Fix and Flip: A Step-by-Step Playbook to Find, Fund, Rehab, and Sell for Profit

Learn about Fix and Flip for real estate investing.

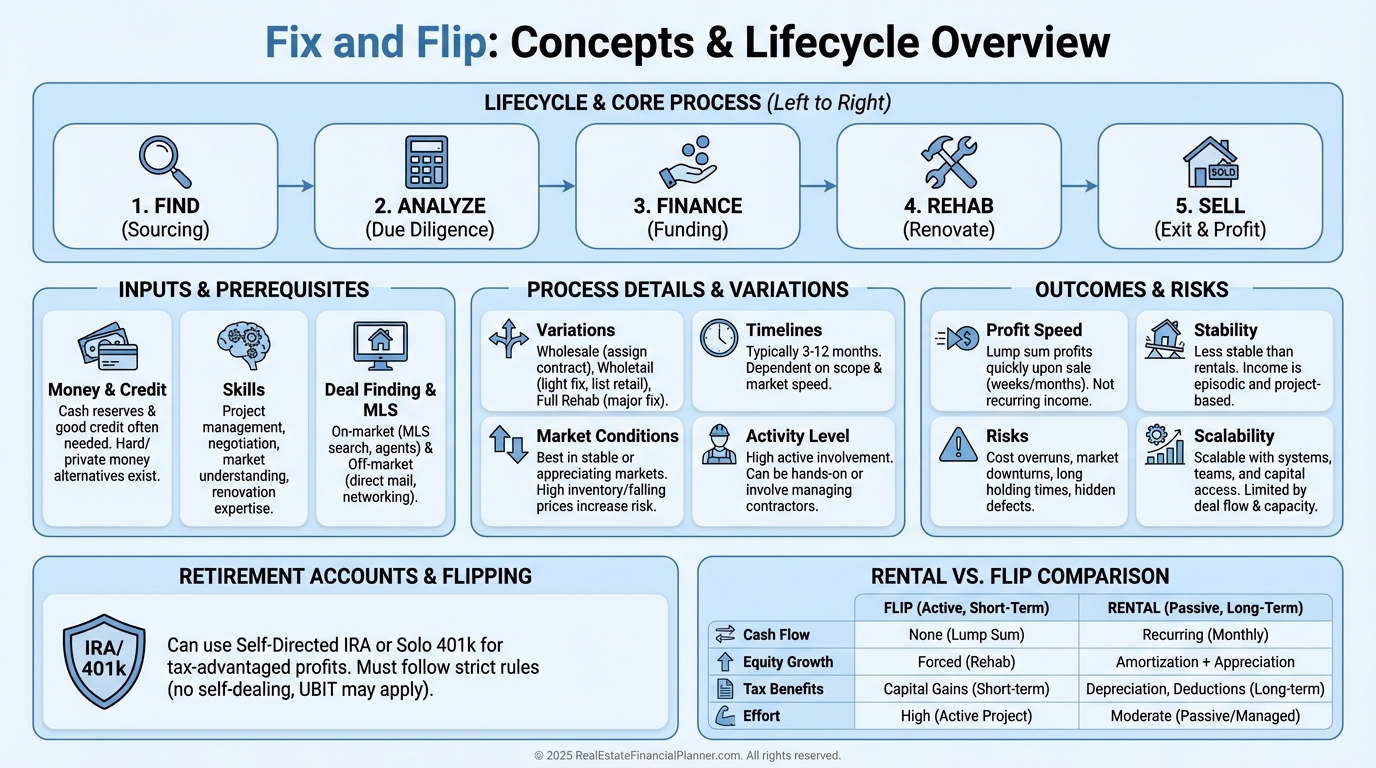

What Fix and Flip Really Is

When I help clients structure a fix and flip, I frame it as a short, high-intensity business project.

You buy a problem, create value fast, and exit cleanly for cash.

At its core, you’re buying below market, forcing appreciation through rehab, and selling into strong demand.

It’s simple on paper, but the margin lives in your modeling, your team, and your speed.

