Reserves: The Investor’s Safety Net—How Many Months You Need, Where to Park Them, and How to Deploy Them Wisely

Learn about Reserves for real estate investing.

Why Reserves Decide Who Survives

When I help clients stress test a portfolio, reserves are the lever that decides whether they sail through storms or sell at a loss.

They are not optional, and they are not for “unexpected” stuff; they fund the normal, inevitable lumpy costs of owning rentals.

It’s a recurring feature of the business.

Reserves buy you time, and time usually buys you better outcomes.

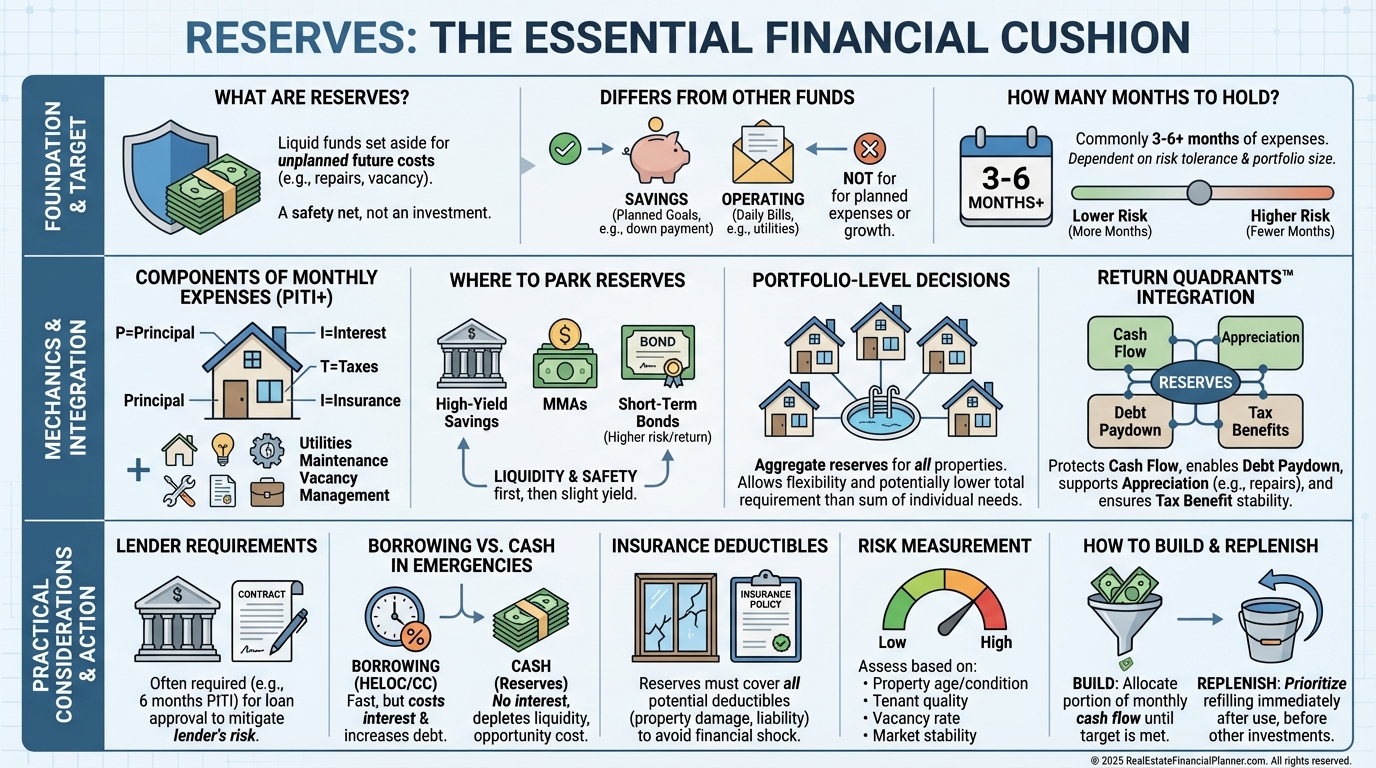

What Reserves Are (And What They Are Not)

