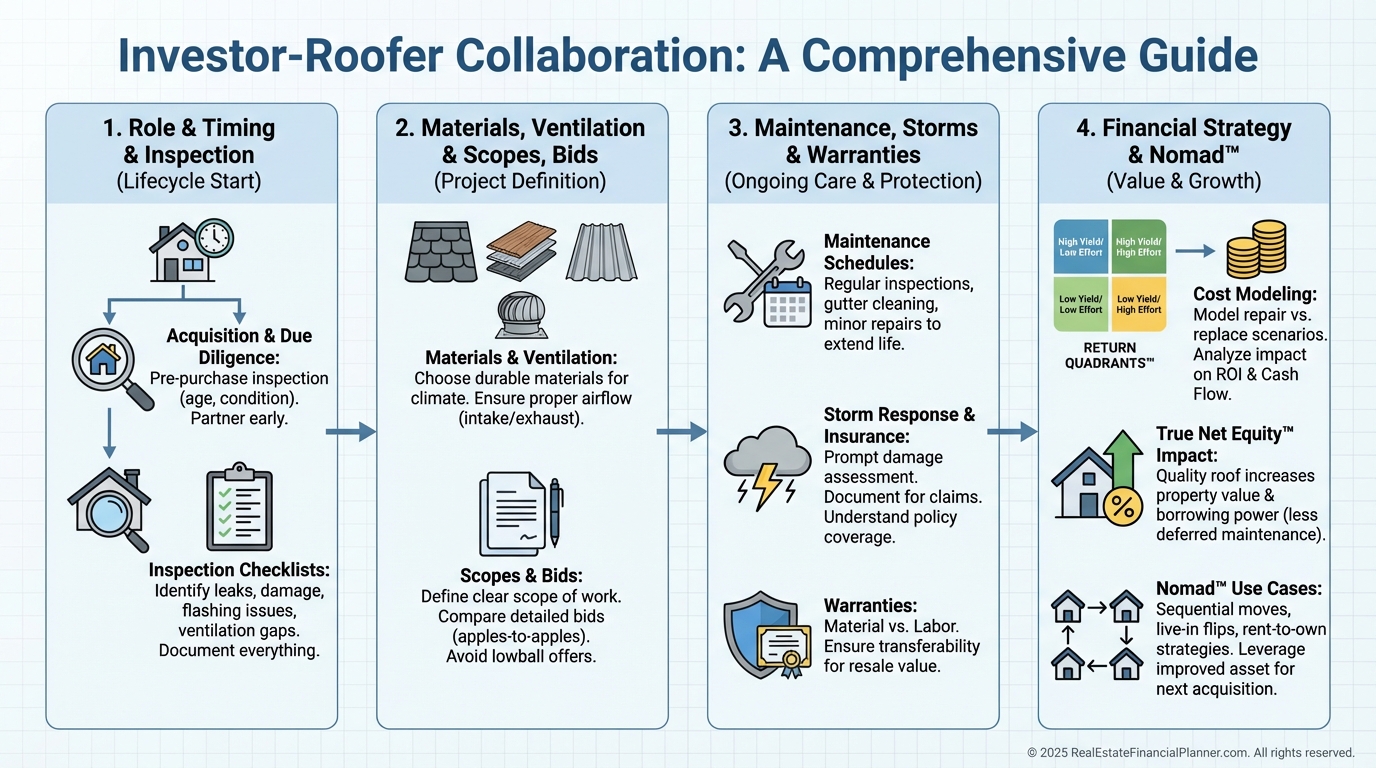

Roofer Playbook for Real Estate Investors: Timing, Scopes, and ROI You Can Trust

Learn about Roofer for real estate investing.

Why a Roofer Belongs on Your Investing Team

When I help clients underwrite deals, I treat the roof like a binary risk: either it’s a non-issue, or it can quietly sink the deal.

A wet roof hides mold, damages framing, and can trigger insurance claims you’d rather avoid.

What a Roofer Actually Does for Your Portfolio

Roofers install, repair, and maintain the first line of defense for your property.

They also inspect, document, and estimate remedies so you can negotiate, budget, and schedule work with confidence.

Expect them to manage installation details like underlayment, flashing, ventilation, and code compliance.

