Single-Member LLCs for Real Estate Investors: The Practical Playbook to Protect Assets, Optimize Taxes, and Scale Confidently

Learn about Single-Member LLCs for real estate investing.

Why Single-Member LLCs Belong in Your Toolkit

When I help clients stress test their portfolios, we don’t start with cash flow; we start with protection.

A single lawsuit can erase a decade of equity gains if you’re not structured correctly.

SMLLCs give you speed, control, and separation without corporate bureaucracy.

They’re my default for buy-and-hold rentals when we want clean lines between properties and personal assets.

What Is a Single-Member LLC?

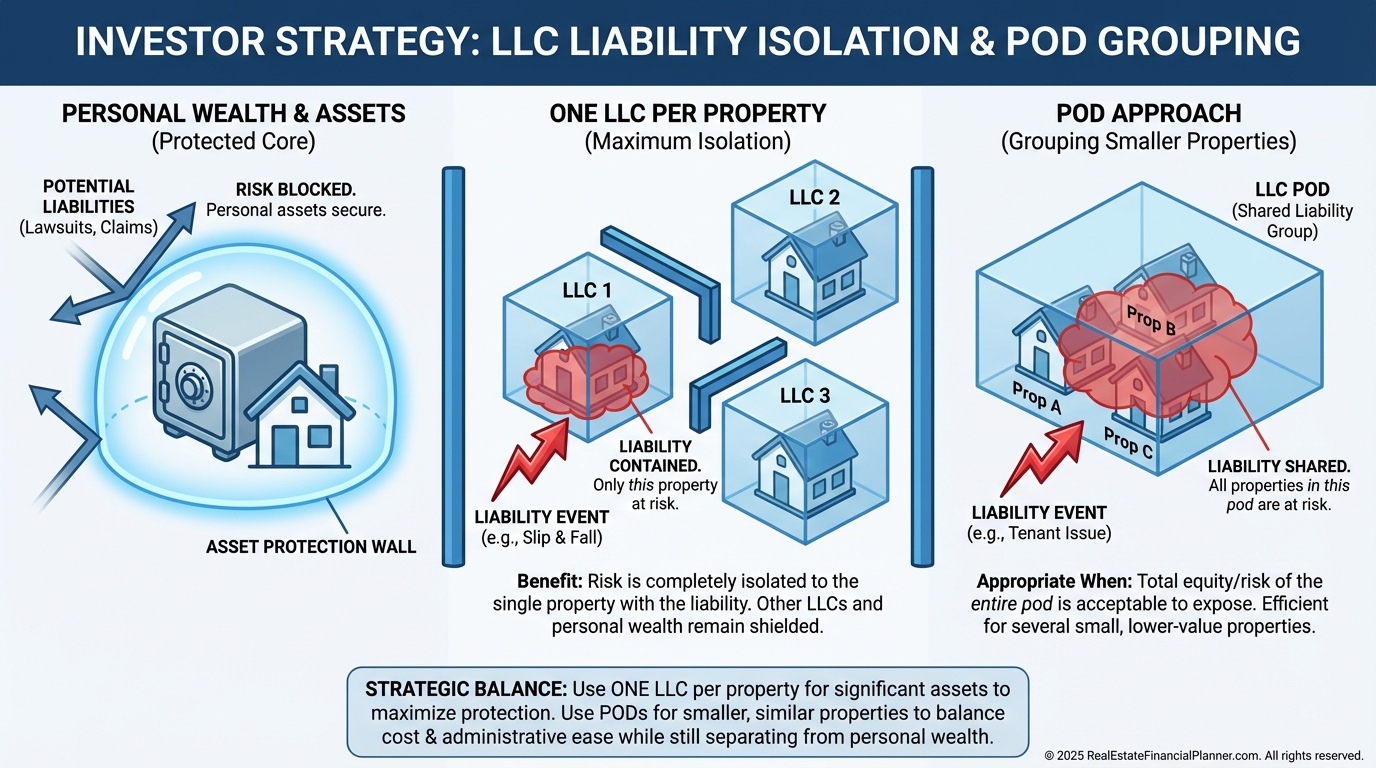

You control every decision, yet your rental, your car, and your personal checking account don’t sit in the same legal bucket.

For most portfolios, I prefer one LLC per property to create firebreaks.

If something happens at Property A, Properties B and C don’t catch fire with it.