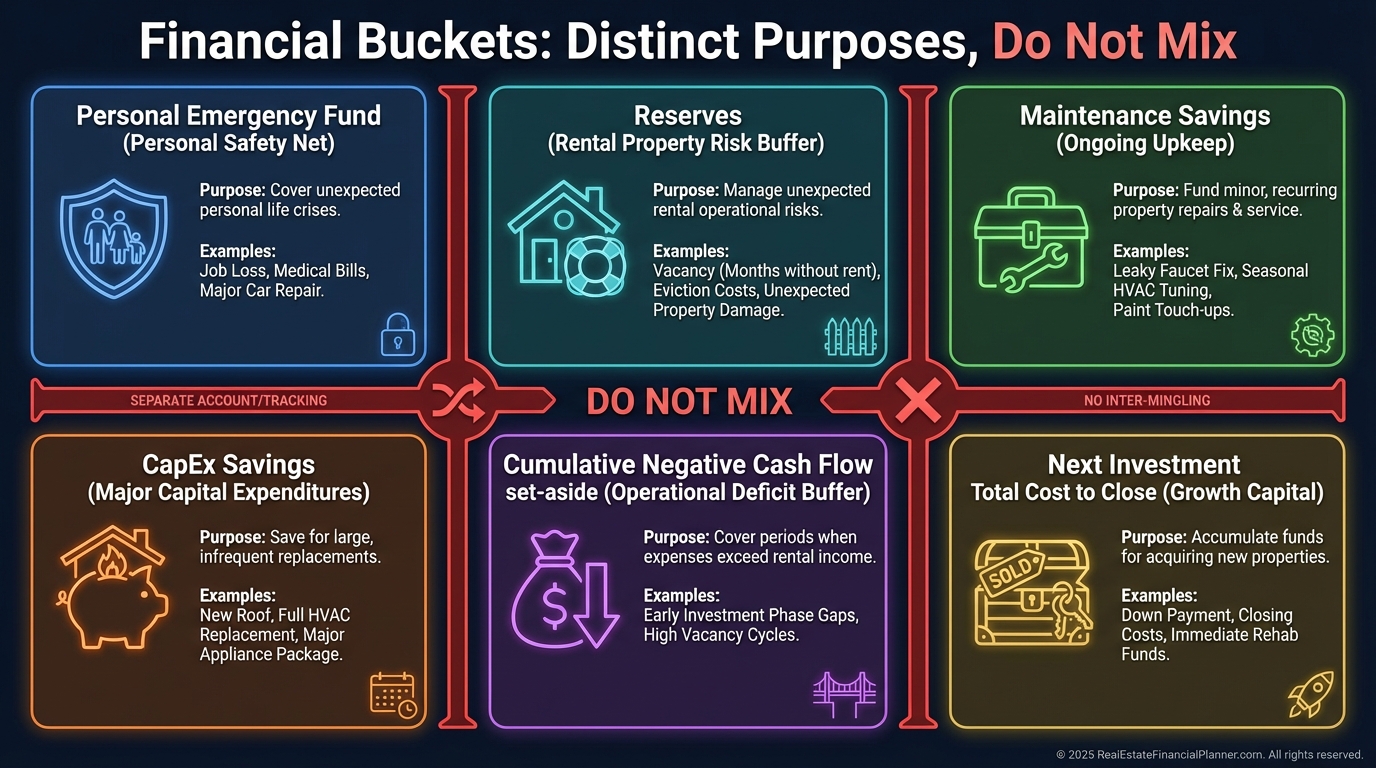

Reserves are liquid funds set aside to cover irregular but inevitable shortfalls and repairs.

They protect your mortgage, your asset, and your sleep.

They are not your CapEx plan, not your routine maintenance budget, not personal emergency money, and not your next-down-payment pile.

They sit quietly until you need them, then they work fast.

How Much to Hold: Months, Not Dollars

Flat dollar rules like “$10,000 per door” fail because properties vary wildly.

Months-of-reserves scale with reality.

