Monthly Other Income: The Serious Investor’s Guide to Adding 10–25% Cash Flow Without Raising Rent

Learn about Monthly Other Income for real estate investing.

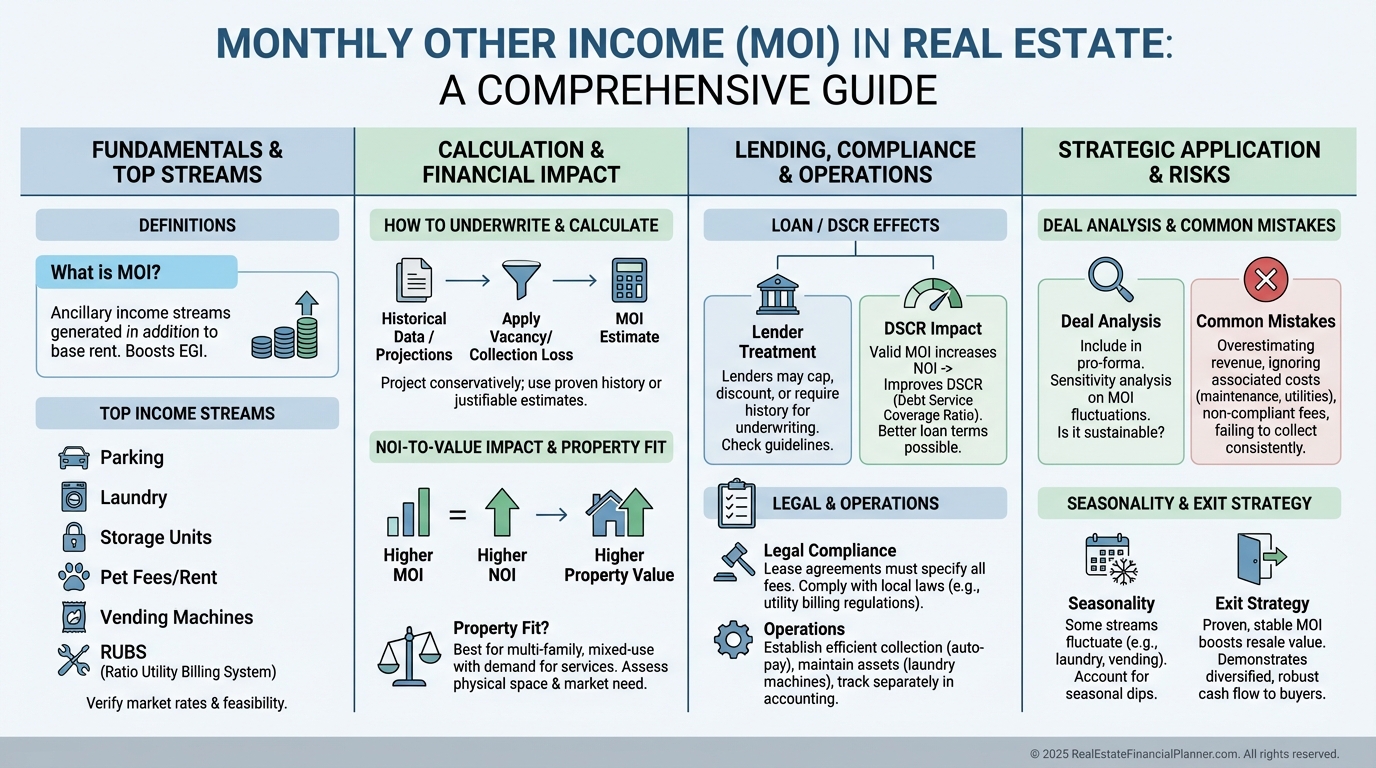

What Monthly Other Income Actually Means

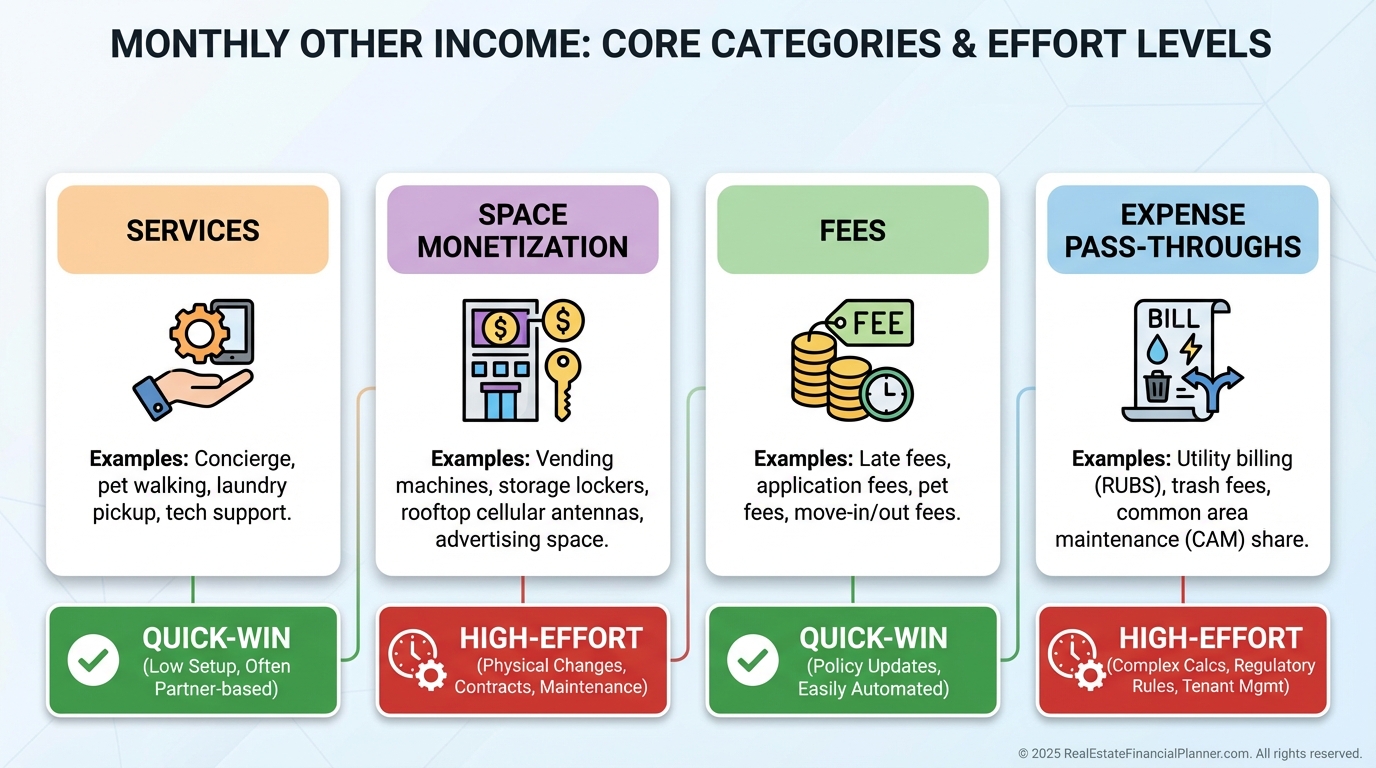

When I help clients analyze deals in The World’s Greatest Real Estate Deal Analysis Spreadsheet™, Monthly Other Income is the catch-all for revenue beyond base rent.

Think monetized services (laundry, parking, storage, vending), recurring fees (pets, reserved amenities), and allowed pass-throughs that reduce your expenses.

The rule I use is simple: value-added, clearly documented, and fair.

If a resident can opt in, understands the benefit, and it’s in the lease, it likely belongs here.

Not every fee qualifies in every market, so we verify legality first and model conservatively.

