Property Management Fees Exposed: Exact Costs, Hidden Traps, and How to Model Them Before You Buy

Learn about Property Management Fees for real estate investing.

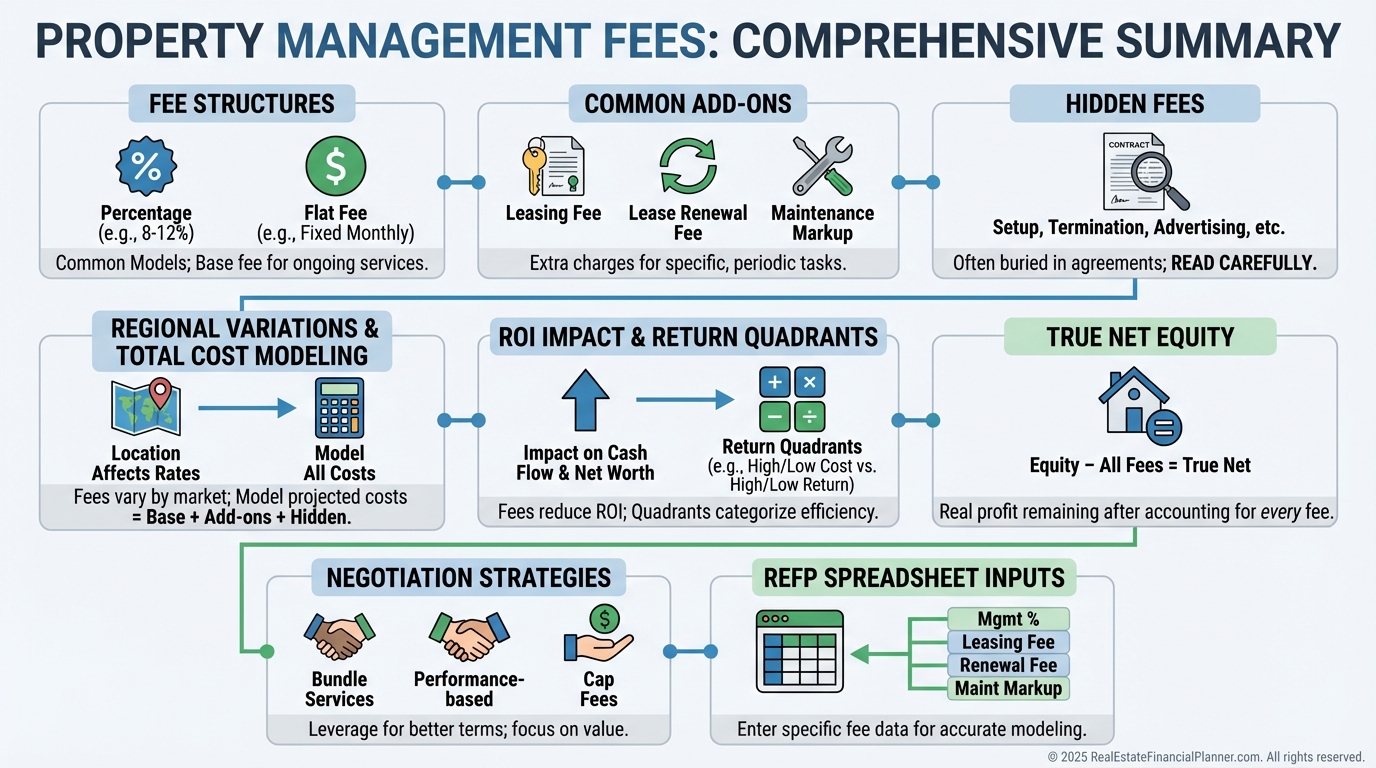

Why Property Management Fees Decide Winners and Losers

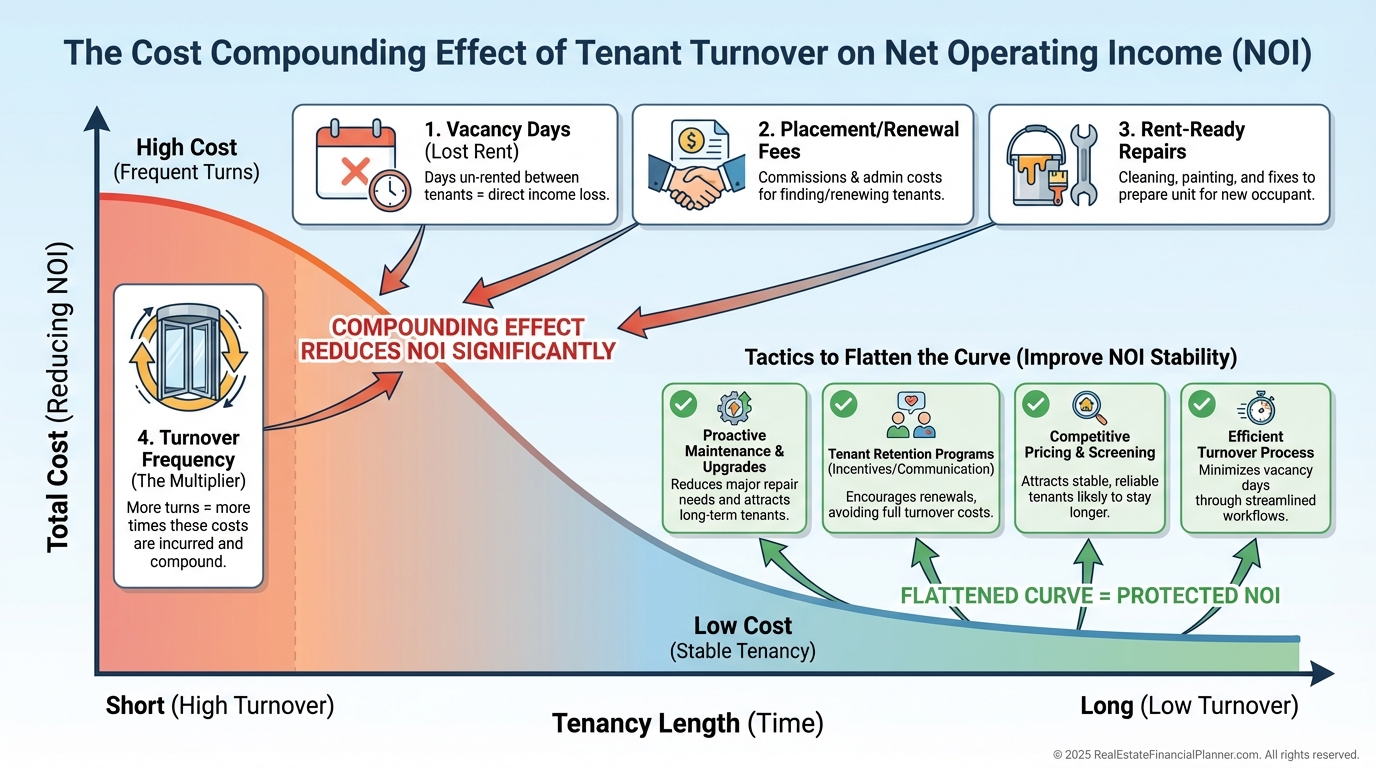

When I help clients underwrite deals, the 8–12% headline fee rarely blows up the numbers.

It’s the extra 4–8% hiding in add-ons that quietly wipes out cash flow.

I’ve seen investors think they bought a 12% return and discover they own a 3% headache.

That mismatch is preventable if you model the total cost before you sign a management agreement.

