Partner Smarter in Real Estate: Roles, Risks, Returns, and Repeatable Deal Flow

Learn about Partner for real estate investing.

Why Partnering Works Across Strategies

When I help clients design their portfolio, I remind them that almost any strategy can use a partner.

Long-term rentals, short-term rentals, BRRRR, fix and flips, small multis, apartments, mixed use, Nomad™, and house hacking all work with partners.

You can run any lease duration—nightly, monthly, or annual—and any property type from single-family to 5+ unit commercial.

The strategy dictates the skills needed, the tempo of cash flow, and how we structure the partnership.

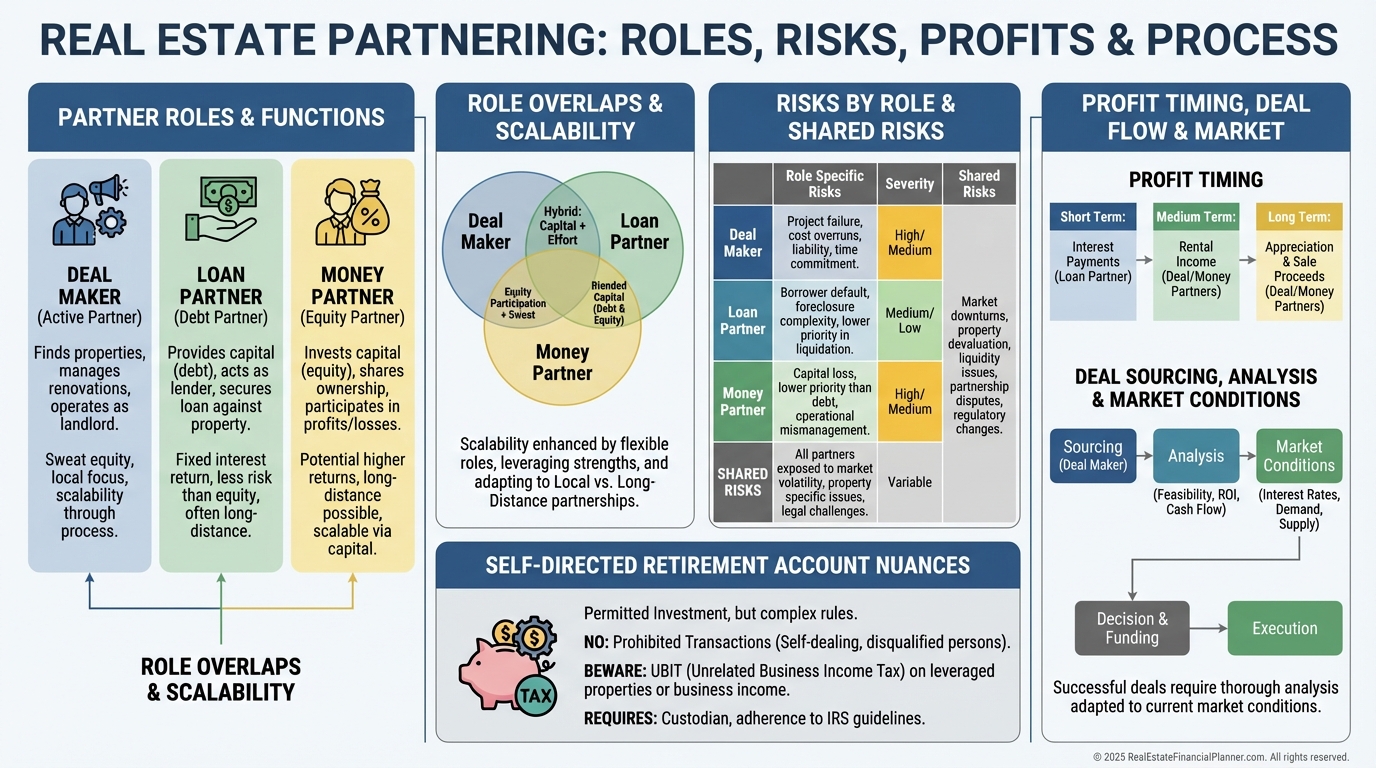

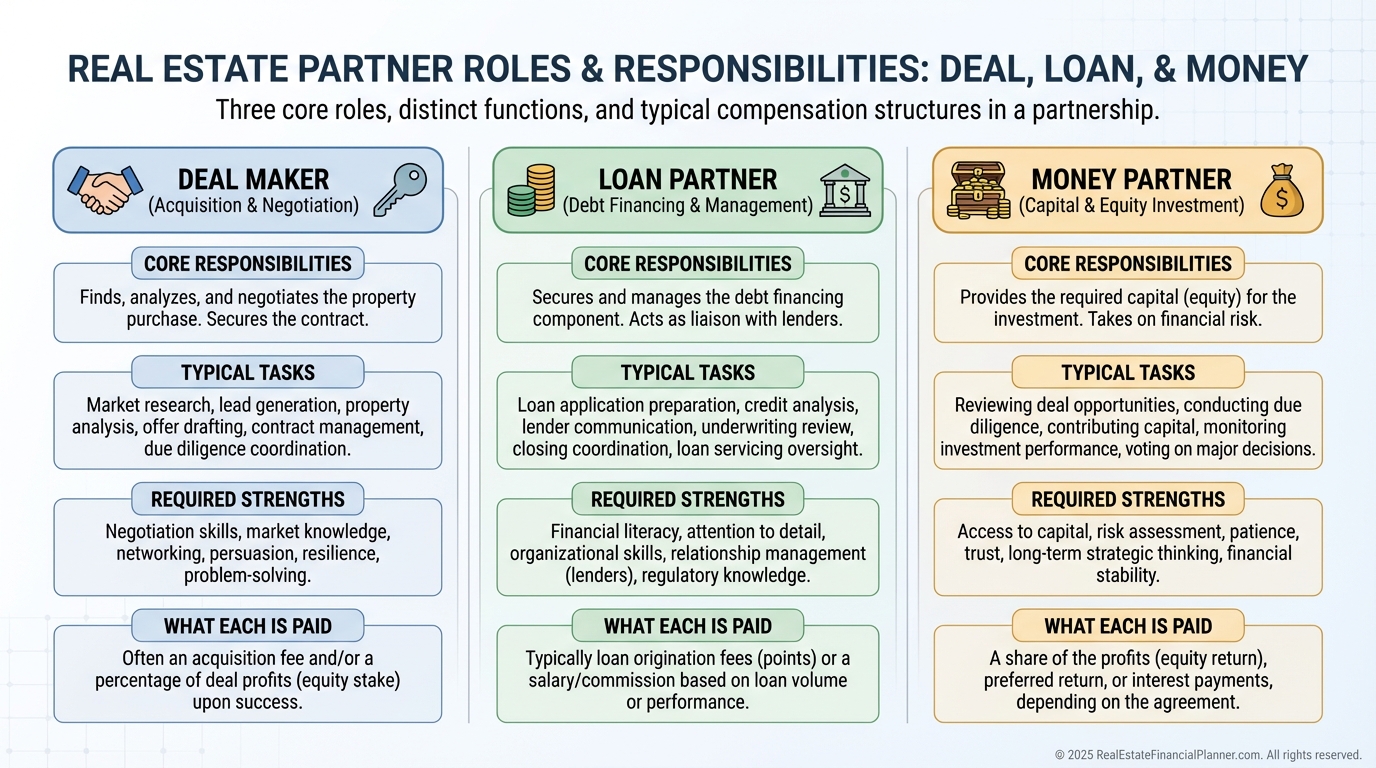

The Three Roles You Can Play

Every partnership revolves around three core roles.

•

Deal Maker (a.k.a. Deal Partner or Syndicator)

•

Loan Partner

•

Money Partner

Each role can be one person or a group, and one person can wear multiple hats.

Deal Maker: The Operating System

The deal maker sources, underwrites, negotiates, closes, operates, and exits.

They coordinate partners, vendors, lenders, property managers, and reporting.

It’s the most work and often includes both investment management and partnership management.

I pay deal makers for the lift—usually an acquisition fee, an asset management fee, and a promote tied to performance.

Loan Partner: The Credit Engine

The loan partner brings credit, income, and sometimes balance sheet strength.

They sign or guarantee debt, help secure favorable terms, and monitor covenants.

I model their compensation against the added return enabled by leverage and the risk of personal guarantees.

Comp can be flat fees, ongoing fees, ownership, or a blend.

Money Partner: The Capital Stack

The money partner funds earnest money, due diligence, down payment, closing costs, rent-ready work, reserves, and cumulative negative cash flow.

They may answer capital calls if the deal needs more cash.

When I structure, I align their downside protection with reserves, clear capital call rules, and priority distributions when warranted.

One Person, Many Hats—Or Many People, One Hat

I often see a deal maker also co-sign the loan, especially on smaller residential loans.

Money partners sometimes also qualify for the loan, simplifying the stack.

And yes, you can have multiple deal makers, multiple loan signers, and multiple capital contributors.