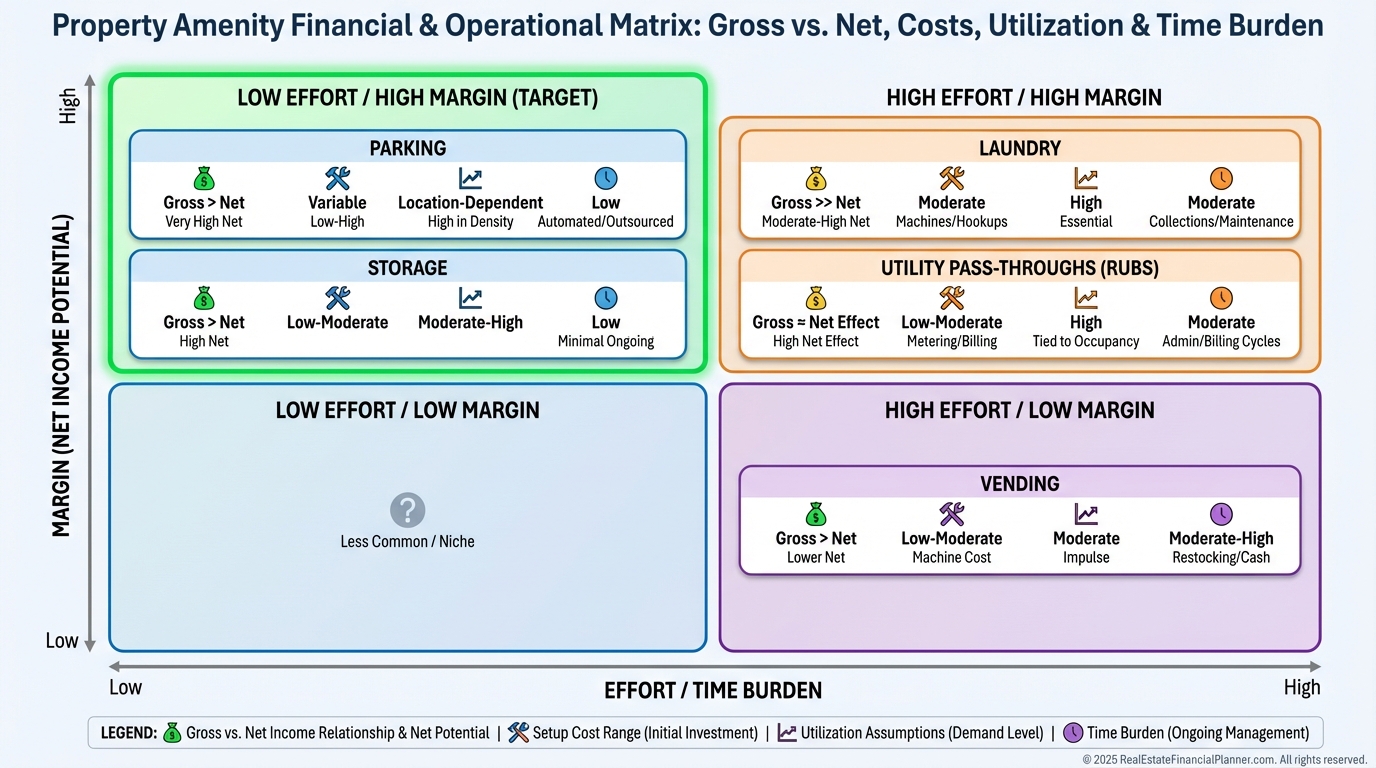

The Most Profitable Streams (and What I Actually See Collected)

I don’t chase novelty.

I start with income that monetizes space you already own and needs minimal babysitting.

•

Coin or app-based laundry: Gross $10–$30 per unit per month if used. Net varies after utilities, repairs, and splits if you outsource. Install can be $3,000–$6,000.

•

Reserved parking: $25–$75 per space monthly in urban cores, often with 50–80% utilization. Light enforcement required.

•

Storage lockers/rooms: $50–$100 per space monthly. Convert dead basements, attics, or garages. Add lighting, locks, and access controls.

•

Utility pass-throughs (legal RUBS/submetering): Not income, but $100–$200 monthly per unit in expense reduction can rival new revenue. Compliance matters.