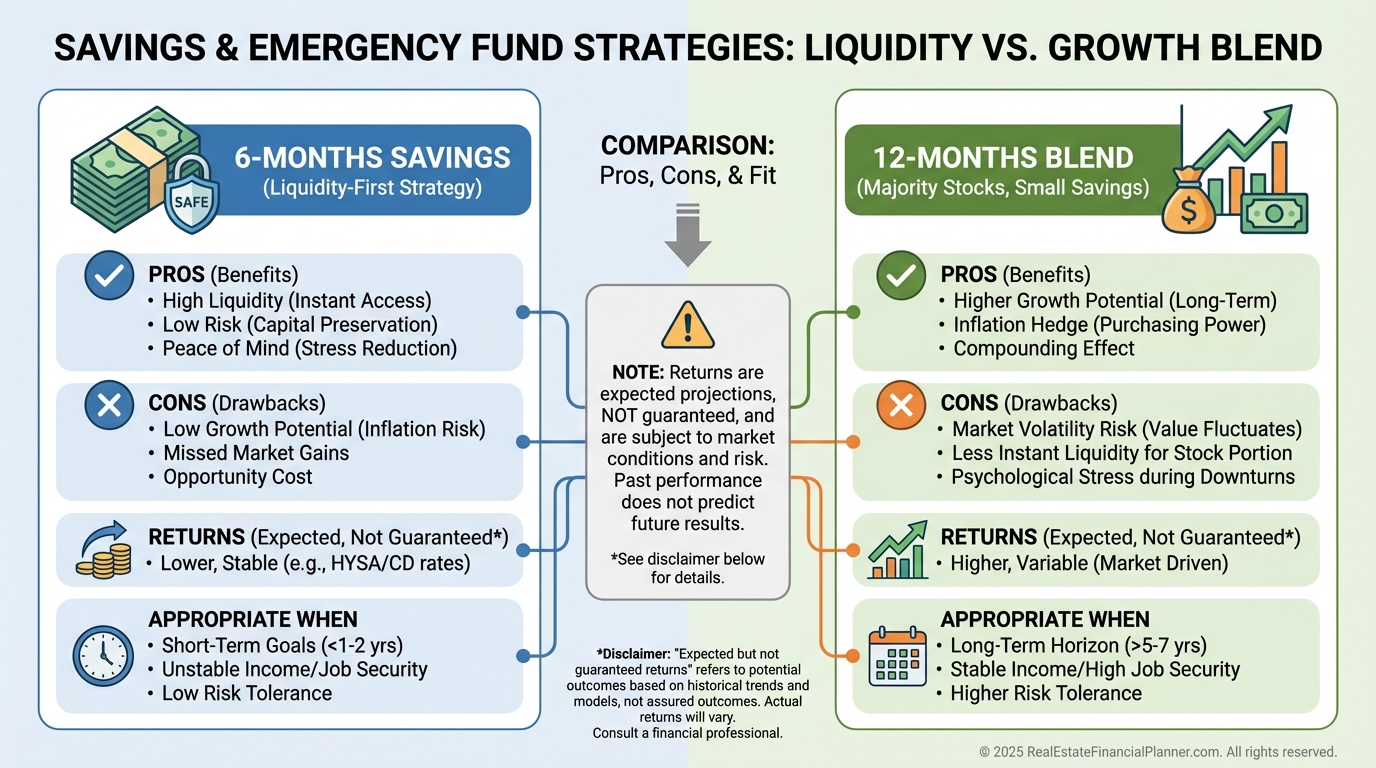

For clients, I model two conservative defaults.

Six months held in a high-yield savings account for maximum liquidity.

Or twelve months where most sits in a diversified stock index and the rest stays in savings to bridge volatility.