On the operations side, I have them set a maintenance cadence, handle storm assessments, and provide fast-turn emergency response.

When to Involve a Roofer

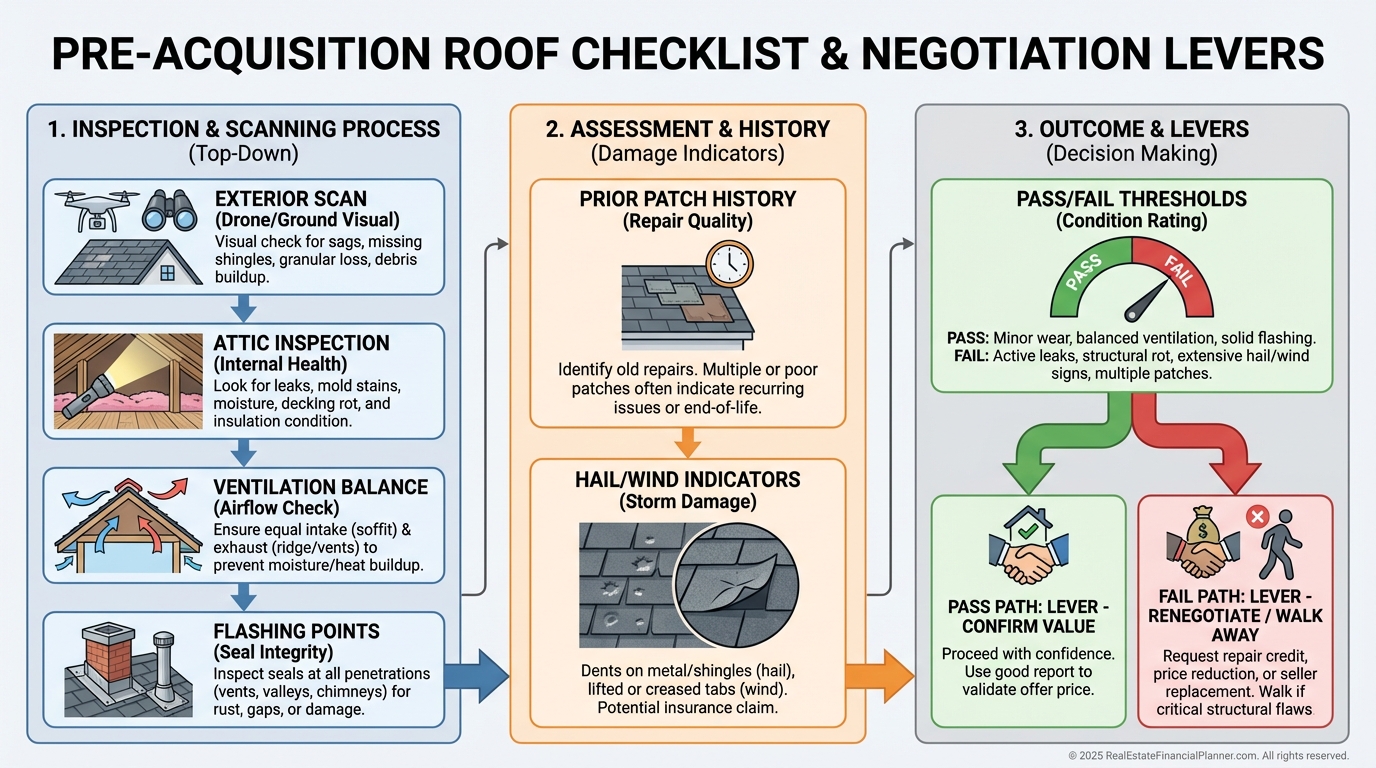

Before you buy, get a roofer to inspect, estimate remaining life, and quote any immediate repairs.

During tenant turnover, schedule preventative maintenance and small fixes, because empty houses make work cleaner and faster.

After hail, wind, ice, or extreme heat waves, order a post-event inspection with photos and a written report.

When your insurance renewal is due, use a roofer’s documentation to validate condition and reduce surprises.