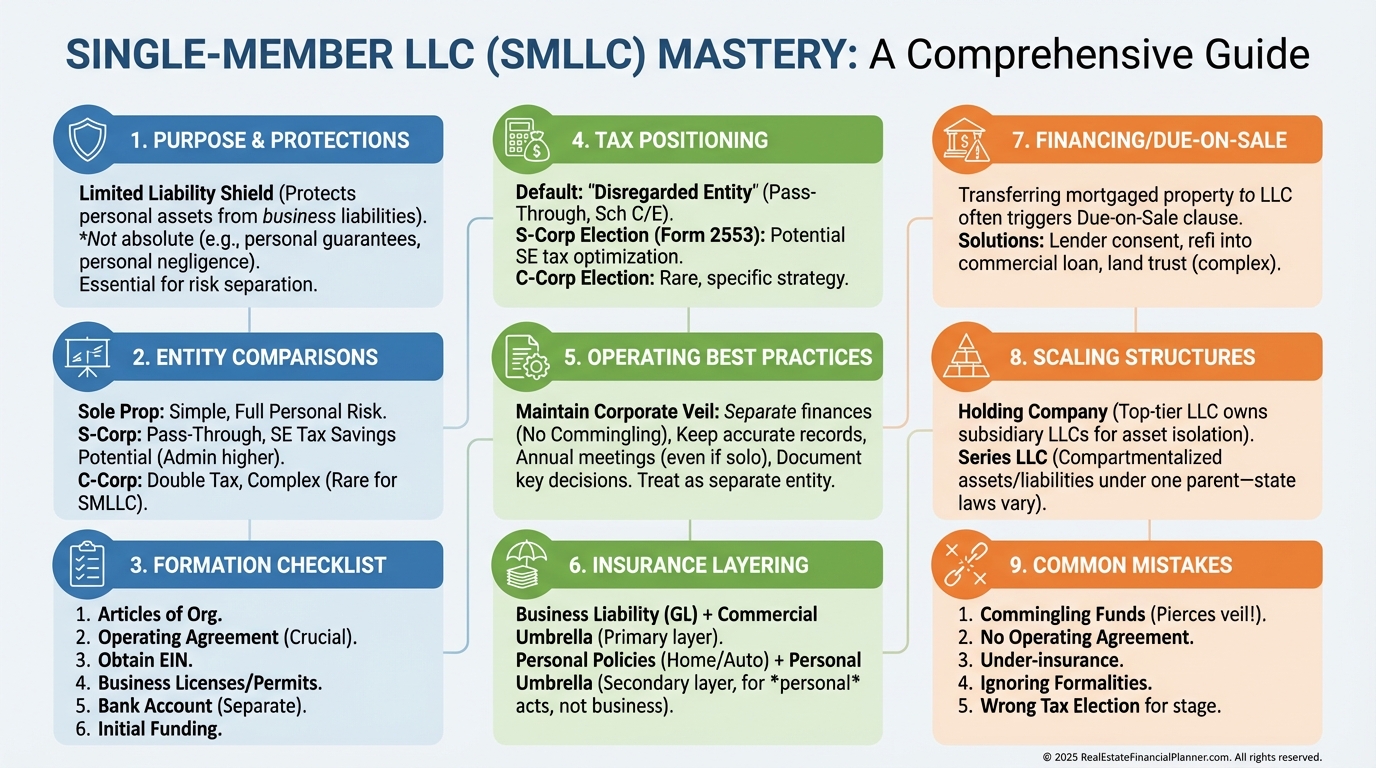

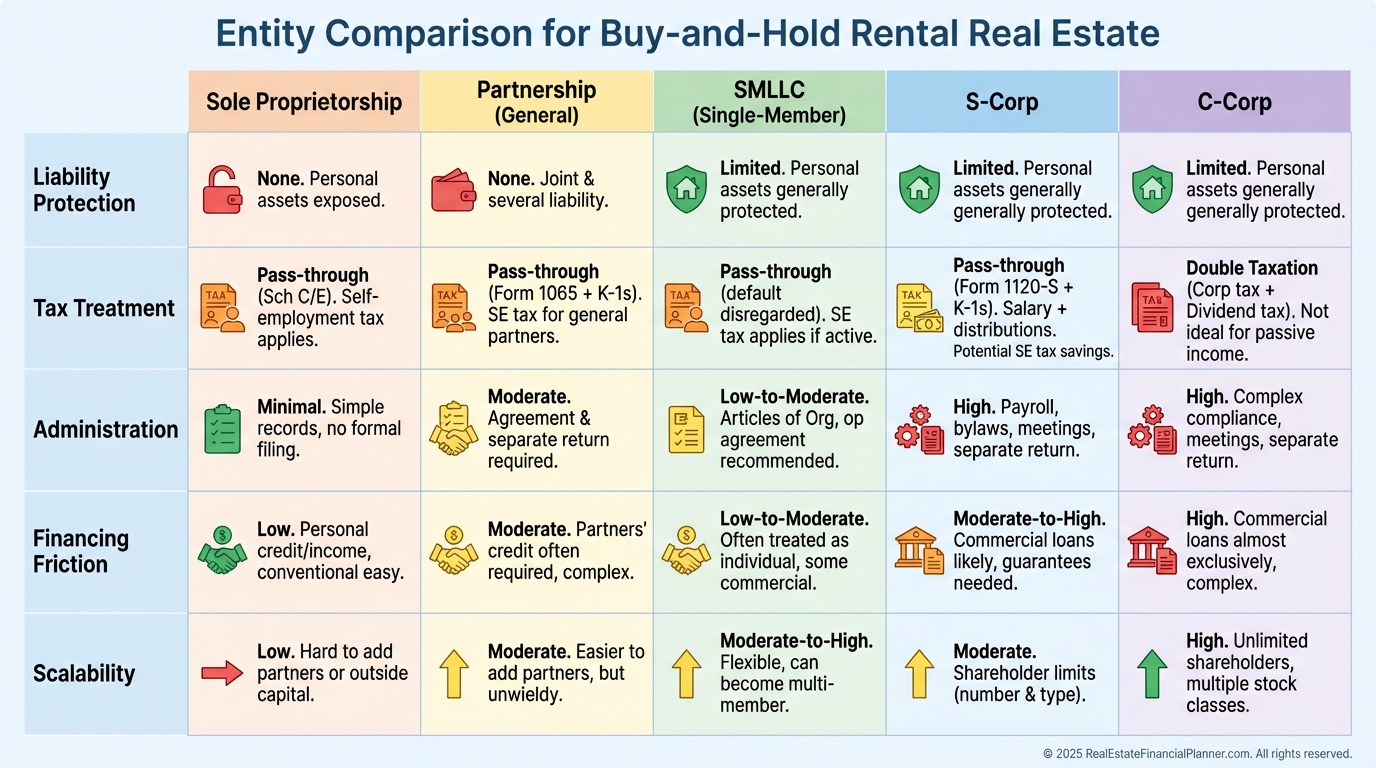

SMLLCs vs Other Entity Types

Sole proprietorships are fast but offer zero protection.

One bad day can take the rentals and the minivan.

S-Corps work for active businesses but add friction for rentals and aren’t ideal for depreciation-driven income.

C-Corps double-tax most investor outcomes and complicate exits.

Partnerships add complexity and partner risk you may not need.

For rentals, SMLLCs hit the balance I want: protection, tax simplicity, and speed.

How I Structure Portfolios With SMLLCs

When I rebuilt after a painful partnership split, I adopted a simple rule: own clean, operate clean, exit clean.

That meant one deeded property per SMLLC, plus consistent banking and recordkeeping.

On duplexes and below, I’ll sometimes group two or three doors if True Net Equity™ per LLC stays modest.

The goal is to keep any one entity from holding more equity than you’re comfortable risking.

