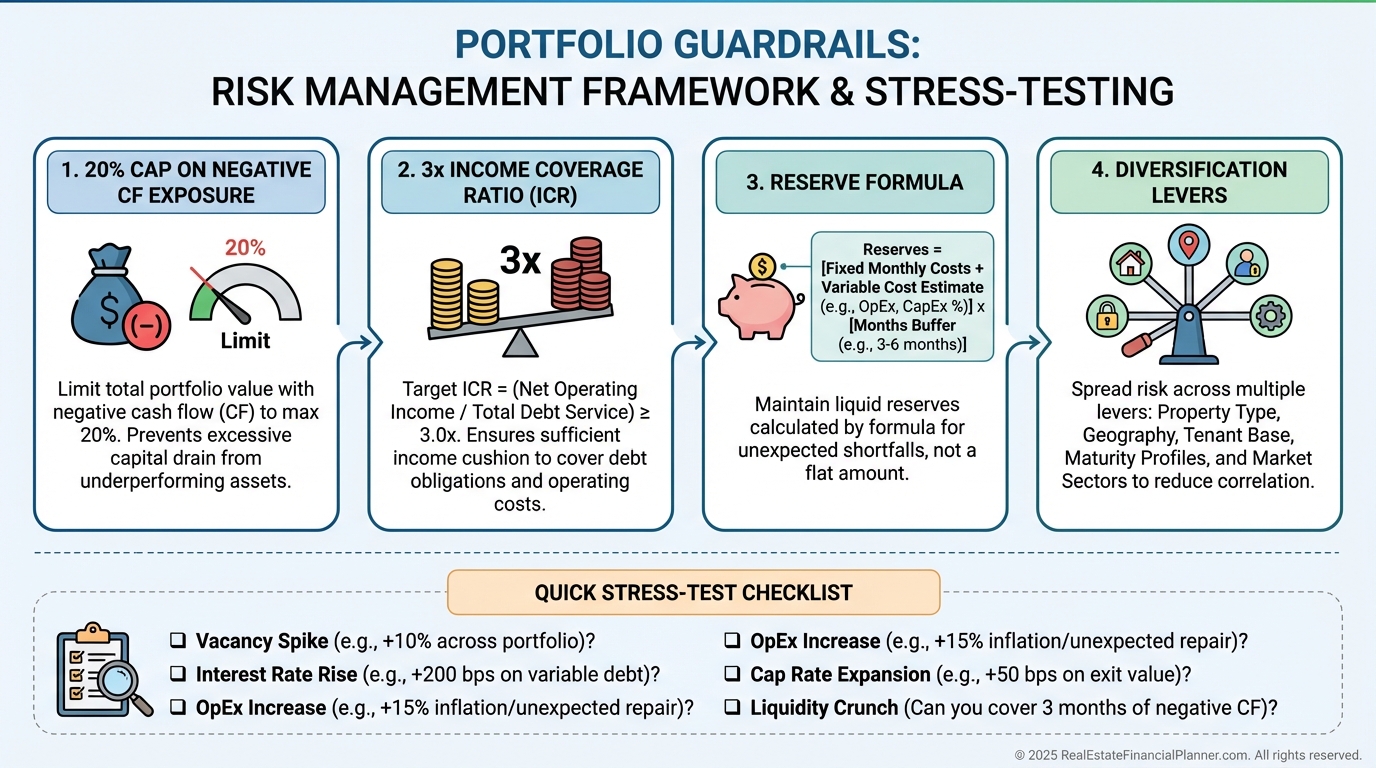

Portfolio Guardrails: How Much Is Safe?

I cap exposure so a single shock doesn’t domino the portfolio.

My rules of thumb:

•

No more than 20% of portfolio value in negative cash flow assets

•

Income Coverage Ratio ≥ 3x total monthly deficits

•

Reserves = 18 months of deficits + 6 months of all property expenses

•

Stress test for 20% rent cuts and 10% higher vacancy

I diversify by geography, property type, and tenant profile to keep risks uncorrelated.

I also pre-plan exits and know my break-even sale price including costs and taxes.