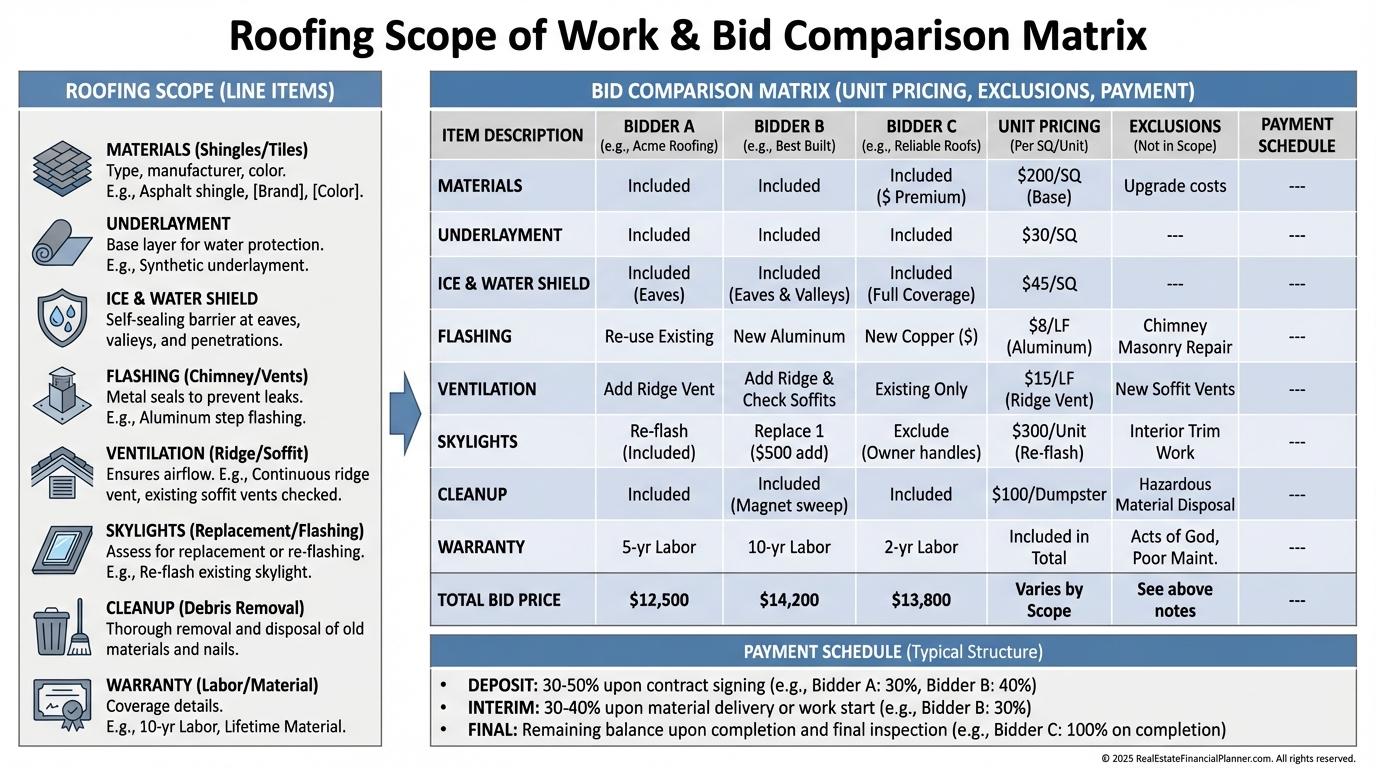

How I Scope, Bid, and Verify Roofing Work

I standardize scopes so bids are apples-to-apples: materials, underlayment type, ice-and-water shield, drip edge, flashing, ventilation, skylights, and disposal.

I require permits, manufacturer-certified crews, insurance certificates with workers’ comp, and lien waivers upon payment.

When I rebuilt after bankruptcy, vague scopes cost me time and capital.

Now I walk every roof with the foreman, check attic ventilation and baffles, and verify flashing details before the first shingle is torn off.