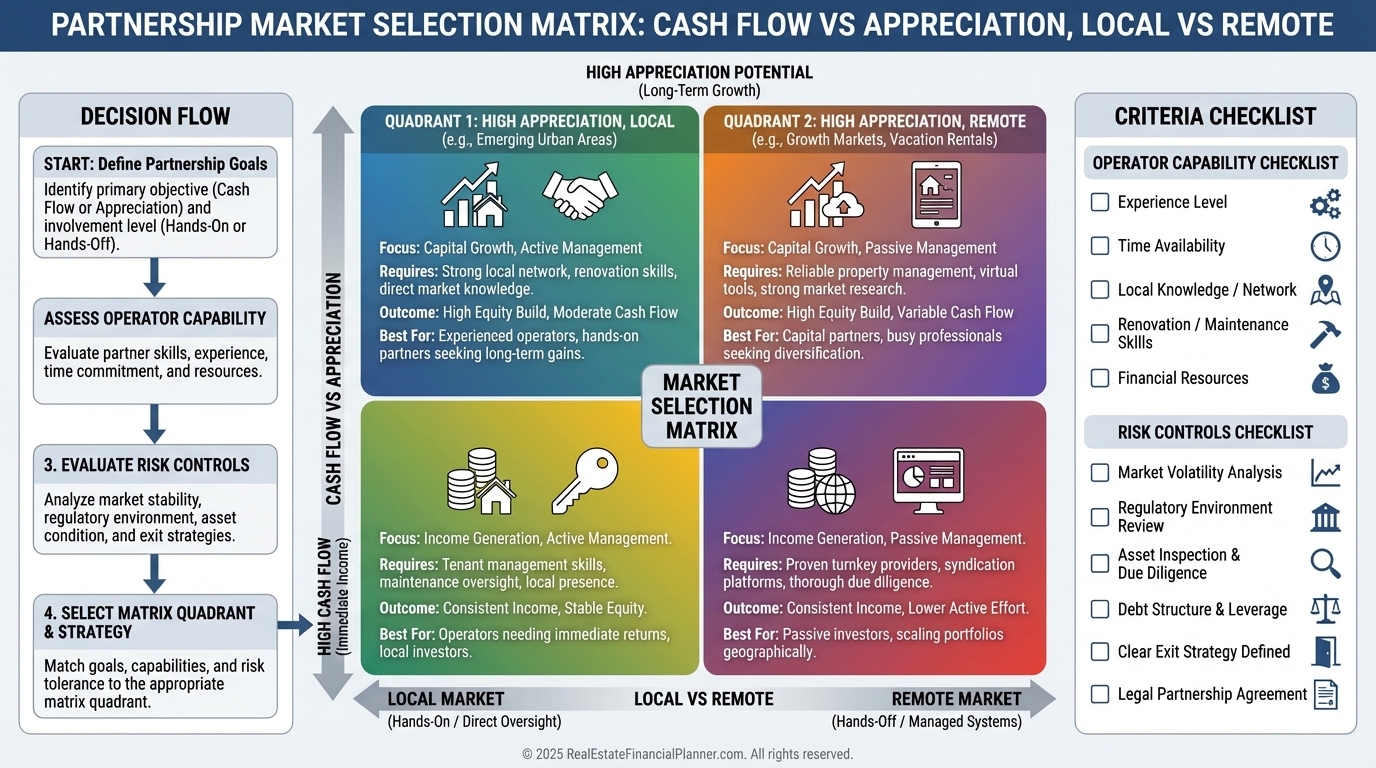

Local vs Long-Distance Partnerships

Many of my clients buy locally with local partners.

Others form partnerships in high-cash-flow or high-growth markets where none of them live.

I care less about geography and more about boots-on-the-ground capability, data integrity, and operational redundancy.

If we can’t verify rents, expenses, and construction quality remotely, we don’t do the deal.