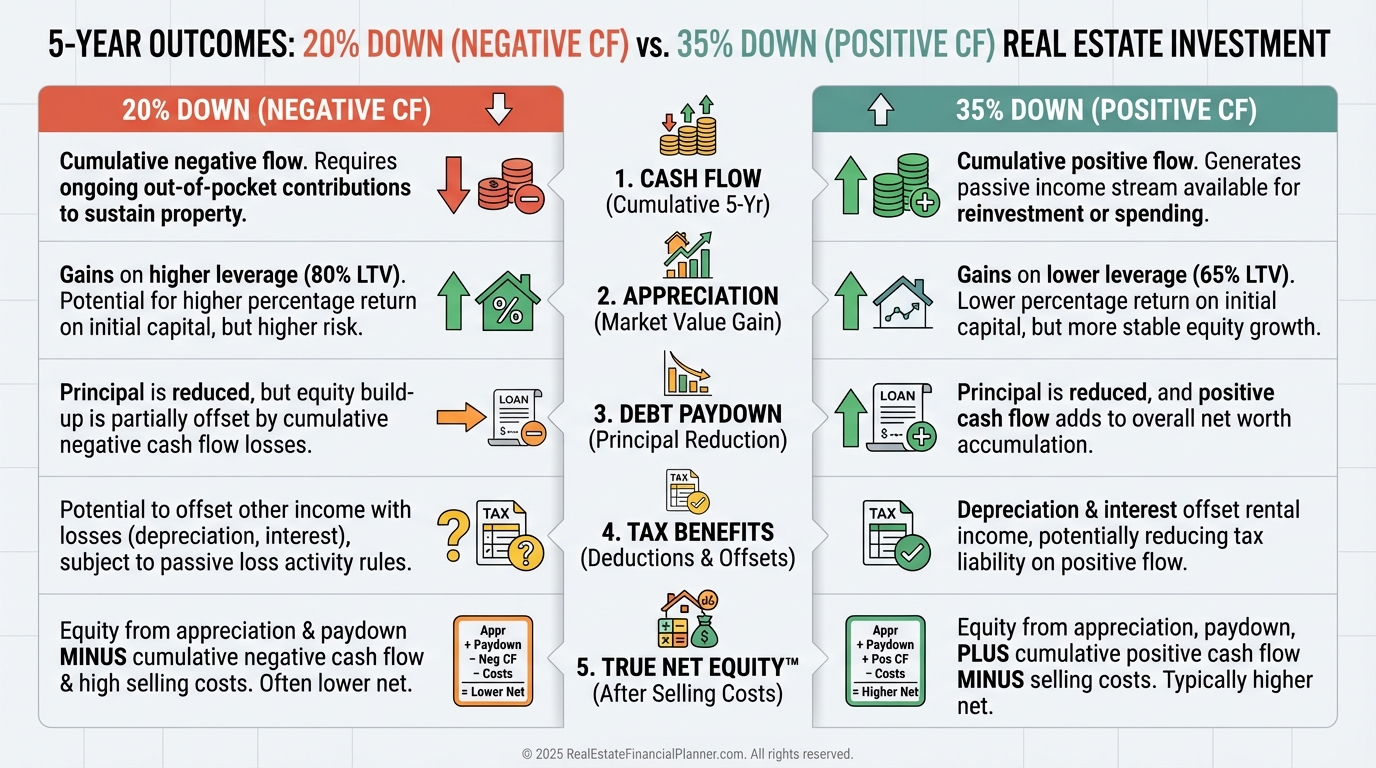

Case Study: 20% Down vs 35% Down on the Same Property

Let’s compare the same $400,000 rental at 6.75% with $2,500 rent.

Scenario A: 20% down has negative $300 per month. Scenario B: 35% down is slightly positive.

Over five years, assume 3% appreciation, standard amortization, and typical depreciation benefits.

Scenario A may produce higher Return on Equity due to leverage, even with the monthly check.

Scenario B produces calmer sleep and earlier free cash flow, with lower total ROI on similar appreciation.

When I run this for clients, we choose based on goals, risk tolerance, and the size of the “deferred down payment” they’re willing to pay.

How I Decide With Clients

We walk through a simple checklist before saying yes.

•

Does Return Quadrants™ clearly outweigh the drip of negative cash flow?

•

Can your non-rental income cover 3x the monthly deficit for 18 months?

•

Do you have multiple levers to improve income within 24 months?

•

Are you willing to Nomad™ for better terms and lower payment if needed?

•

Does the spreadsheet stress test still pass with conservative assumptions?

•

Is there a clear path to positive cash flow or a well-defined exit?

If we can’t write the check confidently for the duration, we don’t buy.

If we can, negative cash flow becomes a controlled tool, not a creeping risk.

The Bottom Line

Negative cash flow is neither hero nor villain. It’s a choice.

Treat it as a deferred down payment, model it rigorously, and keep reserves high.

Use The World’s Greatest Real Estate Deal Analysis Spreadsheet™ to define the plan, track the path, and avoid surprises.

Wealth in real estate is total return, not just monthly spread. Measure it the way professionals do, and act with intention.