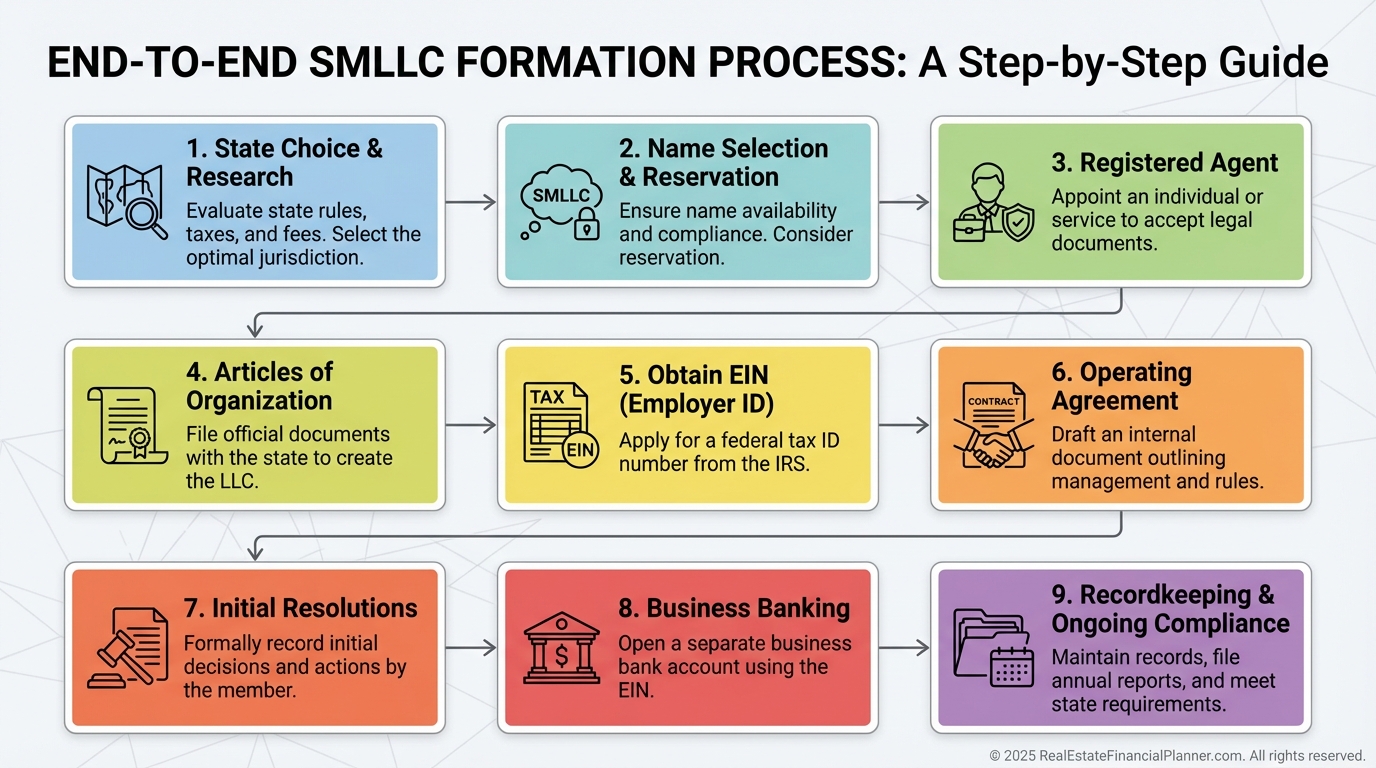

Formation Checklist That Actually Protects You

Choose your state intentionally.

Your home state is simplest for property held there, while some investors prefer privacy-forward states.

Select the name and appoint a registered agent who won’t miss service of process.

File Articles of Organization and get your EIN online for free.

Draft a real operating agreement, even if you’re the only member.

Open a dedicated bank account and adopt a written “no commingling” policy you follow.

I also execute initial resolutions, membership certificates, and an organizer’s statement to document separateness.

Tax Positioning for SMLLCs

By default, the IRS treats an SMLLC as a disregarded entity.

Rental income and expenses generally flow to Schedule E, not Schedule C.

That means no self-employment tax on typical rental income, though NIIT may apply at higher incomes.

Flips, wholesaling, and short-term rentals with substantial services often belong on Schedule C and may trigger self-employment tax.