•

Vending/amenity machines: $15–$50 monthly, but they consume time. I use them only when a vendor does full service.

Strong plays monetize existing space and habits.

Weak plays add new workstreams that distract from rent-ready turns and renewals.

How I Underwrite Monthly Other Income (Step-by-Step)

When I rebuilt systems after the last downturn, I stopped guessing and started modeling like a lender.

Here’s the exact sequence I use.

•

Research comps first. Call three property managers. Ask what they charge and what actually collects.

•

Use conservative utilization. I start at 40–60% for laundry, 30–50% for suburban parking, and 60–80% for urban parking.

•

Subtract real expenses. Laundry needs utilities, repairs, depreciation or lease payments. Storage needs security and periodic checks.

•

Price your time. If you value your time at $50/hour, and a stream consumes two hours monthly, that’s $100 of hidden expense.

•

Stress test seasonality. Assume summer drop-off for laundry and student markets. Use 10–20% seasonal dips in your forecast.

Example I show clients:

•

12 units, urban.

•

Reserved parking: 10 striped spaces, $60 each, 70% utilization = $420/month.

•

Laundry: Two stackables, net $160/month after utilities.

•

Storage: 6 cages at $45, 80% utilization = $216/month.

•

Total Monthly Other Income ≈ $796.

•

Time cost: 2 hours/month at $50/hour = $100.

•

Net NOI increase ≈ $696/month, or $8,352/year.