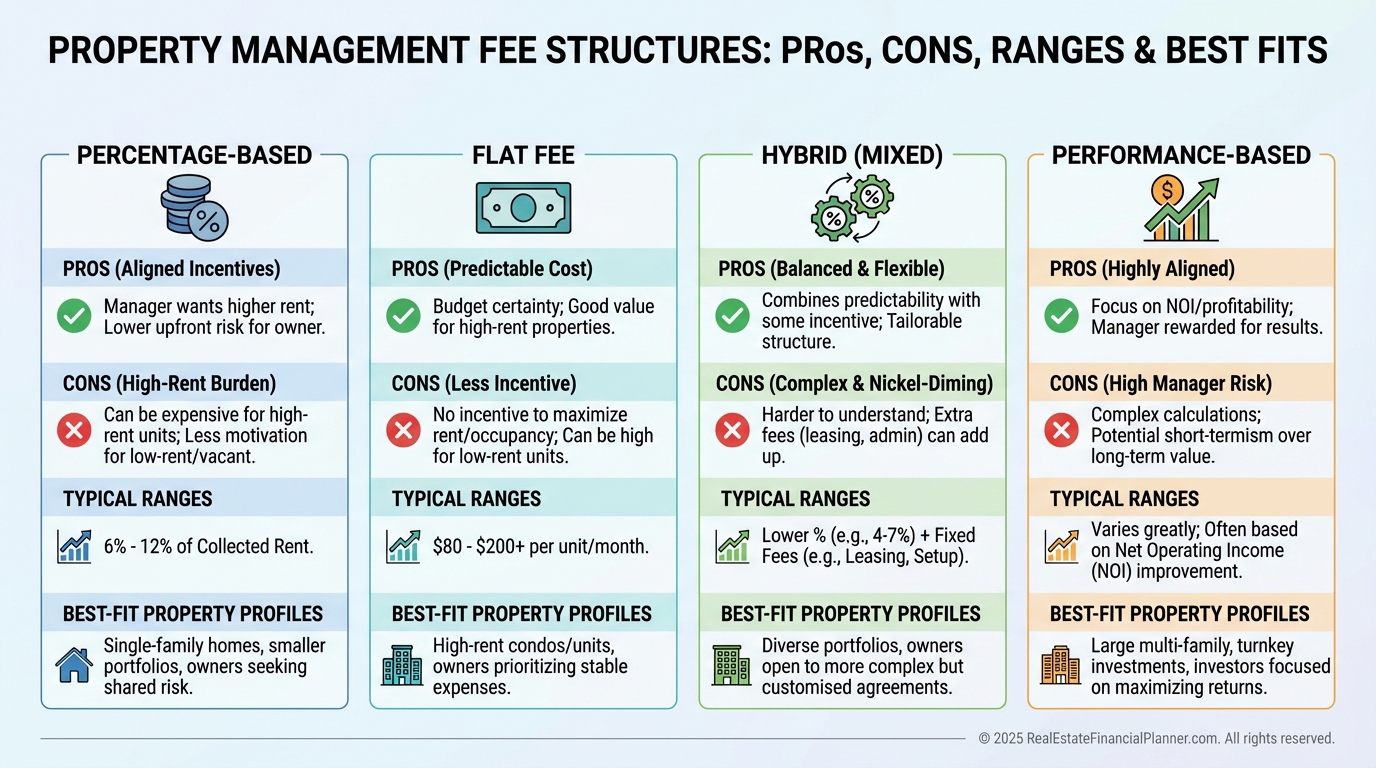

The Four Common Fee Structures Explained

Percentage-based is most common at 8–12% of collected rent.

It aligns incentives, but your cost rises with rent and can punish premium units.

Flat fees are predictable, often $100–$300 per month.

They can be a win for higher-rent properties that would pay more under a percentage.

Hybrid models blend both, like 8% with a $150 minimum.

They stabilize manager income but complicate apples-to-apples comparisons.

Performance-based ties fees to occupancy or NOI.

It’s rare, but when structured well, it can reward what matters most.

What’s Inside the Monthly Fee — and What’s Not

Monthly management usually includes rent collection, tenant communication, basic reporting, and periodic inspections.

It rarely includes leasing, renewal, maintenance markups, eviction, or premium marketing.

Always ask, “What would trigger a separate invoice?”

The answer separates lean managers from death-by-a-thousand-line-items.

The Big-Ticket Add-Ons You’ll Actually Pay

Leasing/tenant placement often runs 50–100% of one month’s rent.

Renewal fees are usually 25–50% of the placement fee or a flat $200–$500.

Maintenance coordination can add 10–20% markup on invoices or $50–$100 per work order.

Eviction coordination often adds $300–$800 on top of court costs and process service.

Setup/onboarding fees of $200–$500 per property are common and sometimes waived for portfolios.

Vacancy fees show up as $50–$100 per month or a percentage of standard fees.

Advertising extras include professional photos ($150–$300), premium listings ($50–$200), and virtual tours ($200–$500).

Late fees are often split 50/50, which can incentivize timely collections.

Annual interior inspections typically cost $100–$200 per visit.

