Condo Investing for Real Estate Investors: How HOAs Can Make or Break Your Returns

Learn about Condos for real estate investing.

Most real estate investors either swear off condos entirely or buy them without understanding what they actually purchased.

Both mistakes are expensive.

When I help clients analyze condos, I usually see one of two problems.

They ignore HOA risk completely, or they overreact and assume every condo is a ticking time bomb.

Condos are neither magic nor poison.

They are simply a different asset class with different rules.

I learned this the hard way rebuilding after bankruptcy.

Cash flow mattered, but predictability mattered more.

A well-run condo association can reduce maintenance, stabilize expenses, and free up your time.

A poorly run one can quietly erase years of returns with a single special assessment.

The difference is never luck.

It is analysis.

What You Are Really Buying When You Buy a Condo

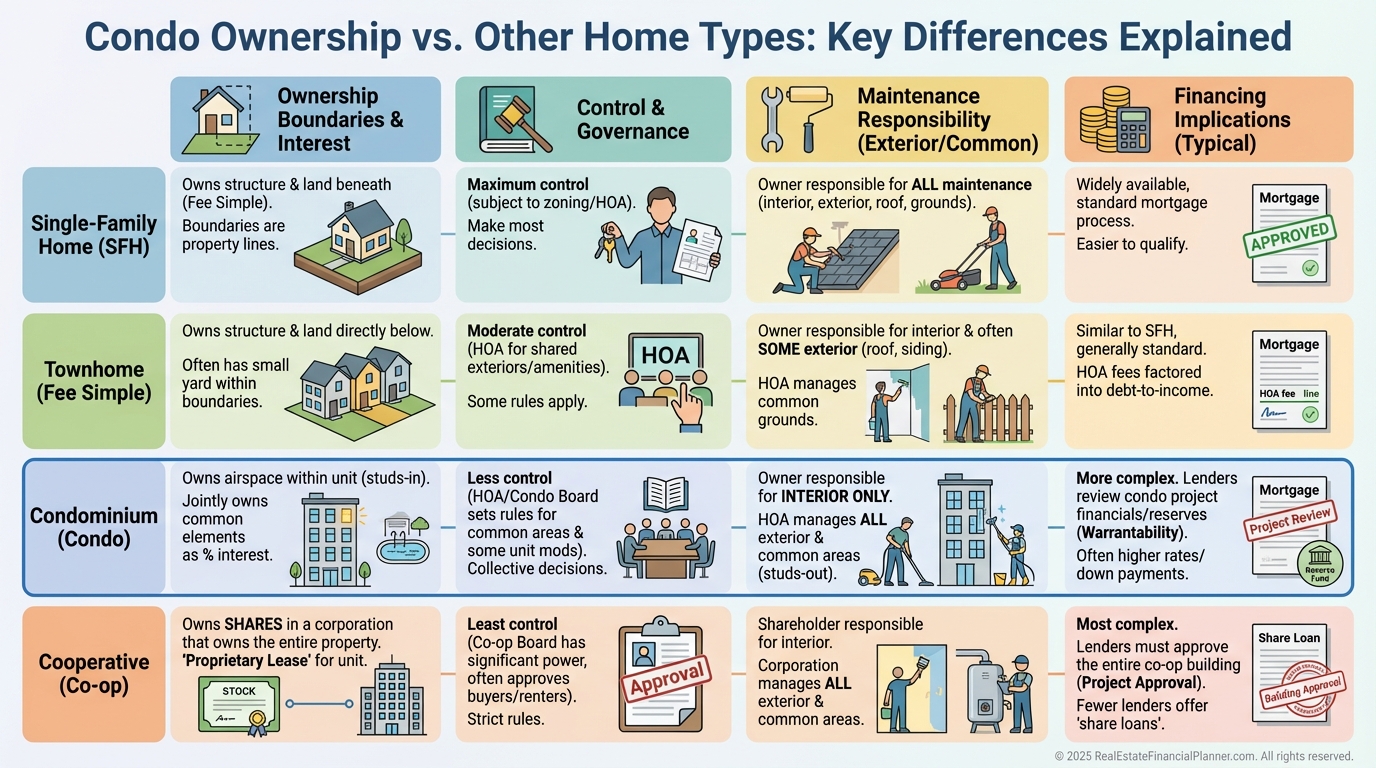

A condo is not just a smaller house.