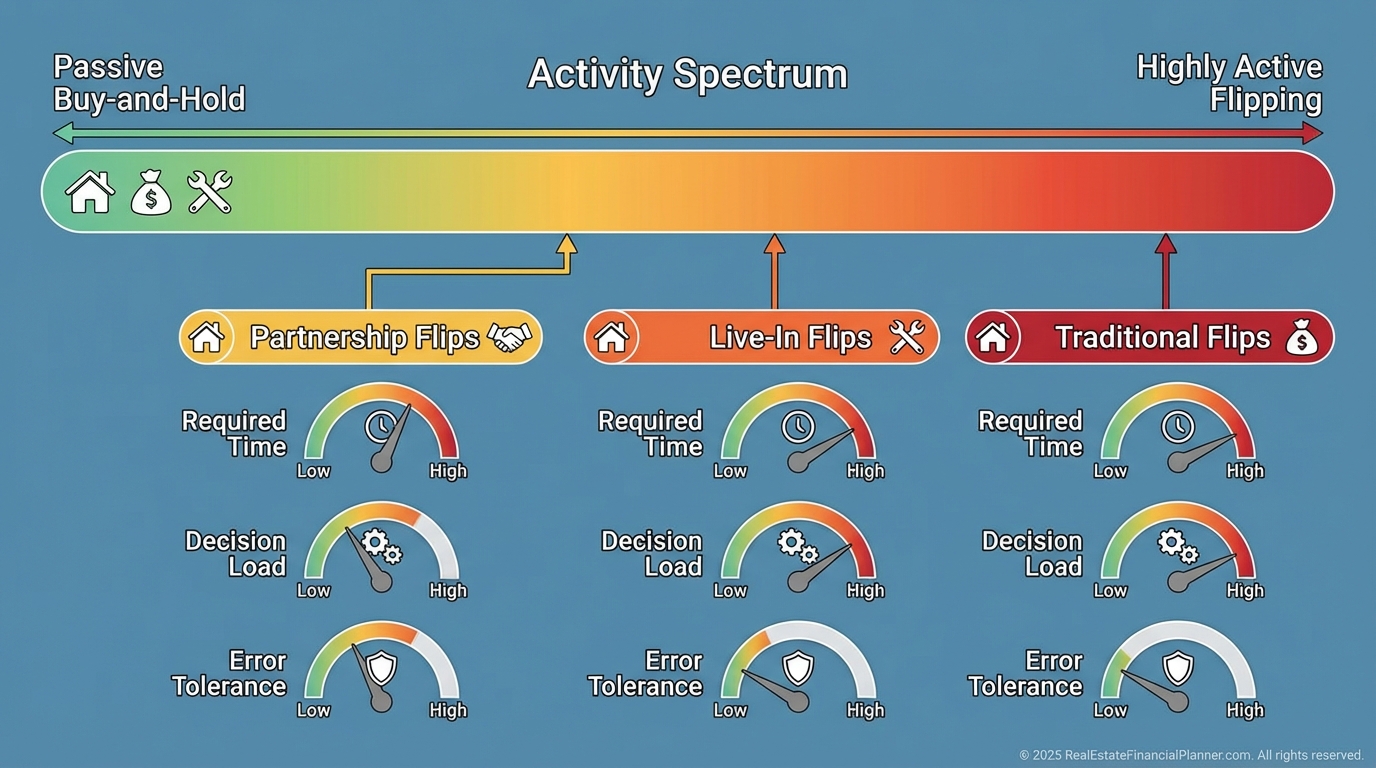

Variations to Match Your Life and Taxes

Traditional flips move fast and maximize turnover.

Live-in flips trade speed for financing advantages and lower holding costs.

Two-year tax-advantaged live-in flips lean into potential Section 121 exclusions but slow your velocity.

Partnership flips leverage a seller’s ownership or a money partner to reduce your cash in and sometimes your risk.

When I rebuilt after a rough year early in my career, I did a live-in flip combined with a Nomad move.

I moved yearly, used low-down owner-occupant financing, and stacked sweat equity into True Net Equity.

How Active Is This, Really?

Flipping is work.

It’s hands-on, deadline-driven, and coordination heavy.

Traditional flips are full-time sprints.

Live-in flips are still active, but you pace the work and reduce pressure.

Partnership flips add people management to project management.