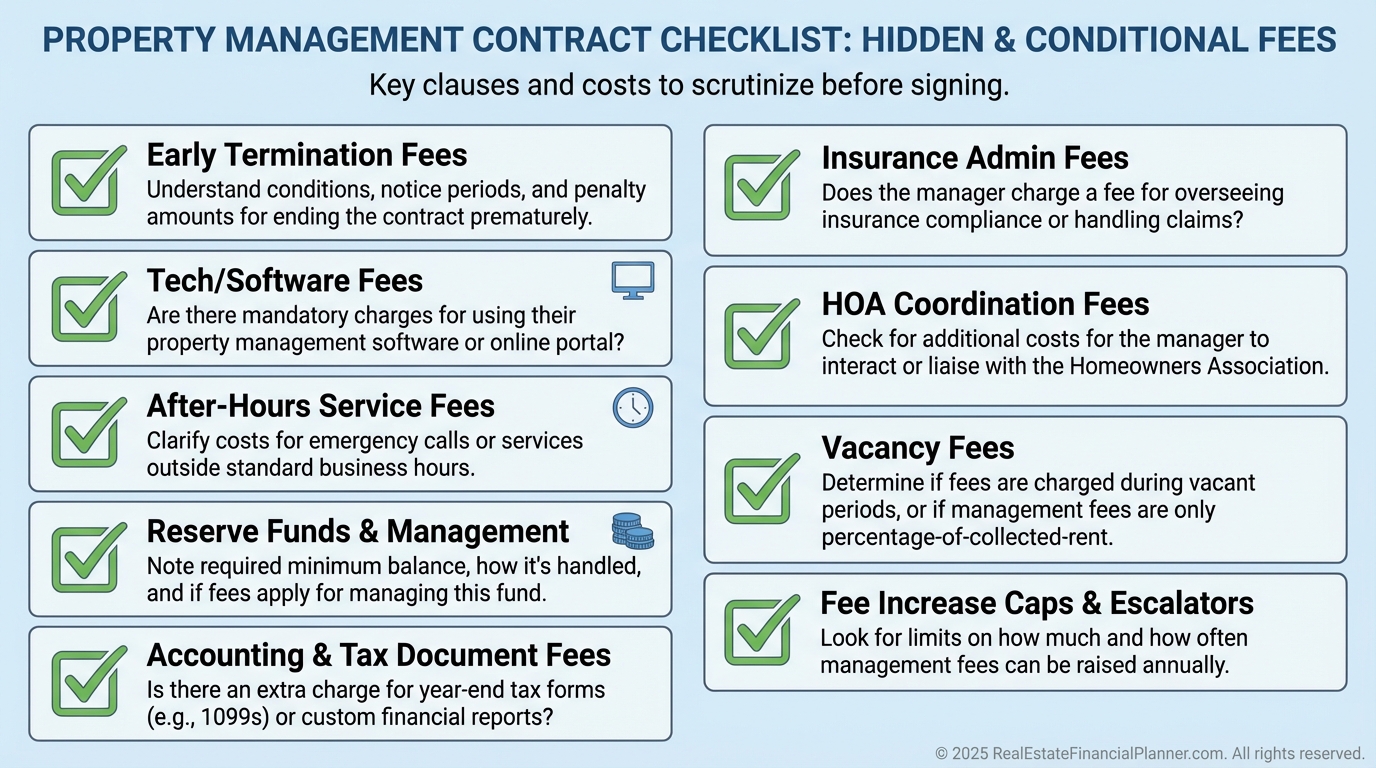

The Hidden and Conditional Fees I Ask About in Every Contract

Early termination penalties can be 2–6 months of fees.

I push for a 30–60 day out with cause.

Technology charges might include portal access, e-payment fees, or document storage.

Clarify what hits you versus the tenant.

After-hours surcharges of $50–$150 per call appear in some agreements.

Define “emergency” in writing.

Reserve requirements of $500–$1,500 per door tie up cash.

Ask where it’s held, who earns interest, and how quickly it’s replenished or returned.

Accounting add-ons include 1099s, tax packages, and custom reports.

Know the price and whether it’s annual or per request.

Insurance and HOA coordination can generate claim filing fees, violation management, and meeting attendance charges.

If you invest in HOA-heavy markets, budget for this.