It is a shared financial system.

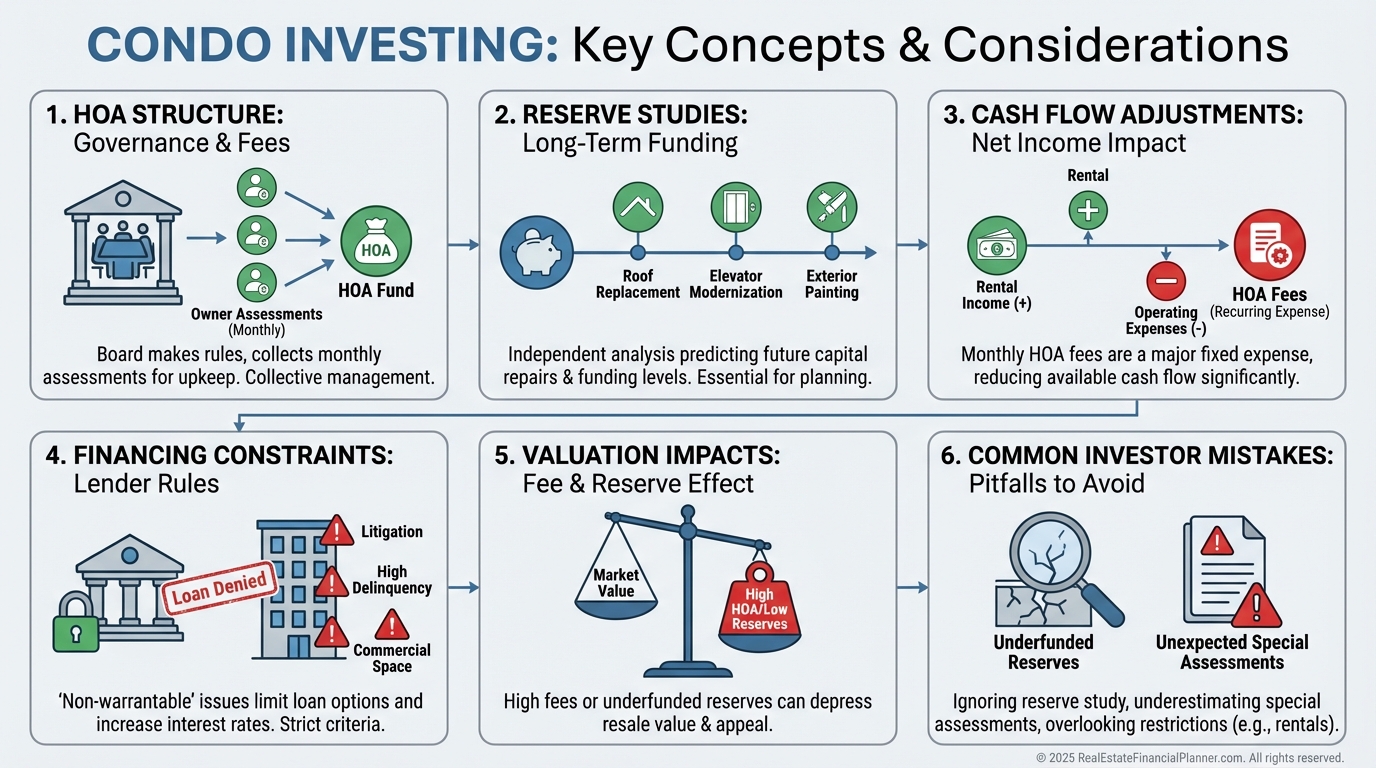

You own the interior of your unit and an undivided interest in everything else.

That “everything else” includes roofs, foundations, plumbing stacks, elevators, parking structures, and lawsuits.

When you buy a condo, you are entering a mandatory partnership.

You do not get to opt out.

This ownership structure changes how I model deals in Real Estate Financial Planner™.

HOA fees are not optional expenses.

They are fixed, contractually enforced obligations.