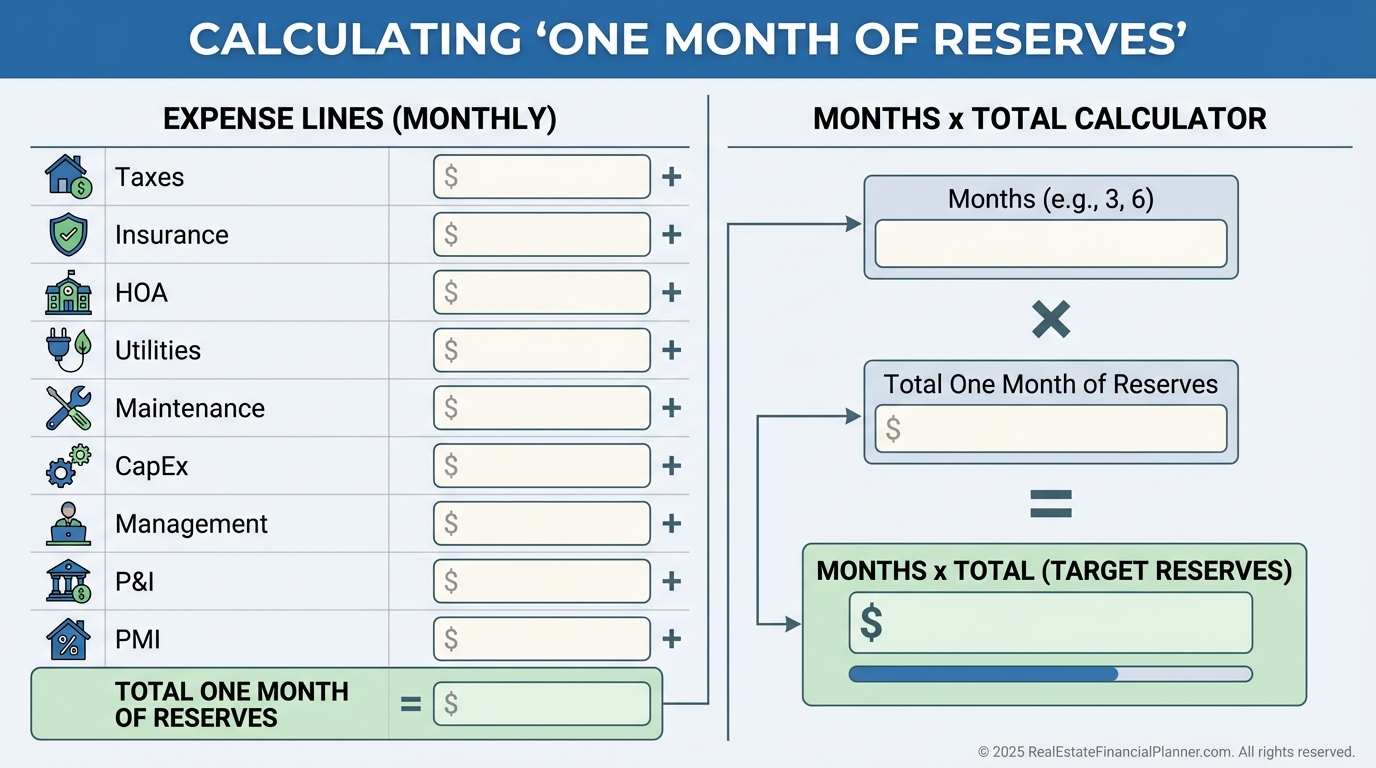

What Goes Into Your Monthly Reserve Number

When I calculate “one month” for a property, I include every dollar you must cover even if the unit is empty or underperforming.

I want the number that keeps you whole while you fix the problem.

Include property taxes, insurance, HOA, landlord-paid utilities, maintenance and CapEx set-asides, property management, total principal and interest, and PMI if applicable.

Your reserve months multiply against this total.

Where to Park Reserves (And Why It Matters)

Liquidity beats yield for the first line of defense.

That’s why I keep six months in savings for clients who prefer simplicity and certainty.

For clients comfortable with market swings, we model twelve months where the majority sits in broadly diversified stocks, recognizing volatility is the price of potentially higher returns.

The bigger buffer offsets drawdown risk if you must sell during a dip.