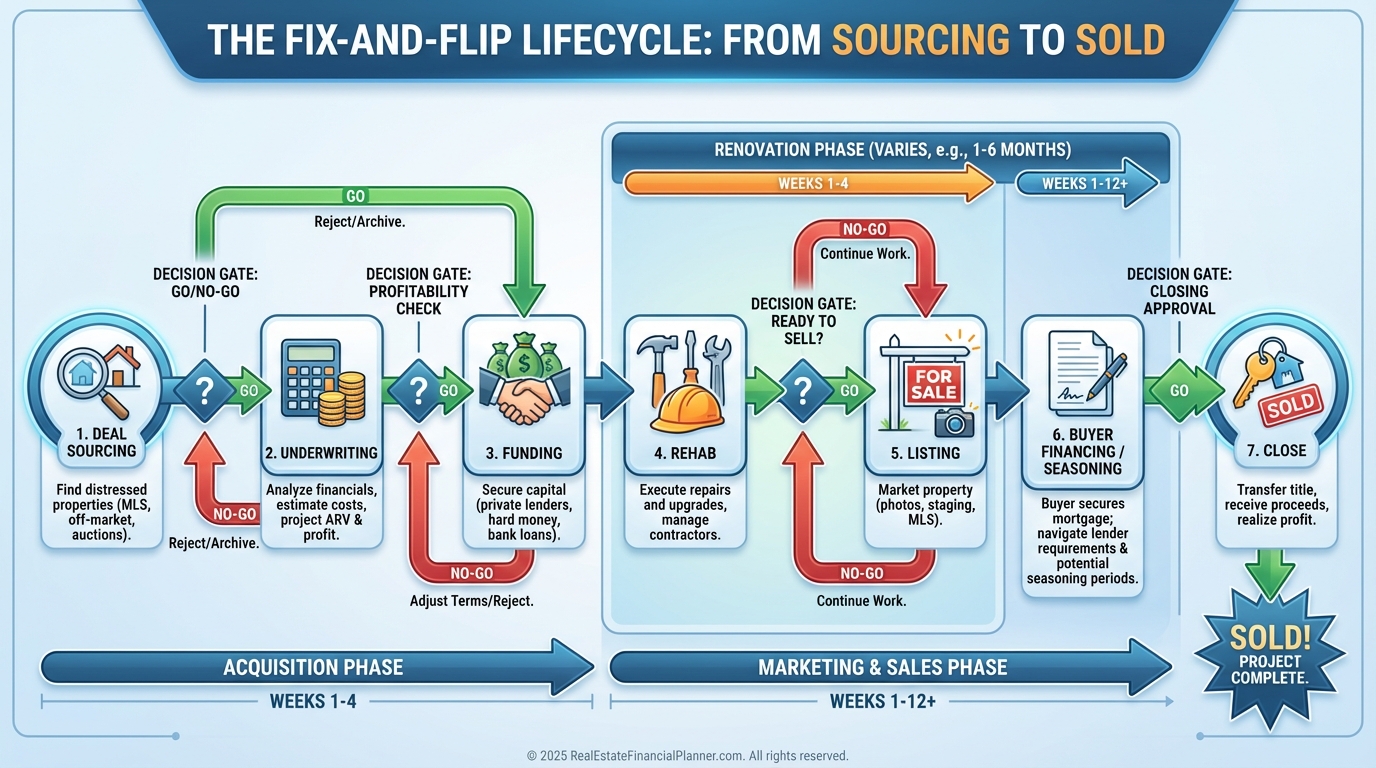

Timeline: How Long Should a Flip Take?

Most successful traditional flips finish in 3–6 months.

That window covers acquisition, permits, rehab, punch, and close.

Live-in flips often run 12+ months to meet occupancy rules and reduce disruption.

Two-year live-in flips aim for tax advantages, but I always model whether paying taxes and turning projects faster produces more True Net Equity per year.