It also changes risk.

You are not just underwriting your unit.

You are underwriting the association’s balance sheet and behavior.

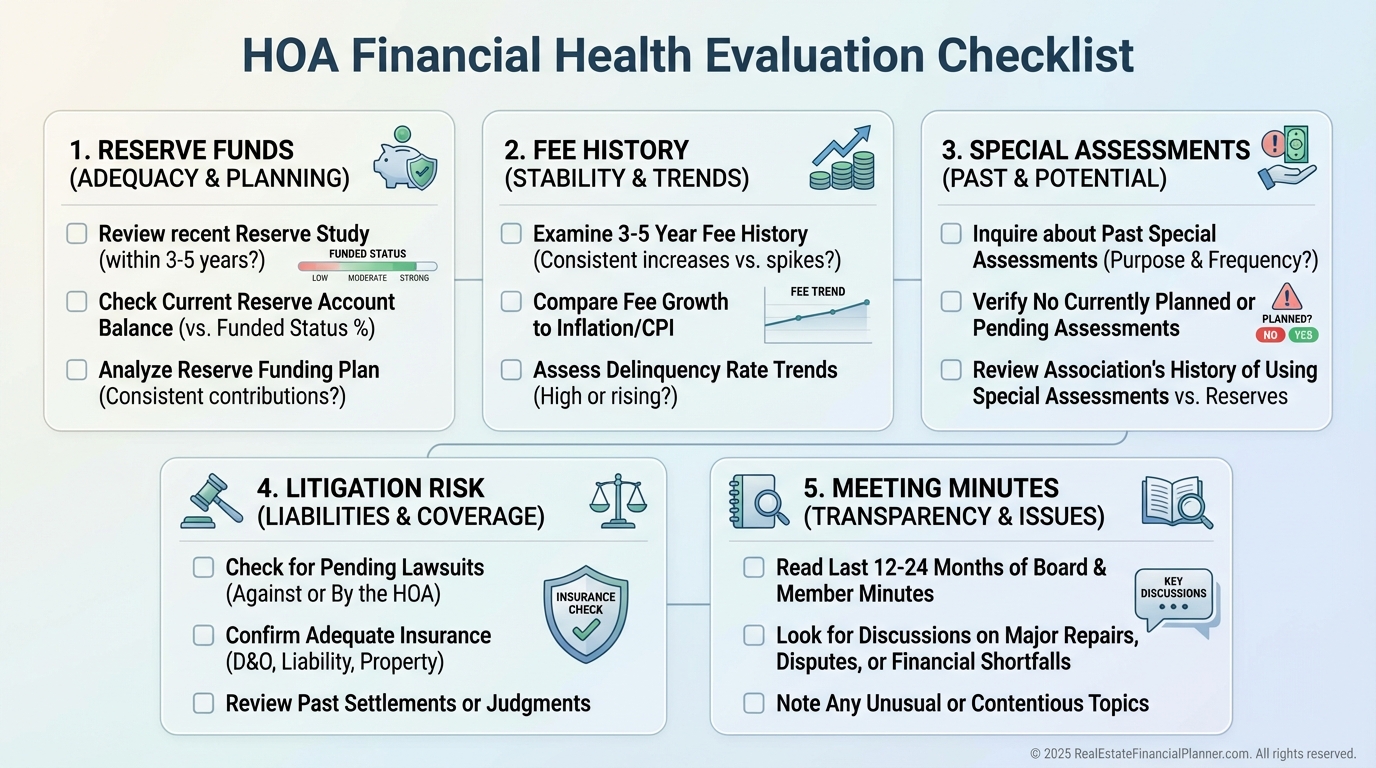

The HOA Is the Deal

I tell clients this all the time.

You are not buying a condo.

You are buying an HOA that happens to include a condo.

The monthly fee is the least important number.

What matters is what that fee represents.