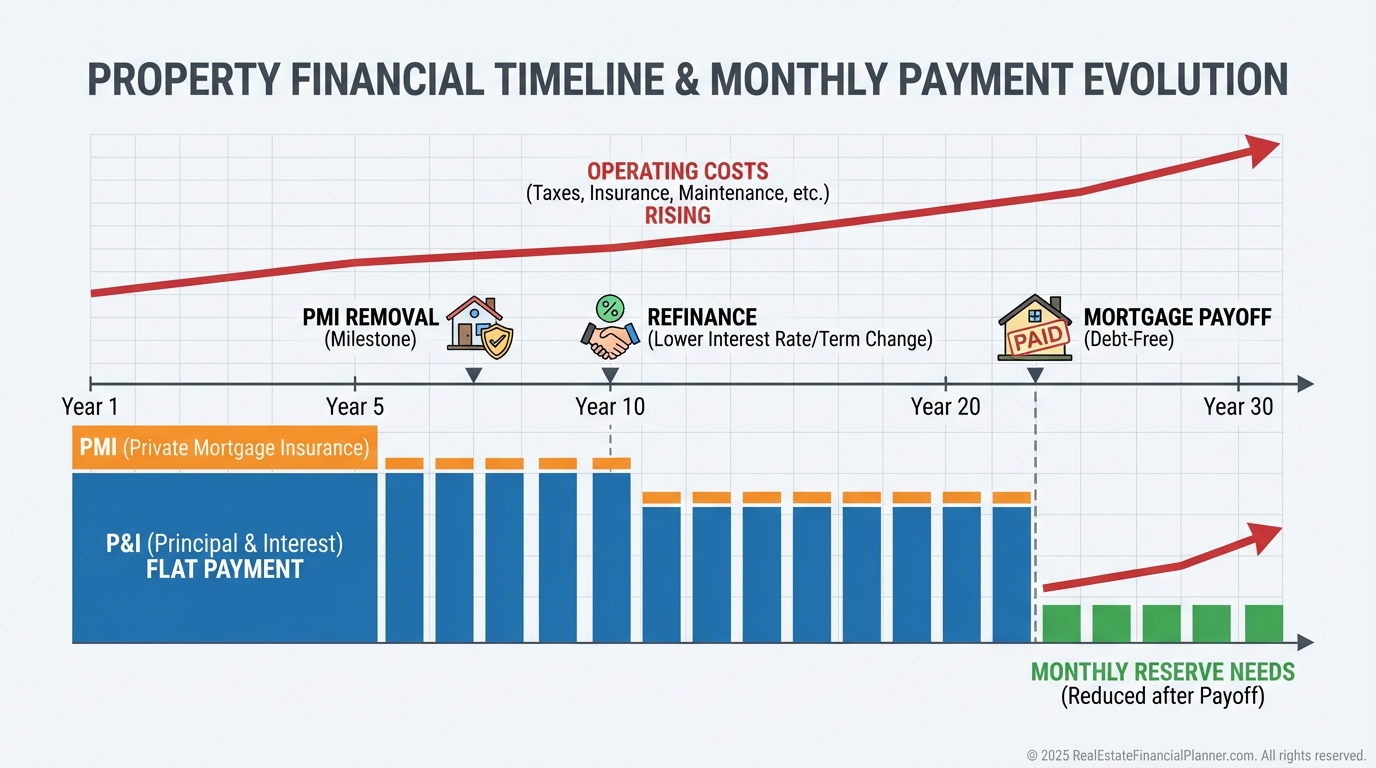

Reserves Are Not Static—They Drift Over Time

One month of reserves tends to grow because operating expenses inflate.

Your P&I payment is fixed until payoff, so your reserve per month often climbs gradually and then drops when the loan and PMI disappear.

If you refi and payment rises, your reserve target rises too.