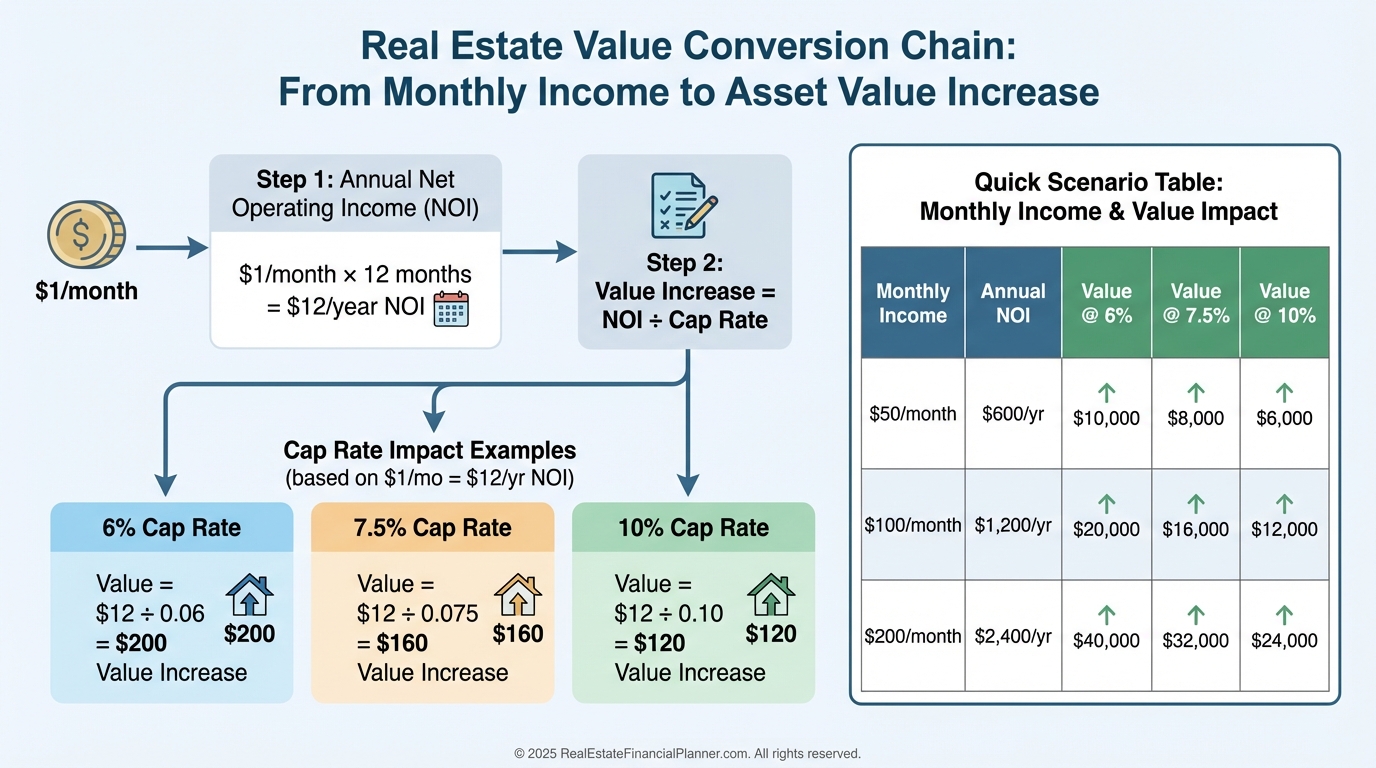

At a 6.5% cap, value impact ≈ $8,352 / 0.065 ≈ $128,646.

That is why we document, defend, and keep it conservative.

Where Monthly Other Income Fits in Return Quadrants™

In Return Quadrants™, this sits squarely in the Cash Flow quadrant by boosting NOI.

It can also support Appreciation indirectly, because buyers capitalize stable, documented NOI at sale.

On True Net Equity™, higher NOI reduces risk and can improve refinance proceeds, which may reduce your equity trapped by high rates.

For Nomad™ investors living in the property first, I often see easy wins like renting the detached garage as storage after you move out.

Small, durable adds compound across a portfolio.