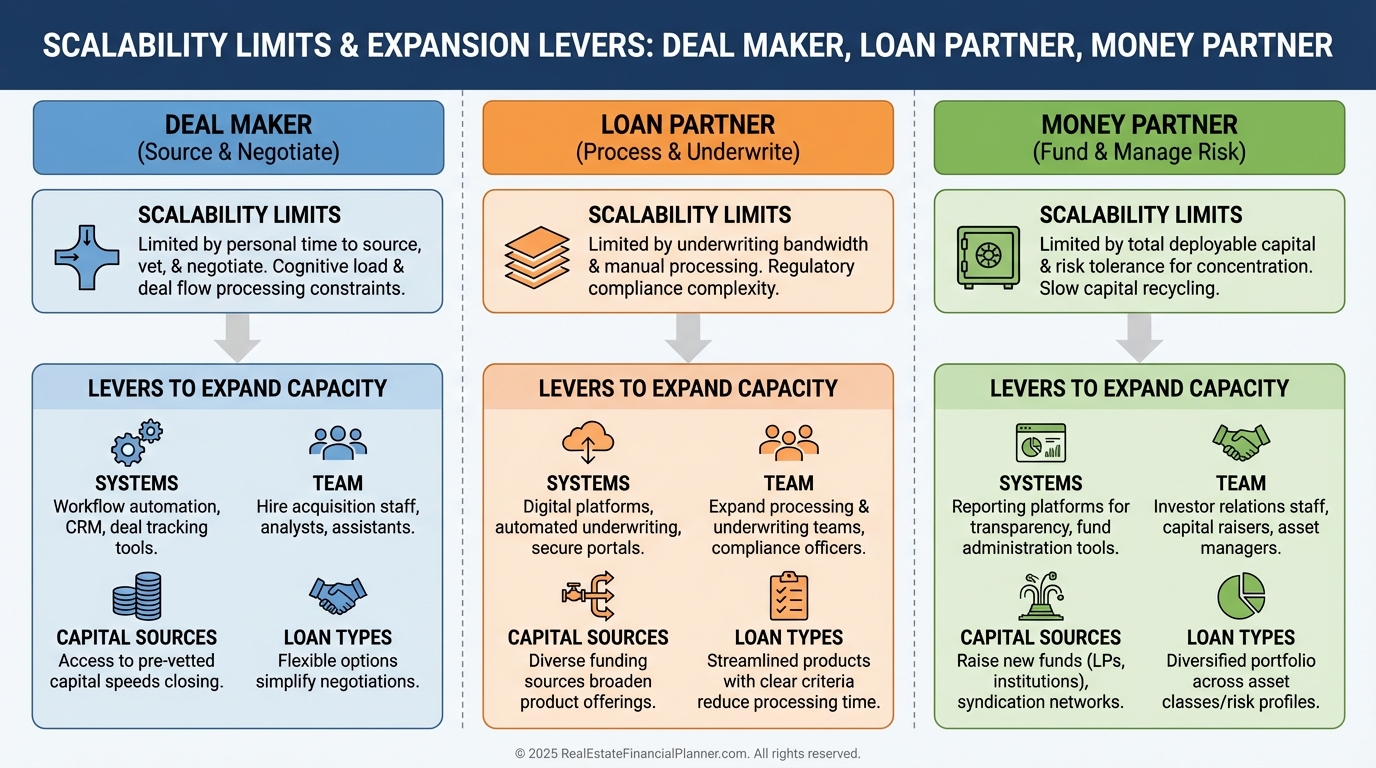

Scalability: What Actually Bottlenecks

Partnerships scale, but each role hits a wall.

Deal makers are limited by great deals, reliable teams, and time.

Money partners are limited by their capital and deal quality.

Loan partners are limited by loan exposure and lending guidelines.

The Hidden Friction: Getting Out Isn’t Easy

Minority partners often can’t force a sale.

Loan partners can’t easily come off a note.

Deal makers can’t stop operating midstream without hurting the asset and their reputation.

Before joining a partnership, I stress-test exit and buy-sell terms, lockbox reserves, and refi/sale decision rules.