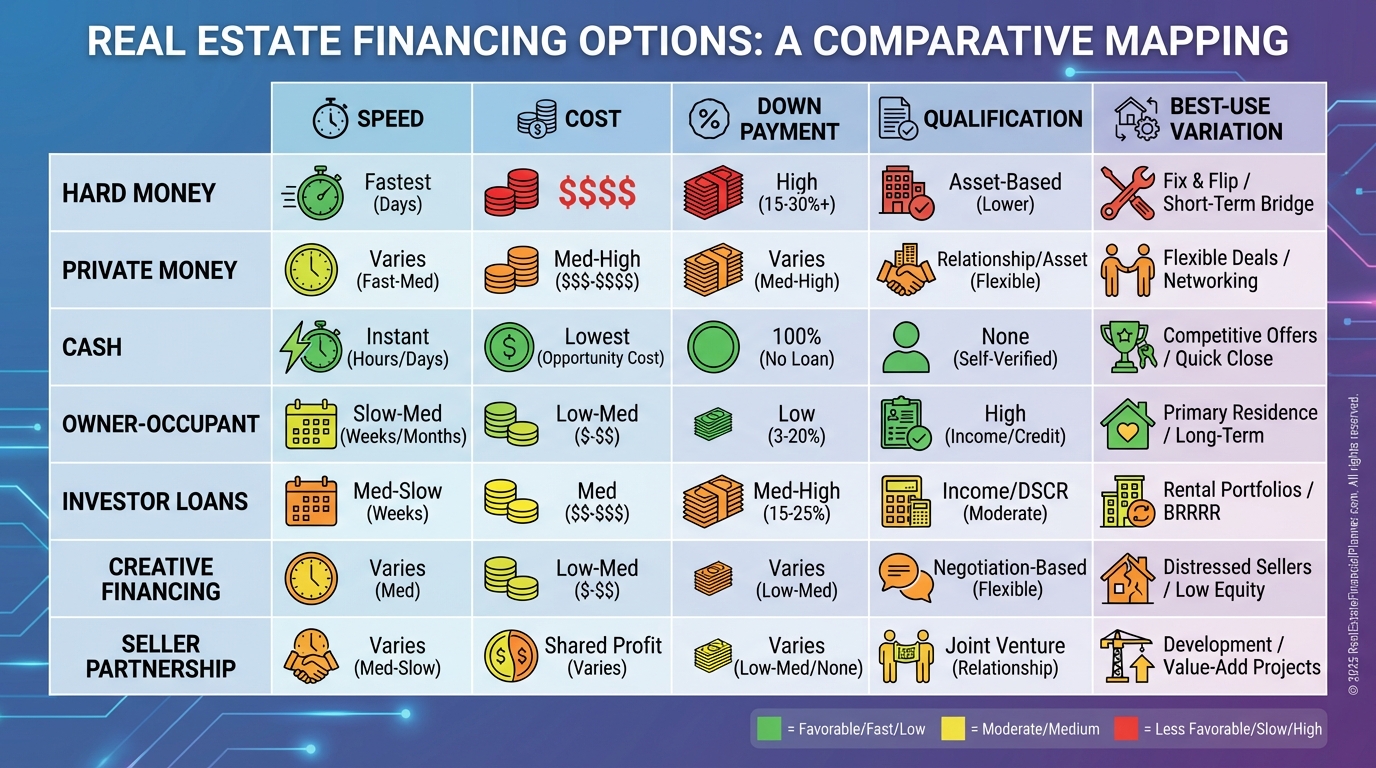

Financing: From Common to Creative

When I model funding in the Real Estate Financial Planner software, I match the loan to the variation, your credit, and your cash.

Hard money and private money dominate traditional flips.

Owner-occupant loans unlock live-in flips and speed approvals once the home is financeable.

Creative structures shine in partnership flips where the seller’s ownership or carryback is a tool, not an obstacle.

•

Hard money: Fast, expensive, and purpose-built for flips.

•

Private money: Flexible and relationship driven.

•

Cash: Fastest close, reduced cost, but ties up capital.

•

Owner-occupant: Great for live-in flips; property must qualify.

•

Conventional investor loans: Lower rates than hard money, but slower and may penalize early payoffs.

•

Creative terms: Subject-to, seller financing, lease options, and shared-equity with sellers.

Money, Credit, and Reserves Required

Plan for marketing to find the deal, down payment and closing costs, rehab, holding, selling, and healthy reserves.

I recommend a 10–15% rehab contingency and three months of full carrying costs on hand.

Credit needs vary.

Hard money often closes with mid-600s and experience, while owner-occupant loans post best pricing at 680–740+.

All-cash eliminates the credit variable but not the need for discipline.

Skills That Add Margin

Finding deals is foundational.

You need lead sources, agent and wholesaler relationships, and direct-to-seller marketing.

Rehab estimating keeps you out of trouble.

I teach clients to estimate materials, labor, permits, and timeline friction, then add contingency.

Rehab management is your execution engine.

Even if you don’t swing a hammer, you must schedule crews, inspect quality, and keep change orders in check.

Selling skills matter.

Pricing, staging, and negotiation directly affect appraisal support and days on market.