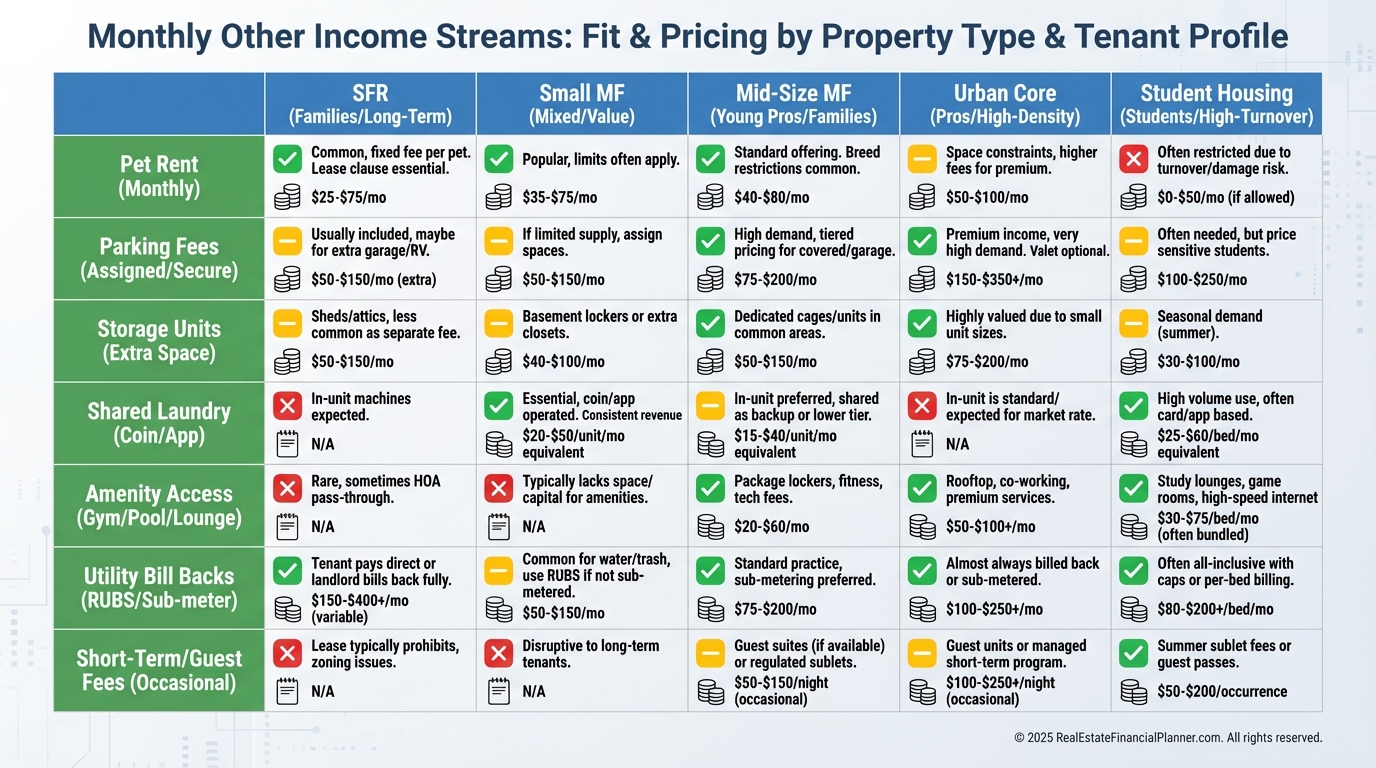

Best Property Fits (Match Streams to Tenants, Not Your Wish List)

•

4+ unit multifamily: Laundry, storage, and parking work because density supports utilization.

•

Urban assets: Parking premiums can carry the show. Storage sells when living space is tight.

•

Student housing: Laundry and bike storage shine. Plan for move-in/move-out surges.

•

Long-term tenants: Storage and reserved spots stick because routines set in.

•

Single-family rentals: Limited, unless you have detached garages, shops, or RV parking to monetize.

Match offers to needs, not to what you hope will work.

Lending, DSCR, and Why Documentation Is Non-Negotiable

Lenders don’t underwrite hopeful money.

They underwrite documented money.

Most will count 75% of properly documented other income toward qualifying income.

On DSCR loans, stronger NOI can improve terms or push a marginal deal over the line.

What I provide lenders:

•

Lease addendums for parking, storage, pets, and laundry.

•

12–24 months of income history where possible.

•

Clear general ledger lines separating each income type.

Generic “other income” gets haircut by underwriters.

Named, recurring, and documented income gets credited.