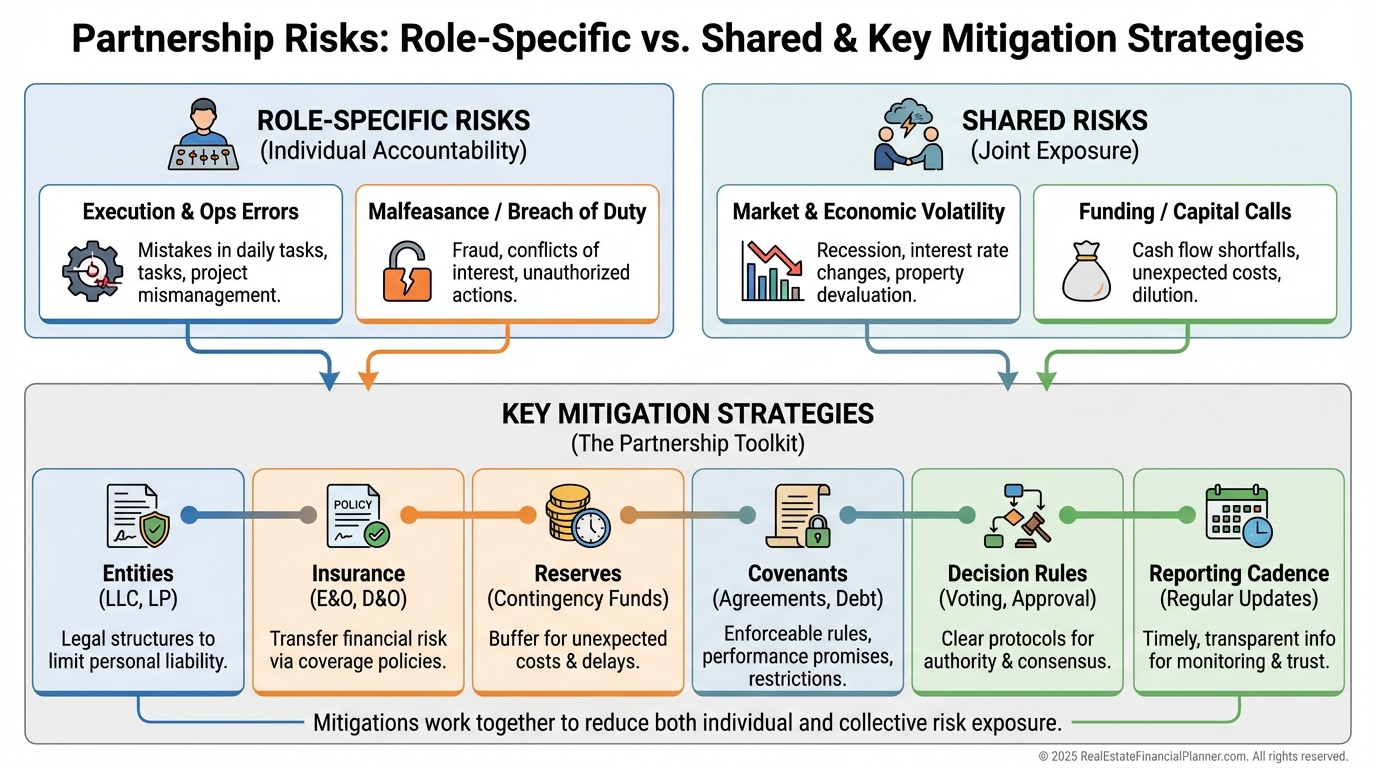

What Each Role Risks

Deal makers risk time, reputation, and litigation from tenants, vendors, and even partners.

Loan partners risk credit hits, guarantees, and potential deficiency judgments.

Money partners risk invested capital and any agreed future capital.

All partners share two shadow risks: being asked to step in operationally if the deal maker fails and being pressured to add more cash if performance lags.