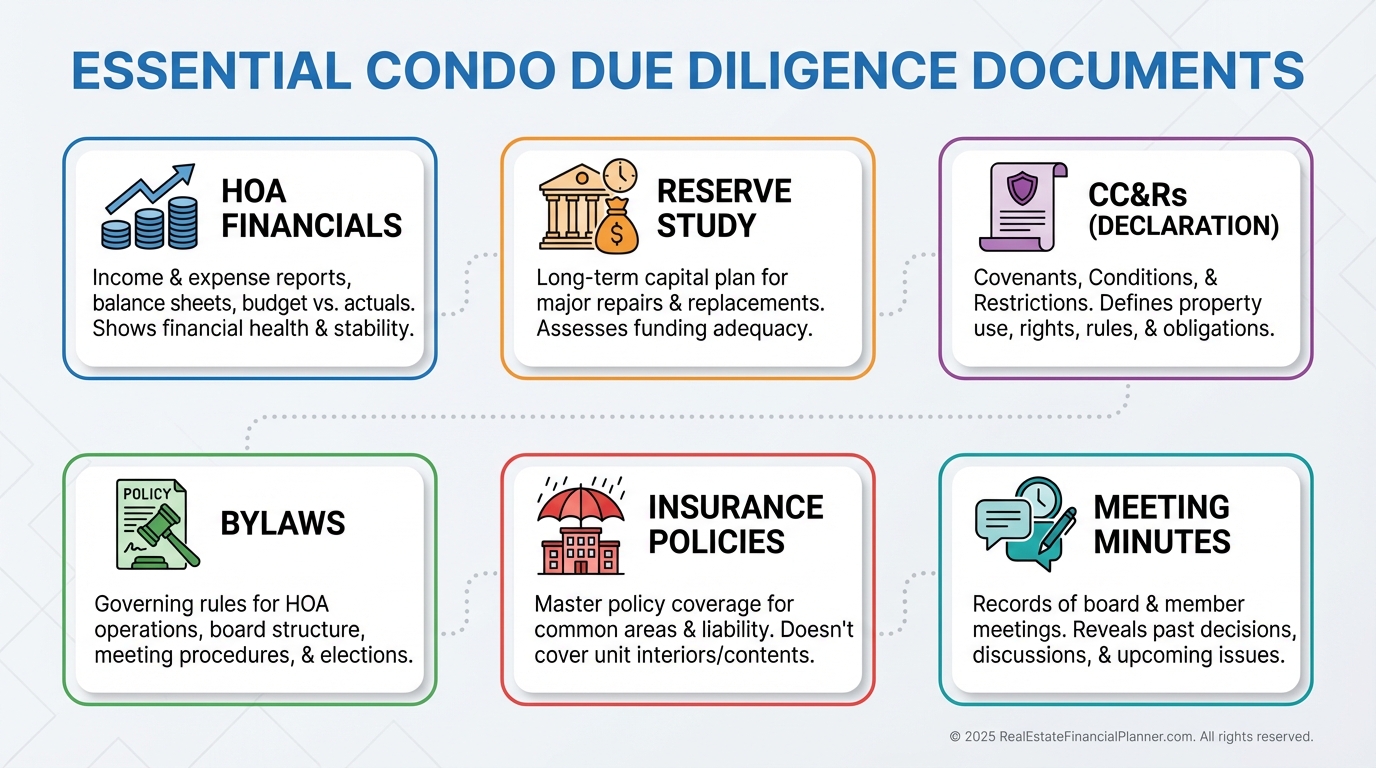

When I review an HOA, I look for three things immediately.

Reserves, history, and honesty.

Healthy reserves signal planning.

Stable fee increases signal realism.

Clear meeting minutes signal transparency.

Low fees with no reserves signal denial.

That is not conservative.

That is dangerous.