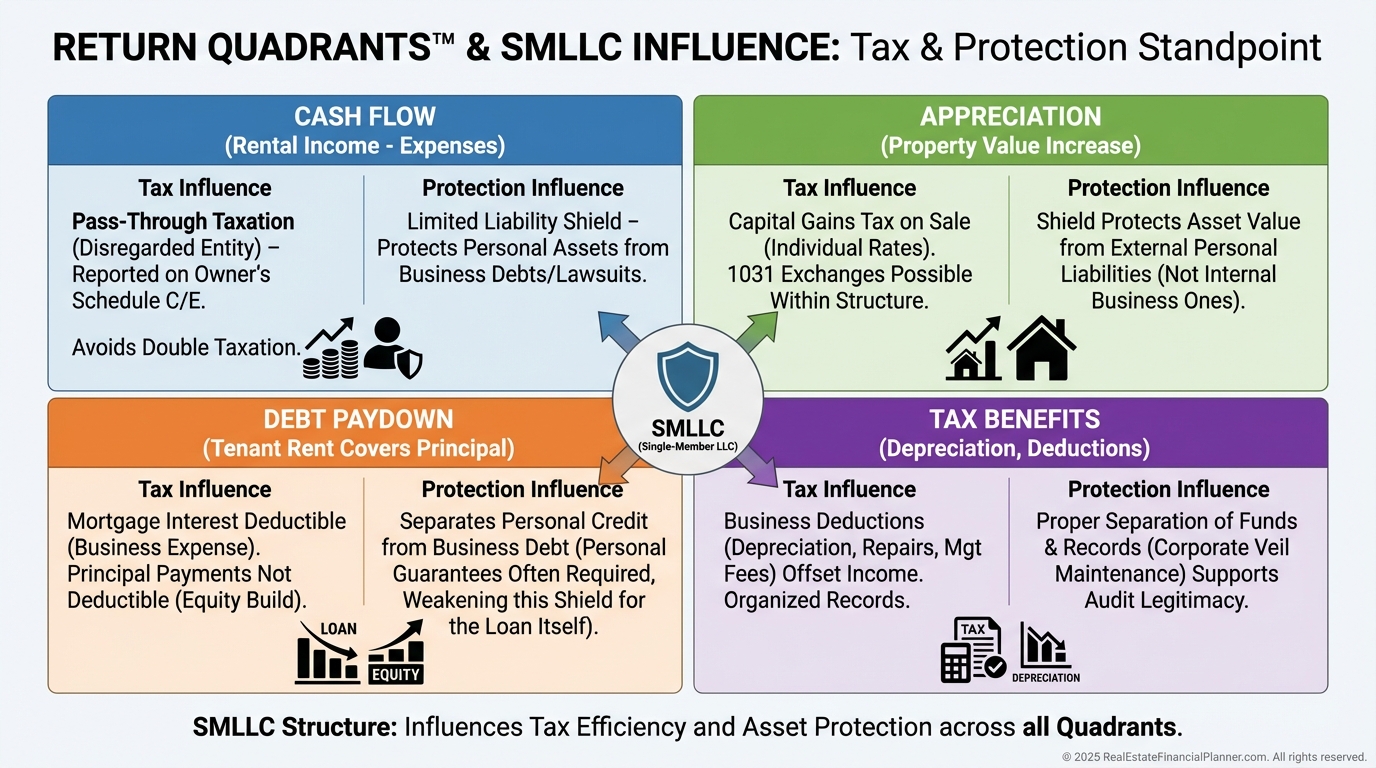

I model tax benefits using Return Quadrants™ to show where wealth shows up: cash flow, appreciation, debt paydown, and depreciation.

Cost segregation can front-load depreciation, but pair it with passive activity rules so your paper losses behave how you expect.

If you qualify as a real estate professional and materially participate, those losses may offset other income.

If not, I plan for carryforwards and time 1031 exchanges to preserve momentum.

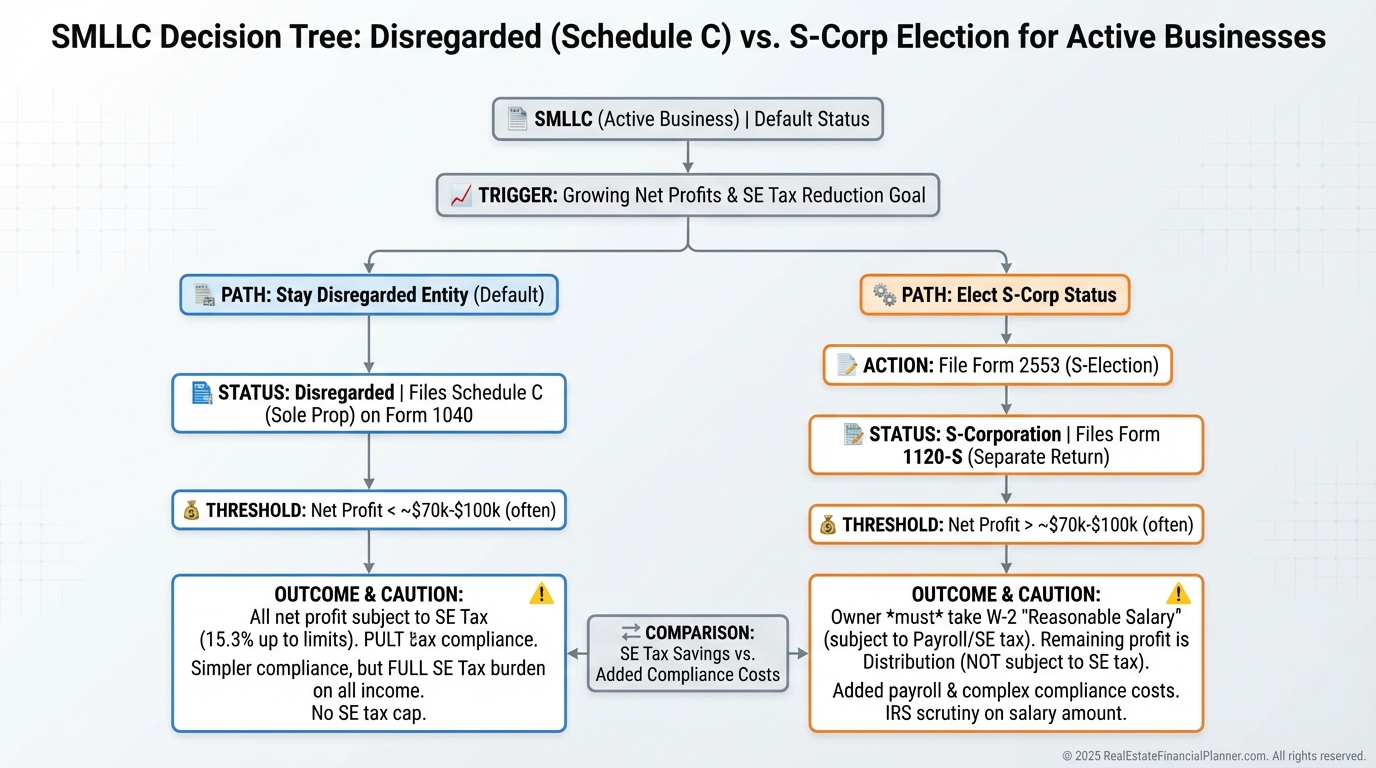

When (and When Not) to Elect S-Corp Status

For rentals, I rarely elect S-Corp status.