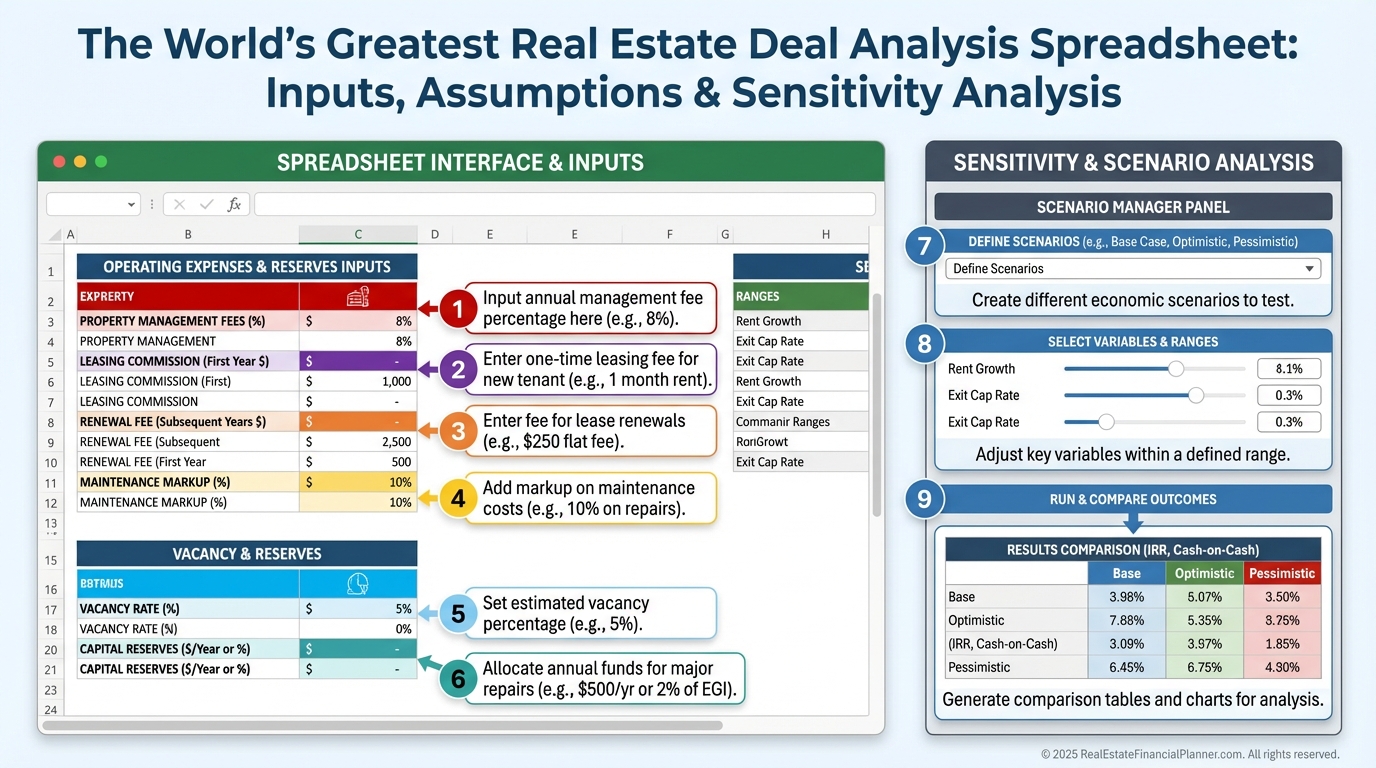

Model It First in The World’s Greatest Real Estate Deal Analysis Spreadsheet™

Before I sign, I model three scenarios in the Spreadsheet™.

Base case with average turnover, best case with strong renewals, and worst case with back-to-back vacancies.

I input the monthly fee, leasing cost, renewal fee, maintenance markup, and any vacancy fee.

Then I run sensitivity on rent, repairs, and tenancy length.

I compare managers on total cost as a percent of gross rent, not just the headline.

That shows whether the 8% manager with junk fees costs more than the 10% all-in pro.

Regional and Property-Type Variations

Urban, high-rent markets often support 6–8% fees with lower placement costs.

Rural or low-rent markets lean toward 10–12% to stay profitable.

Class A units may pay more for concierge-level service, while workforce housing prioritizes cost and fast turns.

Small multifamily can command discounts for scale, but turns and common area issues add coordination time.

If you invest as a Nomad™ and keep properties out of state, expect to pay the market’s going rate.

Focus on quality screening and renewals to control turnover, not on shaving 1% off headline fees.

What These Fees Do to Your Return Quadrants™

Property management primarily hits the Cash Flow quadrant.

It also affects Taxes because fees are deductible expenses that can improve after-tax yield.

Appreciation and Principal Paydown are mostly untouched, but tenant quality influences maintenance and turnover, which loops back to Net Operating Income.