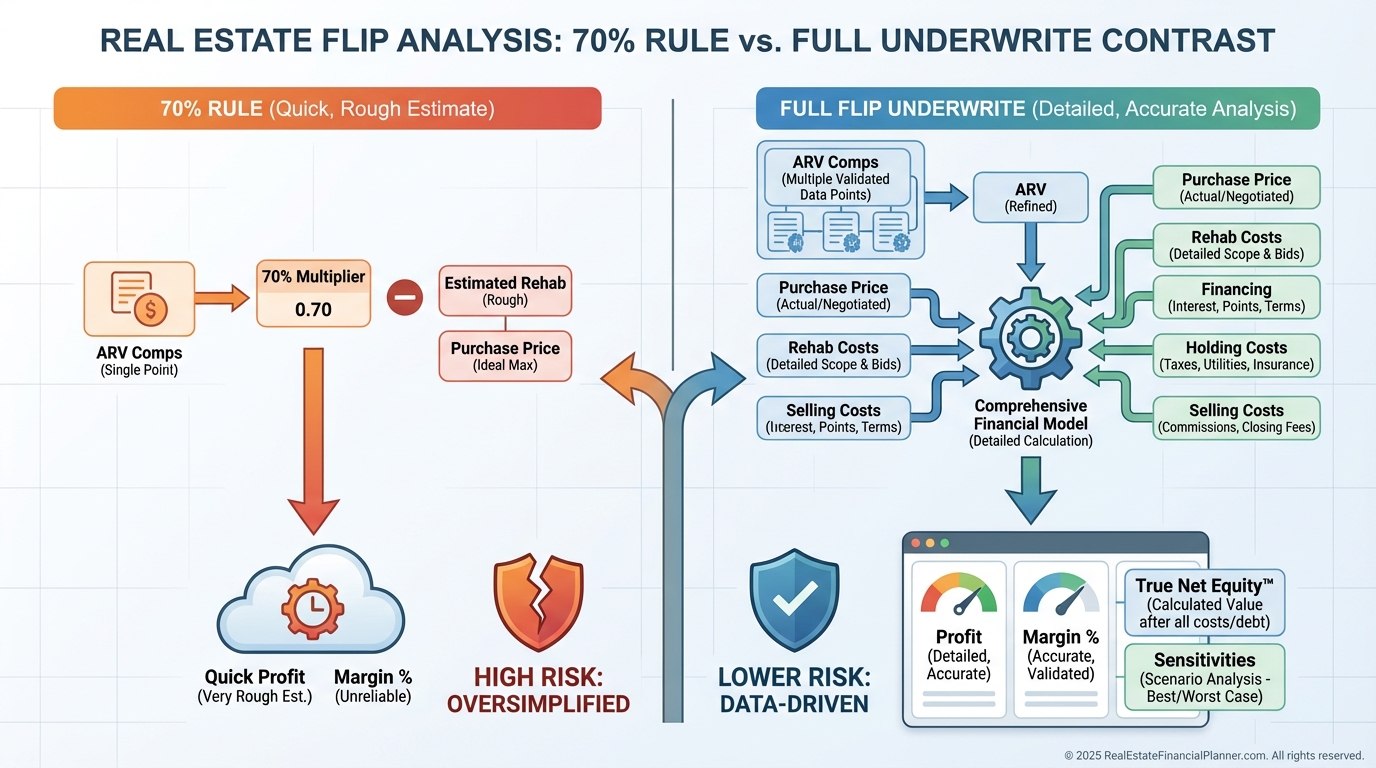

Analyzing Deals: Beyond Rules of Thumb

The 70% rule is a blunt instrument.

I only use it for quick screening before a full underwrite.

For offers, I model line-item costs, use conservative ARV comps, and calculate True Net Equity at exit after selling costs, loan payoff, and taxes.

Then I sanity-check profit as both a dollar target and a percentage of ARV.

•

Inputs I require: purchase price, closing costs in/out, rehab by line, financing costs, holding costs, ARV comps with adjustments, and buyer loan seasoning constraints.

•

Outputs I check: profit, margin % of ARV, timeline, breakeven price, and sensitivity to ARV slip and budget creep.