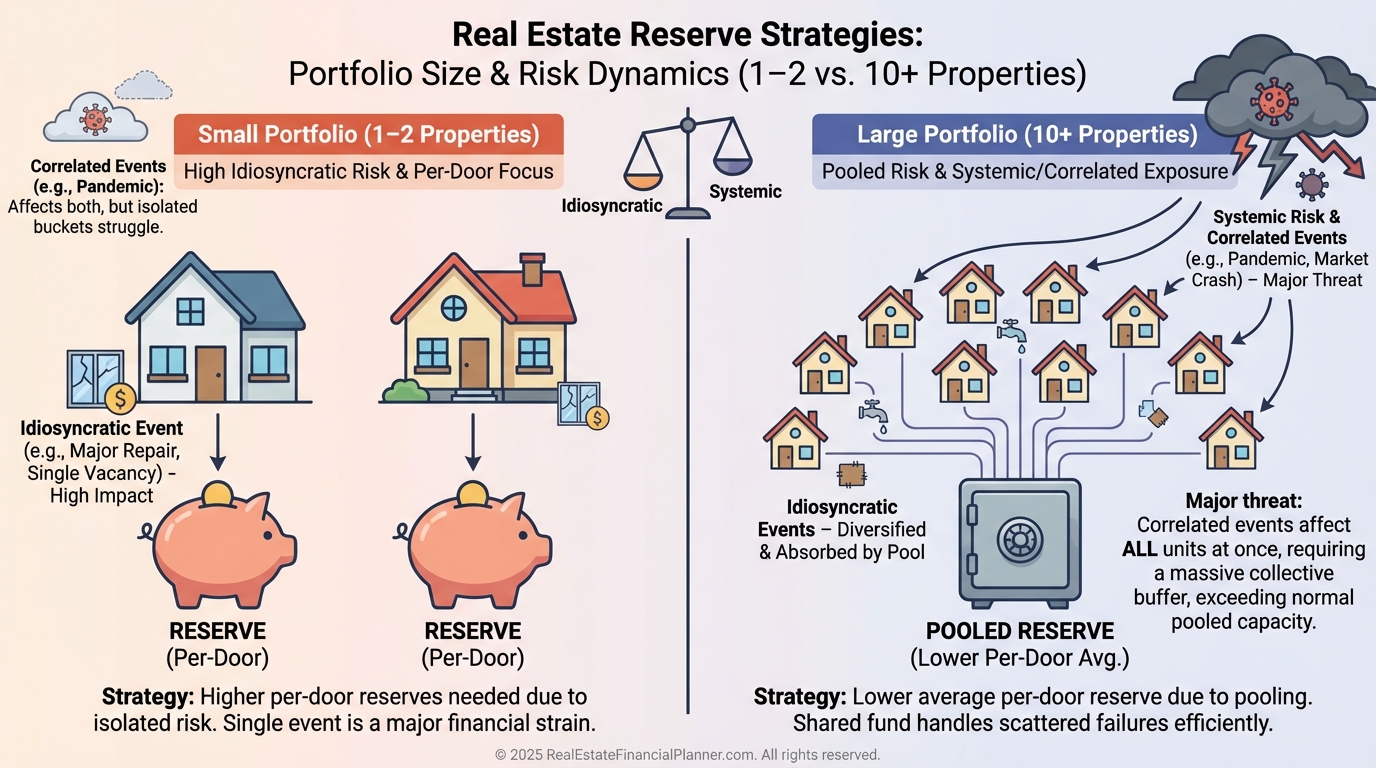

Multiple Properties: Do You Need Full Reserves on Every Door?

Early on, yes.

On door one and two, full reserves are non-negotiable.

As a portfolio grows, some investors argue you can hold less per door because not all units blow up at once.

That’s true in normal times, but systemic shocks hit everything together.

COVID was a masterclass in correlation.

When I model portfolio risk, I assume correlated stress so clients aren’t surprised by reality.

My guidance is conservative: aim for full reserves per property, even if you deploy part of the twelve months in diversified assets.

Building and Replenishing Your Reserve Fund

Fund reserves at purchase.

If you can’t, you aren’t ready to own the property.

Increase reserves over time using positive cash flow, because operating costs inflate even when your payment does not.

If you dip into reserves, pause spending cash flow until you refill the bucket.

When I coach Nomad™ investors moving annually into the next house, we treat owner-occupant reserves and rental reserves separately.

The move only happens after both are fully funded.

Reserves are asset protection.

They prevent panic sales, predatory loans, and desperate decisions.