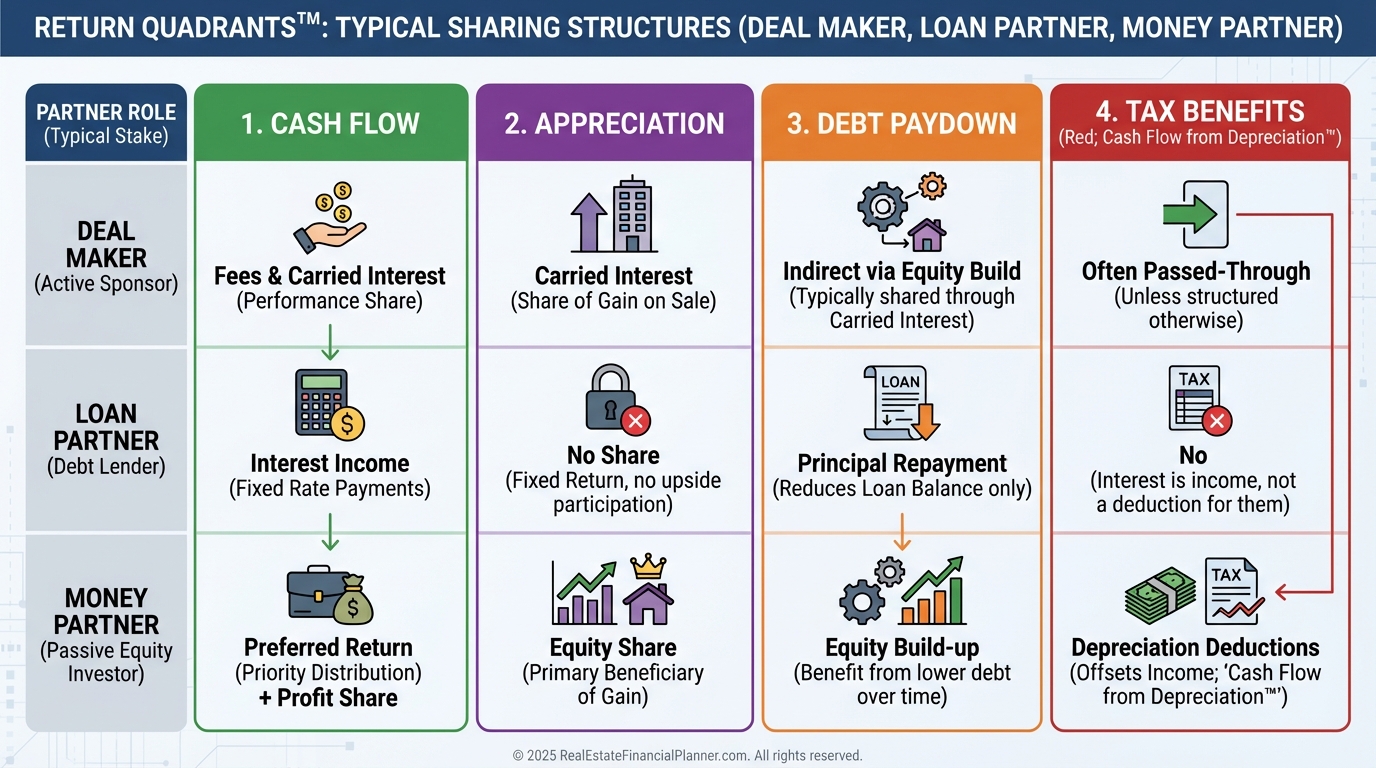

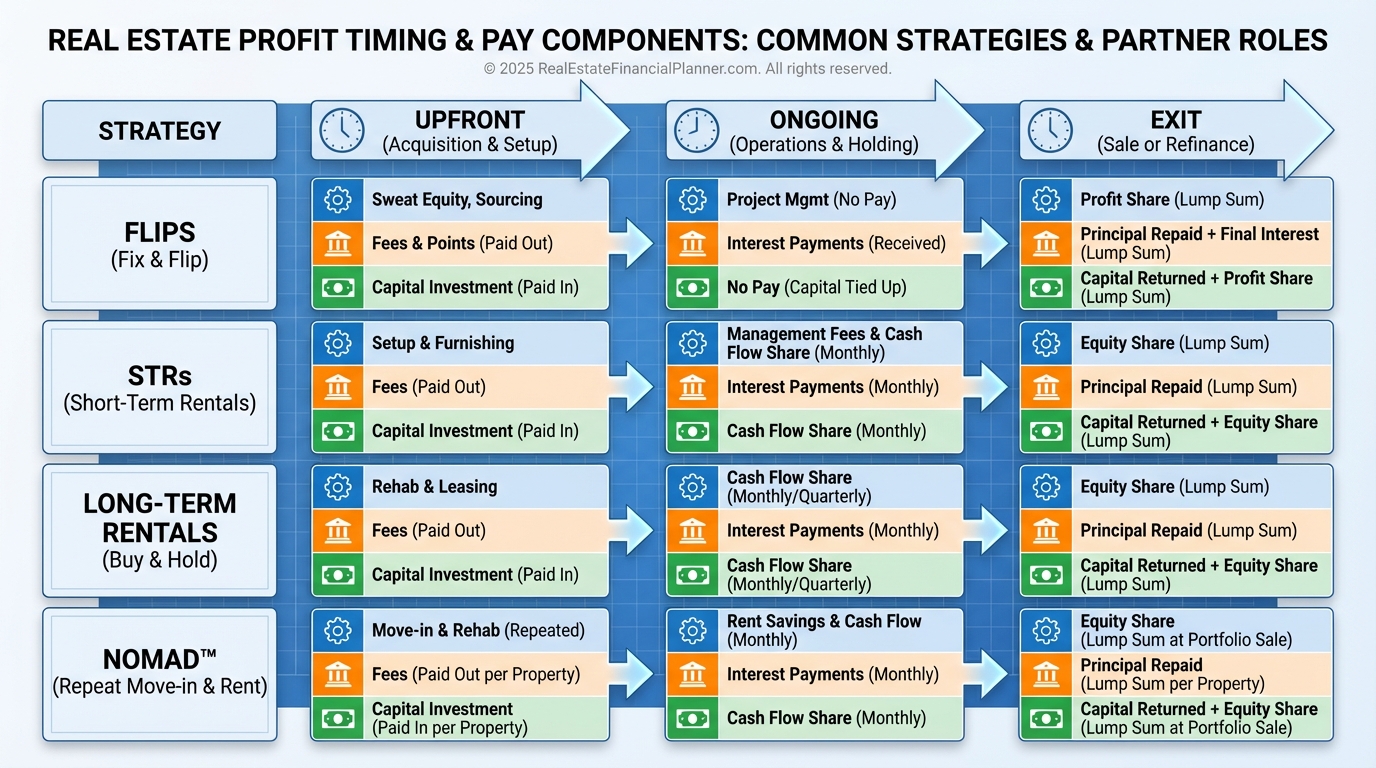

How and When Everyone Gets Paid

Deal makers may earn an acquisition fee, an asset management fee, and a performance-based promote at refi or sale.

Loan partners may earn a flat fee, an ongoing guarantee fee, and/or ownership.

Money partners usually don’t get paid upfront; they receive preferred returns, profit splits, or both.

Strategy matters for timing. Flips and short-term rentals often pay faster. Long-term rentals, small multis, and Nomad™ compound slower but bigger.