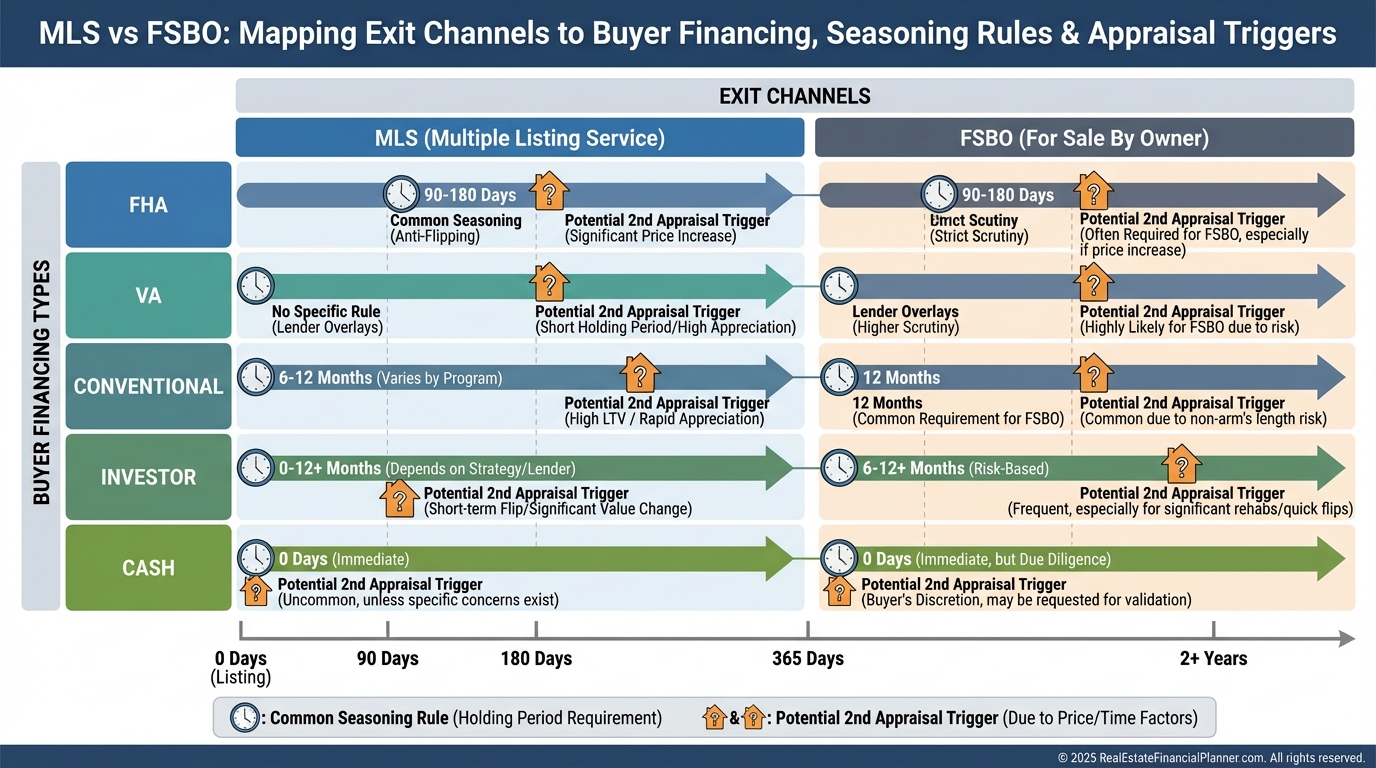

Exit Strategy and Buyer Financing

Most flips exit through the MLS for maximum exposure.

FSBO can work if you have time and local expertise.

Know your buyer’s financing.

Owner-occupant loans widen the buyer pool; investors often bring larger down payments.

FHA requires 90 days of ownership, and large price jumps can trigger additional documentation or second appraisals between days 91–180.

I plan timelines and pricing around those windows to avoid surprise bottlenecks.

Investor vs. Entrepreneur

Flipping sits solidly in real estate entrepreneurship.

You create value through action and coordination.

Even if you fund with your own cash, the work makes the money.

Buy-and-hold is investing; flipping is operating.

That distinction helps you decide how much of your life you want to allocate to each.

Stability and Scalability

Flipping is actively stable.

Your results rely on daily attention, not passive drift.

Scaling is limited by deal flow, capable crews, capital, and your bandwidth.

Experience compounds.

Your team, relationships, and reputation shorten cycles and reduce surprises.

But most clients use flip profits to buy rentals and shift into more stable wealth-building.