Depreciation-driven income doesn’t benefit enough to justify payroll and compliance.

For flips or property management businesses, an S-Corp can reduce self-employment tax by splitting salary and distributions.

I run a decision tree with the CPA before filing anything because elections are easy to make and expensive to unwind.

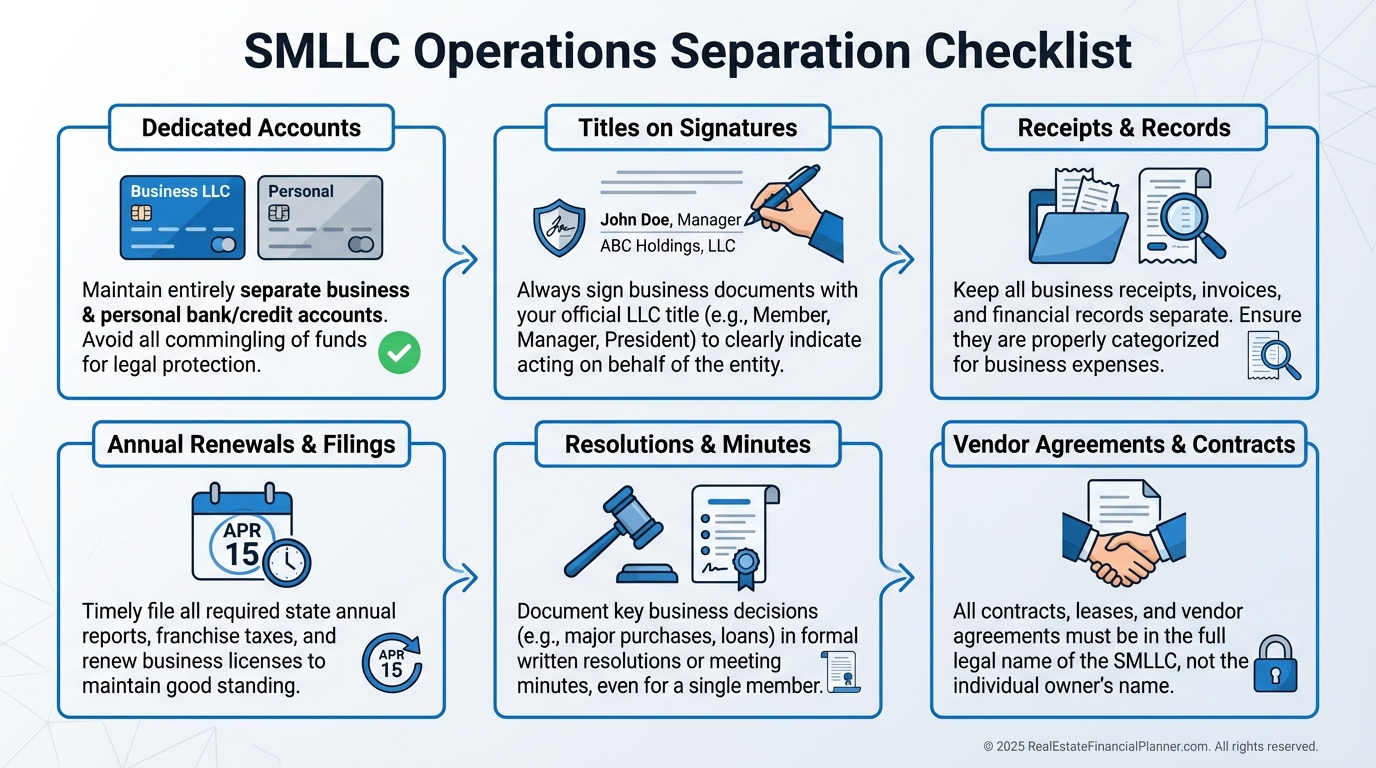

Operating Discipline That Preserves the Veil

Courts look at behavior, not brochures.

I never commingle funds, and I sign as “Member” or “Manager,” not personally.

Each property has its own chart of accounts and receipts.

I keep annual renewals, minutes of major decisions, and vendor agreements in an entity vault.

If you ever need the shield, you want a clean file, not excuses.