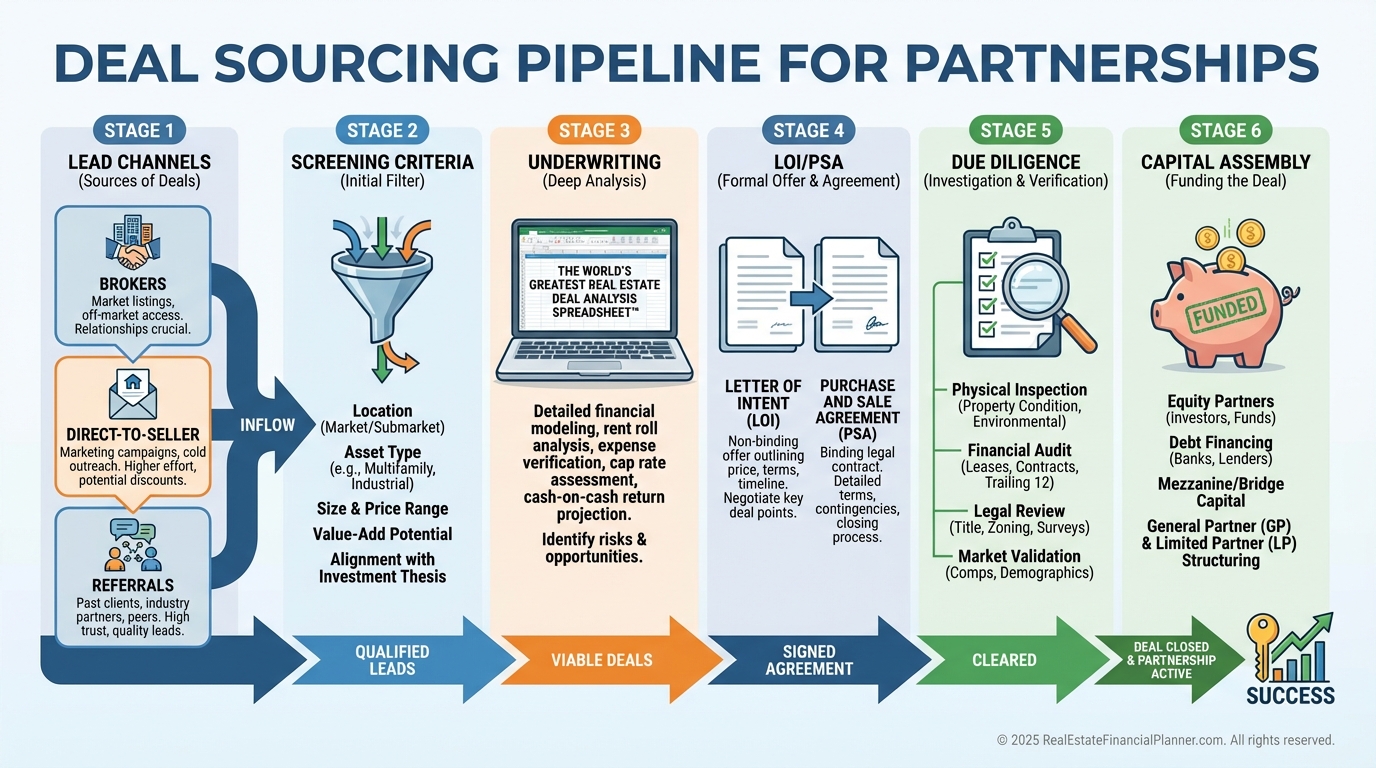

Sourcing Deals as a Partnership

The deal maker usually drives deal flow.

In creative financing partnerships, we target flexible sellers and structure terms.

In apartment deals, we work brokers and direct-to-owner campaigns.

I require a tight “buy box” and minimum underwriting standards before we tour, offer, or raise.

Analyzing Deals Together

I analyze rentals with The World’s Greatest Real Estate Deal Analysis Spreadsheet™ and layer on ownership economics.

We allocate Cash Flow, Cash Flow from Depreciation™ (True Cash Flow™), principal paydown, and capital gains per the partnership agreement.

I also track True Net Equity™ so partners see not just paper appreciation but spendable equity after selling costs, loan payoff, and taxes.

When a client asks, “Is this worth it for my role?” I show role-specific IRR and Return on Equity using Return Quadrants™.

Market Conditions That Help or Hurt Partnerships

Partnerships thrive where we can still find partner-worthy deals after fees and splits.

Strong rent growth, stable expenses, and decent cap rates help.

Negative cash flow markets can still work with larger down payments, creative financing, or value-add, but the margin of error shrinks.

If your local market fails the test, we go remote with disciplined operator controls.

Self-Directed Retirement Accounts in Partnerships

Yes, you can partner with a self-directed IRA/401k, but roles are constrained.

An IRA-owned interest can’t perform prohibited services, so a deal maker using IRA ownership can’t swing a hammer or self-manage.

Non-recourse loans usually require higher down payments, which lowers leveraged returns for the whole partnership.

Money partners funding via SD accounts generally fit cleanly, but we still confirm UBIT/UBTI implications with a CPA.