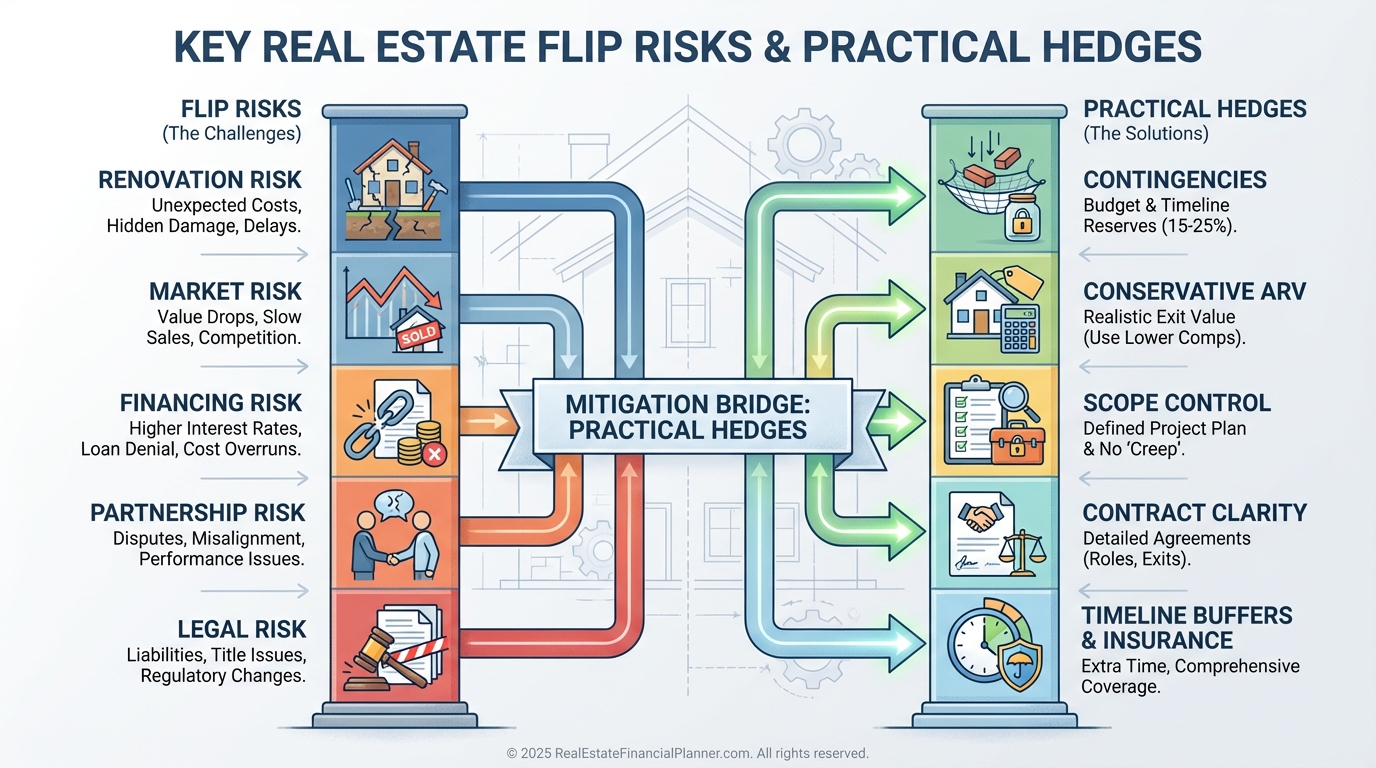

Risk Exposure and How I Hedge It

Renovation risks cause budget creep and delays.

Market risk hits ARV and days on market.

Financing risk shows up in rate changes, draw schedules, or lender overlays.

Partnership risk is real when roles and profit splits are fuzzy.

My hedges are boring and effective.

I underwrite ARV conservatively, add contingency, verify permits early, require weekly photo journals, and pre-write listing copy so we can list fast.