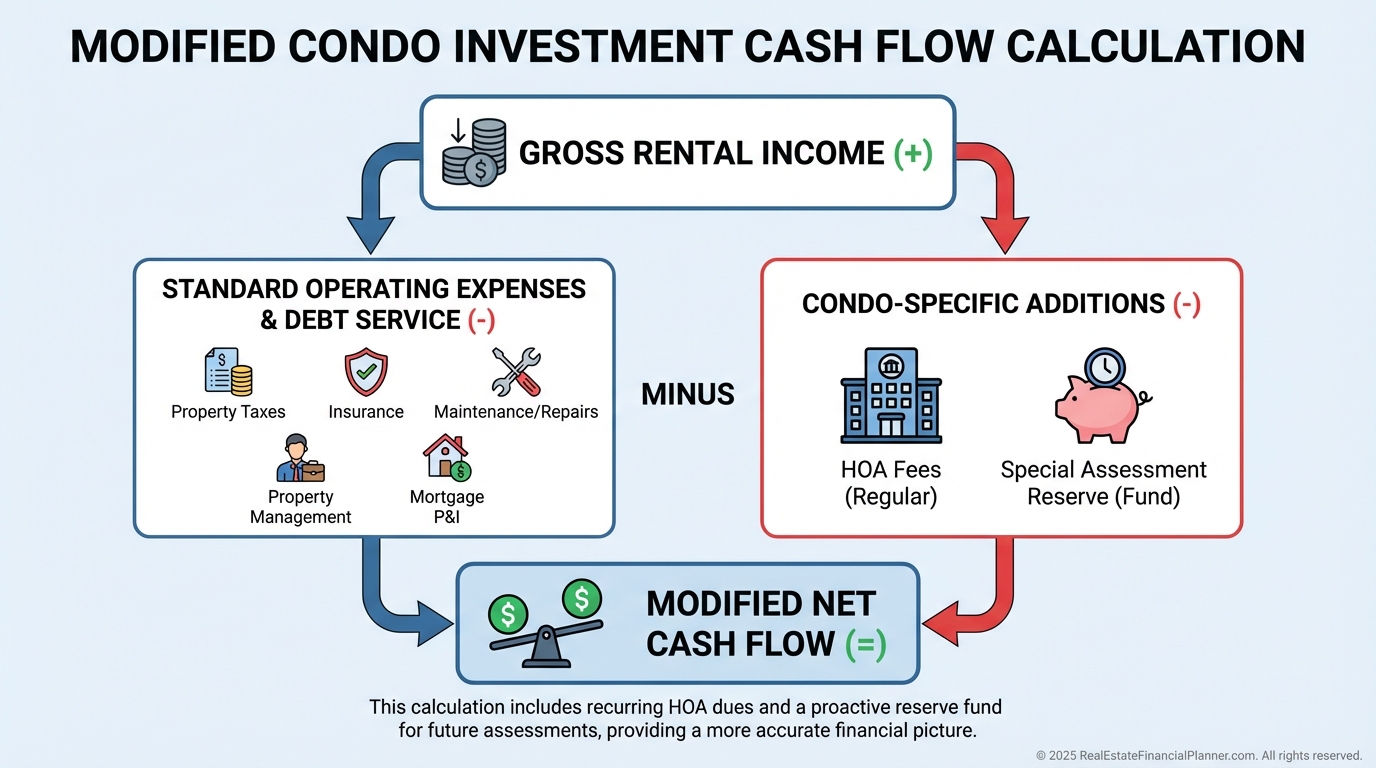

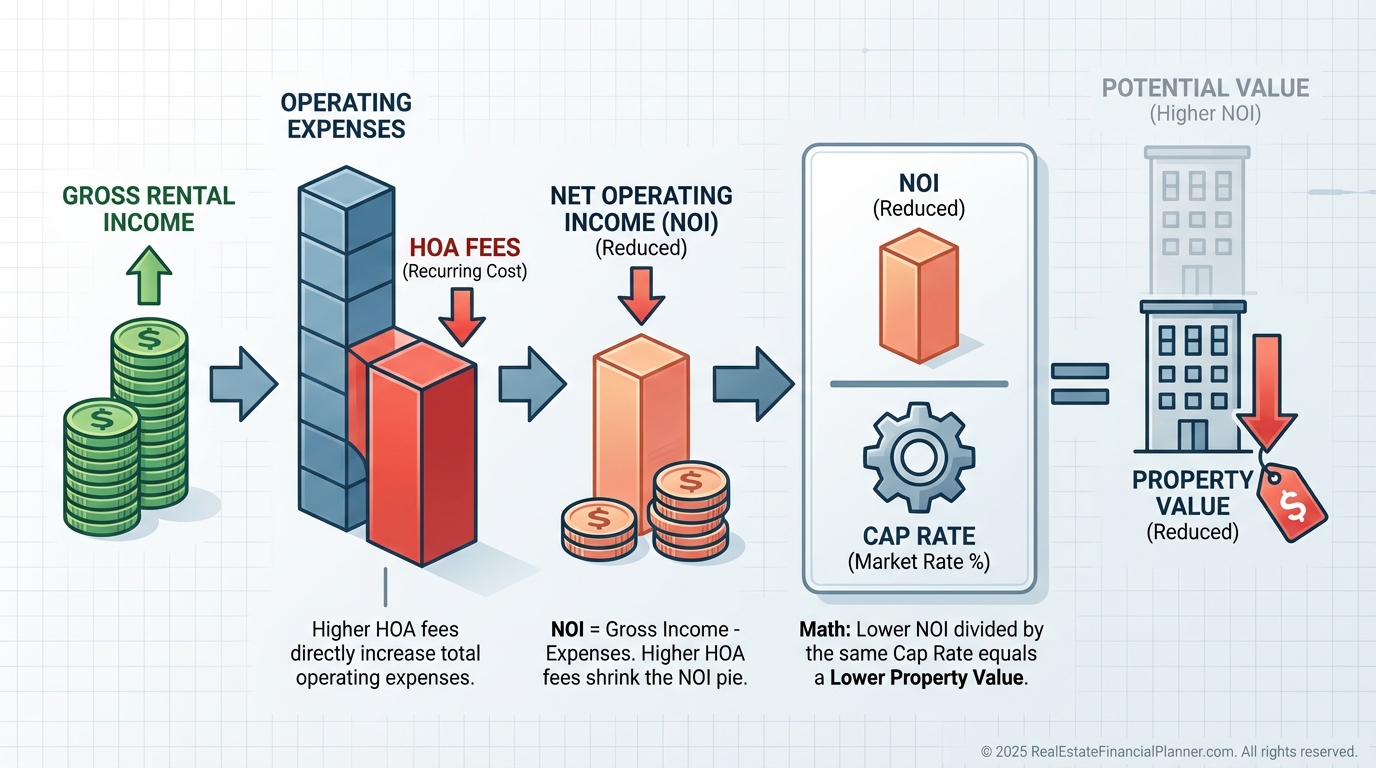

How Condo Cash Flow Really Works

Traditional cash flow formulas lie to condo investors.

Not maliciously, but consistently.

Insurance is usually cheaper.

Maintenance is usually lower.

But HOA fees replace both, and then some.

Special assessments are the silent killer.

When I model condos, I always include an assessment reserve.

Usually ten percent of the HOA fee.

This is not pessimism.

It is pricing reality.

Ignoring it inflates cash flow, understates risk, and creates false confidence.

False confidence is how investors get hurt.

Documents That Matter More Than the Property Itself

Single-family investors rarely read financial statements.

Condo investors must.

The reserve study is the most important document.

It shows what will break, when it will break, and how much it will cost.

When clients skip this step, the assessment never feels random to me.

It feels inevitable.