When I calculate True Net Equity™, I deduct realistic selling costs and needed reserves.

A manager-required reserve reduces deployable equity today, and high fees reduce your future cash contribution to equity.

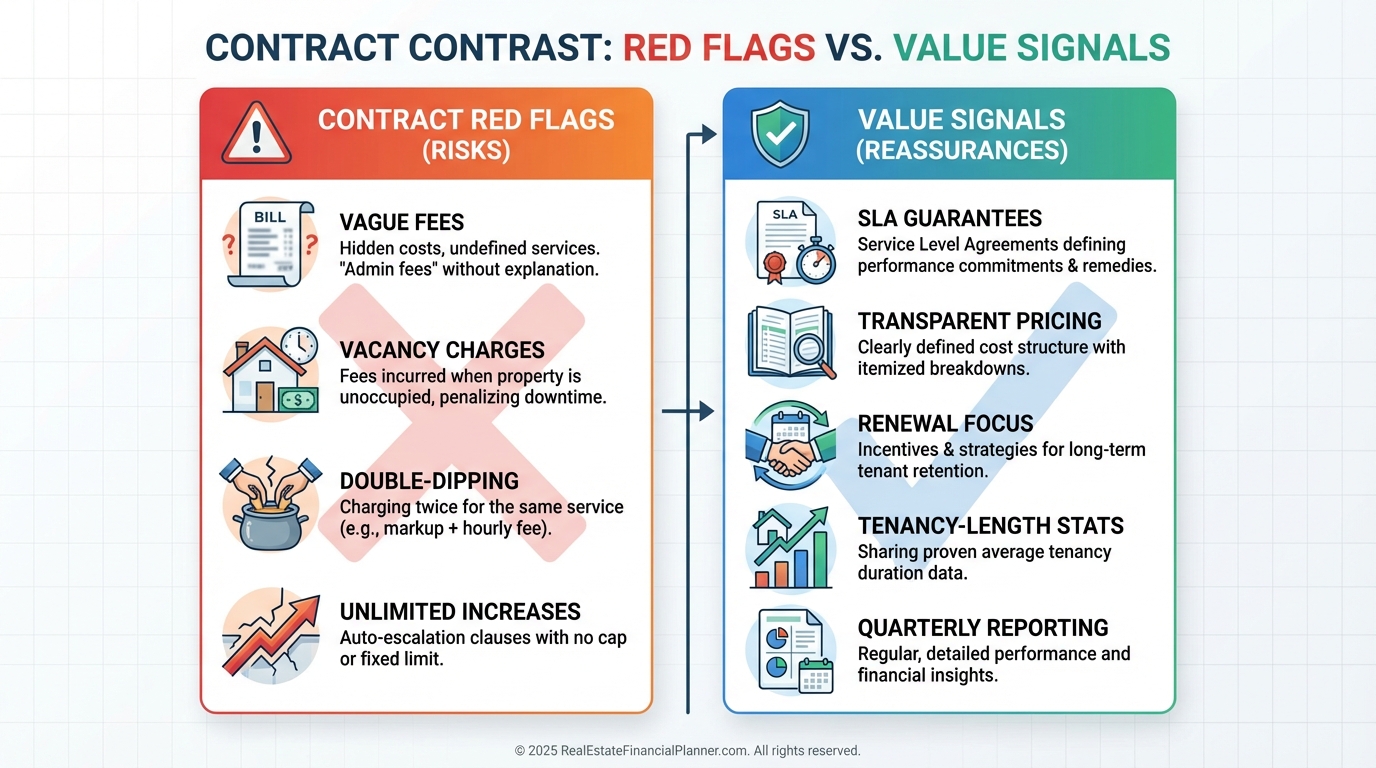

Red Flags vs Value Signals I Look For

Red flags include full management fees charged during vacancy, vague fee descriptions, double-billing a service, and no cap on fee increases.

Another is keeping 100% of late fees without clear justification.

Value signals include published SLAs, transparent price tables, renewal-first culture, and data on average tenancy length by asset class.

I also like managers who proactively budget turns and send quarterly risk reports.