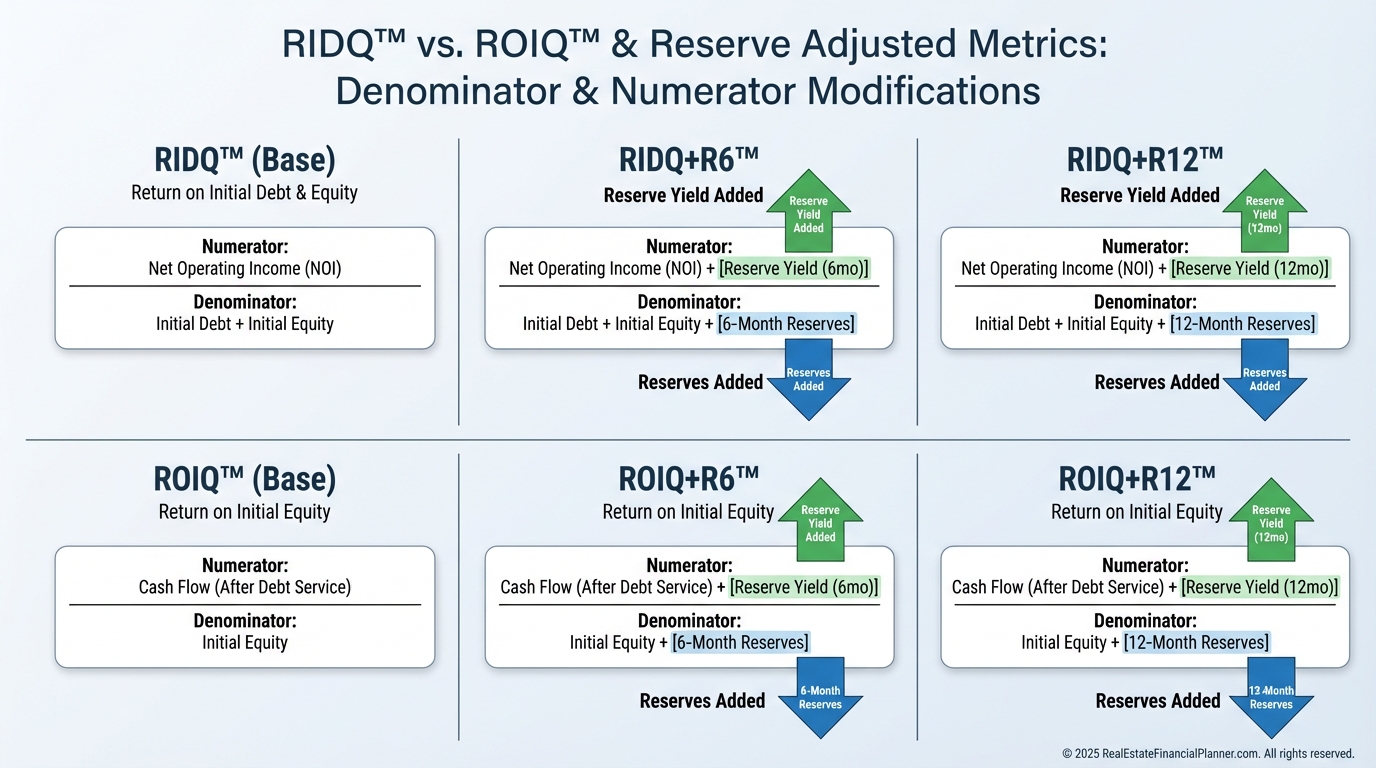

Reserves Inside Return Quadrants™

Most spreadsheets ignore reserves, which inflates ROI.

That’s wrong.

In The World’s Greatest Real Estate Deal Analysis Spreadsheet™, we include reserves in your cost basis and add the return on those reserves to your numerator.

That’s why you’ll see RIDQ+R6™, RIDQ+R12™, ROIQ+R6™, and ROIQ+R12™.

You get truer math, not prettier numbers.