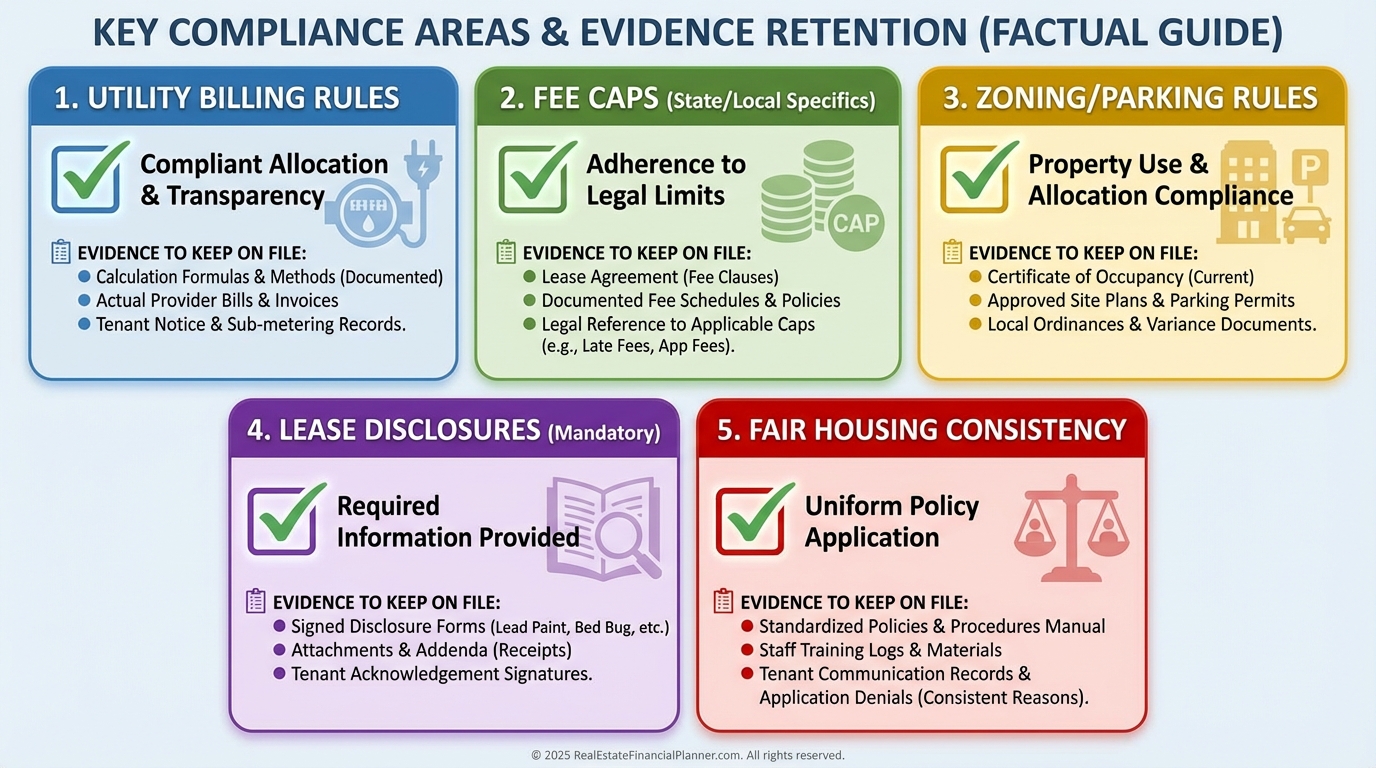

Legal and Regulatory Guardrails You Must Clear First

I warn clients: get legal right before you get clever.

•

Utilities: Many markets require submetering or approved ratio billing (RUBS) methods. Markups are often illegal.

•

Fee caps: Late fees and admin fees are capped or formula-based in many jurisdictions.

•

Parking/storage: Zoning or HOA rules may restrict reserved spaces or accessory storage.

•

Disclosures: Put services, prices, and rules in the lease with plain language.

•

Fair Housing: Apply programs uniformly and publish criteria to avoid claims of selective enforcement.

A quick consult with a local real estate attorney pays for itself.