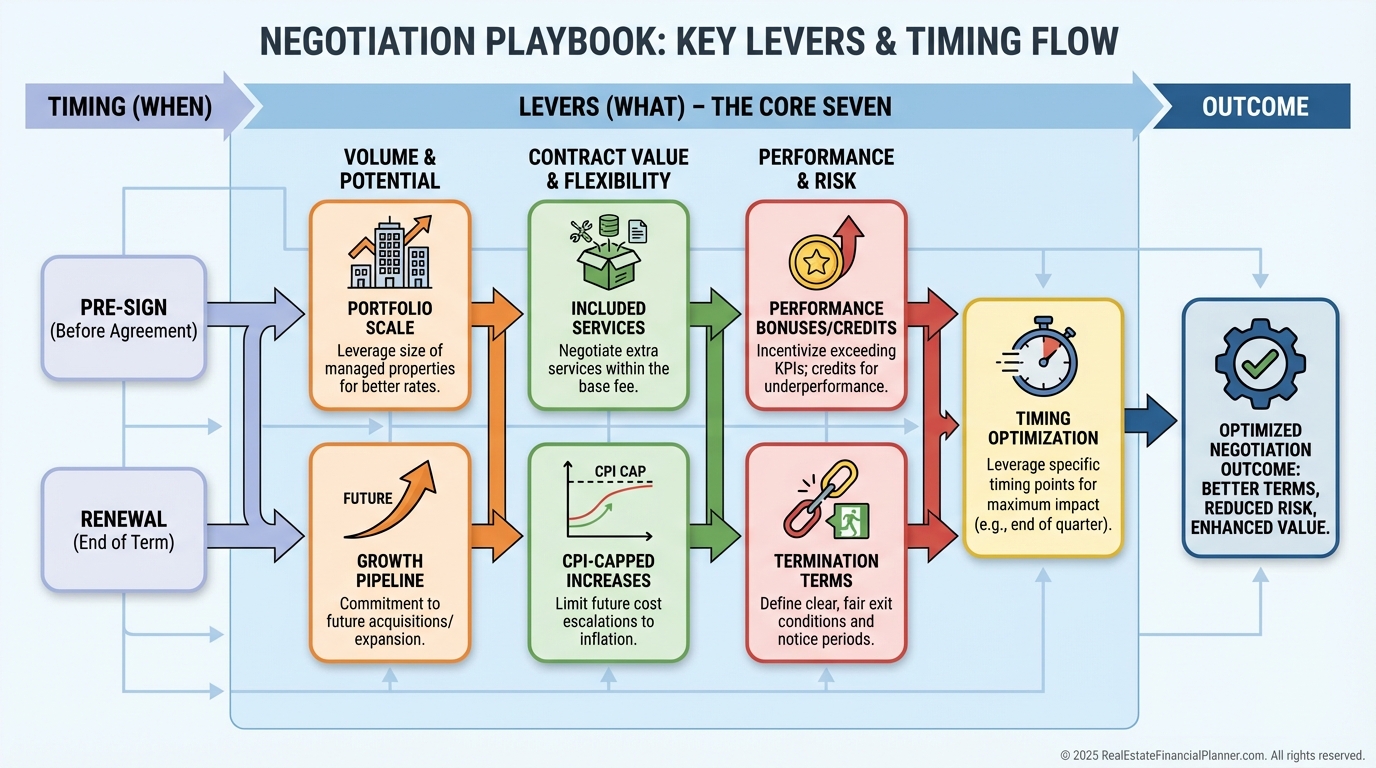

Negotiating Fees Without Burning the Relationship

I negotiate on scope and outcomes, not just percentage.

Managers protect margins; show them how you’ll help them win.

Offer portfolio growth or exclusivity in exchange for better pricing or included services.

Ask for CPI-capped increases, waived setup, or included annual inspections.

Tie small performance bonuses to renewal rates or response times, not just occupancy.

If performance slips, build in credits or the ability to terminate with short notice.