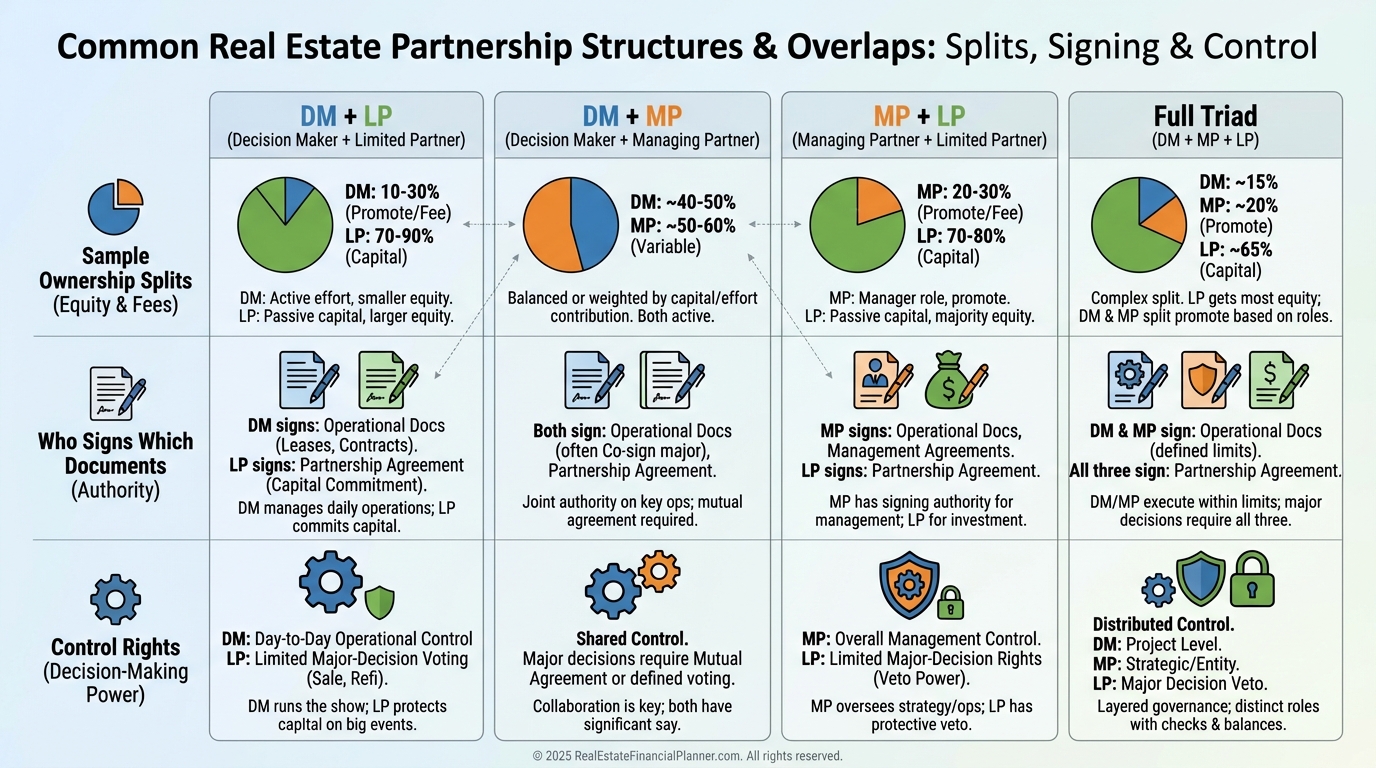

Role Overlaps and Who Signs What

Lenders may require any owner above a threshold to sign.

Seller financing layered with bank or hard money may require different signatures than a plain agency loan.

When I structure overlaps, I put clarity in writing: who commits cash, who signs, who controls, and who decides when to refi or sell.

What I Model Before I Say Yes

I underwrite the deal twice: once as a solo investor and once with partnership fees and splits.

If the deal is only “good” because a partner is subsidizing something unsustainable, I pass.

I test reserves at 6–12 months of expenses, stress rents down 5–10%, and push interest rates up 100–200 bps.

I show partners role-specific cash needs, capital call rules, and timing of distributions so no one is surprised.

Quick Role Checklists

Deal Maker

•

Document your buy box, underwriting, and ops cadence.

•

Define fees, promotes, and decision rights.

•

Build redundancy for management, bookkeeping, and reporting.

Loan Partner

•

Validate DSCR, liquidity, and exposure limits.

•

Negotiate carve-outs, fees, and off-ramps if possible.

•

Confirm personal guarantee scope and insurance coverage.

Money Partner

•

Verify use of funds, reserves, and capital call terms.

•

Clarify preferred return, compounding, and waterfall.

•

Demand quarterly reporting with bank access or third-party oversight.

A Simple Example

Let’s say we buy a $600,000 fourplex at a 6.25% cap with value-add.

The deal maker earns a 2% acquisition fee and 1.5% asset management fee.

The money partner puts in 30% down plus $40,000 in reserves and gets an 8% pref, then 70/30 until a 15% IRR, then 60/40.

The loan partner earns a 1% guarantee fee and 5% ownership.

I model cash flow, True Cash Flow™, and True Net Equity™ each quarter so all three partners see reality, not guesses.

Final Guidance Before You Partner

Pick the role where your advantage is durable, not just convenient today.

Don’t accept a role that caps your future scaling unless the economics justify it.

And write the operating agreement for the worst week you can imagine, not the best day when everyone nods and smiles.

That’s how you partner smarter, protect relationships, and build a portfolio that compounds.