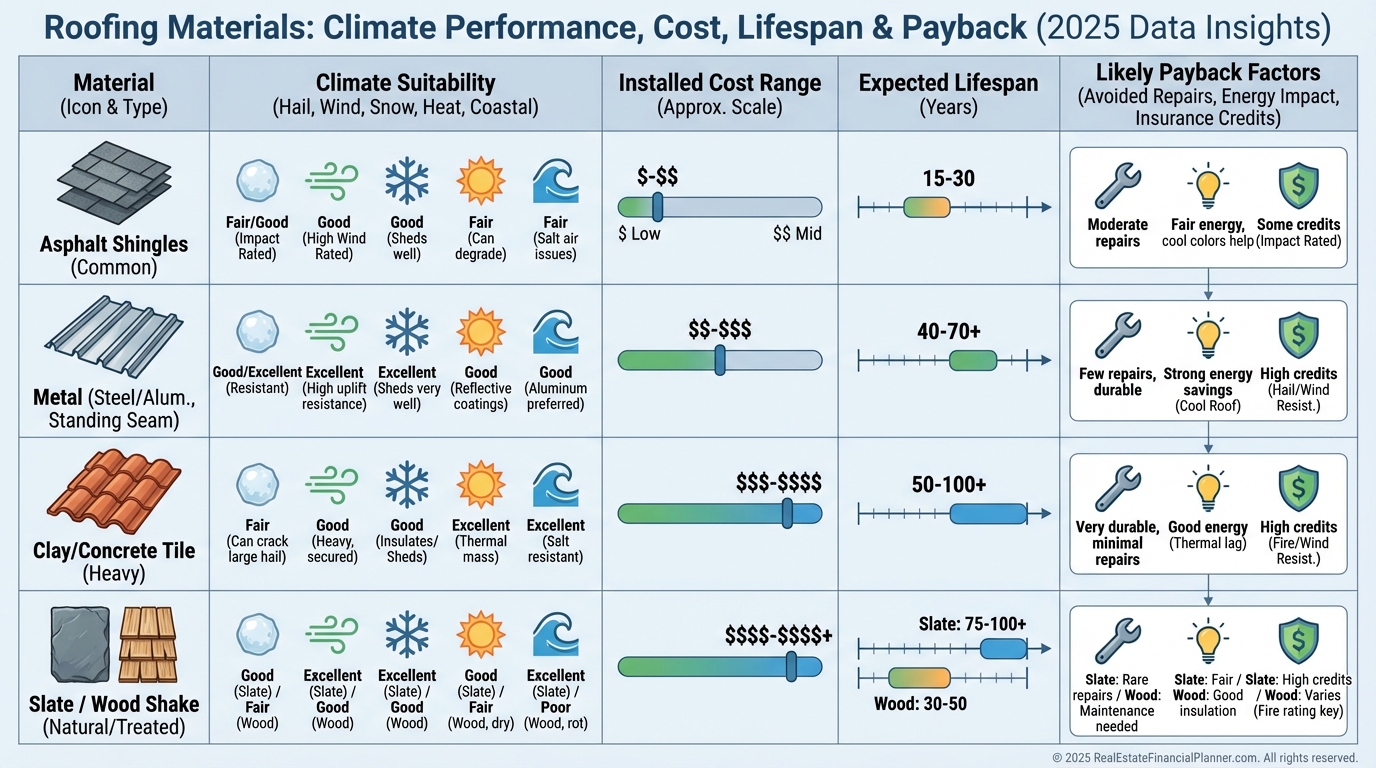

Materials, Ventilation, and Building Science Basics

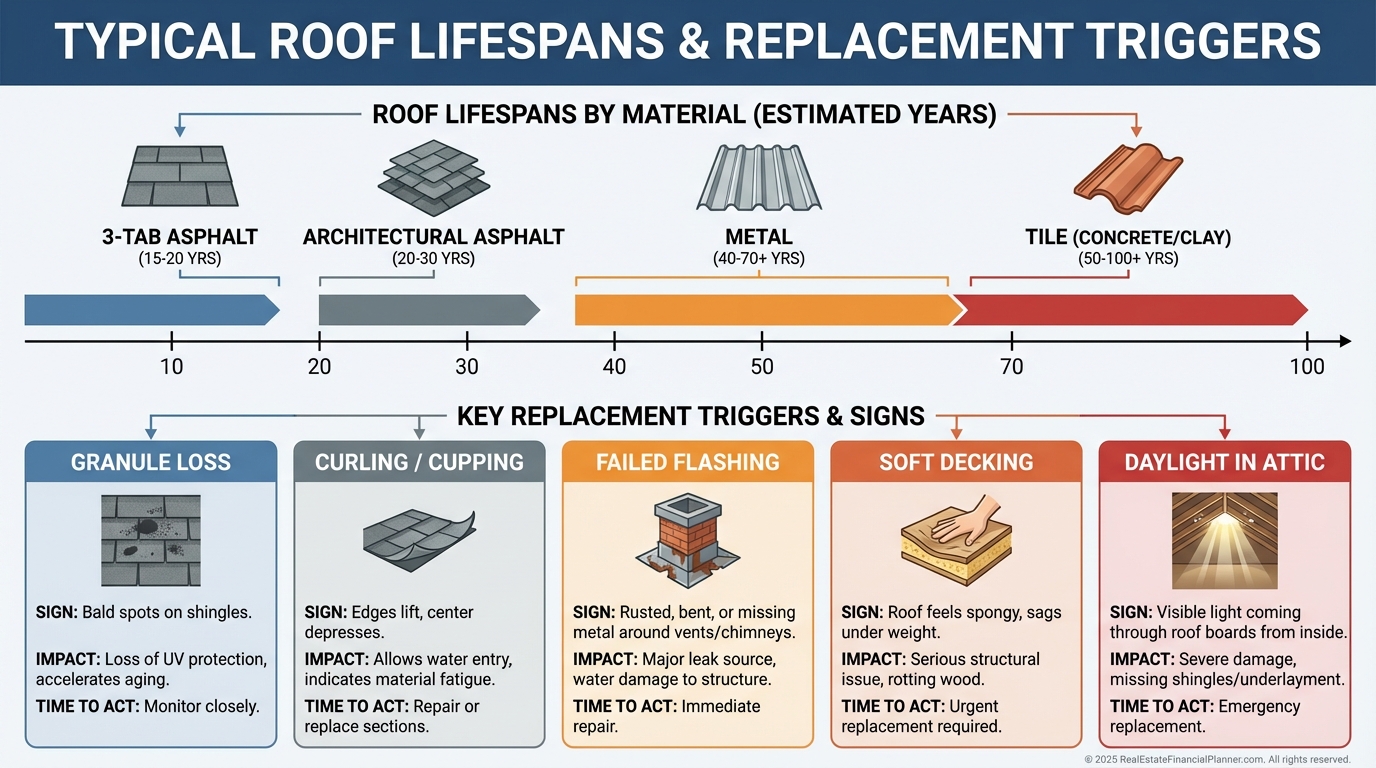

Material choice is climate, budget, and hold-period driven.

Architectural shingles are a solid default; metal or tile may pencil when wind, fire, or longevity matters.

Ventilation is not optional.

Balanced intake and exhaust reduce attic heat, prevent ice dams, and extend shingle life.

Flashings fail more often than shingles.

I require new step flashing at walls, chimney crickets where needed, and sealed penetrations with boots or collars—not caulk only.