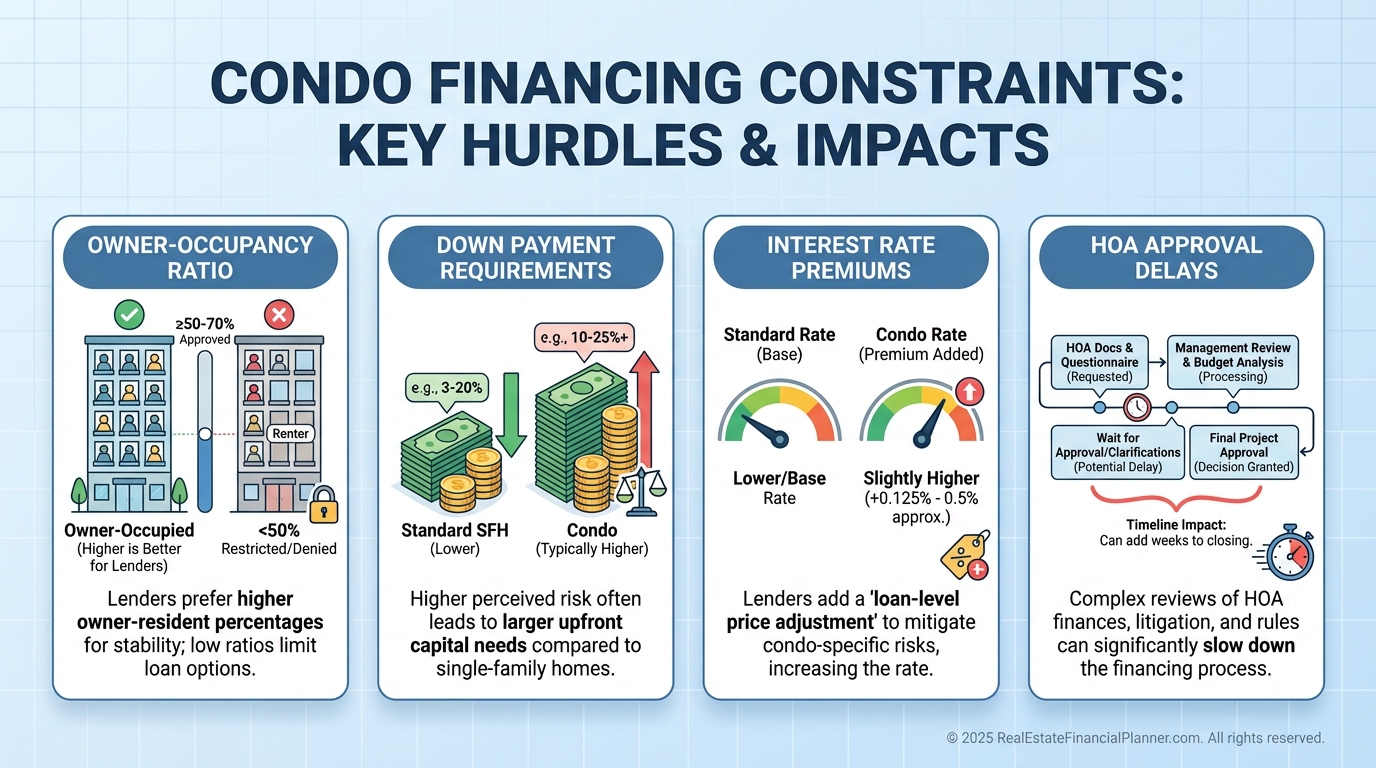

Financing and Exit Constraints Most Investors Miss

Owner-occupancy ratios matter.

So does litigation.

I have seen solid deals die weeks before closing because the HOA failed a lender questionnaire.

That risk needs to be priced in before you write the offer.

Exit strategy matters too.

Condos often sell best to owner-occupants, not investors.

That can be a feature or a bug.

It depends on how you plan.

Valuation Math Most Investors Ignore

HOA fees directly reduce value.

This is math, not opinion.

At the same time, deferred maintenance destroys value faster than fees ever could.

Cheap HOAs often cost the most.

This is where Return Quadrants™ thinking helps.

Cash flow, appreciation, and risk are always connected.

When Condos Actually Make Sense

Condos shine in specific situations.

They are not universal solutions.

Urban cores.

Young professional tenants.

Out-of-state investors.

Time-constrained portfolios.

Lower prices reduce entry barriers.

HOAs reduce operational noise.

For some investors, that tradeoff is worth it.

For others, it is not.

The Mistakes I Warn Clients About Every Time

I see the same errors repeatedly.

Skipping reserve studies.

Ignoring rental caps.

Trusting sellers instead of statements.

Assuming low fees mean efficiency.

None of these are beginner mistakes.

They are optimism mistakes.

Final Thoughts

Condos reward disciplined investors and punish casual ones.

They demand more upfront thinking and less ongoing work.

When analyzed correctly, they can deliver strong Cash Now returns, predictable expenses, and cleaner exits.

When analyzed poorly, they turn good spreadsheets into bad surprises.

If you are willing to underwrite the HOA as carefully as the unit, condos can absolutely belong in your portfolio.

If you are not, they probably should not.

The difference is not intelligence.

It is process.