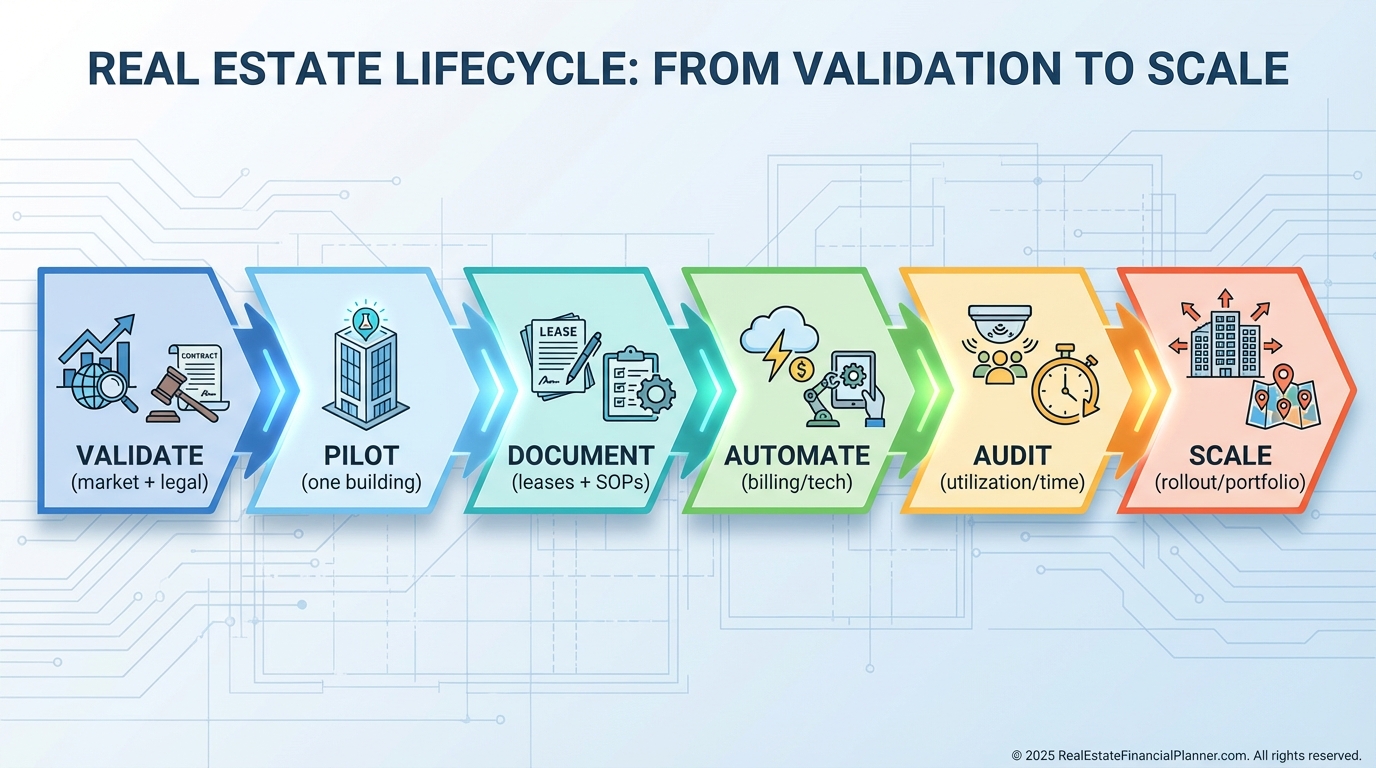

Operations: Build Simple Systems That Scale

Collection needs to be boring and automatic.

I prefer app-pay machines for laundry and bundling parking/storage into monthly rent via addendums.

Outsource where your time is better spent.

Laundry operators will place equipment and split revenue; your net drops, but so does your workload.

Use property management software to tag each income stream with its own GL code.

Quarterly, I audit:

•

Utilization rates

•

Complaints or service tickets

•

Time spent vs. dollars net

If time creep rises, I either automate, outsource, or cut the stream.

Deal Analysis: Where It Lives in Your Pro Forma

I treat Monthly Other Income as upside, not oxygen.

The deal must stand on base rent alone.

Then I layer conservative other-income lines and their expenses into the pro forma.

I also add implementation timelines.

Laundry installs might be 60–90 days out; parking can start next month.

If a stream takes cash today but returns slowly, I model the cash curve and confirm my reserves cover the gap.

When I present to partners, I show base returns and “with-other-income” returns side-by-side.

No magic.

Just math and timing.

Common Mistakes I See (And How We Avoid Them)

•

Overestimating utilization. Start low, let data lift you.

•

Ignoring total cost of ownership. Equipment, utilities, service, and your time matter.

•

Rolling out mid-lease. Wait for turnover unless your lease allows changes with notice.

•

Weak lease language. Spell out services, prices, rules, and remedies.

•

Compliance blind spots. Utility rules and fee caps can unwind a program fast.

•

Chasing pennies, losing hours. If net/hour is poor, stop doing it.

Seasonality and Market Sensitivity

Expect winter laundry peaks and summer dips.

Student-heavy assets swing on academic schedules.

Urban parking stays resilient; vending is cyclical.

In downturns, residents trim optional services first.

Build a cushion and stress test your forecasts at lower utilization.

Exit Strategy and Valuation

Every $1 of stable monthly NOI adds roughly $120–$200 of value at 10–6% caps.

That compounding is real value at sale.

But the market discounts fragile or owner-dependent streams.

Transferability matters.

Parking and storage transfer cleanly.

Complex schemes that depend on you personally will be haircut.

Maintain clean records, show a two-year history, and hand buyers a playbook.

That is how you get credit for the income you worked to build.