Insurance Layering: LLCs Don’t Replace Policies

I buy robust landlord policies for each door.

I also carry an umbrella that names the LLCs and aligns limits with my risk.

Insurance handles defense and settlement.

LLCs limit the blast radius.

Both matter.

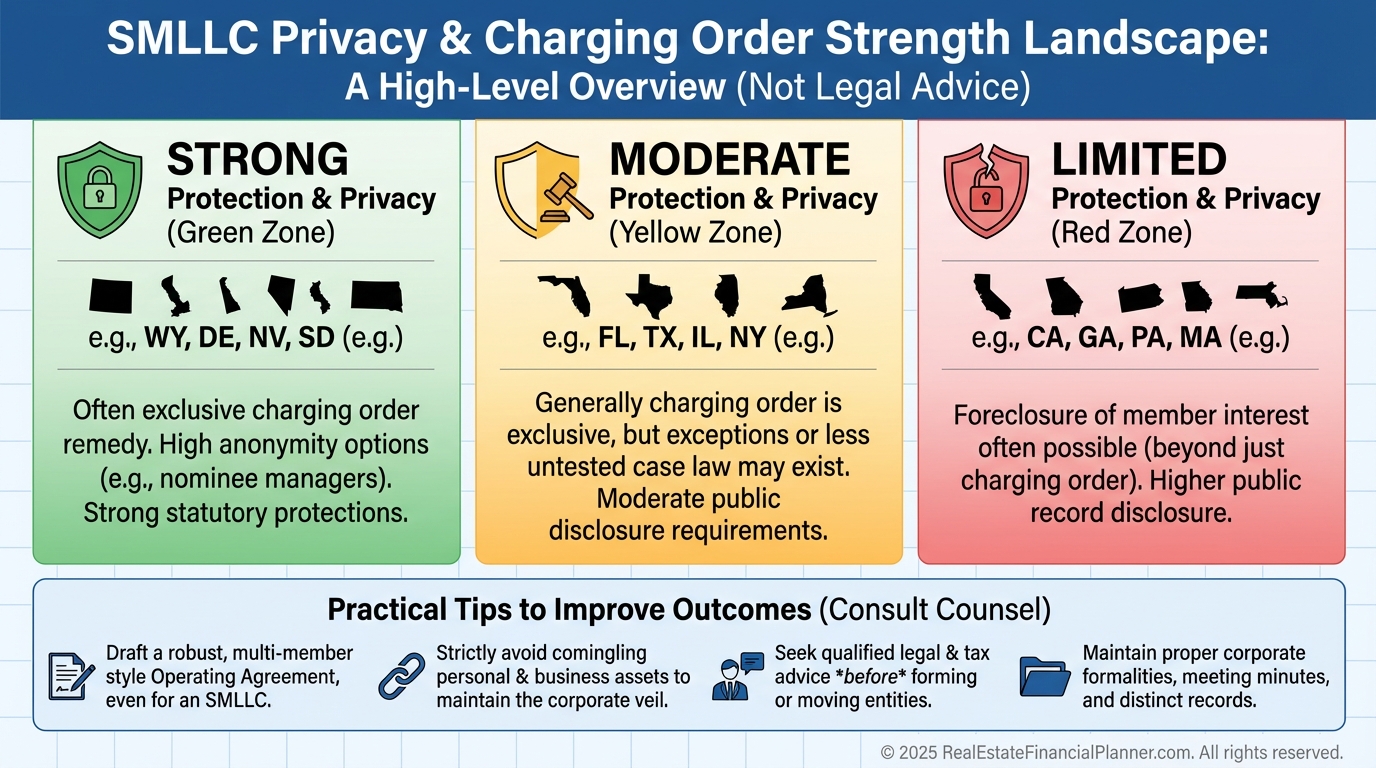

Privacy, Charging Orders, and Real-World Risk

Some states provide stronger charging order protection for single-member LLCs than others.

If privacy and protection are priorities, I evaluate whether a holding company in a stronger state adds value.

Even then, I assume discovery can connect dots, so I behave like everything could be seen.

It keeps my paperwork tight.

Financing, Title, and the Due-on-Sale Question

Most conventional lenders want you to close in your personal name.

Performing loans are rarely called, yet risk isn’t zero.

If we move title, I coordinate with the lender, title counsel, and insurance so coverage, signatures, and notices are correct.

Trusts can add privacy, but they don’t erase lender rights.