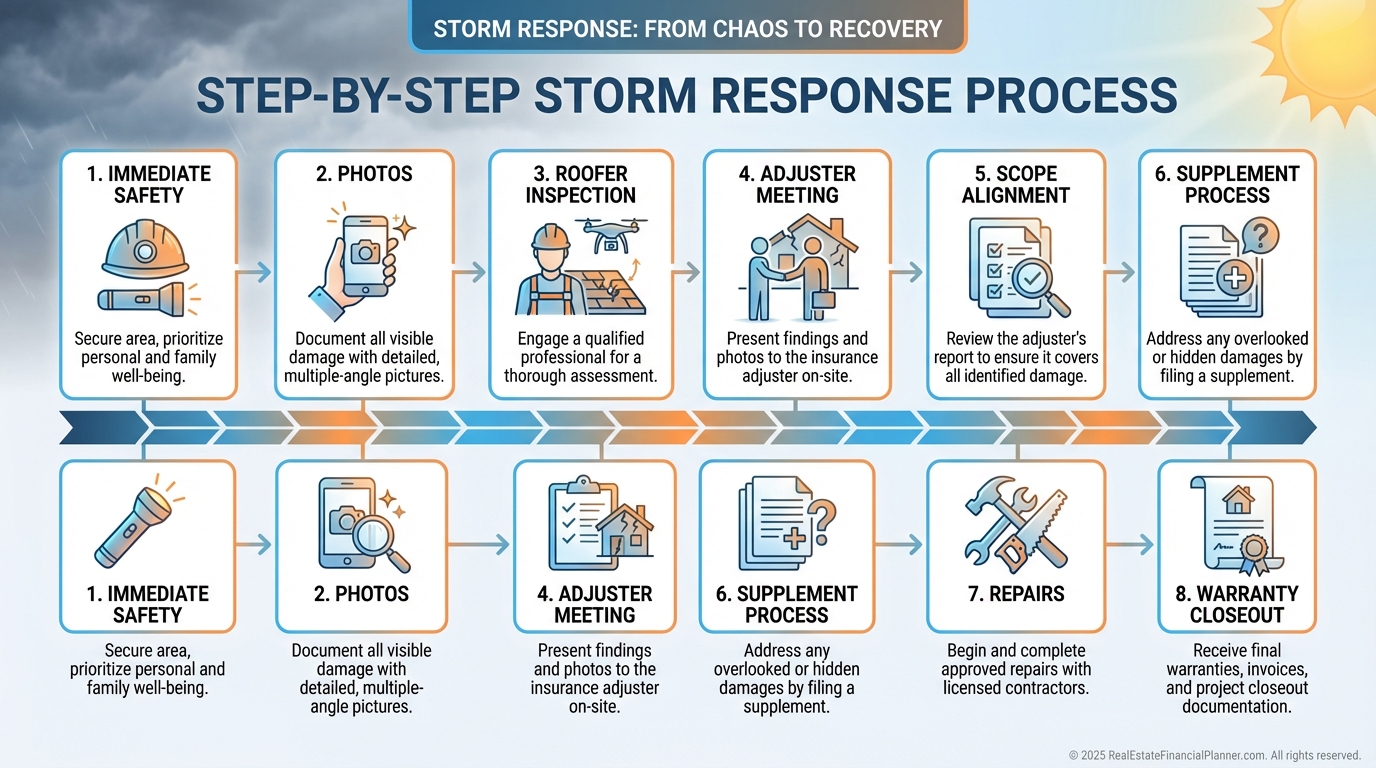

Insurance, Storms, and Emergency Protocols

In storm zones, I coach clients to pre-negotiate emergency tarp rates and response times.

We also map deductible strategy, documentation standards, and vendor priority.

A roofer’s photo set and slope-by-slope notes are often the difference between a denied and an approved claim.

I avoid contingency agreements that tie you to a roofer before the adjuster visit, unless the terms are investor-friendly.