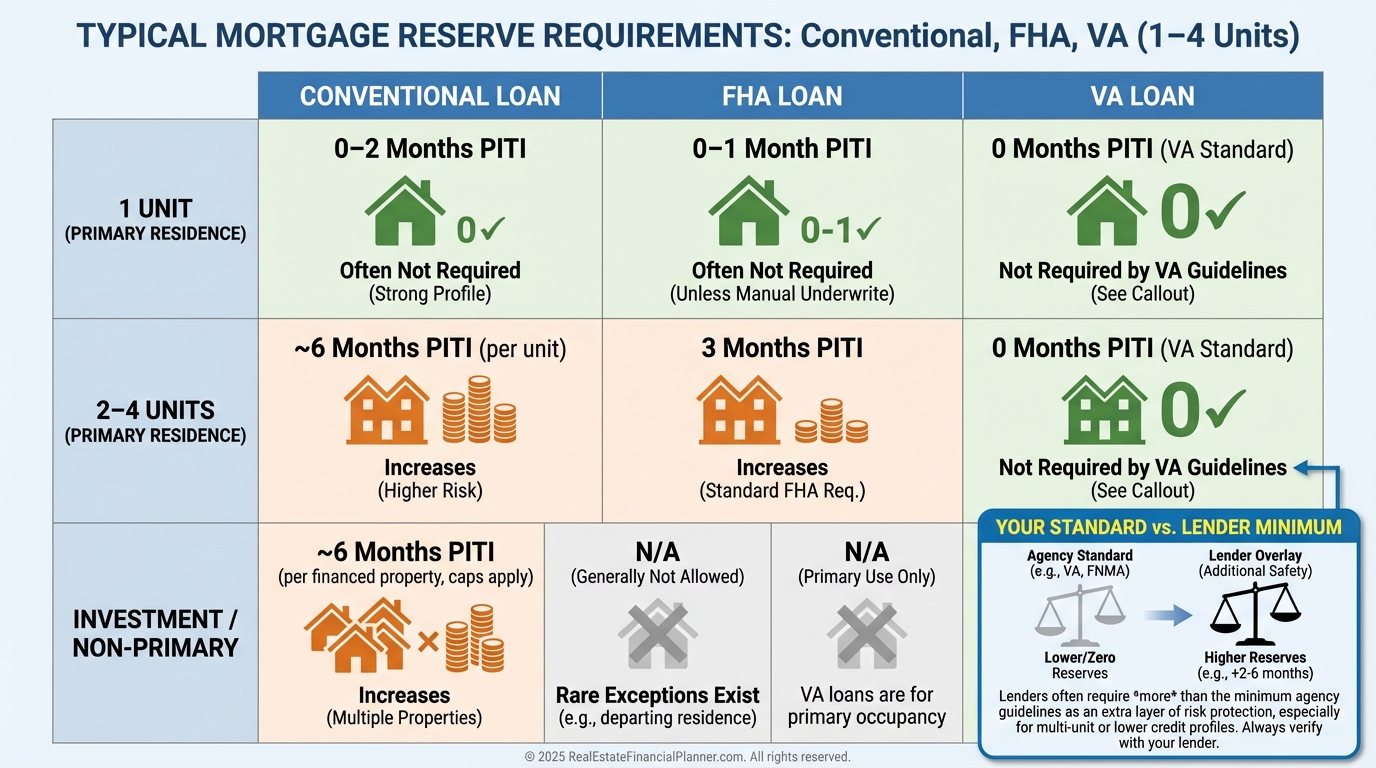

What Lenders Require (And Why You Should Do More)

Lenders typically want 2–6 months of PITI in reserves for investment properties.

Conventional tightens with risk, FHA wants three months on 3–4 units, and VA expects six months when using rents on 3–4 units and often three months for any other rentals you own.

Treat these as the floor, not the goal.

I advise six months in savings or twelve months blended, regardless of the lender’s minimum.

Borrowing in Emergencies vs. Using Cash Reserves

Some investors plan to use a HELOC, credit cards, or margin instead of holding cash.

That works until it doesn’t.

Credit lines get cut during downturns, card limits shrink, and borrowing adds interest when you’re already stressed.

When I model “credit-only” strategies against a simple 6–12 month reserve policy, the reserve strategy wins on survivability.

Your long-term ROI improves when you stay in the game.

Reserves for Insurance Deductibles

Big claims still start with your deductible.

If fire damage triggers a $5,000 deductible, that cash must be ready on day one.

Repairs may be covered, but the mortgage still drafts every month while you rebuild.

Match your reserves to your highest relevant deductible across fire, hail, hurricane percentage deductibles, and flood if applicable, plus months of no-rent survivability.

Measuring Risk With Reserves

Then I overlay Months of Reserves per door and in aggregate.

It’s the simplest “how long can I last?” metric you’ll ever use.

If your property burns $2,500 per month all-in and you have $15,000 liquid, you have six months.

That number decides which investor thrives when the music stops.

And remember, True Net Equity™ is wealth but not liquidity.

Reserves are liquidity.

Both matter, but only one pays the mortgage tomorrow.

Action Steps You Can Do Today

Calculate one month of reserves for each property using the component list.

Set a policy: 6 months in savings or 12 months blended.

Fund reserves at acquisition and route a portion of cash flow to inflation-adjust as costs rise.

Model your deals with ROIQ+R6™ or ROIQ+R12™ so you aren’t lying to yourself with rosy math.

Audit insurance deductibles and match your cash.

If you spend reserves, pause distributions until they’re refilled.