Scaling With Multiple Properties

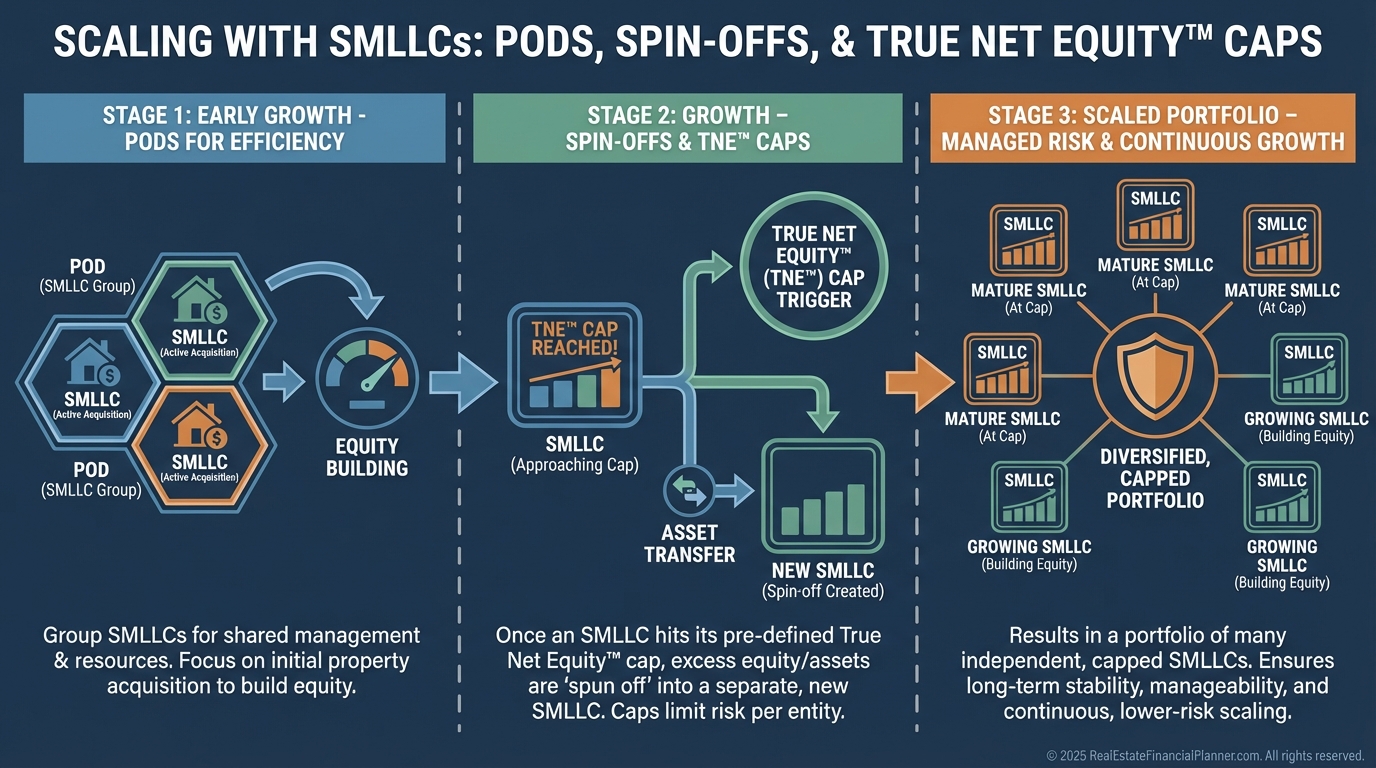

When clients grow, I right-size the risk per entity using True Net Equity™.

If one LLC holds too much equity, I split assets or redirect paydown to other loans to balance exposure.

For fast acquisition phases, a “pod” LLC can hold several lower-equity doors until seasoning.

Then we spin off properties into their own LLCs when equity grows.

The World’s Greatest Real Estate Deal Analysis Spreadsheet™ tracks returns at the property and entity levels so we don’t scale blind.

Common Mistakes I See (And Fix)

Commingling funds or “borrowing” from the LLC for personal items.

Operating without an actual operating agreement and resolutions.

Underinsuring properties because “I have an LLC.”

Electing S-Corp for rentals without modeling the impact.

Ignoring local rental licenses, which hands plaintiffs easy wins.

Letting one LLC quietly accumulate too much equity because the portfolio grew faster than your structure.

A 7‑Day Action Plan

Day 1: Decide your state and risk tolerance per entity.

Day 2: File Articles and appoint a reliable registered agent.

Day 3: Get your EIN and draft a robust operating agreement.

Day 4: Open the bank account and set your accounting file.

Day 5: Update insurance and add the LLC as named insured.

Day 6: Build your entity vault and adopt signing conventions.

Day 7: Load your properties into The World’s Greatest Real Estate Deal Analysis Spreadsheet™, review Return Quadrants™, and set True Net Equity™ caps per LLC.

That one meeting can prevent the three costliest mistakes I see every year.