Modeling the Financial Impact

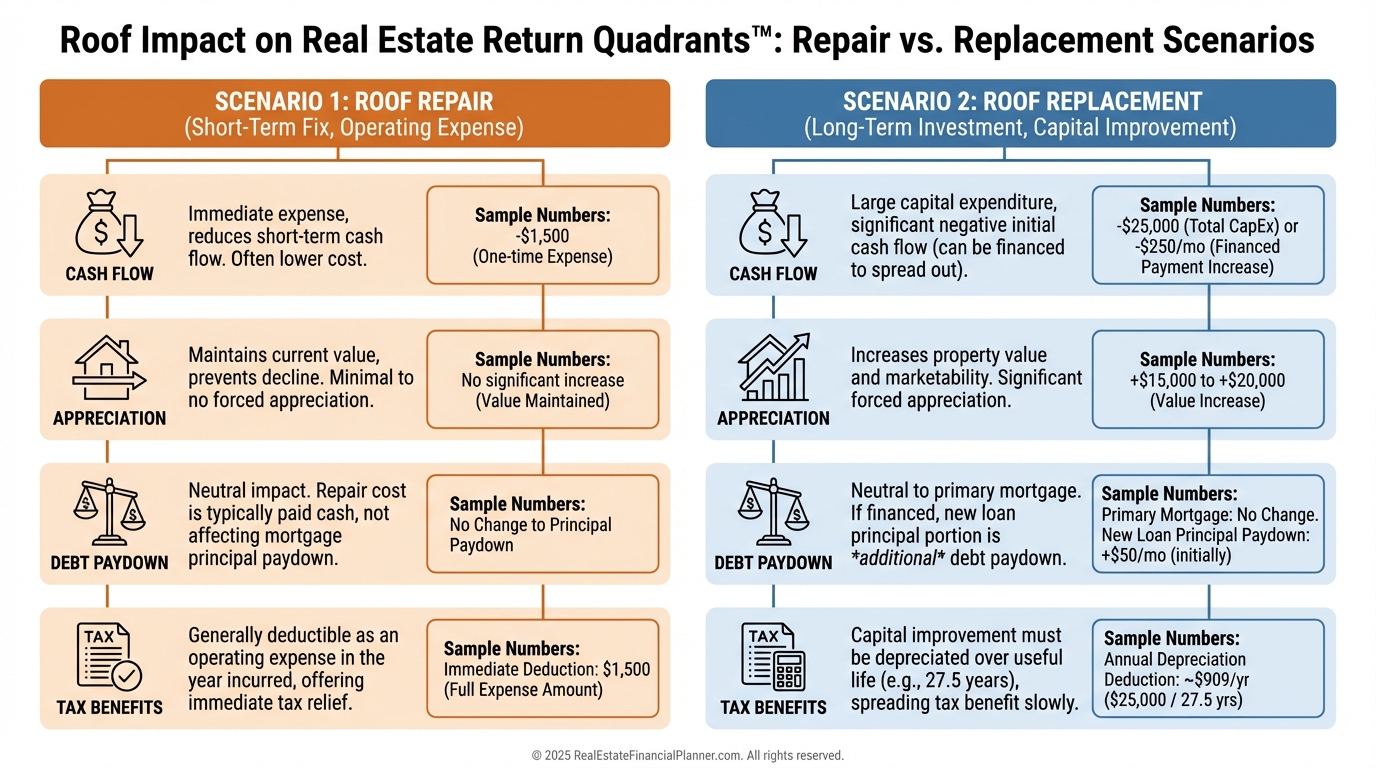

Roof decisions show up in the Return Quadrants™.

Repairs hit cash flow today; replacements are capitalized and depreciated over 27.5 years for residential rentals.

Your lender doesn’t care if the shingles look new when underwriting cash flow, but the appraiser and buyer do when you exit.