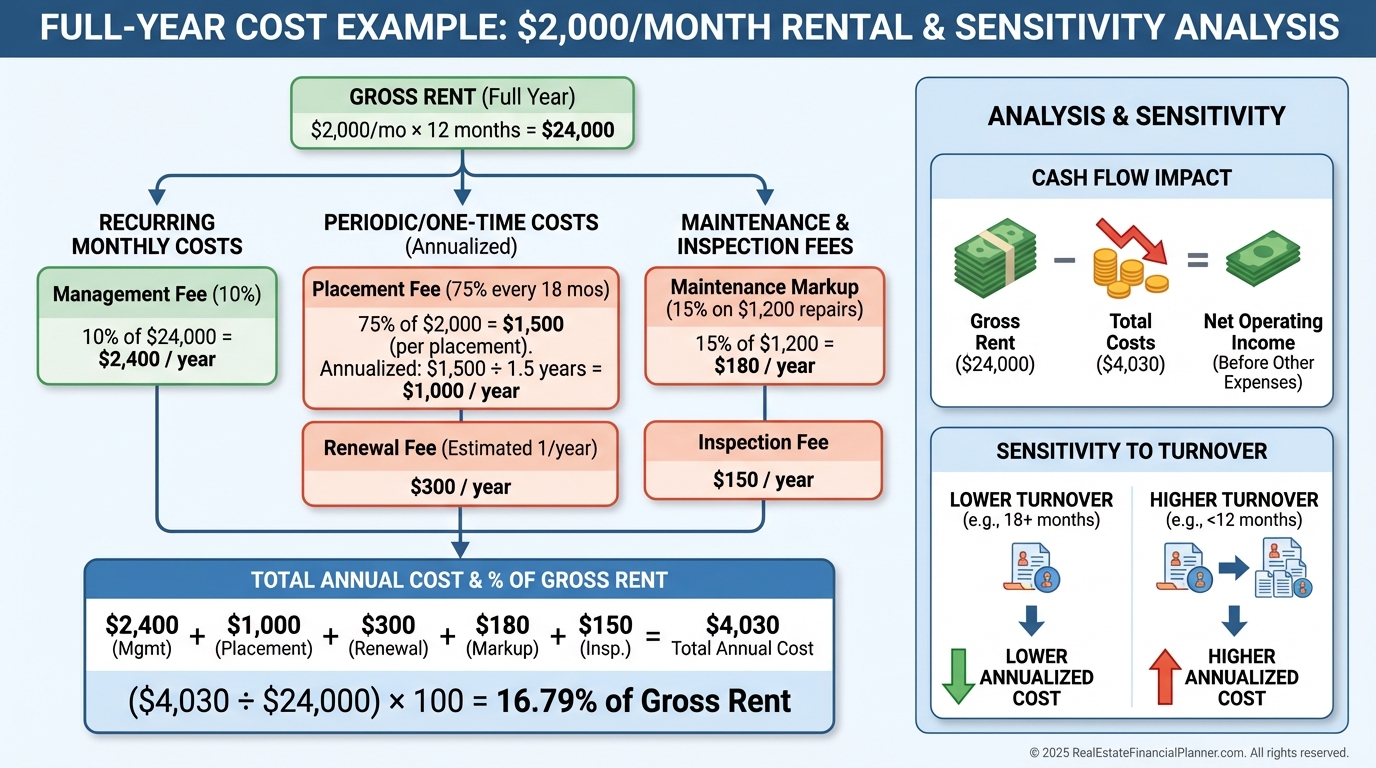

Example: Two Managers, Same Rent, Different Outcomes

Assume $2,000 rent and 18-month average tenancy.

Manager A charges 8% plus 75% placement, $300 renewal, 15% maintenance markup on $1,200 annual repairs, and $75 vacancy fee.

Manager B charges 10% all-in with placement capped at 50% and no vacancy fee.

Annualized costs look like this:

•

A: $1,920 management + $1,000 placement + $300 renewal + $180 maintenance + $150 inspection + $900 vacancy = $4,450 (18.5% of gross)

•

B: $2,400 management + $667 placement + $300 renewal + $0 vacancy + $150 inspection + $180 maintenance = $3,697 (15.4% of gross)

Manager B is cheaper by $753 per year and usually calmer to work with.

Price the total package, not the headline.

Implementation Checklist You Can Use Today

•

Gather each candidate’s full fee schedule and contract.

•

List every fee and mark what’s included versus add-on.

•

Model base/best/worst scenarios in the Spreadsheet™.

•

Compare total annual cost as % of gross rent and its impact on Cash Flow and True Net Equity™.

•

Validate their renewal rate, average tenancy length, and eviction statistics.

•

Negotiate scope, CPI caps, and performance terms before you sign.

•

Calendar a 90-day review and an annual fee audit.

Final Word

The cheapest manager on paper often costs the most in practice.

Model the entire fee stack, reward managers who drive renewals and reduce turns, and protect your downside in the contract.

When you do, property management stops being a mystery line item and becomes a controllable lever in your Return Quadrants™.