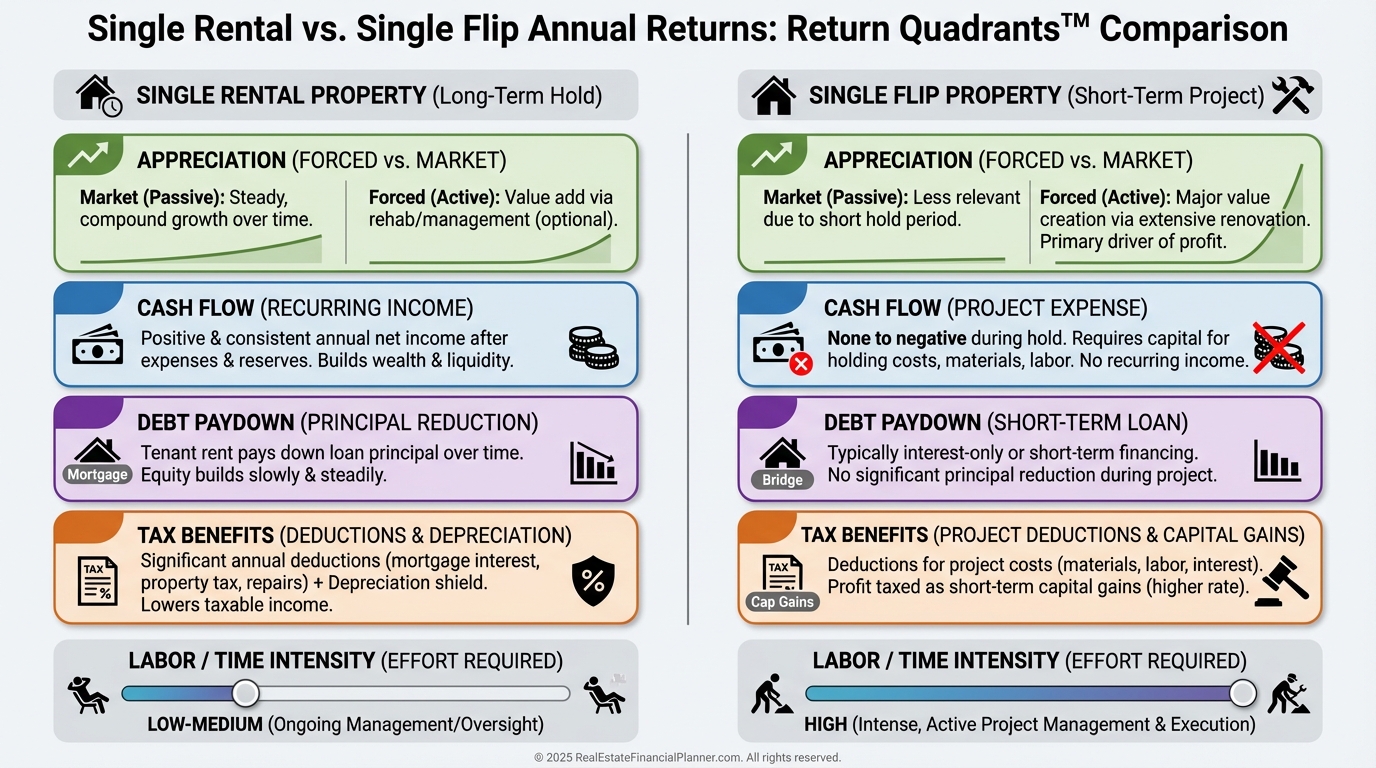

Profit Speed and Targets

Flips pay fast compared to rentals.

Most clients target 10–15% of ARV or a fixed dollar target like $10,000–$30,000 depending on price tier and market.

Return Quadrants for flips are different.

You’re optimizing forced appreciation and sometimes a sliver of debt paydown on amortizing owner-occupant loans.

You usually skip cash flow and depreciation.

I track the interest you earn on reserves and include it as a minor secondary return.

Finding Deals That Pencil

I like diversified pipelines.

If you’re new, work the MLS and build agent relationships while you learn to market direct-to-seller.

Wholesalers can fill gaps, but always underwrite their numbers yourself.

MLS Search Tactics for Fixers

Use keywords like “as-is,” “TLC,” “handyman,” “estate,” “probate,” “smoke,” “water damage,” or “mold.”

Watch days on market and price reductions.

I also flag high tax-to-list price ratios as a rough undervaluation proxy and set alerts for stale listings in target neighborhoods.

Market Conditions: Where Flips Thrive

Ideal markets let you buy at a discount, add value that buyers will pay for, and sell into healthy demand.

Challenging markets have weak demand and long days on market.

In soft markets, I widen buy-box discounts and plan for longer carry.

In hot markets, I tighten project scopes and accelerate finishes buyers actually value.

Accessibility and Availability

Flip-worthy inventory is scarce by definition.

It’s still generally easier to find flips than perfect BRRRR deals because cash flow underwriting isn’t required.

If your local market is thin, consider remote markets only after you’ve built a trustworthy team and clear scope-control process.

Using Retirement Accounts

You can flip inside a self-directed retirement account, but constraints are strict.

Financing is limited and often non-recourse with bigger down payments.

You cannot do the work yourself; prohibited transactions are real.

Often it’s cleaner to be the money partner from your retirement account in someone else’s project.

No live-in flips in retirement accounts, ever.

1 Rental = 1 Flip/Year?

Our modeling in the Real Estate Financial Planner shows one solid rental can rival the annual profit of one average flip.

The difference is labor.

Ten flips a year is a demanding job.

Ten rentals with property management is a business you can keep for decades.

I often advise clients to use flips to accelerate down payments, then pivot to rentals for durable wealth, True Net Equity growth, and optionality.

Your Next Three Moves

First, define your variation and buy box with hard numbers.

Second, line up financing and contractors before you write offers.

Third, build your analyzer with True Net Equity outputs and sensitivity tests so your offers are disciplined and repeatable.

When I help clients execute this sequence, their flips stop feeling risky and start feeling procedural.

That’s when profits get consistent.