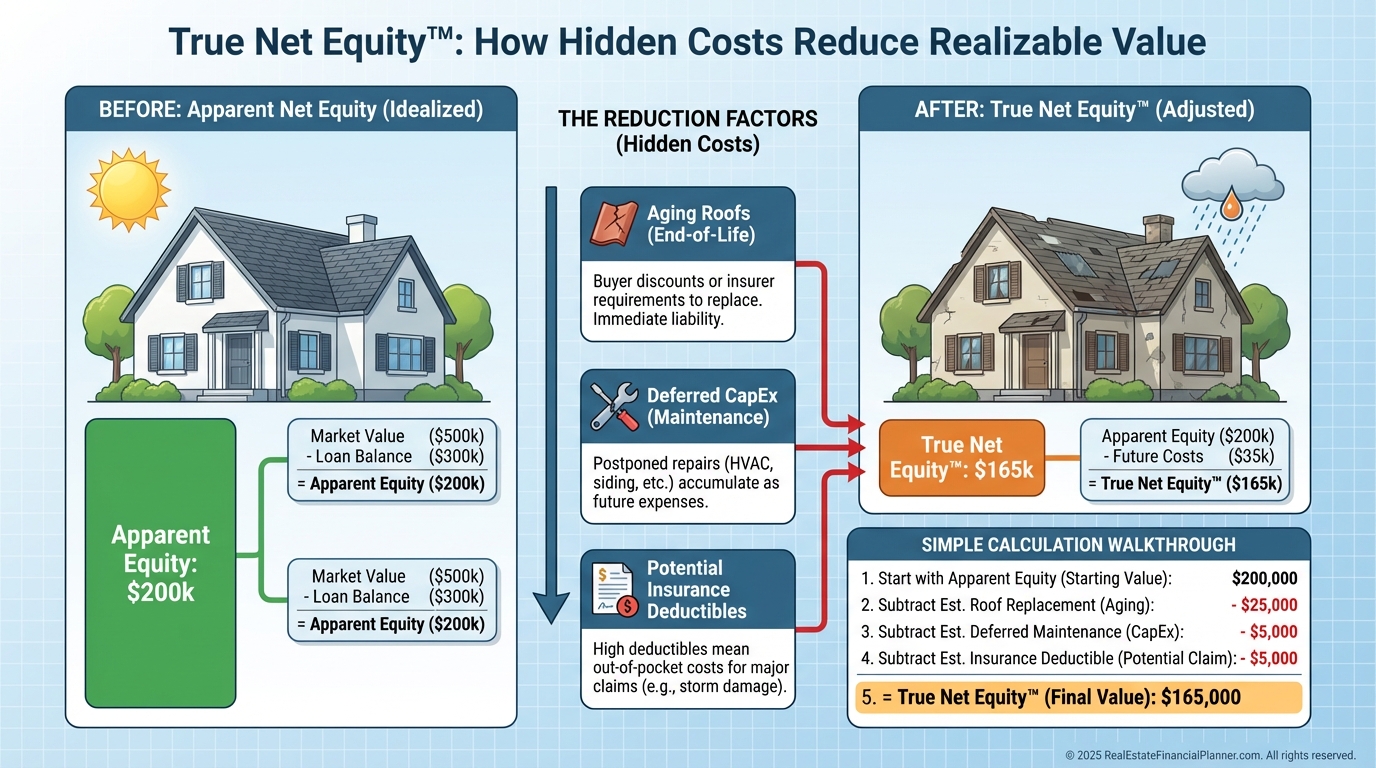

That’s why I adjust True Net Equity™ by subtracting deferred roof CapEx and a risk discount for age and condition.

A simple reserve formula works: monthly reserve = (replacement cost – expected insurance + known soft costs) ÷ remaining months of useful life.

If the roof likely fails in 36 months, I start reserving today and pressure test DSCR with the reserve included.

Due Diligence Before You Buy

I never trust listing photos for roof condition.

I check attic decking for softness, look for daylight at penetrations, and scan ceilings for new paint that hides stains.

I ask the roofer for estimated remaining life, repair-now items, and a replacement quote with material options.

If repairs exceed my tolerance, I renegotiate, escrow funds, or pass.

Systems, Maintenance, and Vendor Management

I schedule a quick visual check at each seasonal service visit and a full inspection every 24–36 months.

Gutter cleaning, sealing minor penetrations, and fastening loose drip edge are cheap insurance.

For vendors, I verify license, insurance, manufacturer status, references, and a clean lien history.

I pay milestones only after a clean deck inspection, mid-job flashings verified, and final punch complete with photos.

Warranties, Permits, and Code

I require permits when local code demands it, and I want manufacturer installation guidelines followed, not just “industry standard.”

Workmanship warranties should be in writing and transferable when possible.

Manufacturer warranties vary wildly and are often voided by poor ventilation or improper flashing, so I verify those details on site.

If there’s a chimney, I ask for a cricket drawing in the scope.

Nomad™ and Live-In Strategies

Nomad™ investors should fix marginal roofs before moving out to minimize turnover days when converting to rental.

When buying as an owner-occupant, I ask sellers for roof disclosures, photos, and any transferable warranties, then schedule my roofer during inspection.

These small steps cut surprises when you refinance or lease.

They also make your insurance carrier happier when you switch from owner-occupant to landlord policy.

Mistakes to Avoid

Don’t accept caulk-only repairs where flashing is required.

Don’t skip attic checks; most roofing problems reveal themselves from the inside first.

Avoid paying in full before lien waivers and final inspection photos.

Don’t forget HOA approvals and color restrictions that can delay scheduling.

Next Actions for Investors

Build your roofer bench now, not after the storm.

Create a standard scope, inspection checklist, and photo documentation policy.

Model reserves with realistic replacement timing so your cash flow and True Net Equity™ reflect reality.

And schedule your first preventative inspection this quarter, even if everything looks fine from the curb.